Professional Documents

Culture Documents

Research On Stocks

Uploaded by

vamc232855Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research On Stocks

Uploaded by

vamc232855Copyright:

Available Formats

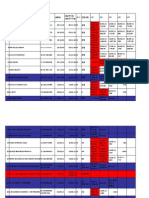

PRIVATE CLIENT RESEARCH

STOCK RECOMMENDATIONS

FEBRUARY 14, 2014

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

79

78

Latest

Reco

Price

as on

14-Feb

(Rs)

Upside/

(Downside)

(%)

74

5.8

EPS (Rs)

PE (x)

RoE (%)

P/ABV (x)

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

23.7

22.1

3.1

3.3

11.8

10.4

0.8

0.8

Banking

Allahabad Bank

Andhra Bank

36,875

28-Jan-14

30,721

14-Feb-14

54

50

Axis Bank

455,780

17-Jan-14

1,176

1,370

Bank of Baroda

221,170

07-Feb-14

538

615

HDFC Bank

1,527,099

20-Jan-14

665

ICICI Bank

REDUCE

REDUCE

55

(8.9)

8.5

8.7

6.5

6.3

5.9

6.0

0.7

0.8

1,103

24.2

130.0

147.6

8.5

7.5

17.2

17.2

1.4

1.2

ACCUMULATE

536

14.7

106.0

110.0

5.1

4.9

13.8

13.0

0.9

0.8

730

BUY

642

13.7

35.8

44.8

17.9

14.3

21.7

23.0

3.7

3.1

BUY

BUY

1,139,614

30-Jan-14

1,002

1,311

Indian Bank

39,904

24-Jan-14

109

115

Indian Overseas Bank

35,387

31-Jan-14

43

Jammu & Kashmir Bank

65,087

12-Feb-14

1,352

Punjab National Bank

182,049

03-Feb-14

549

610

ACCUMULATE

537

13.7

94.6

116.5

5.7

4.6

State Bank of India

989,851

14-Nov-13

1,697

1,819

ACCUMULATE

1,475

23.3

174.2

211.3

8.5

7.0

56,426

03-Feb-13

108

117

ACCUMULATE

103

14.1

24.2

29.8

4.2

3.4

1,132,852

23-Jan-14

842

874

ACCUMULATE

771

13.4

35.4

40.5

21.8

144,204

04-Feb-14

91

135

BUY

95

41.6

13.5

14.3

94,501

20-Jan-14

209

276

BUY

199

38.7

25.8

Mahindra & Mahindra Financial Services 116,730

23-Jan-14

254

265

REDUCE

244

8.6

Shriram Transport Finance Co

30-Jan-14

616

700

ACCUMULATE

557

25.7

Union Bank of India

988

32.6

82.9

95.7

11.9

10.3

13.6

14.0

1.6

1.4

ACCUMULATE

93

23.9

28.7

30.0

3.2

3.1

11.0

10.7

0.5

0.5

44

REDUCE

44

(0.9)

3.7

5.9

12.0

7.5

3.3

5.0

0.7

0.7

1,400

REDUCE

1,342

4.3

237.1

266.1

5.7

5.0

22.0

21.2

1.2

1.0

10.2

11.5

0.8

0.7

11.6

12.8

1.4

1.3

9.4

10.8

0.6

0.5

19.0

20.7

21.2

4.5

4.0

7.1

6.7

14.1

13.5

1.0

0.9

29.8

7.7

6.7

18.6

18.4

1.4

1.2

16.4

19.3

14.9

12.6

19.4

19.7

2.9

2.5

59.6

63.0

9.3

8.8

18.3

16.9

1.6

1.4

NBFCs

HDFC Ltd

IDFC

LIC Housing Finance

124,746

STOCK RECOMMENDATIONS

February 14, 2014

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

14-Feb

(Rs)

Upside/

(Downside)

(%)

118

16

EPS (Rs)

PE (x)

FY14E

FY15E

FY14E

18.1

18.5

17.3

15.4

0.1

RoE (%)

EV/EBIDTA (x)

FY15E

FY14E

FY15E

FY14E

FY15E

6.4

6.8

24.2

18.5

4.4

4.0

156.0

0.9

829.3

11.9

8.3

Auto & Auto Ancillary

Apollo Tyres

59,296

13-Feb-14

118

139

Ashok Leyland

41,512

23-Jan-14

17

18

Bajaj Auto Ltd

532,380

20-Jan-14

1,933

2,239

BUY

1,840

21.7

115.8

139.9

15.9

13.1

38.0

36.9

10.6

Eicher Motors Ltd #

130,937

14-Feb-14

4,819

5,123

ACCUMULATE

4,850

5.6

145.9

260.7

33.2

18.6

20.7

29.8

16.1

9.5

13,441

29-Jan-14

123

136

ACCUMULATE

110

23.7

20.0

18.1

5.5

6.1

13.6

11.0

4.3

4.7

Hero MotoCorp Ltd

387,460

31-Jan-14

1,998

2,140

ACCUMULATE

1,937

10.5

105.0

142.7

18.5

13.6

42.6

51.3

9.8

8.5

Maruti Suzuki India Ltd

474,943

29-Jan-14

1,566

1,608

REDUCE

1,643

(2.2)

84.9

100.5

19.4

16.4

13.0

13.7

7.9

6.6

Tata Motors

1,234,051

11-Feb-14

364

423

389

8.8

47.7

53.3

8.2

7.3

33.0

27.7

4.6

3.8

TVS Motors

38,151

30-Jan-14

71

75

80

(6.6)

5.5

6.8

14.6

11.8

19.4

20.7

9.2

7.4

15.7

Escorts Ltd **

BUY

ACCUMULATE

BUY

ACCUMULATE

Capital Goods & Engineering

ABB Ltd *

122,590

07-Nov-13

645

478

SELL

579

(17.4)

11.5

18.4

50.3

31.4

9.1

13.3

22.4

AIA Engineering

53,181

04-Feb-14

530

520

REDUCE

566

(8.1)

31.9

40.4

17.7

14.0

20.9

22.4

11.1

8.6

Alstom T&D India Ltd *

42,721

04-Feb-14

185

163

SELL

179

(8.8)

4.7

6.3

38.0

28.4

12.6

15.5

15.6

14.2

Bajaj Electricals Ltd

22,630

13-Feb-14

234

197

SELL

229

(14.0)

3.8

14.6

60.3

15.7

5.0

18.0

17.0

7.9

Bharat Electronics

77,120

27-Jan-14

981

1,118

BUY

964

16.0

108.9

108.0

8.9

8.9

13.2

11.9

2.5

2.1

BHEL

363,380

06-Feb-14

161

150

SELL

149

1.0

15.2

14.4

9.8

10.3

11.4

10.2

5.7

5.3

Blue Star

12,680

28-Jan-14

147

175

BUY

141

24.1

7.0

11.9

20.2

11.9

12.5

19.5

10.5

7.0

Crompton Greaves

78,019

30-Jan-14

102

102

REDUCE

122

(16.1)

5.4

8.4

22.5

14.5

9.2

13.1

12.3

8.5

121,926

06-Feb-14

439

445

REDUCE

440

1.2

22.2

23.9

19.8

18.4

24.3

24.8

16.2

13.7

1,795

19-Nov-13

48

54

ACCUMULATE

48

12.0

20.6

21.8

2.3

2.2

12.0

11.6

5.0

4.8

Elgi Equipment Ltd

13,904

11-Feb-14

88

90

REDUCE

88

2.3

3.9

4.9

22.6

18.0

13.7

15.2

12.2

10.2

Engineers India Ltd

51,527

153

19.7

7.8

26.4

2.2

Greaves Cotton

13,965

07-Feb-14

62

75

57

31.1

5.6

5.9

10.2

9.7

17.4

16.3

6.4

5.1

Havells India Ltd

92,671

30-Jan-14

769

720

770

(6.5)

35.7

40.6

21.6

19.0

27.6

25.5

11.9

10.5

Kalpataru Power Transmission

11,052

31-Jan-14

75

85

ACCUMULATE

72

18.1

10.9

12.4

6.6

5.8

8.7

9.2

3.9

3.7

Larsen & Toubro

915,812

23-Jan-14

1,005

1,079

ACCUMULATE

993

8.7

51.7

64.0

19.2

15.5

13.4

14.9

14.0

11.7

Siemens India #

175,331

530

(9.4)

4.9

16.3

108.1

32.5

4.3

13.7

41.7

16.1

11

625

12.8

26.1

35.6

24.0

17.6

8.7

12.3

14.6

10.4

35

34.5

4.5

5.5

7.8

6.4

10.8

12.0

5.0

4.5

Cummins India

Diamond Power Infrastructure

NR

BUY

REDUCE

31-Jan-14

536

480

SELL

Suzlon Energy

16,391

01-Nov-13

10

NA

RATING SUSPENDED

Thermax

74,393

22-Jan-14

667

705

7,305

14-Feb-14

34

47

Time Technoplast Ltd

Kotak Securities - Private Client Research

ACCUMULATE

BUY

For Private Circulation

STOCK RECOMMENDATIONS

February 14, 2014

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Va Tech Wabag Ltd

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

14-Feb

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

FY14E

PE (x)

FY15E

RoE (%)

EV/EBIDTA (x)

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

5.2

15,900

11-Feb-14

560

610

ACCUMULATE

600

1.7

43.3

51.1

13.9

11.7

15.1

15.7

6.7

3,818

01-Nov-13

364

400

ACCUMULATE

378

5.8

33.0

44.0

11.5

8.6

8.0

10.0

5.8

3.8

39,280

31-Jan-14

107

120

BUY

119

1.0

6.6

7.9

18.0

15.0

12.9

14.3

11.8

10.4

ACC #

189,079

07-Feb-14

1,019

1,150

ACCUMULATE

1,007

14.2

58.3

64.3

17.3

15.7

14.4

14.9

11.9

9.1

Grasim Industries

225,110

03-Feb-14

2,574

3,010

BUY

2,455

22.6

211.3

284.0

11.6

8.6

9.5

11.6

5.0

3.9

India Cements

15,058

12-Feb-14

52

48

49

(2.1)

0.8

3.6

61.3

13.6

0.6

2.7

4.7

3.6

Shree Cement

148,502

28-Jan-14

4,330

4,667

ACCUMULATE

4,262

9.5

179.8

224.6

23.7

19.0

15.1

16.3

10.3

8.3

UltraTech Cement

452,922

21-Jan-14

1,719

1,930

ACCUMULATE

1,653

16.8

71.3

91.9

23.2

18.0

12.2

14.0

12.2

0.6

IL&FS Transportation Network Ltd

20,787

13-Feb-14

108

151

BUY

107

41.1

20.1

23.7

5.3

4.5

10.3

11.2

9.4

8.8

IRB Infrastructure Developers

24,279

03-Feb-14

77

116

BUY

73

58.8

12.7

12.9

5.8

5.7

12.2

11.2

6.4

6.2

J Kumar Infraprojects

5,171

14-Feb-14

186

180

Jaiprakash Associates

85,847

12-Feb-14

40

54

Nagarjuna Construction

6,132

13-Feb-14

26

Punj Lloyd Ltd

9,160

07-Nov-13

28

Simplex Infrastructures

4,123

20-Nov-13

65

239,796

04-Feb-14

Hindustan Unilever

1,210,140

ITC Ltd

2,474,612

Marico Ltd

Pidilite Industries

Voltamp Ltd

Voltas Ltd

Cement

REDUCE

Construction

186

(3.2)

33.7

36.8

5.5

5.1

17.1

16.0

4.7

4.2

BUY

REDUCE

39

38.1

1.1

1.6

35.5

24.4

1.8

2.6

10.3

8.9

28

ACCUMULATE

24

17.2

1.1

2.0

21.7

12.0

1.2

2.0

6.9

6.5

27

REDUCE

28

(2.4)

3.0

3.6

9.2

7.7

3.5

4.0

6.7

6.5

63

REDUCE

83

(24.1)

10.9

12.5

7.6

6.6

4.1

4.6

5.6

5.4

723

726

REDUCE

741

(2.0)

21.3

25.9

34.8

28.6

19.0

20.2

21.5

17.7

28-Jan-14

580

550

REDUCE

560

(1.8)

16.6

18.3

33.8

30.6

110.0

85.2

24.7

21.2

20-Jan-14

325

345

ACCUMULATE

320

7.9

11.2

12.3

28.6

26.0

40.7

39.0

19.5

17.9

139,104

30-Oct-13

212

233

ACCUMULATE

216

7.9

7.8

8.5

27.7

25.4

21.2

18.7

19.3

17.0

138,760

30-Jan-14

285

323

ACCUMULATE

273

18.3

10.1

12.2

27.0

22.4

28.3

28.3

18.4

15.2

5,662

04-Feb-14

95

100

ACCUMULATE

90

10.7

8.8

14.5

10.3

6.2

19.4

26.4

1.8

1.5

HCL Technologies

1,057,129

17-Jan-14

1,390

1,422

REDUCE

1,497

(5.0)

84.9

95.0

17.6

15.8

22.6

19.3

11.6

10.3

Infosys Technologies

2,084,524

13-Jan-14

3,550

3,740

ACCUMULATE

3,644

2.6

188.4

211.6

19.3

17.2

25.8

24.5

14.8

12.7

38,707

17-Jan-14

347

339

348

(2.7)

24.6

30.1

14.2

11.6

19.2

20.0

7.5

6.3

FMCG

Godrej Consumer Products Ltd

Information Technology

Geometric Ltd

Infotech Enterpises

Kotak Securities - Private Client Research

REDUCE

For Private Circulation

STOCK RECOMMENDATIONS

February 14, 2014

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

14-Feb

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

PE (x)

RoE (%)

EV/EBIDTA (x)

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

KPIT Technologies

32,198

24-Jan-14

159

169

ACCUMULATE

168

0.4

13.7

15.0

12.3

11.2

21.8

19.7

7.1

5.9

Mphasis Ltd ***

79,965

09-Dec-13

396

413

REDUCE

383

7.8

41.3

9.3

16.8

5.1

3,945

20-Jan-14

28

33

24

37.8

0.9

4.8

26.6

5.0

2.4

11.8

6.0

4.1

23,888

15-Jan-14

389

410

ACCUMULATE

407

0.7

38.1

45.7

10.7

8.9

19.6

20.3

5.7

4.6

NIIT LTD

NIIT Technologies

Oracle Financial Services Software

258,394

BUY

25-Nov-13

3,099

3,428

ACCUMULATE

3,085

11.1

153.5

158.8

20.1

19.4

16.1

14.4

13.9

17.1

Tata Consultancy Services (TCS)

4,243,447

17-Jan-14

2,350

2,505

ACCUMULATE

2,168

15.5

96.7

113.4

22.4

19.1

51.4

46.2

16.5

14.1

Wipro Technologies

1,379,449

20-Jan-14

553

581

ACCUMULATE

564

3.1

31.3

36.5

18.0

15.4

25.2

24.3

12.1

10.0

Zensar Technologies

16,607

23-Jan-14

386

406

REDUCE

385

5.4

55.3

59.2

7.0

6.5

28.0

23.8

4.1

3.0

10.1

Logistics

Adani Port & Special Economic Zone

294,615

28-Jan-14

146

172

BUY

147

17.0

9.8

11.3

15.0

13.0

24.2

22.2

12.7

Allcargo Global Logistics

14,500

14-Jan-14

135

160

BUY

134

19.4

14.0

15.9

9.6

8.4

10.3

10.6

4.9

4.5

Blue Dart Express

14,500

07-Feb-14

3,300

2,520

SELL

3,148

(19.9)

61.1

63.0

51.5

50.0

40.7

33.7

6.2

4.8

139,737

04-Feb-14

728

790

ACCUMULATE

717

10.2

50.5

56.3

14.2

12.7

14.2

14.2

9.3

8.2

Gateway Distriparks Ltd

14,299

04-Feb-14

127

148

BUY

132

11.8

12.2

14.8

10.9

8.9

15.6

16.8

6.4

5.7

Gujarat Pipavav Port Ltd (GPPL)

26,521

20-Dec-13

60

68

63

8.7

3.2

4.1

19.5

15.3

11.2

12.6

12.6

11.0

DB Corp

54,998

17-Jan-14

307

300

303

(1.0)

15.4

17.6

19.7

17.2

25.4

25.2

11.3

9.7

Dish TV India Ltd

48,731

24-Jan-14

50

55

ACCUMULATE

46

20.1

10.0

8.3

Entertainment Network (ENIL)

16,540

12-Feb-14

350

366

ACCUMULATE

347

5.6

17.7

18.3

19.6

18.9

15.4

13.9

10.1

8.8

HT Media

16,771

72

7.8

9.2

9.9

5.4

TV18 Broadcast

35,397

12-Feb-14

22

30

BUY

21

44.9

0.5

1.2

41.4

17.3

2.6

5.7

22.1

11.4

Jagran Prakashan

26,353

31-Jan-14

89

100

ACCUMULATE

88

14.2

6.3

7.4

13.9

11.8

20.3

21.8

7.1

5.9

Sun TV Network

129,705

10-Feb-14

361

403

ACCUMULATE

329

22.4

17.8

20.5

18.5

16.1

23.6

24.6

8.4

Zee Entertainment Ent

255,649

23-Jan-14

284

267

REDUCE

261

2.1

9.2

10.7

28.4

24.4

20.9

21.1

19.7

16.5

Hindalco

206,274

14-Feb-14

100

118

BUY

100

18.1

11.3

12.5

8.8

8.0

8.9

9.0

8.5

6.6

Hindustan Zinc

520,768

20-Jan-14

129

141

ACCUMULATE

123

14.4

16.0

16.6

7.7

7.4

18.1

16.3

3.7

3.0

SAIL

253,201

13-Nov-13

63

51

61

(16.8)

6.7

7.5

9.1

8.2

6.6

7.0

10.5

8.6

Tata Steel Ltd

375,813

12-Feb-14

390

426

371

14.9

36.8

65.1

10.1

5.7

10.5

16.9

5.0

5.0

Container Corporation of India

ACCUMULATE

Media

REDUCE

NR

Metals

Kotak Securities - Private Client Research

SELL

ACCUMULATE

For Private Circulation

STOCK RECOMMENDATIONS

February 14, 2014

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

307

321

Latest

Reco

Price

as on

14-Feb

(Rs)

Upside/

(Downside)

(%)

319

EPS (Rs)

PE (x)

RoE (%)

EV/EBIDTA (x)

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

0.6

14.1

19.9

22.6

16.0

23.4

24.0

9.8

7.8

Mid Cap

Kajaria Ceramics Ltd

24,125

21-Jan-14

ACCUMULATE

614,660

24-Jan-14

325

354

ACCUMULATE

322

9.9

63.6

61.4

5.1

5.2

20.2

15.8

1.5

1.2

145,574

29-Nov-13

300

330

ACCUMULATE

294

12.1

9.6

11.2

30.7

26.3

52.9

61.1

20.5

17.8

Gujarat State Petronet Ltd (GSPL)

31,079

07-Feb-14

61

65

ACCUMULATE

55

17.3

7.7

8.1

7.2

6.9

13.3

12.4

3.7

3.7

Indraprastha Gas (IGL)

35,819

11-Feb-14

264

290

ACCUMULATE

256

13.3

25.7

22.2

10.0

11.5

21.5

16.3

4.7

4.4

Mangalore Refinary & Petrochemicals (MRPL)

70,868

10-Feb-14

44

39

SELL

40

(3.6)

3.0

13.3

8.6

25.0

6.9

Oil India Ltd

274,733

13-Feb-14

461

580

BUY

457

26.9

55.7

59.3

8.2

7.7

15.6

15.0

3.5

3.0

Petronet LNG

86,813

03-Feb-13

110

121

ACCUMULATE

116

4.5

9.0

11.2

12.9

10.4

14.1

15.6

7.9

6.2

1,090,534

30-Jan-14

128

165

BUY

132

24.8

12.4

13.6

10.7

9.7

12.3

12.5

9.4

8.5

175,246

11-Feb-14

75

84

74

13.7

3.6

6.4

20.5

11.5

7.3

11.8

5.8

5.4

30,585

03-Feb-14

203

279

BUY

211

32.1

10.2

10.9

20.7

19.4

8.1

8.1

17.2

15.2

ABG Shipyard Ltd

13,318

22-Nov-13

270

250

SELL

262

(4.5)

2.9

2.2

90.2

118.9

0.8

0.6

10.1

10.2

GE Shipping Company

43,928

NR

289

38.1

7.6

8.2

3.5

Pipavav Defence & Offshore Engg

23,985

13-Dec-13

43

45

REDUCE

35

29.7

0.2

2.0

173.5

17.4

0.7

6.7

11.3

10.8

Shipping Corporation of India

15,077

23-Dec-13

40

46

ACCUMULATE

36

29.2

2.4

14.8

1.8

21.1

10.8

Oil & Gas

Cairn India Ltd

Castrol India Ltd

Power

NTPC

Tata Power Company Ltd

ACCUMULATE

Real Estate

Phoenix Mills Ltd

Shipping

Source: Kotak Securities - Private Client Research

All recommendations are with a 9-12 month perspective from the date of the report/update. Investors are requested to use their discretion while deciding the timing, quantity of investment

as well as the exit.

*

Figures for CY13 & CY14

**

Financials are for FY13 & FY14 - September year end

*** Financials are for FY13 & FY14 - October year end

#

Figures for FY14 & FY15 - September year ending

NR = Not Rated. The investment rating and target price, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s) and/or Kotak Securities policies

in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction involving this company and in certain other circumstances.

NM= Not Meaningful

Kotak Securities - Private Client Research

For Private Circulation

STOCK RECOMMENDATIONS

February 14, 2014

Fundamental Research Team

Dipen Shah

IT

dipen.shah@kotak.com

+91 22 6621 6301

Saurabh Agrawal

Metals, Mining

agrawal.saurabh@kotak.com

+91 22 6621 6309

Ruchir Khare

Capital Goods, Engineering

ruchir.khare@kotak.com

+91 22 6621 6448

Amit Agarwal

Logistics, Transportation

agarwal.amit@kotak.com

+91 22 6621 6222

Sanjeev Zarbade

Capital Goods, Engineering

sanjeev.zarbade@kotak.com

+91 22 6621 6305

Saday Sinha

Banking, NBFC, Economy

saday.sinha@kotak.com

+91 22 6621 6312

Ritwik Rai

FMCG, Media

ritwik.rai@kotak.com

+91 22 6621 6310

Jayesh Kumar

Economy

kumar.jayesh@kotak.com

+91 22 6652 9172

Teena Virmani

Construction, Cement

teena.virmani@kotak.com

+91 22 6621 6302

Arun Agarwal

Auto & Auto Ancillary

arun.agarwal@kotak.com

+91 22 6621 6143

Sumit Pokharna

Oil and Gas

sumit.pokharna@kotak.com

+91 22 6621 6313

K. Kathirvelu

Production

k.kathirvelu@kotak.com

+91 22 6621 6311

Amol Athawale

amol.athawale@kotak.com

+91 20 6620 3350

Premshankar Ladha

premshankar.ladha@kotak.com

+91 22 6621 6261

Rahul Sharma

sharma.rahul@kotak.com

+91 22 6621 6198

Malay Gandhi

malay.gandhi@kotak.com

+91 22 6621 6350

Technical Research Team

Shrikant Chouhan

shrikant.chouhan@kotak.com

+91 22 6621 6360

Derivatives Research Team

Sahaj Agrawal

sahaj.agrawal@kotak.com

+91 79 6607 2231

Prashanth Lalu

prashanth.lalu@kotak.com

+91 22 6621 6110

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where

such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs

of individual clients.

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it,

accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors.

Reports based on technical analysis centers on studying charts of a stocks price movement and trading volume, as opposed to focusing on a companys fundamentals and as such, may not match with a report on a companys fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment

decisions that are inconsistent with the recommendations expressed herein.

Kotak Securities Limited has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group . The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, target price of the Institutional Equities Research Group of Kotak Securities Limited.

We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential

conflict of interest with respect to any recommendation and related information and opinions.

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will

be, directly or indirectly related to specific recommendations or views expressed in this report.

No part of this material may be duplicated in any form and/or redistributed without Kotak Securities prior written consent.

Our research should not be considered as an advertisement or advice, professional or otherwise. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and the like

and take professional advice before investing.

Kotak Securities Limited. Reg Off.: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E) Mumbai 400 05. CIN: U99999MH1994PLC134051, Tel No.: +22 43360000, Fax No.: +22 67132430.Website: www.kotak.com. Correspondence address:

Infinity IT Park, Bldg. No 21, Opp Film City Road, A K Vaidya Marg, Malad (East), Mumbai 400097.Tel No :66056825.SEBI Reg No's: NSE INB/INF/INE 230808130, BSE INB 010808153/INF 011133230/INE 011207251, OTC INB 200808136, MCXSX INE

260808130/INB 260808135/INF 260808135, AMFI ARN 0164.NSDL: IN-DP-NSDL-23-97. CDSL: IN-DPCDSL-158-2001. Investment in securities market is subject to market risk, please read the combined risk disclosure document prior to investing. Compliance Officer - Mr. Sandeep Chordia. Tel. No: 022 6605 6825, Email id: ks.compliance@kotak.com.

In case you require any clarification or have any concern, kindly write to us at below email ids: "For Trading Account related queries: service.securities@kotak.com; "For Demat Account related queries: ks.demat@kotak.com.

Alternatively, you may feel free to contact our customer service desk at our toll free numbers 18002099191 or 1800222299. You may also call at 30305757 by using your city STD code as a prefix.

Kotak

Securities

- Private

Client

Research

ForarePrivate

Circulation

6

In

case you

wish to escalate

your

concern

/ query, please write to us at ks.escalation@kotak.com and if you feel you

still unheard,

write to our customer service HOD at ks.servicehead@kotak.com.

You might also like

- bs1000-2015 04Document4 pagesbs1000-2015 04premalgandhi10No ratings yet

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalNo ratings yet

- IDX Fact Book 2006 PDFDocument57 pagesIDX Fact Book 2006 PDFdavidwijaya1986No ratings yet

- Financial Instrument Symbol Name Last Change Previous CloseDocument12 pagesFinancial Instrument Symbol Name Last Change Previous CloseSumeer BeriNo ratings yet

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1No ratings yet

- Stock Reco 23042020 OgDocument5 pagesStock Reco 23042020 OgManmohan TiwariNo ratings yet

- Valuation SnapshotDocument1 pageValuation SnapshotAleena PaulNo ratings yet

- Company Pricedate Peg Current Pe Current PB 1-Year ReturnDocument11 pagesCompany Pricedate Peg Current Pe Current PB 1-Year ReturnShubham SinghNo ratings yet

- Prudent Investment Insights 31st July 2020 1597474493863Document33 pagesPrudent Investment Insights 31st July 2020 1597474493863bimalishaNo ratings yet

- Stock Latest Price Change Prev Close Volume Quantity Inv. PriceDocument1 pageStock Latest Price Change Prev Close Volume Quantity Inv. PricesenthilkumarNo ratings yet

- Valuation Snapshot: 17 March 2023 18Document1 pageValuation Snapshot: 17 March 2023 18Hari BhaskarNo ratings yet

- Most Active SecuritiesDocument7 pagesMost Active SecuritiesJyothi KrishnaNo ratings yet

- BSE Sensex Status: World IndicesDocument28 pagesBSE Sensex Status: World IndicesHirendra PatilNo ratings yet

- Monthly Closing Prices of SBI and NSEDocument13 pagesMonthly Closing Prices of SBI and NSEMahaveer ShivhareNo ratings yet

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarNo ratings yet

- Australian Company Financial Records and EIN ApplicationsDocument157 pagesAustralian Company Financial Records and EIN Applicationsbatman1234No ratings yet

- KM 397 - Ahmedabad - Udaipur - Axle Load AnalysisDocument21 pagesKM 397 - Ahmedabad - Udaipur - Axle Load AnalysisKavi RangasamyNo ratings yet

- Stock Reco 12112018 VaDocument6 pagesStock Reco 12112018 VaTanmayNo ratings yet

- Sheela CDDocument1 pageSheela CDsushratNo ratings yet

- US Internal Revenue Service: Sec I II III 2003Document160 pagesUS Internal Revenue Service: Sec I II III 2003IRSNo ratings yet

- Valuation SnapshotDocument1 pageValuation SnapshotadityaNo ratings yet

- Angel SuggestedDocument4 pagesAngel Suggestedmangalraj900No ratings yet

- Car Comperative Statement From Jan.11Document3 pagesCar Comperative Statement From Jan.11V V Udaya BhanuNo ratings yet

- Stock market data tableDocument36 pagesStock market data tablebaniNo ratings yet

- Fundamental Analysis of StocksDocument12 pagesFundamental Analysis of Stocksverma vikasNo ratings yet

- 18 Cost Report.......Document57 pages18 Cost Report.......Anushke HennayakeNo ratings yet

- Weekly Market Outlook 11.05.13Document5 pagesWeekly Market Outlook 11.05.13Mansukh Investment & Trading SolutionsNo ratings yet

- Lockup Expiration Dates and CompaniesDocument4 pagesLockup Expiration Dates and CompaniesBhagwan BachaiNo ratings yet

- XL Axiata Tbk. Company Report January 2018Document3 pagesXL Axiata Tbk. Company Report January 2018Choiri AnnisaNo ratings yet

- พลังงานลมในประเทศไทยDocument29 pagesพลังงานลมในประเทศไทยChanade WichasilpNo ratings yet

- 2001 FTSE All-ShareDocument18 pages2001 FTSE All-SharetNo ratings yet

- Antm Tins Ptba 070529 LGDocument1 pageAntm Tins Ptba 070529 LGCristiano DonzaghiNo ratings yet

- TM-20 Apr 2018Document4 pagesTM-20 Apr 2018Anonymous 9xAmuLRrdyNo ratings yet

- Ticker Date/Time Close Change Pix1 Pix2 Pix3 RemarksDocument5 pagesTicker Date/Time Close Change Pix1 Pix2 Pix3 Remarksfajaraljogja100% (1)

- Morning Call Morning Call: Markets Snaps 3-Day Losing StreakDocument4 pagesMorning Call Morning Call: Markets Snaps 3-Day Losing StreakrcpgeneralNo ratings yet

- US Internal Revenue Service: 2004p1212 Sect I-Iii TablesDocument133 pagesUS Internal Revenue Service: 2004p1212 Sect I-Iii TablesIRSNo ratings yet

- Selangor: Transaction Statistics Q3 2015Document14 pagesSelangor: Transaction Statistics Q3 2015Evaline JmNo ratings yet

- MEIS Duty Credit Scrip Issued for Rs. 455,492 ExportsDocument3 pagesMEIS Duty Credit Scrip Issued for Rs. 455,492 ExportsYash SrivastavaNo ratings yet

- Cross - Iyears Companbs BI Dualitman - O Roa ROE SizeDocument8 pagesCross - Iyears Companbs BI Dualitman - O Roa ROE SizeNouman MujahidNo ratings yet

- Data For The Year 2014: Oil and GasDocument14 pagesData For The Year 2014: Oil and Gasعباس ناناNo ratings yet

- CPGT Citra Maharlika Nusantara Corpora Tbk. Company Report AnalysisDocument3 pagesCPGT Citra Maharlika Nusantara Corpora Tbk. Company Report AnalysisIta SulistianiNo ratings yet

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraNo ratings yet

- Forecasting Case - XlxsDocument8 pagesForecasting Case - Xlxsmayank.dce123No ratings yet

- Daily Market Update: Last UpateDocument2 pagesDaily Market Update: Last UpateTowfick KamalNo ratings yet

- PHS Jan-Agt 2021Document2 pagesPHS Jan-Agt 2021Andre GamingNo ratings yet

- Nifty 500Document4 pagesNifty 500vmichelle9No ratings yet

- UntitledDocument22 pagesUntitledvineetNo ratings yet

- Analysis of Power and Energy Sector: Corporate Finance ProjectDocument29 pagesAnalysis of Power and Energy Sector: Corporate Finance ProjectPranjal MehrotraNo ratings yet

- Nusantara Infrastructure TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesNusantara Infrastructure TBK.: Company Report: January 2018 As of 31 January 2018Gaztin Tri SetyaningsihNo ratings yet

- Chennai Tyre Plant Monthly Production ReportDocument2 pagesChennai Tyre Plant Monthly Production ReportDurai NaiduNo ratings yet

- Cardig Aero Services Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesCardig Aero Services Tbk. (S) : Company Report: January 2017 As of 31 January 2017Rudi PramonoNo ratings yet

- Placement 2013-2014 Dtu Full DetailsDocument8 pagesPlacement 2013-2014 Dtu Full Detailsdishant2012No ratings yet

- IDX STATISTICS Indonesia Stock Exchange Quarterly StatisticsDocument1 pageIDX STATISTICS Indonesia Stock Exchange Quarterly StatisticsDefinite NineluckNo ratings yet

- LTO Car Registration Per RegionDocument16 pagesLTO Car Registration Per RegionFranz KarununganNo ratings yet

- Pivot Point Table: Retail ResearchDocument5 pagesPivot Point Table: Retail ResearchDinesh ChoudharyNo ratings yet

- Weekly Market Outlook 29.04.13Document5 pagesWeekly Market Outlook 29.04.13Mansukh Investment & Trading SolutionsNo ratings yet

- Semen Indonesia Sales Volume (In Tons) : Lap AsiDocument1 pageSemen Indonesia Sales Volume (In Tons) : Lap AsiRizal SyaifuddinNo ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- Harbour Line: Mumbai CST To ChemburDocument34 pagesHarbour Line: Mumbai CST To ChemburCarla TateNo ratings yet

- Stop Procrastinating!: AssessmentDocument7 pagesStop Procrastinating!: AssessmentCarla TateNo ratings yet

- Seductress Women Who Ravished The World and Their Lost Art of LoveDocument3 pagesSeductress Women Who Ravished The World and Their Lost Art of LoveCarla TateNo ratings yet

- Link Your Aadhaar With Mobile Number To Stay Active!Document3 pagesLink Your Aadhaar With Mobile Number To Stay Active!Carla TateNo ratings yet

- Other NewsDocument1 pageOther NewsCarla TateNo ratings yet

- Dunning Kruger PDFDocument5 pagesDunning Kruger PDFhubik38No ratings yet

- Sabbatical - Wikipedia, The Free EncyclopediaDocument2 pagesSabbatical - Wikipedia, The Free EncyclopediaCarla TateNo ratings yet

- Epfo - Contact OfficeDocument2 pagesEpfo - Contact OfficeCarla TateNo ratings yet

- To Build Their World-Class CompaniesDocument4 pagesTo Build Their World-Class CompaniesCarla TateNo ratings yet

- Regd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1Document1 pageRegd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1valvinderNo ratings yet

- First Advantage Offshore Services - Associate - Senior Associate, MumbaiDocument1 pageFirst Advantage Offshore Services - Associate - Senior Associate, MumbaiCarla TateNo ratings yet

- Technicals - Nifty Support & ResistanceDocument1 pageTechnicals - Nifty Support & ResistanceCarla TateNo ratings yet

- Serco BPO careers UK bankingDocument2 pagesSerco BPO careers UK bankingCarla TateNo ratings yet

- 101 Tactical TipsDocument34 pages101 Tactical TipsBallu BaluNo ratings yet

- Job - Trainee Executive - Mumbai, Bengaluru - Bangalore, Hyderabad - Secunderabad - Rhizome Hospitality Solutions - 0-To-1 Years of Experience - Jobs IndiaDocument2 pagesJob - Trainee Executive - Mumbai, Bengaluru - Bangalore, Hyderabad - Secunderabad - Rhizome Hospitality Solutions - 0-To-1 Years of Experience - Jobs IndiaCarla TateNo ratings yet

- Altisource QuestionsDocument2 pagesAltisource QuestionsCarla TateNo ratings yet

- Nuggets of WisdomDocument2 pagesNuggets of WisdomCarla TateNo ratings yet

- 5Document8 pages5Carla TateNo ratings yet

- Aptitude Ablity Part IIIDocument4 pagesAptitude Ablity Part IIIShridhar BassapurNo ratings yet

- LyricsDocument1 pageLyricsCarla TateNo ratings yet

- User Manual: S19C350NW S22C350B S22C350H S23C340H S23C350B S23C350H S24C340HL S24C350BL S24C350HL S24C350H S27C350HDocument156 pagesUser Manual: S19C350NW S22C350B S22C350H S23C340H S23C350B S23C350H S24C340HL S24C350BL S24C350HL S24C350H S27C350HCarla TateNo ratings yet

- International Mathematics Olympiad: Sample PaperDocument5 pagesInternational Mathematics Olympiad: Sample PaperCarla Tate100% (1)

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Mr. Kedar MurdeshwarDocument1 pageMr. Kedar MurdeshwarCarla TateNo ratings yet

- What Is Trigger Price or Stop Loss OrderDocument1 pageWhat Is Trigger Price or Stop Loss OrderCarla TateNo ratings yet

- Ind CNX SmallcapDocument3 pagesInd CNX SmallcapCarla TateNo ratings yet

- Movies ListDocument3 pagesMovies ListCarla TateNo ratings yet

- Technicals - Nifty Support & ResistanceDocument1 pageTechnicals - Nifty Support & ResistanceCarla TateNo ratings yet

- 35 Smart Dating Rules Explained: Marius PanzarellaDocument17 pages35 Smart Dating Rules Explained: Marius PanzarellaIgor Alperovich100% (1)

- Understanding GlobalizationDocument22 pagesUnderstanding GlobalizationNica MontevirgenNo ratings yet

- Workbook PDFDocument116 pagesWorkbook PDFSuvodeep GhoshNo ratings yet

- Making An Investment PlanDocument10 pagesMaking An Investment Plananon_118801No ratings yet

- Academic Year 2019-2020: St. John College of Humanities & SciencesDocument78 pagesAcademic Year 2019-2020: St. John College of Humanities & SciencesRinkesh SoniNo ratings yet

- Guidance Note On Accounting For Derivative ContractsDocument25 pagesGuidance Note On Accounting For Derivative Contractsca.atakNo ratings yet

- Ind As 109 PDFDocument5 pagesInd As 109 PDFashmit bahlNo ratings yet

- GTB FinTech Whitepaper (DB012) A4 DIGITALDocument28 pagesGTB FinTech Whitepaper (DB012) A4 DIGITALErinda MalajNo ratings yet

- Relevance of The 4e Marketing Model To TheDocument12 pagesRelevance of The 4e Marketing Model To Theankit palNo ratings yet

- A Sample Digital Marketing Agency Business Plan TemplateDocument24 pagesA Sample Digital Marketing Agency Business Plan TemplateSoulFront Attack50% (2)

- Theories and stages of business internationalisationDocument36 pagesTheories and stages of business internationalisationRomuald DongNo ratings yet

- Untangling The Interlocks: E L P L H V I P C ADocument140 pagesUntangling The Interlocks: E L P L H V I P C APaolo Ervin PerezNo ratings yet

- Terminal Value - Perpetuity Growth & Exit Multiple MethodDocument11 pagesTerminal Value - Perpetuity Growth & Exit Multiple MethodFahmi HaritsNo ratings yet

- @home: - Khushboo Goel From: IIPM (Mumbai) Customer ResearchDocument37 pages@home: - Khushboo Goel From: IIPM (Mumbai) Customer ResearchSunil GoelNo ratings yet

- 11 August GMAT Club AnalysisDocument17 pages11 August GMAT Club AnalysisMANOUJ GOELNo ratings yet

- Protective Put StrategyDocument3 pagesProtective Put StrategydanNo ratings yet

- Chapter 4Document58 pagesChapter 4Anh Võ TừNo ratings yet

- Chapter 4: Negative Externalities and Policy SolutionsDocument36 pagesChapter 4: Negative Externalities and Policy SolutionsSurya SrinivasanNo ratings yet

- Midterm Without AnswersDocument30 pagesMidterm Without AnswersLe Tran Duy Khanh (K17 HCM)No ratings yet

- Pasa-BUY: " " Opportunity SectionDocument3 pagesPasa-BUY: " " Opportunity SectionPeter Cranzo MeisterNo ratings yet

- Lean Vs AgileDocument13 pagesLean Vs AgileSukesh shivyaNo ratings yet

- Source of Regular Input VATDocument1 pageSource of Regular Input VATMarie Tes LocsinNo ratings yet

- A Meeting of MindsDocument3 pagesA Meeting of MindsBui Bich PhuongNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Clothingindustry Blogspot Com 2017 12 Merchandiser-Merchandising-Garment HTMLDocument17 pagesClothingindustry Blogspot Com 2017 12 Merchandiser-Merchandising-Garment HTMLDeepthi SonuNo ratings yet

- 7 Essential Elements Business PlanDocument2 pages7 Essential Elements Business Planminorona2409No ratings yet

- Bus 497a PaperDocument16 pagesBus 497a Paperjack stauberNo ratings yet

- Profitability:: Projected SalesDocument2 pagesProfitability:: Projected SalesRehan ShariarNo ratings yet

- QUESTION - Mid Term Exam - CH 1-2Document2 pagesQUESTION - Mid Term Exam - CH 1-2Akib AbdullahNo ratings yet

- Bond Portfolio StrategiesDocument32 pagesBond Portfolio StrategiesSwati VermaNo ratings yet

- Return and RiskDocument20 pagesReturn and Riskdkriray100% (1)