Professional Documents

Culture Documents

BCM 2333@HK 072815 14130

Uploaded by

bodaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BCM 2333@HK 072815 14130

Uploaded by

bodaiCopyright:

Available Formats

Morning Express

28 July 2015

Focus of the Day

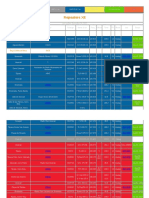

Indices

Sohu (SOHU.US)

Neutral

2Q15 top-line and bottom-line beat

Yuan MA

BUY

SELL

yuan.ma@bocomgroup.com

Last Closing: US$67.54

LT

BUY

Stock

Target Price: US$61.40

Sohus 2Q15 top-line and bottom-line beat. Mobile ad revenue contributed over 50% of

media portal ad revenue. The growth of Sohus video business slowed down due to the

macro environment and policy regarding American TV dramas. Sogou revenue continued

strong growth momentum, up 62%/27% YoY/QoQ to US$147mn. Game revenue was

higher than expectation, while the newly launched games missed expectation. Given the

strength of Sogous business, we lift Sogous 2015E/2016E revenue by 5%/4%, partially

offset by our higher estimate of SBC of Sogou. We also cut game revenue for 2015E by

5% as we are conservative on the mobile game pipeline, offset by lower operating

expenses. We lower Sohus 2015E revenue estimate by 3%, and fine-tune 2015E

non-GAAP net loss per ADS from US$2.31 to US$2.25 as our lower estimate of spending

offsets the decrease in revenue estimate. We fine-tune TP from US$60.33 to US$61.40

and maintain Neutral.

CT Environmental Group (1363.HK/2919.HK)

Neutral

Expecting >50% YoY growth in 1H15 net profit;

maintain Buy

Wallace CHENG

Last Closing: HK$2.65

wallace.cheng@bocomgroup.com

Upside: +36%

1d %

-3.09

-3.84

-8.48

-8.21

-7.00

-6.58

-0.73

-0.58

-0.96

-1.13

-2.57

-2.56

Ytd %

3.16

-6.29

15.17

17.43

52.87

17.08

-2.15

0.42

6.41

-0.93

15.33

12.76

Close

53.47

1,094.18

14.58

5,188.00

123.26

1.56

1.11

3m %

-17.52

-9.73

-12.40

-14.46

-3.57

1.45

0.98

Ytd %

-6.73

-7.65

-7.15

-17.65

-2.82

-0.10

-8.34

bps change

0.39

HIBOR

US 10 yield

2.22

Source: Bloomberg

3m

0.01

0.21

6m

0.00

0.50

Indicators

Brent

Gold

Silver

Copper

JPY

GBP

EURO

HSI Technical

LT

BUY

BUY

SELL

Close

HSI

24,352

H Shares

11,231

SH A

3,903

SH B

341

SZ A

2,260

SZ B

1,204

DJIA

17,441

S&P 500

2,068

Nasdaq

5,040

FTSE

6,505

CAC

4,928

DAX

11,056

Source: Bloomberg

Stock

HSI

50 d MA

200 d MA

14 d RSI

Short Sell (HK$m)

Source: Bloomberg

24,352

26,481

25,069

35

12,684

Target Price: HK$3.60

CTEG posted a positive profit alert for 1H15 interim results, expecting not less than 50%

YoY growth in net profit, i.e. not less than HK$267m net profit during the period. The

positive profit alert is in line with our expectation as the estimated 1H15 net profit

already accounts for 41% of our full year net profit estimate of HK$641m in 2015.

The substantial rise in 1H15 was a result of: (1) full period (i.e. 6 months) contribution

from Yinglong Phase 1 (IWWT) and Qingyuan Lvyou (sludge) projects in 2015 vs ~1 month

contribution from these 2 projects in 1H14; (2) full period contribution from IWWT and

water supply projects in Shunde and Zhongshan (secured in 2H14); (3) contribution from

new copper etching projects and operation management contract from Guangzhou Lvyou

(secured in 1H15); and (4) improved utilization rates of the existing projects.

Download our reports from Bloomberg: BOCMenter

BOCOM Int'l Corporate Access

14 Aug

Phoenix Healthcare (1515.HK)

We would greatly appreciate your support

in the 2015 Asiamoney Brokers Poll as we

strive to provide value-added research

ideas and corporate access activities. Kindly

vote for the BOCOM International research

team at

http://www.globalcapital.com/asiamoneybrokerspoll.

Morning Express

28 July 2015

We maintain our positive stance on CTEG, given its strong execution on new projects and

robust earnings CAGR of 31% during 2014-17. As a result of the recent 1:4 share split, we

adjust our target price from HK$14.4 to HK$3.60. Maintain Buy.

OOIL (316.HK)

Neutral

OOIL released 2Q15 operating data

LT

BUY

SELL

Geoffrey CHENG, CFA

geoffrey.cheng@bocomgroup.com

Last Closing: HK$37.75

Upside: +48.3%

Hang Seng Index (1 year)

29,000

28,000

27,000

26,000

25,000

24,000

23,000

22,000

21,000

Source: Company data, Bloomberg

BUY

HS China Enterprise Index (1 year)

Stock

Target Price: HK$56.00

What's new?

OOIL released 2Q15 operating data. Total shipping volume was down 2.1% YoY. Total

revenue dropped 9.3% YoY and average revenue declined 7.4% YoY.

Analysis:

The operating data reflected the tough operating environment of the container

shipping industry during the quarter. For OOIL, the more important development

was that OOIL increased its loadable capacity by 7.1% YoY during 2Q15, and the

wrong volume resulted in a 6.8% YoY decline in overall load factor for the period.

In 1H15, volume declined 2.3% YoY and revenue reported a 6.4% YoY drop. As the

loadable capacity increased only 2.8% in 1H15, load factor was down 3.8% YoY. In

short, the loadable capacity increase in 1H15 was largely due to the increase in 2Q15.

15,000

14,000

13,000

12,000

11,000

10,000

9,000

8,000

Source: Company data, Bloomberg

Shanghai A-shares (1 year)

5,500

5,000

4,500

4,000

3,500

3,000

2,500

2,000

Average revenue per TEU was down 4.2% YoY to US$987/TEU, with the most notable

decline from the Asia-Europe tradelane, by 12.6% YoY (18.5% YoY in 2Q15).

Source: Company data, Bloomberg

While OOIL used to be resilient against freight rate decline amongst its peers, the

magnitude of decline in average freight rate on the Asia-Europe tradelane was still

hefty for OOIL, in our view. We should, however, appreciate the fact that OOIL

tried to reduce the impact by cutting the shipping volume on the Asia-Europe

tradelane by 11.8% YoY in 2Q15 (3.4% YoY in 1H15). The average revenue

performance of the Transpacific tradelane (up 2.0% YoY) was, however, a pleasant

surprise to us.

Shenzhen A-shares (1 year)

3,500

3,000

2,500

2,000

1,500

1,000

Source: Company data, Bloomberg

Recommendation:

We have a LT BUY recommendation for OOIL at the moment.

Notwithstanding the lacklustre average freight rate performance in 1H15, we think

the substantial decline in bunker price during the period could buffer most of the

impact.

Download our reports from Bloomberg: BOCMenter

Morning Express

28 July 2015

Container Shipping Sector

Weekly container shipping commentary

Geoffrey CHENG, CFA geoffrey.cheng@bocomgroup.com

MP

UP

OP

Despite the lackluster demand on the Asia-Europe tradelane, capacity on the tradelane is

expected to increase, according to Seaintel, an international maritime analyst. The

Shanghai Container Freight Index spiraled down further, by 7.5% WoW, with various

tradelanes reporting their lowest freight rates of this year. The 2Q15 operating data of

OOIL underlined the tough operating environment of the industry. The stock market

tumbled on 27th July, dragging the valuations of HK-listed container shipping companies

lower. Meanwhile, we maintain our MARKET PERFORM recommendation for the

sector.

Great Wall Motor (2333.HK)

Neutral

1H15 results in line

Wei YAO

Last Closing: HK$27.15

LT

BUY

BUY

SELL

wei.yao@bocomgroup.com

Upside: +16.0%

Stock

Target Price: HK$31.50

(1) Great Wall Motor achieved sales revenue of RMB37.145bn in 1H15, up 30.2% YoY.

Net profit reached RMB4.901bn, up 24% YoY, with EPS of RMB1.61. The company

achieved net profit of RMB2.37bn in 2Q15, down 6.7% QoQ and up 21.4% YoY. The 1H15

results were generally in line. (2) 2Q15 profit margin improved further. (3) Sales

performance remained to be an important indicator. (4) The additional share issuance

could favor the companys long-term development but pose a dilutive effect in the short

term. (5) Maintain Neutral. Overall, the 1H15 results of Great Wall Motor were solid and

in line with consensus. We expect FY15/16/17E EPS to reach RMB3.33/3.90/4.36. Looking

ahead, we believe H8 and H6 sales are important indicators. Given the intensified

competition in the SUV industry, the companys new and old product sales were weak.

We maintain Neutral on the counter. Given the potential impact of the non-public

additional share issuance on the future EPS and intensified industry competition, we cut

our TP to HK$31.5, equivalent to FY15E 7.5x PE.

Download our reports from Bloomberg: BOCMenter

Morning Express

28 July 2015

Market Review

Hong Kong stocks plummeted on Monday, with the Hang Seng Index losing 776 points, or

3.1%, to finish at 24,351. HKEx (388.HK) slumped 4.9%. Brokers fell, CITIC Securities

(6030.HK) fell 9.1%. Haitong Securities (6837.HK) dropped 10.7%. Insurers retreated.

China Life (2628.HK) was down 5.5%. Ping An (2318.HK) dropped 2.2%. Mainland

developers declined. CR Land (1109.HK) fell 5%. COLI (688.HK) dropped 4.5%. Auto names

declined. Great Wall Motor (2333.HK) dropped 5.7%. BYD (1211.HK) slumped 7.2%.

US and European stocks finished lower. The DJIA fell 127.94 points, or 0.7%, to 17,440.59.

The S&P 500 dropped 12 points, or 0.6%, to 2,067.64. Stoxx Europe 600 dropped 2.2% to

385.91.

News Reaction

China sees around 4% export growth in 2015, SICC says. The State Information Center of

China (SICC) said it expected exports to reverse the negative growth trend and show

about 6.2% growth in 2H15, while the imports may fall by about 4.5%. The full-year

exports may rise by about 4% while imports may fall by about 10.5%.

Industrial profit remains stable; cumulative fall narrows further, NBS says. The

industrial and corporate financial data of the National Bureau of Statistics (NBS) showed

that the total profit of industrial enterprises above the designated size dipped 0.7% YoY

in 1H15, down 0.1 ppt from that of 5M15. In particular, the total profit slipped 0.3% YoY

in June, compared with the 0.6% YoY growth in May. Dr. He Ping, head of the NBS

Industry Division, believed that the fall in industrial profit in June was mainly affected by

three factors.

1H15 power consumption of manufacturing sector up 0.1% YoY, NEA says. According to

media reports, Liu Qi, deputy director of the National Energy Administration (NEA), said

the power consumption in 1H15 was driven by the high-end equipment manufacturing

and light manufacturing sector. The power consumption of manufacturing sector grew

0.1% YoY in 1H15, up 0.2 ppt YoY from 5M15. In particular, the power consumption of

manufacturing sector increased by 0.7% YoY in June, up 0.5 ppt from the previous month.

SSE and SZSE balance of margin trading & securities lending drops to RMB1.45tn last Fri.

Shanghai Composite Index closed down 1.3% last Friday. On the same day, the balance of

margin trading and securities lending in both Shanghai and Shenzhen bourses reduced

RMB930m to approximately RMB1.45tn.

Huawei to lay fiber-optic cables in Guinea, Africa involving US$240m. According to

media reports, Huawei will lay 4,000km of fiber-optic cables in Guinea, Africa over the

next two years to provide high-speed Internet services. According to the Guinean

government statement, the project will cost US$238m and will be completed by 2017. By

then, Guinea will become the first country in West Africa to benefit from such a wide

cable coverage.

Download our reports from Bloomberg: BOCMenter

Morning Express

28 July 2015

Economic releases for this week - USA

Date Time

27-Jul

28-Jul

29-Jul

30-Jul

Source: Bloomberg

Event

Durable goods order

Consumer Confidence

MBA mortgage applications

Initial jobless claims (k)

Economic releases for this week - China

Survey

3.0%

100.0

-

Prior

-2.2%

101.4

0.1%

225.0

Date Time

-

Event

-

Survey

-

Prior

-

Source: Bloomberg

BOCOM Research Latest Reports

Data

27 Jul 2015

27 Jul 2015

24 Jul 2015

24 Jul 2015

24 Jul 2015

23 Jul 2015

23 Jul 2015

22 Jul 2015

22 Jul 2015

21 Jul 2015

21 Jul 2015

21 Jul 2015

20 Jul 2015

17 Jul 2015

17 Jul 2015

17 Jul 2015

16 Jul 2015

16 Jul 2015

15 Jul 2015

15 Jul 2015

14 Jul 2015

Report

Guangshen Railway (525.HK) - 1H2015 operating data - freight performance worsened, passenger operation

lackluster

GOME (493.HK) - Acquisition of stores from major shareholder improves efficiency; TP pared; Buy

maintained

Biostime (1112 HK) Prolonged price competition; Downgrade to SELL

Daphne (210.HK) - Another year of profit warning; escalating pressure on destocking/store closure serves as

a major downside risk

Transportation Sector - Weekly transportation news wrap

Financial Sector - Banking Sector - Clean politics: The biggest positive driver for the banking sector and the

market

China Property Sector - Market volatility does not alter property uptrend

D&G Technology Holding Company (1301.HK) - Initiate at BUY; Good catalysts from national strategies

Sa Sa (178.HK) - Pressured 1Q; softening outlook sustained

Far East Consortium (35.HK) - Big step of transformation

Container Shipping Sector - Weekly container shipping commentary

Sohu (SOHU.US) - 2Q15 preview: Sogou became profitable; video continues to incur losses

Vinda (3331 HK) - Outperformance continues; raise TP to HK$20.00

China Property Sector - Painful cost for late comers

Transportation Sector - Weekly transportation news wrap

Phoenix Healthcare Group (1515.HK) - Well positioned for China's public hospital industry

Parkson (3368.HK) - Acquisition of Parkson Retail Asia expands foothold in SE Asia; Lower TP and maintain

Neutral

Luk Fook Holdings (590.HK) - Recovery further pushed back

Consumer Discretionary Sector Better Jun sales, but more pressure on discretionary sales

Beijing Enterprises Water Group (371.HK) Strong project acquisition pipeline YTD

Container Shipping Sector - Weekly container shipping commentary

Source: Company data, BOCOM International

Download our reports from Bloomberg: BOCMenter

Analyst

Geoffrey Cheng, CFA

Anita Chu

Summer Wang

Phoebe Wong, CPA

Geoffrey Cheng, CFA, Fay Zhou

Yang Qingli

Philip Tse, CFA FRM, Alfred Lau, CFA, FRM

Fay Zhou, Geoffrey Cheng, CFA

Phoebe Wong, CPA

Alfred Lau, CFA, FRM

Geoffrey Cheng, CFA

Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA

Summer Wang

Philip Tse, CFA, FRM, Alfred Lau, CFA, FRM

Geoffrey Cheng, CFA, Fay Zhou

David Li

Anita Chu

Phoebe Wong, CPA

Phoebe Wong, CPA

Wallace Cheng

Geoffrey Cheng, CFA

Morning Express

28 July 2015

Hang Seng Index Constituents

Company

name

CKH HOLDINGS

CLP HOLDINGS

HONG KG CHINA GS

WHARF HLDG

HSBC HLDGS PLC

POWER ASSETS

HANG SENG BANK

HENDERSON LAND D

HUTCHISON

SHK PPT

NEW WORLD DEV

SWIRE PACIFIC-A

BANK EAST ASIA

GALAXY ENTERTAIN

MTR CORP

SINO LAND

HANG LUNG PPT

KUNLUN ENERGY

CHINA MER HOLD

WANT WANT CHINA

CITIC

CHINA RES ENTERP

CATHAY PAC AIR

TINGYI

SINOPEC CORP-H

HKEX

LI & FUNG LTD

CHINA OVERSEAS

TENCENT

CHINA UNICOM

LINK REIT

CHINA RES POWER

PETROCHINA-H

CNOOC

CCB-H

CHINA MOBILE

LENOVO GROUP

HENGAN INTL

CHINA SHENHUA-H

CHINA RES LAND

COSCO PAC LTD

AIA

ICBC-H

BELLE INTL

SANDS CHINA LTD

PING AN-H

BOC HONG KONG HO

CHINA LIFE-H

BANKCOMM-H

BANK OF CHINA-H

Hang Seng Index

BBG

code

1 HK

2 HK

3 HK

4 HK

5 HK

6 HK

11 HK

12 HK

13 HK

16 HK

17 HK

19 HK

23 HK

27 HK

66 HK

83 HK

101 HK

135 HK

144 HK

151 HK

267 HK

291 HK

293 HK

322 HK

386 HK

388 HK

494 HK

688 HK

700 HK

762 HK

823 HK

836 HK

857 HK

883 HK

939 HK

941 HK

992 HK

1044 HK

1088 HK

1109 HK

1199 HK

1299 HK

1398 HK

1880 HK

1928 HK

2318 HK

2388 HK

2628 HK

3328 HK

3988 HK

Share

price

(HK$)

111.30

65.10

15.68

50.05

67.75

70.05

154.30

51.55

N/A

119.70

9.19

98.45

31.35

33.65

34.45

11.94

21.90

6.79

27.45

8.00

13.52

23.80

19.00

14.94

5.79

209.20

5.93

25.25

145.60

10.56

44.85

19.26

7.47

9.37

6.28

96.70

8.72

85.50

14.52

22.00

9.76

49.05

5.44

8.09

32.55

47.15

30.85

29.05

6.93

4.29

Mkt

cap

(HK$m)

429,582

164,472

181,313

151,703

1,323,980

149,505

294,997

170,382

N/A

344,265

82,682

143,248

82,016

143,229

201,479

72,645

98,232

54,812

71,009

105,054

336,693

57,909

74,743

83,722

897,884

250,504

49,904

248,980

1,365,357

252,881

102,858

92,436

2,657,459

418,347

1,581,183

1,979,935

96,867

104,687

415,706

152,481

28,706

590,924

2,094,062

68,233

262,643

845,441

326,170

942,564

579,178

1,576,659

5d

chg

(%)

-3.22

-1.29

-1.63

-4.94

-4.31

-1.55

-0.13

-3.01

N/A

-3.70

-3.97

-1.94

-5.43

-2.89

-2.13

-3.55

-2.67

-5.83

-7.73

-4.65

-1.89

0.21

-2.86

-4.35

-5.39

-9.52

-4.20

-6.31

-6.37

-3.30

-2.29

-6.05

-6.27

-6.86

-3.68

-1.53

-7.43

-3.88

-7.16

-5.38

-3.37

-3.06

-4.06

-4.15

1.40

-1.92

-4.49

-7.04

-3.08

-3.81

Ytd

chg

(%)

48.29

-3.20

-2.88

-10.63

-8.45

-6.91

19.43

4.43

N/A

1.18

3.03

-2.52

0.32

-22.34

8.33

-4.63

0.69

-7.37

5.17

-21.72

2.27

46.55

12.43

-15.69

-7.36

21.84

-17.51

9.54

29.42

1.54

-7.62

-3.70

-13.14

-10.25

-1.41

6.85

-14.51

5.49

-36.73

7.58

-11.43

13.67

-3.89

-7.22

-14.68

19.22

18.88

-4.60

-4.28

-1.83

24,352

14,772,445

-4.1

3.2

Source: Bloomberg

Download our reports from Bloomberg: BOCMenter

52-week

Hi

Lo

(HK$)

(HK$)

125.00

71.77

69.85

61.80

17.27

15.00

63.90

48.00

84.40

64.35

82.80

64.05

161.50

123.20

59.46

42.46

119.40

85.90

137.60

106.30

11.00

8.52

109.80

90.20

35.85

29.00

66.16

29.40

40.00

29.85

14.20

11.04

26.45

19.86

13.86

6.48

37.00

23.05

11.16

7.20

16.88

11.64

26.15

14.04

20.80

13.56

23.25

13.50

8.23

5.75

311.40

162.00

10.48

5.80

34.05

19.80

171.00

104.50

16.00

9.68

53.65

42.40

24.90

17.60

11.70

7.40

15.88

9.36

7.98

5.34

118.00

84.05

14.30

8.61

107.40

74.05

24.40

14.40

29.10

15.78

12.80

9.00

58.20

39.10

7.10

4.74

12.26

7.60

58.65

25.90

62.90

28.53

33.70

23.85

41.00

21.00

8.61

5.29

5.68

3.42

28,588.5

22,529.8

PE

2014A

2015E

2016E

(X)

(X)

(X)

4.79

13.81

11.68

14.66

15.24

14.52

25.33

23.40

21.75

4.22

12.79

11.53

12.85

10.38

9.98

19.40

18.24

18.10

19.51

13.96

15.28

10.09

16.95

16.49

N/A

15.32

13.61

10.83

16.02

13.87

6.91

11.50

10.77

13.38

13.82

12.68

10.93

12.44

11.57

13.92

19.67

17.61

12.81

19.42

19.71

9.38

13.93

13.16

8.39

15.41

15.85

9.77

11.00

9.20

17.16

14.89

13.40

21.96

19.47

17.80

6.47

6.28

5.87

N/A

109.17

57.49

23.72

10.68

9.49

28.47

22.41

19.67

N/A

15.78

10.40

43.86

27.25

23.80

11.85

13.91

12.14

7.46

7.91

6.93

44.52

34.91

26.76

17.11

15.16

13.41

3.79

22.55

21.08

9.92

7.49

7.33

13.76

18.70

11.97

5.58

14.41

8.45

5.47

5.39

5.14

14.37

14.41

13.52

14.48

11.84

9.87

26.81

22.98

20.02

7.07

8.19

7.73

8.72

10.30

8.82

12.09

11.05

10.24

18.61

19.96

18.03

5.58

5.55

5.30

11.23

10.91

10.16

15.81

20.39

19.62

13.11

12.81

11.81

13.27

11.97

10.86

20.42

14.53

12.71

6.21

6.33

6.20

5.62

5.74

5.46

10.5

11.8

10.7

Yield

P/B

(%)

3.28

4.02

2.03

3.62

5.61

3.84

3.63

1.94

N/A

2.80

4.57

3.96

3.54

0.00

3.05

4.19

3.47

2.95

2.81

2.34

1.59

1.13

1.89

1.85

N/A

1.90

5.75

2.18

0.25

2.36

4.08

4.05

7.09

6.04

5.98

2.98

3.04

2.34

N/A

2.25

3.18

1.07

N/A

5.25

6.12

N/A

3.63

1.72

4.86

5.53

(X)

0.65

1.87

3.45

0.50

0.90

1.23

2.12

0.71

N/A

0.78

0.49

0.68

1.07

3.72

1.23

0.64

0.74

1.04

1.04

6.64

0.81

1.18

1.45

3.44

N/A

10.69

2.46

1.55

12.39

0.88

0.87

1.31

0.93

0.88

0.96

1.85

3.06

5.94

0.78

1.33

0.77

2.40

0.99

2.19

5.27

2.19

1.85

2.32

0.84

0.90

3.4

1.3

Morning Express

28 July 2015

China Ent Index Constituents

Company

name

TSINGTAO BREW-H

JIANGXI COPPER-H

SINOPEC CORP-H

CHINA RAIL GR-H

DONGFENG MOTOR-H

CHINA TELECOM-H

AIR CHINA LTD-H

PETROCHINA-H

HUANENG POWER-H

ANHUI CONCH-H

CHINA LONGYUAN-H

CCB-H

CITIC BANK-H

SHANDONG WEIG-H

CHINA SHENHUA-H

SINOPHARM-H

BYD CO LTD-H

ABC-H

NEW CHINA LIFE-H

PICC GROUP-H

CHINA CINDA-H

ICBC-H

CHINA COM CONS-H

CHINA COAL ENE-H

MINSHENG BANK-H

CHINA VANKE-H

GUANGZHOU AUTO-H

PING AN-H

PICC P&C-H

GREAT WALL MOT-H

WEICHAI POWER-H

GREAT WALL MOT-H

CHINA PACIFIC-H

CHINA LIFE-H

CHINA OILFIELD-H

CHINA NATL BDG-H

BANKCOMM-H

CM BANK-H

BANK OF CHINA-H

CITIC SEC-H

HAITONG SECURI-H

Hang Seng China Ent Indx

BBG

code

Share

price

(HK$)

Mkt

cap

(HK$m)

5d

chg

(%)

Ytd

chg

(%)

168 HK

358 HK

386 HK

390 HK

489 HK

728 HK

753 HK

857 HK

902 HK

914 HK

916 HK

939 HK

998 HK

1066 HK

1088 HK

1099 HK

1211 HK

1288 HK

1336 HK

1339 HK

1359 HK

1398 HK

1800 HK

1898 HK

1988 HK

2202 HK

2238 HK

2318 HK

2328 HK

2333 HK

2338 HK

2333 HK

2601 HK

2628 HK

2883 HK

3323 HK

3328 HK

3968 HK

3988 HK

6030 HK

6837 HK

42.35

10.32

5.79

6.80

8.89

4.33

8.76

7.47

9.38

24.05

8.75

6.28

5.65

5.10

14.52

30.35

32.80

3.55

35.70

3.98

3.54

5.44

10.18

3.70

8.82

18.46

6.13

47.15

15.76

27.15

10.70

27.15

33.35

29.05

9.85

5.95

6.93

20.10

4.29

21.00

13.66

59,444

53,947

897,884

340,761

76,597

350,437

203,340

2,657,459

165,986

122,308

70,318

1,581,183

414,987

22,829

415,706

83,981

127,482

1,360,596

152,298

168,847

128,349

2,094,062

261,327

110,343

383,877

196,583

113,362

845,441

233,697

114,942

53,276

114,942

290,360

942,564

92,513

32,124

579,178

522,241

1,576,659

311,971

220,792

-5.68

-6.69

-5.39

-8.23

-4.92

-2.26

0.00

-6.27

-2.49

-4.56

-4.68

-3.68

-4.07

-3.41

-7.16

-4.56

-10.26

-3.27

-7.27

-6.57

-6.84

-4.06

-5.39

-4.64

-3.50

-2.64

-5.40

-1.92

0.25

-7.65

-1.65

-7.65

-2.63

-7.04

-5.11

-6.89

-3.08

-5.19

-3.81

-10.26

-10.37

-19.49

-22.41

-7.36

6.58

-19.03

-4.63

39.71

-13.14

-10.50

-17.21

8.43

-1.41

-9.16

-18.53

-36.73

10.56

8.07

-9.44

-8.81

9.64

-6.35

-3.89

9.11

-23.87

-13.53

6.71

-13.17

19.22

4.51

-38.44

-34.56

-38.44

-15.36

-4.60

-26.82

-21.09

-4.28

3.29

-1.83

-28.08

-30.02

11,231

4,643,366

-4.61

Source: Bloomberg

Download our reports from Bloomberg: BOCMenter

52-week

Hi

Lo

(HK$)

(HK$)

PE

2014A

2015E

2016E

Yield

P/B

(X)

(X)

(X)

(%)

(X)

42.00

9.65

5.75

3.98

8.79

3.84

4.54

7.40

8.23

22.55

7.12

5.34

4.66

4.11

14.40

22.00

18.70

3.38

26.20

3.10

3.20

4.74

5.45

3.45

6.97

13.36

5.78

28.53

11.45

26.50

9.72

26.50

26.55

21.00

9.73

5.69

5.29

13.12

3.42

16.30

11.50

23.81

9.86

N/A

11.19

4.78

15.77

22.61

13.76

9.89

9.26

19.64

5.47

5.19

16.87

7.07

21.91

146.00

5.09

13.95

10.29

8.60

5.58

9.46

251.32

5.39

10.34

9.89

13.11

12.14

8.23

6.83

8.23

21.84

20.42

5.01

4.32

6.21

7.25

5.62

13.33

13.68

21.71

13.38

15.78

10.00

4.89

13.99

10.40

18.70

7.97

10.02

15.27

5.39

5.12

15.54

8.19

18.42

33.78

5.03

9.96

8.91

6.66

5.55

8.63

N/A

5.30

8.90

8.68

12.81

10.72

6.39

9.47

6.39

15.77

14.53

11.23

5.39

6.33

6.62

5.74

10.95

8.52

19.77

11.36

10.40

8.93

4.48

12.62

9.59

11.97

8.12

9.14

13.13

5.14

4.80

13.27

7.73

15.24

27.12

4.79

8.98

8.28

5.55

5.30

7.66

156.03

4.95

7.62

7.08

11.81

10.21

5.39

8.24

5.39

14.17

12.71

9.05

4.99

6.20

5.96

5.46

9.73

8.02

N/A

2.42

N/A

1.43

2.81

2.19

0.74

7.09

5.06

3.37

0.85

5.98

N/A

1.62

N/A

1.27

0.00

6.40

0.73

0.30

3.47

N/A

2.11

0.81

2.62

3.38

3.26

N/A

2.14

3.68

1.46

3.68

1.87

1.72

6.08

3.46

4.86

4.16

5.53

N/A

2.28

2.88

0.63

N/A

1.22

0.83

0.97

1.70

0.93

1.55

1.55

1.70

0.96

0.78

1.86

0.78

2.46

2.57

0.82

1.85

1.46

1.10

0.99

1.13

0.45

1.01

1.85

0.89

2.19

2.18

1.98

1.06

1.98

2.07

2.32

0.80

0.63

0.84

1.29

0.90

1.78

1.53

-6.29 14,962.74 10,097.35

8.12

8.06

7.34

3.75

1.14

64.00

18.50

8.23

12.30

15.20

6.17

10.20

11.70

11.90

34.15

11.36

7.98

7.40

8.92

24.40

41.75

62.30

4.55

56.55

5.85

5.23

7.10

17.00

5.60

11.88

21.60

9.60

62.90

20.15

60.70

18.20

60.70

47.10

41.00

23.40

9.85

8.61

26.85

5.68

40.50

27.90

Morning Express

28 July 2015

BOCOM International

11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong

Main: + 852 3710 3328

Fax: + 852 3798 0133

Rating System

Company Rating

www.bocomgroup.com

Sector Rating

Buy: Expect more than 20% upside in 12 months

LT Buy: Expect more than 20% upside but longer than 12 months

Neutral: Expect low volatility

Sell: Expect more than 20% downside in 12 months

Outperform (OP): Expect more than 10% upside in 12 months

Market perform (MP): Expect low volatility

Underperform (UP): Expect more than 10% downside in 12 months

Research Team

Head of Research

@bocomgroup.com

Raymond CHENG, CFA, CPA, CA

(852) 2977 9393

@bocomgroup.com

raymond.cheng

Strategy

Economics

Hao HONG, CFA

Miaoxian LI

(852) 2977 9384

hao.hong

(852) 2977 9212

yangqingli

Fei WU

(852) 2977 9392

fei.wu

Shanshan LI, CFA

(86) 10 8800 9788 - 8058

lishanshan

Tony LIU

(852) 2977 9390

xutong.liu

Li WAN, CFA

(86) 10 8800 9788 - 8051

Wanli

Alfred LAU, CFA, FRM

(852) 2977 9235

alfred.lau

Philip TSE, CFA, FRM

(852) 2977 9220

philip.tse

Luella GUO

(852) 2977 9211

luella.guo

(86) 21 6065 3606

louis.sun

(852) 2977 9209

lizhiwu

Geoffrey CHENG, CFA

(852) 2977 9380

geoffrey.cheng

Fay ZHOU

(852) 2977 9381

fay.zhou

(86) 21 6065 3675

wei.yao

Banks/Network Financials

Qingli YANG

(86) 10 8800 9788 - 8043

miaoxian.li

Oil & Gas/ Gas Utilities

Consumer Discretionary

Property

Phoebe WONG, CPA

(852) 2977 9391

phoebe.wong

Anita CHU

(852) 2977 9205

anita.chu

Consumer Staples

Renewable Energy

Summer WANG

(852) 2977 9221

summer.wang

Shawn WU

(852) 2977 9386

shawn.wu

(852) 2977 9387

wallace.cheng

Environmental Services

Wallace CHENG

Louis SUN

Telecom & Small/ Mid-Caps

Healthcare

Zhiwu LI

Transportation & Industrial

David LI

(852) 2977 9203

David.Li

Insurance & Brokerage

Automobile

Jerry LI

(852) 2977 9389

liwenbing

Jennifer ZHANG

(852) 2977 9250

yufan.zhang

Internet

Yuan MA, PhD

(86) 10 8800 9788 - 8039

yuan.ma

Connie GU, CPA

(86) 10 8800 9788 - 8045

conniegu

Mengqi Sun

(86) 10 8800 9788 - 8048

mengqi.sun

Download our reports from Bloomberg: BOCMenter

Wei YAO

Morning Express

28 July 2015

Analyst Certification

The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any

and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the

specific recommendations or views expressed in this report; (iii) no insider information/ non-public price-sensitive information in relation to

the subject securities or issuers which may influence the recommendations were being received by the authors.

The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the

Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days

prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed

companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in

this report.

Disclosure of relevant business relationships

BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Communications,

China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan

Development Holding Co. Ltd., Austar Lifesciences Limited, BAIC Motor Corporation Limited, China Huinong Capital Group Limited, D&G

Technology Holding Company Limited, Guolian Securities Co. Ltd., GF Securities Co. Ltd., PuraPharm Corporation Limited, Chiho-Tiande Group

Limited, Greenland Hong Kong Holdings Limited, Chinasoft International Limited, Forgame Holdings Limited, Legend Holdings Corporation,

Peak Sport Products Co. Limited and Hengtai Securities Co. Ltd. within the preceding 12 months.

BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company

Limited.

BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Chinasoft International Limited.

Disclaimer

By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive

such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to

comply with these limitations may constitute a violation of law.

This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being

supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored

or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for

any purpose without the prior written consent of BOCOM International Securities Ltd.

BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own

or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or

dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may

do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an

underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also

perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as

solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor

should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest.

The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this

report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late

delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty,

express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this

report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any

manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and

damages) of any reliance thereon or usage thereof.

This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM

International Securities Ltds clients generally and does not have regard to the specific investment objectives, financial situation and the

particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be

construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other

financial instruments thereof.

The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or

any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or

the information in this report.

Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own

individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the

legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in

this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation,

rule or other registration or licensing requirement.

BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd.

Download our reports from Bloomberg: BOCMenter

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Mark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsDocument11 pagesMark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsbodaiNo ratings yet

- Quiz 1Document6 pagesQuiz 1Eliza Mae Aquino100% (1)

- PDFDocument72 pagesPDFGCMediaNo ratings yet

- Margiela Brandzine Mod 01Document37 pagesMargiela Brandzine Mod 01Charlie PrattNo ratings yet

- Alice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Document4 pagesAlice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Rachel PauloseNo ratings yet

- Energy & Power 1Q19 PDFDocument25 pagesEnergy & Power 1Q19 PDFbodaiNo ratings yet

- Features: Tracking TechnicalDocument3 pagesFeatures: Tracking TechnicalbodaiNo ratings yet

- Sawasdee SET: S-T Retracement, Opportunity To BuyDocument14 pagesSawasdee SET: S-T Retracement, Opportunity To BuybodaiNo ratings yet

- TH Consumer and Hospitality Sector Update 20180509 RHBDocument14 pagesTH Consumer and Hospitality Sector Update 20180509 RHBbodaiNo ratings yet

- Morning Brief - E - 20170726093031Document25 pagesMorning Brief - E - 20170726093031bodaiNo ratings yet

- TH Property Sector Update 20180509Document5 pagesTH Property Sector Update 20180509bodaiNo ratings yet

- TH Property Sector Update 20180509Document5 pagesTH Property Sector Update 20180509bodaiNo ratings yet

- Morning Brief - E - 20170721100634Document24 pagesMorning Brief - E - 20170721100634bodaiNo ratings yet

- Morning Brief - E - 2018103918368Document18 pagesMorning Brief - E - 2018103918368bodaiNo ratings yet

- Morning Breif - E - 20170801095547Document22 pagesMorning Breif - E - 20170801095547bodaiNo ratings yet

- Company Report - IMPACT - E - 20180219081453Document8 pagesCompany Report - IMPACT - E - 20180219081453bodaiNo ratings yet

- SET to bounce on US inflation missDocument10 pagesSET to bounce on US inflation missbodaiNo ratings yet

- ImagesDocument11 pagesImagesbodaiNo ratings yet

- ImagesDocument9 pagesImagesbodaiNo ratings yet

- ImagesDocument6 pagesImagesbodaiNo ratings yet

- ImagesDocument8 pagesImagesbodaiNo ratings yet

- SET to bounce on US inflation missDocument10 pagesSET to bounce on US inflation missbodaiNo ratings yet

- Big PursuitDocument8 pagesBig PursuitbodaiNo ratings yet

- Sci FinestDocument8 pagesSci FinestbodaiNo ratings yet

- ImagesDocument11 pagesImagesbodaiNo ratings yet

- The Erawan Group: Book Now, Good Price GuaranteedDocument10 pagesThe Erawan Group: Book Now, Good Price GuaranteedbodaiNo ratings yet

- Thai markets move narrowly, foreign funds net sellDocument10 pagesThai markets move narrowly, foreign funds net sellbodaiNo ratings yet

- Bangkok Chain Hospital: A New Lease of LifeDocument11 pagesBangkok Chain Hospital: A New Lease of LifebodaiNo ratings yet

- Fish or Cut BaitDocument10 pagesFish or Cut BaitbodaiNo ratings yet

- Morning Brief - E - 20170222092647Document27 pagesMorning Brief - E - 20170222092647bodaiNo ratings yet

- Time Will PassDocument43 pagesTime Will PassbodaiNo ratings yet

- 20161223175636Document26 pages20161223175636bodaiNo ratings yet

- Aps Lit@tb 110615 93817Document2 pagesAps Lit@tb 110615 93817bodaiNo ratings yet

- 20161223092340Document3 pages20161223092340bodaiNo ratings yet

- Java Thread Priority in MultithreadingDocument3 pagesJava Thread Priority in MultithreadingMITALI SHARMANo ratings yet

- Boundless - 5 Steps For High Impact Work ExperienceDocument3 pagesBoundless - 5 Steps For High Impact Work ExperienceCameron WinnettNo ratings yet

- Lincoln's Last Trial by Dan AbramsDocument6 pagesLincoln's Last Trial by Dan AbramsdosatoliNo ratings yet

- Bible TabsDocument8 pagesBible TabsAstrid TabordaNo ratings yet

- Budget Planner Floral Style-A5Document17 pagesBudget Planner Floral Style-A5Santi WidyaninggarNo ratings yet

- Chemistry The Molecular Science 5th Edition Moore Solutions Manual 1Document36 pagesChemistry The Molecular Science 5th Edition Moore Solutions Manual 1josephandersonxqwbynfjzk100% (27)

- SOP For Storage of Temperature Sensitive Raw MaterialsDocument3 pagesSOP For Storage of Temperature Sensitive Raw MaterialsSolomonNo ratings yet

- Myanmar Thilawa SEZ ProspectusDocument92 pagesMyanmar Thilawa SEZ ProspectusfrancistsyNo ratings yet

- Ice-Cream ConesDocument6 pagesIce-Cream ConesAlfonso El SabioNo ratings yet

- Rashi - Effusion CytDocument56 pagesRashi - Effusion CytShruthi N.RNo ratings yet

- Giai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Document9 pagesGiai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Teddylove11No ratings yet

- ECUMINISMDocument2 pagesECUMINISMarniel somilNo ratings yet

- Repeaters XE PDFDocument12 pagesRepeaters XE PDFenzzo molinariNo ratings yet

- Rational design of Nile bargesDocument8 pagesRational design of Nile bargesjhairNo ratings yet

- Literature Circles Secondary SolutionsDocument2 pagesLiterature Circles Secondary Solutionsapi-235368198No ratings yet

- Economy 1 PDFDocument163 pagesEconomy 1 PDFAnil Kumar SudarsiNo ratings yet

- Leanplum - Platform Data SheetDocument10 pagesLeanplum - Platform Data SheetKiran Manjunath BesthaNo ratings yet

- June 3rd 1947 Partition PlanDocument2 pagesJune 3rd 1947 Partition PlanZ_Jahangeer88% (16)

- One Stop Report - Tata MotorsDocument119 pagesOne Stop Report - Tata MotorsJia HuiNo ratings yet

- Pines City Colleges: College of NursingDocument2 pagesPines City Colleges: College of NursingmagisasamundoNo ratings yet

- MHRP Player SheetDocument1 pageMHRP Player SheetFelipe CaldeiraNo ratings yet

- CARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Document3 pagesCARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Joana Jean SuymanNo ratings yet

- Whipping Cream PowderDocument2 pagesWhipping Cream PowderSALCON ConsultancyNo ratings yet

- User Manual: Imagenet Lite™ SoftwareDocument93 pagesUser Manual: Imagenet Lite™ SoftwareDe Mohamed KaraNo ratings yet

- Describing A CompanyDocument3 pagesDescribing A CompanyAfnanNo ratings yet