Professional Documents

Culture Documents

2 Weeks Maturity Deposit

Uploaded by

Storm Castle0 ratings0% found this document useful (0 votes)

31 views2 pagessaving account

Original Title

yen2weeks

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsaving account

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pages2 Weeks Maturity Deposit

Uploaded by

Storm Castlesaving account

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

2 weeks Maturity Deposit

1. Product Name

2. Eligibility

3. Deposit Term

4. Deposit Method,

Currency, Minimum

Deposit, and

Deposit Unit

5. Handling at

Maturity

6. Interest

7. Interest after

Maturity

8. Cancellation

9. Deposit Insurance

As of October 18, 2009

2 weeks Maturity Deposit (the Deposit)

Individual customers holding PowerFlex accounts with Shinsei Bank (the Bank)

The term of the Deposit shall be 2 weeks. The maturity date shall be the corresponding day

in a week which is 2 weeks after the deposit date. Unless otherwise expressly designated by

depositor, the Deposit shall be automatically renewed for successive 2 weeks on the same

terms and conditions on maturity dates.

(1)Deposit Method: The Deposit shall be made in a lump sum by cash transfer from the

depositors PowerFlex Yen Savings account.

(2)Currency: Yen

(3)Minimum Deposit: 1,000,000 yen

(4)Deposit Unit: 1 yen

On maturity date, the Deposit shall be automatically renewed for successive 2 weeks on

the same terms and conditions with the new principal amount consisting of the

previous principal and the after-tax interest thereon Rollover Type.

Notwithstanding the foregoing, the depositor may apply for automatic cancellation of

the Deposit. In this case, the principal and the after-tax interest shall be paid to the

depositors PowerFlex Yen Savings account on the subsequent maturity date

immediately after such application Cancellation Type.

The depositor may apply for the change of the maturity treatment. Such application

shall be submitted to the Bank (i) by the branch closing time on the preceding business

day of the maturity date at Shinsei Financial Centers, (ii) by the preceding day of the

maturity date via Shinsei PowerCall (telephone banking) and/or Shinsei PowerDirect

(Internet banking). Furthermore, Shinsei MobileDirect is not available for such

application.

(1) Interest Rate

The interest rate to be posted by the Bank as of the deposit shall be applied from the

deposit date (inclusive) to maturity date (exclusive).

Further details of the interest rate of the Deposit are available at Shinsei Financial

Centers or via Shinsei PowerCall (telephone banking).

(2) Payment of Interest

Interest of the Deposit shall be paid in a lump sum on maturity date in such manner

as described in the item 5 above according to the depositors then selection of handling

on maturity.

(3) Calculation of Interest

The interest of the Deposit shall be calculated by the Bank, in connection with the term

from the deposit date (inclusive) to the maturity date (exclusive), in units of 1 yen, on a

per diem basis assuming that there are 365 days per year, wherein fractions less than 1

yen shall be rounded down.

The interest to be applied to the principal and the after-tax interest paid on or after

maturity date shall be calculated and paid as follows according to the depositors then

selection of handling at maturity.

In case of Rollover TypeThe interest rate posted as of the renewal of the Deposit at

Shinsei Financial Center shall be applied for the successive 2 weeks and

shall be the same thereafter. Please see item 6 above for the payment

and/or the calculation of interest.

In case of Cancellation TypeThe principal and the after-tax interest of the Deposit

shall be paid to the PowerFlex Yen Savings account, and then Yen Savings

account interest rate shall be applied to such principal and interest. Please

see the Yen Savings Deposit Product Description for the payments and/or

the calculation of interest.

In case of cancellation before maturity date, the interest rate to be applied to the balance

more than 1 and less than 1 million for PowerFlex Yen Savings account, which is

posted at Shinsei Financial Center as of such cancellation, will apply to the period from the

deposit date (inclusive) to such cancellation date (inclusive). The interest calculated in the

manner as mentioned above will be taxed, and then it shall be paid to the depositors

PowerFlex Yen Savings account, together with the principal of the Deposit, on such

cancellation date.

The Deposit is covered by the Japanese deposit insurance (Deposit Insurance). Provided,

however, that the Deposit is not fully protected by Deposit Insurance; The scope of the

protection by such Deposit Insurance is limited to the extent the principal of 10 million yen

and its interest or otherwise, per a single depositor with a single insured bank, pursuant to

relevant law and ordinance.

Total 20% withholding tax will be deducted from interest of the Deposit to be paid by the

Bank.

For further details, please consult a certified public accountant or a tax accountant.

11. Collateral to the

The Deposit is not eligible for serving as a collateral to the overdrafts as stipulated by the

Overdrafts

General Contractual Conditions on Yen Deposit for PowerFlex

Even if the Deposit has been assigned, transferred, or succeeded to a third party due to an

12Miscellaneous

inheritance of the account, an attachment against the Deposit or otherwise, in case that the

Deposit was cancelled by such successor prior to its maturity date, the item 8 above shall be

applied mutatis mutandis to such cancellation.

The balance and the details of the Deposit will be listed and shown in the column of term

deposits on each of the account statements, the screens of Shinsei PowerDirect and Shinsei

MobileDirect.

* THIS PRODUCT DESCRIPTION IS MADE FOR CONVENIENCE ONLY. THE ORIGINAL TEXT OF THIS

10. Tax

PRODUCT DESCRIPTION SHALL BE IN JAPANESE. IN THE EVENT OF DIFFERENCE IN MEANING, THE

JAPANESE VERSION SHALL PREVAIL.

You might also like

- Citibank Deposit Terms and ConditionsDocument1 pageCitibank Deposit Terms and ConditionsAkshay MittalNo ratings yet

- Terms and Conditions For SavingsDocument10 pagesTerms and Conditions For Savingsdevpal78No ratings yet

- Opening of AccountsDocument6 pagesOpening of AccountswubeNo ratings yet

- Auto FD Account DeclarationDocument2 pagesAuto FD Account DeclarationsumitNo ratings yet

- Customer AccountsDocument32 pagesCustomer AccountsJitendra VirahyasNo ratings yet

- Fixed Deposit RulesDocument3 pagesFixed Deposit Rulesvin123keshriNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- General Banking HeartDocument24 pagesGeneral Banking HeartMD. JAHIDNo ratings yet

- Quick Loan - Terms and ConditionsDocument4 pagesQuick Loan - Terms and ConditionspeterNo ratings yet

- Personal Financing Product Disclosure SheetDocument6 pagesPersonal Financing Product Disclosure SheetMohd Naim Bin KaramaNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsKarthik SingamNo ratings yet

- RHB Personal Financing TermsDocument17 pagesRHB Personal Financing TermsDon LotNo ratings yet

- RD - Terms and ConditionsDocument9 pagesRD - Terms and ConditionsDhiraj NemadeNo ratings yet

- Terms Conditions-Term Deposits RevisedDocument2 pagesTerms Conditions-Term Deposits RevisedSunny KumarNo ratings yet

- Fixed DepositDocument37 pagesFixed DepositMinal DalviNo ratings yet

- Overdraft Against Property Loan AgreementDocument56 pagesOverdraft Against Property Loan Agreementkirubaharan2022No ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsPiyush ckNo ratings yet

- Maybank Islamic FD-i disclosure guideDocument4 pagesMaybank Islamic FD-i disclosure guideLina LanNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Yes FD Sunil Kumar (3) - 240201 - 205332Document2 pagesYes FD Sunil Kumar (3) - 240201 - 205332abdulvajidparuthikkattilNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceSudheer KumarNo ratings yet

- PNB Fixed Deposit FormDocument6 pagesPNB Fixed Deposit FormANKITNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Money Multiplier Deposits Rules: 1. Minimum DepositDocument3 pagesMoney Multiplier Deposits Rules: 1. Minimum DepositSanjeev MiglaniNo ratings yet

- Landbank AccountsDocument17 pagesLandbank AccountscammiecazzieNo ratings yet

- SBI Personal Loans ExplainedDocument2 pagesSBI Personal Loans ExplainedHumaid ShaikhNo ratings yet

- ASB Fin PDS ENG June 2020-2Document4 pagesASB Fin PDS ENG June 2020-2holaNo ratings yet

- Flexi Deposit Builder Deposit Form Copy 2Document2 pagesFlexi Deposit Builder Deposit Form Copy 2EDGAR OGLEETEONo ratings yet

- Sbi Home Loan MitcDocument4 pagesSbi Home Loan MitcfeeldboyNo ratings yet

- PNB MITC conditionsDocument38 pagesPNB MITC conditionswestm4248No ratings yet

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocument4 pagesProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNo ratings yet

- Pricing of Liability Products Dec2021Document9 pagesPricing of Liability Products Dec2021Aditya SharmaNo ratings yet

- Atm Corp Monetization SBLC Procedures-Updated July 2022Document3 pagesAtm Corp Monetization SBLC Procedures-Updated July 2022tiero martinsNo ratings yet

- Sbi Home Loan InfoDocument4 pagesSbi Home Loan InfoBhargavaSharmaNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Special Pre-Approved Personal Loan TermsDocument1 pageSpecial Pre-Approved Personal Loan TermsRam Kannan PNo ratings yet

- Enash 24 FormDocument2 pagesEnash 24 FormmukeshNo ratings yet

- Rules Opening Major Investment Plan AccountsDocument2 pagesRules Opening Major Investment Plan Accountsrossi herathNo ratings yet

- Terms Deposit Rules Terms & ConditionDocument2 pagesTerms Deposit Rules Terms & ConditionKrrish LaraieNo ratings yet

- Bank of India credit card termsDocument16 pagesBank of India credit card termsArun CHNo ratings yet

- Alliance Housing Loan Term Loan Terms ConditionsDocument12 pagesAlliance Housing Loan Term Loan Terms ConditionsRazali ZlyNo ratings yet

- FOREX Cir1684 12Document12 pagesFOREX Cir1684 12sunilNo ratings yet

- Banking Principle,,,Ch - 2Document11 pagesBanking Principle,,,Ch - 2Mubarik AhmedinNo ratings yet

- Directive No. 15. NRBDocument5 pagesDirective No. 15. NRBManish BhandariNo ratings yet

- Yes First Mitc Credit Cards EnglishDocument13 pagesYes First Mitc Credit Cards Englishpriyanka jagtapNo ratings yet

- A, B, C - Specialised AccountingDocument10 pagesA, B, C - Specialised Accountingمحمود احمدNo ratings yet

- Ila FD TermsAndConditions Final ARDocument5 pagesIla FD TermsAndConditions Final ARamerabdullah030No ratings yet

- BNK 632: International Finance &bankingDocument31 pagesBNK 632: International Finance &bankingShubham SrivastavaNo ratings yet

- Opt in TNC 310520 PDFDocument3 pagesOpt in TNC 310520 PDFvinayNo ratings yet

- Terms and Conditions Personal Loan 1687845092306Document7 pagesTerms and Conditions Personal Loan 1687845092306vishal kademaniNo ratings yet

- Flexipay TNCDocument5 pagesFlexipay TNCvenkateshvaddipogu11No ratings yet

- Loan Sanction Letter C33EFFTDocument10 pagesLoan Sanction Letter C33EFFTNAKSH CREATIONNo ratings yet

- Bankwest Term Deposit Terms and ConditionsDocument16 pagesBankwest Term Deposit Terms and ConditionskasugagNo ratings yet

- Foreign ExchangeDocument21 pagesForeign Exchangedamodar.kunchala1No ratings yet

- HL Personal Financing PDSDocument4 pagesHL Personal Financing PDSKavita ManimaranNo ratings yet

- Policy on Cheque Collection and CreditDocument10 pagesPolicy on Cheque Collection and CreditXfyxdNo ratings yet

- Value Plus Current AccountDocument5 pagesValue Plus Current AccountmalikzaidNo ratings yet

- AFFIN Home Invest-i Product Disclosure SheetDocument8 pagesAFFIN Home Invest-i Product Disclosure SheetMrHohoho97No ratings yet

- CLASS NOTES - Sudeshna DuttaDocument97 pagesCLASS NOTES - Sudeshna DuttaBikash Kumar DashNo ratings yet

- Bank Liable for Misappropriation of Trust Funds Deposited in Personal AccountDocument6 pagesBank Liable for Misappropriation of Trust Funds Deposited in Personal AccountKrisha FayeNo ratings yet

- Icaew Accounting Mock (Pilot Test) : 1. EmailDocument13 pagesIcaew Accounting Mock (Pilot Test) : 1. EmailSteve IdnNo ratings yet

- Banks Policy On Covid Related Reschedulement of Dues PDFDocument6 pagesBanks Policy On Covid Related Reschedulement of Dues PDFYuva KonapalliNo ratings yet

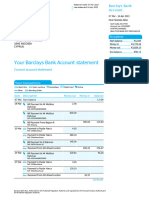

- Barclays Bank UPDATEDocument32 pagesBarclays Bank UPDATEAbdul wahidNo ratings yet

- Word Problems Involving Negative Numbers - Unlocked PDFDocument3 pagesWord Problems Involving Negative Numbers - Unlocked PDFRuchika SachdevaNo ratings yet

- Nationwide Bank StatementDocument5 pagesNationwide Bank StatementZheng YangNo ratings yet

- International Banking & Foreign Exchange ManagementDocument12 pagesInternational Banking & Foreign Exchange ManagementrumiNo ratings yet

- MCB Internet Banking - TCs (Final)Document12 pagesMCB Internet Banking - TCs (Final)Moin Ul HassanNo ratings yet

- Chapter 3 Commercial Banking New - 1535523282Document13 pagesChapter 3 Commercial Banking New - 1535523282Samuel DebebeNo ratings yet

- ICICI Bank Insta Salary PPT Latest UpdatedDocument2 pagesICICI Bank Insta Salary PPT Latest UpdatedSushant MahalleNo ratings yet

- British Households Consumer Durables 1972-1983Document50 pagesBritish Households Consumer Durables 1972-1983雯茜桑No ratings yet

- Honda Financial Analysis ReportDocument90 pagesHonda Financial Analysis ReportShadab HashmiNo ratings yet

- DH 0222Document14 pagesDH 0222The Delphos HeraldNo ratings yet

- SBI empanelment of CA firms as concurrent auditorsDocument33 pagesSBI empanelment of CA firms as concurrent auditorsShadab Malik67% (3)

- Metrobank Business Account SummaryDocument3 pagesMetrobank Business Account SummaryJack ChardwoodNo ratings yet

- 23 7 Checklist For Various Products 15 09Document193 pages23 7 Checklist For Various Products 15 09RadhakrishnanNo ratings yet

- Relationship of Debtor and CreditorDocument15 pagesRelationship of Debtor and CreditorAndualem GetuNo ratings yet

- Opening and Closing of Accounts Fin 4Document13 pagesOpening and Closing of Accounts Fin 4Enitan MustaphaNo ratings yet

- Ca Foundation Accounts Paper Dec23Document11 pagesCa Foundation Accounts Paper Dec23aagarwal786riteshNo ratings yet

- Resolution for Internet Banking FacilityDocument2 pagesResolution for Internet Banking FacilityKarthikNo ratings yet

- FCA Approach Payment Services Electronic Money 2017Document238 pagesFCA Approach Payment Services Electronic Money 2017CrowdfundInsiderNo ratings yet

- May 2004Document83 pagesMay 2004DeepakSehrawatNo ratings yet

- Bank Reconciliation Statement (BRS) Questions PDFDocument11 pagesBank Reconciliation Statement (BRS) Questions PDFAjitesh anandNo ratings yet

- Acca f3 BPP Question Amp Answer BankDocument45 pagesAcca f3 BPP Question Amp Answer BankHải LongNo ratings yet

- Volume02.indd 2Document3 pagesVolume02.indd 2DanniNo ratings yet

- Questions 1 PDFDocument10 pagesQuestions 1 PDFdkishore28100% (1)

- Single Point Solutions Joint Account StatementDocument1 pageSingle Point Solutions Joint Account StatementAnkur SharmaNo ratings yet

- School Audit Focus ChecklistDocument18 pagesSchool Audit Focus ChecklistKesavan Thiviya100% (2)

- Debit Account Transactions Date Description Type Amount Available Norman Carl Richard JRDocument3 pagesDebit Account Transactions Date Description Type Amount Available Norman Carl Richard JRfreeman p. donNo ratings yet