Professional Documents

Culture Documents

Financial Results & Limited Review Report For June 30, 2015 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For June 30, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Agarwal"Prilta$& Co.

CHARTERED ACCOUNTANTS

508, Indra Prakash ,2L, Barakhamba Road, New Delhi - 110001

Phones : 2373OegO/1 Fax : 011-435t6377

E-mail : pagarwal0286@gmail.com

Board of Directors

Indiabulls Wholesale Services Limited

M-62 & 63, First Floor,

Connaught Place,

New Delhi - 110 001

Limited Review Report - for the quarter ended June 30. 2015 Pursuant to Clause 41 of the Listins

Agreement

We have reviewed the accompanying statement of Standalone Unaudited Financial Results of

Indiabulls Wholesale Seruices Limited ("the Company") for the Quarter ended June 30, 2015 ("the

statement"), being submitted by the Company pursuant to the requirement of Clause 41 of the

Listing Agreements with the Stock Exchanges, except for the disclosures regarding 'Public

Shareholding' and 'Promoter and Promoter Group Shareholding' which have been traced

from disclosures made by the management and have not been audited by us. This statement is

the responsibility of the Company's Management and has been approved by the Board of

Directors / committee of Board of Directors. Our responsibility is to issue a report on the

Statement based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410,

"Review of Interim Finonciol lnformotion Performed by the lndependent Auditor of the Entity"

issued by the Institute of Chartered Accountants of India. This standard requires that we plan and

perform the review to obtain moderate assurance as to whether the Statement is free of material

misstatement. A review is limited primarily to inquiries of Company personnel and analytical

procedures applied to financial data and thus provides less assurance than an audit. We have not

performed an audit and accordingly, we do not express an audit opinion.

to our attention that causes us

prepared

with the Accounting

in

accordance

to believe that the accompanying Statement,

Standards notified pursuant to the Companies (Accounting Standards) Rules, 2006 which continue

to apply as per Section 133 of the Companies Act, 2013, read with Rule 7 of the Companies

(Accounts) Rules, 2014 and other recognised accounting practices and policies in lndia, has not

disclosed the information required to be disclosed in terms of Clause 41 of the Listing Agreements

with the Stock Exchanges, including the manner in which it is to be disclosed, or that it contains

Based on our review conducted as stated above, nothing has come

any material misstatment.

FOR AGARWAL PRAKASH

CHARTERED ACCOUNTAN

FRN: 005975N

AGARWAL

PARTN

Place: Mumbai

Date:

03'o August, 20L5

&

Indiabulls Wholesale Services Limited

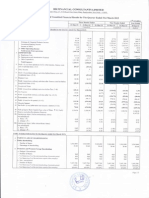

Statement of Unaudited Consolidated Financial Results

for the quarter ended June 30, 20L5

PART I

(t in lakhs)

Quarter ended

Particulars

30.05.2015

31.03.2015

30.06.2014

31.03.2015

(Unaudited)

(Audited)

(Unaudited)

(Audited)

Income from operations

a) Net sales/ Income from operations

b) Other operating income

Total income from operations

2

materials consumed

b) Purchase of stock-in-trade

c) Charrges in inventories of finished goods, work-in-progress and stock-in-trade

128.48

5,200,71

4,956.81,

6,982.68

20,734.46

783.57

44.02

88.00

75r.42

1,402.63

10.82

18.90

55.62

730.1,2

597.60

2,299.70

3,249.21,

20,605.98

477.79

603.63

2,244.58

669.70

666.46

388.20

7,731,.69

3,079.47

2,399.47

2,566.94

9,967.94

5,069.33

4,453.46

5,904.22

18,054.98

131.38

503.35

L,078.46

2,679.48

47 13

77.06

37.92

100.32

r72.57

520.41

1.110.38

2,779.90

Profit from oPerations before other income, finance costs and exceptional items (1-2)

Other income

Profit from ordinary activities before finance costs and exceptional items (3+4)

Finance costs

Profit from ordinary activities after finance costs but before exceptional items (5-6)

1,803.40

950.26

59.35

1,303.39

(1,630.89)

(42e.8s)

1,051.03

7,476.47

(1,630.89)

(42e.8s)

1,051.03

1,476.47

(667.4s)

5.38

Exceptional items

tax (Z+8)

(26.36)

12 r,xtraorcllrlary

ltems (net of tax expense

(9-10)

I6Aet protit after taxes and minority interest

(13+14-15)

raru-up equlry snare capltal (tace value ot ( Z pet equlty share)

I'alcl-up preference share capital (face value of { 10 per preference share)

K'eserves excluclll'I8 revaluailon reserves as per Balance Sheet of previous accoturting year

Earnings per share before extraordinary items (face value of t 2 per equity share)

(EPS for the quarters are not amualised)

Earnings per share after extraordinary items (face value of

(EPS

PART

(307.30)

(1,604.53)

237.60

r,045.65

r,783.77

(1,604.53)

237.60

7,045.65

7,783.71

8.77

8.77

(1,504.53)

237.60

1,036.88

1,774.94

r,071.24

L,074.37

t nil)

13 Net profit for the period/ year (11-12)

14 Share of profit / (loss) of associates

15 Mrnority interest

A.

1

33.75

d) Employee benefits expense

77 Net profit from ordinary activities after tax

L/

6,948.93

77.69

e) Depreciation and amortisation expense

9 Profit from ordinary activities before

10 Tax expense (including deferred tax)

IU

Lv

4,939.72

r02.65

(743.77)

f) Operating and other expenses

Total expenses

4

5

6

7

5,098.06

Expenses

a) Cost of

Year ended

r,074

1.,074.37

251.n

25r.77

25r.77

251,.77

86,982.74

- Basic (t)

(3.16)

0.40

2.05

3.44

- Diluted (t)

(3.16)

0.40

7.99

3.4r

- Basic ({)

(3.16)

0.40

2.05

3.44

- Diluted (t)

(3.16)

0.40

r.99

3.47

35,272,3r9

28,572,770

35,272,379

{ 2 per equity

share)

for the quarters are not amrualised)

II

Particulars of shareholding

Public shareholding

- Number of equity shares

35,272,318

- Percentage of shareholding

69.551.,

56.51%

69.55%,

69.55%

Promoters and promoter group shareholding

a)

Pledged/ Encumbered

- Number of shares

- Percentage of shares (as a"/" of the total shareholding of promoter and promoter group)

- Percentage of shares (as a % of the total share capital of the company)

b) Non-encumbered

- Number of equity shares

15,446,175

- Percentage of shares (as a % of the total shareholding of promoter and promoter group)

- Percentage of shares (as a "/" of the total share capital of the company)

15,446,775

100.00"1,

30.45%

Item exceeding'1,0% of total expenses

- Property management and maintenance expenses

Notes to Financial Results r

27,989,683

100.00"1,

7,149.96

100.00%

30.45%

43.49%

510.56

690.09

15,446,775

100.00%

30.45%

4,203.99

hdiabullsWholesaleserviceSLimitedconductsitsoPerationsalongwithitssubsidialies.ThecorolidatedFimncialStatementsareplepared

PIceduesforthepreparationmdPre*ntationofcorolidatedAccomtsassetoutintheAccomtin8stmdard-21(As21)oL:e:.IslidatedFimncialStatemen

AccomtingStandaIdsassPecifiedmderstion133ofcomPmieSAct,2013IeadwithRule7oftheCompanies1Accom.9$'iitEs,aij{+Famended.Thefinmcialstatementsofipalellt

companymditSsubsidiarieshavebeencombinedonaline-by{inebasisbyaddingtogetherthebookvalueSofitemsota!f6,.riaulrte9|5emdexpe

balances, tlmactioro md resulting wealiad gairo/los*s. The Consolidated Fimcial Statements are p."pur"a by

tciei.

i,..;

-;ilt

"gFlli,|&'rrri?6irir?c,{i,trntingpof

FiguesforthequarterendedMarch31',2o1'5arethebalancingfi8uesbetweenauditedfigwesoftheCompanyiniedp6ctor*retirncia|y$}feafIarchlt,2o15ande

figures upto nine months errded December 31,

2014.

Figues for the prior period/ yea! have been regrouped and/ or reclassified wherever coreidered

necesxry.

',' -

)(:{ I t dg

...,

,; *,,t

-t'i*=;;#;

'V!P{-- --

Indiabulls Wholesale Services Limited

(as

standalone entity)

Statement of Unaudited Financial Results

for the quarter ended June 30, 2015

(t in lakhs)

PART I

Quarter ended

Particulars

1

30.06.2015

31.03.2015

30.06.2014

31.03.2015

(Unaudited)

(Audited)

(Unaudited)

(Audited)

Income from operations

a) Net sales/ Income from operations

834.77

924.72

848.73

6.74

17.69

33.75

728.48

841.51

942.41

882.48

3,719.90

1,83.57

57.47

88.00

751,.42

599.1,1.

730.12

599.94

2,30"t.43

d) Employee benefits expense

9.50

10.55

2.35

30.57

e) Depreciation and amortisation expense

3.37

3.76

6.91,

20.17

b) Other operating income

Total income from operations

2

Year ended

3,59L.42

Expenses

a) Cost of

materials consumed

b) Purchase of stock-in-trade

1.74

c) Changes in inventories of finished goods, work-in-progress and stock-in-trade

f) Other expenses

Total expenses

3

4

5

6

7

8

9

Profrt/ (loss) from ordinary activities before tax

10

Tax expense (including deferred tax)

Profit/ (loss) from operations before other income, finance costs and exceptional items (1-2)

159.80

6'J,.12

427.71

96r.70

758.33

3,532.44

3.21

(Ie.2e)

124.1,5

187.46

Other income

65.20

61.53

22.50

1,,591,.92

Profit/

68.41

42.24

146.65

L,779.38

(loss) from ordinary activities before firunce costs and exceptional items (3+a)

Finance costs

Profit/

2.53

(loss) from ordinary activities after finance costs but before exceptional items (5-6)

15.51

68.41

39.77

1,46.65

t,763.87

68.41

39.77

146.65

1,,763.87

16.18

L9.68

35.90

426.85

52.23

20.03

1,1,0.75

1,337.02

r70.75

7,337.02

Exceptional items

11 Net profit/

(7+8)

(loss) from ordinary activities after tax (9-10)

12 Extraordinary items (net of tax expense { nil)

13 Net profit/ (loss) for the period/ year (11-12)

74 Paid-up equity share capital (face value of { 2 per equity share)

15 Paid-up preference share capital (face value of { 10 per preference share)

16 Reserves excluding revaluation reserves as per Balarrce Sheet of previous accounting year

77 Earnings

(EPS

per share before extraordinary items (face value of

(EPS

PART

52.23

20.03

7.01,4.37

1,074.37

1,01r.24

257.77

251..77

251,.77

1.,01437

251.77

78.005.15

2 per equity share)

for the quarters are not arurualised)

Earnings per share after extraordinary items (face value of

A.

1

42.75

838.30

- Basic (t)

0.11

(0.01)

0.23

2.59

- Diluted (t)

0.11

(0.01)

0.22

2.57

- Basic (t)

0.11

(0.01)

0.23

2.59

- Diluted ({)

0.11

(0.01)

0.22

2.57

{ 2 per equity

share)

for the quarters are not annualised)

II

Particulars of shareholding

Public shareholding

- Number of equity shares

35,272,3L8

- Percentage of shareholding

28,572,r10

35,272,3r9

69.55"1,

56.57"1

69.55"1,

15,446,r75

2r,989,683

35,272,378

69.55',1,

Promoters and promoter group shareholding

a)

Pledged/ Encttmbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of promoter and promoter group)

- Percentage of shares (as a '2, of the total share capital of the Company)

b) Non-encumbered

- Number of equity shares

- Perceutage of shares (as a

15,446,775

'l' of the total shareholding

of promoter and promoter group)

- Percentage of shares (as a '2, of the total share capital of the Company)

B.

15,446,775

100.00'2,

100.00'u,

100.00'2,

100.00'Z'

30.45'1,

30.45'k,

43.49"1,

30.45"1,

Investor complaints

Pending at the begiruring of the quarter

Received during the quarter

Disposed of during the quarter

Remaining turresolved at the end of the quarter

Nil

2

2

Nil

Notes to Financial Results:

md stmdalone fimmial results of hdiabulls Wholesle SeNices Limited ("IWSL, the Compmy") for the quarter ended Jme 30, 2015 have been reviewed by the Audit

committeeandapprovedbytheBoardofDirstorS(''theBoaId'')atitsmeetin8heldonAu8ust03,2015.ThefimcialresultsPefainin8toIndiabullsWholegleIVicesLidtedasa

The comlidated

standalone entity have been subisted to a limited review by the statutoly auditors of the Compmy.

The ComPmy's Pdrury business segment is reflted based on prircipal busines activities carried on by it. As per Accouting Standild (AS - 17) Segment Reporting as spcified mder

setion 133 of ComPanies Act, 2013 read with RuIe 7 of the Compmies (Accomts) Rules, 2014 (as mended), the Compmy operates in one reportable business *gmmt i.e. i.e. pucla*, sale,

dealin8,conShuctimmddeveloPmentof!ealestateProittalongwithallotherrelatedactivitiesmdisprimarilyoperatinginIndiamdhence,

Figwes for the qurter ended March 31, 2015 are the balmcing figues between audited figues of the Compmy in respet of the

figues upto nine months ended Deember 3L,2074.

fimcial

year ended March 31, 2015 md the published

Figures for the prior pefiod/ year have been regrouped and/ or reclassified wherever considered necessary.

Registered Office :M-62 & 63, First Floor, Coruraught Place, New Delhi - 110001

(CIN:

L51

Place:

Mumbai

01

DL 20A7PLCL66209)

Date: August 03, 2015

FOR AND

BOARD OF DIRECTORS

You might also like

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Accounting A Level Notes 9706Document45 pagesAccounting A Level Notes 9706shabanaNo ratings yet

- 16 Construction Internal Audit ProgramDocument16 pages16 Construction Internal Audit ProgramDrive4 BooksNo ratings yet

- Auditing MCQsDocument39 pagesAuditing MCQsHaroon AkhtarNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- SAP Closing Cockpit PDFDocument32 pagesSAP Closing Cockpit PDFviru2all100% (1)

- Internal Audit Procedure enDocument6 pagesInternal Audit Procedure enkumaraNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Document4 pagesFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Stock in Transit (GR - IR Regrouping - Reclassification) - SAP BlogsDocument7 pagesStock in Transit (GR - IR Regrouping - Reclassification) - SAP BlogsusamaNo ratings yet

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet

- Letter of Transmittal: (Author Name) 1Document52 pagesLetter of Transmittal: (Author Name) 1jisanus5salehinNo ratings yet

- TQM Principles and Quality Concepts ExplainedDocument31 pagesTQM Principles and Quality Concepts ExplainedarugeetNo ratings yet

- Organizational StructureDocument8 pagesOrganizational Structureanon_544702787No ratings yet

- Deepti CVDocument2 pagesDeepti CVDeeptiNo ratings yet

- 6330 - PC (Uk) 2023Document14 pages6330 - PC (Uk) 2023Jabbar HassanNo ratings yet

- Chapter Two Audit of Receivables and Sales: Page - 1Document20 pagesChapter Two Audit of Receivables and Sales: Page - 1mubarek oumer100% (1)

- AUDIT MCQs WITH ANSWERsDocument31 pagesAUDIT MCQs WITH ANSWERsRamu378No ratings yet

- Module 2. Part 2 - Bank Reconciliation Proof of CashDocument26 pagesModule 2. Part 2 - Bank Reconciliation Proof of Cashlord kwantoniumNo ratings yet

- MBA accounting essentialsDocument44 pagesMBA accounting essentialsSiddharth MohapatraNo ratings yet

- CAMP - Annual Report 2019 PDFDocument162 pagesCAMP - Annual Report 2019 PDFAma amelia putriNo ratings yet

- Preparing Interim Payment CertificatesDocument4 pagesPreparing Interim Payment CertificatesEticala RohithNo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- Code of Ethics Part III and IV: Attempt HistoryDocument48 pagesCode of Ethics Part III and IV: Attempt HistoryLara FloresNo ratings yet

- Audit 2Document8 pagesAudit 2Tiffany Wijaya100% (1)

- Government Accounting and Non-Profit OrganizationsDocument4 pagesGovernment Accounting and Non-Profit OrganizationsPaupauNo ratings yet

- BV CER Profile 2016Document3 pagesBV CER Profile 2016Harthwell CapistranoNo ratings yet

- Influence of Procurement Management Practices On Performance of Construction Firms in Nairobi County, KenyaDocument21 pagesInfluence of Procurement Management Practices On Performance of Construction Firms in Nairobi County, KenyaM Willy TarmidziNo ratings yet

- Balance Sheet Substantive TestingDocument12 pagesBalance Sheet Substantive TestingangaNo ratings yet

- Advanced Auditing Group Assignment Final 2Document38 pagesAdvanced Auditing Group Assignment Final 2TebashiniNo ratings yet

- ASSIGNMENT in PRELIMINARY ENGAGEMENT ACTIVITIES AND PLANNINGDocument7 pagesASSIGNMENT in PRELIMINARY ENGAGEMENT ACTIVITIES AND PLANNINGLileth ViduyaNo ratings yet

- Transparency PDFDocument9 pagesTransparency PDFJoeNo ratings yet

- Task 3 Part A&C Implementation PlanDocument8 pagesTask 3 Part A&C Implementation PlanFitri AnaNo ratings yet

- TESDA Circular No. 015-2021Document101 pagesTESDA Circular No. 015-2021John Moces ArenasNo ratings yet