Professional Documents

Culture Documents

Map 59 MCQ Paper

Uploaded by

Ridah Solomon0 ratings0% found this document useful (0 votes)

19 views9 pagesManagement Advancement Program exam Past Questions

Original Title

Map 59 Mcq Paper

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentManagement Advancement Program exam Past Questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views9 pagesMap 59 MCQ Paper

Uploaded by

Ridah SolomonManagement Advancement Program exam Past Questions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

Map 59~ € suss test, Satu

ay

1) What defines the rules or guidelines that accountants must follow when they

prepare financial statements?

a. Prudence

b. Matching

©. ‘Transparency

4. GAAP.

2) During the year ABC Manufacturing Ltd did not purchase any new fixed assets v"

and managed to produce and sell more products than the previous year. Which of

the following would you expect to be shown by the ratios?

a, A decline in gross profit margin

b, An increase in the FA turnover rate

©. A decline in Net Asset efficiency

4. A proportional increase in debtor days

3) A successful company's major source of cash should be from...

a. Financing activities

b. Operating activities

©. Investing activities

d. Botha andc

4) ‘What accounting term is used, to describe the reduction inthe value of goodwill

ver a period of time in the accounting books?

a. Depreciation

‘b. Prudence

©. Amottisation

d. Matching

Tht

8) Retained Income is added to which part ofthe accounting statements

a,

Profit in the Income statement

b. Liability in the Balance sheet

©. Equity in the Balance sheet

4. Assets in the Balance sheet

©) Large expenditure on fixed assets is likely to

a

b.

ce

d

Reduce operating capacity

Increase gross profit margins: :

Bring about a decrease in asset efficiency in the Short-Term

Increase the Fixed Asset turnover rate

7) Which of the following is nor true ofa (Pty) Ltd company?

a

b.

has tobe registered withthe registrar of companies

Theit dealings ae governed by the company’s memorandum and articles

of association

‘The shareholder's Hablity is limited to the extent oftheir share capital

Theit shares can be freely traded between thitd parties y

8) Liesurenet accounted for 5-year gym membership by recognising 75% of the total

fee as income in the first year. Which accounting concepts did it violate?

a,

b,

°,

4.

Prudence and Matching |

Consistency and Going Concem

Historical Cost and Prudence

Matching and Consistency

9) All partners in a partnership are said to be Joint ‘ad severally liable, This means

that

a

In the event of bankruptey, they only stand to lose their original share

capital

‘They are all personally liable for the debts of the Partnership RR TCE

Even ‘Silent Partners’ have to contribute something to the business

‘They can not trade their share inthe partnership with a third party

“Sete Rye one ene Set eyamoe,

TTT

10) What can we assume if the ross profit decreases from on

‘perating profit actually goes up?

4 That interest payments have increased

b. That depreciation has got out of contio*

& That we have enjoyed increased efficiency with expenses

4. That shareholders are withdrawing excessive dividends

1) Calculate the retained profit figure for the year if gross profit came to 56 200,

Total expenses amounted 1033 100, corporate tax stood at 35% and the

Company's dividend policy was 6 pay out one thitd oftheir camings after tax,

a 5005

b. 10010

ce. 15015

4 8085

Sell2 340 units of prodilct A for R50 each. Sales for Product B are expected to be

25% up on last year’s igure of R267 000. What will be their total budgeted

tumever?

a 450750

* b. 148.250

©. 475250

4. 183750

19) The net book value of fixed assets amounted 10214 000 as at 30 April 2001,

Daring the vear ended 30% April 2002 new asses costing 73200 were purchased

anda total of 91 640 was charged to the income statement as depreciation,

Caleulate the NBV of fixed assets as at 30 April 2009,

a 49160 :

b. 159.560

©. 287200

195 s60

Ti

14) JPR Lid issued 5.000 new 2 shares atthe eu Tonl market price of R 6,20. IF they

already had a share premium of 17 260, what would itbe after the is

a. 21000

b. 31000

ce. 38200

d. 48200

15) Stock on hand at the end of December 2001 was 7.320 and by the end of

December 2902 this hed gone up by 7 230, What effect would this have on cash. +

flow for the year?

a, (7230)

b. 14550

© (7320)

4. (14.550)

16) Ifa commany has stock fumover rate of 8.25 and their cost of sales amount to

77 440. calculate their stock figure,

a, 3.326

b 620

© 3011

4. 2320

17) ABC Ltd has fixed assets that cost 157 420 and the accumulated depreciatio:

ma

them comes to a total of 42 820, Calculate the fixed asset tumover rate a

813 660,

a 37x nese Bee

b. 19.0x eae

& 52x

7x

TTT

18) Cost of eoodsfseld can be calculated by adding opening stock and net purchases

and subtracting X. What is

Net sales esscel

b. Closing Stock cone

c. Sales discounts

d. Net purchases /

19) A Dohr Fouity rtio of 150% would represent a Debt: Total Capital Employed

ratio of...

a 33%

b. 60%

©. 40% > F

d. 25% etal

20) If stock was expected to rise in direct proportion to Cost of Sales, then calculate

the missing figure (to the nearest whole rand)

YearT Year 2 |

Cost of Sales 89.600 ~ 104205 eee

‘Stock Tia 7 L* I

a, 8827

b. 8940

©, 9.004

d. 9271

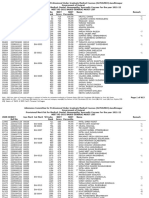

Questions 21 to 35 (inclusive) will be based on the following income statement and

balance sheet, as provided on the following page:

+41

Tener

a

Income Statement

VIE 28 Feb 2003

Sales 157,000

Cost of Sales 72,220

Gross Profit 84,780

Expenses 45,930

General & Admin

Sales & Marketing

Staff Costs

Depreciation

L460

Operating Profit 38,850

Interest Paid 250

Profit Before Tax 38,600

Taxation 15,440

Earnings after Tax 23,160,

Dividend 11,880

Retained Earnings 17,580

Balance Sheet

Capital Employed 28 Feb 2003

Ordinary Shares 600

Share Premium -

Retained Eamings | 36,970

Total Equity > 37,570

L-T Debt 30,000

67,570,

Employment of Capital

Fixed Assets 46,950

Ace Depreciation 14,590

32,400

Current Assets 40,420

Stock 4,630

Debtors 28,560

“Gash 7,230.

Current Liabilities 5,250

Creditors 1,230

Bank Overdraft 4,020

Net Curenit’Assets 85,170

Net Assets 67,570

[YE 28 Feb 2000

300,006

172,320

127,680

73,290

28 Feb 2004

125,360

30,000

155,360

» 8360

166,900

31,180

135,870

TT

4

21) What was the value of accumulated depreciation in the 2002 balance sheet, (prior

to the first year shown here)

a. 14,590

b. 31,180

& 4,590 '

4. 10,000 )

7

72) Ite cost of equity is 25% and the cost of dS is 189% and the tax tate is 30%,

what is the WACC for the 1 year (2003)

a. 21.89%

b. 21.50%

©. 22.56%

d. 19.49%

23) When looking at the cash flow statement, what are your changes in Working

capital balances for the 2nd year (2004),

a = 12,736

b. +12,756

c + 4,964

a. ~ 4,964

24) The cash flow for the year 2004 was:

a. ~ 10,656.

b. + 10.656

c ~ 7,446

d+ 7,446 * :

' What was the price per share?

26) If we wanted to have the same equity to debt ratio for the second year, as we had

in the frst year. Ifthe total equity remains as is shown in the 2004 balance sheet,

by how much could we inerease the debt?

a R95,360

b. 7570

©. 50,128

d. R70,108

27) What is the Fixed asset turnover rate for the 2™ year, and is it better or worse that

the previous year?

a 1.85 worse

b. 18; better

©. 2.25 worse

@ 2.2; better

TIT

nema eThoauacage number of days that we hold Stock for in the second yeiit is;

a. 29.6 day.

b. 8.1 days

© 17.0 days

d. 24,2 days

29) What is the self finding gap portion of the cash Conversion cycle, for the 2

year?

a. 22.9 days

b. 36.3 days

&. 19.9 days

4. 31.4 days

y a. 523% ; better

b. 18.6% ; worse

& 113%; worse

} 25.2%; worse

31) Tin'the 3" year (2005) Thad earning after tax of R42,500, given the dividend

Policy, what do you presume the dividend payout would be? ca

a. R42,500

b. R10,625

©. R21,250

d. R15,790 :

32) Looking et he cash flow, which activity consuined the most amount of cash?

a. Investing activity »

b. Financing activity

©. Sharcholder activity

da Operations activity

©. 15.75 days

35.2 days

74) fw Took at the sales and marketing expense. What Percentage is it of total

expenses in the 2™ year, has that inereased or decreased asa percentage of total

expenses from the previous year?

a. 27.5% ; increase

b. 27.5% 3 decrease

©. 20.5% ; increase

d. 20.5% 5 decrease

TW

35) Focusing on the cash flow, what was the ‘otal for the shareholder activity?

a. R87,390

b. 55,810

©. -R15,390

d. RS6,210

36) In which way could we improve the working capital turnover rate?

a. Therease stock

b. Reduce stock

©. Reduce creditors

d. Reduce Sales

31) Ifa company has @ dividend policy Of paying 15% of caming after tax, as

Gividend. What would their Dividend cover be?

a 15.0 times

b. 85.0 times

c, 6.7 times

4. 83.3 times

a

b. 240 cents

© 14 cents

4. Can't say for sure,

39) Ifthe eapitel employed of & company amounts to R75,000. We know that the

Fixed assets are R28,000 and that Current Assele we 71,500. What is the value

of the net assets?

a. R99,500

b. R75,000

©. R71,500

4. Not enough information given

40) What would the effect of an increase in the tax rate do to the WACC%, for a

Company that has 40% debt and 60% equity?

a. Reduce the WACC%

d. Increase the WACC%

¢. Have No Effect on the WACC%

4. Impossible to say without the exact numbers,

THT

You might also like

- Campaign Dungeon Master Player Characters: Current Standard PT v1.1Document2 pagesCampaign Dungeon Master Player Characters: Current Standard PT v1.1Ridah SolomonNo ratings yet

- Actions in Combat: Improvised Action Attack HelpDocument2 pagesActions in Combat: Improvised Action Attack HelpKelsey Marsh100% (1)

- Campaign Dungeon Master Player Characters: Current Standard PT v1.1Document2 pagesCampaign Dungeon Master Player Characters: Current Standard PT v1.1Ridah SolomonNo ratings yet

- Sasria intermediary fee increase reminderDocument1 pageSasria intermediary fee increase reminderRidah SolomonNo ratings yet

- Spell Lists PDFDocument10 pagesSpell Lists PDFskidamdnevnoNo ratings yet

- Assault On Black Tooth RidgeDocument49 pagesAssault On Black Tooth RidgeRidah Solomon100% (3)

- Draft FSRA Exemption Notice 1 of 2019Document2 pagesDraft FSRA Exemption Notice 1 of 2019Ridah SolomonNo ratings yet

- Films and Publications Amendment BillDocument32 pagesFilms and Publications Amendment BillBusinessTech0% (1)

- Test Pack - Commercial (Example Template)Document85 pagesTest Pack - Commercial (Example Template)Ridah SolomonNo ratings yet

- Charts - Weather, Random Encounters, EtcDocument16 pagesCharts - Weather, Random Encounters, EtcRidah SolomonNo ratings yet

- Sasria intermediary fee increase reminderDocument1 pageSasria intermediary fee increase reminderRidah SolomonNo ratings yet

- Films and Publications Amendment BillDocument32 pagesFilms and Publications Amendment BillBusinessTech0% (1)

- Vitality Main RulesDocument15 pagesVitality Main RulesRidah SolomonNo ratings yet

- Nedbank Payment Requisition FormDocument2 pagesNedbank Payment Requisition FormRidah SolomonNo ratings yet

- DND SpellLists 1.0Document2 pagesDND SpellLists 1.0Ridah SolomonNo ratings yet

- FSC Empowering Supplier DefinitionDocument1 pageFSC Empowering Supplier DefinitionRidah SolomonNo ratings yet

- Spell Lists PDFDocument10 pagesSpell Lists PDFskidamdnevnoNo ratings yet

- Cataclysm Reading OrderDocument1 pageCataclysm Reading OrderRidah SolomonNo ratings yet

- SAIA Alignment ImpactDocument41 pagesSAIA Alignment ImpactRidah SolomonNo ratings yet

- Web Site Functional Specifications DocumentDocument16 pagesWeb Site Functional Specifications Documentmeeta31No ratings yet

- Susan Request (2013)Document129 pagesSusan Request (2013)Ridah SolomonNo ratings yet

- Approval in Principle V 4Document1 pageApproval in Principle V 4Ridah SolomonNo ratings yet

- Leapfrog DetailsDocument1 pageLeapfrog DetailsRidah SolomonNo ratings yet

- SAIA Alignment ImpactDocument41 pagesSAIA Alignment ImpactRidah SolomonNo ratings yet

- Workplace Skills Plan 2011-2012Document30 pagesWorkplace Skills Plan 2011-2012Ridah SolomonNo ratings yet

- BEEBrochure LRDocument39 pagesBEEBrochure LRRidah SolomonNo ratings yet

- Rating Pack 2014-01-15Document6 pagesRating Pack 2014-01-15Ridah SolomonNo ratings yet

- Learner List BreakdownDocument2 pagesLearner List BreakdownRidah SolomonNo ratings yet

- FSC Alignment Issues: Change Implication NotesDocument5 pagesFSC Alignment Issues: Change Implication NotesRidah SolomonNo ratings yet

- Cancellation Letter ExampleDocument1 pageCancellation Letter ExampleRidah Solomon100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DMEUG Allotment Third Round FinalDocument289 pagesDMEUG Allotment Third Round Finalthakulla KhakendraNo ratings yet

- 8th EveningDocument36 pages8th Eveningdaud hasanNo ratings yet

- JEE Main 2021 Question Paper With Answer Key July 27 NewDocument94 pagesJEE Main 2021 Question Paper With Answer Key July 27 NewvicNo ratings yet

- FCE Practice TestsDocument4 pagesFCE Practice Testsjonnogoxy-570No ratings yet

- Wa0001.Document2 pagesWa0001.jayeobagiftNo ratings yet

- Neet List Round 2 List 2Document1 pageNeet List Round 2 List 2YASEEN AKBARNo ratings yet

- GATE Mechanical Engineering 2017 Question PaperDocument21 pagesGATE Mechanical Engineering 2017 Question Papervinay guttNo ratings yet

- Edexcel International Gcse Syllabus May-June2024Document19 pagesEdexcel International Gcse Syllabus May-June2024moo178833No ratings yet

- Iit-Jee Time Table-27-11-2023-2Document1 pageIit-Jee Time Table-27-11-2023-2xyz641137No ratings yet

- Cambridge Igcse Chemistry 0620 Grade Threshold TableDocument2 pagesCambridge Igcse Chemistry 0620 Grade Threshold TableFaridNo ratings yet

- CXC 2022 exam results release dateDocument2 pagesCXC 2022 exam results release date4Ngabrielle hancelNo ratings yet

- Answer Sheet For The Summative Sy 2020-2021Document6 pagesAnswer Sheet For The Summative Sy 2020-2021Haydee YangosNo ratings yet

- ResultDocument169 pagesResultAbdul KibayaNo ratings yet

- Cambridge English Ketfs Petfs Fcefs Cae Cpe Individual Application Form 2016Document1 pageCambridge English Ketfs Petfs Fcefs Cae Cpe Individual Application Form 2016Τζενη ΑθηναNo ratings yet

- Updated Study Plan 101 COS1501 2023Document2 pagesUpdated Study Plan 101 COS1501 2023nxumalopat2No ratings yet

- Cfa Exam Results Since 1963Document1 pageCfa Exam Results Since 1963Mark SinsheimerNo ratings yet

- Sample FET Report PDFDocument4 pagesSample FET Report PDFNishadYadavNo ratings yet

- UPSR Marking SchemeDocument8 pagesUPSR Marking SchemeJayamathiVeerapaNo ratings yet

- Progress Report Card For Academic Session 2019-2020: Class - ViiDocument1 pageProgress Report Card For Academic Session 2019-2020: Class - ViiBoeing MaxNo ratings yet

- Gujarat Neet Merit List 2021Document615 pagesGujarat Neet Merit List 2021seemachuNo ratings yet

- June 2023 CSEC Candidate Listing - Updated 10th February PDFDocument474 pagesJune 2023 CSEC Candidate Listing - Updated 10th February PDFjovann johnNo ratings yet

- Weekly Schedule (26.06.2023-02.07.2023)Document10 pagesWeekly Schedule (26.06.2023-02.07.2023)Atharva SrivastavaNo ratings yet

- MA Telugu Syllabus (R 2016-17)Document30 pagesMA Telugu Syllabus (R 2016-17)Tony DhinakaranNo ratings yet

- 1st Feb Shift 2 Paper Analysis of JEE Main Session 1 2024Document7 pages1st Feb Shift 2 Paper Analysis of JEE Main Session 1 2024Suriyanarayana KNo ratings yet

- User Guide IRCTCDocument23 pagesUser Guide IRCTCManoj KumarNo ratings yet

- Academic Performance Over 3 SemestersDocument1 pageAcademic Performance Over 3 Semestersaiman rusyaidiNo ratings yet

- 1926 SAT TestDocument22 pages1926 SAT TestHuffPost PoliticsNo ratings yet

- CONTENTS - Notices - 225 - CH 53 HPTI 410Document1 pageCONTENTS - Notices - 225 - CH 53 HPTI 410himanshujagga0No ratings yet

- Tài liệu CAE - CPE mới, photo từ sách gốcDocument4 pagesTài liệu CAE - CPE mới, photo từ sách gốcLinh ThùyNo ratings yet

- MADE EASY GATE 2019 Rank Predictor - Rank Calculator and Estimator PDFDocument30 pagesMADE EASY GATE 2019 Rank Predictor - Rank Calculator and Estimator PDFMD SHAHEEN RazaNo ratings yet