Professional Documents

Culture Documents

IIBF Vision June 2015

Uploaded by

rksp99999Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IIBF Vision June 2015

Uploaded by

rksp99999Copyright:

Available Formats

A Monthly Newsletter of Indian Institute of Banking & Finance

(Rs. 40/- per annum)

(ISO 9001 : 2008 CERTIFIED)

Committed to

professional excellence

Volume No. : 7

Issue No. : 11

Banks enroll 63 million people under Jan Suraksha

Banks have enrolled 63.3 million people under the

three Jan Suraksha schemes - Atal Pension Yojana (APY),

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

The schemes were launched on 9th May 2015 by

Shri Narendra Modi, Honorable Prime Minister of

India. PMJJBY is a term life insurance scheme, renewable

from year to year, offering life insurance cover for death

due to any reason. All savings bank account holders in

the 18-50 age groups can join this scheme at a payable

premium of `330 a year. PMSBY is an accident insurance

scheme of `2 lakh sum assured with premium of `12

a year. The accident cover of the member will terminate

on attaining the age of 70 or due to closure of account

with bank or insufficiency of balance to keep insurance

in force. APY is available to unorganized sector workers.

Under the APY, guaranteed minimum pension of

`1,000, `2,000, `3,000, `4,000 and `5,000 a month

will be given at the age of 60 years, depending on the

contributions by the subscribers.

Investment by overseas Indians made easier

The Union Cabinet decided to relax Foreign Direct

Investment (FDI) norms for NRIs, treating nonrepatriable investments made by them on par with

domestic funding. A decision in this regard was

taken by the Union Cabinet. The meeting also decided

to broaden the definition of NRIs to include Overseas

Citizens of India (OCIs) cardholders and Persons of

Indian Origin (POIs) cardholders. The decision that

NRI includes OCI cardholders as well as POI cardholders

is meant to align the FDI policy of the government

to provide POIs and OCIs parity with NRIs in respect

of economic, financial and educational fields. The

measure is expected to result in increased investments

across sectors and greater inflow of foreign exchange

remittance leading to economic growth of the country.

June 2015

No. of Pages - 8

the

n of

ssio develop d

i

m

n

o

The

is "t

ied a

tute ly qualif and

i

t

s

n

I

onal ankers ls

essi

b

prof petent essiona ess

c

com ce prof

a pro

finan through aining,

cy /

n, tr

arily

prim educatio onsultan ing

of

on, c continu nt

inati

d

e

exam elling an evelopm

s

d

n

l

u

a

o

c

"

on

essi ograms.

prof

pr

Top Sto

ries ......

............

............

Bankin

g Policie

............

.......1

s ..........

Bankin

............

g Deve

..

............

lopmen

....2

ts ........

Regula

............

tor's Sp

..........3

eak......

............

Insuran

............

ce ........

........4

............

............

New Ap

............

pointme

.......5

nt / Fore

Produc

x ..........

ts & All

............

iances

....6

............

Financia

............

l Basics

..........6

............

Glossa

............

ry ........

............

............

.....6

............

Institute

............

's Train

.........7

ing Acti

vities ....

News fr

............

om the

.......7

Institute

Market

............

Roundu

............

p ..........

......7

............

............

......8

"The information / news items contained in this publication have appeared in various external sources / media for public use

or consumption and are now meant only for members and subscribers. The views expressed and / or events narrated /

stated in the said information / news items are as perceived by the respective sources. IIBF neither holds nor assumes any

responsibility for the correctness or adequacy or otherwise of the news items / events or any information whatsoever."

Banking Policies

might be extended in congruence with the resolution

period approved by Board for Industrial & Financial

Reconstruction / Corporate Debt Restructuring / Joint

Lenders Forum, on a case to case basis with the prior

approval of RBI, subject to the Independent Credit

Rating Agencies continuing to rate these SRs. At present,

the maximum resolution period permitted to SCs /

RCs for realisation of stressed assets acquired by them

is 8 years. However, in most cases, the repayment period

goes beyond eight years. In such cases, ARCs holding

part of stressed assets, had expressed their inability to

go along with other lenders beyond eight years due

to regulatory constraints. They would exit at the end

of five or eight years, jeopardizing the restructuring

efforts of a majority of lenders. RBI has kept in mind

these constraints while modifying the directions. Now,

with the amendments, ARCs can play an effective role in

resolution of stressed cases.

RBI removes curbs on NBFCs for sale of MFs

RBI has lifted all restrictions on Non-Bank Finance

Companies (NBFCs) to sell Mutual Funds (MFs). Since

the distribution of Mutual Fund products by the NBFCs

is on non-risk sharing basis and purely as a customer

service, RBI has now decided to dispense with the

requirement of prior approval from the Reserve Bank for

NBFCs to distribute Mutual Fund products. It has also

been decided to dispense with the minimum eligibility

criteria. The guidelines on distribution of MF products

by NBFCs have been suitably modified. According to

the new guidelines, the NBFC should only act as an

agent of its customer, forwarding their applications for

purchase or sale of MF units together with the payment

instruments to the MF, the registrars or the transfer

agents. The purchase of units should be at the customers

risk and without the NBFC guaranteeing any assured

return. NBFCs can't acquire units of MFs from the

secondary market for sale to their customers or buy-back

from their customers. In case the NBFC is holding

custody of MF units on behalf of its customers, it should

ensure that its own investments and the investments

belonging to its customers are kept distinct from each

other. The NBFC should not adopt any restrictive

practice of forcing its customers to go in for a particular

MF product sponsored by it. The customers should be

allowed to exercise their own choice.

NBFCs Can Cut Forward Deals in Corp Bonds

RBI has permitted NBFCs registered with RBI including

Government companies as defined in sub-section (45)

of section 2 of the Companies Act, 2013 which adhere

Banking Policies

RBI directive on card issuance

RBI has advised banks that with effect from September 1,

2015, all new cards - debit and credit, domestic and

international - issued by them should be EMV (Europay,

MasterCard, and Visa) chip and pin-based cards. While

some banks have already moved to EMV chip and pin

cards issuance, a large number of banks continue to issue

magnetic stripe cards. The acceptance infrastructure is

getting geared up to accept EMV chip and pin cards.

Thus, given the level of readiness of the card acceptance

infrastructure at point of sale and also the implementation

of PIN@POS for debit cards, the time is appropriate to

move further along the path to migrate away from

magnetic stripe only cards to chip and pin cards.

RBI released framework for dealing with loan frauds

RBI has released framework for dealing with loan frauds for

issues relating to prevention, early detection and reporting

of frauds. The guidelines will come into force with

immediate effect. The most effective way of preventing

frauds in loan accounts is for banks to have a robust

appraisal and an effective credit monitoring mechanism

during the entire life-cycle of the loan account. In case of

accounts classified as 'fraud', banks are required to make

provisions to the full extent immediately, irrespective of the

value of security. However, in case a bank is unable to make

the entire provision in one go, it may now do so over four

quarters provided there is no delay in reporting. Banks are

required to lodge the complaint with the law enforcement

agencies immediately on detection of fraud. The concept

of a Red-Flagged Account (RFA) is being introduced in

the current framework as an important step in fraud risk

control. An RFA is one where a suspicion of fraudulent

activity is thrown up by the presence of one or more Early

Warning Signals (EWS). RBI has provided an illustrative

list of some EWS for the guidance of banks. Borrowers

who have defaulted and have also committed a fraud in

the account would be debarred from availing bank

finance from Scheduled Commercial Banks, Development

Financial Institutions, Government owned NBFCs,

Investment Institutions, etc., for a period of five years from

the date of full payment of the defrauded amount.

RBI allows ARCs resolution period beyond 8 years

RBI has given Asset Reconstruction Companies (ARCs)

long resolution period to ensure smooth working of

restructuring package for stressed accounts. The time

for redeeming Security Receipts (SRs) held against assets

IIBF VISION

June 2015

Banking Policies - Banking Developments

to the prudential norms prescribed for NBFCs by

the Department of Non-Banking Regulation, Reserve

Bank of India, to undertake ready forward contracts in

corporate debt securities. Other institutions, which are

already allowed to enter forward contract deals include

commercial banks, primary dealers, Exim Bank, National

Housing Bank, National Bank for Agriculture and Rural

Development, Small Industries Development Bank of

India, Housing Finance Companies and Mutual Funds.

RBI eases remittance, ECB norms

On a review of the permitted transactions under the

Rupee Drawing Arrangements (RDAs), RBI has decided

to increase the limit of trade transactions from the existing

`5,00,000/- (Rupees Five Lakh only) per transaction to

`15,00,000/- (Rupees Fifteen Lakh only) per transaction.

It has also been decided to permit Authorised Dealer

banks to regularise payments exceeding the prescribed

limit under RDA provided that they are satisfied with the

bonafide of the transaction. With a view to providing

greater flexibility for structuring of ECB arrangements, it

has been decided that recognised non-resident ECB

lenders may extend loans in Indian Rupees provided that

the lender should mobilise Indian Rupees through swaps

undertaken with an Authorised Dealer Category-I bank in

India also the ECB contract should comply with all other

conditions applicable to the automatic and approval

routes as the case may be as well as the all-in-cost of such

ECBs should be commensurate with prevailing market

conditions. For the purpose of executing swaps for ECBs

denominated in Indian Rupees, the recognised ECB

lender, if it desires, may set up a representative office in

India following the prescribed laid down process.

Norms on NPA sale to ARC eased

Reserve Bank of India extended by a year the benefit

which allowed banks to spread over two years the loss

incurred through sale of bad loans to asset reconstruction

companies. RBI said that this dispensation would be

available till March 2016. As per an earlier circular, the

forbearance had ended on March 31, 2015. In order to

incentivise banks that recognised NPAs and sold them

early RBI had allowed through such sale over two years.

RBI advises Banks to appoint Internal Ombudsman

Reserve Bank of India has advised all public sector

banks and some private sector and foreign banks to

appoint an internal ombudsman. The internal

ombudsman would be designated Chief Customer

Service Officer (CCSO). He/she should not have

worked in the bank in which he/she is appointed as

CCSO. RBI has taken this initiative to boost the quality

of customer service and to ensure that there is undivided

attention to resolution of customer complaints in

banks. Reserve Bank of India will shortly issue detailed

operational guidelines to the banks.

SEBI notifies debt conversion norm for banks in

distressed companies

Securities and Exchange Board of India (SEBI) has

notified new norms for banks to convert their debt

into equity to help lenders deal with defaulting

borrowers. The conversion price shall be determined

in accordance with the guidelines specified by Reserve

Bank of India for strategic debt restructuring scheme,

which shall not be less than the face value of the equity

shares. Equity shares so allotted shall be locked-in for

a period of one year from the date of trading approval

provided that for the purpose of transferring the control,

the consortium of banks and financial institutions

may transfer their shareholding to an entity before

completion of the lock-in period subject to continuation

of the lock-in on such shares for the remaining period

with the transferee.

Bill to check piling up of cheque-bounce cases

Mr. Arun Jaitley, Finance Minister introduced the

Negotiable Instruments (Amendment) Bill 2015, which

would help in ensuring a fair trial of cases under Section

138 that deals with cheques being not honoured. This was

done to prevent piling up of cheque-bounce cases in

various courts. The main amendment included in this is

the stipulation that the offence of rejection / return of

cheque u/s 138 of NI Act will be enquired into and tried

only by a Court within whose local jurisdiction the bank

branch of the payee, where the payee presents the cheque

for payment is situated.

Relaxation in requirement of Additional Factor of

Authentication for small value card present transactions

The payment can be made up to `2,000 using NFC

(Near Field Communication) enabled credit and debit

cards without punching the password at any retail

outlet or while shopping online. This is possible because

Reserve Bank of India has waived the second or the

Additional Factor of Authentication (AFA) for small

value transactions. NFC-technology allows users to

Banking Developments

Central Government to print 15 crore `1 notes every year

After a gap of 20 years, the `1 note is set to make a

comeback. The Central Government has decided to print

15 crore `1 notes every year. Incidentally, it is only `1

notes that are issued by the Government of India; all other

currency denominations are issued by RBI.

IIBF VISION

June 2015

Banking Developments - Regulator's Speak...

simply tap their cards onto a point-of-sales equipment to

make payments. Unlike existing credit cards there is no

need for swiping. This will make life easier for consumers

shopping online by enabling them to skip the process of

typing an additional password.

Government to expedite action on single Demat

account & uniform KYC

Shri Arun Jaitley, Union Finance Minister said that action

on Single Demat account and Uniform KYC norms to be

expedited and suitable regulation framework in this regard

be put in place. He said that the common account

aggregation facility is envisaged to allow people to get

details of their financial assets such as bank accounts,

stocks, insurance policies, mutual funds and other

financial instruments at one place. The Financial Stability

and Development Council (FSDC) took stock of the

state of macro-economy and challenges / issues including

external sector vulnerabilities while observing that macroeconomic vulnerabilities have been reduced significantly

in the recent months on the back of various policy

initiatives taken by the Government, improvement in

growth outlook, fall in inflation, recovery in the external

sector and political stability. The Council also discussed

the progress made regarding implementation of its

decision taken on development of Corporate Bond Market

and discussed the way forward for developing a vibrant,

deep & liquid bond market.

Norms for IDF-NBFCs relaxed

Reserve Bank of India has widened the scope of financing

of infrastructure debt funds by permitting them to invest

in Public Private Partnership (PPP) and infrastructure

projects which have completed at least one year of

satisfactory commercial operation and are a party to

a Tripartite Agreement with the Concessionaire and

the Project Authority for ensuring a compulsory buyout

with termination payment. It has also been decided

to allow IDF-NBFCs to undertake investments in

non-PPP projects and PPP projects without a Project

Authority, in sectors where there is no Project Authority,

provided these are post Commercial Operations Date

(COD) infrastructure projects which have completed

at least one year of satisfactory commercial operation.

The maximum exposure that an IDF-NBFC can take

on individual projects will be at 50% of its total Capital

Funds. An additional exposure up to 10% could be

taken at the discretion of the Board of the IDF-NBFC.

RBI may, upon receipt of an application from an IDFNBFC and on being satisfied that the financial position of

the IDF-NBFC is satisfactory, permit additional exposure

up to 15% (over 60%) subject to such conditions as it

IIBF VISION

may deem fit to impose regarding additional prudential

safeguards.

RBI Eases Norms for Remitting FCNR Funds

RBI has clarified that A2 form is to be filed at the time of

purchase of foreign exchange using rupee funds and

hence is not applicable while remitting FCNR (B) funds.

Completion of the declaration cum application form was

earlier mandatory for sending money abroad. RBI has

also advised banks to devise better methods of checking

whether deals are bona fide, rather than insisting on the

physical presence of the account holder, in order to ensure

hassle free remittance of funds to the account holder.

Calendar of reviews to be replaced by seven themes of

Nayak Committee

RBI has prescribed comprehensive 'Calendar of

Reviews' to be deliberated by the Boards of banks and

has made significant additions to the same over the

years. It has been observed that Calendar of Reviews

uses considerable Board time and as a result the Board

may not be in a position to give focused attention

to matters of strategic and financial importance. In

this connection, the Committee to Review Governance

of Boards of Banks in India (Chairman - Dr. P. J. Nayak)

had recommended that discussions in the Boards of

banks need to be upgraded and greater focus should

be on strategic issues. In the first bi-monthly monetary

policy statement 2015-16, it was proposed to do away

with the Calendar of Reviews and instead, replace

it with the seven critical themes prescribed by the

Nayak Committee namely, business strategy, financial

reports and their integrity, risk, compliance, customer

protection, financial inclusion and human resources and

leave it to the banks' Boards to determine other list of

items to be deliberated and periodicity thereof.

Regulator's Speak...

Raising capital has become difficult for banks

According to Mr. S. S. Mundra, Deputy Governor, RBI

conservation of capital and its efficient utilization is a

priority for all banks; especially in wake of the concerns

about the ability of banks to raise additional capital to

support their business. These concerns are not entirely

misplaced, especially for Public Sector Banks (PSBs). The

poor valuations of bank stocks are not helping matters, as

raising equity has become difficult. There is a constraint

on the Government with regards to meeting the capital

needs of PSBs. Hence, certain banks are faced with the

challenge of looking at newer ways of meeting their

capital needs.

4

June 2015

Regulator's Speak... - Insurance

management, jointly or severally exceeds 1% of the paid

up equity capital of the insurance company, unless the

previous approval of the Authority had been obtained for

the said transfer.

IRDAI proposes to tighten registration norms

IRDAI has proposed to tighten the norms for registration

of insurance companies. In its draft regulations, IRDAI

has sought the details of promoters' voting rights, the

products to be sold, financial performance projections and

the areas the insurers would operate in. New companies

being registered will need to comply with the provision

of Indian owned and controlled. Existing companies will

have to comply with this within a year of the norms

coming into force. The application for registration will

be considered after taking into account factors such as

capital structure, extent of obligation to provide insurance

to the rural sector, unorganized workers, and backward

classes of society. It will also look into the business plan for

the succeeding five years, especially the plans to set up

presence in rural areas. The minimum paid-up equity

share capital required for all categories including life,

general, health and re-insurance is `200 crore.

Indian investors cannot hold over 10% paid-up equity

shares in insurance firms

No Indian investor will be allowed to hold shares

exceeding 10% of the paid-up equity shares in an

insurance company, according to Insurance Regulatory

and Development Authority of India (IRDAI). According

to IRDAI (Transfer of Equity Shares of Insurance

Companies) Regulations, 2015 all investors (where there

are one or more investors in an insurance company) jointly

should not hold more than 25% of the paid-up equity

share capital of the insurance company. Further, with

reference to the proposals pertaining to the transfer of

shares in insurance companies, the authority said it might

ask Indian promoters as well as foreign investors to have a

minimum lock-in period for infusion of additional capital

as a pre-condition for approval.

Expert panel on health insurance says pilot products for

5-year tenure needed

An expert committee constituted to examine the health

insurance framework has said there should be experimental

products, with a five-year period. In its report, given

to Insurance Regulatory and Development Authority of

India (IRDAI), it recommended insurers have a category

of closed-end products (termed pilot products) for this

much time. These would cover risks that are otherwise

generally declined or excluded, where they have the option

to renew or not after five years. This is to encourage new

RBI open to increase capital a/c transaction to $250,000

per year

Mr. G. Padmanabhan, Executive Director, said that RBI

has progressively increased the limit for capital account

transactions for Individuals on a per annum basis and

are in consultation with the Government to increase it

to USD 250,000 per year per individual. The experience

so far has been that most of this is used for permissible

current account transactions, presumably because of the

ease. While there are risks associated with full capital

account convertibility, resisting liberalisation over an

extended period may prove futile and counterproductive.

As the economy gets more globalised, it will become

harder to maintain closed capital accounts. So, India

needs to continue moving towards full capital account

convertibility.

Reducing vulnerabilities crucial for emerging economies

Dr. Raghuram Rajan, Governor, Reserve Bank of

India, in his speech to the Economic Club of New York

said that emerging economies have to work to reduce

vulnerabilities in their economies, to get to the point

where, like Australia or Canada, they can allow exchange

rate flexibility to do much of the adjustment for them

to capital inflows. But the needed institutions take time

to develop. In the meantime, the difficulty for emerging

markets in absorbing large amounts of capital quickly

and in a stable way should be seen as a constraint,

much like the zero lower bound, rather than something

that can be altered quickly. Even while resisting the

temptation of absorbing flows, emerging markets will

look to safety nets.

Insurance

Shareholding change in insurers

The Insurance Regulatory and Development Authority

of India (IRDAI) said that no registration of transfer

of shares or issue of equity capital of an insurance

company which would result in a shareholding change

can be made where : After the transfer, if the paid-up

holding of the transferee in the shares of the insurance

company is likely to exceed 5% of its paid-up capital, it

will not be approved. The nominal value of the shares

intended to be transferred by any individual, firm, group,

constituents of a group, or body corporate under the same

IIBF VISION

June 2015

Insurance - New Appointments - Forex - Products & Alliance - Financial Basics

and innovative products. After five years, the companies

have to confirm a pilot product as a regular one, subject to

the various provisions of renewability.

Products

& Alliances

New Appointments

Name

Designation / Organisation

Mr. Arun Shrivastava

Managing Director & Chief Executive Officer,

Syndicate Bank

Mr. Rajnish Kumar

Managing Director, State Bank of India

Organisation Organisation

tied up with

Bank of

Ms. Varsha Purandare Deputy Managing Director & Chief Credit &

Risk Officer, State Bank of India

Baroda

Mr. Mrutyunjay

Mahapatra

Deputy Managing Director & Chief

Information Officer, State Bank of India

Axis Bank

Mr. R. A. Sankara

Narayanan

Executive Director, Bank of India

UAE Exchange

For real time instant credit

of INR remittance facility to

customers.

Ping Pay-multi-

To enable customers with

social payment

smart phones to transfer

solution via-NPCIs

funds, person to person,

Immediate Payment including non-Axis Bank

Forex

Canara Bank

Benchmark Rates for FCNR (B) Deposits

applicable for the month of June 2015

Service (IMPS)

account-holders

M/s. Volvo-Eicher

For financing vocational

Commercial

education loans to students

Vehicles Ltd.,

LIBOR / SWAP for FCNR (B) Deposits

Currency

Purpose

HDFC Bank

LIBOR

SWAPS

1 year

2 years

3 years

4 years

5 years

Apollo Hospitals

For easy disbursal of medical

allowance to the employees

of a company

USD

0.49600

0.86500

1.19900

1.44400

1.64500

GBP

0.65700

0.9783

1.2076

1.3888

1.5096

EUR

0.07600

0.105

0.164

0.256

0.362

JPY

0.14750

0.159

0.169

0.205

0.258

CAD

1.10000

1.046

1.165

1.298

1.436

AUD

2.06900

2.092

2.203

2.433

2.567

CHF

-0.72000

-0.720

-0.550

-0.410

-0.260

State Bank

of India

Bank of India

Master Card

To enhance the payment

experience for customers

Snapdeal

To finance manufactures

and sellers from the small

and medium enterprises

PayPal

To enable SBI debit card

holders to use PayPal for

DKK

0.14200

0.2250

0.3150

0.4380

0.5720

NZD

3.33000

3.360

3.430

3.510

3.600

buying products from

SEK

-0.23200

-0.119

0.076

0.283

0.495

overseas web site and

SGD

1.05000

1.355

1.625

1.853

2.030

HKD

0.57000

0.880

1.160

1.380

1.540

MYR

3.66000

3.650

3.750

3.850

3.950

allow MSMEs to access

PayPals secure payment

solution

Amazon

Source : www.fedai.org.in

meets the aspirations of the

Foreign Exchange Reserves

Item

next generation of customers

As on 22nd May 2015

`Bn.

and small businesses.

US $ Mn.

Total Reserves

22,317.1

351,556.9

(a) Foreign Currency Assets

20,745.6

326,839.3

(b) Gold

1,229.3

19,335.7

(c) SDRs

258.4

4,064.5

(d) Reserve Position in the IMF

83.8

1,317.4

Financial Basics

Hybrid Debt Capital Instruments

In this category falls a number of capital instruments,

which combine certain characteristics of equity and

certain characteristics of debt. Each has a particular

Source : Reserve Bank of India (RBI)

IIBF VISION

To build a digital India which

June 2015

Financial Basics - Glossary - Institute's Training - News from the Institute

feature, which can be considered to affect its quality as

capital. Where these instruments have close similarities to

equity, in particular when they are able to support losses

on an ongoing basis without triggering liquidation, they

may be included in Tier II capital.

News From the Institute

R. K. Talwar Memorial Lecture

The 6th R. K. Talwar Memorial Lecture will be delivered

by Shri. Arvind Panagaria, Vice-Chairman, NITI Aayog,

Government of India on 17th July 2015 at SBI Auditorium,

Mumbai. (For details visit www.iibf.org.in).

Certificate examination for BCs / BFs (PMJDY)

The Institute has recently launched a Certificate

examination for BCs / BFs under the Pradhan Mantri

Jan Dhan Yojana (PMJDY) scheme. The Institute

has also published a book titled Inclusive Banking

thro' Business Correspondent - A tool for PMJDY.

This book has been translated into Hindi and Marathi

also. The first online examination for BCs was held in

May 2015 which was taken by 2,574 candidates. The

next exam is scheduled on 2nd July 2015 (For details

visit www.iibf.org.in).

Call for APABI Conference Papers

The Institute would be organizing the APABI

International Banking Conference 2015 on the theme

New Paradigms in Banking. Papers on any topic related

to the theme of the conference are invited. For details visit

www.iibf.org.in.

Cut-off Date of Guidelines / Important Developments

for Examinations

In respect of the exams to be conducted by the Institute

during May / June of a calendar year, instructions /

guidelines issued by the regulator(s) and important

developments in banking and finance up to 31st December

of the previous year will only be considered for the purpose

of inclusion in the question papers.

In respect of the exams to be conducted by the Institute

during November / December of a calendar year,

instructions / guidelines issued by the regulator(s) and

important developments in banking and finance up to

30th June of that year will only be considered for the

purpose of inclusion in the question papers.

Additional Reading Material for Institute's examination

The Institute has put on its web site additional reading

material, for various examinations, culled out from the

Master Circulars of RBI and other sources. These are

important from examination view point. For details visit

www.iibf.org.in.

Green Initiative

Members are requested to update their e-mail address

with the Institute and send their consent to receive the

Annual Report via e-mail in future.

Glossary

Rupee Drawing Arrangement

Under the Rupee Drawing Arrangements (RDAs),

cross-border inward remittances are received in India

through Exchange Houses situated in Gulf countries,

Hong Kong and Singapore. Prior approval of the

Reserve Bank is required for opening and maintaining

Rupee vostro accounts of these non-resident Exchange

Houses in India.

Institute's Training Activities

Training Programme Schedule for the month of June and

July 2015

No. Name of the programme

1. Recovery Management in

Banks

Date

Location

1st to 3rd June 2015

Chennai

8th to 10th June 2015

Kolkata

2. Customized training

programme on Credit

Appraisal for Officers of

Abhyudaya Co-operative

Bank

1st batch

1st to 3rd June 2015

Mumbai

2 batch

4th to 6th June 2015

Mumbai

3rd batch

8th to 10th June 2015

Mumbai

nd

3. Leadership Development

th

th

7 to 13 June 2015

Mumbai

and Credit Management for

Branch Managers of

Bharatiya Mahila Bank

4. Marketing / Branch

15th to 20th June 2015 Mumbai

Operations and Customer

care / Interpersonal Skills Bharatiya Mahila Bank

5. Two induction programme

22nd to 30th June 2015 Thane

for TJSB for trainee officers

6. Induction programme for

15th to 26th June 2015 Belapur

newly recruited Officers of

Bharatiya Mahila Bank

7. Post examination training

for Certified Bank Trainer

13th to 17th July 2015

NIBM,

Pune

programme

IIBF VISION

June 2015

News from the Institute - Market Roundup

Posted at Mumbai Patrika Channel Sorting Office, Mumbai

WPP Licence No. : MR / Tech / WPP - 62 / N E / 2013 - 15

Licence to post without prepayment.

/ 1998

Sending of hard copies of IIBF Vision document

The Institute is forwarding the monthly IIBF Vision

by e-mails to all the members who had registered

their e-mail ids with the Institute. Members who have

not registered their e-mail ids are requested to register

the same with the Institute on or before 30th September,

2015. The Institute is going to discontinue sending

the hard copies of the IIBF vision with effect from

October-2015 to all members. The members are

requested to note that only the soft copies of IIBF

Vision will be sent by e-mail in the future.

100.00

90.00

80.00

70.00

60.00

100 Jap Yen

30/05/15

29/05/15

27/05/15

24/05/15

21/05/15

15/05/15

EURO

USD

POUND STERLING

Source : Reserve Bank of India (RBI)

Weighted Average Call Rates

% p.a.

28500

7.50

BSE Sensex

28000

7.00

27500

6.50

27000

6.00

26500

5.50

Source : CCIL Newsletter, May 2015

29/05/15

25/05/15

22/05/15

20/05/15

18/05/15

13/05/15

07/05/15

04/05/15

25500

27/05/15

23/05/15

22/05/15

20/05/15

19/05/15

16/05/15

14/05/15

11/05/15

09/05/15

07/05/15

26000

02/05/15

5.00

09/05/15

06/05/15

50.00

Market Roundup

% p.a.

8.00

-1

RBI Reference Rates

110.00

07/05/15

Registered with Registrar of Newspapers under RNI No. : 69228

Postal Registration No. : MH / MR / North East / 295 / 2013 - 15

Published on 25th of every month.

Posting Date : 25th to 30th of every month.

Source : Bombay Stock Exchange (BSE)

Printed by Dr. J. N. Misra, published by Dr. J. N. Misra on behalf of

Indian Institute of Banking & Finance, and printed at Quality Printers (I),

6-B, Mohatta Bhavan, 3rd Floor, Dr. E. Moses Road, Worli, Mumbai - 400 018

and published from Indian Institute of Banking & Finance, Kohinoor City,

Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W), Mumbai - 400 070.

Editor : Dr. J. N. Misra.

INDIAN INSTITUTE OF BANKING & FINANCE

Kohinoor City, Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W),

Mumbai - 400 070.

Tel. : 91-22-2503 9604 / 9746 / 9907

Fax : 91-22-2503 7332

Telegram : INSTIEXAM

E-mail : iibgen@iibf.org.in

Website : www.iibf.org.in

IIBF VISION

June 2015

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- TheMuscleExperiment PDFDocument66 pagesTheMuscleExperiment PDFShuvajoyyy100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- LIIFT4 Weight Progression Tracker 6.10.18 PDFDocument1 pageLIIFT4 Weight Progression Tracker 6.10.18 PDFShuvajoyyy100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Track Your Body Beast Progress in One SheetDocument12 pagesTrack Your Body Beast Progress in One SheetyahooshuvajoyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 75 Workout Routines - All Madbarz Routines - Bar Brothers Algeria - Text PDFDocument79 pages75 Workout Routines - All Madbarz Routines - Bar Brothers Algeria - Text PDFyahooshuvajoy100% (1)

- CrossFit Manual v4Document117 pagesCrossFit Manual v4barbumihai100% (5)

- 31 Blender Drink Recipes PDFDocument18 pages31 Blender Drink Recipes PDFCraig Brown100% (1)

- Bodyweight+M A S S +phase3Document25 pagesBodyweight+M A S S +phase3yahooshuvajoyNo ratings yet

- IRCTC e-Ticketing Service DetailsDocument2 pagesIRCTC e-Ticketing Service DetailsRupKamalKutum100% (3)

- IRCTC e-Ticketing Service DetailsDocument2 pagesIRCTC e-Ticketing Service DetailsRupKamalKutum100% (3)

- IRCTC e-Ticketing Service DetailsDocument2 pagesIRCTC e-Ticketing Service DetailsRupKamalKutum100% (3)

- Tally QuestionsDocument73 pagesTally QuestionsVishal Shah100% (1)

- Proposed Construction of New Kutulo Airstrip - RetenderDocument112 pagesProposed Construction of New Kutulo Airstrip - RetenderKenyaAirportsNo ratings yet

- Welding of Cast IronDocument10 pagesWelding of Cast IronKrishnendu RouthNo ratings yet

- Martillo Komac KB1500 Parts ManualDocument12 pagesMartillo Komac KB1500 Parts ManualJOHN FRADER ARRUBLA LOPEZ100% (1)

- Manage Hospital Records with HMSDocument16 pagesManage Hospital Records with HMSDev SoniNo ratings yet

- Elasticity of DemandDocument64 pagesElasticity of DemandWadOod KhAn100% (1)

- Loan Agreement with Chattel Mortgage SecuredDocument6 pagesLoan Agreement with Chattel Mortgage SecuredManny DerainNo ratings yet

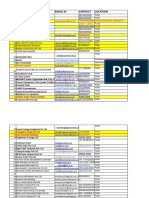

- Company Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDocument65 pagesCompany Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDhruv Parekh100% (1)

- ReportPdfResponseServlet PDFDocument3 pagesReportPdfResponseServlet PDFyahooshuvajoyNo ratings yet

- 0 Notes 190511 075317 bd6Document7 pages0 Notes 190511 075317 bd6yahooshuvajoyNo ratings yet

- CoachWoot Les Mills Pump Workout Tracking Sheet Schedule WorksheetDocument8 pagesCoachWoot Les Mills Pump Workout Tracking Sheet Schedule WorksheetyahooshuvajoyNo ratings yet

- Notes 190511 075317 bd6 PDFDocument4 pagesNotes 190511 075317 bd6 PDFyahooshuvajoyNo ratings yet

- 0 Notes 190511 075317 bd6Document7 pages0 Notes 190511 075317 bd6yahooshuvajoyNo ratings yet

- Bulk Up Calculator: Let's Get Started... Enter Your Current Body Weight BelowDocument1 pageBulk Up Calculator: Let's Get Started... Enter Your Current Body Weight BelowyahooshuvajoyNo ratings yet

- How To Get The Ultimate 6 PackDocument10 pagesHow To Get The Ultimate 6 PackinthemoodforlifeNo ratings yet

- LIIFT4 Weight Progression Tracker 6.10.18Document5 pagesLIIFT4 Weight Progression Tracker 6.10.18yahooshuvajoyNo ratings yet

- CF Start Up Guide #1Document7 pagesCF Start Up Guide #1Black and Gold CrossFit100% (3)

- Indian Bank Home Loan Question BankDocument48 pagesIndian Bank Home Loan Question BankyahooshuvajoyNo ratings yet

- Notes 190511 075317 bd6 PDFDocument4 pagesNotes 190511 075317 bd6 PDFyahooshuvajoyNo ratings yet

- Notes 190511 075317 bd6 PDFDocument4 pagesNotes 190511 075317 bd6 PDFyahooshuvajoyNo ratings yet

- Ensure Diabetes Care: Product InformationDocument3 pagesEnsure Diabetes Care: Product InformationyahooshuvajoyNo ratings yet

- PSLP 4Document5 pagesPSLP 4ShuvajoyyyNo ratings yet

- FXDocument119 pagesFXyahooshuvajoyNo ratings yet

- PSLPDocument49 pagesPSLPyahooshuvajoyNo ratings yet

- General BankingDocument306 pagesGeneral BankingyahooshuvajoyNo ratings yet

- MS 423Document2 pagesMS 423yahooshuvajoyNo ratings yet

- Part II RegistrationDocument2 pagesPart II RegistrationyahooshuvajoyNo ratings yet

- PartlowControllerCatalog PDFDocument98 pagesPartlowControllerCatalog PDFvinh nguyen theNo ratings yet

- Leader in CSR 2020: A Case Study of Infosys LTDDocument19 pagesLeader in CSR 2020: A Case Study of Infosys LTDDr.Rashmi GuptaNo ratings yet

- Error 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and SupportDocument1 pageError 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and Supportsmart.engineerNo ratings yet

- 6 Hagonoy V NLRCDocument2 pages6 Hagonoy V NLRCChristiane Marie Bajada0% (1)

- B JA RON GAWATDocument17 pagesB JA RON GAWATRon GawatNo ratings yet

- Chapter 7 - Trade and Investment EnvironmentDocument7 pagesChapter 7 - Trade and Investment EnvironmentMa. Cristel Rovi RibucanNo ratings yet

- Tabel Condenstatori SMDDocument109 pagesTabel Condenstatori SMDAllYn090888No ratings yet

- bq76pl455 RegistersDocument132 pagesbq76pl455 RegistersAhmet KARANo ratings yet

- Smart Card PresentationDocument4 pagesSmart Card PresentationNitika MithalNo ratings yet

- Loctite 270™: Technical Data SheetDocument4 pagesLoctite 270™: Technical Data SheetM Jobayer AzadNo ratings yet

- JIG LFO Pack 231 PDFDocument16 pagesJIG LFO Pack 231 PDFPratiek RaulNo ratings yet

- Resume DaniellaAmatoDocument2 pagesResume DaniellaAmatoDaniellaNo ratings yet

- Sequence 2: Greet and Seat The GuestDocument3 pagesSequence 2: Greet and Seat The GuestNguyễn Ngọc TrâmNo ratings yet

- Create Email Alerts For Mulitple People or Group - XpoDocument79 pagesCreate Email Alerts For Mulitple People or Group - XponiravmodyNo ratings yet

- The Mpeg Dash StandardDocument6 pagesThe Mpeg Dash Standard9716755397No ratings yet

- TurboVap LV Users ManualDocument48 pagesTurboVap LV Users ManualAhmad HamdounNo ratings yet

- Human Computer InteractionDocument12 pagesHuman Computer Interactionabhi37No ratings yet

- How To Use Oracle Account Generator For Project Related TransactionsDocument40 pagesHow To Use Oracle Account Generator For Project Related Transactionsapnambiar88No ratings yet

- Portfolio Management Banking SectorDocument133 pagesPortfolio Management Banking SectorNitinAgnihotri100% (1)

- 2017 Advanced Computer Networks Homework 1Document6 pages2017 Advanced Computer Networks Homework 1Fadhli RahimNo ratings yet

- Green Ecobuses Run On This Route.: BusesDocument6 pagesGreen Ecobuses Run On This Route.: BusesLuis DíazNo ratings yet

- S-S-, AXXX XXX 008 (BIA Sept. 15, 2017)Document7 pagesS-S-, AXXX XXX 008 (BIA Sept. 15, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet