Professional Documents

Culture Documents

Behavioral Finance

Uploaded by

PratikJain0 ratings0% found this document useful (0 votes)

13 views1 pagesad

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsad

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageBehavioral Finance

Uploaded by

PratikJainsad

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

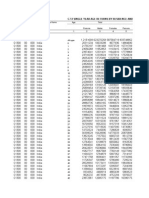

SVKM’S NMIMS

‘choo! of Business Management

Program: MBA. Year :Il Trimester :VI

Subject :Behavioral Finance Marks:40

Date:20th March 2015 Time: 2 Hr. (1.30p.m. - 3.30p.m. )

at

0.2. answer the following a!

1

FINAL EXAMINATION (2014 - 2015)

All questions are compulsory

Itis a closed book, closed laptop and closed network examination.

Be as precise as possible while writing theoretical answers.

Discuss following questions in detail,

‘What do you understand by limits

free arbitrage that imposes limits of arbitrage.

What do you understand by ‘low risk anomaly’? What are the reasons for such anomaly to

persist? Knowing the evidence for ‘low beta-high alpha and high beta-low alpha’. What

prompts/forces most of the professional fund managers to chase high beta stocks?

Discuss anomaly associated with premium/discount associated with close ended funds. What

are the rational explanations offered to explain discount associated with close ended funds? Are

they sufficient? What are the alternative explanations offered to explain persistence of such

anomaly?

Explain how 1) Earnings forecasting errors 2}stop loss triggers 3) margin calls 4) short selling

constraints explain post earnings announcement drift, short term momentum and long term

reversals in stock returns.

bitrage? Dice

‘The agenda for the discussion at a conference at PTA (Professional traders association) was to

discuss the common problem faced by most of the traders associated with small profits and

large losses. One of the trader mentioned-"Last year we closed 70% of the transactions with

profit but loss on remaining 30% led to net losses”. You are invited to provide to explain the

problem faced by the traders. Besides, you are required to explain behavioral aspects that cause

such behavior.

fe. 10 marks

Explain Gambler's fallacy, Overconfidence, representativeness and availability & confirmation

bias. How will they lead to erroneous investment decisions? 4 marks

Explain “Equity premium puzzle". What are the alternative explanations explain it?2 marks

Explain value function offered by prospect theory. Explain certainty effect, reflection effect and

isolation effect associated with prospect theory by citing suitable examples. 2 marks

“In most equity markets globally price discovery is dominated by participants with more

optimistic views than those with pessimistic views” do you agree? Explain. marks

You might also like

- Revised Updated Wealth ManagementDocument3 pagesRevised Updated Wealth ManagementPratikJainNo ratings yet

- Revised Technology Ventures MBA Trim VI Jan-Apr 2016Document3 pagesRevised Technology Ventures MBA Trim VI Jan-Apr 2016PratikJain0% (1)

- Technology VenturesDocument4 pagesTechnology VenturesPratikJainNo ratings yet

- Behavioral Finance Course OutlineDocument4 pagesBehavioral Finance Course OutlinePratikJainNo ratings yet

- IAPM Case Study History AppendedDocument11 pagesIAPM Case Study History AppendedPratikJainNo ratings yet

- Astitva: Without The Cane of Charity - The Battle ForDocument5 pagesAstitva: Without The Cane of Charity - The Battle ForPratikJainNo ratings yet

- Interpersonal Trust at Work QuestionnaireDocument2 pagesInterpersonal Trust at Work QuestionnairePratikJainNo ratings yet

- Wealth Management - CapMktDocument2 pagesWealth Management - CapMktPratikJainNo ratings yet

- Entrepreneurship and Ventuer Capital ManagementDocument2 pagesEntrepreneurship and Ventuer Capital ManagementPratikJainNo ratings yet

- Competencies FrameworkDocument6 pagesCompetencies FrameworkPratikJainNo ratings yet

- Marketing of Insurance - An Indian PerspectiveDocument17 pagesMarketing of Insurance - An Indian PerspectivePratikJainNo ratings yet

- Interpersonal Trust at Work QuestionnaireDocument2 pagesInterpersonal Trust at Work QuestionnairePratikJainNo ratings yet

- Jigar Modi 4260 P2Document7 pagesJigar Modi 4260 P2PratikJainNo ratings yet

- Mutual Fund Marketing in IndiaDocument85 pagesMutual Fund Marketing in Indiamohneeshbajpai100% (3)

- MIMSDocument9 pagesMIMSPratikJainNo ratings yet

- Appendix I 2918Document11 pagesAppendix I 2918PratikJainNo ratings yet

- DDWCT 0000C 14Document356 pagesDDWCT 0000C 14PratikJainNo ratings yet

- List of Second Round Teams With IDsDocument6 pagesList of Second Round Teams With IDsPratikJainNo ratings yet

- C-13 Single Year Age Returns India Rural UrbanDocument147 pagesC-13 Single Year Age Returns India Rural UrbanVivek KumarNo ratings yet

- Silvio NapoliDocument2 pagesSilvio NapoliPratikJain100% (1)

- United Breaks Guitar: Submitted By: Nishant Singh (E058)Document3 pagesUnited Breaks Guitar: Submitted By: Nishant Singh (E058)PratikJain0% (1)

- Solar Energy PrimerDocument16 pagesSolar Energy PrimerFforward1605No ratings yet

- GE's Case NotesDocument1 pageGE's Case NotesPratikJainNo ratings yet

- Submitted By: Nishant Singh (E058) : US Organisational Structure Change From 1950s To 1980s 1950Document3 pagesSubmitted By: Nishant Singh (E058) : US Organisational Structure Change From 1950s To 1980s 1950PratikJainNo ratings yet

- Abdc Journal Quality List 2013Document32 pagesAbdc Journal Quality List 2013PratikJainNo ratings yet

- Corning Inc.: Submitted By: Nishant Singh (E058)Document2 pagesCorning Inc.: Submitted By: Nishant Singh (E058)PratikJainNo ratings yet

- Ellen Moore Case NotesDocument2 pagesEllen Moore Case NotesPratikJain100% (1)

- Foursquare: Submitted By: Nishant Singh (E058)Document1 pageFoursquare: Submitted By: Nishant Singh (E058)PratikJainNo ratings yet

- The Deodorant Market in India - FinalDocument6 pagesThe Deodorant Market in India - Finalabhisheklakh100% (4)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)