Professional Documents

Culture Documents

9 Comprehensive Examination: Case # 1

Uploaded by

Sajid AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9 Comprehensive Examination: Case # 1

Uploaded by

Sajid AliCopyright:

Available Formats

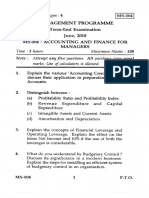

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN

9 t h Comprehensive Examination

Sunday, the 9th August 2009

Time Allowed 2 Hours

Maximum Marks 60

(i) Attempt both the cases 1 and 2 that carry 30 marks each.

(ii) Answers must be neat, relevant and brief.

(iii) In marking the question paper, the examiners take into account the clarity of exposition,

logic of arguments, effective presentation, language and use of clear diagram or chart

where appropriate.

(iv) Read the instructions printed on the top cover of answer script CAREFULLY before

attempting the paper.

(v) Use of non-programmable scientific calculator of any model is allowed.

(v) DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script.

(vi) Question No.1 Multiple Choice Question printed separately, is an integral part of

this question paper.

Marks

CASE # 1

A manufacturer produces 7,500 units per month. Due to increase in demand and consequent

extension of delivery dates and dissatisfaction among customers, the management decided to

increase the output to 11,500 units per month in the next year (against anticipated demand of

14,500 units). Given below is the data of per unit costs and sales value on the basis of current

production level of 7,500 units:

Rs.

Direct material

Direct labour

Fixed overhead (Rs.1,200,000)

Variable overhead

Rs.

180

120

160

240

700

64

90

154

192

30

222

Selling and distribution expenses:

Fixed (Rs.480,000)

Variable

General administrative expenses (fixed Rs.1,440,000)

Profit margin

Sales value

1,076

PTO

1 of 4

Marks

If the proposal to increase in output is adopted, then following changes are expected:

Additional capital outlay of Rs.3,600,000 would be required on which financial charges

would amount to 10% per annum.

There will be an increase of 25% in fixed overheads.

An increase of 20% in fixed selling and distribution expenses is expected.

10% increase in general administrative expenses is also expected besides the

financial charges.

In the coming year there will be an increase of 5% in different items of expenses,

except fixed expenses irrespective of the production level.

If it is decided to maintain the present level of sales, an increase of 2% in sales price is

possible and impact of this increase should be taken for the level of production at

7,500 units per month.

Required:

Prepare a comparative (total and per unit) cost statement showing anticipated margin of profit for

the present output of 7,500 units and proposed output of 11,500 units.

30

CASE # 2

The balance sheet as at June 30, 2009 and income statement for the year ended June 30, 2009

of a firm are given below for using their figures as per requirement:

Balance Sheet

ASSETS

Cash

Rs.

LIABILITIES AND SHAREHOLDERS EQUITY

Rs.

500,000

Notes payable, bank

2,000,000

Accounts receivable

2,500,000

Accounts payable

1,000,000

Inventory

3,500,000

Accrued wages and taxes

1,000,000

Fixed assets, net

8,500,000

Long-term debt

6,000,000

Preference shares capital

2,000,000

Ordinary shares capital

1,000,000

Retained earnings

2,000,000

Total assets

15,000,000

Total liabilities & shareholders equity

2 of 4

15,000,000

Marks

Income Statement

Rs.

Rs.

Net sales:

Credit

8,000,000

Cash

2,000,000

Total

10,000,000

Cost and Expenses:

Cost of goods sold

6,000,000

Selling, general and administrative expenses

1,100,000

Depreciation

700,000

Interest

600,000

8,400,000

Net income before taxes

1,600,000

Taxes on income

600,000

Net income after taxes

1,000,000

Less: Dividends on preference shares

120,000

Net income available to ordinary shareholders

880,000

Add: Retained earnings as at July 1, 2008

1,300,000

Less: Dividends paid on ordinary shares

(180,000)

Retained earnings as at June 30, 2009

2,000,000

Required:

(a)

Complete the following table for use to evaluate the firms position:

15

RATIO

2007

2008

2009

1. Current ratio

250%

200%

INDUSTRY

NORMS

225%

2. Acid-test ratio

100%

90%

110%

3. Receivable turnover

5.0

4.5

6.0

4. Inventory turnover

4.0

3.0

4.0

5. Long-term debt/ total capitalization

35%

40%

33%

6. Gross profit margin

39%

41%

40%

7. Net profit margin

17%

15%

15%

8. Return on equity

15%

20%

20%

9. Return on investment

15%

12%

12%

10. Total asset turnover

0.9

0.8

1.0

11. Interest coverage ratio

5.5

4.5

5.0

PTO

3 of 4

Marks

(b)

Evaluate the position of the company using information from the table worked out in (a)

above. Refer specific ratio levels and trends as evidence.

(c)

Indicate which ratios would be of most interest to you and what your decision would be in

each of the following situations:

(i)

The firm wants to buy goods from you on 90 days credit valuing Rs.250,000.

(ii) The firm wants you being a large insurance company, to pay off its note at the bank

and assume it on a 10-year maturity basis at a current rate of 14%.

(iii) There are 100,000 shares outstanding, and the stock is selling for Rs.40 a share. The

company offers you 50,000 additional shares at this price.

THE END

4 of 4

You might also like

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Document9 pagesThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNo ratings yet

- Costing FM Model Paper - PrimeDocument17 pagesCosting FM Model Paper - Primeshanky631No ratings yet

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- Malaysia) Past Paper Series 2 2010Document7 pagesMalaysia) Past Paper Series 2 2010Fong Yee JeeNo ratings yet

- HI5017 Progressive Tutorial Question Assignment T2 2020 PDFDocument8 pagesHI5017 Progressive Tutorial Question Assignment T2 2020 PDFIkramNo ratings yet

- 8 Comprehensive Examination: Case # 1Document3 pages8 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- Study Material of FMDocument22 pagesStudy Material of FMPrakhar SahuNo ratings yet

- Asad NotesDocument15 pagesAsad NotesassadjavedNo ratings yet

- Quality Cost Report ClassificationsDocument4 pagesQuality Cost Report ClassificationsPopol KupaNo ratings yet

- Marginal Costing and Break-Even AnalysisDocument6 pagesMarginal Costing and Break-Even AnalysisPrasanna SharmaNo ratings yet

- 2016 Accountancy IDocument4 pages2016 Accountancy IDanish RazaNo ratings yet

- Budgets and forecasts for business planningDocument4 pagesBudgets and forecasts for business planningSai SumanNo ratings yet

- 8508 QuestionsDocument3 pages8508 QuestionsHassan MalikNo ratings yet

- COST ACCOUNTING ASSIGNMENTS FOR ALLAMA IQBAL OPEN UNIVERSITYDocument6 pagesCOST ACCOUNTING ASSIGNMENTS FOR ALLAMA IQBAL OPEN UNIVERSITYziabuttNo ratings yet

- Heriot-Watt University Accounting - December 2015 Section II Case Studies Case Study 1Document5 pagesHeriot-Watt University Accounting - December 2015 Section II Case Studies Case Study 1sanosyNo ratings yet

- D10 CaDocument4 pagesD10 CaaskermanNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- Shree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementDocument6 pagesShree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementVeerraju RyaliNo ratings yet

- AFIN317 2016 Semester 1 Final ExamDocument7 pagesAFIN317 2016 Semester 1 Final ExamSandra K JereNo ratings yet

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Budget and Budgetary ControlDocument7 pagesBudget and Budgetary ControlAkash GuptaNo ratings yet

- Cost Accounting 2008wDocument7 pagesCost Accounting 2008wMustaqim QureshiNo ratings yet

- Goals, Functions of Finance Manager, Working Capital RequirementsDocument3 pagesGoals, Functions of Finance Manager, Working Capital RequirementsISLAMICLECTURESNo ratings yet

- 5 - CostDocument34 pages5 - CostAarogyaBharadwajNo ratings yet

- Management Accounting 21.1.11 QuestionsDocument5 pagesManagement Accounting 21.1.11 QuestionsAmeya TalankiNo ratings yet

- P1 Management Accounting Performance EvaluationDocument31 pagesP1 Management Accounting Performance EvaluationSadeep MadhushanNo ratings yet

- 0462Document4 pages0462tinuNo ratings yet

- CUACM 413 Tutorial QuestionsDocument31 pagesCUACM 413 Tutorial Questionstmash3017No ratings yet

- EXAM-223 1 To 3Document9 pagesEXAM-223 1 To 3Nicole KimNo ratings yet

- EN E M A: DT R Examin TionDocument2 pagesEN E M A: DT R Examin TionLokesh GurseyNo ratings yet

- Time: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedDocument4 pagesTime: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedashishvasekarNo ratings yet

- Budget: Profit Planning and Control System: Learning ObjectivesDocument16 pagesBudget: Profit Planning and Control System: Learning ObjectivesFayz Sam0% (1)

- IMT 07 Working Capital Management M2Document7 pagesIMT 07 Working Capital Management M2solvedcareNo ratings yet

- Accounting For Managers: S. No. Questions 1Document5 pagesAccounting For Managers: S. No. Questions 1shilpa mishraNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- HI5017 Tutorial Question Assignment T2 2020Document10 pagesHI5017 Tutorial Question Assignment T2 2020shikha khanejaNo ratings yet

- p1 Question June 2018Document5 pagesp1 Question June 2018S.M.A AwalNo ratings yet

- Problem 1: It Is Required To PrepareDocument7 pagesProblem 1: It Is Required To PrepareGaurav ChauhanNo ratings yet

- ENT 2Document4 pagesENT 2lubaajamesNo ratings yet

- Budgeting and Variance Analysis QuestionsDocument13 pagesBudgeting and Variance Analysis QuestionsAli Rizwan100% (1)

- Introduction To SFAD (Class1)Document17 pagesIntroduction To SFAD (Class1)Asmer KhanNo ratings yet

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- Wef2012 Pilot MAFDocument9 pagesWef2012 Pilot MAFdileepank14No ratings yet

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocument23 pagesGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuNo ratings yet

- (WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 1Document4 pages(WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 1mysouldeepNo ratings yet

- 4587 2261 10 1487 54 BudgetingDocument46 pages4587 2261 10 1487 54 BudgetingDolly BadlaniNo ratings yet

- Calculate Working Capital Requirements from Financial Data ProblemsDocument3 pagesCalculate Working Capital Requirements from Financial Data ProblemsPriyanka RajendraNo ratings yet

- 01.marketing Finance Question SetDocument16 pages01.marketing Finance Question SetPriyahemaniNo ratings yet

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- Chapter 13 Solutions MKDocument26 pagesChapter 13 Solutions MKCindy Kirana17% (6)

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- Capital Budgeting Problems SolutionsDocument22 pagesCapital Budgeting Problems SolutionsChander Santos Monteiro100% (3)

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Chapter 1 SolutionsDocument3 pagesChapter 1 SolutionsChadwick PohNo ratings yet

- Answers to Warm-Up Exercises E14Document10 pagesAnswers to Warm-Up Exercises E14Amanda Ng100% (1)

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- Chapter 8 Solutions GitmanDocument22 pagesChapter 8 Solutions GitmanCat Valentine100% (3)

- Chapter 15Document6 pagesChapter 15Rayhan Atunu100% (1)

- Chapter 12 SolutionsDocument13 pagesChapter 12 SolutionsCindy Lee75% (4)

- Chapter 9 SolutionsDocument11 pagesChapter 9 Solutionssaddam hussain80% (5)

- Chapter 7 SolutionsDocument9 pagesChapter 7 SolutionsMuhammad Naeem100% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- 3-7 2005 Dec Q PDFDocument12 pages3-7 2005 Dec Q PDFSajid AliNo ratings yet

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document14 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document13 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali50% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- AccA P4/3.7 - 2002 - Dec - QDocument12 pagesAccA P4/3.7 - 2002 - Dec - Qroker_m3No ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali67% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document14 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document15 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet