Professional Documents

Culture Documents

Fast Lube-Carwash Survey

Uploaded by

OilLubeNewsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fast Lube-Carwash Survey

Uploaded by

OilLubeNewsCopyright:

Available Formats

www.egenuity.com sales@egenuity.

com

BIG

Difference?

Charting Data for Fast Lubes

With and Without Carwashes

L

Like most journalists, I suffer from “excelophobia” — the fear

SPECIAL FEATURE: Fast Lubes + Carwashes = Synergy

of spreadsheets! True, I can usually bull my way through one,

though the results aren’t always pretty.

Fortunately for me, we have a true spreadsheet goddess on

staff, a virtual magician with a mouse who can take a gargan-

tuan spreadsheet full of data, massage it, tickle it a little and

have it spit out the most interesting things.

Which is why I turned to her recently when we began work-

ing on this special feature on carwashes for National Oil &

Lube News. Like we’ve done on the odd occasion in the past, I

wanted to find out what, if any, differences there are between

those fast lubes that operate in conjunction with a carwash and

those that do not.

To accomplish this, I had our spreadsheet guru work her

magic on our 2009 Fast Lube Operators Survey, breaking out

data for fast lubes and those facilities that include a fast lube

and carwash operating in tandem. We then compared this data

to the national average for all facilities. Though initially pub-

lished last September, the data is still fresh enough to give a

good comparison of lube shops versus lube/wash facilities.

What we found is surprising, mostly in that there were so few

really big surprises. But we’ll let the numbers speak for them- by Garrett McKinnon

selves. NOLN Staff Writer

garrett.mckinnon@noln.net

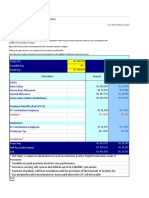

Operations

Ask any lube operator the two biggest metrics in the industry

and chances are he or she will respond “ticket average” and “car

counts.” It is in these areas, specifically the latter, that we find

20 www.noln.net

NOL_1-35.indd 20 4/16/10 10:41:38 AM

www.egenuity.com sales@egenuity.com

one of the few major differences

between the two types of facilities. Operations National

(All Stores)*

Lubes

Only

Lube &

Carwash

Car counts for lube/wash sites are Years in the fast lube business 12.4 12.4 14.9

surprisingly higher than at lube- Number of facilities per response 2.0 1.7 3.0

only sites, 36.3 cars per day for Number of bays per facility 3.2 3.3 2.7

the former versus 31.2 cars per

Cost of goods for standard, full-service LOF $13.24 $13.19 $12.88

day for the latter.

Average ticket total $52.04 $52.02 $51.35

As far as ticket averages are con-

Number of cars serviced per day 32.4 31.2 36.3

cerned, lube/wash sites trail lube-

Break-even car count 22.4 21.7 24.9

only sites, but not by a significant

Operators who own their building/land 52% 42% 75%

margin. Lube/wash facilities aver-

Operators who lease their building/land 26% 32% 6%

age $51.35 per ticket, while lube-

Operators who both own and lease their buildings/land 22% 26% 19%

only facilities average $52.02 per

ticket. (Note that these averages Building/land costs for most recent fast lube (if owned) $552,545 $549,727 $526,923

reflect only the lube portion of a Cost for leasing building/land (per month) $4,472 $4,479 $4,513

vehicle’s service ticket; extra pur- Percentage of business that is oil change 69% 69% 69%

chases made at the carwash are

not reflected.) Prices

Other differences we noted were Price of standard, full-service LOF/multipoint check $34.38 $34.23 $34.27

that lube/wash operators tend to Operators who offer basic, low-cost LOF service 31% 34% 14%

own more stores (3.0 versus 1.7)

SPECIAL FEATURE: Fast Lubes + Carwashes = Synergy

Price, if offered $27.77 $27.71 $27.79

but have smaller lube shops (2.7 Operators who offer premium LOF (w/ specialty/high mileage motor oil) 84% 87% 80%

bays versus 3.3 bays). Plus, lube/ Price, if offered $45.70 $45.75 $45.11

wash operators are far more likely Operators who offer premium LOF (w/ synthetic motor oil) 92% 97% 83%

(75 percent versus 42 percent for

Price, if offered $60.93 $61.87 $58.78

lube-only operators) to own their

Operators increasing LOF price in the past 12 months 63% 63% 52%

building and land rather than

Amount of increase $2.64 $2.49 $2.83

lease it.

Competitors discounting their oil changes 85% 83% 88%

Amount of discount $5.92 $5.93 $5.26

Prices

Operators discounting their own oil changes 63% 69% 40%

While lube-only and lube/wash

Amount of discount $4.70 $4.43 $4.62

facilities may differ a bit in some

areas, in the area of pricing they

are almost identical, with aver- Demographics

age service prices only pennies Fast lubes within three miles of respondent 2.6 2.6 2.4

different in most categories (i.e. Oil change facilities within three miles of respondent 5.3 5.6 5.0

full-service LOF, basic LOF, high-

Population within three-mile radius of best store 20,837 18,718 22,660

mileage LOF). The only area of

Daily traffic count in front of best store 20,077 19,865 22,865

significant difference is in syn-

Customer base that is female 52% 52% 52%

thetic LOFs, where lube-only sites

Miles customers drive between oil changes 4,364 4,310 4,469

charge more than $3 more for the

Portion of overall sales made up of fleet accounts 10% 10% 10%

service on average than do lube/

Customers who drive domestic vehicles 58% 57% 59%

wash sites.

What is different, however, is Customers who drive foreign vehicles 41% 43% 39%

the percentage of operators who Customers who drive luxury vehicles 18% 18% 17%

offer those different LOF services. Customers who drive light trucks 35% 35% 35%

While 34 percent of lube-only Vehicles equipped with oil monitors 52% 53% 50%

sites offer a basic LOF, only 14 Miles driven between oil changes by those vehicles 4,783 4,791 4,829

*This column represents the national average for all facilities. Because some categories are weighted, the national average may not

22 www.noln.net always fall between the average for lube-only and lube/wash facilities.

NOL_1-35.indd 22 4/21/10 1:50:26 PM

www.egenuity.com sales@egenuity.com

Best

Best Selling

Selling Motor

Motor Oil

Oil in

in Fast

Fast

percent of lube/wash sites do. Further, while 97 percent of lube- Lubes

Lubes with

with No

No Carwash

Carwash

only sites offer a synthetic motor oil LOF, only 83 percent of

lube/wash sites do.

Pennzoil

Pennzoil

21%

21%

Demographics Others

Others

24%

24%

Like prices, there are few major differences between lube-only

sites and lube/wash sites in the area of customer demographics. Shell

Shell

5% Valvoline

5% Valvoline

Perhaps the only significant difference is in population, as lube/ Chevron

Chevron

15%

15%

wash sites tend to be built in denser population centers (22,660 Best Selling Motor Oil in Fast

6%

6%

Lubes with Carwash Castrol

population within three miles for lube/wash sites versus 18,718 Castrol

8%

8% Mobil

Mobil

Quaker

Quaker

population for lube-only sites) and on streets that enjoy a high- State

State

12%

12%

9%

9%

er traffic flow (22,865 cars per day versus 19,865 for lube-only Others

sites). 19%

Both categories report that 52 percent of their customer base Shell Pennzoil

is female, and the percentage of customers who drive foreign 4%

Exxon

37%

and luxury vehicles, as well as pickups, are either identical or 4%

Havoline

very similar. 7%

We did note, however, that customers who frequent lube/ Quaker

wash sites tend to have slightly higher oil change intervals State

7% Mobil Valvoline

(4,469 miles versus 4,310 miles) than customers who frequent 11% 11%

SPECIAL FEATURE: Fast Lubes + Carwashes = Synergy

lube-only sites.

Employees Employees National

(All Stores)

Lubes

Only

Lube &

Carwash

It pays to be the owner of a lube/

wash facility. Literally. According Length of employment for managers 6.7 yrs 6.9 yrs 6.4 yrs

to the data we parsed, the annual Length of employment for technicians 2.9 yrs 3.0 yrs 2.6 yrs

salary paid to owners of lube/wash Starting rate paid to lube techs $8.15 $8.19 $8.01

sites is nearly $15,000 more than Hourly rate paid to lube techs $9.30 $9.36 $9.10

the salary paid to owners of lube- Annual salary paid to managers $37,925 $38,020 $38,310

only sites. Managers, too, earn Annual salary paid to owners (if full-time employee) $58,719 $55,030 $70,000

more, though not significantly Owners who work: On site 73% 73% 75%

($38,310 versus $38,020). From remote location 27% 27% 25%

That salary advantage does not

extend to lube techs, however, as Sales

techs at lube/wash sites earn on av-

Yearly sales per store: $558,395 $557,022 $566,575

erage 26 cents per hour less than

Portion of gross sales used for: Payroll 27.9% 28.0% 27.2%

1

techs at lube-only sites. Not sur-

prisingly, average technician ten- Lease/Mortgage 11.5% 11.8% 11.0%

COGS 29.4% 29.3% 30.2%

2

ure is lower at lube/wash sites than

lube-only sites (2.6 years versus 3.0 Net Profit 12.5% 12.2% 13.0%

years). Operations 3

15.8% 15.8% 15.9%

Other 2.9% 2.9% 2.7%

4

Includes all payroll (taxes included), salary of owner (if “hands-on” employee),

Sales

1

unemployment taxes, Workers’ Compensation, health insurance, bonuses, etc.

Given the car count advantage 2

Includes materials and supplies necessary to perform services.

held by lube/wash sites, it comes as 3

Includes utilities, maintenance, company insurance, advertising, franchise fees,

uniforms, freight, postage, administrative costs, office supplies, non-income taxes,

no surprise that they hold a small training, company vehicle, etc. used to operate business on a day-to-day basis.

advantage over lube-only sites 4

Dues, subscriptions, warranties, travel/entertainment, etc.

24 www.noln.net

NOL_1-35.indd 24 4/21/10 1:51:18 PM

www.egenuity.com sales@egenuity.com

Best Selling Synthetic Motor Oil in Fast

Lubes with No Carwash

Other

Amsoil

when it comes to yearly sales per lube facility. (Again, keep in up in this data,

Quaker and

State

4%

7%

that is the additional profit center repre-

Other

mind we’re comparing sales for only the fast lube portion of sented by the carwash.

5%

Castrol

TossMobil

the1 sales and profit generated by a

57%

Amsoil

the business, not the overall business.) Lube/wash sites generate carwash of any type onto the pile, and an operator suddenly is

Quaker State

8%

Castrol

an average of $566,575 per year in sales, while lube-only sites looking atPennzoil

a8%much more profitable business, perhaps one reason Pennzoil

generate an average of $557,022 (though it should be noted the why lube/wash owners enjoy a much higher average annual sal-

Valvoline

Valvoline

difference amounts to less than 2.0 percent). ary than do lube-only

11%

owners. S Mobil 1

Given their lower technician wages, lube/wash sites have a

slim advantage in the payroll arena, spending an average of 27.2

percent of annual gross sales on payroll, while lube-only sites Best

Best Selling

Selling

Lubes

Synthetic

Synthetic Motor

Motor

with Carwash

Oil inOil

Fast

in Fast Lubes w/ Carwash

spend an average of 28.0 percent. Lube-only sites enjoy an ad- Quaker

State Other

vantage in cost of goods (12.2 percent versus 13.0 percent), but Castrol 2%

2%

6%

lube/wash sites have a slightly higher pre-tax profit (13.0 per- Havoline

4% Mobil 1

66%

BestBest

Other

Selling

Selling Synthetic

Synthetic Motor

Motor OilFast

Oil in

in Lubes withw/

Fast Lubes

Quaker State Nono

Carwash

Carwash

cent versus 12.2 percent for lube-only sites).

Valvoline

7% Castrol

Havoline

Other

Pennzoil Amsoil

7%

Oil & Equipment 13% Valvoline

Pennzoil

Quaker 4%

State

As we noted earlier, fewer lube/wash sites push “specialty” mo- Mobil 1

5%

Castrol

Mobil 1

57%

tor oil changes using high-mileage, synthetic or lower-cost mo- 8%

tor oil. Not surprisingly, then, the total sales of “house” motor Pennzoil

8%

oil at lube/wash sites is higher than at lube-only sites, with house

motor oil accounting for 83 percent of sales at lube/wash sites Valvoline

SPECIAL FEATURE: Fast Lubes + Carwashes = Synergy

11%

and 77 percent at lube-only sites.

Also not surprising given the

need for hot water at many car- Oil & Equipment National

(All Stores)

Lubes

Only

Lube &

Carwash

washes, fully 46 percent of the

lube/wash operators who respond- Total sales represented by ”house“ motor oil brand 81% 77% 83%

ed to our survey noted they imple- Customers committed to a specific brand of motor oil 45% 49% 41%

ment used motor oil for heating Operations that implement used oil for heating purposes 31% 24% 46%

purposes. Compare that with only Operations being paid for their used oil 96% 94% 99%

24 percent of lube-only sites that Amount per gallon $0.51 $0.50 $0.54

do so. Operations invoicing customers for environmental fees 28% 26% 37%

In other areas, lube/wash sites Average amount $1.91 $1.82 $2.16

and lube-only sites share compara- Per-gallon cost of highest volume bulk oil $7.96 $7.79 $8.37

ble breakdowns in motor oil sales

Overall breakdown of motor oil sales:

by type (i.e. conventional, synthet-

Conventional/synthetic blend 72% 72% 70%

ic, diesel, etc.) and by weight/grade

High mileage 8% 8% 9%

(i.e. 5W-20, 5W-30, etc.).

Full synthetic 10% 10% 9%

Diesel 8% 8% 10%

Final Rinse

Other 2% 2% 2%

Though there are a few notable

Operations that sell re-refined motor oil 5% 2% 11%

differences between lube/wash

sites and lube-only sites, taken as Overall breakdown of motor oil sales by weight/grade:

a whole the two types of fast lube 5W-20 21% 20% 23%

shops operate surprisingly similar, 5W-30 49% 49% 49%

with similar sales and profit mar- 10W-30 19% 20% 18%

gins. 5W-40 2% 2% 1%

Perhaps the biggest difference, 15W-40 8% 8% 8%

however, is one that does not show Other 1% 1% 1%

26 www.noln.net

NOL_1-35.indd 26 4/16/10 10:51:25 AM

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Distributor Guide '12: Automotive Filter CorporationDocument6 pagesDistributor Guide '12: Automotive Filter CorporationOilLubeNewsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- NOLN 25th Anniversary: An Interview With Steve HurtDocument2 pagesNOLN 25th Anniversary: An Interview With Steve HurtOilLubeNewsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Buyers GuideDocument2 pagesBuyers GuideOilLubeNewsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tops in The Industry 2013Document6 pagesTops in The Industry 2013OilLubeNewsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Tops in The Fast Lube Industry Rankings - 2011Document6 pagesTops in The Fast Lube Industry Rankings - 2011OilLubeNewsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Fast Lube Distributors Guide - 2011Document8 pagesFast Lube Distributors Guide - 2011OilLubeNewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Fast Lube Computer Guide 2012Document5 pagesFast Lube Computer Guide 2012OilLubeNewsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Best Looking Lube Contest 2012Document9 pagesBest Looking Lube Contest 2012OilLubeNewsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Mining For Industry DataDocument4 pagesMining For Industry DataOilLubeNewsNo ratings yet

- NOLN 25th Anniversary: A Quarter-Century of FirstsDocument2 pagesNOLN 25th Anniversary: A Quarter-Century of FirstsOilLubeNewsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 2012 Guide To Fast Lube Programs and FranchisesDocument8 pages2012 Guide To Fast Lube Programs and FranchisesKara Cash BishopNo ratings yet

- VendorSpeak 2010Document5 pagesVendorSpeak 2010OilLubeNewsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Any Car, Any TimeDocument5 pagesAny Car, Any TimeOilLubeNewsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 2011 Fast Lube Operators SurveyDocument12 pages2011 Fast Lube Operators SurveyOilLubeNewsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- NOLN 25th Anniversary: Industry ChangesDocument2 pagesNOLN 25th Anniversary: Industry ChangesOilLubeNewsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 2011 Guide To Additives & CleanersDocument14 pages2011 Guide To Additives & CleanersOilLubeNewsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Foam N Wash & Oil Change Plus FeatureDocument2 pagesFoam N Wash & Oil Change Plus FeatureOilLubeNewsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Best Looking Lube 2010Document11 pagesBest Looking Lube 2010OilLubeNewsNo ratings yet

- 2010 Specialty Motor Oil GuideDocument9 pages2010 Specialty Motor Oil GuideOilLubeNewsNo ratings yet

- Carwash TypesDocument2 pagesCarwash TypesOilLubeNewsNo ratings yet

- Fast Lube Program Guide - 2011Document7 pagesFast Lube Program Guide - 2011OilLubeNewsNo ratings yet

- Distributor Guide 2010Document8 pagesDistributor Guide 2010OilLubeNewsNo ratings yet

- 2010 Guide To Additives & CleanersDocument17 pages2010 Guide To Additives & CleanersOilLubeNewsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2010 Guide To Additives & CleanersDocument17 pages2010 Guide To Additives & CleanersOilLubeNewsNo ratings yet

- 2010 Fast Lube Programs GuideDocument7 pages2010 Fast Lube Programs GuideOilLubeNewsNo ratings yet

- 2009 Distributor GuideDocument9 pages2009 Distributor GuideOilLubeNewsNo ratings yet

- Best Looking Lube!: The Results Are in From Our Annual Lube Shop Beauty ContestDocument11 pagesBest Looking Lube!: The Results Are in From Our Annual Lube Shop Beauty ContestOilLubeNewsNo ratings yet

- Partnership Definition and ElementsDocument38 pagesPartnership Definition and Elementsarian110% (1)

- Estate Creator Six Pay policy analysisDocument2 pagesEstate Creator Six Pay policy analysisSuman BalaNo ratings yet

- Human resources management overviewDocument74 pagesHuman resources management overviewSHUBHAM YADAVNo ratings yet

- Declaration by EmployeeDocument1 pageDeclaration by EmployeesaifullahNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- HR Metrics Checklist PDFDocument5 pagesHR Metrics Checklist PDFSankar SedulappanNo ratings yet

- Tutorial Questions (Chapter 3)Document2 pagesTutorial Questions (Chapter 3)Nabilah Razak0% (1)

- Gmail - Regalix - Salary Break Up Confirmation - UMDocument1 pageGmail - Regalix - Salary Break Up Confirmation - UMZubair AhmedNo ratings yet

- Actors' Equity Association Agreement and Rules for Chicago Area TheatresDocument120 pagesActors' Equity Association Agreement and Rules for Chicago Area TheatresJJayGrNo ratings yet

- Teaching Jobs in Korea - Universities and CollegesDocument12 pagesTeaching Jobs in Korea - Universities and Collegesmr kangNo ratings yet

- BATB ReportDocument5 pagesBATB ReportimtiazrashedNo ratings yet

- R.A. 6727 - Wage Rationalization Act - BARDocument21 pagesR.A. 6727 - Wage Rationalization Act - BARarloNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- Unveiling The Aftermath of Education-Job Mismatch Among Uic Business Administration GraduatesDocument46 pagesUnveiling The Aftermath of Education-Job Mismatch Among Uic Business Administration GraduatesAndreaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- O Demonio FamiliarDocument27 pagesO Demonio FamiliarBeatriz E. RodriguezNo ratings yet

- MBA - IInd - Human Resource Management - Unit 1 - Introduction, Nature, Objectives, ScopeDocument9 pagesMBA - IInd - Human Resource Management - Unit 1 - Introduction, Nature, Objectives, ScopeshriyaNo ratings yet

- Report On Compensation and BenefitsDocument64 pagesReport On Compensation and BenefitsShilpa VaralwarNo ratings yet

- PhilippinesDocument75 pagesPhilippinesRichel AbelidaNo ratings yet

- Sector Grant and Budget Guidelines 2017/18Document152 pagesSector Grant and Budget Guidelines 2017/18NsubugaNo ratings yet

- Provincial Government of Agusan Del SurDocument4 pagesProvincial Government of Agusan Del SurSem VillarealNo ratings yet

- b24 Oracle PracticeDocument4 pagesb24 Oracle Practiceakash2930No ratings yet

- UNIT 5 RemunerationDocument23 pagesUNIT 5 RemunerationRahul kumarNo ratings yet

- 19 Princess Talent Center vs. MasagcaDocument31 pages19 Princess Talent Center vs. MasagcaFrench Vivienne TemplonuevoNo ratings yet

- Revised Leave RulesDocument24 pagesRevised Leave RulesSidraa KanwalNo ratings yet

- Management Accounting (University of Dhaka) Management Accounting (University of Dhaka)Document41 pagesManagement Accounting (University of Dhaka) Management Accounting (University of Dhaka)Coco ZaideNo ratings yet

- Payroll and Benefits PDFDocument16 pagesPayroll and Benefits PDFNeha MohnotNo ratings yet

- HRM Practices in Bangladesh's Private & Public SectorsDocument11 pagesHRM Practices in Bangladesh's Private & Public Sectorsimrul khanNo ratings yet

- Prubankers Association Vs Prudential Bank & Trust Company - GR No. 131247 - January 25, 1999Document5 pagesPrubankers Association Vs Prudential Bank & Trust Company - GR No. 131247 - January 25, 1999BerniceAnneAseñas-ElmacoNo ratings yet

- GBMLT Manpower Services vs. Malinao (G.R. No. 189262 July 6, 2015) - 10Document15 pagesGBMLT Manpower Services vs. Malinao (G.R. No. 189262 July 6, 2015) - 10Amir Nazri KaibingNo ratings yet

- Westward Exports Ltd Case Study - Improving Production Quality and EfficiencyDocument13 pagesWestward Exports Ltd Case Study - Improving Production Quality and EfficiencyMuthu RamachandranNo ratings yet

- Genuine Temporary Entrant Screening Form: Visa HistoryDocument2 pagesGenuine Temporary Entrant Screening Form: Visa HistorySalman QaiserNo ratings yet