Professional Documents

Culture Documents

Ansonia Debt Analysis

Uploaded by

The Valley IndyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ansonia Debt Analysis

Uploaded by

The Valley IndyCopyright:

Available Formats

City of Ansonia, Connecticut

Existing & Proposed Debt Analysis

April 7, 2016

Barry Bernabe

Managing Director

PrroENrx

ADVISORS, LLC

Long-term lnterest Rates

Ten Year U.S. Treasury Yield - January 1,1970 to April 2016

17o/o

17o/"

dMWtu

%*t*M \

160/o

15o/o

13o/o

it

12o/o

11o/o

1Oo/o

7olo

60/o

5o/o

4o/o

3o/o

2o/o

1olo

r1

A f'

, /v "\n/

Ul -,rrl"

\-

-l

/Y'LA

160/o

1$Vo

14o/"

13o/o

12o/o

11o/o

\-

.I

9o/o

8o/o

\-

il-,

14o/o

High: September 1981 t 16.0%

Low: July 2012, 1.5OYo

1Oo/o

\-

9o/o

\-

\-

'\.

^l lkry\ tu

v u

8o/o

\-

\/\n. -Y-\.

ts

r^ltl,/w

11

'

7o/o

60/o

\-

vlr,r1

\.

r v[ /\*

--***M,,

qEEE

FF+ BFTE EqBEqEEq

EqqHE?E* q

5 8t58gi 0$5 $PI fi95 $t5 $E 5 g E E si i

n

5o/o

4o/o

3o/o

2o/o

1olo

Prronxrx

,"\D\IIS0R\Lt"C

Page 2

Standard & Poor's Rating Scale

H

ighest

AAA

A,A+

AA

aA-

A+

&

BBB -+

Lowest

BBB

BBB-

Greenwich, Westport, West Hartford

Shelton, Southington, Suffield

Derby, Seymour, Watertown

Ansonia, Bolton, Portland

Bridgeport, Waterbury

Hartford, Hamdefl, West Have n

East Haven, New Haven

None

None

None

PuonNrx

ADVISORS,IJ,C

Page 3

Existinq Short-Term Bond Anticipation Notes (BANs)

Project

Amount

Authorized

Demolition of the Rircrside Housing Complex

$5,200,000

2013-14 CIP - Various Capital lmprorcments

5,120,000

Total

Lot A TaxExempt to

Mature 5123116

Lot B Taxable

to Mature

5t23t16

$2,975,000

3,750,000

$3,750,000

$2,975,000

Page 4

Existinq Debt Seruice Pavments

$3,500,000

$3,000,000

N2013-14

CIP

aRiverside

P&l

rExisting NET Debt Service

$2,500,000

$2,000,000

$1,500,000

$1,000,000

N

INN

$500,000

H#+d

t#t-H

l]JrJ]+

ffi

$0

FiscalYear

Page 5

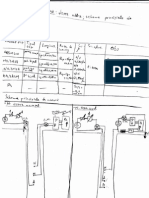

Proposed Capital Projects

DITAIL LSI{G }iAtrl6N C&PlTAt Pl&frl

*EVISEil" tsH&TTISPY

It

EDUC&TIfi1,J

&HB

3*ARI} {}F EDUC$.TI,flT{

s#ARLT f}['' EDUC&T}ON

&HS

I{MS

Wxt*r Trs*lmsnl progrEm 10 tl8 il{i}k&d in{o

Fhs$,, BsilBrs sild Hot Wstsr fl6fli*rs

]OARD SF SSUC*\TI0N

EMS

l$dt*l

mAs!

\,ll'Sll

f,ortstllo Clas.srooms [ti) MBad Sxhsol

MfiAN

h,&$ed

q.&til1iq

F(*V*T*t1aSIi$n St XnN I\'YU n$ilq$Sr$\iltl1 Eti$qrBlifiet

SESd CTR

Ssn{ar fisntxrA#.fuch Fsss 53.001{

3SAftII

*F

&t1,!i

0F E*uc&3'Hlfil

}OARD OF EOUC& }{II{

g$AHU

it-iN

]ULT{JRE*RECREATIfiN

'UL lJlt8-iliElrllxrR

I

llrf,a

r'{f.}tAs ,l{uc I uFnE

NFR,ASTRUCTLIRE

NFRSSTSUCTURE

NNRASf RI,JCTUFIE

Tresir'*Br"rt Dfl]srBEr {o he h{}dked inio sMS

S hns Addilioil*l P{&ino

O{Aa

ri{$dI3 {'

fiA] trH FAT.ELS. SWITChiES &ND W}RiI{G OF {:ITY $d&i.L

FXNIlT

PH0{'1f SYSTftd ARMS

F}T*$!S SYSTNM FOR FUEILIC WORKS

VNICE NVEN IF SHOF{E SYSTEM .CITY H.ALI. WJVGIC.EMAIL

;1Mi!T'

NfRASTRUCIU*E ToTs[

IUALTU tir{.h.L I Y

q,h{MLi

lnstail{Bfrn

}USLIC S&F'ETY

}U3Lif; SAFETY

,ilALIC SAFETY

qRb.!s

(RlLtS

Rslrls** JSS Anrbui*nEs f$rav* Sj

RsplN$s l-i*hl Trailsr {

q"FtMs

il*nrnHsnicr:r.-tin ns

]UsL'fl

&1

LJxvNr: GeflBlEla,r :i!sl*f}"r

Up$rsds

itNs

PerBild'rsr I Fril]tBativa G&dr

}U8LIC SAFETY

;isfi

Backup Gsn*{Eio,

}UBLIC SAFETY

301-lf;s

Fnilsbl8 Rsdio!

SA.FSTY

fire Housss

i1 )

'lJuLlu ltiRl't,1T I$lSl

,U.{LIC IIVT]RKS

}US

}UELIC WT]R*TS

}UALIC WORKS

}SJ

rusltc woRt{s

Ffd

FS

1ffi tofi " 3i4 i$n *ic& LIE tru*k - 4 ri/hsNl drivs

7t'Ridino Mower

f ity Wlds Euildiilg Up$r*des {SSE ATTCHM6}iTi

Fronl St*tls st Citv l"lell

,u$l-t{: ultt}FtKs T$tet

35.tloo

$1$,*fifi

510.flo0

3S.$S$

30.000

LS44"i

J{M.$ftO

sffi ofi$

?t? a{s

875.offS

5{!,tH}0

50.00{:t

2,55 !.472

}Lr,LIUL,

1fil,oul

1T]U"UU{J

t0,s$0

t*.000

is.tfrxl

t5.0${}

&5,*SS

8ri 0flfl

;2t!,#13il

22{.i.t}uu

Jr],$$l

3ff_000

?*5"S#]

i85,0s0

15.000

15.000

1*S.**fr

r8$ 00s

5,*m

15,t8t

75,SSS

5.000

15.000

75.000

bJ].$iHJ

5]1,U{.UJ

J3.("m

t5,$ts

3h"uu$

45.008

:3$.Sil0

tltl.0il$

5*.*rH

5{l.o0s

3.rc.*o{l

34fi.000

FC{

5U,UU{.}

trl{

It&lll{}v{ $$illi't$ fl Is}ns,t* {listssititrtIrEfi N

R*Nd Millil:e- Drr'"t*ss. Fsvind & Lir:d Striiriilfl

$t.L\]u

iOADV$&YS

50*.s&

50$.00*

IOABWAl'5

i4i\J

l'}.$.edB$sy

IOAD'oVAYE

FYS

nlillinu srd Dauinu

Ro*d$r*ir ilrillins eild pav,ng

I r 5.Urf]

r15.OGo

775"0t]r]

775.00S

/.lJJ.{}

l1)

:$5.344

3.ff8_OL1*

J5{J,LTL{.}

4.tLU.ffi

3C"T44

t6

3fiO.*fi*

TOADUYAYS

(lJAIrY{ rru l6IAl

Srsnd Tctel

2$16-lSX.)

GEftl Ft N,Sl

$RAt{'ts

srs.;lnil

itsil,Euu

?s.35d

35,SS0

r,s,14.71s

3

FllrJlST

usqj- {.n-aj

!s3.1$S

E[,qS

(}l kISUGA.Iltlt{ {ot$t

-:uL I UNb.ftbutdLA

EtlI{utHn

1E-l7

MES*RIFTION

t\u& unil"&qBurcs $s.ris &tr"lli F.lsld {r$sffld*

Fum}tsss p*riablss I ,rinyl* sids lvr 3)

3OAfiD OF EDLIil.ATIC*J

YEAR CINS

,gdlu.,uu{.t

,IKI"UUU

4. I t!l.UUll

l,Iil x.{r

3t1*.$lq

Page 6

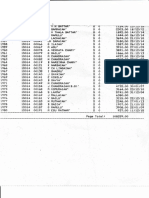

Existing & Proposed Debt Spreadsheet

Line

Descriiption

2004 Bond Principal

2

3

Tvpe

FY

2015-16

FY

2OL6-LI

FY 2OL7-L8

School

1,610,000

1,080,000

1,075,000

2011 Bond Principal

School

1,190,000

1.200.000

1,180,000

2004 Bond lnterest

School

L37,225

72,675

24,1,88

School

L24.200

88.350

52,650

ARMS/PW

85,356

85,356

2011 Bond lnterest

Chase Ambulance & Dump Truck Lease

FY

2018-19

FY

20L9-20

FY

2020-2L

1,165,000

77,475

Plow Truck Lease

77,913

85,356

7L.913

Fire Truck and Sweeper

Fire/PW

1.44,400

L3L,47A

t3L,470

L37,470

73L,470

78,865

Riverside BAN Principal

Citv/Housins

1s0.000

18s,000

325,000

300,000

300,000

300,000

Riverside BAN lnterest

City/Housing

50,000

50,000

50,000

50,000

s0,000

s0,000

200,000

200,000

200,000

200,000

200,000

150,000

125,000

LL7,OOO

110,500

108,000

25,000

540,000

1,0s5,000

1,110,000

3,273,664

PW

10

2OL3-L4 CIP Princioal

City

LI

2OL3-L4 CIP lnterest

Citv

L2

Future 2OL6-L7 CIP Debt Service

City

L3

L4

15

Total Gross Debt

3.613.094

Less State Reimbursements

Net Debt Service

Amount budgeted for Debt Service

50,000

FY

3,314,764

(1,464,s74\

1,846,865

(1,399,132)

2,520,945

(672,952

1-,846,970

(1,,762,1.s81

1.850.936

1,850,190

1.,874,532

L,847,993

L,846,970

L,8,46,965

2075-76

Page

Existing & Proposed Debt Service

$3,500,000

$3,000,000

Capacity N2013-14 CIP

e Riverside P&l

r Existing NET Debt Service

EFuture Debt

$2,500,000

$2,000,000

$1,500,000

$1,000,000

o

N

o

N

FiscalYear

Page 8

Summary Points

o Though the Fed has started to raise short-term interest rates, they remain at close to

historic Iow levels (about 0.50%) and so do long-term rates.

.

.

The City has rating of AA- which will allow for strong investor demand.

The City has an opportunity for a possible upgrade to AA

o The City's existing debt service amortizes

very aggressively.

Structured appropriately - the City can issue over $4 million per year with no impact on

the debt service budget.

o The City currently budgets about $1.8 million per year for debt service. The City would

need to keep debt service budgeted at the $1.8 million.

Page 9

You might also like

- Allama Zameer Akhtar Naqvi - Shahzadi Zainab-E-Kubra (S.a) Aur Tareekh-E-Mulk ShamDocument227 pagesAllama Zameer Akhtar Naqvi - Shahzadi Zainab-E-Kubra (S.a) Aur Tareekh-E-Mulk Shamبندہء خدا100% (1)

- Traditional Arabic Manuscript AnalysisDocument3 pagesTraditional Arabic Manuscript AnalysisSyuhada OpandiNo ratings yet

- Khatm-E-nubuwwat and Karachi File 0404Document1 pageKhatm-E-nubuwwat and Karachi File 0404abad bookNo ratings yet

- Special Points-SeparateDocument18 pagesSpecial Points-Separateshamsorah100% (3)

- Allama Sadiq Hassan - Inteqam-E-Mukhtar (R.a)Document307 pagesAllama Sadiq Hassan - Inteqam-E-Mukhtar (R.a)زندگی پس از مرگ100% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- I1:L/ 3iit L? ST Ari Eil &fri)Document3 pagesI1:L/ 3iit L? ST Ari Eil &fri)Diviti SwamyNo ratings yet

- 15014-Un-Paid-Agl 2019Document5 pages15014-Un-Paid-Agl 2019N Swamy DivitiNo ratings yet

- LC PDFDocument5 pagesLC PDFAde NiedNo ratings yet

- Sunni TehreekDocument13 pagesSunni Tehreekabad bookNo ratings yet

- Masael-us-Sharia - Tarjuma Wasael-us-Shia - 16 of 17Document399 pagesMasael-us-Sharia - Tarjuma Wasael-us-Shia - 16 of 17Shian-e-Ali NetworkNo ratings yet

- Romanian Offer Letter 2014-08-18Document12 pagesRomanian Offer Letter 2014-08-18Ghassan Lutfi100% (1)

- Share of Naat, Poets in Movement For Creation of Pakistan and Its Soliditary Shahzad Ahmed PH.D 2012Document507 pagesShare of Naat, Poets in Movement For Creation of Pakistan and Its Soliditary Shahzad Ahmed PH.D 2012Muhammad Ahmed Tarazi100% (1)

- 15002-D List-3.19Document5 pages15002-D List-3.19N Swamy DivitiNo ratings yet

- Masael-us-Sharia - Tarjuma Wasael-us-Shia - 03 of 17Document454 pagesMasael-us-Sharia - Tarjuma Wasael-us-Shia - 03 of 17Shian-e-Ali Network100% (1)

- Sajid Mir AND MOTOR CYCLEDocument6 pagesSajid Mir AND MOTOR CYCLEabad bookNo ratings yet

- Sarvesh 5C English - 20220630 - 0002Document2 pagesSarvesh 5C English - 20220630 - 0002SarveshNo ratings yet

- Marriage CertificateDocument1 pageMarriage CertificateSally SmithNo ratings yet

- Suqraat by Kora Mesan Translated by Sabiha HassanDocument241 pagesSuqraat by Kora Mesan Translated by Sabiha HassanAhmed Ali86% (14)

- 1 SD 5 PDFDocument5 pages1 SD 5 PDFPamela DelgadoNo ratings yet

- JPNT Maths p1Document13 pagesJPNT Maths p1Mohd ShuhaimiNo ratings yet

- Ni T Li R NL L RRN:) H Jun LFR 31 $F, T 16Document1 pageNi T Li R NL L RRN:) H Jun LFR 31 $F, T 16Diviti SwamyNo ratings yet

- DeLaSalle ComicBook For BookletDocument32 pagesDeLaSalle ComicBook For BookletHappy DirigeNo ratings yet

- R PNBPC$SRD (XX ?00 Rspu-T0010003T8 1001R.1: Lil Sa .G Br6Perit, I0R1 - M$Eeags Repo, RTDocument12 pagesR PNBPC$SRD (XX ?00 Rspu-T0010003T8 1001R.1: Lil Sa .G Br6Perit, I0R1 - M$Eeags Repo, RTDuong NhanNo ratings yet

- Treasure Hunting Dec. 1995Document72 pagesTreasure Hunting Dec. 1995Mark Etheridge100% (1)

- Khatm-E-nubuwwat and Karachi File 0409Document1 pageKhatm-E-nubuwwat and Karachi File 0409abad bookNo ratings yet

- GMC Bowling 1-27-16Document11 pagesGMC Bowling 1-27-16jmjr30No ratings yet

- Baba Sahiba by Ashfaq AhmedDocument334 pagesBaba Sahiba by Ashfaq AhmedSyed Muhammad Jamal100% (1)

- Bungalow House PlansDocument7 pagesBungalow House PlansLidiah ImzaNo ratings yet

- Madarasas: AND PAKISTANDocument8 pagesMadarasas: AND PAKISTANabad bookNo ratings yet

- TT (E ID (Ot : / / Xa Ar E Sgrew TNGDocument13 pagesTT (E ID (Ot : / / Xa Ar E Sgrew TNGmjrodillNo ratings yet

- Rekening BCA Bulan 4 23Document15 pagesRekening BCA Bulan 4 23Ary PujiantoNo ratings yet

- LamhaatDocument527 pagesLamhaattheurbanbedouin1No ratings yet

- Concise Summary of Existentialist Philosophy in RomaniaDocument27 pagesConcise Summary of Existentialist Philosophy in RomaniageorgebogdanNo ratings yet

- The Four Stagls of Life:: 76 FTH TRSB Pusatt Expre, S, SDocument8 pagesThe Four Stagls of Life:: 76 FTH TRSB Pusatt Expre, S, SNancyNo ratings yet

- Betty and Veronica 228Document36 pagesBetty and Veronica 228Alfredo Silva0% (1)

- Pakistan Du Lakht Kesa Howa by RTD Gen Rao Farman AliDocument205 pagesPakistan Du Lakht Kesa Howa by RTD Gen Rao Farman AliAhmed Ali100% (3)

- Img NewDocument21 pagesImg NewstrunfuletzNo ratings yet

- (Đọc Hiểu) n2 Dokkai Mondai 55+Document97 pages(Đọc Hiểu) n2 Dokkai Mondai 55+Nguyễn Vũ Minh ChâuNo ratings yet

- No. 8tg2g9: Ffi 0v7yory$.1Document8 pagesNo. 8tg2g9: Ffi 0v7yory$.1Rohit ThakurNo ratings yet

- Karachi MadrassaDocument6 pagesKarachi Madrassaabad bookNo ratings yet

- Velocity of SoundDocument5 pagesVelocity of SoundJoychandra WahengbamNo ratings yet

- RR - Urr".ffi: Ii"I, FDocument20 pagesRR - Urr".ffi: Ii"I, FAlexandru RomanNo ratings yet

- ? (Ffi 'RMRLR: " - Utl LrjffiDocument1 page? (Ffi 'RMRLR: " - Utl LrjffiJessica McdanielNo ratings yet

- Jus AmmaDocument35 pagesJus Ammaagung wihandokoNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 151 PiasaDocument223 pages151 PiasaROE40No ratings yet

- Majals HaqBamaeKhutbaeFidakDocument162 pagesMajals HaqBamaeKhutbaeFidakSyedHassanAskariKazmiNo ratings yet

- RPDA Public Records Request November 2009Document5 pagesRPDA Public Records Request November 2009wstNo ratings yet

- Deity AwardDocument1 pageDeity AwardGreg HovsepianNo ratings yet

- Inventory Listing With 56 ItemsDocument2 pagesInventory Listing With 56 ItemsChandrasekhar BabuNo ratings yet

- Masail Us Shariya 01 of 17Document443 pagesMasail Us Shariya 01 of 17Makhdoom Asim Javed100% (2)

- BAB20Document3 pagesBAB20Izzaty KhalilNo ratings yet

- Operational Research in Bomber CommandDocument713 pagesOperational Research in Bomber CommandMalcolm HuntNo ratings yet

- Cage-Variations IV (1963)Document4 pagesCage-Variations IV (1963)micaelamiauNo ratings yet

- Masael-us-Sharia - Tarjuma Wasael-us-Shia - 14 of 17Document469 pagesMasael-us-Sharia - Tarjuma Wasael-us-Shia - 14 of 17Shian-e-Ali NetworkNo ratings yet

- SismoDocument3 pagesSismoYborianSeyerNo ratings yet

- Anything Goes: An Advanced Reader of Modern Chinese - Revised EditionFrom EverandAnything Goes: An Advanced Reader of Modern Chinese - Revised EditionRating: 5 out of 5 stars5/5 (1)

- Budget AMD ReadableDocument26 pagesBudget AMD ReadableThe Valley IndyNo ratings yet

- Ansonia-Primrose Tax IncentiveDocument5 pagesAnsonia-Primrose Tax IncentiveThe Valley IndyNo ratings yet

- Ansonia ResponseDocument68 pagesAnsonia ResponseThe Valley IndyNo ratings yet

- Derby Investigative ReportDocument16 pagesDerby Investigative ReportThe Valley IndyNo ratings yet

- Derby Mayor's Budget ProposalDocument14 pagesDerby Mayor's Budget ProposalThe Valley IndyNo ratings yet

- Letter To Connecticut Superintendents - Uvalde Texas School ShootingDocument2 pagesLetter To Connecticut Superintendents - Uvalde Texas School ShootingThe Valley Indy100% (1)

- Tribal Council ResolutionDocument2 pagesTribal Council ResolutionThe Valley IndyNo ratings yet

- Hud Disposition Approval 2021Document6 pagesHud Disposition Approval 2021The Valley IndyNo ratings yet

- McGowan Olson LawsuitDocument27 pagesMcGowan Olson LawsuitThe Valley IndyNo ratings yet

- A Legal Notice From August 2019Document1 pageA Legal Notice From August 2019The Valley IndyNo ratings yet

- Final (Unsigned) Agreement Ansonia Opera House Lease 3-18-2022Document13 pagesFinal (Unsigned) Agreement Ansonia Opera House Lease 3-18-2022The Valley IndyNo ratings yet

- FY23 Derby Schools Budget Book To CityDocument25 pagesFY23 Derby Schools Budget Book To CityThe Valley IndyNo ratings yet

- Olson Drive LawsuitDocument5 pagesOlson Drive LawsuitThe Valley IndyNo ratings yet

- FY23 Derby Schools Budget Book To CityDocument25 pagesFY23 Derby Schools Budget Book To CityThe Valley IndyNo ratings yet

- FY 23 Ansonia Mayor's PresentationDocument64 pagesFY 23 Ansonia Mayor's PresentationThe Valley IndyNo ratings yet

- 2022-02-08 TRSSC Press ReleaseDocument1 page2022-02-08 TRSSC Press ReleaseThe Valley IndyNo ratings yet

- Hire Bob's Construction LLCDocument1 pageHire Bob's Construction LLCThe Valley IndyNo ratings yet

- Temporary Regional School Study CommitteeDocument8 pagesTemporary Regional School Study CommitteeThe Valley IndyNo ratings yet

- Derby, CT - S&P Rating Report Dec-29-2021Document8 pagesDerby, CT - S&P Rating Report Dec-29-2021The Valley IndyNo ratings yet

- May 2021 Master's TableDocument1 pageMay 2021 Master's TableThe Valley IndyNo ratings yet

- Derby Fund Balance Press Release 7-26-2021Document2 pagesDerby Fund Balance Press Release 7-26-2021The Valley IndyNo ratings yet

- Derby Summer Concert Flyer - 2021Document1 pageDerby Summer Concert Flyer - 2021The Valley IndyNo ratings yet

- Turco's Lawsuit Against DerbyDocument9 pagesTurco's Lawsuit Against DerbyThe Valley IndyNo ratings yet

- The Derby 2020 Annual AuditDocument88 pagesThe Derby 2020 Annual AuditThe Valley IndyNo ratings yet

- Bingo at Christ Episcopal Church in AnsoniaDocument1 pageBingo at Christ Episcopal Church in AnsoniaThe Valley IndyNo ratings yet

- Flag Retirement June 12, 2021Document1 pageFlag Retirement June 12, 2021The Valley IndyNo ratings yet

- 2020-2021 Ansonia Middle School Quarter 4 Honor RollDocument2 pages2020-2021 Ansonia Middle School Quarter 4 Honor RollThe Valley IndyNo ratings yet

- 2019 Correction Action PLan DERBYDocument11 pages2019 Correction Action PLan DERBYThe Valley IndyNo ratings yet

- 2021 Derby-Shelton Memorial Day Parade Line-UpDocument4 pages2021 Derby-Shelton Memorial Day Parade Line-UpThe Valley IndyNo ratings yet

- 2021 Derby-Shelton Parade InfoDocument2 pages2021 Derby-Shelton Parade InfoThe Valley IndyNo ratings yet