Professional Documents

Culture Documents

Newb 2

Uploaded by

JordanDelaCruz0 ratings0% found this document useful (0 votes)

11 views13 pages12345

Original Title

newb2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document12345

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views13 pagesNewb 2

Uploaded by

JordanDelaCruz12345

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 13

! —_____

How does Investing and i

Differ? ; ns

| Time period

¢ INVESTORS * TRADERS

¢ Invest for the long * Capture short-term

term price trends with

long and short

trades

When to buy and sell —

¢ INVESTORS ¢ TRADERS

© Buy low, sell high e Buy high, sell higher

© Sell high, buy low

Trading actively

e¢ INVESTORS ¢ TRADERS

* Don'tovertrade—it © Trade whenever

only racks up there’s opportunity

the more you trade,

commission costs.

the more you make

Cost averaging (cutting losses)

INVESTORS © TRADERS

© Buy more ofagood When the position

stock when it is retraces - exit the

cheap. trade. Always!

| Know your stock

© INVESTORS ¢ TRADERS

Only invest in * Ifthe chart looks

companies you good — trade it.

understand.

Where’s the action?

et INVESTORS ¢ TRADERS

* Avoid hot sectors ¢ Search out hot

with ‘hot' valuations. sectors with ‘hot’

volatility, =~

Diversification

* INVESTORS © TRADERS

Focus on one or two

© Spread risk through ©

sectors at a time.

diversification.

——=—

Omparison Chart

TIME PERIOD.

When to buy and sell

TRADING ACTIVITY

Cost averaging (cutting

losses)

Know your Stock

Where's the action?

Diversification

Invest for the long term

Buy low, sell high

Don't overtrade - it only racks

up commission costs.

Buy more of a good stock when

itis cheap.

Only invest in companies you

understand.

Avoid hot sectors with ‘hot’

valuations

‘Spread risk through

diversification

a ee

‘Capture short-term price trends

with tong and short trades

+ Buy higher, sell higher

+ Sell high, buy low

‘Trade whenever there's

‘opportunity: the more you trade,

the more you make

When the position retraces - exit

the trade, Always! -

Ifthe chart looks good ~ trade it.

Search out hot sectors with ‘hot’

volatility.

Focus on one or two sectors at a

time. 7

)

Your Financial Independence

Plan - Set the GOAL First!

What is it really going to take?

| Lets get MOVING...It all START’s with Mindset!

Your mind is constantly evaluating with everything you

do: “Is this going to be good for me?” or “Is this going to

be bad for me?”

You are driven by 2 controls... what you see as ‘good’

experiences and what you see as ‘bad’ experiences.

It is your ‘perception’ of the experience that defines

whether you actually do it or not.

This part of your mind is called the SUBCONSCIOUS

ee

4 People Really DO what they FEEL

&

For Example...Take Chocolate...

142

Psychology - Belief Systems

POSITIVE Belief Orientation

Poe Group

® The quality of most people’s lives are a

direct reflection of the expectations of their

peer group

® Love your Family — Choose your Friends

¢ Choose your friends — WISELY

|

| Why learn to Invest?

The Non-Iinvestor (Worker)

You GIVE your TIME for MONEY

|

You SPEND your MONEY on your

LIFESTYLE

|

Your LIFESTYLE is then SACRIFICED to

y make more MONEY

Why learn to Invest?

THE INVE$TOR (VALUES LIFE)

—e—vr—

yo

Rule#1 — Set a Meaningful Goal

Rule#2 — Plan it Exactly

Rule#3 — Schedule it and lock the door

Rule#4 — Get around the path walkers

Setup Yourself for Success - Practical

oal for you?

What is a meaningful trading g

5 \

Why is this a meaningful goal?

Setup Yourself for Success - Practical

How can you schedule this — so it happens

— and doesn’t become ‘another goal’ or

‘dream’ you miss out on? Use the PAIN!

TH 4

Ue

| Setup Yourself for Success - Practical

Identify the Path Walkers! Who can | get

around to ensure that my belief is built and

take the appropriate actions?

Trading Psychology — Avoiding the Pitfalls

© Over-confidence

e Researchers have found that people consistently

overrate their abilities, knowledge, and skill—

especially in areas outside of their expertise.

¢ Solution

¢ Investors must seek and weigh quality feedback

and stay within their circle of competence, until

their results prove different

® Ask your coach if they think you understand the

concepts

© Solicit Feedback from your peer group

Earnings: A company’s ultimate goal is to maximise profitability,

© inereasing sales and efficiently managing internal processes,

management can increase arguably the most important metric of all - the

earnings per share (EPS).

As earnings increase, a company’s popularity is likely to rise as well. Asa

result of more investors buying into the company, the price to earnings

ratio (P/E), measuring the relative cheapness or dearness of the firm, is

fr)

likely to be pushed higher, to so-called overvalued levels.

Return

efficiency neaPltal Employed (ROCE) is « powerful measure of manage

tatu é ‘8 another tool to find th he Companies able to produce superior share

ROCE expiair

Other erEl2ins a fim's probity in elation to investors’ capital ivestment in

Ti Comparing profits with the ital used in

percentage 19 pr Capital used in making the profit as a

IN other words the ROCE is an indicator of how well a company as utilising

gapital to generate revenu

ROCE levels of over 15% are likely to be significantly above any cost of borrowing

that money or the return that shareholders could get elsewhere for the level of risk

associated with holding the shares,

Value is the concept not the calculations. It is the actual be

of a company, different from the market price which is subject to

deviate away from a fair, reflective valuation:

i . i i it measure, is

Price / Earnings: The most widely used investment

calculated as the previous day's closing share price divided by the

earnings per share-basic (EPS-basic). PE ratio is used to appraise

a company's profit performance.

t

a |

Where a company’s prospects are considered by the stock market |

.

to be good, then it is likely that the company's share Price will rise,

producing a higher PE ratio.

Price / Earnings Growth: The PEG ratio is a tool that can help

investors find undervalued stocks. When used in Conjunction with

other ratios, and the sector, it gives investors a Perspective of how

the market views a firm's growth potential in relation to EPS

growth.

Analyst Forecasts: These ‘target values’ that professionals set for the

future prospects of listed companies give us the forecasts for profits,

|

earnings (EPS) and dividends for up to the next three years. Consensus

forecasts offer the aggregate figures predicted for companies with one or

more covering analysts.

u

4

e \

Broker Recommendations: Made by investment firms, whilst not

outright recommendations to buy or sell a stock do give an indication of

how the professional market rates a stock,

Broker picks are relative! ‘Strong Buy’, for example, indicates that the

broker recommends a particular company over other companies in the

sector. However, it is not a recommendation that you buy stocks in the

company if you are otherwise not interested in the sector.

* Brokers have an annoying tendency to speak in code, but we

have the universal financial dictionary to understand the meanings

behind the recommendations.

Strong Buy, Overweight +20% gain in stock price for next

42 months,

Buy, Add +10% to 20% gain in stock price for

next 12 months,

Hold, Neutral, Equal Weight 0% to +10% gain in stock price for

next 12 months

Sell, Reduce 0% to -10% falll in stock price for

next 12 months

Strong Sell, Underweight ~10% to -20% fall in stock price for

next 12 months

make-up and

© Gearing: Helps investors to evaluate a company’s financial

defaultrisk, It looks ata firm's level of debt as a proportion of total equity

Gearing of 50% mean half a firm's equity capital is borrowed, {f debt

levels exceed that of equity, the company is generally considered as

over-geared and is hence, a risky investment. Directors typically «,

reduce levels of debt in a firm. ee

The lower the gearing level, the less pressure their will be or

f N profits ar

cash growth from being restricted and tied up in interest rensymhente a

How we balance our portfolio

Normal Portfolio Aggressive Portfolio

@ Stocks # Index

@Stocks mBonds

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

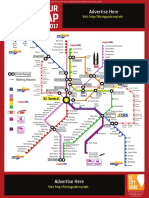

- Kuala Lumpur Train Map July 2017Document1 pageKuala Lumpur Train Map July 2017Mustafidzul MustaphaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Answer Key - Ic - Mock Exam - Set A PDFDocument9 pagesAnswer Key - Ic - Mock Exam - Set A PDFZyzy Lepiten80% (46)

- Answer Key - Ic - Mock Exam - Set A PDFDocument9 pagesAnswer Key - Ic - Mock Exam - Set A PDFZyzy Lepiten80% (46)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CA Affirms RTC Ruling on Slander CaseDocument1 pageCA Affirms RTC Ruling on Slander CaseJordanDelaCruzNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- DIGEST Apex v. Southeast Mindanao Gold Mining CorpDocument2 pagesDIGEST Apex v. Southeast Mindanao Gold Mining CorpCamille Espeleta100% (5)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- THIS IS YOUR E-TicketDocument4 pagesTHIS IS YOUR E-TicketJordanDelaCruzNo ratings yet

- L&sagt SDocument11 pagesL&sagt SJordanDelaCruzNo ratings yet

- Travel Itinerary for Ms Sandy Mejia from Manila to Kuala LumpurDocument3 pagesTravel Itinerary for Ms Sandy Mejia from Manila to Kuala LumpurJordanDelaCruzNo ratings yet

- PigsDocument17 pagesPigsJordanDelaCruzNo ratings yet

- KL-to-MLA Itinerary PDF PDFDocument4 pagesKL-to-MLA Itinerary PDF PDFJordanDelaCruzNo ratings yet

- Code of Practice and Minimum Standards For The Welfare of PigsDocument23 pagesCode of Practice and Minimum Standards For The Welfare of Pigskiel macatangayNo ratings yet

- Dispute FormDocument1 pageDispute FormPring SumNo ratings yet

- Underwriting Briefs AND Notes (Philippines)Document11 pagesUnderwriting Briefs AND Notes (Philippines)JordanDelaCruzNo ratings yet

- 1 - . - . - . 2 Dance With My Father - . - . - 3 Picture of You - . - . - . 3Document4 pages1 - . - . - . 2 Dance With My Father - . - . - 3 Picture of You - . - . - . 3JordanDelaCruzNo ratings yet

- Van Tharp Worrying While TradingDocument5 pagesVan Tharp Worrying While TradingLokator100% (1)

- Dance SongsDocument1 pageDance SongsJordanDelaCruzNo ratings yet

- Liberality in Favor of AccusedDocument1 pageLiberality in Favor of AccusedJordanDelaCruzNo ratings yet

- Business Proposal 2016Document6 pagesBusiness Proposal 2016JordanDelaCruzNo ratings yet

- FX Trading Station Usqwertyer GuideDocument56 pagesFX Trading Station Usqwertyer GuideJordanDelaCruzNo ratings yet

- Crim 1st Quiz FinalsDocument2 pagesCrim 1st Quiz FinalsJordanDelaCruzNo ratings yet

- WordsDocument1 pageWordsJordanDelaCruzNo ratings yet

- Easy Lemon Cupcakes With Lemon ButtercreamDocument23 pagesEasy Lemon Cupcakes With Lemon ButtercreamJordanDelaCruzNo ratings yet

- Date Submit Ted Company Name Site Resu Me Position Feedback/NotesDocument1 pageDate Submit Ted Company Name Site Resu Me Position Feedback/NotesJordanDelaCruzNo ratings yet

- Suspension of Work on Repair Project Due to Closed RoadDocument1 pageSuspension of Work on Repair Project Due to Closed RoadJordanDelaCruzNo ratings yet

- Suspension of Work on Repair Project Due to Closed RoadDocument1 pageSuspension of Work on Repair Project Due to Closed RoadJordanDelaCruzNo ratings yet

- Macariola vs. Asuncion 114 SCRA 77Document4 pagesMacariola vs. Asuncion 114 SCRA 77JordanDelaCruzNo ratings yet

- BagaDocument1 pageBagaJordanDelaCruzNo ratings yet

- 1Document1 page1JordanDelaCruzNo ratings yet

- Sanada WritesDocument1 pageSanada WritesJordanDelaCruzNo ratings yet