Professional Documents

Culture Documents

Internship Report On IFIC Bank

Uploaded by

Monjurul AlamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internship Report On IFIC Bank

Uploaded by

Monjurul AlamCopyright:

Available Formats

INTRODUCTION

1.1 Scene behind the Study

Banks play an important role in the development of a country.

Bangladesh Government and Central Bank developed implemented

different rules and regulation on behalf of the healthier economy.

World Bank also gave his favorable eyes to restructure the banking

society. “MBM- for 21st centuries banking” is the most dynamic

innovation for the new millennium. This internship program is part

of our Academic structure. I have tried my best in be oriented with

the practice of banking in real life.

Modern banks play an important part in promoting economic

development of a country. Banks provide necessary funds for

executing various programs underway in the process of economic

development. They collect savings of large masses of people

scattered through out the country, which in the absence of banks

would have remained ideal and unproductive. These scattered

amounts are collected, pooled together and made available to

commerce and industry for meeting the requirements. Economy of

Bangladesh is in the group of world’s most underdeveloped

economies. One of the reasons may be its underdeveloped banking

system. Government as well as different international organizations

have also identified that underdeveloped banking system causes

some obstacles to the process of economic development. So they

have highly recommended for reforming financial sector. Since

1990, Bangladesh Government has taken a lot of financial sector

reform measurements for making financial sector as well as

banking sector more transparent, and formulation and

implementations of these reform activities has also been

participated by different international organization like World Bank,

IMF etc.

In 1996, World Bank published ‘Bangladesh: Agenda for action’ in

which it has suggested a lot of recommendations for economic

development of our country. These recommendations include

special presentation for reforming banking sector. In this agenda,

World Bank has suggested to introduce MBM as follows:

“Professional sings the banking business will generate large, long

term payoffs in the form of a more efficient banking system apart

from functional and technology-related training required at

Bangladesh Bank and the commercial banks. Consideration should

be given to starting a Masters in Bank Management program at the

Bangladesh Institute of Bank Management.”

Practical orientation in IFIC Bank – Motijheel Branch 1

Our high banking official has also felt the importance of having

entry-level officer who are well educated in banking field.

Accordingly, MBM program has been started in earlier of this year.

The entire fourth term of this MBM program has been designed for

gaining practical knowledge about banking and all the MBM

students are required to go to various financial institutions for

practical exposure. Having completed practical orientation, all the

students are also required to submit a report on their experience.

1.2 Objectives of the Study

The primary objective of this study is to attend the course of

Practical Orientation in Banks, which is the subject of MBM 4th

Term. But the objective behind this study is something broader.

Objectives of the study are summarized in the following manner

a. To comply with the entire branch banking procedures

b. To make a bridge between the theories and practical procedures

of banking day to day operations

c. To understand the terms that has been taught in the last nine

months in BIBM and the courses that will be taught in the next

year courses

d. To analyze the performance of the branch as well as IFIC Bank

Limited as a whole.

e. To have some practical exposures that will be helpful for my

second year courses in the MBM program.

1.3 Important of the Report

This report is prepared to give a concrete idea about the dealing

and transactions of any Commercial Bank. I believe that my report

will help a lot those who want an orientation about banking. Bank

management also can be using the information of my observation

for their managerial decision if needed.

1.4 Methodology

This report has been prepared on the basis of experience gathered

during the period of internship form 12 October to 28 December.

Within this period I visited three department namely General

Banking, Advances and Foreign Exchange departments.

Practical orientation in IFIC Bank – Motijheel Branch 2

Firstly total duration were divided into total working days that

came to a total working day of 58 days and were distributed in the

following manner

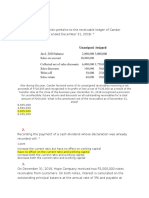

Departments Duration In Days

General Banking From 12 October to 30 October 15 Days

Advances From 31 October to 28 November 24 Days

Foreign Exchange From 30 November to 28 December 19 Days

Duration of rotation in different departments in the branch is

shown in the graph below.

I have worked different kinds of desks .I have collected some data

for organize the report. Both primary and secondary data sources

were used to generate this report.

Primary data sources:

1. Schedule survey

2. Informal discussion with professionals

3. Observation while working in different desks etc.

Secondary data sources:

1. Previous internship reports

2. Corporate newsletters

3. Manual

4. Different publications of Bangladesh Bank.

Practical orientation in IFIC Bank – Motijheel Branch 3

1.5 Organisation of the Report

This report has been prepared in different chapters in order to

explain my experience in the easiest way. Traditional over view is

presented in the 1st chapter. Second chapter contains about the

IFIC Bank at a glance. General banking and its operation in

detailed in the 3rd chapter. Advances are discussed in fourth

chapter. Foreign exchange is discussed in the fifth chapter. Finally,

observation and research consulted wit hare in the chapter six.

1.6 Limitations of the Study

Ten weeks observation and orientation is not enough to be an

expert on commercial banking though I have been received the

maximum assistance from the every individual of the Motijheel

Branch. Definitely, I could not produce an outstanding report for

the time limitations.

Practical orientation in IFIC Bank – Motijheel Branch 4

BACKGROUND OF IFIC BANK

2.1 Portrait of the Bank

International financial investment and commerce (IFIC) Bank

Limited started banking operations on June 24, 1983. Prior of that

it was set up in 1976 as a joint venture finance company at the

instant of the Government of the People’s Republic of Bangladesh.

Government then held 49 percent shares while the sponsors and

general public held the rest.

The objectives of the finance company were to establish venture

Banks finances companies and affiliates abroad and to carry out

normal functions of a finance company at home.

When the Government decided to open up banking in the privet

sector in 1983 the above finance company was converted a full-

fledged commercial Bank. Along with this, the Government also

allowed four other commercial banks in the private sector.

Subsequently, the Government denationalized two banks, which

were, then fully Government-owned.

While in all these Banks Government is holding nominal 5 percent

shares, an exception was made in the case of the Bank. It retained

40 percent shares of the Bank.

The decision by the Government to retain 40 percent shares in IFIC

Bank was in pursuance of the original objectives, namely,

promotion of the participation of Government and private sponsors

to establish joint venture Banks, financial companies, branches and

affiliates abroad.

2.2 Ownership Structure

The sponsors hold ownership of the Bank in the private sector and

Government of the People’s Republic of Bangladesh. Sponsors and

individuals now own about 62 percent of the share capital and the

Government owns a little more than 38 percent of the shares.

2.3 Capital and Reserves

The Bank started with an Authorized capital of Tk. 100 million in

1983. Paid up capital at that time stood at Tk. 71.50 million only.

Over the last 19 years, the authorized and paid-up capital has

increased substantially. The paid capital stood at Tk. 406.39 million

as on December 31,2001.

Practical orientation in IFIC Bank – Motijheel Branch 5

The Bank has built up a strong reserve base over the years. In last

19 years its Reserves and Surplus have increased overly. As

against Tk. 21.20 million only in 1983 Reserve and surplus

increased to Tk.622.53 million in 2001. This consistent policy of

building up Reserves has enabled the Bank to maintain a better

adequacy ratio as compared to others.

With the active support and guidance from the Government, the

bank has been showing a steady and improved performance. In its

fifteen years operation, the bank has earned the status of leading

in terms of both business and goodwill.

Starting modest deposit of only Tk. 863.40 million in 1983 the

Bank has closed its business with Tk. 17616.68 million of deposit

as on December 31, 2001. The annual growth rate has mostly been

higher compared to both banking sector growth and individual

growth rates achieved by others.

As against a profit of Tk. 21.94 million in 1984, the Bank earned a

record profit of Tk. 248.00 million for the year ended on December

2001.

2.4 Distribution of Branches

The Bank covers by its activities all the important trading and

commercial centers of the country. As on December 22, 2002 it

had 55 branches within Bangladesh.

2. 5 Operation Abroad

Joint Venture

a. Bank of Maldives - In 1983, IFIC Bank set up a joint venture

bank names Bank of Maldives Limited (BML). It is the first

bank of Maldives. In 1992, as per contract, IFIC Bank handed

over the management of BML to Maldives.

b. Oman-Bangladesh Exchange - To facilitate remittance by

Bangladeshi in Oman, IFIC bank set up a money exchange

company as a joint venture, named Oman-Bangladesh

Exchange.

Branch abroad

a. Pakistan Branch - IFIC Bank opened its first overseas branch

in Karachi, Pakistan. It opened its second branch at Lahore in

Pakistan.

Practical orientation in IFIC Bank – Motijheel Branch 6

b. Nepal Bangladesh Limited - In December 1993, the Bank got

permission to establish a joint venture bank with 50% equity

capital in Nepal. The Bank known as, Nepal Bangladesh Ltd.

came into operation in June 1994.

2.6 Human Resource Development

The Bank has a Human Resource Development & Research

Department to develop human resources internally. The Academy

is equipped with professional library, modern training aids

professional faculty and other facility. It is now under Personnel &

Human Resource Development & Research Division. The Academy

conducts regularly foundation courses, specialized courses and

seminars on different areas of banking to take care of the

professional needs.

Total manpower stood at 1737 as on December 31, 2001.

Practical orientation in IFIC Bank – Motijheel Branch 7

2.7 HIERARCHY of the Management of this Bank

S e n i o r E x e c u t i v e V i c e - P r e s i d e n t

E x e c u t i v e V i c e - P r e s i d e n t

S e n i o r V i c e - P r e s i d e n t

F i r s t V i c e - P r e s i d e n t

V i c e - P r e s i d e n t

S e n i o r A s s t t . V i c e - P r e s i d e n t

F i r s t A s s t t . V i c e - P r e s i d e n t

A s s t t . V i c e P r e s i d e n t

S e n i o r S t a f f O f f i c e r

S t a f f O f f i c e r

O f f i c e r G r a d e - I

P r o b a t i o n a r y O f f i c e r

O f f i c e r G r a d e - I I

A s s i t a n t O f f i c e r

O f f i c e A s s i s t a n t

D r i v e r

S e c u r i t y S t a f f

O f f i c e A t t e n d a n t

Practical orientation in IFIC Bank – Motijheel Branch 8

GENERAL BANKING

3.1 Introduction

General Banking department performs the core functions of Bank

operates the day to day transactions. They take the deposit from

the customer and meet their demand for cash honoring their

cheeks. The department is very rush and the employee here are

too upgrade to their duty. They pass entry of every transaction

within the day. It opens new accounts, remit funds, issues bank

draft and pay order etc. Since Bank is confined to provide these

services everyday, general banking is knows as “Retail Banking”.

3.2 Different Departments of General Banking

It has five major parts in the branch to perform. The sections are

as following

a. Account opening section

b. Remittance

c. Checks clearing

d. Cash

e. FDR

3.3 Different Types of A/C:

3.3.1 CD A/C IN IFIC BANK, Motijheel Branch.

This is very popular type of account among the business people.

The Main feature of this account is that the A/C holder can draw

money from the account as many times as he needs. No interest is

allowed on this type of account. But the depositors in this account

generally get other customer service such as overdraft facility,

collection of cheques, transfer of money, providing agency facility,

and general ancillary services. This minimum amount of balance

required to open account and to be maintained varies accordingly.

In general IFIC Bank, Motijheel Branch asks fir as least Tk. 5000

minimum balance to be maintained. The account opening form

current A/C has to be filled up by the applicant of the account. The

required identification information is collected. Any new holder has

to be introduced by a customer who has as current account in the

bank branch. The introducer can be an officer of the branch also.

For applicants with passports don’t need any introducer as because

for passport holder Government himself is the introducer. A set of

specimen signature is collected fir later verification in the cheque.

Practical orientation in IFIC Bank – Motijheel Branch 9

3.3.2 Savings (SB) A/C in IFIC Bank Ltd. Motijheel Branch

All the features of current a/c’s are available for savings deposit

accounts accept, a customer can draw money from this type of

account only a limited number of times. The minimum amount of

balance to be maintained with this type of account is Tk. 2000. The

forms for opening this type of A/C is almost like CD A/C except

little exception.

3.3.3 STD A/C in IFIC Bank Ltd., Motijheel Branch

The STD account is a very important class of account in this

branch. The minimum amount of balance has to be maintained

with STD A/C is Tk. 200,000.

3.3.4 Fixed Deposit Receipt (FDR) Account:

During opening of this sorts of account, along with other

conventional procedure, the A/C holder is given the receipt of his

deposited amount and date to maturity of his deposit. An interest

rate ranging from 6% to 9% is offered depending on different

amount and tenure of deposits.

3.4 Account opening

This sections opens accounts. Selection of customer is very

important for the bank because banks success and failure largely

depends on their customers. If customer is bad, they may create

fraud and forgery by their account with bank and thus destroy

goodwill of banks. So, this section takes extreme caution in

selecting its customer base. This section opens the account fir the

customer. In general banking, the account section plays a very

important role. Selection of customer for opening account is very

crucial for the institution. If the account holder finds out irregular

largely depends on their customer. It hampers the goodwill also.

So the bank should be extreme caution in its selection.

Practical orientation in IFIC Bank – Motijheel Branch 10

3.4.1 Accounts Opening Process

Receiving filled up application in bank’s prescribed form

Step 1

mentioning what type of account is desired to be opened

1. The form is filled up by the applicant himself / herself

2. Two copies of passport size photographs from individual

are taken, in case of firms photographs of all partners are

taken

Step 2 3. Applicants must submit required documents

4. Application must sign specimen signature sheet and give

mandate

5. Introducer’s signature and accounts number – verified by

legal officer

Step 3 Authorized Officer accepts the application

Step 4 Minimum balance is deposited – only cash is accepted

Account is opened and a Cheque book and pay-in-slip book is

Step 5

given

Practical orientation in IFIC Bank – Motijheel Branch 11

3.4.2 Account Opening Procedure with a low Chart

Applicant fills up the application form in the

He required filling up the specimen

For individual introduction is needed by an account holder

The authorized officers scrutinize the introduction and

examine the documents submitted

Issuance of deposit slip and the deposit must be made

in case, no check no draft is acceptable to the bank

After depositing cash one checkbook issued

Account opened

3.5 Target Customers o IFIC Bank, Motijheel Branch

The customers for loan service are categorized as follows:

i. Individual person

ii. Sole proprietorship firm

iii. Partnership firm

iv. Private Limited Company

v. Public Limited Company

vi. Government and semi Government Organization

vii. Bank Employee

Practical orientation in IFIC Bank – Motijheel Branch 12

3.6 Special Caution or the documents from the Account opener of

the following types

In order to open an account in IFIC bank LTD , Motijheel Branch,

the party has to fill up an account opening form and specimen

signature card provided by the banker. There are different forms

for different types of account. The customer has to fill that

particular form for which account he wants to open. Generally, the

following information is required to open an account:

• Name of the applicant(s)

• Profession/Nature of business

• Permanent & present address

• Special instruction regarding the operation the account (if any)

• Introducer’s name & account number

• Specimen signature in the signature card

• Partner’s name, address and signature (in case of partnership

firm)

• Photocopy of Passport/Ward Commissioner’s certificate/

Chairman certificate of Union parishad/Employer’s certificate

regarding identification and nationality of the person(s)

concerned

• Two copies of photographs

The Bangladesh Bank has recently made the selection of a nominee

by the applicant mandatory and the applicant, in the relevant part

of the form, must attest the photograph of the nominee.

The concerned officers verify the account opening form. If the

particulars are properly filled up and in order, the customer is

entitled to open the account. He has to submit some particular

documents, which vary due to the kinds of the accounts.

Documents required for opening an account:

In order to open any kind of account a customer is required to

submit particular documents that vary due to the kinds of account.

Here are required documents according to the kinds of accounts:

Practical orientation in IFIC Bank – Motijheel Branch 13

For Individual/joint/Partnership/Social Club:

The bank requires the following documents, which must be up-to-

date and duly completed:

• Account opening form properly filled up and signed by the

applicant(s)

• Specimen signature in the signature card

• Two copies of photographs of each partner/director

• The photos must be attested by the introducer

• Mandate or authority from the opening an individual,

partnership account is to be obtained where a customer want

to authorize another person to operate on his account.

• Certified true copies of by-laws, rules, regulations

constitutions in case of societies, club, association and limited

companies etc.

• Certified copy of resolution authorizing opening and operation

of the account with bank passed by the executive committee/

managing committee of the society/ club of association,

limited companies etc.

• List of the directors.

• Partnership deed or letter of partnership for partnership firm.

For sole proprietorship concern:

• All the general information regarding opening an account

• Trade license

For limited companies/corporation:

• Account opening form.

• Specimen signature card.

• Memorandum and articles of association.

• Resolution of board of directors authorizing opening of the

account with the bank.

• Certificate of incorporation.

• Certificate of commencement at business.

• List of directors

Practical orientation in IFIC Bank – Motijheel Branch 14

• Individual bio-data of each director & Photocopy of Passport/

Ward Commissioner’s certificate/Chairman certificate of Union

Parishad/Employer’s certificate regarding identification and

nationality of the directors concerned

Minimum deposit for opening an account:

Every customer has to deposit a certain sum of money to

incorporate the account.

• For current account initial deposit is Tk 10,000

• For savings account initial deposit is Tk 5,000

3.7 Chequebook issue:

The following procedures are maintained for issuing a Chequebook:

• Firstly the customer will fill up the cheque requisition form.

• The leaves of the Chequebook under issue shall be counted to

ensure that all the leaves and the requisition slip are intact

and the name & account number shall be written on all the

leaves of the Chequebook and on requisition slip.

• The name and the account number of the customer shall be

written in the Chequebook register against the particular

Chequebook series.

• Then the officer in charge signs the register, Chequebook, and

the requisition slip.

• Then the Chequebook is handed over to the customer after

taking acknowledgement on the requisition slip.

A cover file containing the requisition slip shall be effectively

preserved as vouchers. If any defect is noticed by the ledger

keeper, he will make a remark to that effect on the requisition slip

and forward it to the cancellation officer to decide whether a new

Chequebook should be issued to the customer or not.

3.8 Transfer of an account to another Branch:

Sometimes the customer wants to transfer his account to another

branch due to various reasons. IFIC Bank, Motijheel Branch, also

Practical orientation in IFIC Bank – Motijheel Branch 15

gives this kind of facility to the customer. In this case, they will

have to submit an application to the branch manager stating the

reasons. The officer verifies the signature and finds out the balance

of the account holder. The holder also submits the rest cheque

leaves along with the application. Then the officer issues an Inter

Branch Credit Advice (IBCA) to that branch and a debit voucher

with the balance of deposit in that account. He also sends the

account opening form and specimen signature card to that new

branch. The new branch officer verifies the customer signature with

account opening form supplied to him. The amount mentioned in

the (IBCA) considered as the initial deposit of the new branch.

3.9. Closing Procedure of an account:

For two reasons an account can be closed:

3.9.1. By Banker: banker has the right to close the account if the

customer does not maintain any transaction six years and the

balance is become lower than the minimum balance.

3.9.2 By Customer: if the customer wants to close his account he

will write an application to the manager and the manager then

close the account.

Firstly, the concerned customer has to apply for closing his/her

account. Then to close the account the cheque book is to be

returned to the bank. After charging the account closing charge the

Manager will close the account. Closing charges are as follows:

For savings bank account--------------20 Taka

For current account----------------------30 Taka

The rest amount of money laid in the respective account is paid to

the customer by a payment order. In case of payment order

certain commissions and vat are cut off from the account.

3.10 Local Remittance

Sending money from one place to another place for the customer is

another important service of banks. And this service is an

important part of country’s payment system. For this service,

people, especially businessmen can transfer funds from one place

to another place very quickly. There are five kinds of techniques for

remitting money from one place to another place.

Practical orientation in IFIC Bank – Motijheel Branch 16

Bank transfer funds from one place to another place on behalf of

its customers. The main modes of transfer fund are:

These are:

Demand Draft

Pay Order

Telegraphic Transfer

Telephone Transfer

Mail Transfer – Time consuming and not frequently used

Telegraphic and Telephone transfer are almost the same, both are

them are known as TT in short. So the basic three types of local

remittances are discussed below:

Practical orientation in IFIC Bank – Motijheel Branch 17

Points Pay Order Demand Draft TT

Pay Order gives Demand Draft is an Issuing branch

the payee the order of issuing bank requests

right to claim on another branch of another branch

payment from the same bank to pay to pay specified

Explanation the issuing specified sum of money to the

bank money to payee on specific payee

demand. on demand by

Telegraph/

Telephone

Payment from Payment from ordered Payment from

Payment

issuing branch branch ordered branch

from

only

Within the Outside the Anywhere in the

Generally clearinghouse clearinghouse area of country

used to area of issuing issuing branch. Payee

Remit fund branch. can also be the

purchaser.

Payment is 1.Confirm that the DD 1.Confirm

made through is not forged one. issuing branch

clearing

2.Confirm with sent 2.Confirm Payee

Payment

advice A/C

Process of

the paying 3.Check the ‘Test 3.Confirm

bank Code’ amount

4.Make payment 4.Make payment

5.Receive advice

Only Commission + telex Commission +

Charge

commission charge telephone

Unlike Cheque, there is no possibility of dishonoring of PO/

Possibility of DD/TT because before issuing, issuing bank takes out the

dishonor amount of the instrument in advance from the customer–

common for all instruments

Practical orientation in IFIC Bank – Motijheel Branch 18

3.10.1 Test Arrangement

For all these techniques of remittance except telephone transfers,

Test is deployed. Test is security number by decoding which the

paying bank can be sure that the DD/TT/MT is not forged one. Only

authorized officers know the test number. Bank maintains secret

code for each of its officers, date, week, year, and amount to be

transferred.

3.10.2 Payment Order

A payment Order (PO) is an instrument to remit fund within a

clearing zone. The PO can only be cashed through the issuing

branch.

3.10.3 Issuing of a Payment Order

The procedures for issuing a PO are as follows:

• Customer submit application to the officer along with money

• Give necessary entry in the bills payable register where payees

name, date, PO- no, etc. are mentioned

• Prepared the instruments

• After approved the instruments by authority, it is delivered to the

customer

• Signature of the customer is taken on the counterpart.

Rate of commission:

Commission Up to Tk

Tk 15 Tk 1 to Tk 1000

Rate of commission:

Commission Up to Tk

Tk 15 Tk 1 to Tk 1000

Tk 25 Tk 1001 to Tk 100000

Tk 50 Tk 100001 to Tk 500000

Tk 100 Above Tk 1000

Practical orientation in IFIC Bank – Motijheel Branch 19

3.10.4 Demand Draft:

A demand draft is also called the Bankers Draft. It is an

instrument, issued by a particular branch, drawn on another

branch of the same bank, instructing to pay a certain amount of

money. DD is very much popular instrument for remitting money

from one place to another place. The remitter of funds can

purchase a DD making the amount payable to any one including

him. The banker is discharged from liability only by payment in due

course.

According to section 13 of Negotiable Instruments Act, DD is not a

Negotiable Instrument. But a DD has all the attributes of a bill of

exchange. Such as Instrument in writing, containing an

unconditional order, signed by the banker etc. Hence a DD is

treated as bill of exchange.

3.10.5 Procedure for issuing a DD is as follows:

• Deposit money with DD application

• Necessary entries are given to register

• Issuing of the Account payee only crossed instrument.

3.10.6 Telegraphic Transfer:

Telegraphic Transfer are affected by telegram, telephone, telex as

desired by the remitter. Transfer of funds by telegraphic Transfer is

the most rapid and convenient but expensive method.

Some times the remitter of the funds requires the money to be

available to the payee immediately. In that case the banker is

requested to remit the funds telegraphically. Such type of

remittance is called Telegraphic Transfer (TT). But in practice

banker uses telephone to remit fund. Banker uses a test serial to

maintain secrecy.

Practical orientation in IFIC Bank – Motijheel Branch 20

3.10.7 Procedure for the outgoing TT:

• Deposit of money by the customer along with application form

• In receipt of money a cost memo is given to the customer

containing TT serial number, which is informed to the

awaiting party in the paying branch by the customer.

• Tested telex message is prepared, where TT serial number,

notifying party name is mentioned.

• The telex department confirms transmission of the message.

3.10.8 Procedure for the incoming TT:

• After receiving the telex, it is authenticated by tested

• TT serial number is verified by the “TT in concern branch” register

• Voucher is released in this respect giving accounting treatment

as:

3.10.9 Accounting entries for the PO, DD and MT

Cases PO / DD TT / MT

Cash A/C------------------Dr. Cash A/C------------Dr.

Against Cash – IFIC General A/C ----Cr. IFIC General A/C ---Cr.

Originating Commission A/C ----Cr. Commission A/C ----Cr.

Telex Charge A/C---Cr.

Party A/C------------------Dr. Party A/C------------Dr.

Against Transfer – IFIC General A/C ----Cr. IFIC General A/C ---Cr.

Originating Commission A/C ----Cr. Commission A/C ----Cr.

Telex Charge A/C---Cr.

IFIC General A/C -------Dr. IFIC General A/C -----Dr.

Responding

Party A/C ---------Cr. Party A/C -------Cr.

When Advice IFIC General A/C ------------------------------------------Dr.

Received - for Bills Payable DD Payable A/C ------------------------Cr.

DD

When DD Placed Bills Payable DD Payable A/C ------------------------ -Dr.

Against Advice Party A/C ---------------------------------------Cr.

When DD Paid Sundry Asset DD Paid without Advice A/C -----------Dr.

without receiving Party A/C ----------------------------------------------Cr.

Advice

3.10.10 Cancellation of DD / PO / TT

Practical orientation in IFIC Bank – Motijheel Branch 21

Application in written to the Manager of the account

Step 1

maintaining branch

Step 2 Verification of the specimen signature

Bills Payable DD Payable ----------------Dr.

Step 3 Incoming

IFIC General A/C --------------------Cr.

Journal

FIC General A/C --------------------------Dr.

Posting Outgoing

Party A/C -----------------------------Cr.

Step 4 Send letter to the paying Bank.

3.11 Cheque Clearing

This section receives all kinds of Cheques in favor of the client for

clearing as the part of their banking service. After receiving the

Cheque it is necessary to endorse it and cross it specially. Basically

the Cheques for clearing are of following types:

Types Explanation Clearing Process

Inward

Cheques received from the Party’s A/C ------Dr.

Clearing

Clearing House, of our bank IFIC General Account -------Cr.

Cheque

Outward These Cheques are directly sent to

Cheques of other

Clearing OBC the respective branch and request

branch of IFIC

(Outward them to send IBCA. When IBCA

Bank within our

Bills for comes, then customer’s accounts

clearing house

Collection) are credited for the amount of the

area

Cheque.

Clearing Cheques of These Cheques are sent to clearing

Cheque another bank house via the Motijheel Branch.

within our When drawee bank honor the

clearing house Cheques, then the account of

area Cheque depositors are credited.

Practical orientation in IFIC Bank – Motijheel Branch 22

Types Explanation Clearing Process

These Cheques are cleared in two

ways:

Firstly, if any branch of our bank

exists within the clearinghouse

area of drawee bank, then we send

the Cheque to that branch of our

Cheques of

OBC bank and that branch collects the

another bank

(Outward proceeds through clearing house

which is situated

Bills for formalities and sends an IBCA to

outside the

Collection) us.

clearing area

In second way, if there is no

branch of our bank, then we

directly sends the Cheque to the

drawee bank and request them to

send the proceeds by TT, MT, or

DD or by in any other means

These Cheques are settled by

From other branch of IFIC sending IBCA, i.e. debiting

Inward Bank depositor’s account and crediting

Bills for sender’s branch account.

Collection

These Cheques are settled debiting

(IBC) From another bank outside the depositor’s account and sending

clearinghouse DD, MT, TT in favor of sender’s

bank

3.12 Cash Section

Cash department is the most vital and sensitive organ of the

branch as it deals with all kinds of cash transactions. This

department starts the day with cash in vault. Each day some cash

that is opening cash balance are transferred to the cash officers

from the cash vault. Net figure of this cash receipts and payments

are added to the opening cash balance. The figure is called closing

balance. This closing balance is then added to the vault. And this is

the final cash balance figure for the bank at the end of any

particular day. Cash department in the IFIC Bank, Motijheel Branch

is authorized dealer of foreign currency, so it can deal with buying

and selling of foreign currency.

Practical orientation in IFIC Bank – Motijheel Branch 23

3.12.1 Functions of Cash Department

1. Cash payment is made only against cheque

2. This is the unique function of the banking system

Cash Payment which is known as “payment on demand”

3. It makes payment only against its printed valid

Cheque

1. It receives deposits from the depositors in form of

cash

Cash Receipt

2. So it is the “mobilization unit” of the banking system

3. It collects money only its receipts forms

3.12.2 Cash payment or Cheque cancellation process

Step 1 Receiving Cheque by the employee in the cash counter

Verification of the followings by the cash Officer in the

computer section

1. Date of the Cheque (it is presented within 6 month

from issue date)

Step 2 2. Issued from this branch

3. Amounts in figure and sentence written does not

differ

4. Signature of the drawer does not differ

5. Cheque is not torn or mutilated

Step 3 Gives pay cash seal and sends to the payment counter

Step 4 Payment officer makes payment

3.12.3 Books Maintained by this Section

It keeps account of cash balance in vault in the

Vault Register

bank.

Cash Receipt Register Cash receipt in whole of the day is recorded here.

Cash Payment Cash payments are made in a day are entered

Register here.

Cash calculation for final entry in vault register is

Rough Vault –Register done here, as any error and correction here is not

acceptable.

Balance here is compared with vault register. If

Cash Balance Book

no difference is found, indicates no error.

Practical orientation in IFIC Bank – Motijheel Branch 24

In book 1 and book 5, notes and currency are recorded by

mentioning their denominations and number of each denomination.

Same set of these books is maintained separately for both local

and foreign currency.

3.13 FDR

This branch maintains a separate section for maintaining Fixed

Deposit. FDR is an important factor for the bank and volume of

FDR determines the investment base of the bank. FDR is found to

be 60% of the total deposit of this branch. Basically this is the

mobilization unit of the Bank. It is obvious to give due importance.

3.13.1 Liquidation of FDR

i. Only the account holder himself and the authorized person can

liquid the FDR after maturity.

ii. In case of joint name, authentication from both is necessary.

iii. In case of ‘Either of Survivorship ‘ clause – any one can

liquid.

iv. In case of Death, the survivor cannot encash the FDR even if

there exist the either or survivor clause – succession

certificate from the court is needed.

v. If demanded before the maturity the last expired duration is

considered to pay interest.

FDR section provides another service on behalf of the government.

These services– this bank issues and encash the following two

government securities:

i. Five Years Bangladesh Sanchay Patra

ii. Pratirakha Sanchay Patra

This section of this branch is also fully computerized. No ledger, no

other subsidiary books are maintained separately in this section. All

entry is given directly in the computer and then necessary

information is printed when required.

Practical orientation in IFIC Bank – Motijheel Branch 25

3.14 Establishment section

This section deals with employee’s salary, many types of internal

expenses such as purchase of pen, paper, equipment, machinery

and payment of labor cost and employee conveyance. In case of

leave of absence employee collects prescribed form from this

section. This section of the bank is simply maintained by a single

person

3.15 Accounts section

This is obviously an independent and unique department, which

works as the composition of all the departments of the branch,

but it is under the In-Charge of the General Banking in this

branch. This section in this branch is fully computerized. So the

conventional large ledger and journal books are not kept like the

nationalized banks. Only four personnel maintain the entire

accounts section. It receives the vouchers from all departments

and prepares the subsidiaries and maintains accounts.

3.15.1 Books maintained by this section

Daily Position It shows the daily position of the branch

It records all cash transaction of the day under

Clean Cash

different head

It keeps the vouchers from different department along

Extract

with their summary sheet

There are different heads of the general ledger which

General Ledger are prescribed by the head office and the accounts are

maintained through those heads

It is the balance sheet of the concern under periodic

Statement of accounting system. It shows the daily profit of the

Affairs concern along with the asset and liability of the

respective day.

Practical orientation in IFIC Bank – Motijheel Branch 26

ADVANCE

4.1 Introduction

This is the survival unit of the bank because until and unless the

success of this section the survival is a question to every bank. If

this section is not properly working the bank itself may become

bankrupt. This is important because this is the earning unit of the

bank. Banks are accepting deposits from the depositors in

condition of providing interest to them as well as safe keeping their

interest. Now the question may gradually arise how the bank will

provide interest to the clients and the simple answer is – advance.

Why the bank provides advances to the borrowers –

a. To earn interest from the borrowers and give the depositors

interest back

b. To accelerate economic development by providing different

industrial as well as agricultural advances

c. To create employment by providing industrial loans

d. To pay the employees as well as meeting the interest groups

Credit is continuous process. Recovery of one credit gives rise to

another credit. In this process of revolving of funds, bank earns

income in the form of interest. A bank can invest its fund in many

ways. Bank makes loans and advances to traders, businessmen,

and industrialists. Moreover nature of credit may differ in terms of

security requirement, disbursement provision, terms and conditions

etc.

We often use loans and advances as an alternative to one another.

But academically this concept is incorrect. Academically Advances

is the combination such items where loans is a part only. For this

credit section of the banks is known as advance section.

Academically Advance is the combined form of the following items

Credit:

An important function of bank.

Credit is the finance made available by one party to another.

Credit is simply opposite of debt. Debt is the obligation to

make future payment.

Credit is the claim to receive this payment.

Practical orientation in IFIC Bank – Motijheel Branch 27

Credit allowed to the potential clients of a bank.

To earn money in form of interest.

Receiving back the credit amount after the maturity or as per

contract.

Banking business is like all other profit-oriented business .It

depends mainly on how much profit they con make. Profit is the

yardstick for the bank to move on. Banking is a business that deals

only with money and credit. Banks are profit oriented. They invest

their fund in many to earn income.

Huge amount of income derives from loans and advances. Banks

makes loans and advances to traders, businessman and

industrialists against the security.

4.2 Sources of fund for lending:

1.Own fund:

a) Paid up capital

b) Reserve

c) Undistributed profit/ Retained earning

2.Outside source:

a) Deposit (up to 80%)

b) Borrowings from other banks

c) Refinance.

4.3 General principle of good lending:

1. Saftey-“Safety is the first”

2. Liquidity

3. Purpose

4. Profitability

5. Security

6. Diversity/ spread

7. National interest

Practical orientation in IFIC Bank – Motijheel Branch 28

4.4 General criterion for selection of borrower:

1. Character-Intention to pay the loan.

2. Capacity-Borrower’s competence in the field of employ to fund

profitably and ability to generate income.

3. Capital-Financial strength to cover a risk.

4. Condition-It general business condition.

5. Collateral-Implies additional security.

4.5 Creation on Charges on Security:

Banks gives different types of loans and advances. Banks take

different types of security for loans and advances. Charging a

security means making it available as a cover for an advance.

The common modes of charging securities are as following:

1. Pledge

2. Hypothecation

3. Mortgage

4. lien

5. Assignment

6. Set-off

4.5.1 Pledge:

Pledge is the bailment of goods as security for payment of a debt

or performance of a promise. Bailment is the delivery of goods by

one person to another for some purpose under a contract.

Delivery of goods:

Actual delivery

Symbolic or constructive delivery

Characteristics of a valid pledge:

The ownership of the goods remains with the pledgor.

Delivery of goods is necessary.

Practical orientation in IFIC Bank – Motijheel Branch 29

Pledgee has aright to retaining the goods for the security until

final payment of debt.

Right to sell the goods after reasonable notice, if the borrower

default.

Goods should not be accepted as securities in pledge account:

Chemicals

Explosive

Inflammable goods

Goods that may cause damage

Non saleable goods

Goods that have no open market

Price of goods constantly fluctuate

Adulterate goods

Goods of inferior quality

Old stock of goods

4.5.2 Hypothecation:

In this charge creation method, physically the goods remained in

the hand of debtor. But document of title of goods are handed over

to the banker .The method is also called equitable charge. Since

the goods are in the hand of the borrower, bank inspects the goods

regularly to judge its quality and quantity for the maximum safety

of loan.

Characteristics of hypothecation:

Only moveable assets and book debts can be hypothecated.

The charge is floating.

The stocks are constantly changing.

4.5.3 Mortgage:

When a customer as a security for loan offers immovable property,

like building and land, a charge there on is created by means of a

mortgage.

Practical orientation in IFIC Bank – Motijheel Branch 30

Elements of mortgage:

1. Mortgagor

2. Mortgage

3. Mortgage money

4. Mortgage deed

5. Mortgage Property schedule

Land/Building

Benefits that arise out of the Land/Building

Things that are attached to the earth

Characteristics of Mortgage:

1. It does not transfer the ownership of the property to the

Mortgagor.

2. It relates only immovable.

3. The object of a mortgage is to give security for the loan.

4. The mortgagor gets back all his rights after repayment of loan.

Types of Mortgage:

1. Legal/Registered Mortgage

2. Equitable Mortgage

3. Mortgage by conditional sale

4. English Mortgage

5. Usufructuary Mortgage

6. Anomalous Mortgage

Banks takes only two types of mortgage:

Legal/Registered mortgage:

In this way the mortgagor transfers to the mortgage the legal title

and interest of the property.

Practical orientation in IFIC Bank – Motijheel Branch 31

Equitable mortgage:

Another method Called equitable mortgage is also used in bank for

creation of charge. Here mere deposit of title to goods is sufficient

for creation of charge. Registration is not required. But in equitable

mortgage bank an undertaking from the customer that if bank

required, customer is bound to register the property to bank.

4.6 Processing of Loan

Application for loan

Applicant applies for the loan in the prescribed form of bank.

Getting credit information:

The bank collects credit information about the applicant to

determine the credit worthiness of the borrower. Bank collects the

information about the borrower from the following sources:

i. Personal investigation

ii. Confidential Report from other Bank Head Office/Branch/

Chamber of the Commerce

iii. CIB report from Central Bank

Analyzing these information:

Bank then starts examination that whether the loan applied for is

complying with its lending policy. If comply, then it examines the

documents submitted and the credit worthiness. Credit worthiness

analysis, i.e. analysis financial conditions of the loan applicant are

very important. If loan amount is more than 50 Lac then bank goes

for Lending Risk Analysis (LRA) and Spreadsheet Analysis (SA)

which are recently introduced by Bangladesh Bank. According to

Bangladesh Bank rule. LRA and SA are must for the loan exceed

one core.

If these two analyses reflect favorable condition and documents

submitted for the loan appear to be satisfactory, then bank goes

for further action.

Practical orientation in IFIC Bank – Motijheel Branch 32

4.7 Existing Process of Handling Loans:

The process of sanctioning a loan is as follows:

Getting Loan Proposal from Party

About Project

Collection Information

About Party

Evaluating Project & Proposal

BR. Level Evaluation

Legal Assessment

Evaluating Collateral

Evaluation by Agent

Branch Level

Decision

Principal Officer Leave

Sanctioning & Disbursing Loan

Supervision of Loan

Legal Recovery

Recovery of Loan

Usual Recovery

Practical orientation in IFIC Bank – Motijheel Branch 33

4.8. Information Collection

The loans and advance department gets a form filled by the party

seeking a lot of information. The information are listed below:

1. Name and address (present and permanent)

2. Constitution or status of the business

3. Date of establishment and place of incorporation

4. Particulars of properties, partners and directors

5. Background and business experience

6. Particulars of personal asset, names of subsidiaries, percentage

of share holding and nature business

7. Details of liabilities in name of borrowers, in names of any

directors

8. Financial statement of for the last three years

9. Nature and details of business/products

10. Details of requested credit facilities

11. Details of securities offered

12. Other relevant information

13. Proposed debt equity ratio

4.9. Relevant Matter of Document Checked Before Sanctioning

Any Loan

a) There must be an account of the person want to take loan. The

account must transact for not less than 3 months to 6 months,

otherwise the loan will not be sanctioned.

b) After checking the duration of A/C than the transaction made by

the account holder must be checked. The debit credit position

must be also checked, because it is related with future

dealings of the borrower.

c) The purpose for what the loan is taken by the borrower is

another important matter to see and check. Whether the

purpose is business or else must be checked with its

marketability. Because there is risk of fraud and forgery by

the borrower by seeing one purpose in cash of ding any illegal

business.

d) The banker should check through security whether it is enough

or not

Practical orientation in IFIC Bank – Motijheel Branch 34

4.10 Proposal Analysis

The project proposal is analyzed and decision about the project is

taken. The loans and advance department is responsible for the

analysis. After preliminary appraisal of the loan project the final

approval is obtained from the manager. If the loan amount crosses

a certain amount (not fined) manager sends the loan project to the

principal office for final approval. The experts in principal branch

find out different projected ratios and develop an understanding

about the potentiality of the project. Bank evaluates a loan

proposal by considering few predetermined variables. These are

safety, liquidity, profitability, security, purpose of the loans,

sources of repayment, diversification of risks etc. The most

important measure of appraising a loan proposal is safety of the

project. Safety is measured by the security offered by the borrower

and repaying capacity of him. The attitude of the borrower is also

an important consideration; liquidity means the inflow of cash into

the project in course of its operation. The profit is the blood of any

commercial institution. Before approval of any project the bank

authority has to be sure that the proposed project will be profitable

venture. Profitability is assessed from the projected profit and loss

statement. The security is the only tangible remains with the

banker. Securing or collateral is the only weapon to recover the

loan amount. So bank has to see that the collateral it is accepting

is accepting is easy sale and sufficient to cover the loan amount.

Bank cannot sanction loan by only depending on collateral. The

sources of the payment of the project should be a feasible one.

During sanctioning any loan bank has to be attentive about

diversification of risk. All money must not be disbursed amongst a

small number of people. In addition any project must be

established for the national interest growth.

4.11 Collateral Evaluation

The IFIC Bank, Motijheel Branch is very cautions about valuation of

the collateral. The bank officials and simultaneously evaluate the

collateral the party offers by private firm. This two-way valuation of

the collateral increases the accuracy of its value estimated. Three

types of value of the collateral are assumed; current market price,

distress price and price after five years. The legal officers of the

bank check the documents ascertain their impurity.

Practical orientation in IFIC Bank – Motijheel Branch 35

4.12 Final Decision about the Project

If the loan decision remains with branch level, branch sections the

loan and if the approving authority is head office then the decision

comes to the branch by telex or fax.

4.13 Proper Supervision of the Project

If such provision is kept in the sanction contracts the bank officials

go to the project area and observes how loan is utilized. Of no such

close to supervise the loan is added, even then the bank can see

the performance of the project.

4.14 Forms of Advance:

Banks generally offer different kinds of credit facilities to their

customer. They are different forms with different categories.

The credit facilities may be broadly classified into following

categories:

a) Overdraft

2 b) Loan

4.15 Overdraft:

Overdraft are those advance which is allowed on current account

operated upon by cheques. The customer may be sanctioned a

certain limit within which .he can overdraw his current within a

certain period .The customer can withdrawals or deposits any

numbers of within his limit. Interest is calculated and charged only

on the actual debit balances on daily product basis. Overdraft

facility is generally given to businessman for expansion of their

business.

Bank gives overdraft in following three ways:

SOD (secured overdraft)

Cash credit

Export cash credit

Practical orientation in IFIC Bank – Motijheel Branch 36

4.15.1 Secured Overdraft (SOD):

Secured overdraft is a continuous credit facility to the customer of

the bank. This kinds of credit facility is given on following security:

Various kinds of Sanchay Patras

Government security

FDR (fixed deposit receipts)

Shares

ICB unit certificate

Work order

If any customer wants to get SOD facility from the Bank, he has to

submit an application to the Bank manager .It must be done in

prescribed form of the bank. In this has to submit details about his

business. After getting application form bank made an office note.

In this note bank officer write down the following things:

Nature of limit

Extent of limit

Security

Margin

Rate of interest rate

Validity

Then the Bank Authority mark the security as a lien in their

register. For getting any credit facility from the Bank the customer

must have a current account in that bank branch. Bank can give up

to 80% credit facility of the security like FDR, BSB, PSP, ICB unit

certificate.

SOD limit for FDR, BSB, PSP, ICB unit certificate:

Two care from branch level

Above from head office

SOD limit for different kinds share:

20 lac from branch label

If it is more then 20 lac, the branch has to take approved from

head office

Practical orientation in IFIC Bank – Motijheel Branch 37

For share bank can sanction 70% credit facility for “A” grade share

and 60% for “B” grade share .In case of SOD on share the last six

months average value or present value, which one is higher, is

considered.

SOD on work order:

If any party wants to get SOD facility from the bank after getting

work order, he has to submit an application with reliable security

mention there .In past time bank give SOD facility without any

collateral security. But now bank do not give any SOD facility

against work order .If bank see that all of his papers are eligible for

getting SOD facility, bank asks him to give a power of attorney to

the bank for receiving all kinds of payment for the work. He can

get up to 50%of the amount of the work that he has to done. But

he has to submit his collateral security for that. He gets 50% SOD

facility against his collateral security. After getting power of

attorney bank sends a request letter to the authority by which the

work has been issued. Then that authority sends a letter to the

bank that they will make all of the payment of the party through

the bank. After getting the letter the bank credits the SOD amount

to the customers current account. When bank gets payment from

the authority, they make a ratio and cut off their amount from that

payment.

The following charge documents are taken from the customer:

D.P (promissory note) note: Three types

1) Single DP note

2) Joint DP note

3) Joint and several DP note

Letter of arrangement

Letter of continuity

Letter of lien for advances against share, stocks and security.

4.15.2 Cash Credit (CC):

Cash credit is the favorite mode of borrowing by traders,

industrialist etc. for meeting their working capital. Cash credit is a

kind of continuous overdraft. For cash credit facilities Banks allow a

limit for his customer. Cash credit facilities is given for one year.

Practical orientation in IFIC Bank – Motijheel Branch 38

In Banking system cash credit is given for two purpose .The

purpose are as following:

Working capital

Trading purpose

It is a favorite mode of advance for the customer. For cash credit

facility bank allow a limit for his customer. The customer can make

continuous transaction with in that limit. CC is given for one year.

After one year the customer can renew his CC facility.

Interest:

For CC facility interest is counted daily basis. That means customer

has to only that amount of interest which is outstanding in his CC

account. Interest is cut off from customer current in tram wise.

Mode of security:

For CC banks take two type of security. These are as following:

Pledge

Hypothecation

Pledge:

Pledge means the customer transfer his goods to the bank. But the

ownership ship of the goods is in his position. That means only

transfer the goods to the banks but not ownership.

Hypothecation:

It is a kind of security where neither the ownership nor the position

of the goods is transfer to the bank.

But nowadays banks do not give any CC facility without any

extra security like Land, Building etc .The security has been

taken by Bank as equitable mortgage.

If any person wants to get any CC facility from the Bank, he

has to submit an application to the Bank by giving details

condition of his business.

This has to done in a printed form of the bank.

Practical orientation in IFIC Bank – Motijheel Branch 39

In this form the customer mention the limit of his Cc facility,

which is he wants to get from the bank. He also gives details

about security.

After getting the application bank analysis the application very

carefully.

If the bank satisfy about his security, bank takes a survey

about the security.

The banks have some enlisted surveyor. After getting survey

report, if bank personals are satisfied about the security, they

will give CC facility to the customer.

In branch level bank cannot give more then 30lac taka to his customer.

But if bank want give more then 30 lacs. The branch has to get

approval from head office of the bank.

For giving CC bank take following charge document:

1. DP note

2. Letter of arrangement

3. Letter of continuity

4. Letter of hypothecation of goods

5. Stock of goods report

6. Personal guarantee of all the director of the company

7. Deed on additional charge on the fixed assets of the company

8. Form for filling charge with register of joint stock companies

9. Resolution of board of directors

10. Insurance policy for stock

In CC facility bank only allow 50% credit facility of the stock that

the customer has been pledge or hypothecation. Bank gives CC

only for one year. After one year customer has to renewal it.

4.15.3. Export Cash Credit (ECC):

1. ECC to Whom:

ECC facility is allowed to an exporter to finance the purchase

and/or manufacturing of the goods to be shipped by him.

Practical orientation in IFIC Bank – Motijheel Branch 40

2. Consideration for ECC:

In following this loan, the following should also be taken into

consideration:

a. Bank must obtain insurance cover under Export Credit

Guarantee Scheme of Sadharan Bima Corporation (both

pre-shipment and post-shipment).

b. ECC is utilized solely for the purchase of goods to be

shipped under letter of credit/contract.

c. Goods purchased or under manufacture under this

arrangement are kept separate from all other goods, and

a Stock Report signed by the parties and duly certified by

the shippers or the Clearing Agents or an Officer of the

Bank is submitted to the Bank.

d. Goods are kept fully insured against all risks.

e. Shipment is made through the Clearing Agent approved

by the Bank.

f. Goods under ECC must comply with the terms of the

credit/ contract.

g. No advance is obtained from any other Bank, on the

goods purchased or manufactured with the amount

advanced under the ECC.

h. The original letter of credit/contract is stamped “Under

our Lien” and retained with the Bank so that the

exporters do not avail similar facility with any other Bank

against the same letter of credit.

3. Charge Documents:

Obtain the following charge documents from the exporter:

a. Demand Promissory Note

b. Letter of Lien for ECC

c. Letter of Pledge/hypothecation

d. Letter of Arrangement

e. Letter of Disbursement

f. Letter of Partnership alongwith Registered Partnership

Deed in case of Partnership Accounts.

Practical orientation in IFIC Bank – Motijheel Branch 41

g. Resolution alongwith Memorandum & Articles of

Association of the Company in case of accounts of Limited

Company. In case of Corporation, resolution of the Board

alongwith Charter.

h. An undertaking from the Directors of the Public Company

to obtain prior clearance from the Bank before declaring

any

4.16 Loan:

In case of loan, the banker advances a lump sum for a certain

period at an agreed rate of interest. The entire amount is paid

an occasion either in cash or by credit in this current account,

which he can draw at any time. The interest is charged for the

full amount sanctioned whether he withdraws the money from

his account of not. The loan may be repaid in installments or

at expire of a certain period. Loan may be demand loan or a

term loan.

Advance made in a lump sum repayment either on fixed

installment basis or in lump sum on subsequent debit except

by way of interest, incidental charge, etc. is called a loan.

After creation of loan there will be only repayment by

borrower. The loan may be repaid in installment or at expire

of a certain period.

Loans are normally allowed to those parties who have either

fixed source of income who desire to pay it in lump sum.

Banks gives different types of loan to his party.

4.17 Types of loans:

The different types of loan that banks give to his party are as

following:

1. Term loan: a) Industrial

b) Transport loan

c) House building loan

d) Others

2. Staff house building loan

Practical orientation in IFIC Bank – Motijheel Branch 42

3. Loan against trust receipt

4. Staff loan against PF (Provident Fund)

5. Consumer credit

6. LIM (Loan against Imported Merchandise)

7. Loan general/Demand loan

4.17.1 Term Loans:

Types of Loans Characteristics

a. It is given for 3 years at equal monthly installment

Industrial Loans b.

Grace Period is allowed depending on types of project

c. To facilitate the industrial growth this is given

a. This is given to accelerate the transport facility

nationwide

Transport Loans b. It is given for 3 years at equal monthly installment

c. Others conditions are almost same as the Industrial

Loans

a. This Loan is give for the construction of dwelling house.

House Building b. It is given for 3 years at equal monthly installment

Loans c. Term of this loan is only three years.

d. This Loan is not given frequently.

Others Loan – Actually Agricultural loan is not given from this branch of

Including IFIC Bank but the all other items excluding the mentioned

agricultural Loan above will go under this head of term loans.

4.17.2 Staff house Building Loan (SHBL):

Every employee is eligible to get SHBL, which is 120 times of his

basic salary. For SHBL, the staff has to apply in the prescribed

form of the bank and that form must be send to the head office

through manager of the respective branch by recommendation.

Head office sanction an advice to the manager of the respective

branch with the approval of sanction of SHBL and the term and

condition of the loan.

Grace period – period require to earn visible return

Practical orientation in IFIC Bank – Motijheel Branch 43

Rate of interest:

Rate of interest is one percent higher then bank rate.

Disbursement of the loan is made through payment order in favor

of the company/person from which the land/building is bought.

Security:

Legal mortgage of that land or flat.

Documents to be obtained:

1. DP note

2. Letter of disbursement

3. Letter of installment

4. Letter of authority for deducting salary

5. Interim guarantee

6. Deed of legal mortgage

7. An undertaking on non-judicial stamp shall be obtained from

the borrower authorizing the bank to realize loan installments

from monthly salary.

8. An undertaking on non-judicial stamp that the bank will have

the right to adjust liability from the service benefits.

Repayment of HSBL loan will start after one year from

disbursement date. The loan has to cut off with in twenty year

from his salary.

4.17.3 Consumer Credit Scheme (CCS):

Eligibility Criteria:

a. The potential borrower must be a national of Bangladesh and

aged at least 18 (eighteen) years.

b. The potential borrower’s employer business or profession, as

the case may be should preferable be located in the same

town/city as his/her residence and lending branch of IFIC

Bank Ltd.

c. The potential borrower must provide his/her permanent

residential address in case he/she is living a rented house/flat.

Practical orientation in IFIC Bank – Motijheel Branch 44

d. Each prospective borrower must open a Savings Account with

our branch (if not already held).

e. The potential borrower should preferable be a regular Income

Tax and/or other applicable Tax payer. Last Tax paid

assessment certificate prominently indicating TIN should

preferable be submitted with the loan application form.

For service holder:

a. Borrower can be any person employed by a reputed company

as a confirmed employee. He must submit certificate

regarding salary, confirmation and length of service.

b. His minimum monthly take home salary should not be less

than Tk. 5000/- and 3 (three) times of Equated Monthly

Installment (EMI).

c. He must have at least 5 (five) years of employment left.

For Self Employed Person:

A self employed person must be of repute in the respective

profession/business.

a. He must have a net take home income of at least Tk. 10,000/-

per month and 3 (three) times of EMI.

b. He is running his own business for at least 5 (five) years and

has a satisfactory banking relationship with IFIC Bank Ltd.

For defense service personnel:

a. Employer’s certificate should be obtained only from the

commanding officer of borrower’s unit.

b. In case of a solder, the guarantor should not be below the

rank of Junior Commission Officer.

c. The respective unit of the borrower will provide a guarantee

certificate that the borrower will pay the monthly installments

in due time.

All other terms & conditions are same as service holder.

Item Financed:

Domestic Appliances, Office Equipment & Entertainment Equipment

Practical orientation in IFIC Bank – Motijheel Branch 45

Limit Range:

Tk. 10,000/- to Tk. 7,00,000/-

Loan Amount:

Loan amount will be 80% of the Invoice/Quotation amount.

Down Payment:

Minimum equity contribution will be 20% of the invoice/ quotation

amount which will be realized from the borrower’s Savings

Account.

Interest Rate and Fees:

a. Each set of Application Forms Tk. 30/-

b. Interest rate @ Tk. 14.50 P.A. with quarterly rest.

c. 2% service charge of the loan amount (minimum Tk. 500/-)

will be realized from the borrower’s Savings Accounts.

d. 2% Risk Fund of the loan amount will be realized from the

borrowers’ Savings Account.

Payment Order:

A payment order of the Invoice/Quotation amount will be issued in

fervor of the supplier of the consumer item.

Application Form & Other Forms:

Customer must submit Application Form (Bank’s prescribed form)

duly field in and also submit the following forms,

a. Form A – Letter from the borrower to his/her employer

b. Form B – Employer’s certificate to the Bank

c. Form C – Particulars of guarantor and a letter of guarantee

duly executed from a person acceptable to the Bank.

Photograph:

A recent passport size photograph of the customer (attested by the

employer or the guarantor when customer is a businessman) and

the guarantor (attested by the Gazette Officer).

Delivery Challan & Money Receipt

Borrower must deliver Money Receipt and Delivery Challan of the

asset purchased to the lending.

Practical orientation in IFIC Bank – Motijheel Branch 46

Repayment Arrangement:

a. The installment shall be payable monthly on or before 7th of

the subsequent month.

b. Post dated cheques of the amount equal to the installment

size (one of each installment) and one undated cheque

(double of installment size) in favour of IFIC Bank Ltd. should

be submitted before disbursement of the loan.

Penal Interest:

Penal Interest for delay payment will be charged @ Tk. 50/- if the

installment is not paid within 15 days from the 7th of each month.

Thereafter, penal interest for delayed payment will be charged @

Tk. 75/- for subsequent delay of each 15 days.

4.17.4 Staff loan against provident fund:

IFIC bank has so long been allowing loan to staff against provident

fund upto 80% of their own contribution adjustable in 24 (twenty

four) equal monthly installments.

We are now pleased to inform you that Management has, of late,

decide to allow loan to staff against their provident fund as per the

following criterion: -

Sl. Criterion P.F. Loan Repayment

No. ceiling period

(Maximum)

i) Employees having less than 5 80% of own 48 equal

years continuous confirmed contribution monthly

service in the Bank installments

ii) Employees having 5 years less 60% of both 48 equal

than 7 years continuous confirmed contribution monthly

service in the Bank installments

iii) Employees having 7 years less 70% of both 48 equal

than 10 years continuous contribution monthly

confirmed service in the Bank installments

iv) Employees having 10 years above 80% of both 48 equal

continuous confirmed service in contribution monthly

the Bank installments

This facility will come into force with immediate effect.

All other terms & conditions will remain unchanged.

Practical orientation in IFIC Bank – Motijheel Branch 47

4.17.5. Advances (Loans) Against Trust Receipts:

1. Advance Against Trust Receipts:

a. Advance against a Trust Receipt obtained from the customers

are allowed when the documents covering an important

shipment are given (to first class parties only) without

payment.

b. The customer holds the goods or their sale proceeds in trust for

the Bank, till such time, the loan allowed against the Trust

Receipt is fully paid off.

c. The Trust Receipt is a document which creates the Banker’s lien

on the goods and practically amounts to hypothecation of the

proceeds of sale in discharge of the lien.

2. Period Of Trust Receipt:

The period of Trust Receipt may be 30, 60 or 90 days as allowed

by the Head Office. The loan is adjustable within this period. It

should be noted that the sale proceeds of goods held in Trust must

be deposited in the Bank by the borrower irrespective of the period

of the Trust Receipt.

3. Charge Documents:

Obtain the following charge documents allowing the advance:

a. Demand Promissory Note.

b. Trust Receipt.

c. Letter of Arrangement.

d. Letter of Disbursement.

e. Letter of Partnership alongwith Registered Partnership

Deed in case of Partnership Accounts.

f. Resolution along with Memorandum & Articles of

Association of company in case of accounts of Limited

Company. In case of Corporation, resolution of the Board

along with Charter.

g. Personal guarantee of Director in case of limited

company.

h. Insurance Policy covering the goods against all risk with

bank Mortgage clause is obtained where Trust Receipt

facility is allowed against imported goods.

i. The particulars of LIM transactions should be recorded in

LIM Register and LIM liability Ledger.

Practical orientation in IFIC Bank – Motijheel Branch 48

4.17.6. Advance (Loan) Against Imported Merchandise (LIM):

A. Head Office Approval For LIM:

a. Advance (Loan) against the security of merchandise