Professional Documents

Culture Documents

"Your Way Home Arizona": Pima County Program Description

Uploaded by

markkerrward5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"Your Way Home Arizona": Pima County Program Description

Uploaded by

markkerrward5Copyright:

Available Formats

“Your Way Home Arizona”

Pima County Program Description

“Your Way Home Arizona” (YWH) will offer 22% in down payment assistance to qualified

homebuyers purchasing an eligible foreclosed home in Pima County. Family Housing

Resources (FHR) will administer the program in partnership with participating lenders

and real estate agents. The assistance is funded by the Arizona Department of Housing

(ADOH) via the Neighborhood Stabilization Program (NSP) authorized by the 2008

Housing and Economic Recovery Act.

Eligible Properties

Foreclosed properties only. The mortgage foreclosure is complete and the investor

owns the property. The property must be vacant at the time of listing

One-unit single family homes, condos, townhomes and affixed manufactured homes.

The program has specific addendums that must be signed by the Seller and the final

purchase price of the home must be discounted 1% lower than the “review” appraisal

Eligible properties must be located in the following Zip Codes in Pima County

85705 85711 85730 85629 85641

85706 85713 85746 85653 85712

85710 85714 85757 85704 85741

85742 85743 85745 85747 85756

Down Payment Requirement

A minimum of 3 % of the purchase price is required as down payment. 1% must come

from the homebuyer’s own funds. 2% can came from any other approved source (Seller,

Real Estate Agent and Lender are not approved sources).

“Your Way Home” (YWH)

Program Description Page 2

Homebuyer Qualifications

The income limit for the household is no greater than 120% of the median income for

Pima County (see chart below)

The homebuyer is not required to be a first-time homebuyer. However, if someone in

the household owns a residence, it must have been leased/rented for the previous 12

months before applying for the program

The property purchased must be used for the homebuyer’s primary residence

The homebuyers housing ratio must be at or below 31%; debt ratio at or below 43%

The homebuyer must have 2 months of PITI (total monthly mortgage payment) in

reserves (savings account) when they close on their home

HHD Size 1 2 3 4 5 6 7 8

Max 120% $49,560 $56,640 $63,720 $70,800 $76,560 $82,200 $87,840 $93,480

Purchase Price limit $316,250

Homebuyer Assistance

22% of the purchase price

Assistance is in the form of a second loan at 0% interest and no monthly payment

The second loan is forgiven after a period of time based upon the amount of the loan:

o 5 year for assistance of $15,000 or less

o 10 years for assistance of $15,001 - $40,000

o 15 years for assistance of more than $40,000

How to Apply

1. The homebuyer meets with a participating lender to obtain pre-approval. Check the

website www.yourwayhomeaz.com for a list of participating lenders

2. The homebuyer signs-up for FHR’s Homebuyer Education Class. Applicants attending

FHR class must apply for the program with FHR.

3. The FHR Counselor will contact the homebuyer for an appointment to apply for the

assistance after receiving the pre-approval information from the lender.

For more information, contact Denise at FHR 318-0993

www.familyhousingresources.com

Addition Info

Click the links below for PDF documents.

Role of Lender and Agent

http://www.familyhousingresources.com/pdf/HBE/1_RolesofLenderandAgent.pdf

Determination of Income

http://www.familyhousingresources.com/pdf/HBE/2_DeterminationofIncome.pdf

Property Requirements

http://www.familyhousingresources.com/pdf/HBE/3_PropertyRequirements.pdf

Application Page 5

http://www.familyhousingresources.com/pdf/HBE/4_ApplicationPage5.pdf

Realtor Escrow Form

http://www.familyhousingresources.com/pdf/HBE/5_YWHRealtorEscrowInfo.pdf

Certificate of Seller

http://www.familyhousingresources.com/pdf/HBE/6_CertificateofSellerNSP062609SW.pdf

Certificate of Seller Freddie Mac

http://www.familyhousingresources.com/pdf/HBE/7_FreddieMacAZCertificateofSeller.pdf

Fannie Mae Addendum

http://www.familyhousingresources.com/pdf/HBE/8_FannieNSPADDENDUM.pdf

You might also like

- Your Way Home ArizonaDocument2 pagesYour Way Home Arizonamarkkerrward5No ratings yet

- HOAP GuidelinesDocument6 pagesHOAP GuidelineshometownhousingNo ratings yet

- Citi Home Run ProgramDocument1 pageCiti Home Run ProgramSomeshKaashyapNo ratings yet

- DpapdfDocument1 pageDpapdfapi-299744415No ratings yet

- USDA Guaranteed Rural Housing Loans (Section 502) : PurposeDocument2 pagesUSDA Guaranteed Rural Housing Loans (Section 502) : PurposeSUPER INDUSTRIAL ONLINENo ratings yet

- City of East Lansing Avondale Square Down Payment Assistance Procedural GuideDocument13 pagesCity of East Lansing Avondale Square Down Payment Assistance Procedural GuidehometownhousingNo ratings yet

- HOMEBUYER AGREEMENT GUIDEDocument3 pagesHOMEBUYER AGREEMENT GUIDEKayNo ratings yet

- US Social Housing Bond Provides 12% ReturnsDocument6 pagesUS Social Housing Bond Provides 12% ReturnsSo LokNo ratings yet

- Opening The Door To Homeownership: Homebuyer Loan ProgramsDocument10 pagesOpening The Door To Homeownership: Homebuyer Loan ProgramsAnwar BrooksNo ratings yet

- FIMC RMBasicsFlyerDocument1 pageFIMC RMBasicsFlyerL.p. VogtmanNo ratings yet

- Risk Mitigation PolicyDocument11 pagesRisk Mitigation PolicyAdrian GarciaNo ratings yet

- HB Shap Program OverviewDocument3 pagesHB Shap Program OverviewSharonda Grove-WilliamsNo ratings yet

- PrintableDocument2 pagesPrintableapi-309082881No ratings yet

- Rent To OwnDocument3 pagesRent To OwnEfefiong Udo-NyaNo ratings yet

- New Orleans Soft Second Mortgage FundingDocument23 pagesNew Orleans Soft Second Mortgage FundingPropertywizzNo ratings yet

- Documents You Must Include With Your Application:: Mortgage Pre-QualificationDocument8 pagesDocuments You Must Include With Your Application:: Mortgage Pre-QualificationAnonymous RtqTxAn7wNo ratings yet

- Making Home Affordable: Act Now To Get The Help You NeedDocument7 pagesMaking Home Affordable: Act Now To Get The Help You NeedKathryn PriceNo ratings yet

- US Mortgage For Non Residents Loan RequirementsDocument3 pagesUS Mortgage For Non Residents Loan RequirementsRajesh SomshekharNo ratings yet

- RYPKEMA Quotes PDFDocument5 pagesRYPKEMA Quotes PDFNicholas BradleyNo ratings yet

- Mortgage Compliance Investigators - Loan Disposition Analysis (LDA)Document15 pagesMortgage Compliance Investigators - Loan Disposition Analysis (LDA)Billy BowlesNo ratings yet

- Navigating The World of Housing FinanceDocument9 pagesNavigating The World of Housing FinanceTanu RathiNo ratings yet

- Ann Arbor Housing Commission Homeownership ProgramDocument4 pagesAnn Arbor Housing Commission Homeownership ProgramuserNo ratings yet

- 6 STEPS TO BUYING A HOUSEDocument35 pages6 STEPS TO BUYING A HOUSEDiwakar SHARMA100% (1)

- The Low-Income First-Time Homebuyers Act 2023Document2 pagesThe Low-Income First-Time Homebuyers Act 2023Ezra HercykNo ratings yet

- Homeowner Affordability and Stability Plan Executive SummaryDocument4 pagesHomeowner Affordability and Stability Plan Executive SummaryMohit TakyarNo ratings yet

- Loan Cheat Sheet by Jocelyn PredovichDocument1 pageLoan Cheat Sheet by Jocelyn PredovichJocelyn Javernick PredovichNo ratings yet

- Reverse Mortgage Loans for Senior CitizensDocument26 pagesReverse Mortgage Loans for Senior CitizensJuliet PetersNo ratings yet

- NY COVID Rent ReliefDocument2 pagesNY COVID Rent ReliefJoe SpectorNo ratings yet

- HAFA Policies Bank of AmericaDocument5 pagesHAFA Policies Bank of AmericaMelissa Rose Zavala100% (1)

- Section 8 Housing ProgramDocument5 pagesSection 8 Housing Programscott nachatiloNo ratings yet

- Loans For Beginning Farmers and Ranchers-FactsheetDocument3 pagesLoans For Beginning Farmers and Ranchers-FactsheetKuhnNo ratings yet

- FHA Reduces Mortgage Insurance Premiums and Cancels Annual PremiumsDocument4 pagesFHA Reduces Mortgage Insurance Premiums and Cancels Annual Premiumsnghiemta18No ratings yet

- DunbarNoteFunding-Note Holders HandbookDocument51 pagesDunbarNoteFunding-Note Holders HandbookCharles Dunbar100% (1)

- Front-End Ratio:: Debt-To-Income RatiosDocument3 pagesFront-End Ratio:: Debt-To-Income RatiosAbhishek GavandeNo ratings yet

- Guide To Buying A HomeDocument4 pagesGuide To Buying A HomeDan LynchNo ratings yet

- Mi Homes Fillable Application Packet - 04.01.22Document14 pagesMi Homes Fillable Application Packet - 04.01.22Cee SNo ratings yet

- 53 FHA Loans in OhioDocument5 pages53 FHA Loans in OhioDaniyal ShaikhNo ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- Loan Modification Program InfoDocument3 pagesLoan Modification Program InfoDeborah Tarpley HicksNo ratings yet

- Administrative Regulations for Implementing Chapter 44-12-2021Document19 pagesAdministrative Regulations for Implementing Chapter 44-12-2021w92fgc9r5tNo ratings yet

- USDA Rural Development programs help rural homeowners and buyersDocument6 pagesUSDA Rural Development programs help rural homeowners and buyersSarah CornNo ratings yet

- HAFA UpdatesDocument1 pageHAFA Updatesjoy_bowlesNo ratings yet

- FHLBSF First-Time Homebuyer ProgramsDocument2 pagesFHLBSF First-Time Homebuyer Programsw_deesNo ratings yet

- LHCs First-Time Home Buying GuideDocument7 pagesLHCs First-Time Home Buying GuideTy SidNo ratings yet

- Planning For Homeownership GuideDocument20 pagesPlanning For Homeownership Guideapi-295818061No ratings yet

- PGT-Credit Coop - Business Plan - Edited - December 15 2023Document18 pagesPGT-Credit Coop - Business Plan - Edited - December 15 2023Lieca AmbolNo ratings yet

- Home Buying: The Complete Guide ToDocument32 pagesHome Buying: The Complete Guide ToPrem .A. NandakumarNo ratings yet

- SFRAccess SFR Program Desc 4-10Document9 pagesSFRAccess SFR Program Desc 4-10jjNo ratings yet

- 3 Types of Apartment LoansDocument17 pages3 Types of Apartment LoansJason CarterNo ratings yet

- FNSCRD301 Process Applications For CreditDocument5 pagesFNSCRD301 Process Applications For Creditpatrick wafulaNo ratings yet

- Reverse Mortgage BasicsDocument11 pagesReverse Mortgage BasicsSidharth A.murabatteNo ratings yet

- Announcement 09-33 Amends These Guides: Servicing New Deed-For-Lease™ ProgramDocument4 pagesAnnouncement 09-33 Amends These Guides: Servicing New Deed-For-Lease™ Programapi-26722057No ratings yet

- NP WD 2-1 TarinSearleDocument2 pagesNP WD 2-1 TarinSearleTarin SearleNo ratings yet

- Homeready Mortgage: Built For Today'S Home BuyersDocument2 pagesHomeready Mortgage: Built For Today'S Home BuyerstimlegNo ratings yet

- Real Estate TermsDocument7 pagesReal Estate TermsTope MedelNo ratings yet

- 5.29.09 HUD AnnouncmentDocument3 pages5.29.09 HUD AnnouncmentThe Pinnacle TeamNo ratings yet

- Getting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageFrom EverandGetting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageNo ratings yet

- July 2012 Newsletter PDFDocument7 pagesJuly 2012 Newsletter PDFmarkkerrward5No ratings yet

- Ride Guide Feb - Aug. 2012Document1 pageRide Guide Feb - Aug. 2012markkerrward5No ratings yet

- October 2012 NewsletterDocument9 pagesOctober 2012 Newslettermarkkerrward5No ratings yet

- October 2012 NewsletterDocument9 pagesOctober 2012 Newslettermarkkerrward5No ratings yet

- Sun Shuttle Service Changes 2Document2 pagesSun Shuttle Service Changes 2markkerrward5No ratings yet

- Microsoft Power Point - FY 2013 Budget Update and DiscussionDocument21 pagesMicrosoft Power Point - FY 2013 Budget Update and Discussionmarkkerrward5No ratings yet

- Englis SP Mariachi FlyerDocument2 pagesEnglis SP Mariachi Flyermarkkerrward5No ratings yet

- Community FlyerDocument1 pageCommunity FlyerRichard G. FimbresNo ratings yet

- April Pools Day 033012Document2 pagesApril Pools Day 033012markkerrward5No ratings yet

- City of Tucson Ward 5 Newsletter: A Letter From Councilmember FimbresDocument5 pagesCity of Tucson Ward 5 Newsletter: A Letter From Councilmember Fimbresmarkkerrward5No ratings yet

- Neighborhood Clean UpDocument1 pageNeighborhood Clean Upmarkkerrward5No ratings yet

- Fy2013 Prelim Budget Info 02-07-12Document12 pagesFy2013 Prelim Budget Info 02-07-12markkerrward5No ratings yet

- PNIP Open House Flyer With LinksDocument1 pagePNIP Open House Flyer With Linksmarkkerrward5No ratings yet

- Fy2013 Prelim Budget Info 02-07-12Document12 pagesFy2013 Prelim Budget Info 02-07-12markkerrward5No ratings yet

- PNIP Open House Flyer With LinksDocument1 pagePNIP Open House Flyer With Linksmarkkerrward5No ratings yet

- Neighborhood Clean UpDocument1 pageNeighborhood Clean Upmarkkerrward5No ratings yet

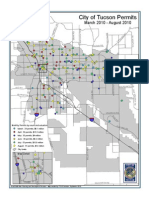

- Map AugustDocument1 pageMap Augustmarkkerrward5No ratings yet

- Saguaro NP Hispanic Focus - Group - FlyerDocument1 pageSaguaro NP Hispanic Focus - Group - Flyermarkkerrward5No ratings yet

- Arizona Department of Housing 2010 Information BulletinDocument4 pagesArizona Department of Housing 2010 Information Bulletinmarkkerrward5No ratings yet

- PDSD July 2010Document1 pagePDSD July 2010markkerrward5No ratings yet

- AARP Tucson Open House 10-13-11Document1 pageAARP Tucson Open House 10-13-11markkerrward5No ratings yet

- Media PDSD Sep 2011Document1 pageMedia PDSD Sep 2011markkerrward5No ratings yet

- AzDA - Free Diabetes Screenings & EducationDocument1 pageAzDA - Free Diabetes Screenings & Educationmarkkerrward5No ratings yet

- Scan 0003Document1 pageScan 0003markkerrward5No ratings yet

- Finance RPTDocument3 pagesFinance RPTmarkkerrward5No ratings yet

- Scan 0003Document1 pageScan 0003markkerrward5No ratings yet

- Monthly Status ReportDocument12 pagesMonthly Status ReportRichard G. FimbresNo ratings yet

- Wd5Aug2010 2Document1 pageWd5Aug2010 2markkerrward5No ratings yet

- Wd5Aug2010 1Document1 pageWd5Aug2010 1markkerrward5No ratings yet

- Map July 2010Document1 pageMap July 2010markkerrward5No ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- The History of Microfinance PDFDocument8 pagesThe History of Microfinance PDFTheodorah Gaelle MadzyNo ratings yet

- Finding Simple InterestsDocument14 pagesFinding Simple InterestsRhomel Phillipe' de GuzmanNo ratings yet

- Tax 896-Income Tax Act, 2015 (Act 896) As Amended by Acts 902, 907, 915, 924, 941, 956, 967 and 973Document111 pagesTax 896-Income Tax Act, 2015 (Act 896) As Amended by Acts 902, 907, 915, 924, 941, 956, 967 and 973memphixxNo ratings yet

- Debt Consolidation TipsDocument6 pagesDebt Consolidation TipsKrittiNo ratings yet

- Nature and Characteristics of Credit Transactions - DepositDocument12 pagesNature and Characteristics of Credit Transactions - Depositviva_33No ratings yet

- Corporate Tax ProblemsDocument21 pagesCorporate Tax Problemsnavtej02No ratings yet

- Watkins Superseding IndictmentDocument28 pagesWatkins Superseding IndictmentKyle WhitmireNo ratings yet

- 041123-SBI Analyst Presentation Q2FY24Document58 pages041123-SBI Analyst Presentation Q2FY24Madem Soma Sundara PrasadNo ratings yet

- Business Plan MagnetiteDocument45 pagesBusiness Plan MagnetiteJuliano ConstanteNo ratings yet

- Loan Repossession DisputeDocument2 pagesLoan Repossession DisputeHarsha AmmineniNo ratings yet

- Job Advert - Credit OfficerDocument3 pagesJob Advert - Credit OfficerRashid BumarwaNo ratings yet

- Chinabank Vehicles ListDocument10 pagesChinabank Vehicles ListrapturereadyNo ratings yet

- A Project Report On "The Study On The Different Types of Loans Offered by ICICI Bank." Submitted ToDocument83 pagesA Project Report On "The Study On The Different Types of Loans Offered by ICICI Bank." Submitted ToAdarsh GiladaNo ratings yet

- Union Bank of India PDFDocument58 pagesUnion Bank of India PDFashwin thakurNo ratings yet

- CMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Document21 pagesCMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Darren WolbergNo ratings yet

- Loan Documentation EssentialsDocument13 pagesLoan Documentation EssentialsDza SunnyNo ratings yet

- Property Management Training ManualDocument48 pagesProperty Management Training Manualjr_raffy589567% (3)

- Data AnalysisDocument5 pagesData AnalysisMagical MakeoversNo ratings yet

- Here Is Where The Parties Provide For Their Offers and Bargain With Each Other."Document12 pagesHere Is Where The Parties Provide For Their Offers and Bargain With Each Other."Madeline AtintoNo ratings yet

- Why interest is prohibited - A statistical justificationDocument14 pagesWhy interest is prohibited - A statistical justificationusmanNo ratings yet

- Material BudgetDocument37 pagesMaterial BudgetRahul SardaNo ratings yet

- Mergers & Inquisitions - Financial Institutions Group - FIG Investment Banking GuideDocument43 pagesMergers & Inquisitions - Financial Institutions Group - FIG Investment Banking GuideGABRIEL SALONICHIOSNo ratings yet

- PNB Retail Lending SchemesDocument6 pagesPNB Retail Lending Schemesanon_617153150No ratings yet

- All ThesisDocument111 pagesAll ThesisArjun kumar ShresthaNo ratings yet

- SCS May22 - Aug22 Mock Exam 5 PDF AnswersDocument13 pagesSCS May22 - Aug22 Mock Exam 5 PDF AnswersSanjay MehrotraNo ratings yet

- BRAC BankDocument64 pagesBRAC BankHumaira HossainNo ratings yet

- The Financing Cycle Summary, Case Study, AssignmentsDocument18 pagesThe Financing Cycle Summary, Case Study, AssignmentsbernadetteNo ratings yet

- En Le Havre RulesDocument16 pagesEn Le Havre RulesCaio MellisNo ratings yet

- FINTECH RESEARCH WORK-on 24 MayDocument17 pagesFINTECH RESEARCH WORK-on 24 MaySushank Agrawal100% (1)