Professional Documents

Culture Documents

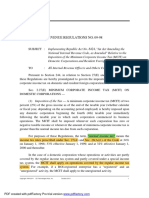

Finance Act 2004

Uploaded by

openid_kMOmF8UfOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Act 2004

Uploaded by

openid_kMOmF8UfCopyright:

Available Formats

technical

relevant to CAT Scheme Paper 9 (GBR) and

Professional Scheme Papers 2.3 (GBR) and 3.2 (GBR)

finance act 2004

This article looks at the changes made

by the Finance Act 2004, and should be

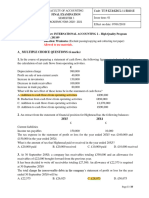

The corporation tax relief table that will be given for the June and December 2005 sittings is as

follows:

read by those of you who are taking Paper

2.3 (GBR) at either the June or December Financial year 2002 2003 2004

2005 sittings. Candidates sitting CAT Paper

9 (GBR) and Professional Scheme Paper 3.2 Starting rate Nil Nil Nil

(GBR) should read this article making Small companies rate 19% 19% 19%

reference to the appendices on pages 41 and Full rate 30% 30% 30%

42. The aim of the article is to summarise Starting rate lower limit 10,000 10,000 10,000

the changes made by the Finance Act Starting rate upper limit 50,000 50,000 50,000

2004 and to look at the more important Small companies rate lower limit 300,000 300,000 300,000

changes in greater detail. The article also Small companies rate upper limit 1,500,000 1,500,000 1,500,000

includes details of legislation that was Taper relief fraction

enacted prior to the Finance Act 2004, but Starting rate 19/400 19/400 19/400

has only come into effect from Small companies rate 11/400 11/400 11/400

6 April 2004.

Please note that if you are sitting CAT

Scheme Paper 9 (GBR), Professional Scheme

Papers 2.3 (GBR) or 3.2 (GBR) in December

2004, you will be examined on the Finance EXAMPLE 1 c Corporation tax is £22,800 (120,000 at

Act 2003, which is the legislation as it For the year ended 31 March 2005 Easy Ltd 19%) as the profits of £122,000

relates to the tax year 2003-04. Therefore, has FII of £2,000 and profits chargeable to (120,000 + 2,000) are between

this article is not relevant to you, and you corporation tax of: £50,000 and £300,000.

should instead refer to the Finance Act 2003 a £6,000 d Marginal relief applies as the profits of

article on pages 38 to 45 of the September b £20,000 £602,000 (600,000 + 2,000) are

2003 issue of student accountant. c £120,000 between £300,000 and £1,500,000.

d £600,000 The company’s corporation tax liability is

CORPORATE BUSINESSES as follows:

Rates of corporation tax a Corporation tax is nil as the profits of £

The rates of corporation tax for the financial £8,000 (6,000 + 2,000) do not exceed 600,000 at 30% 180,000

year 2004 are unchanged at nil, 19% and £10,000. Marginal relief 11/400

30%, as are all the lower and upper limits. b Starting rate marginal relief applies as the (1,500,000 - 602,000) x

The corporation tax rates for the financial year profits of £22,000 (20,000 + 2,000) 600,000

2004 can therefore be summarised as are between £10,000 and £50,000. The 602,000 24,613

follows: company’s corporation tax liability is as Liability 155,387

follows:

Level of profits Effective £ Dividends

rate 20,000 at 19% 3,800 Until 31 March 2004 the payment of a

Up to £10,000 Nil Marginal relief dividend had no impact on the amount of

£10,001 to £50,000 23.75% 19/400 (50,000 - 22,000) x corporation tax paid by a company. However,

£50,001 to £300,000 19% 20,000 from 1 April 2004 profits paid out as a

£300,001 to £1,500,000 32.75% 22,000 1,209 dividend are now subject to a minimum rate

Over £1,500,000 30% Liability 2,591 of corporation tax of 19%. The reason for this

November/December 2004 student accountant 35

change is to ensure that a minimum amount dividends are paid to corporate shareholders, d For the year ended 31 March 2005,

of tax is paid regardless of how profits are and for groups of companies. These rules are Daisy Ltd has profits chargeable to

extracted from a company. The minimum tax not examinable. corporation tax of £5,000. During the

rate of 19% will be given to you in the tax year the company paid a dividend of

rates and allowances section of the EXAMPLE 2 £20,000. Although a dividend of

examination paper. a For the year ended 31 March 2005, Albert £20,000 has been paid, the additional

This minimum rate will only affect Ltd has profits chargeable to corporation liability is restricted to £950 (5,000 at

companies with profits below £50,000, and tax of £10,000. During the year the 19%), and this is Daisy Ltd’s corporation

then only if they pay a dividend. Companies company paid a dividend of £8,000. tax liability for the year ended 31 March

with profits of £50,000 or more will already There would have been no corporation tax 2005. The excess amount of dividend of

be paying corporation tax at the rate of 19% liability if the dividend had not been paid, £15,000 (20,000 - 5,000) that has not

or higher, and so will not be subject to any so the underlying rate is nil. The profits of been subject to the minimum rate of

additional liability if a dividend is paid. £8,000 that are paid out as a dividend are corporation tax is carried forward to the

taxed at the minimum rate of 19%, so year ended 31 March 2006, and this

Calculation Albert Ltd’s corporation tax liability for the may result in further additional tax being

It is first necessary to calculate the year ended 31 March 2005 is £1,520 due in that year.

corporation tax liability ignoring the dividend, (8,000 at 19%).

and then to work out an underlying rate of b For the year ended 31 March 2005, Basil Capital allowances

corporation tax. Ltd has profits chargeable to corporation Information and communications technology

Those profits that are paid out as a tax of £40,000. During the year the The first-year allowance of 100% that applied

dividend are taxed at the minimum rate of company paid a dividend of £25,000. to expenditure by small businesses on

19%, while the remainder of the profits are The corporation tax liability ignoring the information and communications technology

taxed at the underlying rate. The actual dividend is as follows: equipment has ceased. A question could still

corporation tax liability is then found by £ be set where the 100% first-year allowance

adding the two figures together. 40,000 at 19% 7,600 was available on expenditure incurred prior to

Marginal relief 31 March 2004.

Restriction 19/400 (50,000 - 40,000) 475

Where a company pays a dividend that is Liability 7,125 First-year allowance

higher than the amount of profits chargeable For a period of one year only, the rate of

to corporation tax, then the corporation tax The underlying rate is 17.8125 (7,125/ first-year allowance for small businesses has

liability is restricted to 19% of the profits. 40,000 x 100). The amount of been increased from 40% to 50%. For

However, the excess amount of dividend that corporation tax on the profits paid out as companies, the rate of 50% will apply to

has not been subject to the minimum rate of dividends is £4,750 (£25,000 at 19%). expenditure during the period from 1 April

corporation tax of 19% is carried forward to The amount of corporation tax on the 2004 to 31 March 2005. For

the following accounting period. This may remainder of the profits is £2,672 unincorporated businesses the relevant

then be subject to the minimum rate of 19% (£40,000 - £25,000 = £15,000 at period is from 6 April 2004 to 5 April 2005.

in the following year, depending on the level 17.8125%). Basil Ltd’s corporation tax Medium-sized businesses continue to qualify

of profits. liability for the year ended 31 March 2005 for the first-year allowance of 40%.

is therefore £7,422 (4,750 + 2,672).

Due date c For the year ended 31 March 2005, Cherie Definition of small and medium-sized

The corporation tax liability will include any Ltd has profits chargeable to corporation tax The definitions of small and medium-sized

additional tax due as a result of paying a of £100,000. During the year the company businesses have been made more lenient. To

dividend. Details are included on the paid a dividend of £40,000. The be treated as small or medium-sized, a

self-assessment corporation tax return, and corporation tax liability ignoring the business must now meet two out of the

the corporation tax liability is then payable on dividend is £19,000 (100,000 at 19%). following three requirements:

the normal due date nine months after the Since the minimum rate of 19% is already

end of the accounting period. payable on all of the profits, there is no

additional liability as a result of paying the

Special rules dividend. Cherie Ltd’s corporation tax

There are special rules when an accounting liability for the year ended 31 March 2005

period spans 31 March 2004, where is therefore £19,000.

36 student accountant November/December 2004

technical

Small Medium- EXAMPLE 3

business sized Ming Ltd prepares accounts to 30 September. The tax written down value of its general pool at

business 1 October 2003 was £22,700. The following transactions took place during the year ended

Turnover must 30 September 2004:

not exceed £5.6m £22.8m

Assets must 10 October 2003 Purchased a computer for £2,400

not exceed £2.8m £11.4m 25 January 2004 Purchased machinery for £4,700

The number of 7 April 2004 Purchased a computer for £4,100

employees must 10 June 2004 Purchased a motor car for £11,200

not exceed 50 250 30 August 2004 Purchased machinery for £8,800

These conditions can be met for either the Ming Ltd is a small company. Ming Ltd’s capital allowance claim for the year ended

current year or the previous year, see 30 September 2004 is as follows:

Example 3.

Pool Allowances

Interest on underpaid and overpaid £ £ £

corporation tax WDV b/f 22,700

The assumed rates of interest on underpaid Additions 11,200

and overpaid corporation tax are based on 33,900

the actual rates in force (for income tax WDA – 25% 8,475 8,475

purposes) at 6 April 2004. For the June 25,425

and December 2005 sittings the assumed Additions qualifying for FYA

rate of interest on underpaid corporation tax Computer 2,400

will therefore be 6.5%, and the assumed FYA 100% 2,400 2,400

rate of interest on overpaid corporation tax

will be 2.5%. Machinery 4,700

FYA 40% 1,880 1,880

Transfer pricing 2,820

From 1 April 2004 there are a number of Computer 4,100

changes to the transfer pricing rules. Machinery 8,800

Although the transfer pricing rules will now 12,900

generally only apply to larger companies, FYA 50% 6,450 6,450

the scope of the rules has been extended to 6,450

include transactions wholly within the UK. WDV c/f 34,695

Previously, the transfer pricing rules only Capital allowances 19,205

applied to transactions involving an

overseas company.

As far as Paper 2.3 is concerned, the

changes are not examinable. Any question

on transfer pricing will therefore continue to

involve an overseas company, and it should

be assumed that the companies are large

enough for the transfer rules to apply.

Value added tax

Registration and deregistration limits

The limit of annual turnover above which VAT

registration is compulsory has been increased

from £56,000 to £58,000, and the

deregistration limit has been increased from

£54,000 to £56,000.

November/December 2004 student accountant 37

technical

Cash accounting and annual accounting Personal pension schemes Business assets

schemes Contribution limits The definition of a business asset for taper

The turnover limits for the cash accounting The amount of contribution that an relief purposes has been extended in respect

and annual accounting schemes have been individual can make into a personal pension of disposals made after 5 April 2004. An

raised to £660,000. Previously, businesses scheme regardless of earnings is unchanged asset owned by an individual now qualifies as

could only use either scheme if their turnover at £3,600. a business asset where it is used for the

was below £600,000. The maximum amount of net relevant purposes of a trade carried on by another

earnings that can be used in the calculation individual or by a partnership.

UNINCORPORATED BUSINESSES of personal pension contributions qualifying

Rates of income tax for tax relief has increased from £99,000 EXAMPLE 5

The rates for 2004-05 are as follows: to £102,000 for 2004-05. On 15 December 2004 William disposed of

Starting rate £1 to £2,020 10% the following assets:

Basic rate £2,021 to £31,400 22% Pension simplification A 30% shareholding in Green Ltd, an

Higher rate £31,401 and above 40% The taxation of pensions is to be simplified by unquoted trading company. The shares

replacing the existing pension schemes with were acquired in June 2002, and their

Dividends continue to be taxed at the lower just one new scheme. The simplification will disposal resulted in a capital gain of

rate of 10% if they fall below the higher not take place until 6 April 2006, and this £42,000.

rate threshold of £31,400, and at the change will not be examinable at Paper 2.3 A 1% shareholding in Red plc, a quoted

higher rate of 32.5% where they exceed the until the June 2007 sitting. trading company. The shares were

threshold. acquired in July 1996, and their disposal

Savings income continues to be taxed at Capital gains tax resulted in a capital gain (after

the starting rate of 10% if it falls within the Individual exemption limit indexation) of £56,000.

first £2,020 of taxable income, and at the The annual exemption limit for 2004-05 has

lower rate of 20% if it falls between been increased from £7,900 to £8,200. William is not an employee of either Green

£2,021 and the higher rate threshold of Ltd or Red plc, and has taxable income of

£31,400. Taper relief for business assets £21,500 for 2004-05. His capital gains tax

The taper relief table that will be given for the liability for 2004-05 is as follows:

Personal allowance June and December 2005 sittings is as

The personal allowance for people aged under follows: £ £

65 for 2004-05 is at £4,745. Shareholding in

Complete years Gains on Gains on Green Ltd 42,000

EXAMPLE 4 after 5 April business non-business Taper relief x 25% 10,500

For 2004-05 Ingrid has a salary of £27,000, 1998 for which assets assets

building society interest of £800 (net) and asset held Shareholding in

dividends of £9,000 (net). Her income tax 1 50% 100% Red plc 56,000

liability is as follows: 2 25% 100%

£ 3 25% 95% Taper relief x 75% 42,000

Employment income 27,000 4 25% 90% 52,500

Building society interest 5 25% 85% Annual exemption 8,200

(800 x 100/80) 1,000 6 25% 80% 44,300

Dividends (9,000 x 100/90) 10,000 7 25% 75% Capital gains tax:

38,000 8 25% 70% 9,900 (31,400 - 21,500) at 20% 1,980

Personal allowance 4,745 9 25% 65% 34,400 (44,300 - 9,900) at 40% 13,760

Taxable income 33,255 10 25% 60% 15,740

Income tax:

2,020 at 10% 202 For disposals of non-business assets during Green Ltd is a qualifying company as it

20,235 at 22% 4,452 2004-05, taper relief will be based on is an unquoted trading company.

1,000 at 20% 200 seven complete years of ownership where Maximum taper relief is available as the

8,145 at 10% 814 the asset was owned prior to 17 March shares have been held for two complete

1,855 at 32.5% 603 1998. Only 75% of the gain will be years.

Tax liability 6,271 chargeable.

38 student accountant November/December 2004

technical

Red plc is not a qualifying company as EMPLOYEES figure of 145 grams per kilometre, so the

it is quoted, William is not an Approved mileage allowances relevant percentage is 18% (15% plus a 3%

employee, and the shareholding is less For 2004-05 the approved mileage allowances charge for a diesel car). The motor car was

than 5%. Taper relief is based on seven are unchanged at 40p per mile for the first only available for eight months of 2004-05, so

complete years of ownership as the 10,000 business miles, and then 25p per mile the benefit is £1,620 (13,500 x 18% x 8/12).

shares were acquired before 17 March thereafter.

1998. Betty

EXAMPLE 7 The CO2 emissions are above the base level

Class 2 and Class 4 National Insurance Diane uses her own 1800cc motor car for figure of 145 grams per kilometre. The CO2

contributions business travel. During 2004-05 she drove emissions figure of 203 is rounded down to

For 2004-05 Class 2 NIC has been increased 12,000 miles in the performance of her 200 so that it is divisible by five. The

to £2.05 per week. The rates of Class 4 NIC duties. Her employer pays her 30p per mile. minimum percentage of 15% is increased in

are unchanged at 8% and 1%. The rate of The mileage allowance of £3,600 (12,000 at 1% steps for each five grams per kilometre

8% is paid on profits between £4,745 and 30p) received is tax free. Diane can make an above the base level, so the relevant

£31,720, and the rate of 1% is paid on all expense claim of £900 as follows: percentage is 26% (15% + 11% (200 - 145

profits over £31,720. £ = 55/5)). The motor car was available

The Class 4 NIC information that will 10,000 miles at 40p 4,000 throughout 2004-05 so the benefit is £4,264

be given in the tax rates and allowances 2,000 miles at 25p 500 (16,400 x 26%).

section of the examination paper for the 4,500

June and December 2005 sittings is as Mileage allowance 3,600 Charles

follows: Expense claim 900 The CO2 emissions are above the base level

% figure of 145 grams per kilometre. The

Class 4 £1 to £4,745 per year Nil Company car benefit relevant percentage is 38% (15% + 23%

£4,746 to £31,720 per year 8.0 For 2004-05 the base level of CO2 emissions (260 - 145 = 115/5)), but this is restricted to

£31,721 and above per year 1.0 used to calculate company car benefits has the maximum of 35%. The motor car was

been reduced from 155 grams per kilometre available throughout 2004-05 so the benefit is

EXAMPLE 6 to 145 grams per kilometre. £6,710 (22,600 x 35% = 7,910 - 1,200).

Jimmy is a self-employed builder and Jenny The contributions by Charles towards the use

is a self-employed consultant. Their EXAMPLE 8 of the motor car reduce the benefit.

Schedule D Case I profits for 2004-05 are During 2004-05 Fashionable plc provided the

£25,000 and £50,000 respectively. Class 4 following employees with company motor cars: Company car fuel benefit

NIC liabilities for 2004-05 are as follows: Amanda was provided with a new diesel The fuel benefit is calculated as a percentage

powered company car on 6 August 2004. of a base figure that is announced each year.

£ The motor car has a list price of £13,500 For 2004-05 the base figure is unchanged at

Jimmy 25,000 - 4,745 = 20,255 and an official CO2 emission rate of 132 £14,400. The percentage used in the

at 8% 1,620 grams per kilometre. calculation is exactly the same as that used for

Jenny 31,720 - 4,745 = 26,975 Betty was provided with a new petrol calculating the related company car benefit.

at 8% 2,158 powered company car throughout

50,000 - 31,720 = 18,280 2004-05. The motor car has a list price EXAMPLE 9

at 1% 183 of £16,400 and an official CO2 emission Continuing with Example 8.

2,341 rate of 203 grams per kilometre. Amanda was provided with fuel for

Charles was provided with a new petrol private use between 6 August 2004 and

Interest on underpaid and overpaid tax powered company car throughout 5 April 2005.

The assumed rates of interest on underpaid 2004-05. The motor car has a list price Betty was provided with fuel for private use

and overpaid income tax, Class 4 NIC and of £22,600 and an official CO2 emission between 6 April and 31 December 2004.

capital gains tax are based on the actual rates rate of 264 grams per kilometre. Charles Charles was provided with fuel for private

in force at 6 April 2004. For the June and paid Fashionable plc £1,200 during use between 6 April 2004 and 5 April

December 2005 sittings the assumed rate of 2004-05 for the use of the motor car. 2005. He paid Fashionable plc £600

interest on underpaid tax will therefore be during 2004-05 towards the cost of

6.5%, and the assumed rate of interest on Amanda private fuel, although the actual cost of

overpaid tax will be 2.5%. The CO2 emissions are below the base level this fuel was £1,000.

November/December 2004 student accountant 39

technical

Amanda Class 1A NIC non-core topic marks. Previously, the only

The motor car was only available for eight The rate of Class 1A NIC that employers pay aspect of groups of companies examinable in

months of 2004-05, so the fuel benefit is on taxable benefits provided to employees is the compulsory section was that the number

£1,728 (14,400 x 18% x 8/12). unchanged at 12.8%. From the June 2005 of associated companies might be given.

sitting onwards, the rate of Class 1A NIC will If not examined as a distinct question, tax

Betty be given to you in the tax rates and planning could form part of a question in

Fuel was only available for nine months of allowances section of the examination paper. either the compulsory or optional sections of

2004-05, so the fuel benefit is £2,808 the paper.

(14,400 x 26% x 9/12). EXAMPLE 10 It would be perfectly possible for a paper

Simone Ltd has one employee who is paid from June 2005 onwards to look exactly the

Charles £40,000 per year, and was provided with the same as a paper set prior to then. However,

The motor car was available throughout following taxable benefits during 2004-05: the changes are designed to give more

2004-05 so the benefit is £5,040 (14,400 x £ emphasis on VAT and capital gains, as well

35%). There is no reduction for the Company motor car 6,400 as allowing more flexibility regarding the

contributions made since the cost of private Car fuel 4,320 choice of topics that are examined at any

fuel was not fully reimbursed. Living accommodation 1,800 one sitting.

Official rate of interest The Class 1 and Class 1A NIC liabilities are David Harrowven is examiner for Paper

The official rate of interest is used when as follows: 2.3 (GBR)

calculating the benefit in kind arising from a £

beneficial loan or from the provision of living Employee Class 1 NIC

accommodation costing in excess of 31,720 - 4,745 = 26,975 at 11% 2,967

£75,000. For the June and December 2005 40,000 - 31,720 = 8,280 at 1% 83

sittings the actual official rate of interest of 3,050

5% for 2004-05 will be used.

Employer Class 1 NIC

National Insurance 40,000 - 4,745 = 35,255 at 12.8% 4,513

Class 1 National Insurance contributions

For 2004-05 the rates of Employee Class 1 NIC Employer Class 1A NIC

are unchanged at 11% and 1%. The rate of 12,520 (6,400 + 4,320 + 1,800)

11% is paid on earnings between £4,745 per at 12.8% 1,603

year and £31,720 per year, and the rate of 1%

is paid on all earnings over £31,720 per year. SYLLABUS GUIDANCE

The rate of Employer Class 1 NIC is From the June 2005 sitting onwards there

unchanged at 12.8%, and is paid on all will be less guidance given in the syllabus as

earnings over £4,745 per year. regards the optional section of the paper.

The Class 1 NIC information that will be Questions 3 and 4 will continue to be on VAT

given in the tax rates and allowances section and capital gains respectively, and in both

of the examination paper for the June and cases the question may either be based on an

December 2005 sittings is as follows: incorporated business or an unincorporated

% business.

Class 1 Employee £1 to £4,745 Questions 5, 6 and 7 will now be on any

per year Nil area of the syllabus. Questions will, however,

£4,746 to £31,720 continue to be set on groups of companies,

per year 11.0 overseas aspects and the six listed tax

£31,721 and planning topics on a regular basis.

above per year 1.0 Question 1 might include some aspect of

Class 1 Employer £1 to £4,745 groups of companies if this topic is not

per year Nil examined in the optional section. However,

£4,746 and any area examined will be very

above per year 12.8 straightforward, and will be part of the 10

40 student accountant November/December 2004

technical

APPENDIX 1: RELEVANT TO CAT PAPER 9 Interest on underpaid and overpaid Class 2 and Class 4 National Insurance

(GBR) – JUNE AND DECEMBER 2005 corporation tax contributions

SITTINGS The calculation of this remains The rates of both Class 2 and Class 4 will be

This appendix outlines the effects of the non-examinable for Paper 9. The treatment given in Paper 9 in the same way as they are

changes made in the Finance Act 2004 to of interest paid or received, ie as Schedule for Paper 2.3. The revised Class 2 rate is

Paper 9, Preparing Taxation Computations D Case III, is however still part of the required knowledge. A calculation of both

(GBR). The sub-headings refer to the syllabus. Class 2 and Class 4 contributions may be

headings in the main article on Paper 2.3 tested.

(GBR), written by David Harrowven. Value added tax

Both registration and deregistration rules Interest on underpaid and overpaid tax

CORPORATE BUSINESSES along with the rules for cash accounting and This is not part of the Paper 9 syllabus and

Rates of corporation tax annual accounting are in the Paper 9 therefore will not be examined.

These will affect Paper 9 in exactly the same syllabus. Therefore, the revised limits for

way as Paper 2.3. The same detail on rates these areas are all examinable in the 2005 EMPLOYEES

will be given in the table attached to the papers. Approved mileage allowances

Paper 9 examination paper. The rates remain unchanged and will be given

UNINCORPORATED BUSINESSES in the rates and allowances table in the

Dividends Rates of income tax Paper 9 exam.

The new minimum 19% tax rule will be The revised thresholds are all examinable in

examined in Paper 9. It is envisaged that only 2005. Company car benefit

the basic rule of taxing dividends paid at 19% The new reduced base level of CO2 emissions

and remaining profit at the underlying rate Personal allowance limit of 145 grams per kilometre is

will be tested. The restriction rule will not be The new rate of £4,745 for 2004-05 is examinable in the 2005 examinations but will

examined. examinable. Candidates are reminded that be given as part of the rates and allowances

Due to the complications involved with this is the only personal allowance table.

the introduction of this new legislation it has examinable in Paper 9 – the age-related

been decided that this area will not be allowances are specifically excluded from the Company car fuel benefit

examined in Paper 9 until the June 2006 syllabus. The unchanged base level figure of £14,400

session at the earliest. Any question involving will be examinable in the 2005 examinations

the starting rate or small company rate of tax Personal pension schemes but will be given in the rates and allowances

before then will not include dividend Both the maximum contribution level of table.

payments in that question. £3,600 regardless of earnings and the

maximum net relevant earnings figure of Official rate of interest

Capital allowances £102,000 are required knowledge for the The rate to be used in Paper 9 remains at 5%.

The new rules outlined in the main article will 2005 exams.

be examined in Paper 9. The first-year The new simplification rules will not be National Insurance

allowance of 100% for communications tested as yet, and will be introduced no The rates for 2003-04 are unchanged for

technology equipment, which ceased on earlier than 2007. 2004-05 and are therefore examinable in the

31 March 2004, may still be tested. For same way as before. The same detail as

instance, where an account period runs from Capital gains tax shown for Paper 2.3 will be used in the rates

1 January to 31 December 2004. Individual exemption limit and allowances table for Paper 9.

The new rate of 50% first-year allowance The new annual exemption limit of £8,200

for small companies for the period 1 April will be used for the 2005 exams. Keith Molson is examiner for Paper 9 (GBR)

2004 to 31 March 2005 and for

unincorporated businesses from 6 April 2004 Taper relief for business assets

to 5 April 2005 is also required knowledge The same table in exactly the same detail will

for Paper 9. The more lenient definition of be given in Paper 9.

small and medium-sized companies must The extended definition of a business asset

also be known for Paper 9. to include assets owned by individuals and

used for trade purposes by another individual

or partnership will not be examined.

November/December 2004 student accountant 41

technical

APPENDIX 2: RELEVANT TO PAPER 3.2 £200,000 per annum from 6 April 2004. EMPLOYEES

(GBR) – JUNE AND DECEMBER 2005 Capital gains deferral relief will be abolished Approved mileage allowances

SITTINGS for chargeable gains reinvested in VCT The rates remain unchanged and will be given

This appendix outlines the effects of the shares issued from 6 April 2004. As with in the rates and allowances table in the Paper

changes made in the Finance Act 2004 on VCTs, individuals can obtain income tax 3.2 exam.

Paper 3.2, Advanced Taxation (GBR). All relief on investments in EIS shares of up to

comments made in the main article will apply £200,000 per annum from 6 April 2004. Company car benefit

to Paper 3.2. In addition, students should be However, the tax relief remains at 20%. The new reduced base level of CO2 emissions

aware of the following issues. limit of 145 grams per kilometre is examinable

Taxation of trusts in the 2005 examinations and will be given as

CORPORATE BUSINESSES From 6 April 2004, the rate of tax on part of the rates and allowances table.

Transfer pricing chargeable gains of trustees, and on the

Prior to the 2004 Act, transfer pricing only income of accumulation and discretionary Company car fuel benefit

applied to cross-border transactions. The aim trusts, is to be increased from 34% to 40%. The unchanged base level figure of £14,400

of the legislation was to ensure that all such Dividend income, until now taxable at 25%, will be examinable in the 2005 examinations

transactions between connected parties were will be charged at 32.5% from the same date. and will be given in the rates and allowances

made at an ‘arms length’ open market value. table.

From 1 April 2004, UK companies will have Inheritance tax: pre-owned assets

to adopt this approach when dealing with From 6 April 2005 the Inland Revenue will Benefits in kind – vans

connected parties resident in the UK. Note impose an income tax charge on deemed The provision of vans is treated as a benefit in

that small and medium-sized companies will be benefits received by a former owner of kind where there is an element of private use.

exempted from the regulations insofar as they property. The result is similar to a benefit in From 6 April 2005, no benefit will be charged

apply within the UK. kind on an asset used by an employee. The if the only permitted private use is for the

This topic will be examinable in Paper charge applies to the use of land, chattels employee to drive the van to his home.

3.2. Please note that the rules on thin and certain types of intangible property. From 6 April 2007, the scale charge for all

capitalisation remain outside the scope of the Several exemptions from the charge are other private use of vans is to increase to

paper, and will not be examined. available. This topic will be examinable in £3,000 per year regardless of the age of the

Paper 3.2 from December 2005 onwards. van, and that if the employer also provides fuel

Capital allowances for private motoring, an additional fuel charge

The new rules outlined in the main article will Taper relief for business assets of £500 will also apply. Under current rules,

be examined in Paper 3.2. The first-year The same table in exactly the same detail will fuel can be provided free from income tax. This

allowance of 100% for communications be given in Paper 3.2. The extended will not be examinable until June 2007.

technology equipment, which ceased on 31 definition of a business asset to include

March 2004, may still be tested. The new assets owned by individuals and used for Ray Abercromby is examiner for Paper

rate of 50% first-year allowance is also trade purposes by another individual or 3.2 (GBR)

required knowledge for Paper 3.2. The more partnership will be examinable.

lenient definition of small and medium-sized This relief effectively extends the benefits

companies must also be known for Paper 3.2. of business taper relief, and makes it more

attractive for investors to hold commercial

PERSONAL TAXES property. However, students should be aware

Rates of income tax that the taper relief treatment of the

The revised thresholds are all examinable in asset-holder is dependent on the business

2005. status of the tenant.

Venture Capital Trusts (VCTs) and Enterprise National Insurance

Investment Schemes (EIS) The rates of both Class 2 and Class 4 will be

Subscriptions for shares in qualifying VCTs given in Paper 3.2 in the same way as that

during the fiscal years 2004-05 and for Paper 2.3. The revised Class 2 rate is

2005-06 will attract income tax relief at required knowledge. A calculation of both

40%, and not the usual 20%. The amount Class 2 and Class 4 contributions may be

that an individual can invest will double to required in the examination.

42 student accountant November/December 2004

You might also like

- CGT 1Document25 pagesCGT 1Donald HollistNo ratings yet

- UK TaxDocument8 pagesUK TaxAvinash sncsNo ratings yet

- Sa Mar11 F6UK Cgtpart1Document13 pagesSa Mar11 F6UK Cgtpart1Shahid KamarNo ratings yet

- Navigating Chargeable Gains_ Insights into Capital Gains Tax for ACCA UK-TX FA2021Document5 pagesNavigating Chargeable Gains_ Insights into Capital Gains Tax for ACCA UK-TX FA2021Gaziyah BenthamNo ratings yet

- Workshop1_CapitalStructure_SolutionsDocument7 pagesWorkshop1_CapitalStructure_Solutionsriyat0601No ratings yet

- Income Taxation and MCIT RulesDocument4 pagesIncome Taxation and MCIT RulesMJNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- F6 Exam DetailDocument4 pagesF6 Exam DetailDanish HabibNo ratings yet

- Accounting For Income Tax HandoutsDocument4 pagesAccounting For Income Tax HandoutsMichael Bongalonta0% (1)

- Tax Calculation Summary Notes 2022Document53 pagesTax Calculation Summary Notes 2022Haroon khanNo ratings yet

- Finance Act 2020 - ACCA GlobalDocument65 pagesFinance Act 2020 - ACCA GlobalRaza AliNo ratings yet

- AIOU Business Taxation Assignment GuideDocument4 pagesAIOU Business Taxation Assignment GuideUsman Shaukat Khan100% (1)

- Maximizing Returns_ Exploring Property Income Taxation for ACCA UK-TX FA2021Document5 pagesMaximizing Returns_ Exploring Property Income Taxation for ACCA UK-TX FA2021Gaziyah BenthamNo ratings yet

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocument8 pagesCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNo ratings yet

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- 11 Handout 1Document4 pages11 Handout 1Jeffer Jay GubalaneNo ratings yet

- ICAEW - Tax - Mini Test 3 - STDDocument6 pagesICAEW - Tax - Mini Test 3 - STDlinhdinhphuong02No ratings yet

- This Study Resource Was: Revenue Regulations No. 9-98Document6 pagesThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoNo ratings yet

- 29_Ke-toan-quoc-te-2_201109_Đề-01_Cky3_CLC_13h30_10.09.2021-2Document10 pages29_Ke-toan-quoc-te-2_201109_Đề-01_Cky3_CLC_13h30_10.09.2021-2uthanh2209No ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Advanced Taxation (United Kingdom) : Monday 2 June 2008Document14 pagesAdvanced Taxation (United Kingdom) : Monday 2 June 2008Hassan BilalNo ratings yet

- Chargeable Gains, Part 1: Scope of Capital Gains Tax (CGT)Document12 pagesChargeable Gains, Part 1: Scope of Capital Gains Tax (CGT)Ishmail A. kargboNo ratings yet

- Finance Act 2020Document9 pagesFinance Act 2020Raza AliNo ratings yet

- Quiz Chapter+9 Income+Taxes+-+Document5 pagesQuiz Chapter+9 Income+Taxes+-+Rena Jocelle NalzaroNo ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- Chargeable Transfers - UKDocument8 pagesChargeable Transfers - UKAlellie Khay JordanNo ratings yet

- P6uk 2008 Dec QDocument14 pagesP6uk 2008 Dec QHassan BilalNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Karachi Institute Assignment 06Document8 pagesKarachi Institute Assignment 06Muhammad AdilNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- Income Tax Trading Losses - July 2023Document3 pagesIncome Tax Trading Losses - July 2023maharajabby81No ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Chapter 5Document7 pagesChapter 5yebegashetNo ratings yet

- R2.TAXM - .L Solution CMA June 2021 Exam.Document8 pagesR2.TAXM - .L Solution CMA June 2021 Exam.Pavel DhakaNo ratings yet

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- F6uk 2010 Dec Q PDFDocument10 pagesF6uk 2010 Dec Q PDFInsia AhmedNo ratings yet

- Xeinadin / Liam Burns & Co 2023 Budget ReviewsDocument12 pagesXeinadin / Liam Burns & Co 2023 Budget ReviewsDeaglanO'MaitiuNo ratings yet

- Salient Tax ChangesDocument32 pagesSalient Tax Changesmir makarim ahsanNo ratings yet

- IAS12 - Examples - SolutionDocument9 pagesIAS12 - Examples - SolutionTrần Nguyễn Tuệ MinhNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- Examinable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFDocument5 pagesExaminable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFJudithNo ratings yet

- PIT03 The Taxation of InterestDocument10 pagesPIT03 The Taxation of InterestAlellie Khay D JordanNo ratings yet

- Personal Income Tax (PIT) GuideDocument30 pagesPersonal Income Tax (PIT) GuideChe OmarNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Tax rates 2019/20 overviewDocument4 pagesTax rates 2019/20 overviewIssa BoyNo ratings yet

- P6-Corporation TaxDocument16 pagesP6-Corporation TaxAnonymous rePT5rCrNo ratings yet

- September 2018 SolutionDocument12 pagesSeptember 2018 SolutionJalees Ul HassanNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Budget 2023 Retabled EditionDocument36 pagesBudget 2023 Retabled EditionCharlene TooNo ratings yet

- CAF-2-TAX-Spring-2021Document6 pagesCAF-2-TAX-Spring-2021duocarecoNo ratings yet

- Tax Planning Advice for REP Limited and LamarDocument10 pagesTax Planning Advice for REP Limited and LamarJalees Ul HassanNo ratings yet

- Finance Act 2021 - ACCA GlobalDocument56 pagesFinance Act 2021 - ACCA GlobalhfdghdhNo ratings yet

- 06 Actvity 1 1Document4 pages06 Actvity 1 14mpspxd5msNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- Individuals Required To File Income Tax Returns: Filing of Returns, Payment of Tax & Compliance RequirementsDocument27 pagesIndividuals Required To File Income Tax Returns: Filing of Returns, Payment of Tax & Compliance Requirementsstannis69420No ratings yet

- F6 Qbda PDFDocument36 pagesF6 Qbda PDFqqqNo ratings yet

- Human Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksDocument25 pagesHuman Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksExtreme TronersNo ratings yet

- Emanel Et - Al Informed Consent Form EnglishDocument6 pagesEmanel Et - Al Informed Consent Form English4w5jpvb9jhNo ratings yet

- Day 16. The 10th ScoringDocument8 pagesDay 16. The 10th ScoringWahyu SaputraNo ratings yet

- Prisons We Choose To Live InsideDocument4 pagesPrisons We Choose To Live InsideLucas ValdezNo ratings yet

- JNMF Scholarship Application Form-1Document7 pagesJNMF Scholarship Application Form-1arudhayNo ratings yet

- Church Sacraments SlideshareDocument19 pagesChurch Sacraments SlidesharelimmasalustNo ratings yet

- Class Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseDocument17 pagesClass Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseNidhi ShahNo ratings yet

- ISO 50001 Audit Planning MatrixDocument4 pagesISO 50001 Audit Planning MatrixHerik RenaldoNo ratings yet

- TARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFDocument25 pagesTARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFWilliam WulffNo ratings yet

- Ei 22Document1 pageEi 22larthNo ratings yet

- A Bibliography of China-Africa RelationsDocument233 pagesA Bibliography of China-Africa RelationsDavid Shinn100% (1)

- Subject and Object Questions WorksheetDocument3 pagesSubject and Object Questions WorksheetLucas jofreNo ratings yet

- Intermediate Macro 1st Edition Barro Solutions ManualDocument8 pagesIntermediate Macro 1st Edition Barro Solutions Manualkietcuongxm5100% (22)

- Music Business PlanDocument51 pagesMusic Business PlandrkayalabNo ratings yet

- Syllabus For M. Phil. Course Part - I Paper - I Title: General Survey of Buddhism in India and Abroad 100 Marks Section - ADocument6 pagesSyllabus For M. Phil. Course Part - I Paper - I Title: General Survey of Buddhism in India and Abroad 100 Marks Section - ASunil SNo ratings yet

- Apollo 11tech Crew DebriefDocument467 pagesApollo 11tech Crew DebriefBob AndrepontNo ratings yet

- Frankfurt Show Daily Day 1: October 16, 2019Document76 pagesFrankfurt Show Daily Day 1: October 16, 2019Publishers WeeklyNo ratings yet

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- Religious Marriage in A Liberal State Gidi Sapir & Daniel StatmanDocument26 pagesReligious Marriage in A Liberal State Gidi Sapir & Daniel StatmanR Hayim BakaNo ratings yet

- Why EIA is Important for Development ProjectsDocument19 pagesWhy EIA is Important for Development Projectsvivek377No ratings yet

- Global BF Scorecard 2017Document7 pagesGlobal BF Scorecard 2017sofiabloemNo ratings yet

- Language Hub Student S Book Elementary Unit 1 1Document9 pagesLanguage Hub Student S Book Elementary Unit 1 1Paulo MalheiroNo ratings yet

- Non Disclosure Agreement - 3Document3 pagesNon Disclosure Agreement - 3Atthippattu Srinivasan MuralitharanNo ratings yet

- Can You Dribble The Ball Like A ProDocument4 pagesCan You Dribble The Ball Like A ProMaradona MatiusNo ratings yet

- Chapter 16 Study GuideDocument2 pagesChapter 16 Study GuideChang Ho LeeNo ratings yet

- Meeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsDocument74 pagesMeeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsjkbuckwalterNo ratings yet

- International HR Management at Buro HappoldDocument10 pagesInternational HR Management at Buro HappoldNishan ShettyNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document6 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Doughty IncNo ratings yet

- Informative Speech OutlineDocument5 pagesInformative Speech OutlineMd. Farhadul Ibne FahimNo ratings yet

- Effective Team Performance - FinalDocument30 pagesEffective Team Performance - FinalKarthigeyan K KarunakaranNo ratings yet