Professional Documents

Culture Documents

P46: Employee Without A Form P45: Section One

Uploaded by

Asad Qamar MonnooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P46: Employee Without A Form P45: Section One

Uploaded by

Asad Qamar MonnooCopyright:

Available Formats

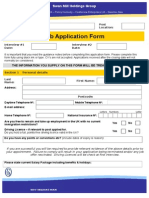

P46: Employee without a Form P45

Section one To be completed by the employee

Please complete section one and then hand back the form to your present employer.

If you later receive a form P45 from your previous employer, please hand it to your

present employer.

Your details Please use capitals

National Insurance number Date of birth

This is very important in getting your tax and benefits right.

D D M M Y Y Y Y

Address

Name Postcode

Title – enter MR, MRS, MISS, MS or other title

House or flat number

Surname or family name

Rest of address including house name or flat name

First or given name(s)

Are you male or female?

Male Female

Your present circumstances Student Loans

Please read all the following statements carefully and If you left a course of Higher Education before last

tick the one that applies to you. 6 April and received your first Student Loan

A – This is my first job since last 6 April and instalment on or after 1 September 1998 and

I have not been receiving taxable Jobseeker’s you have not fully repaid your student loan,

Allowance or taxable Incapacity Benefit tick box D. (If you are required to repay your

A Student Loan through your bank or building

or a state or occupational pension.

D

society account do not tick box D.)

OR

B – This is now my only job, but since last 6 April

I have had another job, or have received Signature and date

taxable Jobseeker’s Allowance or Incapacity I can confirm that this information is correct

Benefit. I do not receive a state or Signature

B

occupational pension.

OR

C – I have another job or receive a state or

C

occupational pension. Date

D D M M Y Y Y Y

P46(2006) Page 1 HMRC 11/05

Section two To be completed by the employer

Guidance on how to complete this form, including what to do if your employee has

not entered their National Insurance number on page 1, is in your Employer Helpbook

E13 Day to day payroll and at www.hmrc.gov.uk/employers/working_out.htm#part4

Employee’s details Please use capitals

Date employment started Works/payroll number and Department or branch (if any)

D D M M Y Y Y Y

Job title

Employer’s details Please use capitals

Employer’s PAYE reference Address

Postcode

/

Employer’s name

Building number

Rest of address

Tax code used

If you do not know the tax code to use or the current tax threshold, please go to

www.hmrc.gov.uk/employers/rates_and_limits.htm

Box A ticked

A

Emergency code on a cumulative basis

Box B ticked

Emergency code on a non-cumulative

B

Week 1/Month 1 basis

Box C ticked

C

Code BR

Tax code used

Please send this form to your HM Revenue & Customs office on the first pay day. However, if the employee

has ticked box A or box B and their earnings are below the tax threshold, do not send the form until their

earnings exceed the tax threshold.

Page 2

You might also like

- P46: Employee Without A Form P45: Section OneDocument1 pageP46: Employee Without A Form P45: Section OnepolaxNo ratings yet

- P46 Employee Tax FormDocument2 pagesP46 Employee Tax FormCharlotte JamesNo ratings yet

- Maternity Benefit FormDocument12 pagesMaternity Benefit Formapi-259279833No ratings yet

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section OneFrancisco Ramirez100% (2)

- 3.13 HMRC Tax FormDocument1 page3.13 HMRC Tax FormRyan DuffyNo ratings yet

- Starter Checklist EssentialsDocument4 pagesStarter Checklist EssentialsAnca IroaiaNo ratings yet

- Teaching Application FormDocument6 pagesTeaching Application FormEthan YatesNo ratings yet

- Ca 3916Document4 pagesCa 3916Fernando Mochales GutiérrezNo ratings yet

- App Form Consultants and Specialists CON201-1508Document16 pagesApp Form Consultants and Specialists CON201-1508gmantzaNo ratings yet

- App Form Hospital Doctors HOS203-1510Document16 pagesApp Form Hospital Doctors HOS203-1510gmantzaNo ratings yet

- Ca 3916Document5 pagesCa 3916GenovevaShtereva100% (1)

- Employee tax details without P45 formDocument2 pagesEmployee tax details without P45 formdeepika505No ratings yet

- Claim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentDocument2 pagesClaim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentbvkettNo ratings yet

- 03 Pif PDFDocument11 pages03 Pif PDFPein NguyenNo ratings yet

- EQUAL OPPORTUNITIES JOB APPLICATIONDocument4 pagesEQUAL OPPORTUNITIES JOB APPLICATIONMaydelle LorenzoNo ratings yet

- Starter Checklist FormDocument4 pagesStarter Checklist FormcallejerocelesteNo ratings yet

- Durham County Council Job Application FormDocument14 pagesDurham County Council Job Application FormacybnsoNo ratings yet

- Job Application Form Parkfield Primary Sept 21Document9 pagesJob Application Form Parkfield Primary Sept 21binoychundayilNo ratings yet

- Graduate External Application FormDocument12 pagesGraduate External Application FormNatalie RodriguesNo ratings yet

- Application Form Toys "R" Us Is An Equal Opportunities EmployerDocument4 pagesApplication Form Toys "R" Us Is An Equal Opportunities EmployeroutsiderzNo ratings yet

- 16-19 Bursary Application Form 1314Document2 pages16-19 Bursary Application Form 1314OSFCWebdevNo ratings yet

- Teaching Staff Application Form Impington Village CollegeDocument13 pagesTeaching Staff Application Form Impington Village Collegedmal88No ratings yet

- Application Form: Section 1 Personal DetailsDocument9 pagesApplication Form: Section 1 Personal DetailsLinh TranNo ratings yet

- Swan Mill Group Job ApplicationDocument15 pagesSwan Mill Group Job ApplicationSAINTJOENo ratings yet

- New Staff FormDocument1 pageNew Staff FormCosmina Catina MihailaNo ratings yet

- Bartell Drugs Employment ApplicationDocument4 pagesBartell Drugs Employment ApplicationSwayzie OrtizNo ratings yet

- University of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearDocument5 pagesUniversity of Pittsburgh: Financial Aid Application Supplement (FAAS) For The 2014-15 School YearAisha KannehNo ratings yet

- Application Form OnsideDocument5 pagesApplication Form OnsideRebecca BaronNo ratings yet

- Employment Application: Yrs. MoDocument5 pagesEmployment Application: Yrs. Mospakdaman1No ratings yet

- Application For Employment: DateDocument4 pagesApplication For Employment: DateDonovan BradleyNo ratings yet

- ApplicationDocument2 pagesApplicationrjbranchNo ratings yet

- AppForm - Layout M. CityDocument10 pagesAppForm - Layout M. CityRahmaatul HusnaNo ratings yet

- Mahdlo Application FormDocument4 pagesMahdlo Application FormRebecca BaronNo ratings yet

- Maternity Benefit: What Do I Need To Complete This Application Form?Document16 pagesMaternity Benefit: What Do I Need To Complete This Application Form?Vlad PerjuNo ratings yet

- BASM Employment Application Form (English)Document7 pagesBASM Employment Application Form (English)adeleNo ratings yet

- Apply for Unemployment Benefit Student HardshipDocument32 pagesApply for Unemployment Benefit Student HardshipGorjanIvanovskiNo ratings yet

- 2017 New NSFAS Application FormDocument11 pages2017 New NSFAS Application FormGohan100% (1)

- Application For Boundary Oak School Employment: ConfidentialDocument6 pagesApplication For Boundary Oak School Employment: ConfidentiallivrosNo ratings yet

- Child Benefit: Data Classification RDocument16 pagesChild Benefit: Data Classification RDalia GomesNo ratings yet

- Teacher of MathematicsDocument16 pagesTeacher of MathematicsChrist's SchoolNo ratings yet

- z83 Form For TDIDocument2 pagesz83 Form For TDIFrancis Murphy0% (1)

- Science Technician (Part-Time)Document15 pagesScience Technician (Part-Time)Christ's SchoolNo ratings yet

- Science TechnicianDocument15 pagesScience TechnicianChrist's SchoolNo ratings yet

- Application Form: Yayasan Rumah EnergiDocument3 pagesApplication Form: Yayasan Rumah EnergiSoedist JavaNo ratings yet

- 2023 Apprenticeship Application and Agreement January 2023Document6 pages2023 Apprenticeship Application and Agreement January 2023Danny MahomaneNo ratings yet

- Work Experience and Student Placements ApplicationDocument2 pagesWork Experience and Student Placements ApplicationJunnarie AdolfoNo ratings yet

- Shelley Application FormDocument12 pagesShelley Application Formrob dylanNo ratings yet

- Application for Driver PositionDocument11 pagesApplication for Driver PositionJamesss BlackNo ratings yet

- Ronald Mcdonald House Charities Application Form: Section 1 Personal DetailsDocument7 pagesRonald Mcdonald House Charities Application Form: Section 1 Personal DetailsLhogendhran SermugamNo ratings yet

- About This Form: Starter ChecklistDocument2 pagesAbout This Form: Starter ChecklistcallejerocelesteNo ratings yet

- Aldrees e FormDocument9 pagesAldrees e FormAtif Hussain KhattiNo ratings yet

- Teacher of TechnologyDocument16 pagesTeacher of TechnologyChrist's SchoolNo ratings yet

- Application For Student FinanceDocument26 pagesApplication For Student FinanceRobert SandovalNo ratings yet

- Ohio Valley Farmers Market Application 2013Document2 pagesOhio Valley Farmers Market Application 2013Diane ConroyNo ratings yet

- Apply Formula One JobDocument4 pagesApply Formula One Jobt8e7w2koNo ratings yet

- Part Ii - Fafsa SP2022Document14 pagesPart Ii - Fafsa SP2022Unspecified XNo ratings yet

- Child-Care Services: Step-by-Step Startup GuideFrom EverandChild-Care Services: Step-by-Step Startup GuideNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Corporate Recruiter Reveals Job Search for the Experienced ProfessionalFrom EverandCorporate Recruiter Reveals Job Search for the Experienced ProfessionalNo ratings yet

- Brandon Charles: EducationDocument1 pageBrandon Charles: EducationsamyoeNo ratings yet

- A2 Mathematics (Maths) Core Three (C3) Solution Bank Answers Chapter 1Document29 pagesA2 Mathematics (Maths) Core Three (C3) Solution Bank Answers Chapter 1samyoe100% (2)

- Core Maths 3 Chapter 2Document77 pagesCore Maths 3 Chapter 2samyoeNo ratings yet

- C3 REV 2 Mathematics A2 Help If You Need The TingDocument43 pagesC3 REV 2 Mathematics A2 Help If You Need The TingsamyoeNo ratings yet

- Edexcel Biology A2 Core Practical WorkbookDocument39 pagesEdexcel Biology A2 Core Practical WorkbookTim Filtness80% (20)

- KEF Fact SheetDocument2 pagesKEF Fact SheetsamyoeNo ratings yet

- Edexcel Biology A2 Core Practical WorkbookDocument39 pagesEdexcel Biology A2 Core Practical WorkbookTim Filtness80% (20)