Professional Documents

Culture Documents

IPO

Uploaded by

Lavanya SivapragasamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IPO

Uploaded by

Lavanya SivapragasamCopyright:

Available Formats

Incorporate in 1896, MOIL Limited (Manganese Ore India Limited) is India based p

roducer of manganese ore, primarily used to make ferro-alloys for steel producti

on. MOIL is a 'Mini Ratna' PSU, owned by Government of India and under the admin

istrative control of the Ministry of Steel.

MOIL Limited is the largest producer of manganese ore by volume in India. MOIL o

perate seven underground mines (Kandri, Munsar, Beldongri, Gumgaon, Chikla, Bala

ghat and Ukwa mines) and three opencast mines (Dongri Buzurg, Sitapatore/Sukli,

and Tirodi) to produce more then 1,093,363 tonnes of manganese ore.

In addition to high, medium and low grade manganese ore, company produces mangan

ese dioxide and chemical grade manganese ore. The major competitive strengths of

the company are:

1. Largest producer of manganese ore in India with access to significant reserve

s;

2. Well positioned to capture the growth potential of the Indian steel industry;

3. Track record of growth and efficient operations;

4. Strategic location of the mines and

5. Strong capabilities for exploration, mine planning and research development.

Company Promoters:

The promoters of the company is the President of India, acting through the MoS,

Government of India (GoI).

Present paid-up Equity Share capital of GoI - 81.6%

Post-Offer paid-up Equity Share capital of GoI - 71.6

Company Financials:

Particulars For the year/period ended (in Rs. Millions)

31-Mar-10 31-Mar-09 31-Mar-08 31-Mar-07 31-Mar-06

Total Income 10,878.53 14,394.09 10,154.48 4,167.41

3,637.37

Profit After Tax (PAT) 4,663.46 6,637.93 4,798.15 1,342.09

1,145.17

Objects of the Issue:

The objects of the Offer are:

1. To carry out the disinvestment of 33,600,000 Equity Shares by the Selling Sha

reholders and

2. To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Issue Detail:

»» Issue Open: Nov 26, 2010 - Dec 01, 2010

»» Issue Type: 100% Book Built Issue IPO

»» Issue Size: 33,600,000 Equity Shares of Rs. 10

»» Issue Size: Rs. 1,237.51 Crore

»» Face Value: Rs. 10 Per Equity Share

»» Issue Price: Rs. 340 - Rs. 375 Per Equity Share

»» Market Lot: 17 Shares

»» Minimum Order Quantity: 17 Shares

»» Listing At: BSE, NSE

Maximum Subscription Amount for Retail Investor: Rs. 2,00,000

MOIL Limited IPO Grading / Rating

CARE has assigned an IPO Grade 5 to MOIL Limited IPO. This means as per CARE com

pany has 'Strong fundamentals'. CARE assigns IPO grading on a scale of 5 to 1, w

ith Grade 5 indicating strong fundamentals and Grade 1 indicating poor fundament

als. Click here to download the CARE IPO Grading Document for Coal India Ltd.

Check IPO Ratings from other stock analysts.

MOIL Limited IPO Tags:

MOIL Allotment, MOIL IPO Subscription, MOIL IPO Retail Subscription, MOIL Listin

g, MOIL Ltd IPO, MOIL IPO, MOIL IPO Bidding, MOIL IPO Allotment Status, MOIL drh

p and MOIL Ltd IPO listing.

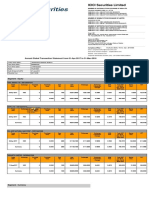

Bidding Status (IPO subscription detail):

Number of Times Issue is Subscribed (BSE + NSE)

As on Date & Time Qualified Institutional Buyers (QIBs) Non Institutiona

l Investors Retail Individual Investors (RIIs) Employee Reservations

Total

Shares Offered / Reserved 16,464,000 4,939,200 11,524,800

672,000 33,600,000

Day 1 - Nov 26, 2010 17:00 IST 1.0300 0.8800 0.3600

0.0100 0.7600

Day 2 - Nov 29, 2010 17:00 IST 2.1400 2.4000 2.8000

0.1300 2.3700

Day 3 - Nov 30, 2010 19:00 IST 49.1600 8.7700 10.8600

0.2000 29.1000

Day 4 - Dec 01, 2010 22:00 IST 49.1600 143.3000 32.8600

0.5700 56.4300

MOIL Limited IPO Alerts

1. Monday, December 13, 2010 9:51:24 AM

IPO Listing - MOIL Limited

2. Saturday, December 11, 2010 1:46:25 AM

IPO Allotment - MOIL Limited

3. Thursday, December 02, 2010 3:41:31 AM

MOIL Limited IPO finally subscribed 56.43 times

4. Friday, November 19, 2010 12:25:22 PM

MOIL Limited IPO Grading 5/5

5. Friday, November 19, 2010 12:17:08 PM

Upcoming IPO - MOIL Limited

IPO Rating

2422

4.5

Rating:

IPO Listing Detail

Listing Date: Wednesday, December 15, 2010

BSE Scrip Code: 533286

NSE Symbol: MOIL

Listing In: 'B' Group of Securities

Sector: Mining - Minerals

ISIN: INE490G01020

Issue Price: Rs. 375.00 Per Equity Share

Face Value: Rs. 10.00 Per Equity Share

Listing Day Trading Information

BSE

Issue Price: Rs. 375.00

Open: Rs. 551.00

Low: Rs. 458.50

High: Rs. 591.05

Last Trade: Rs. 466.50

Volume: 31,568,413

NSE

Rs. 375.00

Rs. 565.00

Rs. 456.65

Rs. 590.00

Rs. 465.05

65,132,435

second.....

Incorporated in 1907, Tata Steel Ltd is India s largest steel companies with a ste

el production capacity of approximately 27.2 mtpa. The Company has a presence ac

ross the entire value chain of steel manufacturing, including producing and dist

ributing finished products as well as mining and processing iron ore and coal fo

r its steel production. According to WSA, the company was the seventh largest st

eel company in the world in terms of crude steel production volume in 2009. Tata

Steel's operations are primarily focused in India, Europe and other countries i

n Asia Pacific. In Financial Year 2010, the Company s operations in Europe and Ind

ia represented 62.9% and 28.8%, respectively, of its total steel production.

Tata Steel Ltd offers a broad range of steel products including a portfolio of h

igh value-added downstream products such as hot rolled coils, sections, plates a

nd wires. Tata Steel is also a large producer of ferro chrome in India. The Comp

any s customers primarily comprise the construction, automotive, aerospace, consum

er goods and material handling and general engineering industries.

Company Promoters:

The promoter of the Company is Tata Sons Limited.

Company Financials:

Particulars For the year/period ended (in Rs. Million)

30-Sep-10 31-Mar-10 31-Mar-09 31-Mar-08 31-Mar-07

31-Mar-06

Total Income 567,136.1 1,035,789.7 1,475,949.3 1,320,094.9

254,317.4 204,583.9

Profit After Tax (PAT) 37,584.2 (21,208.4) 48,492.4 123,217.

6 41,656.1 37,210.7

Objects of the Issue:

The objects of the Issue are to:

1. Part finance the Company s share of capital expenditure for expansion of existi

ng works at Jamshedpur;

2. Payment of redemption amounts on maturity of certain redeemable non-convertib

le debentures issued by the Company on a private placement basis; and

3. General corporate purposes.

Issue Detail:

»» Issue Open: Jan 19, 2011 - Jan 21, 2011

»» Issue Type: 100% Book Built Issue FPO

»» Issue Size: 57,000,000 Equity Shares of Rs. 10

»» Issue Size: Rs. 3,385.80 - 3,477.00 Crore

»» Face Value: Rs. 10 Per Equity Share

»» Issue Price: Rs. 594 - Rs. 610 Per Equity Share

»» Market Lot:

»» Minimum Order Quantity:

»» Listing At: BSE, NSE

Tata Steel Ltd FPO Tags:

Tata Steel Ltd FPO, Tata Steel FPO, Tata Steel FPO Bidding, Tata Steel FPO Allot

ment Status, Tata Steel FPO drhp and Tata Steel FPO listing

You might also like

- Objects of The IssueDocument6 pagesObjects of The Issuerakeswar1No ratings yet

- IPO Study and Review: Submited by - Deepak Maru Roll No. 14 Nitesh Salunke Roll No. 16Document7 pagesIPO Study and Review: Submited by - Deepak Maru Roll No. 14 Nitesh Salunke Roll No. 16nitinworld89No ratings yet

- Project Report On SailDocument92 pagesProject Report On SailAjay KumarNo ratings yet

- 2453 CapitalDocument19 pages2453 CapitalNaveen KsNo ratings yet

- Market Outlook 29th August 2011Document4 pagesMarket Outlook 29th August 2011Angel BrokingNo ratings yet

- IPO Details NewDocument136 pagesIPO Details Newniharikasharma88No ratings yet

- Bombay Stock ExchangeDocument41 pagesBombay Stock Exchangekhariharan88% (8)

- Fundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...Document77 pagesFundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...chao sherpa100% (1)

- NageshwarDocument104 pagesNageshwarAshish JhaNo ratings yet

- UTI Fund Guide: Investment Options from India's Largest Mutual FundDocument17 pagesUTI Fund Guide: Investment Options from India's Largest Mutual FundRaj KumarNo ratings yet

- Financial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeDocument28 pagesFinancial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeYashas PariharNo ratings yet

- Presentation On Book Building: Presented By: Nasir HussainDocument18 pagesPresentation On Book Building: Presented By: Nasir HussainKingAravindNo ratings yet

- L&T Finance Holdings IPO DetailsDocument50 pagesL&T Finance Holdings IPO DetailsSaumil ShahNo ratings yet

- Role of SEBI in regulating capital marketsDocument44 pagesRole of SEBI in regulating capital marketsGagan PreetNo ratings yet

- Indiabulls Power IPO: 2. DB Realty LTD (DBRL)Document4 pagesIndiabulls Power IPO: 2. DB Realty LTD (DBRL)D Attitude KidNo ratings yet

- Market Outlook 22 ND February 2012Document4 pagesMarket Outlook 22 ND February 2012Angel BrokingNo ratings yet

- Sun Pharma: Multi Commodity Exchange of India LTDDocument8 pagesSun Pharma: Multi Commodity Exchange of India LTDgargrahulNo ratings yet

- Personal Investment Assignment Prof. Maria Joseph Topic: EquityDocument14 pagesPersonal Investment Assignment Prof. Maria Joseph Topic: EquityNeeraj ShahNo ratings yet

- Emaar MGF Land LimitedDocument7 pagesEmaar MGF Land Limitedamrindersingh996650No ratings yet

- Reasons for selecting steel and auto stocksDocument6 pagesReasons for selecting steel and auto stocksSreekumar ThottapillilNo ratings yet

- Shivam Kumar 1032 PDFDocument8 pagesShivam Kumar 1032 PDFShivam KumarNo ratings yet

- Fundamental Analysis of Iron and Steel Industry and Tata Steel IndiabullsDocument75 pagesFundamental Analysis of Iron and Steel Industry and Tata Steel IndiabullsCHIRAG JAIN 1823614No ratings yet

- IPO Note - Lub-Rref BDDocument6 pagesIPO Note - Lub-Rref BDturjoyNo ratings yet

- Indian IPO Market AnalysisDocument53 pagesIndian IPO Market AnalysisAkshay JadhavNo ratings yet

- Sec-F Grp-3 CF-II Project - Tata SteelDocument20 pagesSec-F Grp-3 CF-II Project - Tata SteelPranav BajajNo ratings yet

- Coal India LimitedDocument6 pagesCoal India LimitedHarsh BinaniNo ratings yet

- Outline of Mitsui: October 2010Document13 pagesOutline of Mitsui: October 2010mimimjaukNo ratings yet

- A R 2009Document30 pagesA R 2009pauperprinceNo ratings yet

- MF Report May 2010Document6 pagesMF Report May 2010sid_maliya1No ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Ipo ...... Details of Adani Power Ltd.Document11 pagesIpo ...... Details of Adani Power Ltd.Abbas AnsariNo ratings yet

- Company Background: Multi Commodity Exchange of India Limited IPODocument6 pagesCompany Background: Multi Commodity Exchange of India Limited IPOcrapidomonasNo ratings yet

- Tata SteelDocument18 pagesTata SteelShrikant SabatNo ratings yet

- IPO Analysis MCXDocument5 pagesIPO Analysis MCXViral ChauhanNo ratings yet

- Market Outlook 14th October 2011Document6 pagesMarket Outlook 14th October 2011Angel BrokingNo ratings yet

- Financial Strategies of MMTC LTDDocument42 pagesFinancial Strategies of MMTC LTDAkansha DuttaNo ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- A SEMINAR PRESENTATION ON IpoDocument13 pagesA SEMINAR PRESENTATION ON IpoSanjay HingankarNo ratings yet

- Project Report On Capital MarketDocument50 pagesProject Report On Capital MarketOmkar RajmaneNo ratings yet

- Stock Market IndicesDocument47 pagesStock Market Indicessushantgawali67% (3)

- Drgorad SM ProjectDocument10 pagesDrgorad SM ProjectDeepak R GoradNo ratings yet

- Tata Steel Industry AnalysisDocument35 pagesTata Steel Industry AnalysisDhaval PatelNo ratings yet

- IpoDocument23 pagesIpopallavi_gogoi_pgp12No ratings yet

- SEBI July 2011 BulletinDocument104 pagesSEBI July 2011 Bulletincater101No ratings yet

- Market Outlook 10th JanDocument14 pagesMarket Outlook 10th JanAngel BrokingNo ratings yet

- Financial Analysis of Steel SectorDocument75 pagesFinancial Analysis of Steel SectorAnkush HarinkhedeNo ratings yet

- Analysis of Tata Steel's Financial ReportsDocument34 pagesAnalysis of Tata Steel's Financial Reportsgbagaria1No ratings yet

- Merchant Banking 6948Document12 pagesMerchant Banking 6948Ankit SinghNo ratings yet

- Performance Evaluation of Gold ETFDocument29 pagesPerformance Evaluation of Gold ETFNithish SebastianNo ratings yet

- Capital Market ScenarioDocument2 pagesCapital Market ScenarionilakashNo ratings yet

- Summer Internship On The Project: "Marketing of Secondary and By-Products"Document41 pagesSummer Internship On The Project: "Marketing of Secondary and By-Products"Aashay MishraNo ratings yet

- Hindustan Copper: Stretched ValuationsDocument7 pagesHindustan Copper: Stretched ValuationsAngel BrokingNo ratings yet

- DB Realty Limited: Another Mumbai-Based PlayerDocument8 pagesDB Realty Limited: Another Mumbai-Based PlayerVahni SinghNo ratings yet

- Presented By:: Shubham Bhutada Aurangabad (MH)Document30 pagesPresented By:: Shubham Bhutada Aurangabad (MH)1986anu100% (1)

- Coal India IPO raises $53 billionDocument5 pagesCoal India IPO raises $53 billionsumitpriyaNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- MMTCDocument13 pagesMMTCbarotviral05No ratings yet

- Launch an "ICO" & Token Crowdsale: The Complete Guide to Prepare Your Startup for Launching Successful Initial Coin Offering, Raising Venture & Cryptocurrency CapitalFrom EverandLaunch an "ICO" & Token Crowdsale: The Complete Guide to Prepare Your Startup for Launching Successful Initial Coin Offering, Raising Venture & Cryptocurrency CapitalRating: 5 out of 5 stars5/5 (2)

- Japan's Financial Crisis: Institutional Rigidity and Reluctant ChangeFrom EverandJapan's Financial Crisis: Institutional Rigidity and Reluctant ChangeNo ratings yet

- 4 - Hedging Strategies Using Futures PDFDocument74 pages4 - Hedging Strategies Using Futures PDFsiddhant singhNo ratings yet

- English HKSI LE Paper 5 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- 281 A 7708Document2 pages281 A 7708tjarnob13No ratings yet

- 2013 Fall: Day R Thurs S Sat Time RoomDocument5 pages2013 Fall: Day R Thurs S Sat Time Roommail2raksNo ratings yet

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document2 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Lakshmi MuraliNo ratings yet

- Blu Dayz Spa Business and Marketing Plan - International ManagementDocument39 pagesBlu Dayz Spa Business and Marketing Plan - International ManagementYannick Harvey100% (2)

- Financial Management June 2013 Marks Plan ICAEWDocument7 pagesFinancial Management June 2013 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- Overview of RbiDocument28 pagesOverview of RbiAnkit KacholiyaNo ratings yet

- Investors' perception of India's derivatives marketDocument9 pagesInvestors' perception of India's derivatives marketVishal SutharNo ratings yet

- Term Paper On Investment Management: Presented byDocument42 pagesTerm Paper On Investment Management: Presented byChinmoy Prasun GhoshNo ratings yet

- Ia 3 PrelimDocument12 pagesIa 3 PrelimshaylieeeNo ratings yet

- DonationDocument11 pagesDonationIvan Ruzzel Pesino100% (5)

- Introduction To Derivatives: B. B. ChakrabartiDocument34 pagesIntroduction To Derivatives: B. B. ChakrabartiSiddharth AgarwalNo ratings yet

- Order BookDocument8 pagesOrder BookAnalyticNo ratings yet

- Best Day Trading IndicatorsDocument9 pagesBest Day Trading IndicatorsIancu JianuNo ratings yet

- SEBI disclosure reasons delay financial resultsDocument2 pagesSEBI disclosure reasons delay financial resultsAdityaNo ratings yet

- Internship Report On Foreign Remittance Activities of Janata Bank LimitedDocument46 pagesInternship Report On Foreign Remittance Activities of Janata Bank LimitedTanvir SharifeeNo ratings yet

- Hedging and Related Risk Management TechniquesDocument18 pagesHedging and Related Risk Management TechniquesGaurav GuptaNo ratings yet

- Technical Analysis On Indian Stock MarketsDocument52 pagesTechnical Analysis On Indian Stock MarketsPrakash AnzieNo ratings yet

- HHHJKDocument479 pagesHHHJKShaik UzmaNo ratings yet

- Equity Research on Aditya Birla CapitalDocument80 pagesEquity Research on Aditya Birla CapitalNikhil MalankarNo ratings yet

- Growth Vs Value GSDocument21 pagesGrowth Vs Value GSSamay Dhawan0% (3)

- Research Note 18 (I) Foreign Corrupt Practices Act ("FCPA")Document5 pagesResearch Note 18 (I) Foreign Corrupt Practices Act ("FCPA")rajofnandaNo ratings yet

- 2018 MayDocument64 pages2018 MayVeriaktar Veriaktaroğlu100% (2)

- IGB's Annual General Meeting Agenda and ResolutionsDocument100 pagesIGB's Annual General Meeting Agenda and Resolutionstajuddin8No ratings yet

- Masala Bonds PDFDocument2 pagesMasala Bonds PDFBinay TripathyNo ratings yet

- 6 Key Factors That Influence Exchange RatesDocument9 pages6 Key Factors That Influence Exchange RatesRizwan BashirNo ratings yet

- Weekly Forex Breakout Strategy - FIRSTSTRIKEDocument8 pagesWeekly Forex Breakout Strategy - FIRSTSTRIKEgrigoreceliluminatNo ratings yet

- Uchicago - Finmath - Curriculum - GuideDocument1 pageUchicago - Finmath - Curriculum - GuideMário CerqueiraNo ratings yet

- Comparative Analysis On NBFC & Banks NPADocument33 pagesComparative Analysis On NBFC & Banks NPABHAVESH KHOMNENo ratings yet