Professional Documents

Culture Documents

FINA2204 Selected Financial Formulas

Uploaded by

Pradip-Manisha Shankar0 ratings0% found this document useful (0 votes)

87 views1 pageOriginal Title

DMP204Formulae

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

87 views1 pageFINA2204 Selected Financial Formulas

Uploaded by

Pradip-Manisha ShankarCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

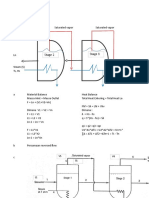

FINA2204 Selected formulae

1. black-Scholes Option pricing model: S σ2 S σ2

ln + r + T ln + r − T

X 2 X 2

d1 = d 2 = d1 − σ T =

C = S N (d1 ) − Xe − rT N (d 2 ) σ T σ T

2. The value of a forward contract

At time t: Vt = St – F0(1+r)–(T – t) At time T: VT = ST – F0

3. Forward and futures pricing model

f0 = S0 + θ - χ E(ST) = f0 + E(φ).

With dividend payment: f0 = (S0 – D0)(1+r)T or f 0 (T) = S0e (rc −δ c )T

F0d / f (1 + rd )T

4. Interest rate parity =

S0d / f (1 + rf )T

5. Futures hedge ratio Nf = –∆S/∆f

D S S (1 + y f )

N f =

Price sensitivity hedge ratio: D f f (1 + y S )

Stock index futures hedging: Nf = – (βS / βf) (S / f)

6. T-bond cash delivery cost

= f0(T)(CF) + AIT – [(B + AIt)(1+r)(T-t) – CIc,T]

7. Interest rate swaps

Days

Net cash flow: (Notional principal) (LIBOR - Fixed rate)

360

1

Pricing of interest swaps: R = 1 1 − B 0(t n ) B0( ti ) =

q n

t

1 + LIBOR0 ( ti ) i

∑ 0(t i )

B 360

i =1

Valuation of interest rate swaps: VSWAP = VFLRB – VFXRB

days n 1 + L 0(t1 ) q

VFXRB = R (∑ B0(ti ) ) + B0(tn ) VFLRB =

360 i =1 1 + L t (t1 ) (t1 − t)/360

Notional Principal( LIBOR T - f)(m/360)

8. Payoff of an FRA:

1 + LIBOR T (m/360)

9. Interest rate options:

payoff of an interest rate call: (Notional Principal) (Max(0, LIBOR − X)(m/360) )

Payoff of an interest rate put: (Notional Prinicpal)(Max(0, X - LIBOR)(m/360) )

10. Portfolio insurance Number of puts/stocks: N = V / (S0+P)

Formula Sheet 2006

You might also like

- McDonald Derivative MarketsDocument1 pageMcDonald Derivative MarketsforalluNo ratings yet

- Formulas: CHAPTER 5: Financial Forwards and FuturesDocument6 pagesFormulas: CHAPTER 5: Financial Forwards and Futures宇红海No ratings yet

- Calculating initial and subsequent actual marginDocument1 pageCalculating initial and subsequent actual marginRizki MaulanaNo ratings yet

- Formula Sheet Finance Foundations Semester 1Document2 pagesFormula Sheet Finance Foundations Semester 1Liy TehNo ratings yet

- Formule Investicije 2018Document3 pagesFormule Investicije 2018aldinaNo ratings yet

- Controls Combined Lecture NotesDocument312 pagesControls Combined Lecture NotesA FNo ratings yet

- MBS Modelling 3 DuringDocument22 pagesMBS Modelling 3 DuringddwadawdwadNo ratings yet

- Managerial Fin 2Document5 pagesManagerial Fin 2api-3698549No ratings yet

- 16 Lagrange MethodDocument19 pages16 Lagrange MethodJhoan Marie SaritadoNo ratings yet

- CFA Level II Cheat Sheet: Equity Fixed IncomeDocument1 pageCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095No ratings yet

- Table LaplaceDocument1 pageTable LaplaceAndres MartínezNo ratings yet

- 6-02-Interpolasi LagrangeDocument16 pages6-02-Interpolasi LagrangenaufalNo ratings yet

- GW9Document1 pageGW9wangshiui2002No ratings yet

- Formulario FTELDocument2 pagesFormulario FTELluccacontas01No ratings yet

- Formular MT 2019Document1 pageFormular MT 20195658780qazNo ratings yet

- Bahan Kukiah Matematika Ekonomi Lanjutan Prof. Nachrowi Djalal Nachrowi, PHDDocument3 pagesBahan Kukiah Matematika Ekonomi Lanjutan Prof. Nachrowi Djalal Nachrowi, PHDKusnadi SPdNo ratings yet

- University of Hertfordshire Control Systems Formula SheetDocument12 pagesUniversity of Hertfordshire Control Systems Formula SheetEidren 02No ratings yet

- LE 1 - Cheat SheetDocument1 pageLE 1 - Cheat SheetRogie M BernabeNo ratings yet

- Chap 5Document2 pagesChap 5Ya Ya0% (1)

- Ee4501f18 HW 7Document3 pagesEe4501f18 HW 7al-muntheral-mairikiNo ratings yet

- FORMULA SHEETDocument3 pagesFORMULA SHEETJibin K JacobNo ratings yet

- Corvinus 2021 Dynamic Macroeconomics Problem Set 01 SolutionDocument5 pagesCorvinus 2021 Dynamic Macroeconomics Problem Set 01 SolutionsamNo ratings yet

- The Black-Scholes GreeksDocument38 pagesThe Black-Scholes GreeksFion TayNo ratings yet

- Electrical 4Document2 pagesElectrical 4Puran Singh LabanaNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- EE-2110 - Formula SheetDocument2 pagesEE-2110 - Formula Sheetberickson_14No ratings yet

- ECE 5520 Lecture 2Document37 pagesECE 5520 Lecture 2lamdinh261No ratings yet

- Math 273 Written Assignment 10 SolutionsDocument5 pagesMath 273 Written Assignment 10 SolutionsRutendo ChihotaNo ratings yet

- Lecture 9 Part1 PDFDocument6 pagesLecture 9 Part1 PDFpraveenNo ratings yet

- Brazo robótico - Aplicación y cinemáticaDocument4 pagesBrazo robótico - Aplicación y cinemáticaEDITORNo ratings yet

- Fixed Income Cap and Floor PricingDocument10 pagesFixed Income Cap and Floor PricingJean BoncruNo ratings yet

- MLC Fall 2015 Written Answer QuestionsDocument17 pagesMLC Fall 2015 Written Answer QuestionsHông HoaNo ratings yet

- Math221: HW# 5 Solutions: Andy Royston November 7, 2005Document9 pagesMath221: HW# 5 Solutions: Andy Royston November 7, 2005Zahid KumailNo ratings yet

- KTTT Lec2Document38 pagesKTTT Lec2Trường HoàngNo ratings yet

- Analysis of 1-D Problems: 1 Where Are We Headed?Document8 pagesAnalysis of 1-D Problems: 1 Where Are We Headed?Haytham AlmaghariNo ratings yet

- C3 1 5 10 Solution PDFDocument5 pagesC3 1 5 10 Solution PDFChanon TonmaiNo ratings yet

- Problem Set 6 SolutionsDocument5 pagesProblem Set 6 SolutionsKrupali ShahNo ratings yet

- Table 1: Laplace TransformsDocument2 pagesTable 1: Laplace TransformsDaniel AndradeNo ratings yet

- Laplace MatlabDocument21 pagesLaplace MatlabIrwan WahyudiNo ratings yet

- Review ChapterDocument13 pagesReview ChaptermirosehNo ratings yet

- Num ProjectDocument11 pagesNum ProjectYaomin SongNo ratings yet

- Saturated vapor mass and heat balanceDocument6 pagesSaturated vapor mass and heat balancesongjihyo16111994No ratings yet

- Formula SheetDocument4 pagesFormula Sheetgeyoxi5098No ratings yet

- Finance Exam Formula SheetDocument2 pagesFinance Exam Formula SheetMindaugas PinčiukovasNo ratings yet

- Laplace Transform TableDocument5 pagesLaplace Transform TableMahmut KILIÇNo ratings yet

- Tutorial 5-8Document26 pagesTutorial 5-8Adil RasheedNo ratings yet

- Circuitos 2 Primer OrdenDocument17 pagesCircuitos 2 Primer OrdenDanny Martínez PhantomNo ratings yet

- Communications Formula SheetDocument1 pageCommunications Formula SheetNoOne OfNoteNo ratings yet

- Presentation - COMPUTATIONAL GEOMETRY FOR MACHININGDocument28 pagesPresentation - COMPUTATIONAL GEOMETRY FOR MACHININGMuhammad Atif Qaim KhaniNo ratings yet

- FuturesAndOptionsL10 PDFDocument54 pagesFuturesAndOptionsL10 PDFHhsfdksdfkk4No ratings yet

- 6-03-Interpolasi DividedDocument20 pages6-03-Interpolasi DividednaufalNo ratings yet

- EE 4741 Power Electronics: Jungwon Choi, Jwchoi@umn - EduDocument18 pagesEE 4741 Power Electronics: Jungwon Choi, Jwchoi@umn - EduTrung Nam HaNo ratings yet

- MATH40082 (Computational Finance) Assignment No. 2: Advanced MethodsDocument6 pagesMATH40082 (Computational Finance) Assignment No. 2: Advanced Methodscracking khalifNo ratings yet

- FM - S17 - Formulae and Tables PDFDocument3 pagesFM - S17 - Formulae and Tables PDFSarveshNo ratings yet

- Circuit Anlaysis S DomainDocument7 pagesCircuit Anlaysis S DomainKartik TyagiNo ratings yet

- EE611 Solutions To Problem Set 1Document5 pagesEE611 Solutions To Problem Set 1Chetangouda PatilNo ratings yet

- DigitalCommthr Compiled SumaDocument68 pagesDigitalCommthr Compiled SumaPunith Gowda M BNo ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Aula 09 Calculo TermicoDocument17 pagesAula 09 Calculo TermicoGiovani GlitzNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Kelompok 7Document8 pagesKelompok 7felicia sunartaNo ratings yet

- Case Study On Agency TheoryDocument2 pagesCase Study On Agency TheoryGammoudi30% (10)

- Financial Reporting in Hyperinflationary EconomiesDocument71 pagesFinancial Reporting in Hyperinflationary EconomiesMarian MarNo ratings yet

- The Voucher System of ControlDocument32 pagesThe Voucher System of ControlNicole LaiNo ratings yet

- Financial Statements of BMW AgDocument52 pagesFinancial Statements of BMW AgSimranNo ratings yet

- Choose Your Smallcase Explore Smallcase On Zerodha PDFDocument1 pageChoose Your Smallcase Explore Smallcase On Zerodha PDFhsrahdnNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- PG Diploma in Securities - Introduction to Capital Markets & Securities Law MCQsDocument9 pagesPG Diploma in Securities - Introduction to Capital Markets & Securities Law MCQsAnandNo ratings yet

- Adjusting Journal Entries: (4 Step of The Accounting Process)Document47 pagesAdjusting Journal Entries: (4 Step of The Accounting Process)Joy Pacot100% (1)

- Unit 3: Current Liabilities and ContingenciesDocument22 pagesUnit 3: Current Liabilities and Contingenciesyebegashet100% (1)

- Financial Ratios MGT657Document8 pagesFinancial Ratios MGT657Iman NadzirahNo ratings yet

- Syllabus of BBI (3rd Year)Document9 pagesSyllabus of BBI (3rd Year)sameer_kiniNo ratings yet

- Bos 50846 MCQP 4Document190 pagesBos 50846 MCQP 4Reddy Sanjeev RkoNo ratings yet

- TablesDocument3 pagesTablesJPNo ratings yet

- Fundamentals of Corporate Finance Australian 2Nd Edition Berk Test Bank Full Chapter PDFDocument42 pagesFundamentals of Corporate Finance Australian 2Nd Edition Berk Test Bank Full Chapter PDFRussellFischerqxcj100% (10)

- Pacific Grove Spice Company SpreadsheetDocument7 pagesPacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- Corporate Finance InfosysDocument23 pagesCorporate Finance InfosysDevesh Singh SenwalNo ratings yet

- G11 - Acctng1 - Problem JournalsDocument10 pagesG11 - Acctng1 - Problem JournalsKaye VillaflorNo ratings yet

- Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Document4 pagesBhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Shavya RastogiNo ratings yet

- Financial Valuation Methods For BiotechnologyDocument3 pagesFinancial Valuation Methods For Biotechnologyavestus100% (1)

- Startmate Clean Shareholders AgreementDocument23 pagesStartmate Clean Shareholders Agreementjung34No ratings yet

- Bai Mujjal of Sukuk 31.3.2014Document11 pagesBai Mujjal of Sukuk 31.3.2014Shaikh GMNo ratings yet

- SQE - Basic AccountingDocument30 pagesSQE - Basic AccountingCristinaNo ratings yet

- Financial Analysis of Wipro LTD PDFDocument25 pagesFinancial Analysis of Wipro LTD PDFMridul sharda100% (2)

- Optimize Working Capital ManagementDocument7 pagesOptimize Working Capital ManagementCarlo C. Cariaso III0% (1)

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument7 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDIVYANSHU SHEKHARNo ratings yet

- Techoptions Balance Sheet 2013-2014Document4 pagesTechoptions Balance Sheet 2013-2014Vivek PatilNo ratings yet

- Infosys 1nfosys 13-143-14Document29 pagesInfosys 1nfosys 13-143-14AdityaMahajanNo ratings yet

- Investment Property: By:-Yohannes Negatu (Acca, DipifrDocument31 pagesInvestment Property: By:-Yohannes Negatu (Acca, DipifrEshetie Mekonene AmareNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet