Professional Documents

Culture Documents

Anderson Tax Court Mar 7 2011

Uploaded by

tangledskein200Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anderson Tax Court Mar 7 2011

Uploaded by

tangledskein200Copyright:

Available Formats

UNITED STATES TAX COURT

WALTER C. ANDERSON, )

)

Petitioner, )

)

v. ) Docket No. 20364-07

)

COMMISSlONER OF INTERNAL REVENUE, ) Judge Gustafson

)

Re spondent . )

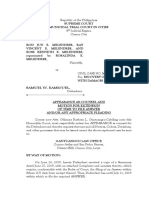

DECISION

Pursuant to agreement of the parties in the above-entitled

case, it is

ORDERED and DECIDED: That the following statement shows

the deficiencies in income tax and penalties due from the

petitioner for the taxable years 1995 through 1999, inclusive,

without taking into consideration the jeopardy assessments made

on May 22, 2007:

Year Deficiency Penalty - §6663

1995 None None

1996 None None

1997 None None

1998 $50,022,418 $37,516,813

1999 $91,475,355 $68,467,528

(Signed) David Gustafson

Judge

Entered:

* * * * *

SERVED MAR - 7 2011

Docket No. 20364-07 - 2 -

It is stipulated that the foregoing decision is in

accordance with the opinion and orders of the Court on the

parties' motions for summary judgment, the order dated June 12,

2009 taking notice of respondent's concession of all tax and

penalty issues for 1995, 1996, and 1997, and the prior

stipulations of the parties, and that the Court may enter the

decision without prejudice to the petitioner's right to contest

the correctness of the summary judgment opinion and orders

entered herein.

It is further stipulated that, effective upon entry of this

decision by the Court, petitioner waives the restriction

contained in I.R.C. §6213(a) prohibiting collection of the

deficiencies and penalties (plus statutory interest) until the

decision of the Tax Court has become final.

WILLIAM J. WILKINS

Chief Counsel

Internal Revenue Service

By• A

WALTER C. ANDERSON N C. MCDOUGAL

Petitioner Special Trial Attorney

#27981 (Small Business/Self-

FCI Camp Employed)

Federal Correctional Tax Court Bar No. MJ0560

Institution Main Street Centre

P.O. Box 420 600 East Main Street

Fairton, NJ 08320 Suite 1601

Richmond, VA 23219-2430

Telephone: (804) 916-3942

Date: Date: 2-d'//

You might also like

- Walt Anderson Tax Evader On CNBC 9 PM April 14 2011Document20 pagesWalt Anderson Tax Evader On CNBC 9 PM April 14 2011tangledskein200No ratings yet

- In Anderson Case, Uneasy Role For Firms - Legal Times 2005Document4 pagesIn Anderson Case, Uneasy Role For Firms - Legal Times 2005tangledskein200No ratings yet

- Walt Anderson - Criminal Tax Evader March 2011Document15 pagesWalt Anderson - Criminal Tax Evader March 2011tangledskein200No ratings yet

- Walt Anderson - Story of Criminal Tax Fraud - Draft of SlidesDocument52 pagesWalt Anderson - Story of Criminal Tax Fraud - Draft of Slidestangledskein200No ratings yet

- Bankruptcy Docket 05-00775 DOCKET 35 Pages 2010Document34 pagesBankruptcy Docket 05-00775 DOCKET 35 Pages 2010tangledskein200No ratings yet

- IRC 4942-g Qualifying Distributions - 1988 Cured Delay in Benefit To Charity TRA69 IssueDocument22 pagesIRC 4942-g Qualifying Distributions - 1988 Cured Delay in Benefit To Charity TRA69 Issuetangledskein200No ratings yet

- WHERE Is This "Smaller World" Trust Entity Described in SEC Filings ? - QuestionDocument1 pageWHERE Is This "Smaller World" Trust Entity Described in SEC Filings ? - Questiontangledskein200No ratings yet

- US Internal Revenue Service: Metest040505Document19 pagesUS Internal Revenue Service: Metest040505IRSNo ratings yet

- Tax Court 20364-07 May 12 2010 OrderDocument2 pagesTax Court 20364-07 May 12 2010 Ordertangledskein200No ratings yet

- WHERE Is This "Smaller World" Trust Entity Described in SEC Filings ? - QuestionDocument1 pageWHERE Is This "Smaller World" Trust Entity Described in SEC Filings ? - Questiontangledskein200No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Entry of Appearance With Motion For ExtensionDocument3 pagesEntry of Appearance With Motion For ExtensionGilianne Kathryn Layco Gantuangco-Cabiling100% (1)

- Injunction TemplateDocument7 pagesInjunction TemplateJeromeKmt100% (11)

- Fafel v. DiPaola, 399 F.3d 403, 1st Cir. (2005)Document15 pagesFafel v. DiPaola, 399 F.3d 403, 1st Cir. (2005)Scribd Government DocsNo ratings yet

- Odalis Vanessa Garay-Murillo, A206 763 642 (BIA Nov. 30, 2017)Document5 pagesOdalis Vanessa Garay-Murillo, A206 763 642 (BIA Nov. 30, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- The Local GovernmentDocument24 pagesThe Local GovernmentMelchor Padilla DiosoNo ratings yet

- Court Appeal Dismissal ChallengedDocument15 pagesCourt Appeal Dismissal ChallengedNick TanNo ratings yet

- Guidelines on Productivity Enhancement Incentive for Government EmployeesDocument4 pagesGuidelines on Productivity Enhancement Incentive for Government Employeescykee100% (1)

- Alcantara Vs PefiancoDocument3 pagesAlcantara Vs PefiancoYahiko YamatoNo ratings yet

- Contra Death Penalty For CorruptorsDocument3 pagesContra Death Penalty For CorruptorsAlvera Widi100% (2)

- LLB-Constitution FAQDocument7 pagesLLB-Constitution FAQchhedamaitriNo ratings yet

- Debt Settlement AgreementDocument3 pagesDebt Settlement AgreementRocketLawyer100% (12)

- Worcester V OcampoDocument4 pagesWorcester V OcampoLibay Villamor Ismael100% (1)

- DR. ELEANOR A. OSEA, Petitioner, vs. DR. CORAZON E. MALAYA, RespondentDocument3 pagesDR. ELEANOR A. OSEA, Petitioner, vs. DR. CORAZON E. MALAYA, RespondentJohnlen TamagNo ratings yet

- Motion to Continue ActionDocument2 pagesMotion to Continue ActionpolbisenteNo ratings yet

- AISA vs. NLRCDocument2 pagesAISA vs. NLRCBeth ClederaNo ratings yet

- Case Digest - Credit Transaction2Document11 pagesCase Digest - Credit Transaction2Mecs NidNo ratings yet

- USA Vs Matt DeHartDocument9 pagesUSA Vs Matt DeHartNational Post100% (1)

- PCIB vs. Escolin Case DigestDocument5 pagesPCIB vs. Escolin Case DigestPia Benosa67% (3)

- 011Document10 pages011Moyna Ferina RafananNo ratings yet

- 6 (18) People vs. Halil Gambao y EsmailDocument18 pages6 (18) People vs. Halil Gambao y EsmailNeil ChavezNo ratings yet

- Dokpdf Engleski Za Pravnike 1 WebDocument60 pagesDokpdf Engleski Za Pravnike 1 WebZlatan Dokic0% (1)

- Makati Taxation of Service Contractor ReceiptsDocument15 pagesMakati Taxation of Service Contractor ReceiptsArchie GuevarraNo ratings yet

- LSM Assignmen1Document6 pagesLSM Assignmen1mhrafin04No ratings yet

- Lawsuit Filed by Jason Roe Against Paige KreegelDocument33 pagesLawsuit Filed by Jason Roe Against Paige KreegelPeter SchorschNo ratings yet

- Seville Vs NDCDocument5 pagesSeville Vs NDCtaga_pi7ong_gatangNo ratings yet

- Jermaine Walker v. Chicago Et Al.Document36 pagesJermaine Walker v. Chicago Et Al.Steve WarmbirNo ratings yet

- Judge cited witness in contempt, granted bail in non-bailable casesDocument8 pagesJudge cited witness in contempt, granted bail in non-bailable casesMaJoyGasAriNo ratings yet

- Acting Governor cannot preside over SPDocument1 pageActing Governor cannot preside over SPPia PandoroNo ratings yet

- Imasen Vs AlconDocument17 pagesImasen Vs AlconJoel ArzagaNo ratings yet

- FIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDDocument13 pagesFIRAC On DLF Power Ltd. vs. Mangalore Refinery and Petrochemical LTDKartikey swamiNo ratings yet