Professional Documents

Culture Documents

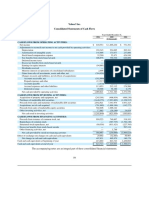

Unconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010

Uploaded by

maqsoom4710 ratings0% found this document useful (0 votes)

15 views1 pageProfit before taxation 12,343,106 10,536,120 (13,058) (16,322) Less: Dividend income (1,118,270) (1,374,967) 131,075 Adjustments for non-cash charges 9,932 7,515 Depreciation / amortization 850,537 633,056 35,903 37,546 provision against non-performing loans, advances - net 3,074,576 3,162,963 15,057 12,512 provision for diminution

Original Description:

Original Title

0DC63d01

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProfit before taxation 12,343,106 10,536,120 (13,058) (16,322) Less: Dividend income (1,118,270) (1,374,967) 131,075 Adjustments for non-cash charges 9,932 7,515 Depreciation / amortization 850,537 633,056 35,903 37,546 provision against non-performing loans, advances - net 3,074,576 3,162,963 15,057 12,512 provision for diminution

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageUnconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010

Uploaded by

maqsoom471Profit before taxation 12,343,106 10,536,120 (13,058) (16,322) Less: Dividend income (1,118,270) (1,374,967) 131,075 Adjustments for non-cash charges 9,932 7,515 Depreciation / amortization 850,537 633,056 35,903 37,546 provision against non-performing loans, advances - net 3,074,576 3,162,963 15,057 12,512 provision for diminution

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Unconsolidated Statement of Cash Flows

for the year ended December 31, 2010

December 31, December 31, Note December 31, December 31,

2010 2009 2010 2009

US $ in ‘000 Rupees in ‘000

CASH FLOWS FROM OPERATING ACTIVITIES

144,133 125,070 Profit before taxation 12,343,106 10,536,120

(13,058) (16,322) Less: Dividend income (1,118,270) (1,374,967)

131,075 108,748 11,224,836 9,161,153

Adjustments for non–cash charges

9,932 7,515 Depreciation / amortization 850,537 633,056

35,903 37,546 Provision against non–performing loans, advances – net 3,074,576 3,162,963

15,057 12,512 Provision for diminution in the value of investments – net 1,289,404 1,054,046

(3,277) 3,331 (Reversal) / provision against lendings to financial institutions (280,595) 280,595

279 94 Unrealized loss on revaluation of held for trading securities 23,884 7,897

(1,030) (301) Reversals against off balance sheet obligations – net (88,239) (25,353)

3,866 (670) Provision / (reversals) against other assets – net 331,077 (56,431)

– 111 Operating fixed assets written off 5 9,373

(140) (50) Gain on sale of fixed assets (11,977) (4,220)

– – Bad debts written off directly – –

60,590 60,088 5,188,672 5,061,926

191,665 168,836 16,413,508 14,223,079

(Increase) / decrease in operating assets

197,516 (149,693) Lendings to financial institutions 16,914,583 (12,610,344)

(9,418) (800) Held for trading securities (806,565) (67,385)

(219,883) (326,857) Advances – net (18,830,047) (27,534,993)

(19,395) (24,572) Other assets (excluding advance taxation) (1,660,945) (2,069,966)

(51,180) (501,922) (4,382,974) (42,282,688)

Increase / (decrease) in operating liabilities

11,168 2,492 Bills payable 956,362 209,939

(219,263) 140,215 Borrowings from financial institutions (18,776,934) 11,811,971

495,223 372,734 Deposits 42,409,231 31,399,716

15,254 (30,228) Other liabilities 1,306,263 (2,546,450)

302,382 485,213 25,894,922 40,875,176

442,867 152,127 37,925,456 12,815,567

(20,153) (23,795) Income tax paid – net (1,725,871) (2,004,490)

422,714 128,332 Net cash flows from operating activities 36,199,585 10,811,077

CASH FLOWS FROM INVESTING ACTIVITIES

(317,679) (134,002) Net investments in available–for–sale securities (27,204,980) (11,288,568)

11,925 22,142 Net investments in held–to–maturity securities 1,021,179 1,865,280

13,003 16,311 Dividend income received 1,113,562 1,374,038

(44,070) (23,404) Investments in operating fixed assets (3,774,048) (1,971,579)

263 250 Proceeds from sale of fixed assets 22,489 21,058

(336,558) (118,703) Net cash used in investing activities (28,821,798) (9,999,771)

CASH FLOWS FROM FINANCING ACTIVITIES

(26) 35,600 Net (payment) / receipt of sub–ordinated loan (2,200) 2,999,000

(34,791) (24,610) Dividends paid (2,979,352) (2,073,173)

(34,817) 10,990 Net cash (used in) / from financing activities (2,981,552) 925,827

51,339 20,619 Increase in cash and cash equivalents during the year 4,396,235 1,737,133

318,507 299,016 CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 27,275,922 25,189,600

921 5,081 EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS 78,838 428,027

370,767 324,716 CASH AND CASH EQUIVALENTS AT END OF THE YEAR 34 31,750,995 27,354,760

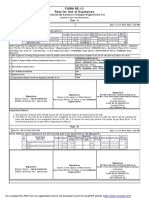

The annexed notes 1 to 46 and annexures I to II form an integral part of these unconsolidated financial statements.

Chief Financial Officer President and Chief Executive Director

Director Chairman

67

You might also like

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Samsung Electronics Co., Ltd. interim cash flow statementDocument2 pagesSamsung Electronics Co., Ltd. interim cash flow statementMohammadNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNo ratings yet

- Statement of Cash FlowsDocument1 pageStatement of Cash FlowsAllan BatiancilaNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Copy of (SW.BAND) Урок 6. Lenta - DCF - SolutionDocument143 pagesCopy of (SW.BAND) Урок 6. Lenta - DCF - SolutionLee SinNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazNo ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- Cash Flow StatementDocument2 pagesCash Flow Statementsasanka1987No ratings yet

- A. Net IncomeDocument8 pagesA. Net IncomeAeron Paul AntonioNo ratings yet

- Consolidated Financial Statements Mar 11Document17 pagesConsolidated Financial Statements Mar 11praynamazNo ratings yet

- Financial Statement of YAKULT Philippines CorpDocument5 pagesFinancial Statement of YAKULT Philippines CorpMonii OhNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Annual financial report of company operationsDocument2 pagesAnnual financial report of company operationsusama siddiquiNo ratings yet

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờNo ratings yet

- Consolidated Financial Statements Dec 312012Document60 pagesConsolidated Financial Statements Dec 312012Inamullah KhanNo ratings yet

- Ashfaq Textile Mills LTD - 2001Document10 pagesAshfaq Textile Mills LTD - 2001Prince AdyNo ratings yet

- FSA ProjectDocument59 pagesFSA ProjectIslam AbdelshafyNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Income Statements: Brown & Company PLCDocument5 pagesIncome Statements: Brown & Company PLCprabathdeeNo ratings yet

- PROJECT PART A Company Information - Standard FormatDocument10 pagesPROJECT PART A Company Information - Standard FormatRISHAB GUPTANo ratings yet

- Consolidated Profit and Loss Account for 2010Document1 pageConsolidated Profit and Loss Account for 2010Darshan KumarNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Balance SheetDocument6 pagesBalance SheetayeshnaveedNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Cashflow StatementDocument1 pageCashflow Statementarslan.ahmed8179No ratings yet

- Beng Kuang Marine Limited: Page 1 of 10Document10 pagesBeng Kuang Marine Limited: Page 1 of 10pathanfor786No ratings yet

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 pageILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNo ratings yet

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDocument17 pagesPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- 07-MIAA2021 Part1-Financial StatementsDocument4 pages07-MIAA2021 Part1-Financial StatementsVENICE OMOLONNo ratings yet

- Fecto Sugar Mills Annual ReportDocument30 pagesFecto Sugar Mills Annual ReportSyeda Kainat AqeelNo ratings yet

- Power Cement Limited: Jun/2017 Cash Flows From Operating ActivitiesDocument24 pagesPower Cement Limited: Jun/2017 Cash Flows From Operating ActivitiesUsama malikNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- 11 MalabonCity2018 - Part4 AnnexesDocument4 pages11 MalabonCity2018 - Part4 AnnexesJuan Uriel CruzNo ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- Bangladesh Lamps 3rd Q 2010Document3 pagesBangladesh Lamps 3rd Q 2010Sopne Vasa PurushNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Dandot Mar 09Document6 pagesDandot Mar 09studioad324No ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- Part D.2-Vertical AnalysisDocument32 pagesPart D.2-Vertical AnalysisQuendrick Surban100% (1)

- Consolidated Financial Statements Mar 09Document15 pagesConsolidated Financial Statements Mar 09Naseer AhmadNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Exponential smoothing forecast formulaDocument1 pageExponential smoothing forecast formulamaqsoom471No ratings yet

- MGT101Fall2008 FinalTerm OPKST MGT101 Financial AccountingDocument58 pagesMGT101Fall2008 FinalTerm OPKST MGT101 Financial Accountingmaqsoom471No ratings yet

- Punjab Food Deptt Center SamundriDocument4 pagesPunjab Food Deptt Center Samundrimaqsoom471No ratings yet

- Belence Shjeet AblDocument1 pageBelence Shjeet Ablmaqsoom471No ratings yet

- MGT101Fall2008 FinalTerm MGT101 FinancialAccountingDocument13 pagesMGT101Fall2008 FinalTerm MGT101 FinancialAccountingmaqsoom471No ratings yet

- Eng 301 Quiz From AssignmentsDocument4 pagesEng 301 Quiz From Assignmentsmaqsoom471No ratings yet

- Mgt411 Assignment Result Fall 2009Document2 pagesMgt411 Assignment Result Fall 2009maqsoom471No ratings yet

- Maqsoom - Raza MBA (Finance) : Foundation - IDocument4 pagesMaqsoom - Raza MBA (Finance) : Foundation - Imaqsoom471No ratings yet

- Internship Report Format MBA (MIS)Document7 pagesInternship Report Format MBA (MIS)ersathisNo ratings yet

- Eng301 BC Final Term PaperDocument9 pagesEng301 BC Final Term Papermaqsoom471No ratings yet

- Mgt402 Assigenment Result Fall2009Document5 pagesMgt402 Assigenment Result Fall2009maqsoom471No ratings yet

- MGT502 (Online Quiz # 4)Document24 pagesMGT502 (Online Quiz # 4)maqsoom471100% (1)

- Mgt411 Assignment Result Fall2009Document2 pagesMgt411 Assignment Result Fall2009maqsoom471No ratings yet

- Mgt411 Assignment Result Fall2009Document2 pagesMgt411 Assignment Result Fall2009maqsoom471No ratings yet

- Click Here To Save Answer & MoveDocument4 pagesClick Here To Save Answer & Movemaqsoom471No ratings yet

- MGT101Fall2008 FinalTerm OPKST MGT101 FinancialAccountingDocument53 pagesMGT101Fall2008 FinalTerm OPKST MGT101 FinancialAccountingmaqsoom471No ratings yet

- MGT501Fall2008 FinalTerm OPKSTHumanResourceManagement MGT501Document42 pagesMGT501Fall2008 FinalTerm OPKSTHumanResourceManagement MGT501maqsoom471No ratings yet

- How Is The Satisficing Decision Maker BestDocument7 pagesHow Is The Satisficing Decision Maker Bestmaqsoom471No ratings yet

- Question # 1 of 20 (StartDocument6 pagesQuestion # 1 of 20 (Startmaqsoom471No ratings yet

- MGT411Spring 2009 FinalTerm OPKSTMoneyampBanking MGT411Document40 pagesMGT411Spring 2009 FinalTerm OPKSTMoneyampBanking MGT411maqsoom471No ratings yet

- MGT101Fall2008 FinalTerm OPKST MGT101 Financial AccountingDocument12 pagesMGT101Fall2008 FinalTerm OPKST MGT101 Financial Accountingmaqsoom471No ratings yet

- Question # 1 of 20 (StartDocument6 pagesQuestion # 1 of 20 (Startmaqsoom471No ratings yet

- MGT411Spring 2009 FinalTerm OPKST Money Banking MGT411Document51 pagesMGT411Spring 2009 FinalTerm OPKST Money Banking MGT411maqsoom471No ratings yet

- MGT411Spring 2009 FinalTerm OPKST MoneyampBankingMGT4111Document44 pagesMGT411Spring 2009 FinalTerm OPKST MoneyampBankingMGT4111maqsoom471No ratings yet

- Finalterm Examination Spring 2009 Mgt411 - Money &Document11 pagesFinalterm Examination Spring 2009 Mgt411 - Money &maqsoom471No ratings yet

- MGT402Spring 2009 FinalTerm OPKST Cost Management Accounting MGT4022Document12 pagesMGT402Spring 2009 FinalTerm OPKST Cost Management Accounting MGT4022maqsoom471No ratings yet

- MGT402Spring 2009 FinalTerm OPKST Cost Management Accounting MGT4022Document53 pagesMGT402Spring 2009 FinalTerm OPKST Cost Management Accounting MGT4022maqsoom471No ratings yet

- MGT402Spring 2009 FinalTerm OPKST Cost Amp Management Accounting MGT402Document11 pagesMGT402Spring 2009 FinalTerm OPKST Cost Amp Management Accounting MGT402maqsoom471No ratings yet

- Spring 2009 FinalTerm OPKST MGT402Document12 pagesSpring 2009 FinalTerm OPKST MGT402zd_yNo ratings yet

- M8-2 - Train The Estimation ModelDocument10 pagesM8-2 - Train The Estimation ModelJuan MolinaNo ratings yet

- En dx300lc 5 Brochure PDFDocument24 pagesEn dx300lc 5 Brochure PDFsaroniNo ratings yet

- Interpretation of Arterial Blood Gases (ABGs)Document6 pagesInterpretation of Arterial Blood Gases (ABGs)afalfitraNo ratings yet

- Marketing Plan for Monuro Clothing Store Expansion into CroatiaDocument35 pagesMarketing Plan for Monuro Clothing Store Expansion into CroatiaMuamer ĆimićNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even Analysiscyper zoonNo ratings yet

- GlastonburyDocument4 pagesGlastonburyfatimazahrarahmani02No ratings yet

- RACI Matrix: Phase 1 - Initiaton/Set UpDocument3 pagesRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaNo ratings yet

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocument210 pagesSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- Electronics Ecommerce Website: 1) Background/ Problem StatementDocument7 pagesElectronics Ecommerce Website: 1) Background/ Problem StatementdesalegnNo ratings yet

- Nursing Care Management of a Client with Multiple Medical ConditionsDocument25 pagesNursing Care Management of a Client with Multiple Medical ConditionsDeannNo ratings yet

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocument4 pagesData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêNo ratings yet

- Wasserman Chest 1997Document13 pagesWasserman Chest 1997Filip BreskvarNo ratings yet

- Logic and Set Theory PropositionDocument3 pagesLogic and Set Theory PropositionVince OjedaNo ratings yet

- PESO Online Explosives-Returns SystemDocument1 pagePESO Online Explosives-Returns Systemgirinandini0% (1)

- Trading As A BusinessDocument169 pagesTrading As A Businesspetefader100% (1)

- Top Malls in Chennai CityDocument8 pagesTop Malls in Chennai CityNavin ChandarNo ratings yet

- Do You Agree With Aguinaldo That The Assassination of Antonio Luna Is Beneficial For The Philippines' Struggle For Independence?Document1 pageDo You Agree With Aguinaldo That The Assassination of Antonio Luna Is Beneficial For The Philippines' Struggle For Independence?Mary Rose BaluranNo ratings yet

- Sentinel 2 Products Specification DocumentDocument510 pagesSentinel 2 Products Specification DocumentSherly BhengeNo ratings yet

- Entity Level ControlsDocument45 pagesEntity Level ControlsNiraj AlltimeNo ratings yet

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocument6 pagesLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0No ratings yet

- 5054 w11 QP 11Document20 pages5054 w11 QP 11mstudy123456No ratings yet

- Simply Put - ENT EAR LECTURE NOTESDocument48 pagesSimply Put - ENT EAR LECTURE NOTESCedric KyekyeNo ratings yet

- Marine Engineering 1921Document908 pagesMarine Engineering 1921Samuel Sneddon-Nelmes0% (1)

- Unit-1: Introduction: Question BankDocument12 pagesUnit-1: Introduction: Question BankAmit BharadwajNo ratings yet

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaNo ratings yet

- Archlinux 之 之 之 之 Lmap 攻 略 ( 攻 略 ( 攻 略 ( 攻 略 ( 1 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 )Document16 pagesArchlinux 之 之 之 之 Lmap 攻 略 ( 攻 略 ( 攻 略 ( 攻 略 ( 1 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 )Goh Ka WeeNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Lankeda 3d Printer Filament Catalogue 2019.02 WGDocument7 pagesLankeda 3d Printer Filament Catalogue 2019.02 WGSamuelNo ratings yet