Professional Documents

Culture Documents

Balance Sheet: Sources of Funds

Uploaded by

Abhisek SarkarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet: Sources of Funds

Uploaded by

Abhisek SarkarCopyright:

Available Formats

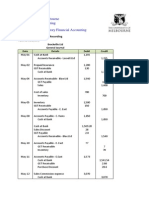

Balance sheet

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Sources of funds

Owner's fund

Equity share capital 457.74 425.38 354.43 319.39 313.14

Share application money - 400.92 - - 0.07

Preference share capital - - - - -

Reserves & surplus 21,064.75 14,226.43 11,142.80 6,113.76 4,986.39

Loan funds

Secured loans - - - - -

Unsecured loans 1,67,404.44 1,42,811.58 1,00,768.60 68,297.94 55,796.82

Total 1,88,926.93 1,57,864.31 1,12,265.83 74,731.09 61,096.42

Uses of funds

Fixed assets

Gross block 4,707.97 3,956.63 2,386.99 1,917.56 1,589.47

Less : revaluation reserve - - - - -

Less : accumulated depreciation 2,585.16 2,249.90 1,211.86 950.89 734.39

Net block 2,122.81 1,706.73 1,175.13 966.67 855.08

Capital work-in-progress - - - - -

Investments 58,607.62 58,817.55 49,393.54 30,564.80 28,393.96

Net current assets

Current assets, loans & advances 5,955.15 6,356.83 4,402.69 3,605.48 2,277.09

Less : current liabilities & provisions 20,615.94 22,720.62 16,431.91 13,689.13 7,849.49

Total net current assets -14,660.79 -16,363.79 -12,029.22 -10,083.65 -5,572.40

Miscellaneous expenses not written - - - - -

Total 46,069.63 44,160.49 38,539.45 21,447.82 23,676.64

Notes:

Book value of unquoted investments - - - - -

Market value of quoted investments - - - - -

Contingent liabilities 4,87,176.37 4,14,533.93 5,99,928.79 2,09,338.61 1,44,137.86

Number of equity sharesoutstanding (Lacs) 4577.43 4253.84 3544.33 3193.90 3131.42

Profit loss account

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Income

Operating income 19,958.76 19,770.72 12,354.41 8,303.34 5,567.67

Expenses

Material consumed - - - - -

Manufacturing expenses - - - - -

Personnel expenses 2,289.18 2,238.20 1,301.35 776.86 486.82

Selling expenses 83.12 108.68 114.73 74.88 80.85

Adminstrative expenses 4,936.73 4,583.86 2,247.48 1,519.32 1,424.59

Expenses capitalised - - - - -

Cost of sales 7,309.02 6,930.74 3,663.56 2,371.06 1,992.26

Operating profit 4,863.44 3,928.87 3,803.73 2,752.83 1,645.91

Other recurring income 17.72 - 43.04 102.96 31.38

Adjusted PBDIT 4,881.17 - 3,846.77 2,855.79 1,677.29

Financial expenses 7,786.30 8,911.10 4,887.12 3,179.45 1,929.50

Depreciation 394.39 359.91 271.72 219.60 178.59

Other write offs - - - 241.09 245.16

Adjusted PBT 4,486.77 3,568.97 3,575.05 2,395.10 1,253.54

Tax charges 1,340.99 1,054.92 690.90 497.70 383.03

Adjusted PAT 2,944.68 2,240.75 1,589.48 1,142.50 870.51

Non recurring items 4.02 4.19 0.70 -1.05 0.27

Other non cash adjustments -0.93 -0.59 -0.06 -0.35 -

Reported net profit 2,947.77 2,244.35 1,590.12 1,141.10 870.78

Earnigs before appropriation 6,403.33 4,818.98 3,522.15 2,596.12 1,473.12

Equity dividend 549.29 425.38 301.27 223.57 172.23

Preference dividend - - - - -

Dividend tax 91.23 72.29 51.20 38.00 24.16

Retained earnings 5,762.81 4,321.31 3,169.68 2,334.55 1,276.73

Cash flow

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Profit before tax 4,289.14 3,299.25 2,280.63 1,638.75 1,253.51

Net cashflow-operating activity 9,389.89 -1,736.14 3,583.43 666.63 1,724.76

Net cash used in investing activity -551.51 -663.78 -619.82 -311.40 -381.97

Netcash used in fin. activity 3,598.91 2,964.66 3,628.34 1,637.88 1,104.87

Net inc/dec in cash and equivlnt 12,435.78 564.74 6,591.95 1,993.11 2,447.66

Cash and equivalnt begin of year 17,506.62 14,778.34 8,074.54 6,188.66 3,741.00

Cash and equivalnt end of year 29,942.40 15,343.08 14,666.49 8,181.77 6,188.66

Ratios

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Per share ratios

Adjusted EPS (Rs) 64.33 52.68 44.85 35.77 27.80

Adjusted cash EPS (Rs) 72.95 61.14 52.51 50.20 41.33

Reported EPS (Rs) 64.42 52.77 44.87 35.74 27.81

Reported cash EPS (Rs) 73.03 61.24 52.53 50.16 41.34

Dividend per share 12.00 10.00 8.50 7.00 5.50

Operating profit per share (Rs) 106.25 92.36 107.32 86.19 52.56

Book value (excl rev res) per share (Rs) 470.19 344.44 324.38 201.42 169.24

Book value (incl rev res) per share (Rs.) 470.19 344.44 324.38 201.42 169.24

Net operating income per share (Rs) 436.03 464.77 348.57 259.98 177.80

Free reserves per share (Rs) 363.55 252.37 269.89 155.69 132.01

Profitability ratios

Operating margin (%) 24.36 19.87 30.78 33.15 29.56

Gross profit margin (%) 22.39 18.05 28.58 30.50 26.35

Net profit margin (%) 14.76 11.35 12.82 13.57 15.55

Adjusted cash margin (%) 16.71 13.15 15.01 19.07 23.11

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Adjusted return on net worth (%) 13.68 15.29 13.82 17.75 16.42

Reported return on net worth (%) 13.70 15.32 13.83 17.74 16.43

Return on long term funds (%) 56.08 83.31 62.34 74.91 60.06

Leverage ratios

Long term debt / Equity - - - - -

Total debt/equity 7.78 9.75 8.76 10.62 10.53

Owners fund as % of total source 11.39 9.30 10.24 8.60 8.67

Fixed assets turnover ratio 4.24 5.00 5.18 4.33 3.50

Liquidity ratios

Current ratio 0.28 0.27 0.26 0.26 0.29

Current ratio (inc. st loans) 0.03 0.03 0.03 0.04 0.03

Quick ratio 7.14 5.23 4.89 4.07 5.18

Inventory turnover ratio - - - - -

Payout ratios

Dividend payout ratio (net profit) 21.72 22.16 22.16 22.91 22.55

Dividend payout ratio (cash profit) 19.15 19.10 18.93 16.32 15.17

Earning retention ratio 78.25 77.79 77.83 77.11 77.44

Cash earnings retention ratio 80.82 80.87 81.07 83.69 84.83

Coverage ratios

Adjusted cash flow time total debt 50.13 54.91 54.14 42.60 43.11

Financial charges coverage ratio 1.63 1.44 1.79 1.90 1.87

Fin. charges cov.ratio (post tax) 1.43 1.29 1.38 1.50 1.67

Component ratios

Material cost component (% earnings) - - - - -

Selling cost Component 0.41 0.54 0.92 0.90 1.45

Exports as percent of total sales - - - - -

Import comp. in raw mat. consumed - - - - -

Long term assets / total Assets 0.91 0.90 0.91 0.89 0.92

Bonus component in equity capital (%) - - - - -

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Balance Sheet: Sources of FundsDocument9 pagesBalance Sheet: Sources of FundsHrishit RakshitNo ratings yet

- Financial Statement of Bharti Airtel LTD.: Balance SheetDocument3 pagesFinancial Statement of Bharti Airtel LTD.: Balance SheetGaurav KalraNo ratings yet

- CRISIL assigns 'AA' ratingDocument4 pagesCRISIL assigns 'AA' ratingsumit_pNo ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- Acc LTD Balance Sheet: Sources of FundsDocument75 pagesAcc LTD Balance Sheet: Sources of FundsSaad YousufNo ratings yet

- 5 Year Balance Sheet and Profit & Loss DataDocument3 pages5 Year Balance Sheet and Profit & Loss DataJay MogradiaNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDocument4 pagesWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNo ratings yet

- Tata Motors LTDDocument3 pagesTata Motors LTDRajesh BokadeNo ratings yet

- Profit and Loss Account of GodrejDocument4 pagesProfit and Loss Account of GodrejDeepak PatelNo ratings yet

- Balance Sheet: Sources of FundsDocument14 pagesBalance Sheet: Sources of FundsJayesh RodeNo ratings yet

- Asian PaintsDocument2 pagesAsian Paints3989poojaNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- 1 - Abhinav - Raymond Ltd.Document5 pages1 - Abhinav - Raymond Ltd.rajat_singlaNo ratings yet

- Profit and loss analysis of 5 yearsDocument5 pagesProfit and loss analysis of 5 yearspratikNo ratings yet

- Balance Sheet RsDocument5 pagesBalance Sheet RsBinesh BashirNo ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Mutual Fund Selector Buy? Sell? Hold?: Sep ' 13 Sep ' 12 Sep ' 11 Sep ' 10 Sep ' 09Document3 pagesMutual Fund Selector Buy? Sell? Hold?: Sep ' 13 Sep ' 12 Sep ' 11 Sep ' 10 Sep ' 09Anit Jacob PhilipNo ratings yet

- Steel Authority of India Balance Sheet and Profit & Loss AnalysisDocument12 pagesSteel Authority of India Balance Sheet and Profit & Loss AnalysisPadmavathi shivaNo ratings yet

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata MotorsVivek SinghNo ratings yet

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerNo ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- Balance Sheet Rs. in CroresDocument5 pagesBalance Sheet Rs. in CrorespratscNo ratings yet

- Five Year Finance Summary of Grasim IndustriesDocument12 pagesFive Year Finance Summary of Grasim IndustriesSarva ShivaNo ratings yet

- Capital Structure of Tata SteelDocument9 pagesCapital Structure of Tata SteelRaj KishorNo ratings yet

- BajajDocument22 pagesBajajPulkit BlagganNo ratings yet

- Phillips Carbon Black financial performanceDocument6 pagesPhillips Carbon Black financial performanceSagar SahaNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Idbi Financial In4mationDocument9 pagesIdbi Financial In4mationKishor PatelNo ratings yet

- Financial Modelling CIA 2Document45 pagesFinancial Modelling CIA 2Saloni Jain 1820343No ratings yet

- Appl Ication Mon EyDocument14 pagesAppl Ication Mon EyDevesh PantNo ratings yet

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDocument17 pagesHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNo ratings yet

- Balance Sheet BPCL Comman Size: Du Pont AnalysisDocument11 pagesBalance Sheet BPCL Comman Size: Du Pont AnalysisAkshay VibhuteNo ratings yet

- 5 Year Comparative NTPCDocument11 pages5 Year Comparative NTPCShivanshi SharmaNo ratings yet

- Finance Satyam AnalysisDocument12 pagesFinance Satyam AnalysisNeha AgarwalNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Income Statement, Balance Sheet, Cash Flow Analysis 2016-2021Document9 pagesIncome Statement, Balance Sheet, Cash Flow Analysis 2016-2021Shahrukh1994007No ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- Analyzing the financial performance of ACC and Madras CementDocument13 pagesAnalyzing the financial performance of ACC and Madras CementAshish SinghNo ratings yet

- Bajaj Auto Ratio AnalysisDocument2 pagesBajaj Auto Ratio AnalysisATANU GANGULYNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- UTV Software Communications LTDDocument4 pagesUTV Software Communications LTDNeesha PrabhuNo ratings yet

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaNo ratings yet

- TCS balance sheet and income statement analysis for 2006-2010Document8 pagesTCS balance sheet and income statement analysis for 2006-2010Surbhi LodhaNo ratings yet

- Balance Sheet of TCSDocument8 pagesBalance Sheet of TCSAmit LalchandaniNo ratings yet

- HindalcoDocument13 pagesHindalcosanjana jainNo ratings yet

- Pidilite Industries Profit & Loss AnalysisDocument112 pagesPidilite Industries Profit & Loss AnalysisAbhijit DileepNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- Interglobe Aviation Financial AnalysisDocument8 pagesInterglobe Aviation Financial AnalysisKarthik AnanthNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Bombay DyeingDocument3 pagesBombay DyeingJinal_Punjani_5573No ratings yet

- Nerolec Balance Sheet: Sources of FundsDocument3 pagesNerolec Balance Sheet: Sources of Funds3989poojaNo ratings yet

- Maruti Suzuki India LTD 03Document5 pagesMaruti Suzuki India LTD 03sidhantbehl17No ratings yet

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- Grasim Industries Consolidated Balance Sheet AnalysisDocument5 pagesGrasim Industries Consolidated Balance Sheet AnalysisDaniel Mathew VibyNo ratings yet

- LIC Housing Finance Ltd. - Research Center: Balance SheetDocument3 pagesLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345No ratings yet

- LECTURE NOTES ON MONEY, BANKING AND THE FINANCIAL SYSTEMDocument138 pagesLECTURE NOTES ON MONEY, BANKING AND THE FINANCIAL SYSTEMmusham9No ratings yet

- SBI Clerk General Knowledge Books and AuthorDocument4 pagesSBI Clerk General Knowledge Books and AuthorAnil SharmaNo ratings yet

- Business Environment Hand Full of NotesDocument18 pagesBusiness Environment Hand Full of NotesjpkjayaprakashNo ratings yet

- Management Information Systems (MIS) : University of Technology Computer Science Department 4 ClassDocument26 pagesManagement Information Systems (MIS) : University of Technology Computer Science Department 4 ClassTamaris88No ratings yet

- SMUDocument10 pagesSMUAbhisek Sarkar0% (1)

- Notes On Manage Ment - OdtDocument13 pagesNotes On Manage Ment - OdtAbhisek SarkarNo ratings yet

- MBA Project On Financial RatiosDocument66 pagesMBA Project On Financial Ratiosvinothmba10No ratings yet

- Comparative Study of Financial Report of Three Indian Banks by RAFIK KAATDocument73 pagesComparative Study of Financial Report of Three Indian Banks by RAFIK KAATKhushi L SosaNo ratings yet

- SAP Standard Reports - ERP Operations - SCN WikiDocument8 pagesSAP Standard Reports - ERP Operations - SCN WikiRaksha RaniNo ratings yet

- Aa2e Hal Testbank Ch04Document26 pagesAa2e Hal Testbank Ch04jayNo ratings yet

- Assignment/ TugasanDocument7 pagesAssignment/ TugasanFauziah Mustafa100% (1)

- Dwnload Full Auditing and Assurance Services 17th Edition Arens Test Bank PDFDocument36 pagesDwnload Full Auditing and Assurance Services 17th Edition Arens Test Bank PDFmutevssarahm100% (14)

- Practice Exercise - Lagos - BlankDocument3 pagesPractice Exercise - Lagos - Blankraazzaa8No ratings yet

- SAP FICO (Finance and Controlling) : SAP R/3 Systems Introduction To ERPDocument4 pagesSAP FICO (Finance and Controlling) : SAP R/3 Systems Introduction To ERPibmangiNo ratings yet

- Cash Flow Problem Solver - Depreciation, Taxes, NPV, IRRDocument45 pagesCash Flow Problem Solver - Depreciation, Taxes, NPV, IRRHannah Fuller100% (1)

- Udoh, Emmanuel Billy: Personal StatementsDocument3 pagesUdoh, Emmanuel Billy: Personal StatementsImmanuel Billie AllenNo ratings yet

- Impairment loss calculation problemsDocument2 pagesImpairment loss calculation problemsShane TabunggaoNo ratings yet

- 01-Sta - mariaIS2021 Audit ReportDocument107 pages01-Sta - mariaIS2021 Audit ReportAnjo BrillantesNo ratings yet

- Soal + JawabDocument4 pagesSoal + JawabNaim Kharima Saraswati100% (1)

- Finals Quiz Assignment Private Equity Valuation Method With AnswersDocument3 pagesFinals Quiz Assignment Private Equity Valuation Method With AnswersRille Estrada CabanesNo ratings yet

- Ways To Teach AccountDocument7 pagesWays To Teach AccountMicheal HaastrupNo ratings yet

- Financial Accounting MGT101 Power Point Slides Lecture 30Document13 pagesFinancial Accounting MGT101 Power Point Slides Lecture 30Waqar AhmedNo ratings yet

- Ultralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnDocument3 pagesUltralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnAmit PandeyNo ratings yet

- B.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemDocument4 pagesB.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemJestine AlcantaraNo ratings yet

- Worksheet Finacre KashatoDocument4 pagesWorksheet Finacre KashatoKHAkadsbdhsg50% (2)

- Approaches, Techniques and Tools For Financial Management in South AfricaDocument36 pagesApproaches, Techniques and Tools For Financial Management in South AfricaYeah Seen Bato BeruaNo ratings yet

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNo ratings yet

- Toaz - Info Ch06 PRDocument60 pagesToaz - Info Ch06 PRErica Joy BatangNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- April and Arias Partnership Financial StatementDocument8 pagesApril and Arias Partnership Financial StatementJames Jharred UmlasNo ratings yet

- Sem5 MCQ MangACCDocument8 pagesSem5 MCQ MangACCShirowa ManishNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancebadenagaNo ratings yet

- Course Outline Financial AccountingDocument3 pagesCourse Outline Financial Accountingjoel collins100% (1)

- Test Bank For Managerial AccountingDocument54 pagesTest Bank For Managerial Accountingsadiq626100% (2)

- Bookkeeping Kit Cheat SheetDocument4 pagesBookkeeping Kit Cheat SheetAllan AmitNo ratings yet

- Management Controls PDF FreeDocument78 pagesManagement Controls PDF FreeJohn Rich GamasNo ratings yet

- Introduction To AccountingDocument162 pagesIntroduction To AccountingKunjunni MashNo ratings yet

- Assignment Cover Sheet (Group) ATMC Melbourne: Student Id Student NameDocument11 pagesAssignment Cover Sheet (Group) ATMC Melbourne: Student Id Student NameRakshya humagainNo ratings yet