Professional Documents

Culture Documents

A Better Medicare. A Better You: MD Medicarechoice, Inc

Uploaded by

lancastd54Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Better Medicare. A Better You: MD Medicarechoice, Inc

Uploaded by

lancastd54Copyright:

Available Formats

A better Medicare.

A better you

MD MEDICARECHOICE, INC.

MD MedicareChoice Florida Optimum

SUMMARY OF BENEFITS

H5729-005

A Medicare Approved

Coordinated Care Plan

1 H5729 005_03_CO0524 (10/07)

Section I - Introduction to the Summary of Benefits

for

MD MedicareChoice Florida Optimum

January 1, 2008 - December 31-2008

Alachua, Brevard, Charlotte, Duval, Escambia, Hernando,

Hillsborough, Lake, Lee, Manatee, Marion, Orange, Osceola,

Palm Beach, Pasco, Pinellas, Polk, Sarasota, Seminole,

Volusia Counties, FL.

The name of the PartnerCare Medicare Maximum FLA plan will now be MD

MedicareChoice Florida Optimum. We have chosen a name that is consistent with the

member population that we serve. All of your member materials will now show the new name

of the plan as MD MedicareChoice Florida Optimum.

SECTION I - INTRODUCTION TO SUMMARY OF BENEFITS

Thank you for your interest in MD MedicareChoice Florida Optimum. Our plan is offered by MD

MedicareChoice, Inc., a Medicare Advantage Health Maintenance Organization (HMO). This

Summary of Benefits tells you some features of our plan. It doesn't list every service that we

cover or list every limitation or exclusion. To get a complete list of our benefits, please call MD

MedicareChoice Florida Optimum and ask for the "Evidence of Coverage".

YOU HAVE CHOICES IN YOUR HEALTH CARE

As a Medicare beneficiary, you can choose from different Medicare options. One option is the

Original (fee-for-service) Medicare Plan. Another option is a Medicare health plan, like MD

MedicareChoice Florida Optimum. You may have other options too. You make the choice. No

matter what you decide, you are still in the Medicare Program.

You may join or leave a plan only at certain times. Please call MD MedicareChoice Florida

Optimum at the telephone number listed at the end of this introduction or 1-800-MEDICARE (1-

800-633-4227) for more information. TTY users should call 1-877-486-2048. You can call this

number 24 hours a day, 7 days a week.

2 H5729 005_03_CO0524 (10/07)

HOW CAN I COMPARE MY OPTIONS?

You can compare MD MedicareChoice Florida Optimum and the Original Medicare Plan using

this Summary of Benefits. The charts in this booklet list some important health benefits. For each

benefit, you can see what our plan covers and what the Original Medicare Plan covers.

Our members receive all of the benefits that the Original Medicare Plan offers. We also offer

more benefits, which may change from year to year.

WHERE IS MD MedicareChoice Florida Optimum AVAILABLE?

The service area for this plan includes: Alachua, Brevard, Charlotte, Duval, Escambia, Hernando,

Hillsborough, Lake, Lee, Manatee, Marion, Orange, Osceola, Palm Beach, Pasco, Pinellas, Polk,

Sarasota, Seminole, Volusia Counties, FL. You must live in one of these areas to join the plan.

WHO IS ELIGIBLE TO JOIN MD MedicareChoice Florida Optimum?

You can join MD MedicareChoice Florida Optimum if you are entitled to Medicare Part A and

enrolled in Medicare Part B and live in the service area. However, individuals with End Stage

Renal Disease are generally not eligible to enroll in MD MedicareChoice Florida Optimum unless

they are members of our organization and have been since their dialysis began.

CAN I CHOOSE MY DOCTORS?

MD MedicareChoice Florida Optimum has formed a network of doctors, specialists, and

hospitals. You can only use doctors who are part of our network. The health providers in our

network can change at any time. You can ask for a current Provider Directory for an up-to-date

list or visit us at www.mdmedicarechoice.com. Our customer service number is listed at the end

of this introduction.

WHAT HAPPENS IF I GO TO A DOCTOR WHO'S NOT IN YOUR NETWORK?

If you choose to go to a doctor outside of our network, you must pay for these services yourself.

Neither MD MedicareChoice nor the Original Medicare Plan will pay for these services.

DOES MY PLAN COVER MEDICARE PART B OR PART D DRUGS?

MD MedicareChoice Florida Optimum does cover both Medicare Part B prescription drugs and

Medicare Part D prescription drugs.

WHERE CAN I GET MY PRESCRIPTIONS IF I JOIN THIS PLAN?

MD MedicareChoice Florida Optimum has formed a network of pharmacies. You must use a

network pharmacy to receive plan benefits. We may not pay for your prescriptions if you use an

out-of-network pharmacy, except in certain cases. The pharmacies in our network can change at

any time. You can ask for a current Pharmacy Network List or visit us at

www.mdmedicarechoice.com. Our customer service number is listed at the end of this

introduction.

WHAT IS A PRESCRIPTION DRUG FORMULARY?

MD MedicareChoice Florida Optimum uses a formulary. A formulary is a list of drugs covered

by your plan to meet patient needs. We may periodically add, remove, or make changes to

coverage limitations on certain drugs or change how much you pay for a drug. If we make any

3 H5729 005_03_CO0524 (10/07)

formulary change that limits our members' ability to fill their prescriptions, we will notify the

affected enrollees before the change is made. We will send a formulary to you and you can see

our complete formulary on our Web site at http://www.mdmedicarechoice.com/formulary.pdf.

If you are currently taking a drug that is not on our formulary or subject to additional

requirements or limits, you may be able to get a temporary supply of the drug. You can contact us

to request an exception or switch to an alternative drug listed on our formulary with your

physician's help. Call us to see if you can get a temporary supply of the drug or for more details

about our drug transition policy.

HOW CAN I GET EXTRA HELP WITH PRESCRIPTION DRUG PLAN COSTS?

If you qualify for extra help with your Medicare prescription drug plan costs, your premium and

costs at the pharmacy will be lower. When you join MD MedicareChoice Florida Optimum,

Medicare will tell us how much extra help you are getting. Then we will let you know the amount

you will pay. If you are not getting this extra help you can see if you qualify by calling 1-800-

MEDICARE (1-800-633-4227), TTY users should call 1-877-486-2048. You can call this number

24 hours a day, 7 days a week.

WHAT ARE MY PROTECTIONS IN THIS PLAN?

All Medicare Advantage Plans agree to stay in the program for a full year at a time. Each year, the

plans decide whether to continue for another year. Even if a Medicare Advantage Plan leaves the

program, you will not lose Medicare coverage. If a plan decides not to continue, it must send you

a letter at least 90 days before your coverage will end. The letter will explain your options for

Medicare coverage in your area.

As a member of MD MedicareChoice Florida Optimum, you have the right to request a coverage

determination, which includes the right to request an exception, the right to file an appeal if we

deny coverage for a prescription drug, and the right to file a grievance. You have the right to

request a coverage determination if you want us to cover a Part D drug that you believe should be

covered. An exception is a type of coverage determination. You may ask us for an exception if

you believe you need a drug that is not on our list of covered drugs or believe you should get a

non-preferred drug at a lower out-of-pocket cost. You can also ask for an exception to cost

utilization rules, such as a limit on the quantity of a drug. If you think you need an exception, you

should contact us before you try to fill your prescription at a pharmacy. Your doctor must provide

a statement to support your exception request. If we deny coverage for your prescription drug(s),

you have the right to appeal and ask us to review our decision. Finally, you have the right to file a

grievance if you have any type of problem with us or one of our network pharmacies that does not

involve coverage for a prescription drug.

WHAT IS A MEDICATION THERAPY MANAGEMENT (MTM) PROGRAM?

A Medication Therapy Management (MTM) Program is a free service we may offer. You may be

invited to participate in a program designed for your specific health and pharmacy needs. You

may decide not to participate but it is recommended that you take full advantage of this covered

service if you are selected. Contact MD MedicareChoice Florida Optimum for more details.

4 H5729 005_03_CO0524 (10/07)

Please call MD MedicareChoice for more information about this plan.

Visit us at www.mdmedicarechoice.com or, call us:

Customer Service Hours:

Monday, Tuesday, Wednesday, Thursday, Friday, 8:00 a.m. - 8:00 p.m. Eastern

Current and Prospective members should call (888)-901-9208 for questions related to the

Medicare Advantage program. (TTY/TDD (866)-268-1800).

Current and Prospective members should call (888)-901-9208 for questions related to the

Medicare Part D Prescription Drug program. (TTY/TDD (866)-268-1800)

For more information about Medicare, please call Medicare at 1-800-MEDICARE

(1-800-633-4227).

TTY users should call 1-877-486-2048. You can call 24 hours a day, 7 days a week.

Or, visit www.medicare.gov on the web.

If you have special needs, this document may be available in other formats.

If you have any questions about this plan's benefits or costs, please contact MD

MedicareChoice for details.

5 H5729 005_03_CO0524 (10/07)

SECTION II - SUMMARY OF BENEFITS

Benefit Original Medicare MD MedicareChoice Florida Optimum

IMPORTANT INFORMATION

1 - Premium and $96.40 monthly Medicare Part B General

Other Important Premium. $0 monthly plan premium in addition to

Information your $96.40 monthly Medicare Part B

premium.

$135 yearly Medicare Part B In-Network

deductible. $3000 out-of-pocket limit. Contact the

plan for services that apply.

If a doctor or supplier does not Out-of-Network

accept assignment, their costs are Unless otherwise noted, out-of-network

often higher, which means you pay services not covered.

more.

2 - Doctor and You may go to any doctor, In-Network

Hospital Choice specialist or hospital that accepts You must go to network doctors,

Medicare. specialists, and hospitals.

(For more Referral required for network hospitals

information, see and specialists (for certain benefits).

Emergency - #15

and Urgently

Needed Care -

#16.)

SUMMARY OF BENEFITS

INPATIENT CARE

3 - Inpatient For each benefit period: Days 1 - In-Network

Hospital Care 60: $1024 deductible Days 61 - 90: For Medicare-covered hospital stays:

$256 per day Days 91 - 150: $512

per lifetime reserve day

(includes Please call 1-800-MEDICARE (1- Days 1 - 5: $25 copay per day

Substance Abuse 800-633-4227) for information

and about lifetime reserve days.

Rehabilitation

Services)

Lifetime reserve days can only be Days 6 - 90: $0 copay per day

used once.

6 H5729 005_03_CO0524 (10/07)

A "benefit period" starts the day $0 copay for additional hospital days

you go into a hospital or skilled

nursing facility. It ends when you

go for 60 days in a row without

hospital or skilled nursing care. If

you go into the hospital after one

benefit period has ended, a new

benefit period begins. You must pay

the inpatient hospital deductible for

each benefit period. There is no

limit to the number of benefit

periods you can have.

No limit to the number of days covered

by the plan each benefit period.

Except in an emergency, your doctor

must tell the plan that you are going to be

admitted to the hospital.

4 - Inpatient Same deductible and copay as In-Network

Mental Health inpatient hospital care (see For hospital stays:

Care "Inpatient Hospital Care" above).

190 day limit in a Psychiatric Days 1 - 5: $25 copay per day

Hospital.

Days 6 - 90: $0 copay per day

You get up to 190 days in a Psychiatric

Hospital in a lifetime.

Except in an emergency, your doctor

must tell the plan that you are going to be

admitted to the hospital.

5 - Skilled For each benefit period after at least General

Nursing Facility a 3-day covered hospital stay: Days Prior authorization is required.

1 - 20: $0 per day Days 21 - 100:

$128 per day

(in a Medicare- 100 days for each benefit period. In-Network

certified skilled For SNF stays:

nursing facility)

7 H5729 005_03_CO0524 (10/07)

A "benefit period" starts the day Days 1 - 7: $0 copay per day

you go into a hospital or SNF. It

ends when you go for 60 days in a

row without hospital or skilled

nursing care. If you go into the

hospital after one benefit period has

ended, a new benefit period begins.

You must pay the inpatient hospital

deductible for each benefit period.

There is no limit to the number of

benefit periods you can have.

Days 8 - 100: $25 copay per day

100 days covered for each benefit period

No prior hospital stay is required.

6 - Home Health $0 copay. General

Care Authorization rules may apply.

(includes In-Network

medically $0 copay for Medicare-covered home

necessary health visits.

intermittent

skilled nursing

care, home

health aide

services, and

rehabilitation

services, etc.)

7 - Hospice You pay part of the cost for In-Network

outpatient drugs and inpatient You must get care from a Medicare-

respite care. certified hospice.

You must get care from a Medicare-

certified hospice.

OUTPATIENT CARE

8 - Doctor Office 20% coinsurance General

Visits See "Routine Physical Exams," for more

information.

In-Network

$0 copay for each primary care doctor

visit for Medicare-covered benefits

$5 copay for each specialist visit for

Medicare-covered benefits.

9 - Chiropractic 20% coinsurance In-Network

Services $0 copay for Medicare-covered visits.

8 H5729 005_03_CO0524 (10/07)

Routine care not covered Medicare-covered chiropractic visits are

for manual manipulation of the spine to

correct a displacement or misalignment of

a joint or body part.

20% coinsurance for manual

manipulation of the spine to correct

subluxation if you get it from a

chiropractor or other qualified

provider.

10 - Podiatry 20% coinsurance In-Network

Services $0 copay for

Medicare-covered visits

Routine care not covered. up to 6 routine visit(s) every year

20% coinsurance for medically Medicare-covered podiatry benefits are

necessary foot care, including care for medically-necessary foot care.

for medical conditions affecting the

lower limbs.

11 - Outpatient 50% coinsurance for most General

Mental Health outpatient mental health services. Authorization rules may apply.

Care

In-Network

$0 copay for Medicare-covered Mental

Health visits.

12 - Outpatient 20% coinsurance General

Substance Abuse Authorization rules may apply.

Care

In-Network

$0 copay for Medicare-covered visits.

13 - Outpatient 20% coinsurance for the doctor General

Services/Surgery Authorization rules may apply.

20% of outpatient facility In-Network

$0 copay for each Medicare-covered

ambulatory surgical center visit.

$100 copay for each Medicare-covered

outpatient hospital facility visit.

14 - Ambulance 20% coinsurance In-Network

Services $75 copay for Medicare-covered

ambulance benefits.

(medically If you are admitted to the hospital, you

necessary pay $0 for Medicare-covered ambulance

ambulance benefits.

services)

9 H5729 005_03_CO0524 (10/07)

15 - Emergency 20% coinsurance for the doctor In-Network

Care $50 copay for Medicare-covered

emergency room visits.

(You may go to 20% of facility charge, or a set Out-of-Network

any emergency copay per emergency room visit Not covered outside the U.S. except

room if you under limited circumstances. Contact the

reasonably plan for more details.

believe you need

emergency care.)

You don't have to pay the In and Out-of-Network

emergency room copay if you are If you are admitted to the hospital within

admitted to the hospital for the 48-hour(s) for the same condition, you

same condition within 3 days of the pay $0 for the emergency room visit

emergency room visit.

NOT covered outside the U.S.

except under limited circumstances.

16 - Urgently 20% coinsurance, or a set copay General

Needed Care $0 copay for Medicare-covered urgent-

care visits.

(This is NOT NOT covered outside the U.S.

emergency care, except under limited circumstances.

and in most

cases, is out of

the service area.)

17 - Outpatient 20% coinsurance General

Rehabilitation Authorization rules may apply.

Services

(Occupational In-Network

Therapy, $0 copay for Medicare-covered

Physical Occupational Therapy visits.

Therapy, Speech

and Language

Therapy)

$0 copay for Medicare-covered Physical

and/or Speech/Language Therapy visits.

OUTPATIENT MEDICAL SERVICES AND SUPPLIES

18 - Durable 20% coinsurance General

Medical Authorization rules may apply.

Equipment

(includes In-Network

wheelchairs, $0 copay for Medicare-covered items.

oxygen, etc.)

10 H5729 005_03_CO0524 (10/07)

19 - Prosthetic 20% coinsurance General

Devices Authorization rules may apply.

(includes braces, In-Network

artificial limbs 10% of the cost for Medicare-covered

and eyes, etc.) items.

20 - Diabetes 20% coinsurance In-Network

Self-Monitoring $0 copay for Diabetes self-monitoring

Training, training.

Nutrition

Therapy, and

Supplies

(includes $0 copay for Nutrition Therapy for

coverage for Diabetes.

glucose

monitors, test

strips, lancets,

screening tests,

and self-

management

training)

$0 copay for Diabetes supplies.

21 - Diagnostic 20% coinsurance for diagnostic General

Tests, X-Rays, tests and x-rays Authorization rules may apply.

and Lab Services

$0 copay for Medicare-covered lab In-Network

services $0 copay for Medicare-covered:

Lab Services: Medicare covers - lab services

medically necessary diagnostic lab

services that are ordered by your

treating doctor when they are

provided by a Clinical Laboratory

Improvement Amendments (CLIA)

certified laboratory that participates

in Medicare. Diagnostic lab services

are done to help your doctor

diagnose or rule out a suspected

illness or condition. Medicare does

not cover most routine screening

tests, like checking your

cholesterol.

- diagnostic procedures and tests

$0 to $25 copay for Medicare-covered X-

rays.

$0 to $25 copay for Medicare-covered

11 H5729 005_03_CO0524 (10/07)

diagnostic radiology services.

$20 copay for Medicare-covered

therapeutic radiology services.

PREVENTIVE SERVICES

22 - Bone Mass 20% coinsurance In-Network

Measurement $0 copay for Medicare-covered bone

mass measurement

(for people with Covered once every 24 months

Medicare who (more often if medically necessary)

are at risk) if you meet certain medical

conditions.

23 - Colorectal 20% coinsurance In-Network

Screening $0 copay for Medicare-covered colorectal

Exams screenings.

(for people with Covered when you are high risk or

Medicare age 50 when you are age 50 and older.

and older)

24 - $0 copay for Flu and Pneumonia In-Network

Immunizations vaccines $0 copay for Flu and Pneumonia

vaccines.

(Flu vaccine, 20% coinsurance for Hepatitis B $0 copay for Hepatitis B vaccine.

Hepatitis B vaccine

vaccine - for

people with

Medicare who

are at risk,

Pneumonia

vaccine)

You may only need the Pneumonia No referral needed for Flu and

vaccine once in your lifetime. Call pneumonia vaccines.

your doctor for more information.

25 - 20% coinsurance In-Network

Mammograms $0 copay for Medicare-covered screening

(Annual mammograms.

Screening)

(for women with No referral needed.

Medicare age 40

and older)

Covered once a year for all women

with Medicare age 40 and older.

One baseline mammogram covered

for women with Medicare between

age 35 and 39.

12 H5729 005_03_CO0524 (10/07)

26 - Pap Smears $0 copay for Pap smears In-Network

and Pelvic $0 copay for Medicare-covered pap

Exams smears and pelvic exams.

(for women with Covered once every 2 years.

Medicare) Covered once a year for women

with Medicare at high risk.

20% coinsurance for Pelvic Exams

27 - Prostate 20% coinsurance for the digital In-Network

Cancer rectal exam. $0 copay for Medicare-covered prostate

Screening cancer screening.

Exams

(for men with $0 for the PSA test; 20%

Medicare age 50 coinsurance for other related

and older) services.

Covered once a year for all men

with Medicare over age 50.

28 - ESRD 20% coinsurance for dialysis General

Authorization rules may apply. Out-of-

area Renal Dialysis services do not

require Authorization.

In-Network

$0 copay for in and out-of-area dialysis

$0 copay for Nutrition Therapy for Renal

Disease

29 - Prescription Most drugs not covered. (You can Drugs covered under Medicare Part B

Drugs add prescription drug coverage to General

Original Medicare by joining a 10% of the cost for Part B-covered drugs

Medicare Prescription Drug Plan.) (not including Part B-covered

chemotherapy drugs).

10% of the cost for Part B-covered

chemotherapy drugs.

Drugs covered under Medicare Part D

General

This plan uses a formulary. The plan will

send you the formulary. You can also see

the formulary at

http://www.mdmedicarechoice.com/form

ulary.pdf on the web.

13 H5729 005_03_CO0524 (10/07)

Different out-of-pocket costs may apply

for people who

- have limited incomes,

- live in long term care facilities, or

- have access to Indian/Tribal/Urban

(Indian Health Service).

The plan offers national in-network

prescription coverage. This means that

you will pay the same amount for your

prescription drugs if you get them at an

in-network pharmacy outside of the plan's

service area (for instance when you

travel).

Total yearly drug costs are the total drug

costs paid by both you and the plan.

The plan may require you to first try one

drug to treat your condition before it will

cover another drug for that condition.

Some drugs have quantity limits.

Your provider must get prior

authorization from MD MedicareChoice

Florida Optimum for certain drugs.

The plan will pay for certain over-the-

counter drugs as part of its utilization

management program. Some over-the-

counter drugs are less expensive than

prescription drugs and work just as well.

Contact the plan for details.

If the actual cost of a drug is less than the

normal copay amount for that drug, you

will pay the actual cost, not the higher

copay amount.

You may have to pay more than your

copay if you choose to use a higher cost

drug when a lower cost drug is available.

In-Network

$0 deductible.

Initial Coverage

You pay the following until total yearly

drug costs reach $2850:

Retail Pharmacy

Generic

14 H5729 005_03_CO0524 (10/07)

- $0 copay for a one-month (31-day)

supply of drugs

- $0 copay for a three-month (93-day)

supply of drugs

- $0 copay for a 93-day supply of drugs

Preferred Brand

- $15 copay for a one-month (31-day)

supply of drugs

- $45 copay for a three-month (93-day)

supply of drugs

- $45 copay for a 93-day supply of drugs

Non-Preferred Brand

- $30 copay for a one-month (31-day)

supply of drugs

- $90 copay for a three-month (93-day)

supply of drugs

- $90 copay for a 93-day supply of drugs

Specialty Drugs

- 25% coinsurance for a one-month (31-

day) supply of drugs

- 25% coinsurance for a three-month (93-

day) supply of drugs

- 25% coinsurance for a 93-day supply of

drugs

Long Term Care Pharmacy

Generic

- $0 copay for a one-month (31-day)

supply of drugs

Preferred Brand

- $15 copay for a one-month (31-day)

supply of drugs

Non-Preferred Brand

- $30 copay for a one-month (31-day)

supply of drugs

Specialty Drugs

- 25% coinsurance for a one-month (31-

day) supply of drugs

Mail Order

Generic

- $0 copay for a one-month (31-day)

supply of drugs

15 H5729 005_03_CO0524 (10/07)

- $0 copay for a three-month (93-day)

supply of drugs

- $0 copay for a 93-day supply of drugs

Preferred Brand

- $15 copay for a one-month (31-day)

supply of drugs

- $45 copay for a three-month (93-day)

supply of drugs

- $45 copay for a 93-day supply of drugs

Non-Preferred Brand

- $30 copay for a one-month (31-day)

supply of drugs

- $90 copay for a three-month (93-day)

supply of drugs

- $90 copay for a 93-day supply of drugs

Specialty Drugs

- 25% coinsurance for a one-month (31-

day) supply of drugs

- 25% coinsurance for a three-month (93-

day) supply of drugs

- 25% coinsurance for a 93-day supply of

drugs

Coverage Gap

You pay the following:

The plan covers All Generics through the

gap.

Retail Pharmacy

Generic

- $0 copay for a one-month (31-day)

supply of drugs

- $0 copay for a three-month (93-day)

supply of drugs

- $0 copay for a 93-day supply of drugs

Long Term Care Pharmacy

Generic

- $0 copay for a one-month (31-day)

supply of drugs

Mail Order

Generic

- $0 copay for a one-month (31-day)

supply of drugs

16 H5729 005_03_CO0524 (10/07)

- $0 copay for a three-month (93-day)

supply of drugs

- $0 copay for a 93-day supply of drugs

For all other covered drugs, after your

total yearly drug costs reach $2850, you

pay 100% until your yearly out-of-pocket

drug costs reach $4050.

Catastrophic Coverage

After your yearly out-of-pocket drug

costs reach $ 4050, you pay the greater

of:

- $ 2.25 copay for generic (including

brand drugs treated as generic) and $ 5.60

copay for all other drugs, or

- 5% coinsurance.

Out-of-Network

Plan drugs may be covered in special

circumstances, for instance, illness while

traveling outside of the plan's service area

where there is no network pharmacy. You

may pay more than the copay if you get

your drugs at an out-of-network

pharmacy.

Out-of-Network Initial Coverage

You pay the following until total yearly

drug costs reach $2850:

Out-of-Network Pharmacy

Generic

- $0 copay for a one-month (31-day)

supply of drugs

- $0 copay for a (29-day) supply of drugs

Preferred Brand

- $15 copay for a one-month (31-day)

supply of drugs

- $15 copay for a (29-day) supply of

drugs

Non-Preferred Brand

- $30 copay for a one-month (31-day)

supply of drugs

- $30 copay for a (29-day) supply of

drugs

Specialty Drugs

17 H5729 005_03_CO0524 (10/07)

- 25% coinsurance for a one-month (31-

day) supply of drugs

- 25% coinsurance for a (29-day) supply

of drugs

Out-of-Network Coverage Gap

You pay the following:

Generic

- $0 copay for a one-month (31-day)

supply of drugs

- $0 copay for a (29-day) supply of drugs

Out-of-Network Catastrophic Coverage

After your yearly out-of-pocket drug

costs reach $ 4050, you pay the greater

of:

- $ 2.25 copay for generic (including

brand drugs treated as generic) and $ 5.60

copay for all other drugs, or

- 5% coinsurance.

30 - Dental Preventive dental services (such as In-Network

Services cleaning) not covered. $0 copay for Medicare-covered dental

benefits

$0 copay for the following preventive

dental benefits:

- up to 2 oral exam(s) every year

- up to 2 cleaning(s) every year

- fluoride treatments

- up to 1 dental x-ray(s) every year

Plan offers additional comprehensive

dental benefits.

$500 limit for comprehensive dental

benefits every year

31 - Hearing Routine hearing exams and hearing General

Services aids not covered. Authorization rules may apply.

20% coinsurance for diagnostic In-Network

hearing exams. $0 copay for diagnostic hearing exams

- routine hearing tests

- fitting-evaluations for a hearing aid

$0 copay for up to 600 hearing aid(s)

every three years.

32 - Vision 20% coinsurance for diagnosis and General

Services treatment of diseases and conditions Authorization rules may apply.

of the eye.

18 H5729 005_03_CO0524 (10/07)

Routine eye exams and glasses not In-Network

covered. $0 copay for diagnosis and treatment for

diseases and conditions of the eye

Medicare pays for one pair of and up to 1 routine eye exam(s) every

eyeglasses or contact lenses after year

cataract surgery.

Annual glaucoma screenings $0 copay for

covered for people at risk. - one pair of eyeglasses or contact lenses

after each cataract surgery

- up to 1 pair(s) of glasses every year

- up to 1 pair(s) of contacts every year

33 - Physical 20% coinsurance for one exam In-Network

Exams within the first 6 months of your $0 copay for routine exams.

new Medicare Part B coverage

When you get Medicare Part B, you Limited to 1 exam(s) every year.

can get a one time physical exam

within the first 6 months of your

new Part B coverage. The coverage

does not include lab tests.

Health/Wellness Not covered. General

Education Authorization rules may apply.

In-Network

This plan covers health/wellness

education benefits.

-Nutritional benefit

- Health Club Membership/Fitness

Classes

- Nursing Hotline

Transportation Not covered. General

Authorization rules may apply.

(Routine) In-Network

$0 copay for up to 24 one-way trip(s) to

plan-approved location every year.

19 H5729 005_03_CO0524 (10/07)

You might also like

- Medicare Explained: A Quick Guide to Parts, Coverage ChoicesDocument4 pagesMedicare Explained: A Quick Guide to Parts, Coverage Choices1224adhNo ratings yet

- Rapidcare Medical Billing ManualDocument93 pagesRapidcare Medical Billing Manualapi-19789919100% (3)

- Different Types of Medicare Insurance PlanDocument7 pagesDifferent Types of Medicare Insurance PlanGetmy PolicyNo ratings yet

- CME Beginners Gude Medicare EbookDocument5 pagesCME Beginners Gude Medicare EbookAnonymous qEHjKlXjNo ratings yet

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionFrom EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionNo ratings yet

- Maximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsFrom EverandMaximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsRating: 5 out of 5 stars5/5 (1)

- Medicare: Socialsecurity - GovDocument24 pagesMedicare: Socialsecurity - Govtreb trebNo ratings yet

- Medicare Part C Medicare AdvantageDocument3 pagesMedicare Part C Medicare AdvantageJonathan CoutiñoNo ratings yet

- 2020 Complete Drug List FormularyDocument204 pages2020 Complete Drug List FormularyYvetal GardeNo ratings yet

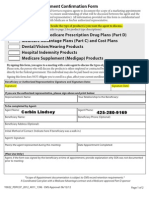

- Scope of Appointment FormDocument2 pagesScope of Appointment Formapi-260208821No ratings yet

- 11037Document4 pages11037api-309082881No ratings yet

- MD Medicarechoice Florida Optimum MB: Section I - Introduction To The Summary of Benefits ForDocument18 pagesMD Medicarechoice Florida Optimum MB: Section I - Introduction To The Summary of Benefits Forlancastd54No ratings yet

- Medicare Part D DissertationDocument7 pagesMedicare Part D DissertationPayToWritePaperSingapore100% (1)

- Ppo BR MD Pref Sta PR VaDocument16 pagesPpo BR MD Pref Sta PR VaMichael D ReevesNo ratings yet

- Summary of Benefits: For Bcbsga Mediblue Access (Ppo)Document44 pagesSummary of Benefits: For Bcbsga Mediblue Access (Ppo)J MillerNo ratings yet

- Scope of Appointment Form 2011 UniversalDocument2 pagesScope of Appointment Form 2011 UniversalvmgreekNo ratings yet

- HumanaChoice SNP-DE H5216-267 Summary of BenefitsDocument24 pagesHumanaChoice SNP-DE H5216-267 Summary of Benefitsadela EstradaNo ratings yet

- 2011 Medicare & You BookletDocument136 pages2011 Medicare & You Bookletgmen869101No ratings yet

- 2013 Scope of Appointment Form - CORBINDocument2 pages2013 Scope of Appointment Form - CORBINCorbin LindseyNo ratings yet

- Welcome To Medicare!: Things To Think About When You Compare Medicare Drug CoverageDocument4 pagesWelcome To Medicare!: Things To Think About When You Compare Medicare Drug CoverageAlsayed General HospitalNo ratings yet

- 4 Ways To Help Lower Your Medicare Prescription Drug Costs: Revised July 2013Document2 pages4 Ways To Help Lower Your Medicare Prescription Drug Costs: Revised July 2013api-239463541No ratings yet

- ComprKaiehensive FormularyDocument77 pagesComprKaiehensive Formularypeter_rabbitNo ratings yet

- Medicare Private Fee For Service PlansDocument28 pagesMedicare Private Fee For Service PlansMabz BuanNo ratings yet

- Summary of Benefits: Humana Gold Plus H1036-237 (HMO)Document20 pagesSummary of Benefits: Humana Gold Plus H1036-237 (HMO)Cesar HNo ratings yet

- 2020 Benefits Information Guide: Understanding Your Options Staffing EmployeesDocument28 pages2020 Benefits Information Guide: Understanding Your Options Staffing Employeeseric.risnerNo ratings yet

- C 075849Document95 pagesC 075849James LindonNo ratings yet

- Coordination of Benefits: Where Can I Get More Information?Document2 pagesCoordination of Benefits: Where Can I Get More Information?api-309082881No ratings yet

- California 3-Tier Drug List GuideDocument146 pagesCalifornia 3-Tier Drug List GuiderambabuNo ratings yet

- Fan Understanding The Insurance ProcessDocument12 pagesFan Understanding The Insurance ProcessWill SackettNo ratings yet

- CMS Competitive Bidding Program Changes Medicare CoverageDocument8 pagesCMS Competitive Bidding Program Changes Medicare CoveragecartilemeaNo ratings yet

- 2012 Comprehensive Formulary: List of Covered DrugsDocument51 pages2012 Comprehensive Formulary: List of Covered DrugsKapilNo ratings yet

- Fidelis Drug List 2018Document80 pagesFidelis Drug List 2018Annie AnnaNo ratings yet

- 2012 Vitality Bluecross Blueshield Issue 1Document28 pages2012 Vitality Bluecross Blueshield Issue 1Ebad UllahNo ratings yet

- ALL Medicare Is Health InsuranceDocument2 pagesALL Medicare Is Health InsuranceJoni RasmantoNo ratings yet

- Summary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareFrom EverandSummary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareNo ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet

- MedicareMedicaid PDFDocument4 pagesMedicareMedicaid PDFAlexanderNo ratings yet

- Fidelis Care 2011 Formulary (List of Covered Drugs)Document54 pagesFidelis Care 2011 Formulary (List of Covered Drugs)genom2007No ratings yet

- Patient Right to Choose Fundamental for Better HealthcareDocument1 pagePatient Right to Choose Fundamental for Better HealthcaremtfifeNo ratings yet

- Smileeee 86826468Document7 pagesSmileeee 86826468Frvrkpop LifeNo ratings yet

- 2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareDocument5 pages2006 Medicare Part D Payments: Total Drug Spend Troop Out of Pocket Cost Portion Covered by MedicareVinodh KumarNo ratings yet

- Ba25180st Rev0912 WBDocument6 pagesBa25180st Rev0912 WBJamesMyersNo ratings yet

- Medicare Formulary - MidwestDocument115 pagesMedicare Formulary - MidwestChrisandJenn SherburneNo ratings yet

- Coordination of Benefits: Tell Your Insurance Company or Employer Benefits Administrator About ChangesDocument2 pagesCoordination of Benefits: Tell Your Insurance Company or Employer Benefits Administrator About Changesapi-239463541No ratings yet

- Medicare Coverage Outside United StatesDocument4 pagesMedicare Coverage Outside United StatesNoel CastrejonNo ratings yet

- Anthem Scope of App.Document2 pagesAnthem Scope of App.family-instituteNo ratings yet

- Medicare MedicaidDocument4 pagesMedicare Medicaidarnab dasNo ratings yet

- Blue Shield of California Choosing Your Health Plan A16646 2011Document54 pagesBlue Shield of California Choosing Your Health Plan A16646 2011DennisNo ratings yet

- Membership Handbook PDFDocument44 pagesMembership Handbook PDFAli BariNo ratings yet

- Three Main Types of US Health Insurance PlansDocument5 pagesThree Main Types of US Health Insurance PlansTanya Delaine AmonNo ratings yet

- State Health Exchanges and Qualified Health PlansDocument49 pagesState Health Exchanges and Qualified Health PlansRajiv GargNo ratings yet

- Group Health Incorporated (GHI) Prescription Drug Plan 2007 High Performance Formulary (List of Covered Drugs)Document46 pagesGroup Health Incorporated (GHI) Prescription Drug Plan 2007 High Performance Formulary (List of Covered Drugs)jhamid_igasanNo ratings yet

- Medicare Questions AnsweredDocument8 pagesMedicare Questions Answeredhazareerubina54No ratings yet

- Summary of Benefits: Humana Gold Plus H1036-065C (HMO)Document20 pagesSummary of Benefits: Humana Gold Plus H1036-065C (HMO)Cesar HNo ratings yet

- RDL Alpha List PDFDocument127 pagesRDL Alpha List PDFmdaihNo ratings yet

- Humana Scope of App. - 2Document2 pagesHumana Scope of App. - 2family-instituteNo ratings yet

- Humana 2022 Plan 2 RX3 Drug List - StandardDocument104 pagesHumana 2022 Plan 2 RX3 Drug List - StandardWalter PilimonNo ratings yet

- My Docs Mdmedicare InfoDocument4 pagesMy Docs Mdmedicare Infolancastd54No ratings yet

- MdmedichaoiceDocument324 pagesMdmedichaoicelancastd54No ratings yet

- My Docs Mdmedicare InfoDocument4 pagesMy Docs Mdmedicare Infolancastd54No ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet

- 001Document18 pages001lancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- 001Document18 pages001lancastd54No ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet

- 001Document18 pages001lancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet

- 001Document18 pages001lancastd54No ratings yet

- A Better Medicare. A Better You: MD Medicarechoice, IncDocument19 pagesA Better Medicare. A Better You: MD Medicarechoice, Inclancastd54No ratings yet

- MdmedichaoiceDocument324 pagesMdmedichaoicelancastd54No ratings yet

- PharmacyDocument182 pagesPharmacylancastd54No ratings yet