Professional Documents

Culture Documents

QR Sept10

Uploaded by

Sagar PatilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QR Sept10

Uploaded by

Sagar PatilCopyright:

Available Formats

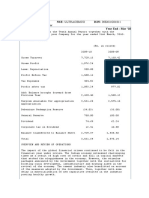

UNITED BREWERIES LIMITED

Regd. Office: UB Tower, UB City, 24, Vittal Mallya Road, Bangalore - 560 001

Unaudited Financial Results for the period ended September 30, 2010

Rs. in Lakhs (except in respect of items 16 to 18) Unaudited Audited Three Months Ended Six Months Ended Year Ended 30.9.2010 30.9.2009 30.9.2010 30.9.2009 31.03.2010 56,691 (899) 7,156 14,637 1,368 5,899 3,512 2,424 11,117 5,501 3,323 54,038 2,653 1,702 4,355 1,244 54 3,057 3,057 (866) 2,191 2,191 2,400 0.82 60,058,335 25.02 41,225 (603) 7,031 8,746 1,125 3,752 2,583 2,074 7,638 4,301 2,960 39,607 1,618 1,554 3,172 1,592 22 22 1,536 1,536 (365) 1,171 1,171 2,400 0.40 60,058,335 25.02 134,254 (398) 15,968 33,600 2,973 13,689 6,243 4,775 23,903 12,440 7,072 120,265 13,989 3,525 17,514 2,586 (4) 71 14,861 14,861 (5,055) 9,806 9,806 2,400 3.91 60,058,335 25.02 97,748 (91) 11,982 23,830 2,322 10,048 4,760 4,123 18,631 9,696 5,774 91,075 6,673 3,443 10,116 3,299 (371) 30 7,158 7,158 (2,438) 4,720 4,720 2,400 1.79 60,058,335 25.02 199,745 (462) 25,216 51,153 4,911 20,064 9,892 8,827 37,033 18,891 11,325 186,850 12,895 7,768 20,663 6,216 (782) 116 15,113 15,113 (5,416) 9,697 9,697 2,400 88,888 3.68 60,058,335 25.02

Sl. No.

Particulars

1 (a) Net Sales/Income from Operations (b) Other Operating Income 2 Expenditure a) (Increase) / Decrease in stock in trade and work in progress b) Consumption of Raw Materials c) Consumption of Packing Materials d) Power & Fuel Cost e) Purchase of Traded Goods f) Employees Cost g) Depreciation h) Advertisement & Sales Promotion i) Selling & Distribution j) Other Expenditure k) Total 3 Profit from Operations before Other Income, Interest and Exceptional Items (1-2) 4 Other Income 5 Profit before Interest and Exceptional Items (3+4) 6 Interest Charges - Interest - Exchange difference - Other Finance Charges 7 Profit after Interest but before Exceptional Items (5-6) 8 Exceptional Items (1-2) 9 Profit (+)/Loss (-) from Ordinary Activities before tax (7+8) 10 Tax expense 11 Net Profit(+) / Loss(-) from Ordinary Activities after tax (9-10) 12 Extraordinary Items (net of tax expense Rs.Nil) 13 Net Profit (+) / Loss(-) for the period (11-12) 14 Paid-up equity share capital (Face value of Re.1 each) 15 Reserves excluding Revaluation Reserves as per balance sheet of previous accounting year 16 Earnings Per Share (EPS) (in Rs.) 17 Public Shareholding - Number of Shares - Percentage of Shareholding 18 Promoters and Promoter group Shareholding a) Pledged / Encumbered - Number of Shares - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company) b) Non - Encumbered - Number of Shares - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company)

17,203,422 9.56 7.17

23,937,422 13.30 9.97

17,203,422 9.56 7.17

23,937,422 13.30 9.97 156,052,498 86.70 65.01

17,203,422 9.56 7.17 162,786,498 90.44 67.81

162,786,498 156,052,498 162,786,498 90.44 67.81 86.70 65.01 90.44 67.81

STATEMENT OF ASSETS & LIABILITIES AS AT 30th SEPTEMBER, 2010 (UNAUDITED) Rs. in Lakhs Particulars Shareholders Fund: (a) Capital (b) Reserves and Surplus Total (a) + (b) Loan Funds Deferred Tax Liability TOTAL LIABILITIES Fixed Assets Investments Current assets loans and advances (a) Inventories (b) Sundry Debtors (c) Cash and Bank balances (d) Other current assets (e) Loans and Advances Total (a) to (e) Less: Current Liabilities and Provisions (a) Liabilities (b) Provisions Total (a) + (b) Miscellaneous expenditure (to the extent not written off) Profit and Loss Account TOTAL ASSETS Notes: Unaudited as at 30.09.2010 27,090 98,694 125,784 56,670 1,943 184,397 83,180 10,407 24,103 64,194 9,662 5,061 25,919 128,939 34,998 3,131 38,129 184,397 Unaudited as at 30.09.2009 27,090 85,785 112,875 62,165 1,970 177,010 81,347 14,907 20,521 55,657 1,727 2,958 26,268 107,131 25,803 572 26,375 177,010 Audited as at 31.03.2010 27,090 88,888 115,978 67,133 2,163 185,274 83,832 15,307 19,602 61,625 8,332 3,545 27,694 120,798 32,123 2,540 34,663 185,274

1. The Company is engaged in manufacture, purchase and sale of Beer including licensing of brands which constitutes a single business segment. The Company also considers the whole of India as a single geographical segment. 2. Exchange difference represents loss (gain) on liability restated at the exchange rates as at the end of the respective periods on foreign currency loan availed by the Company for working capital purposes. The Company has opted to repay the entire facility during the quarter ended June 2010 booked a gain of Rs. 4 Lakhs on settlement of the facility. 3. The Company's investments in Millennium Alcobev Private Limited and Maltex Malsters Private Limited are long term and strategic in nature. The diminution in book value of these investments is only temporary in nature and further the Company has also obtained an independent valuation in respect of these investments, which is in excess of the book value, and hence no provision for diminution is considered necessary. 4. The Company does not own any brewing facility in Tamil Nadu, which is one of the major markets in India contributing about 18% of the Company's business. With an intention of ensuring supplies from Balaji Distilleries Limited (BDL), having brewing facilities in Tamil Nadu, the Company has entered into an agreement with the promoters of BDL to secure to the Company perpetual usage of brewery and for grant of first right of refusal in case of sale or disposal of the brewery in any manner by BDL, and has advanced an amount of Rs.15,500 Lakhs to one of the Promoter Companies of BDL, acting for and on behalf of the other Promoters also. Subsequently, the Boards of Directors of BDL and United Spirits Limited (USL) have considered and approved a proposal for merger of BDL into USL, which is subject to obtaining of the necessary regulatory approvals by both the Companies. The Company has obtained a commitment from USL that the arrangement with Promoters will be adhered to on completion of the proposed merger. The advance will be repaid upon the completion of the merger or in accordance with the terms of the related Agreement, whichever is earlier. In June 2009, BDL has allotted 90,000,000 Equity Shares upon conversion of warrants to certain parties. These parties have entered into a supplemental agreement with the Company to the effect that they will be bound by the terms and conditions of the earlier agreement between the Company and the promoters of BDL. 5. During the quarter ended June 30,2008 the Company has raised Rs.42,278 (net of issue expenses) Lakhs through an issue of shares on rights basis (Rights Issue).The proceeds of the rights issue have been utilised in the following manner: a. Rs. 20,255 Lakhs for repayment of cash credit/overdraft accounts and for additional working capital requirements. b. Rs. 22,023 Lakhs for Capital Expenditure. 6. Investor complaints pending as on July 1, 2010 were Nil. During the quarter ended September 30, 2010, eight (8) Complaints were received and disposed and there were no complaints unresolved as on that date. 7. The Company has paid a dividend @ Rs. 3/- per Cumulative Redeemable Preference Share amounting to Rs. 867 Lakhs (inclusive of Dividend Distribution Tax) for the year ended March 31, 2010 to Scottish & Newcastle India Limited. A final dividend of Rs.0.36 per equity share of Re.1/- equivalent to 36% amounting to Rs.1,008 lakhs (inclusive of Dividend Distribution Tax) was paid by the Company for the year ended March 31, 2010. 8. Earnings per Share (EPS) is stated after providing for pro-rated Dividend on the Cumulative Redeemable Preference Shares for the period ended September 2010. 9. The figures relating to the previous year/period(s) have been regrouped / reclassified wherever necessary. 10. A Scheme of Amalgamation for amalgamating Associated Breweries & Distilleries Limited, Millennium Alcobev Private Limited and Empee Breweries Limited into the Company has been filed with the High Court at Karnataka. Millennium Beer Industries Limited and United Millennium Breweries Limited are proposed to be amalgamated through a Scheme to be filed through Board for Industrial & Financial reconstruction. The above schemes are effective April 01, 2010 subject to necessary approvals. 11. The unaudited results for the quarter ended September 30, 2010 have been approved by the Board of Directors at its meeting held on October 28, 2010 and have been subjected to limited review by the auditors of the company. By the Authority of the Board, Sd/Place : Amsterdam, Netherlands KALYAN GANGULY Date : October 28, 2010 Managing Director

You might also like

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- SL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedDocument4 pagesSL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedZhang Jing CarrieNo ratings yet

- C.A. Final Financial Reporting Consolidated BSDocument7 pagesC.A. Final Financial Reporting Consolidated BSDivyesh TrivediNo ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Ajooni BiotechDocument21 pagesAjooni BiotechSunny RaoNo ratings yet

- AcctsDocument63 pagesAcctskanchanthebest100% (1)

- 29234rtp May13 Ipcc Atc 1Document50 pages29234rtp May13 Ipcc Atc 1rahulkingdonNo ratings yet

- Cash Flow Statement PracticeDocument6 pagesCash Flow Statement PracticeVinod Gandhi100% (3)

- Wipro AnalysisDocument20 pagesWipro AnalysisYamini NegiNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqNo ratings yet

- Notes 2008-09Document17 pagesNotes 2008-09Avinash BagadeNo ratings yet

- Balance Sheet PDFDocument21 pagesBalance Sheet PDFLambourghiniNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanNo ratings yet

- Bajaj Auto LTD: Presented By: Hitesh RameshDocument15 pagesBajaj Auto LTD: Presented By: Hitesh RameshnancyagarwalNo ratings yet

- Case Study - ACI and Marico BDDocument9 pagesCase Study - ACI and Marico BDsadekjakeNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Annual Report 2013-2014Document164 pagesAnnual Report 2013-2014Akash SharmaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Strategic Business Reporting - United Kingdom (SBR - Uk)Document8 pagesStrategic Business Reporting - United Kingdom (SBR - Uk)vaaniNo ratings yet

- Financial Accounting Practice May 2009Document8 pagesFinancial Accounting Practice May 2009samuel_dwumfourNo ratings yet

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelNo ratings yet

- Pakistan Synthetics Limited Condensed Interim Balance Sheet AnalysisDocument8 pagesPakistan Synthetics Limited Condensed Interim Balance Sheet AnalysismohammadtalhaNo ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IISYED ANEES ALINo ratings yet

- HSTL Annual-Report 2021Document72 pagesHSTL Annual-Report 2021ums 3vikramNo ratings yet

- Comprehensive Assignment FAR-IIDocument7 pagesComprehensive Assignment FAR-IISonu MalikNo ratings yet

- Strategic Business Reporting - International (SBR - Int)Document8 pagesStrategic Business Reporting - International (SBR - Int)Karan KumarNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- Balance Sheet: As at June 30, 2011Document45 pagesBalance Sheet: As at June 30, 2011Rana HaiderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- India Bulls Securities LTDDocument13 pagesIndia Bulls Securities LTDTiny TwixNo ratings yet

- Minda Annual ReportDocument78 pagesMinda Annual Reportitsme_puneetNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Advanced Accounting QN August 2018 Group AssignmentDocument9 pagesAdvanced Accounting QN August 2018 Group AssignmentGift MoyoNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Taj Textile Mills Limited: Quarterly Accounts September 30, 2006 (Un-Audited)Document8 pagesTaj Textile Mills Limited: Quarterly Accounts September 30, 2006 (Un-Audited)Muhammad Karim KhanNo ratings yet

- Manac-1: Group Assignment BM 2013-15 Section ADocument12 pagesManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Auditors' Report InsightsDocument47 pagesAuditors' Report Insightsprashanthmec20056679No ratings yet

- Sinclairs ARDocument66 pagesSinclairs ARAhmed MadhaNo ratings yet

- Coal India LimitedDocument14 pagesCoal India LimitedSarju MaviNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Olympus Kodak Sony Fujifilm Canon JVC: Cameras Price ListDocument1 pageOlympus Kodak Sony Fujifilm Canon JVC: Cameras Price ListSagar PatilNo ratings yet

- 1.1 Perspective Management-Dr - MeenaDocument68 pages1.1 Perspective Management-Dr - MeenaHarshal TakNo ratings yet

- Exam CircularDocument2 pagesExam CircularSagar PatilNo ratings yet

- Sagar PattilDocument77 pagesSagar PattilSagar PatilNo ratings yet

- Political BarrierDocument1 pagePolitical BarrierBrenda WijayaNo ratings yet

- BudgetingDocument130 pagesBudgetingRevathi AnandNo ratings yet

- Stock Market Gaps TradingDocument21 pagesStock Market Gaps TradingneagucosminNo ratings yet

- Responsibility CentersDocument15 pagesResponsibility CentersMayuresh BhagwateNo ratings yet

- Making Your Real Estate Fortune - Robert AllenDocument491 pagesMaking Your Real Estate Fortune - Robert Allenknfzed100% (1)

- Futures and Options DefinitionsDocument14 pagesFutures and Options DefinitionsReySelvak100% (1)

- International Investment Law ArticleDocument37 pagesInternational Investment Law ArticleChloe SteeleNo ratings yet

- Ind Nifty RealtyDocument2 pagesInd Nifty RealtyParth AsnaniNo ratings yet

- The Significance of IT Security Management & Risk AssessmentDocument30 pagesThe Significance of IT Security Management & Risk AssessmentBradley Susser100% (1)

- Risk Profiler Form IndividualsDocument4 pagesRisk Profiler Form IndividualsBharathi 3280No ratings yet

- BBVA OpenMind Libro El Proximo Paso Vida Exponencial2Document59 pagesBBVA OpenMind Libro El Proximo Paso Vida Exponencial2giovanniNo ratings yet

- National Income Accounting: Unit I PPT 2Document36 pagesNational Income Accounting: Unit I PPT 2Prateek TekchandaniNo ratings yet

- 01 Equity MethodDocument41 pages01 Equity MethodAngel Obligacion100% (1)

- Jeda ConsDocument2 pagesJeda ConsNathan ChinhondoNo ratings yet

- Sample Manulife ProposalDocument7 pagesSample Manulife ProposalRicci MelecioNo ratings yet

- Billionaires Secrets PDFDocument30 pagesBillionaires Secrets PDFAbel Quintos67% (3)

- GSA AbilityDocument27 pagesGSA AbilityAqsa TariqNo ratings yet

- Accounting 101 Sample ExercisesDocument12 pagesAccounting 101 Sample ExercisesFloidette JimenezNo ratings yet

- 1st Mid Term Exam Fall 2015 AuditingDocument5 pages1st Mid Term Exam Fall 2015 AuditingSarahZeidatNo ratings yet

- Personal Finance Quiz No.2Document3 pagesPersonal Finance Quiz No.2MarjonNo ratings yet

- Airport BackgroundDocument27 pagesAirport Backgroundseanne07No ratings yet

- Abdhini Biswas Product CannibalisationDocument45 pagesAbdhini Biswas Product Cannibalisationabdhini biswasNo ratings yet

- QAFD Project SolverDocument5 pagesQAFD Project SolverUJJWALNo ratings yet

- List of Banks EtcDocument3 pagesList of Banks EtcMehmood Ul HassanNo ratings yet

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocument8 pagesNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudAnkit ChawlaNo ratings yet

- World Tax ReformDocument333 pagesWorld Tax ReformncariwibowoNo ratings yet

- Ona Vs CIR Digest PersonalDocument2 pagesOna Vs CIR Digest PersonalTrish VerzosaNo ratings yet

- General Re's Agreed Statement of FactsDocument14 pagesGeneral Re's Agreed Statement of FactsDealBookNo ratings yet

- Introduction of India InfolineDocument79 pagesIntroduction of India InfolineArvind Mahandhwal100% (1)

- CFO Tax Partner CPA in Houston TX Resume Darryl SiefkasDocument3 pagesCFO Tax Partner CPA in Houston TX Resume Darryl SiefkasDarrylSiefkasNo ratings yet