Professional Documents

Culture Documents

Japan Paraíso Fiscal

Uploaded by

pma_507Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Japan Paraíso Fiscal

Uploaded by

pma_507Copyright:

Available Formats

Mapping Financial Secrecy

Japan

Report on Japan

Japan is ranked at eighth position on the 2011 Financial Secrecy Index. This ranking is based on a combination of its secrecy score and a scale weighting based on its share of the global market for offshore financial services. Japan has been assessed with 64 secrecy points out of a potential 100, which places it in the mid range of the secrecy scale (see chart 1 below). Japan accounts for slightly under 2 per cent of the global market for offshore financial services, making it a small player compared with other secrecy jurisdictions (see chart 2 below).

Chart 1 - How Secretive?

Moderately secretive

Chart 2 - How Big?

31-40 41-50 51-60 61-70 71-80 81-90

huge

large small tiny

Exceptionally secretive

91-100

Part 1: Telling the story

Japan, like Germany, is not widely regarded as a secrecy jurisdiction but our decision finally to include it in this years index is vindicated. With a relatively high secrecy score of 64, and a huge offshore market - it has slightly under 2% of the global market share in offshore financial services - Japan is a major player in the secrecy world. Japans Big Bang in terms of offshore finance happened with the setting up of the so-called Japan Offshore Market in 1986. Essentially, this was an effort to attract foreign financial business by exempting it from tax and a range of financial regulations, and it was modelled on a similar U.S. facility set up by the United States two years earlier (and it was also a reaction to the rapid growth of the offshore Euromarkets generally, pioneered by the City of 1 Published on October 4, 2011 Tax Justice Network

Mapping Financial Secrecy

Japan

London since the 1950s.) This was followed by similar tax exemptions for Japanese government bonds in 1999, and for municipal bonds in 2007. The scope of the tax exemption was widened in 2010 to include corporate bonds. Japans weak provisions on transparency and information exchange, combined with its taxfree treatment of various forms of foreign investment (and exemption from financial regulations) has made it a major destination for illicit financial flows. The countrys relatively poor record of co-operation with foreign governments on money-laundering adds to our concerns about this little-noticed secrecy jurisdiction.

Next steps for Japan Japans 64 per cent secrecy score shows that it must still make major progress in offering satisfactory financial transparency1. If it wishes to play a full part in the modern financial community and to impede and deter illicit financial flows, including flows originating from tax evasion, aggressive tax avoidance practices, corrupt practices and criminal activities, it should take action on the points noted where it falls short of acceptable international standards. See part 2 below for details of Japans shortcomings on transparency. See this link http://www.secrecyjurisdictions.com/kfsi for an overview of how each of these shortcomings can be fixed.

Part 2: Secrecy Scores

The secrecy score of 64 per cent for Japan has been computed by assessing the jurisdictions performance on the 15 Key Financial Secrecy Indicators, listed below. Japan - KFSI Assessment Japan - Secrecy Score

36% 64%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 KFSI

Transparency Score

Secrecy Score

The numbers on the horizontal axis of the bar chart on the left refer to the Key Financial Secrecy Indicators (KFSI). The presence of a blue bar indicates a positive answer, as does blue text in the KFSI list below. The presence of a red bar indicates a negative answer as does red text in the KFSI list. Where the jurisdictions performance partly, but not fully 2 Published on October 4, 2011 Tax Justice Network

Mapping Financial Secrecy

Japan

complies with a Key Financial Secrecy Indicator, the text is coloured violet in the list below (combination of red and blue). This paper draws on key data collected on Japan. Our data sources include regulatory reports, legislation, regulation and news available at 31.12.20102. The full data set is available here3. Our assessment is based on the 15 Key Financial Secrecy Indicators (KFSIs, below), reflecting the legal and financial arrangements of Japan. Details of these indicators are noted in the following table and all background data can be found on the Mapping Financial Secrecy web site4. This data is the basis on which the Financial Secrecy Index5 is compiled.

The Key Financial Secrecy Indicators and the performance of Japan are: TRANSPARENCY OF BENEFICIAL OWNERSHIP Japan 1. Banking secrecy: Does the jurisdiction have banking secrecy? Japan does not adequately curtail banking secrecy 2. Trust and Foundations Register: Is there a public register of Trusts and Foundations? Japan does not put details of trusts on public record 3. Recorded Company Ownership: Does the relevant authority obtain and keep updated details of the beneficial ownership of companies? Japan does not maintain company ownership details in official records KEY ASPECTS OF CORPORATE TRANSPARENCY REGULATION Japan 4. Public Company Ownership: Does the relevant authority make details of ownership of companies available on public record online for less than US$10? Japan does not require that ownership of companies is put on public record 5. Public Company Accounts: Does the relevant authority require that company accounts are made available for inspection by anyone for a fee of less than US$10? Japan does not require that company accounts be available on public record 6. Country-by-Country Reporting: Are companies listed on a national stock exchange required to comply with country-by-country financial reporting? Japan does not require country-by-country financial reporting by companies EFFICIENCY OF TAX AND FINANCIAL REGULATION Japan

Published on October 4, 2011 Tax Justice Network

Mapping Financial Secrecy

Japan

7.

Fit for Information Exchange: Are resident paying agents required to report to the domestic tax administration information on payments to non-residents? Japan requires resident paying agents to tell the domestic tax authorities about payments to non-residents

8.

Efficiency of Tax Administration: Does the tax administration use taxpayer identifiers for analysing information effectively, and is there a large taxpayer unit? Japan partly uses appropriate tools for effectively analysing tax related information

9.

Avoids Promoting Tax Evasion: Does the jurisdiction grant unilateral tax credits for foreign tax payments? Japan avoids promoting tax evasion via a tax credit system

10. Harmful Legal Vehicles: Does the jurisdiction allow cell companies and trusts with flee clauses? Japan partly allows harmful legal vehicles INTERNATIONAL STANDARDS AND COOPERATION Japan 11. Anti-Money Laundering: Does the jurisdiction comply with the FATF recommendations? Japan partly complies with international anti-money laundering standards 12. Automatic Information Exchange: Does the jurisdiction participate fully in Automatic Information Exchange such as the European Savings Tax Directive? Japan does not participate fully in Automatic Information Exchange 13. Bilateral Treaties: Does the jurisdiction have at least 60 bilateral treaties providing for broad information exchange, covering all tax matters, or is it part of the European Council/OECD convention? As of June 30, 2010, Japan had few tax information sharing agreements complying with basic OECD requirements 14. International Transparency Commitments: Has the jurisdiction ratified the five most relevant international treaties relating to financial transparency? Japan has partly ratified relevant international treaties relating to financial transparency 15. International Judicial Cooperation: Does the jurisdiction cooperate with other states on money laundering and other criminal issues? 4 Published on October 4, 2011 Tax Justice Network

Mapping Financial Secrecy

Japan

Japan partly cooperates with other states on money laundering and other criminal issues

Our definition of financial transparency can be found here: http://www.secrecyjurisdictions.com/PDF/FinancialTransparency.pdf. 2 With the exception of KFSI 13 for which the cut-off date is 30.6.2010. For more details, look at the endnote number 2 in the corresponding KFSI-paper here: http://www.secrecyjurisdictions.com/PDF/13-Bilateral-Treaties.pdf. 3 That data is available here: http://www.secrecyjurisdictions.com/sj_database/menu.xml. 4 http://www.secrecyjurisdictions.com. 5 http://www.financialsecrecyindex.com/.

Published on October 4, 2011 Tax Justice Network

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Qualified Theft and Estafa JurisprudenceDocument3 pagesQualified Theft and Estafa JurisprudenceGabriel Jhick SaliwanNo ratings yet

- Nomura Jun12 - Panamá ReportDocument4 pagesNomura Jun12 - Panamá Reportpma_507No ratings yet

- Report On Switzerland: Chart 1 - How Secretive? Chart 2 - How Big?Document9 pagesReport On Switzerland: Chart 1 - How Secretive? Chart 2 - How Big?eggsiginoNo ratings yet

- Panama Índice de Libertad EconómicaDocument2 pagesPanama Índice de Libertad Económicapma_507No ratings yet

- List Nov 11Document1 pageList Nov 11pma_507No ratings yet

- Belgium Paraíso FiscalDocument5 pagesBelgium Paraíso Fiscalpma_507No ratings yet

- Alemania Paraíso FiscalDocument6 pagesAlemania Paraíso Fiscalpma_507No ratings yet

- Lista Ocde 2010Document16 pagesLista Ocde 2010pma_507No ratings yet

- Canada Paraíso FiscalDocument7 pagesCanada Paraíso Fiscalpma_507No ratings yet

- USA Paraiso FiscalDocument10 pagesUSA Paraiso Fiscalpma_507No ratings yet

- Tax Transparency 2011: Report On Progress Del Global Forum On Transparency and Exchange of Information For Tax PurposesDocument101 pagesTax Transparency 2011: Report On Progress Del Global Forum On Transparency and Exchange of Information For Tax Purposespma_507No ratings yet

- United Kingdom Paraíso FiscalDocument10 pagesUnited Kingdom Paraíso Fiscalpma_507No ratings yet

- BPI V Far East MolassesDocument4 pagesBPI V Far East MolassesYodh Jamin OngNo ratings yet

- PP vs. Gabrino - Ruling - LawphilDocument5 pagesPP vs. Gabrino - Ruling - LawphillalaNo ratings yet

- Public Hearing on Bluehouse ProjectDocument2 pagesPublic Hearing on Bluehouse ProjectChristjohn VillaluzNo ratings yet

- Standing Order No. 303/ 2010 Guidelines To Be Followed by The Police While Investigating Cases of RapeDocument14 pagesStanding Order No. 303/ 2010 Guidelines To Be Followed by The Police While Investigating Cases of RapeVaibhav ShuklaNo ratings yet

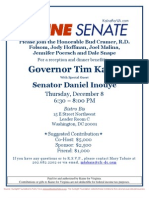

- Reception and DinnerDocument2 pagesReception and DinnerSunlight FoundationNo ratings yet

- Key Answers C2Document15 pagesKey Answers C2Yolanda OrtizNo ratings yet

- CasesDocument14 pagesCasesKate SchuNo ratings yet

- FIFA World Cup Milestones, Facts & FiguresDocument25 pagesFIFA World Cup Milestones, Facts & FiguresAleks VNo ratings yet

- Gonojagoron Mancha Movement in BangladeshDocument17 pagesGonojagoron Mancha Movement in BangladeshThavamNo ratings yet

- The Dogmatic Structure of Criminal Liability in The General Part of The Draft Israeli Penal Code - A Comparison With German Law - Claus RoxinDocument23 pagesThe Dogmatic Structure of Criminal Liability in The General Part of The Draft Israeli Penal Code - A Comparison With German Law - Claus RoxinivanpfNo ratings yet

- Boulder District Attorneys Office Letter To Kathleen ChippiDocument1 pageBoulder District Attorneys Office Letter To Kathleen ChippiMichael_Lee_RobertsNo ratings yet

- Saad Zaghlul PashaDocument27 pagesSaad Zaghlul PashaPetru MoiseiNo ratings yet

- AtonementDocument11 pagesAtonementArianna TafuroNo ratings yet

- Perspectives Test 1Document5 pagesPerspectives Test 1ΒΡΕΦΟΝΗΠΙΑΚΟΣ ΝΕΑΣ ΚΥΔΩΝΙΑΣ50% (2)

- Prolonged PregnancyDocument41 pagesProlonged PregnancyArif Febrianto100% (1)

- Pirate+Borg BeccaDocument1 pagePirate+Borg BeccaamamNo ratings yet

- CBSE Class 10 History Question BankDocument22 pagesCBSE Class 10 History Question BankbasgsrNo ratings yet

- TORTSDocument447 pagesTORTSLiene Lalu NadongaNo ratings yet

- Joe Cocker - When The Night Comes ChordsDocument2 pagesJoe Cocker - When The Night Comes ChordsAlan FordNo ratings yet

- Ieds Catalog 09-21-2017 Low CompressDocument40 pagesIeds Catalog 09-21-2017 Low Compresswhorne24No ratings yet

- 7 de MayoDocument5 pages7 de MayoFABIAN MORALESNo ratings yet

- Philippine Airlines Not Liable for Bumping Off Late PassengersDocument10 pagesPhilippine Airlines Not Liable for Bumping Off Late PassengersAngelReaNo ratings yet

- Edi-Staffbuilders International Vs NLRCDocument7 pagesEdi-Staffbuilders International Vs NLRCErvenUmaliNo ratings yet

- Lesson 1 and 2 Reading Comprehension Inferential QuestionsDocument2 pagesLesson 1 and 2 Reading Comprehension Inferential QuestionsAhmadNo ratings yet

- 467Document5 pages467Andreea HarhasNo ratings yet

- Lawsuit Against City of SacramentoDocument8 pagesLawsuit Against City of SacramentoIsaac GonzalezNo ratings yet

- Esguerra NotesDocument38 pagesEsguerra NotesjohnllenalcantaraNo ratings yet

- Gsis V Balais Case DigestDocument4 pagesGsis V Balais Case DigestsilverdimaampaoNo ratings yet

- Railway Recruitment Recruitment Cell, Central Railway RailwayDocument14 pagesRailway Recruitment Recruitment Cell, Central Railway RailwayAkash MhantaNo ratings yet