Professional Documents

Culture Documents

Scheduled Bank & Non-Scheduled Bank

Uploaded by

Ankit SuranaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheduled Bank & Non-Scheduled Bank

Uploaded by

Ankit SuranaCopyright:

Available Formats

SCHEDULED AND NON SCHEDULED BANK INCOME SOURCE OF COMMERICAL BANK

Submitted by: Group-2 Abhishek Tiwari Anish Pandey Ankit Surana Anubhav Srivastava

SCHEDULED BANK & NON-SCHEDULED BANK

Scheduled Banks in India: Banks included in the Second Schedule of Reserve Bank of India(RBI) Act, 1934. Conditons Capital and collected funds of bank should not be less than Rs. 5 lac. Any activity of the bank should not adversely affect the interests of depositors. Facilities Bank becomes eligible for debts/loans on bank rate from the RBI. Bank automatically acquire the membership of clearing house. NON- SCHEDULED BANK Banks not included in Reserve Bank of India(RBI) Act, 1934 are NonScheduled Bank and capital & collected funds less than 5 Lac. The difference between schedule and non schedule is immaterial as the number of non schedule bank is almost nil. Since May 2007 there does not exist any non-scheduled commercial bank. Source:http://www.rbi.org.in/scripts/PublicationsView.aspx?id=10780

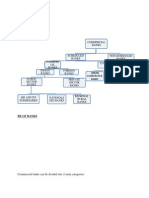

LIST OF SCHEDULED BANKS

Scheduled banks Types 1. Scheduled Commercial banks. 2. Scheduled Co-operative Banks . Schedule Bank

Schedule Commercial Bank

Schedule Co-operative Bank

Public Sector Bank Old Private Sector Bank

Private Sector Bank New Private Sector Bank

Foreign Bank

Regional Rural Bank

Nationalized Bank

SBI and Associated Bank

NATIONALIZED BANKS: 26

STATE BANK GROUP:6

1. Allahabad Bank 2. Andhra Bank 3. Bank of Baroda 4. Bank of India 5. Bank of Maharashtra 6. Canara Bank 7. Central Bank of India 8. Corporation Bank 9. Dena Bank 10. IDBI Bank Ltd. 11. Indian Bank 12. Indian Overseas Bank 13. Oriental Bank of Commerce 14. Punjab & Sind Bank 15. Punjab National Bank 16. Syndicate Bank 17. UCO Bank 18. Union Bank of India 19. United Bank of India 20. Vijaya Bank

State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of India State Bank of Mysore State Bank of Patiala State Bank of Travancore

OLD PRIVATE BANK:14

New Private Banks:7

Axis Bank Ltd. Development Credit Bank Ltd HDFC Bank Ltd. ICICI Bank Ltd. IndusInd Bank Ltd. Kotak Mahindra Bank Ltd. Yes Bank Ltd

Catholic Syrian Bank Ltd. City Union Bank Ltd. Dhanalakshmi Bank Ltd. Federal Bank Ltd. ING Vysya Bank Ltd. Jammu & Kashmir Bank Ltd. Karnataka Bank Ltd. Karur Vysya Bank Ltd. Lakshmi Vilas Bank Ltd. Nainital Bank Ltd. Ratnakar Bank Ltd. SBI Commercial & International Bank Ltd South Indian Bank Ltd. Tamilnad Mercantile Bank Ltd.

Foreign Bank:32

32 Foreign Bank in India.

INCOME SOURCE :COMMERCIAL BANK

With liberalization, globalization and privatization, Banks moved to Fee Based activities rather than Interest based activities.

Interest Income Interest/Discount Income on Investment Balance with RBI Others

Non-Interest Income Commission & Brokerage Sale of Investment Sale of Land Building Exchange Transaction Income from E-Delivery Channels Misc. Income FACTS & ANALYSIS: Lets divide Indian banking industry into four parts. Public Sector Bank Group G-I (26) Old Private Sector Bank Group G-II (14) New Private Sector Bank Group G-III (07) Foreign Bank Group G-IV (32)

Parameters of Study Share of commodities exchange and brokerage in other income. Share of sales in investment in other income. Share of exchange transaction in other income. Interest income as a percentage to total income Non-interest income as a percentage to total income

You might also like

- Scheduled Bank Non Scheduled Bank PDFDocument6 pagesScheduled Bank Non Scheduled Bank PDFSelvaraj Villy100% (1)

- Ib Presen SandyDocument20 pagesIb Presen Sandysandeepbist88No ratings yet

- CH 1Document13 pagesCH 1sanjayNo ratings yet

- 1 Ibps Po 2014 Banking Awareness NotesDocument64 pages1 Ibps Po 2014 Banking Awareness NotesJohnNashNo ratings yet

- Indian Banking System IntroductionDocument26 pagesIndian Banking System Introduction00000rohit100% (1)

- Structure of Commercial Banking in IndiaDocument43 pagesStructure of Commercial Banking in IndiaViral PathakNo ratings yet

- Banking Sector VeraDocument3 pagesBanking Sector Verarupeshverma491993No ratings yet

- Icici BankDocument43 pagesIcici BankRosalie StryderNo ratings yet

- Structure of Commercial Banks in IndiaDocument11 pagesStructure of Commercial Banks in IndiaVijayalakshmi100% (2)

- Banking System in IndiaDocument33 pagesBanking System in Indiadevinder07No ratings yet

- Indian Banking System StructureDocument13 pagesIndian Banking System StructureNandhini VirgoNo ratings yet

- Banking in India: Bank of Bengal (HQ)Document16 pagesBanking in India: Bank of Bengal (HQ)Kiran GireeshNo ratings yet

- Fedai: Foreign Exchange Dealer's Association of India (FEDAI)Document71 pagesFedai: Foreign Exchange Dealer's Association of India (FEDAI)Dilip Kumar100% (1)

- BANKING HISTORYDocument8 pagesBANKING HISTORYmkpatidarNo ratings yet

- Chapter-4 Organizational Structure of HDFC BankDocument17 pagesChapter-4 Organizational Structure of HDFC Bankshraddha100% (1)

- Wa0001Document94 pagesWa0001Akash Ðaya SinhaNo ratings yet

- Customer Satisfaction OF Icici Bank: A Summer Training Report ONDocument88 pagesCustomer Satisfaction OF Icici Bank: A Summer Training Report ONGeetanshu SinghNo ratings yet

- Potential of life insurance industry in JaipurDocument50 pagesPotential of life insurance industry in JaipurSurendra RatiwalNo ratings yet

- Banking Structure in IndiaDocument24 pagesBanking Structure in Indiasandeep95No ratings yet

- Performance of Scheduled Commercial Banks in IndiaDocument15 pagesPerformance of Scheduled Commercial Banks in IndiaPsubbu RajNo ratings yet

- Unit - 1Document93 pagesUnit - 1Suji MbaNo ratings yet

- Competitive Landscape: Market Structure ProtagonistsDocument5 pagesCompetitive Landscape: Market Structure ProtagonistsParikshit Vilas LokeNo ratings yet

- 2-The Origin & Growth of BankingDocument25 pages2-The Origin & Growth of Bankingraghav4231No ratings yet

- Banks in IndiaDocument15 pagesBanks in IndiaGaurav SharmaNo ratings yet

- Banking Sector of India PresentationDocument30 pagesBanking Sector of India Presentationvinni vone89% (53)

- Growth in Banking SectorDocument30 pagesGrowth in Banking SectorHarish Rawal Harish RawalNo ratings yet

- Classification of BanksDocument39 pagesClassification of BanksPrajith VNo ratings yet

- Synopsis Icici & Customer SatisfactionDocument17 pagesSynopsis Icici & Customer SatisfactionbhatiaharryjassiNo ratings yet

- Classification of Commercial BanksDocument2 pagesClassification of Commercial BanksPrakash KrishnanNo ratings yet

- Bank & Bill Discounting: Lalita Choudhary TYBBI, 11Document40 pagesBank & Bill Discounting: Lalita Choudhary TYBBI, 11VIVEK MEHTANo ratings yet

- Homeloans IciciDocument83 pagesHomeloans Icicitajju_121No ratings yet

- Private BanksDocument3 pagesPrivate BanksJasmeet KaurNo ratings yet

- Outlook Task2Document79 pagesOutlook Task2Rajveer singh PariharNo ratings yet

- CITIBANKDocument28 pagesCITIBANKAnirudh SinghNo ratings yet

- Scheduled Commercial BanksDocument9 pagesScheduled Commercial BanksMinakshi JalanNo ratings yet

- Customer SatisfactionDocument65 pagesCustomer SatisfactionChandan SrivastavaNo ratings yet

- S.B.R. Govt. (Auto.) Women'S College: Department of CommerceDocument47 pagesS.B.R. Govt. (Auto.) Women'S College: Department of CommerceAnit PatroNo ratings yet

- A Study of Financial Performance: A Comparative Analysis of Sbi and Icici BankDocument17 pagesA Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bankganesh dvssNo ratings yet

- A Project Report On Comparison Between HDFC Bank & ICICI BankDocument75 pagesA Project Report On Comparison Between HDFC Bank & ICICI Bankvarun_bawa25191592% (12)

- Structure of Commercial BanksDocument4 pagesStructure of Commercial BanksMunish PathaniaNo ratings yet

- Function of Public Sector BanksDocument51 pagesFunction of Public Sector BanksdynamicdeepsNo ratings yet

- Indian Banking Industry - CHALLENGES DTDocument8 pagesIndian Banking Industry - CHALLENGES DTShadab AshfaqNo ratings yet

- Types of Bank in IndiaDocument31 pagesTypes of Bank in Indiakumawat_381568954No ratings yet

- By Sandeep Keshri Alumini IPEXDocument33 pagesBy Sandeep Keshri Alumini IPEXgladalokNo ratings yet

- Summer Training Project ReportDocument66 pagesSummer Training Project ReportJimmy GoelNo ratings yet

- List of BanksDocument6 pagesList of Bankslucky1142No ratings yet

- A study on home loans of icici bank (1)Document50 pagesA study on home loans of icici bank (1)Saumya BajpaiNo ratings yet

- Banking Structure in IndiaDocument9 pagesBanking Structure in IndiaDhanu BhardwajNo ratings yet

- Sectoral Presentation On: BankingDocument23 pagesSectoral Presentation On: Bankingswapnit9995No ratings yet

- Icici Vs SbiDocument16 pagesIcici Vs SbiJay KoliNo ratings yet

- Commercial Banking NotesDocument68 pagesCommercial Banking NotesG NagarajanNo ratings yet

- Role of Indian Banks & Financial InstitutionsDocument55 pagesRole of Indian Banks & Financial InstitutionsPriyesh V RameshNo ratings yet

- Indian Banking System OverviewDocument82 pagesIndian Banking System OverviewSvijayakanthan SelvarajNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Trial Balance: Private Sector Financing for Road Projects in IndiaFrom EverandTrial Balance: Private Sector Financing for Road Projects in IndiaNo ratings yet

- Supply Chain ManagementDocument10 pagesSupply Chain ManagementAnkit SuranaNo ratings yet

- Financils of 5 CompaniesDocument8 pagesFinancils of 5 CompaniesAnkit SuranaNo ratings yet

- Day 1 NU RaviDocument19 pagesDay 1 NU RaviAnkit SuranaNo ratings yet

- Ifs02 LeaseDocument6 pagesIfs02 LeaseAnkit SuranaNo ratings yet

- Differences between Co-operative Banks and Commercial BanksDocument6 pagesDifferences between Co-operative Banks and Commercial BanksAnkit SuranaNo ratings yet

- ZKL Price List India 2013 - Zip - Cc-14!8!13Document35 pagesZKL Price List India 2013 - Zip - Cc-14!8!13viperrexxNo ratings yet

- Scholarship List (Other Bank)Document3 pagesScholarship List (Other Bank)Aditri ThakurNo ratings yet

- Customs Notification 36 - 2023Document2 pagesCustoms Notification 36 - 2023Raja SinghNo ratings yet

- July 2023 Banking & Financial Current Affairs NotesDocument118 pagesJuly 2023 Banking & Financial Current Affairs NotesGagan AgrawalNo ratings yet

- Debt J-LDocument576 pagesDebt J-LmerrylmorleyNo ratings yet

- Jawaban Tugas 1 Laboratorium AuditingDocument7 pagesJawaban Tugas 1 Laboratorium AuditingWibisono Sudirman90% (10)

- Japan Yen To Sri Lankan Rupees - Google SearchDocument1 pageJapan Yen To Sri Lankan Rupees - Google Searchhasitha.mahesh.hNo ratings yet

- FIRMS ContactsDocument25 pagesFIRMS Contactspratyush1200No ratings yet

- One Rupee SchemeDocument6 pagesOne Rupee SchemeSaravananNo ratings yet

- Good Stock Return GR0124000174Document2 pagesGood Stock Return GR0124000174manoj kushwahaNo ratings yet

- Promotruper Mensual 2013Document1 pagePromotruper Mensual 2013Pablo AcuñaNo ratings yet

- Industries in HaridwarDocument5 pagesIndustries in HaridwarShubham MishraNo ratings yet

- List of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Document2 pagesList of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Vikram PhalakNo ratings yet

- SBI Circle Contact Details with Nodal OfficersDocument2 pagesSBI Circle Contact Details with Nodal OfficersLearn AutoNo ratings yet

- MSME Care ListDocument5 pagesMSME Care Listmksingh13No ratings yet

- TECHNOWA Invoice 170 - 24.05.2023Document1 pageTECHNOWA Invoice 170 - 24.05.2023Mathewraj Dhanasekaran palanivelNo ratings yet

- Tara Sanitary Wares & Tiles: QuotationDocument2 pagesTara Sanitary Wares & Tiles: Quotationsharath mathewNo ratings yet

- 25 Historic and Memorable Currency Notes of Pakistan - SHUGHALDocument13 pages25 Historic and Memorable Currency Notes of Pakistan - SHUGHALMalik Umar AbidNo ratings yet

- Manhattan Platinum Transaction History Oct-AugDocument3 pagesManhattan Platinum Transaction History Oct-AugMichael MyintNo ratings yet

- TW2A12823900009RPOSDocument3 pagesTW2A12823900009RPOSarun poojariNo ratings yet

- Currency Converter Currency Name Amount: From United States of American Dollar - USD 100.000 To 77.313Document7 pagesCurrency Converter Currency Name Amount: From United States of American Dollar - USD 100.000 To 77.313Gomv ConsNo ratings yet

- Big GroupDocument31 pagesBig Groupvanita kunnoNo ratings yet

- Advising LC MARCH 2020 No. Date Our Ref. No. L/C No. Beneficiary Applicant Issuing Bank Country CCY Amount Amount (IDR)Document3 pagesAdvising LC MARCH 2020 No. Date Our Ref. No. L/C No. Beneficiary Applicant Issuing Bank Country CCY Amount Amount (IDR)Joshua JoviandoNo ratings yet

- Wa0039.Document50 pagesWa0039.shraddhaNo ratings yet

- English (En) : Home News Index Useful Links Paper/PDF VersionDocument28 pagesEnglish (En) : Home News Index Useful Links Paper/PDF VersionGee LeeNo ratings yet

- Nefteft MICR CodesDocument1,192 pagesNefteft MICR CodesDeepesh DivakaranNo ratings yet

- Mintwise Regular Coins of Republic IndiaDocument2 pagesMintwise Regular Coins of Republic IndiaPremPuesKumarNo ratings yet

- All Bank Micr Code No.Document85 pagesAll Bank Micr Code No.Ramkrishna MondalNo ratings yet

- RMA NPKA 01-NOV-2013sDocument4 pagesRMA NPKA 01-NOV-2013sAnup Lal RajbahakNo ratings yet

- Bank account statement for PT Bintang Wirama LestariDocument1 pageBank account statement for PT Bintang Wirama LestariAndiPetta100% (1)