Professional Documents

Culture Documents

CFA1 (2011) Alternative Investments

Uploaded by

zavia_02Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFA1 (2011) Alternative Investments

Uploaded by

zavia_02Copyright:

Available Formats

CFALEVEL1 STUDYSESSION18

ALTERNATIVE INVESTMENTS

Open- end vs. Closed- end NAV

a. Managed investment companies (mutual funds)

Investment company fees

one-time fees ongoing annual fees

Style Sector

b. Strategies

Index Global Stable Value

Definition

mimic an index

In-kind process

Advantages

price tax

Diversification

74.1. Alternative InvestmentsPart 1

Advantages

Exchange traded Better risk management Composition is known Operating expense ratio No trading at a discount or premium Tax

b,c. ETF

Dividend Few indices Disadvantages Intraday trade Inefficient markets Larger investors Market risk Asset class/ sector risk Risks Trading prices # NAV (depth and liquidity) Tracking errors Derivative risks --> credit risk Currency and country risks

Outright ownership

a

Types Leveraged equity position Mortgages Aggregation vehicles

Characteristics

d,e,f. Real Estate Investment

Cost method

e,f. Approaches to the valuation of real estate

Sales comparison method

Income method

Discounted after tax cash flow model

Seed stage

R&D

Formative stage

Start-up financing Early stage First stage financing

Initial marketing

74.2. Alternative InvestmentsPart 2

Commercial production

Stages

Balanced stage Expansion stage financing Later stage Second stage investing

Producing and selling products Not yet generating income

Third stage financing

Major expansion

g,h. Venture capital investing

Illiquidity

Mezzanine (bridge financing)

IPO

Long term horizon Difficulty in valuation Limited data Characteristics Entrepreneurial / Management mismatches Fund Manager incentive mistakes Timing in the business cycle Requirement for extensive operations analysis h. NPV of a venture capital project

Absolute return Limited partnership Forms Limited liability corporation Offshore corporation Long/short funds Classifications Market-neutral funds Global macro funds Event- driven funds Leverage Illiquidity Potential for mispricing k. Counterparty credit risk Settlement errors Short covering Margin calls Performance Self-selection bias Backfilling bias l. Biases Survivorship bias Smoothed pricing Option-like strategies Fee structures and gaming Effect of survivorship bias

i. Hedge fund

Unique risks

74.3. Alternative InvestmentsPart 3

Fund to invest in hedge funds

j. Fund of funds investing

Benefits Drawbacks

m. How legal issues affect valuation

m,n. Closely held companies

n. Valuation methods

Cost approach Comparable approach Income approach

o1. Distressed securities investing

o2. Compare VC with distressed securities investing

Role as an investment vehicle Commodities Motivation for investing in Commodities derivatives Commodity-linked securities Sources of return on Collateralized commodity futures position

p,q,r Commodities

a. Relationship between spot prices and expected future prices

Contango Backwardation

75. Investing In Commodities

Sources of return b. Commodity investment Risk Effect on portfolio

c. Commodity index strategy

Active investment

You might also like

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- Class NotesDocument77 pagesClass NotesSphamandla MakalimaNo ratings yet

- E&S Business Plan ReportDocument8 pagesE&S Business Plan ReportViknesh VikneshNo ratings yet

- Value CreationDocument71 pagesValue CreationSolNo ratings yet

- Lean Six Sigma Financial ImpactDocument26 pagesLean Six Sigma Financial Impactp4i9e8r5No ratings yet

- IP and Finance - Accounting and Valuation of IP Assets and IP-based FinancingDocument27 pagesIP and Finance - Accounting and Valuation of IP Assets and IP-based FinancinglizanthusNo ratings yet

- Financial Management - Module 1-6Document136 pagesFinancial Management - Module 1-6April OcampoNo ratings yet

- FINACC1 - Investment in Equity and Debt Instruments PDFDocument4 pagesFINACC1 - Investment in Equity and Debt Instruments PDFJerico DungcaNo ratings yet

- Business ValuationsDocument29 pagesBusiness ValuationsRishabh singhNo ratings yet

- BA449Chap005Document50 pagesBA449Chap005mashalerahNo ratings yet

- Valuation: Dr. Kumar Bijoy Financial ConsultantDocument26 pagesValuation: Dr. Kumar Bijoy Financial ConsultantrajanNo ratings yet

- Valuing Distressed Firms & Assets Under 40 CharactersDocument67 pagesValuing Distressed Firms & Assets Under 40 CharactersSaputra SanjayaNo ratings yet

- Establishing Objectives and Budgeting For The Promotional ProgramDocument15 pagesEstablishing Objectives and Budgeting For The Promotional ProgramQuang Nguyễn PhúNo ratings yet

- Comprehensive Finance Cheat Sheet Collection 1698244606Document52 pagesComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolfNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument42 pagesInvesting and Financing Decisions and The Balance SheetSap 155155No ratings yet

- FrameworksDocument13 pagesFrameworksShonit ChamadiaNo ratings yet

- Types of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderDocument16 pagesTypes of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderAin roseNo ratings yet

- Finc8019 S12Document27 pagesFinc8019 S12mcahya82No ratings yet

- V6HgxNl5RVOtpyb8KVjV Business Glossary 20220104Document12 pagesV6HgxNl5RVOtpyb8KVjV Business Glossary 20220104aleksandroNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- WH Tis ?: Fundamental Analysis A Fundamental AnalysisDocument7 pagesWH Tis ?: Fundamental Analysis A Fundamental AnalysisAbhinandan ChatterjeeNo ratings yet

- Alternative Investments SummaryDocument1 pageAlternative Investments Summarymanar.boulaabaNo ratings yet

- Lecture 4 - ReformattingDocument31 pagesLecture 4 - ReformattingnopeNo ratings yet

- PFRS for SMEs vs Full PFRS: Key DifferencesDocument14 pagesPFRS for SMEs vs Full PFRS: Key DifferencesAnthon GarciaNo ratings yet

- Derivatives IDocument59 pagesDerivatives IMDNo ratings yet

- Investments For Accounting SummaryDocument2 pagesInvestments For Accounting SummarymyzevelNo ratings yet

- Valuation Aspect in M&A DealsDocument21 pagesValuation Aspect in M&A DealsShivam KapoorNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 1st MeetingDocument69 pagesFINANCIAL MANAGEMENT MODULE 1 6 1st MeetingMarriel Fate CullanoNo ratings yet

- 12 BST All FactorsDocument1 page12 BST All FactorsProject IBDNo ratings yet

- Cross-Border M&A Valuation - Issues: Jayasimha P Director - Investment BankingDocument17 pagesCross-Border M&A Valuation - Issues: Jayasimha P Director - Investment Bankingmansavi bihaniNo ratings yet

- Lu - Valuation Challenges Credit Institutions Investment Firms - 03072015Document17 pagesLu - Valuation Challenges Credit Institutions Investment Firms - 03072015Simon AltkornNo ratings yet

- Technology Consulting - by SlidesgoDocument7 pagesTechnology Consulting - by Slidesgokriti.u24No ratings yet

- Financial Asset ManagementDocument26 pagesFinancial Asset ManagementDayani MasNo ratings yet

- SMEs - Key Differences Between Full PFRS and PFRS for SMEsDocument17 pagesSMEs - Key Differences Between Full PFRS and PFRS for SMEsDesai SarvidaNo ratings yet

- MBA Marketing 2Document23 pagesMBA Marketing 2Bianca Leyva100% (1)

- FSDM DM FP 1 1 20181204Document14 pagesFSDM DM FP 1 1 20181204saibabuNo ratings yet

- 4 Customer Relationship Cycle - RetentionDocument15 pages4 Customer Relationship Cycle - RetentionKartikey GargNo ratings yet

- Investment Management: CAFTA WebinarDocument38 pagesInvestment Management: CAFTA WebinarAryan PandeyNo ratings yet

- The Dupont Chart As An Analysis and Reporting Tool: Click Mouse To View SlidesDocument5 pagesThe Dupont Chart As An Analysis and Reporting Tool: Click Mouse To View SlidesChabala Vinay KumarNo ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare50% (2)

- M&A Valuation Bootcamp MaterialsDocument162 pagesM&A Valuation Bootcamp Materialsw_fibNo ratings yet

- Frameworks - IIMADocument8 pagesFrameworks - IIMAParth SOODANNo ratings yet

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

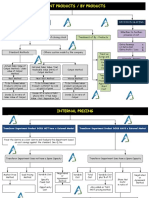

- Joint Products / by Products: Accounting Decision MakingDocument16 pagesJoint Products / by Products: Accounting Decision MakingKaran KashyapNo ratings yet

- Advance Corporate FinanceDocument53 pagesAdvance Corporate FinanceIdham Idham IdhamNo ratings yet

- Managing The Finance FunctionDocument12 pagesManaging The Finance FunctionDumplings DumborNo ratings yet

- ICAI Jan 30 2016Document34 pagesICAI Jan 30 2016Devasish ParmarNo ratings yet

- 02 Value Drivers - HWS2021Document38 pages02 Value Drivers - HWS2021Gonzalo De CorralNo ratings yet

- Aviation SeminarDocument40 pagesAviation SeminarSAlNo ratings yet

- Viewing Business Through The Lens of Financial StatementsDocument55 pagesViewing Business Through The Lens of Financial StatementsAkib Mahbub KhanNo ratings yet

- Deepanshucv & RDocument15 pagesDeepanshucv & RDeepanshu PathakNo ratings yet

- Managing Finance FunctionDocument3 pagesManaging Finance FunctionJoban Las PinyasNo ratings yet

- Formulate An Offer: Stephen Lawrence and Frank MoyesDocument13 pagesFormulate An Offer: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- Solution 3.1c Agency Risk Identification MatrixDocument17 pagesSolution 3.1c Agency Risk Identification MatrixrickmortyNo ratings yet

- Slides Part 1Document60 pagesSlides Part 1nichtnancyNo ratings yet

- B. FIG Analyst Training - Partie IDocument186 pagesB. FIG Analyst Training - Partie IFabrizio100% (1)

- CH Audit IFRS 9 BrochureDocument12 pagesCH Audit IFRS 9 BrochurelinaNo ratings yet

- BPP F3 MindmapDocument2 pagesBPP F3 MindmapGaurav HandaNo ratings yet

- Management Control SystemsDocument12 pagesManagement Control Systemswahyu dirosoNo ratings yet

- Presentation TranscriptDocument6 pagesPresentation TranscriptSagar JagwaniNo ratings yet

- Bba 1007 Business Mathematics and StatisticsDocument20 pagesBba 1007 Business Mathematics and StatisticsVentusNo ratings yet

- Curriculum and syllabus guide for commerce classes 11 and 12Document6 pagesCurriculum and syllabus guide for commerce classes 11 and 12Jay Karta100% (1)

- Overview of Financial Services in IndiaDocument2 pagesOverview of Financial Services in IndiaRahulRaheja100% (1)

- WWE® ThunderDome™ Takes Over Tropicana FieldDocument2 pagesWWE® ThunderDome™ Takes Over Tropicana FieldTitoNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument8 pagesFixed Asset and Depreciation Schedule: Instructions: InputsFaruk RhamadanNo ratings yet

- Corpo Syllabus - Atty Fabian Week5Document2 pagesCorpo Syllabus - Atty Fabian Week5Mark Joseph VirgilioNo ratings yet

- Michael Varley ResumeDocument3 pagesMichael Varley ResumeElizabeth YangNo ratings yet

- GS - Operating LeverageDocument29 pagesGS - Operating LeveragenewbedNo ratings yet

- Introducing A Travel Agency in BangladeshDocument40 pagesIntroducing A Travel Agency in BangladeshZubairia KhanNo ratings yet

- Wipro Balance Sheet - in Rs. Cr.Document3 pagesWipro Balance Sheet - in Rs. Cr.lakshmi336No ratings yet

- Mutual Fund Unit 2Document30 pagesMutual Fund Unit 2Aman Chauhan100% (1)

- Class X E Book Maths Chapter VI InstalmentDocument11 pagesClass X E Book Maths Chapter VI InstalmentManish KhakhraNo ratings yet

- Solution To Assignment 1 Winter 2017 ADM 4348Document19 pagesSolution To Assignment 1 Winter 2017 ADM 4348CodyzqzeaniLombNo ratings yet

- Ezz Steel, Al Ezz Steel Com..Document2 pagesEzz Steel, Al Ezz Steel Com..شادى احمدNo ratings yet

- Eie G8 SbiDocument32 pagesEie G8 Sbipiruthvi chendurNo ratings yet

- Krupanidhi School of Management: # 12/1, Chekka Bellandur Village, Carmelaram Post, Varthur Hobli, Bangalore-35Document3 pagesKrupanidhi School of Management: # 12/1, Chekka Bellandur Village, Carmelaram Post, Varthur Hobli, Bangalore-35RahulKrishnanNo ratings yet

- Icex FinalDocument33 pagesIcex FinalAmi Parekh MehtaNo ratings yet

- Contemporary Issues in Accounting: Solution ManualDocument20 pagesContemporary Issues in Accounting: Solution ManualKeiLiew0% (1)

- Econ Past Paper Questions and AnswersDocument6 pagesEcon Past Paper Questions and AnswersPharez Mc TairNo ratings yet

- ItlpDocument14 pagesItlpA_saravanavelNo ratings yet

- Multiple Choice Questions On Financial Accounting V2Document6 pagesMultiple Choice Questions On Financial Accounting V2Kate FernandezNo ratings yet

- File 7365772675460733734Document16 pagesFile 7365772675460733734Raisa Gelera100% (1)

- Beta CalculationDocument8 pagesBeta Calculationbrahmi_xyzNo ratings yet

- DormantDocument86 pagesDormantReechie TeasoonNo ratings yet

- Disclosure Statement Pursuant To The Pink Basic Disclosure GuidelinesDocument24 pagesDisclosure Statement Pursuant To The Pink Basic Disclosure GuidelinesRenato GoncalvesNo ratings yet

- THE COMPANIES ACT, 2017 (XIX of 2017) : Memorandum OF Association OFDocument5 pagesTHE COMPANIES ACT, 2017 (XIX of 2017) : Memorandum OF Association OFZainab IshaqNo ratings yet

- Ipo PDFDocument7 pagesIpo PDFGoutam ReddyNo ratings yet

- MCQ Test BankDocument97 pagesMCQ Test BankMilanNo ratings yet

- Corporate Finance: The Core Chapter 5 Interest RatesDocument207 pagesCorporate Finance: The Core Chapter 5 Interest Ratesedgargallego6260% (1)