Professional Documents

Culture Documents

Universiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370

Uploaded by

Nurul 'AinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Universiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370

Uploaded by

Nurul 'AinCopyright:

Available Formats

CONFIDENTIAL

AC/OCT 2009/TAX370

UNIVERSITI TEKNOLOGI MARA FINAL EXAMINATION

COURSE COURSE CODE EXAMINATION TIME

TAXATION 2 TAX370 OCTOBER 2009 3 HOURS

INSTRUCTIONS TO CANDIDATES 1. 2. 3. This question paper consists of FIVE (5) questions. Answer ALL questions in the Answer Booklet. Start each answer on a new page. Do not bring any material into the examination room unless permission is given by the invigilator. Please check to make sure that this examination pack consists of: i) ii) iii) the Question Paper an Answer Booklet - provided by the Faculty a two-page Appendix 1

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 9 printed pages

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

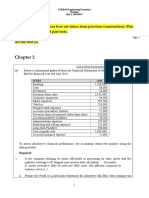

CONFIDENTIAL QUESTION 1

AC/OCT 2009/TAX370

Multispeed Bhd is a manufacturer of health and recreational equipment. The Trading, Profit and Loss Account for the year ended 31 March 2009 is as follows: Notes Sales Less: Cost of sales Add: Other income Less: Depreciation Remuneration Legal and professional fees Research and development Marketing and entertainment Leasing Finance charges General expenses Donations General provision for doubtful debt Interest on loan Net profit before taxation Notes: Cost of sales includes: 1 RM RM 3,206,700 (1,540,500) 1,666,200 216.400 1,882,600 13,600 417,600 48,700 119,000 68,800 18,000 60,000 339,000 152,700 5,000 21,600

3 4 5 6 7 8 9 10

(1,264,000) 618,600

(0

(ii) (iii) (iv)

Royalty of RM200.000 was paid to a non resident company on 15 March 2009. Withholding tax on the royalty was paid to the Inland Revenue Board on 30 April 2009. Closing stock amounted to RM20.000 is after deduction of goods damaged in fire. Purchase of a motorcycle to be used in the business for RM5,000. Insurance premium paid to a Japanese insurance company for RM14.000 on the importation of raw materials.

Other income comprises (i) (ii) (iii) (iv) Rental of a warehouse in Klang Interest on overdue trade debtors Interest on fixed deposit from Brunei (remitted on 3 November 2008) Dividend from Tenaga National Bhd (single tier) RM 48,000 6,400 112,000 50.000 216.400

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL 3. Remuneration comprises:

AC/OCT 2009/TAX370

RM (i) (ii) (iii) Employees salaries (include RM12,000 paid to a disabled employee) Overtime Contribution to Employees Provident Fund 300,000 36,600 81,000 417.600

4.

Legal and professional fees comprise: (i) (ii) (iii) (iv) (v) (vi) (vii) Renewal of rental agreement Recovery of a loan from an ex-employee Recovery of trade debt Stamp duty on increase in authorized share capital Auditing and accounting fees Staff recruitment charges paid to an employment agency Designing fees for business brochures RM 6,000 1,500 7,200 14,000 8,000 10,000 2.000 48.700

Research and development comprise: (i) (ii) (iii) Research expenses incurred on an approved project to produce an improved product Approved training expenses on the approved project Routine product testing RM 38,000 55,000 26,000 119.000 RM (i) Reimbursement of entertainment expenses incurred by company's marketing employees in entertaining clients (wholly related to sales) Cost of entertaining suppliers Lucky draw prizes to customers Promotional gifts at a trade fair held in Jakarta

Marketing and entertainment comprise:

(ii) (iii) (iv)

25,000 1,800 22,000 20.000 68.800

7.

Leasing A car which was not licensed for commercial transportation was leased at a monthly rate of RM1,500 since 1 June 2007. The cost of the car was RM180,000

8.

Finance charges comprise: (i) (ii) Foreign exchange loss on repayment of foreign loan Foreign exchange gain arising from settlement by overseas trade debtors RM 109,000 (49,000) 60.000 CONFIDENTIAL

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

AC/OCT 2009/TAX370

9.

General expenses comprise: (i) (ii) (iii) Scholarship to staff children Cost of constructing a building for child care centre for the employees benefits Revenue expenses incurred on the maintenance of the child care centre RM 15,000 300,000 24,000

339,000

10. Donations and contributions comprise: RM (i) (ii) (iii) (iv) (v) Cash donation to Putrajaya Public Library [the company elected S34(6)(g)] Cash donation to MAKNA [an approved institution under S44(6)] Television set to MAKNA Zakat Construction of a toilet for public use {S 34(6)(ha)} 110,000 3,000 6,000 8,700 25,000

152.700

11. Additional information: The initial and annual allowances on assets as at 31 March 2009 were: Initial allowance Annual allowance (RM) (RM) 6,000 14,000 14,000

Industrial building Plant and machinery

Capital allowances brought forward from previous years were RM5,700. Required: (i) Compute the income tax payable for Multispeed Bhd for the year of assessment 2009. Every item in the notes to the statement must be shown in your computation. Write 'NIL' where no adjustment is necessary. (26 marks) A penalty will be imposed on Multispeed Bhd if the difference between the tax estimate and the actual income tax payable exceed the 30% margin of error. Explain how Multispeed Bhd may avoid such penalty. (2 marks) When should the tax estimate for the year of assessment 2010 be submitted to the Inland Revenue Board? If Multispeed Bhd has estimated its tax payable for RM190,000, state the minimum amount to be estimated for tax payable for the year of assessment 2010? (2 marks) (Total: 30 marks) CONFIDENTIAL

(ii)

(iii)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL QUESTION 2 (A)

AC/OCT 2009/TAX370

MajuTerus Sdn Bhd commenced its manufacturing business in a rented factory on 1 March 2004 and prepares its first set of accounts to 28 February 2005 and to 28 February subsequently. In 2006, the company constructed its own factory building. Expenditures incurred on the construction were as follows: RM Cost of land Legal fees and stamp duty (RM30.000 relates to the purchase of land) Architect fees Construction cost Drainage and irrigation Electrical wiring and fittings Cost of machinery Cost of preparing site to install machinery 900,000 100,000 100,000 1,200,000 200,000 300,000 200,000 350,000

The building was completed in December 2006 and was immediately used as a factory on 1 January 2007. Based on the suggestion made by the company's employees, MajuTerus Sdn Bhd constructed two more buildings that were immediately used for the specific purpose once it is completed. The buildings were as follows: Living accommodation for employees - Construction cost - RM500,000 (including cost of land RM80.000) - Date of completion - 20 May 2007 Child care centre - Construction cost - Date of completion -

RM280.000 30 September 2008

Required: Compute the industrial building allowances for all relevant years of assessment up to year of assessment 2009. (13 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL (B)

AC/OCT 2009/TAX370

Matahari Sdn Bhd acquired a cocoa farm plantation from Solar Berhad on 31 March 2003. The company commenced business on 1 May 2003 and makes up its accounts to 30 April every year. Details of the capital expenditure incurred were as follows: Date 15 April 2003 10 October 2003 25 February 2004 5 August 2006 Clearing the old cocoa trees Planting of cocoa seedlings Construction of labour quarters Construction of club house for farm staffs RM 90,000 160,000 96,000 45,000

On 1 December 2007, the whole farm was sold to Suria Sdn. Bhd. for RM650,000. The financial year end of Suria Sdn Bhd is 31 July every year. Required: Compute the agriculture allowances and charges due to both companies for the relevant years of assessment up to year of assessment 2009 if Matahari Sdn. Bhd. made an election under Paragraph 27 of Schedule 3, Income Tax Act 1967. (12 marks) (Total: 25 marks) QUESTION 3 (A) Marquisa Sdn Bhd, a licensed manufacturer under the Sales Tax Act 1972, manufactures two types of product; Charming and Beautiful. Both products are not exempted from sales tax. The cost per unit and selling price per unit for both products are as follows: Charming RM Cost per unit Selling price per unit 800 1,200 Beautiful RM 500 1,000

The following were the transactions carried out by the company in the month of July and August 2009: 05/07/09 Sold 10 units of Charming and 20 units of Beautiful to a company located in Pulau Pangkor and Pulau Tioman respectively. Donated 12 units of Charming to Rumah Kanak-kanak Cacat, Johor Bharu. Export 1,000 units of Charming to Singapore. Sold 100 units of Beautiful to a company in Negeri Sembilan.

CONFIDENTIAL

18/07/09

31/07/09 08/08/09

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL 30/08/09 -

AC/OCT 2009/TAX370

The owner took two units of Charming and one unit of Beautiful for his own use.

Required: (i) Calculate the sales value and the amount of sales tax payable by Marquisa Sdn Bhd, if any, in respect of each of the above transactions assuming the rate of sales tax is 10%. (5 marks) State when is the sales tax due for payment by Marquisa Sdn Bhd. (1 mark) (iii) Calculate the amount of penalty that would be imposed if Marquisa Sdn Bhd paid the sales tax on 7 November 2009. (2 marks)

(ii)

(B)

(a) Who is chargeable to service tax and what is the rate of tax? (3 marks) (b) AMS Associates is an accounting firm in Sungai Petani. Its annual turnover was RM350,000 for the financial year which ended 31 December 2008. On 30 April 2008, AMS Associates had completed an accounting job for KAPKAP Trading. AMS Associates sent a bill to KAPKAP Trading charging accounting fees of RM4,000 and sundry expenses of RM75. The owner of KAPKAP Trading sent a cheque on 15 May 2008 to settle the bill in full. Required: (i) Prepare the invoice to be issued to KAPKAP Trading. Show your workings. (2 marks) (ii) When must AMS Associates remit the service tax collected to the relevant authority in respect of the above transaction in order to avoid late payment penalty? (1 mark) (Total: 14 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/OCT 2009/TAX370

QUESTION 4 Shachita Sdn Bhd is a manufacturer of isotonic drinks. It decided to expand its business by producing a new herbal drinks and the capital expenditures incurred in 2009 are as follows: RM 500,000 20,000 75,000

Land Machinery Motor vehicle Factory building

100,000

Other information in 2009 is as follows: RM 1. 2. 3. 4. Adjusted business income Current year capital allowance Unabsorbed capital allowance brought forward from previous year Unrealized reinvestment allowance from previous year

170,000 45,000 6,000

5,300

Required (i) Compute the chargeable income for Shachita Sdn Bhd for the year of assessment 2009. Show your workings. (7 marks) State any three (3) conditions that must be fulfilled for claim of reinvestment allowance in relation to rearing of chicken and ducks. (4 marks) (Total: 11 marks)

(ii)

QUESTION 5 (A) Intekma Sdn Bhd commenced business on 1 June 2004 as a travel agent and made up its accounts to 31 December annually. In January 2005, Puncak Sdn Bhd acquired ordinary shares of Intekma Sdn Bhd. As a result, Intekma Sdn Bhd was required to change its accounting date to 30 September to conform to its parents company. The accounts prepared by Intekma Sdn Bhd over the years were as follows:Accounting Period 1 June 2004 - 31 December 2004 1 January 2005 - 30 September 2005 1 October 2005 - 30 September 2006 1 October 2006 - 30 September 2007 1 October 2007 - 30 September 2008

Hak Cipta Universiti Teknologi MARA

Adjusted Income / (Loss) RM 12,000 45,000 (13,000) 25,000 46,000

CONFIDENTIAL

CONFIDENTIAL Required:

AC/OCT 2009/TAX370

State the basis period for each year of assessment up to year of assessment 2009 and calculate the adjusted income / (loss) for each of the relevant year of assessment. State the overlapping period (if any). (8 marks) (B) (i) List all the six (6) types of income which will attract withholding tax if they are paid to a non-resident recipient. (3 marks) (ii) Ayer Moiek Sdn Bhd is currently developing a sport complex for futsal in Sungai Layar. During the year ended 30 September 2009 the company made the following payments: 1. RM3,500,500 to Sport Unity Ltd. (resident in Australia) for work carried out for the sport complex. The breakdown of the RM3,500,500 is as follows: Nature of payment Cost of plant and machinery Technical advice on the installation of plant and machinery rendered in Malaysia Contract work on infrastructure and building carried out in Malaysia 2. RM 1,200,000 700,000 1,600,500

RM998.000 being royalties paid to Sport Planet Ampang (resident company based in Ampang, Selangor) for use of patents relating to foundation work.

Required: State with reasons whether the above payments made by Ayer Moiek Sdn Bhd are subject to withholding tax. State the rate(s) imposed, sections (if any) and the amount of withholding tax (if applicable), and the due date of payment. (9 marks) (Total: 20 marks)

END OF QUESTION PAPER

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

APPENDIX 1(1)

AC/OCT2009/TAX370

The following tax rates and allowances are to be used in answering the questions:

(a) Companies (b) Small Companies (c) Resident individuals Chargeable Income RM 2,500 0 2,501 5,000 5,001 20,000 20,001 35,000 35,001 50,000 50,001 70,000 70,001 100,000 Above 100,000

Income Tax Rates 25% 20%

Rate

0% 1% 3% 7% 12% 19% 24% 27%

27%

Cumulative Tax RM 0 25 475

1,525 3,325 7,125 14,325

(d) Non-resident individuals

Benefits-in kind (BIK) scale rates as per Inland Revenue Board (IRB) guidelines.

Cost of car when new RM Up to 50,000 50,001 75,000 75,001 100,000 100,001 150,000 150,001 200,000 200,001 250,000 250,001 350,000 350,001 500,000 500,001 and above

Annual value of BIK RM 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

APPENDIX 1 (2)

AC/OCT2009/TAX 370

Household furnishing, apparatus and appliances

Types of BIK Semi-furnished with furniture in lounge, dining room or bedroom Plus one or more of the following: Air-conditioners, curtains, carpets Plus one or more of the following: Kitchen equipment, crockery, utensils, appliances i.e fully furnished

Annual value of BIK RM 840

1,680

3,360

Rate of Capital Allowances Motor Vehicles Initial allowance Annual allowance 20% 20% Plant & Machinery 20% 14% Computers Others Industrial Building 10% 3%

20% 40%

20% 10%

Real property gains tax Tax rate % A Companies

Disposal within the following period after acquisition: In the first two years In the third year In the fourth year In the fifth year In the sixth year of thereafter

B Other exept C

C Non-citizens

30 20 15 5 5

30 20 15 5 0

30 30 30 30 5

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

You might also like

- TAX320Document14 pagesTAX320Faiz MohamadNo ratings yet

- This Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARADocument7 pagesThis Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARAFaiz Mohamad0% (1)

- ACC4182010 BDocument10 pagesACC4182010 Bashra16605No ratings yet

- mkt243 2011 S1Document6 pagesmkt243 2011 S1rxzlajuNo ratings yet

- Dec 06Document13 pagesDec 06Kelly Tan Xue LingNo ratings yet

- TAX320Document13 pagesTAX320Faiz MohamadNo ratings yet

- Tutorial 4 - Industrial Building AllowanceDocument3 pagesTutorial 4 - Industrial Building AllowanceChan YingNo ratings yet

- D12999R64581 PDFDocument8 pagesD12999R64581 PDFNoor Liza AliNo ratings yet

- FAR100 FAR110-oct2007Document9 pagesFAR100 FAR110-oct2007kaitokid77No ratings yet

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument20 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTang Swee ChanNo ratings yet

- TAX320Document14 pagesTAX320Faiz MohamadNo ratings yet

- F6mys 2007 Dec PPQDocument19 pagesF6mys 2007 Dec PPQAnslem TayNo ratings yet

- Finance 242Document11 pagesFinance 242norfitrahmNo ratings yet

- Malaysian Tax FrameworkDocument11 pagesMalaysian Tax FrameworkDylan Ngu Tung HongNo ratings yet

- Final Examination Personal TaxationDocument9 pagesFinal Examination Personal TaxationNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- F6 Pilot PaperDocument19 pagesF6 Pilot PaperSoon SiongNo ratings yet

- Fundamentals Level – Skills Module Taxation (MalaysiaDocument12 pagesFundamentals Level – Skills Module Taxation (MalaysiaBeeJuNo ratings yet

- Fin420 540Document11 pagesFin420 540Zam Zul0% (1)

- Bmac 5203Document10 pagesBmac 5203ShaanySirajNo ratings yet

- Topic5 Capital Allowance Student 2016Document3 pagesTopic5 Capital Allowance Student 2016Veenesha MuralidharanNo ratings yet

- Tax 2014Document12 pagesTax 2014kannadhassNo ratings yet

- Fin420 - Fin540oct 09Document12 pagesFin420 - Fin540oct 09Mohamad Noor ZhafriNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2009/FAR360 2Syazliana KasimNo ratings yet

- Pyq Acc 116Document7 pagesPyq Acc 116HaniraMhmdNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingNo ratings yet

- A221 MC 3 - StudentDocument5 pagesA221 MC 3 - StudentNajihah RazakNo ratings yet

- Tutorial Chapter 3 (IBA)Document4 pagesTutorial Chapter 3 (IBA)Nashrul IqmalNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2006/ACC165/211Document6 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2006/ACC165/211Mamek Zaidi KuddiqNo ratings yet

- MC 3 - PPE - A201 - StudentDocument4 pagesMC 3 - PPE - A201 - Studentlim qsNo ratings yet

- TMA 1 BA2 Jan 2015 RevisionDocument4 pagesTMA 1 BA2 Jan 2015 RevisionHamshavathini YohoratnamNo ratings yet

- PPE Accounting for Apparel ManufacturerDocument4 pagesPPE Accounting for Apparel ManufacturerTeo ShengNo ratings yet

- Ppe ExerciseDocument8 pagesPpe ExerciseNajihah NordinNo ratings yet

- Homework Akaun Cuti ChinaDocument5 pagesHomework Akaun Cuti ChinaAnonymous ICYc0CNo ratings yet

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Tutorial 1: 1. Included in The Cost of Sales AreDocument3 pagesTutorial 1: 1. Included in The Cost of Sales AreOrangeeeeNo ratings yet

- SEMESTER A141 BKAM3023 MANAGEMENT ACCOUNTING II TUTORIAL QUESTIONSDocument11 pagesSEMESTER A141 BKAM3023 MANAGEMENT ACCOUNTING II TUTORIAL QUESTIONSAwnieAzizanNo ratings yet

- AFAB233 Tutorial - PPE - 021819Document7 pagesAFAB233 Tutorial - PPE - 021819Leshiga GunasegarNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- 2009 June QuestionsDocument10 pages2009 June QuestionsFatuma Coco BuddaflyNo ratings yet

- Engineering Economics RevisionDocument43 pagesEngineering Economics RevisionDanial IzzatNo ratings yet

- ACCT6034 MID RCQuestionDocument5 pagesACCT6034 MID RCQuestionOshin MenNo ratings yet

- COEB442 - Sem - 2 - 2015-2016 RevisionDocument37 pagesCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNo ratings yet

- ICA10Document5 pagesICA10Mohamad FaisalNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Document5 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Syazliana KasimNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- Deloitte Tax Challenge 2012Document4 pagesDeloitte Tax Challenge 2012伟龙No ratings yet

- Tax ComputationDocument13 pagesTax ComputationEcha Sya0% (1)

- BKAR 1013 FINANCIAL ACCOUNTING AND REPORTING IDocument4 pagesBKAR 1013 FINANCIAL ACCOUNTING AND REPORTING Idini sofiaNo ratings yet

- Acca Tx-Mys 2019 SeptemberDocument13 pagesAcca Tx-Mys 2019 SeptemberChoo LeeNo ratings yet

- Taxation Exam Qualifying ExaminationDocument11 pagesTaxation Exam Qualifying ExaminationkannadhassNo ratings yet

- Tutorial 4 5 - FA MA QuestionDocument6 pagesTutorial 4 5 - FA MA Questionyongjin95No ratings yet

- Universiti Teknologi Mara Final Examination: Confidential EM/APR 2010/MEM575/KJP585/450Document8 pagesUniversiti Teknologi Mara Final Examination: Confidential EM/APR 2010/MEM575/KJP585/450Pierce EpoiNo ratings yet

- Far100 110Document12 pagesFar100 110itssfatinNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- BUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMFrom EverandBUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Defination of Total Quality ManagementDocument4 pagesDefination of Total Quality ManagementAinnur ArifahNo ratings yet

- Acc - System Develop in Muslim SocietyDocument23 pagesAcc - System Develop in Muslim SocietyAinnur ArifahNo ratings yet

- Provisions and Contingencies SlidesDocument28 pagesProvisions and Contingencies SlidesAinnur Arifah100% (1)

- Masb 9Document30 pagesMasb 9Ainnur ArifahNo ratings yet

- Masb 9Document30 pagesMasb 9Ainnur ArifahNo ratings yet

- Maf 680Document5 pagesMaf 680Ainnur ArifahNo ratings yet

- ESanchit Document Code With Declaration Level C 1Document9 pagesESanchit Document Code With Declaration Level C 1Shylesh KumarNo ratings yet

- Invoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoDocument1 pageInvoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoBinode SarkarNo ratings yet

- MOV EIL Spec 2 PDFDocument134 pagesMOV EIL Spec 2 PDFpl_arunachalam79No ratings yet

- PeopleSoft v9 1 Accounts PayableDocument20 pagesPeopleSoft v9 1 Accounts PayableRaghu VenkataNo ratings yet

- GST Notes For Vi SemesterDocument55 pagesGST Notes For Vi SemesterNagashree RANo ratings yet

- LEO CopiesDocument18 pagesLEO CopiesSuneethaaNo ratings yet

- Sap Fund MGMTDocument21 pagesSap Fund MGMTRupang ShahNo ratings yet

- Customer Details: GST NO.:24AAFCA3788D1ZSDocument2 pagesCustomer Details: GST NO.:24AAFCA3788D1ZSMojilo GujjuNo ratings yet

- Logistic Officer Interview Questions and AnswersDocument25 pagesLogistic Officer Interview Questions and AnswersMuhammadHumayunKhrel100% (4)

- Chapter 1Document6 pagesChapter 1Xsob LienNo ratings yet

- Account Configuration Guide - ADocument33 pagesAccount Configuration Guide - Apeixe.sanguebomNo ratings yet

- R12 India Localization Technical OverviewDocument86 pagesR12 India Localization Technical OverviewRamesh Babu Pallapolu100% (2)

- Fire Fighting EquipmentDocument48 pagesFire Fighting EquipmentMuhammadIqbalMughalNo ratings yet

- Po and Goods Received Policy (Pay by Invoice Format)Document3 pagesPo and Goods Received Policy (Pay by Invoice Format)snadminNo ratings yet

- CRM Billing V2Document9 pagesCRM Billing V2Suresh BabuNo ratings yet

- Customs Valuation System in EthiopiaDocument107 pagesCustoms Valuation System in EthiopiaabaynehNo ratings yet

- Implementing Receivables Credit To CashDocument438 pagesImplementing Receivables Credit To CashHimanshu GosainNo ratings yet

- New Arambagh Trading - PCG1408Document1 pageNew Arambagh Trading - PCG1408AvijitSinharoyNo ratings yet

- Contractor Welcome PackDocument11 pagesContractor Welcome PackerikNo ratings yet

- Bgi-Ethiopia Process of Purchasing Revision: 01 Date:1/11/2016 Purchase RequestDocument44 pagesBgi-Ethiopia Process of Purchasing Revision: 01 Date:1/11/2016 Purchase RequestZewduErkyhunNo ratings yet

- Internship Report (Fahad Nasir) 2Document23 pagesInternship Report (Fahad Nasir) 2Fahad NasirNo ratings yet

- E Logistics 1Document23 pagesE Logistics 1hakimaNo ratings yet

- Geneva OverviewDocument54 pagesGeneva OverviewNishant KumarNo ratings yet

- Kunci Jawaban Auditing Chapter 14 Arens 15th EditionDocument8 pagesKunci Jawaban Auditing Chapter 14 Arens 15th EditionArfini Lestari100% (2)

- GL Drilldown For Financials For India TransactionsDocument39 pagesGL Drilldown For Financials For India TransactionsPrem KishanNo ratings yet

- Telia Hinnasto MHS 03 2018 ENDocument4 pagesTelia Hinnasto MHS 03 2018 ENEduardo SantosNo ratings yet

- Service tax registers and reportsDocument4 pagesService tax registers and reportstamal.me1962100% (1)

- ZOL invoice statement for customer ID 146589Document2 pagesZOL invoice statement for customer ID 146589CharlieEleerNo ratings yet

- GST EcosystemDocument15 pagesGST EcosystemAmarjit PriyadarshanNo ratings yet

- Merchant Banking: Chapter 1 - IntroductionDocument38 pagesMerchant Banking: Chapter 1 - IntroductionJermaine WeissNo ratings yet