Professional Documents

Culture Documents

Claw3201 Sem 1 2012 Lecture 1

Uploaded by

Kun YueOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Claw3201 Sem 1 2012 Lecture 1

Uploaded by

Kun YueCopyright:

Available Formats

2012-3-5

Australian Taxation System Lecture 1

Introduction [text: Chapter 1, Fundamental Tax Legislation pages VII-XXIX and Income Tax Assessment Act 1997 Parts 1-1 and 1-2]

What is this lecture about?

Administration Assessment: mainly problem solving Skills to solve tax problems

Reading and applying cases Reading and applying statute laws Reading and applying rulings Finding relevant materials

Administration

UOS Outline Assessment Prescribed Books Reference Books Overview Context

Context

Just what is a tax?

Maybe not as easy as it seemed. Tax can shape society: literally

Where does tax law come from?

Australia is blessed with 2 primary tax acts and heaps of supporting acts The Income Tax Assessment Act 1936 The Income Tax Assessment Act 1997

Why learn about tax?

What the???

2012-3-5

The essential elements of any tax system

Who taxes Who to tax What to tax When to tax How much to tax What to do with the tax Just what is the system?

The Australian taxation system

Reflect on ss 6-5 and 6-10 ITAA97 as to: Who? What? Then ss4-10 and 4-15 ITAA97 as to: How much? Then s 3-5(1) as to: When? Difficulties when applied internationally

Commonwealth taxation

The Constitution The States and Territories The Commonwealth parliament The government The Treasury The Commissioner of Taxation The Australian Taxation Office [annual report

summary at p9]

http://www.ato.gov.au/corporate/content.aspx?doc=/content/53636.htm&mnu=49806&mfp=001/00 1

OECD: Tax Revenue Statistics 2006

(% of total tax revenue)

OECD average Taxes Aus NZ Jap Ger Fra UK US

Personal income tax

37

41

19

25

18

29

37

25

Corporate income tax

22

16

17

11

12

11

Social security

37

38

37

19

24

25

Consumption tax

27

33

19

28

25

29

17

31

Australian Taxation Numbers

Australian Bureau of Statistics Tax stats 09/10

http://www.abs.gov.au/ausstats/abs@.nsf/mf/5506.0

What makes a good tax system?

Equity Efficiency Simplicity

ATO Tax rates 11/12

http://www.ato.gov.au/individuals/content.aspx?doc=/content/12333.ht m&mnu=42590&mfp=001

ATO Tax rates post 1 July 2012 carbon price: http://www.ato.gov.au/content/00309813.htm ATO: Tax Tables 11/12

http://www.ato.gov.au/businesses/content.aspx?doc=/content/33283.ht m&alias=taxtables

These may conflict There may be others for example:

prevention of tax avoidance international competitiveness

2012-3-5

Basics of income tax law

No statutory overarching definition of income Judges adopted trust definition of income, though this was probably the definition of income according to the general law Central part the flow concept Capital / Income distinction [fruit / tree]

Australian tax statutes

What is a tax? Elements of tax:

Compulsory, no goods or services in return, liability imposed according to general criteria, does not have to go into consolidated revenue

Problem of unjust appropriation 51(xxxi) Constitution Current statutes Income Tax Assessment Act 1997 [ITAA1997] and supplemented by Income Tax Assessment Act 1936 [ITAA 1936] Constitutional basis of taxation law s 51(ii) of the Australian Constitution and procedural rule in s 55.

Sources of law and where to find them

ITAA 1936, 1997 why two statutes? Section 13 of ITAA 1997 Cases and materials available through the library electronic database catalogue, T for Tax and Accounting Online, Tax Notes and TAXABS. See also: AustLII, ATO website, ATO Legal Database, Treasury website COMLAW most important for statute Rulings available on Tax and Accounting Online through the library and the ATO Legal Database

Rulings

IT: Tax rulings up until 30 June 1992 TR: Tax Rulings 1 July 1992 onwards TD: Tax Determinations Constitutes a Statutory Estoppel See 35770 schedule 1 Taxation Administration Act 1953 If the Act is more favourable to the taxpayer, subject to time limits, Commissioner may apply the Act

Conclusion: 3 sources of law

Statutes: ITAA 1936, 1997. Cases: mainly in the Federal Court in the High Court of Australia, Family Court Has Jurisdiction. After 1 July 1992 Rulings where they are more favourable to the taxpayer than the general law. If in doubt get a ruling For ruling to be binding it must be strictly followed: Bellinz

Other tax acts

Fringe Benefits Tax Assessment Act 1986 A New Tax System (Goods and Services Tax) Act 1999 Income Tax Rates Act 1986 Taxation Administration Act 1953 International Tax Agreements Act 1953

2012-3-5

Statutory tax formula

Yearly impost: s3-5(1) ITAA 97 Tax payable = (taxable income x rate) offsets [s4-10] Taxable income = assessable income deductions [s415]: Use these formulas to see how to minimise your tax. Rates set in Income Tax Rates Act 1986 Tax rates are progressive and differ between:

Companies and other entities Residents and non-residents There may be penalty rates [eg trusts] Note withholding tax Capital Gains Tax discount This leads to a lot of tax planning

Capital/income distinction

Capital gains for individuals, trusts and superannuation funds still treated favourably under the tax regime: Division 115 of ITAA97 and concessions in Division 152 Companies get no concession for Capital Gains and may have trouble using losses

Withholding tax

Withholding tax does not depend on source but the residences of the payer and payee Only applies to dividends, interest and royalties. Withholding tax rates affected by DTAs [double tax treaties] A tax sharing regime involving credits A tax on gross income A final tax section: 128D ITAA 1936

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HMA v. FAMCO - ComplaintDocument28 pagesHMA v. FAMCO - ComplaintSarah BursteinNo ratings yet

- Sunanda Pushkar FinalDocument47 pagesSunanda Pushkar FinalLive LawNo ratings yet

- 5 - Jimenez V SorongonDocument2 pages5 - Jimenez V SorongonAmberChanNo ratings yet

- FSSAI Registration in Coimbatore, Get FSSAI License in 1-Day - Biztone - in PDFDocument5 pagesFSSAI Registration in Coimbatore, Get FSSAI License in 1-Day - Biztone - in PDFBiztoneNo ratings yet

- 7.philippine Airlines vs. COADocument11 pages7.philippine Airlines vs. COAGwyneth SantosNo ratings yet

- Public Law ConstitutionDocument88 pagesPublic Law ConstitutionAlaa NouiNo ratings yet

- Hindu Marriage Act, 2017 of PakistanDocument8 pagesHindu Marriage Act, 2017 of PakistanLatest Laws TeamNo ratings yet

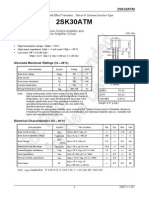

- 2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsDocument4 pages2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsIee Jimmy Zambrano LNo ratings yet

- Task 2 - Analysis The Significance of Consumer Protection Laws and Online Trading in CanadaDocument5 pagesTask 2 - Analysis The Significance of Consumer Protection Laws and Online Trading in CanadaPhu Khet NaingNo ratings yet

- Exotic Animals DocumentDocument4 pagesExotic Animals DocumentLas Vegas Review-JournalNo ratings yet

- 04 Garcia-Quiazon vs. Belen, 702 SCRA 707, G.R. No. 189121 July 31, 2013Document14 pages04 Garcia-Quiazon vs. Belen, 702 SCRA 707, G.R. No. 189121 July 31, 2013Jaypoll DiazNo ratings yet

- CONTRACT OF LEASE Ni TilloDocument2 pagesCONTRACT OF LEASE Ni TilloDeil L. NaveaNo ratings yet

- Nekrilov v. City of Jersey City, No. 21-1786 (3d Cir. Aug. 16, 2022)Document48 pagesNekrilov v. City of Jersey City, No. 21-1786 (3d Cir. Aug. 16, 2022)RHTNo ratings yet

- PetitionDocument8 pagesPetitionJason SansoneNo ratings yet

- CMO 41 2015 Revised Rates To Be Charged by Off Dock Container Yard Container Freight Stations OCC Stamped by UPDocument4 pagesCMO 41 2015 Revised Rates To Be Charged by Off Dock Container Yard Container Freight Stations OCC Stamped by UPPortCallsNo ratings yet

- Ii Mech Iv Sem QB 2013 2014 Even PDFDocument117 pagesIi Mech Iv Sem QB 2013 2014 Even PDFNatesha SundharanNo ratings yet

- CONTRACTSDocument28 pagesCONTRACTSBiway Regala100% (1)

- Case DigestDocument22 pagesCase DigestPheobelyn EndingNo ratings yet

- Police Shooting Leaves Student ParalyzedDocument2 pagesPolice Shooting Leaves Student ParalyzedKarenGarcíaNo ratings yet

- Philippine Bank Deposits During WWII Deemed NullDocument5 pagesPhilippine Bank Deposits During WWII Deemed NullAr Yan SebNo ratings yet

- AmrikDocument3 pagesAmrikstar trendzNo ratings yet

- December 2, 2015 Tribune Record GleanerDocument16 pagesDecember 2, 2015 Tribune Record GleanercwmediaNo ratings yet

- Variable Life Insurance - Request For Policy Surrender v89Document4 pagesVariable Life Insurance - Request For Policy Surrender v89Jason JayNo ratings yet

- The Legal Profession in England and WalesDocument8 pagesThe Legal Profession in England and WalesNita Lorina MariaNo ratings yet

- Moot Problem Raj Vs Shivani MalhotraDocument14 pagesMoot Problem Raj Vs Shivani MalhotraRanendraprataproutNo ratings yet

- Causes of French Rev 2Document2 pagesCauses of French Rev 2margajavi2No ratings yet

- Artex Development Co. vs. Wellington Ins. CoDocument2 pagesArtex Development Co. vs. Wellington Ins. CoJohn Mark RevillaNo ratings yet

- Real Estate Mortgate Case DIgestsDocument14 pagesReal Estate Mortgate Case DIgestsDonald Dwane Reyes100% (1)

- Class ActionDocument4 pagesClass ActiongeetuaggarwalNo ratings yet

- G.R. No. L-21906 August 29, 1969 - INOCENCIA DELUAO, ET AL. v. NICANOR CASTEEL, ET AL.Document12 pagesG.R. No. L-21906 August 29, 1969 - INOCENCIA DELUAO, ET AL. v. NICANOR CASTEEL, ET AL.Dah Rin CavanNo ratings yet