Professional Documents

Culture Documents

Market Outlook 27th March 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 27th March 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

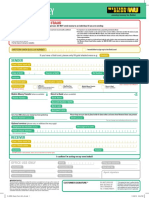

Market Outlook

India Research

March 27, 2012

Dealers Diary

The Indian markets are expected to open in the green today tracing positive opening in most of the Asian bourses. Asian stocks rose the most in two weeks, after Federal Reserve Chairman Ben S. Bernanke said monetary policy needs to focus on creating jobs and South Koreas consumer confidence improved. The US markets (Nasdaq and the S&P 500) closed at their fresh multi-year highs on Monday. The strong upward move by stocks came on the heels of a speech by Bernanke, who noted that the U.S. unemployment rate has declined faster than the Fed predicted but cautioned that the jobs market remains far from normal. He also assured that the Fed's zero-interest rate policy and other support measures would continue to reduce unemployment over time by promoting economic growth. Weak global cues on fears over Spain's fiscal outlook and lingering worries about slowing global growth dragged Indian shares sharply lower on Monday. Also, with the government preparing to pass retrospective amendments to the income-tax laws, investors fear that new tax rules could affect capital inflows through participatory notes.

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%)

(Pts)

(Close)

(1.8) (309.0) 17,053 (1.8) (1.4) (1.2) (94.0) (93.0) (75.4) 5,184 6,249 6,533 6,391 7,235 9,861 7,910 6,011

(Close)

(1.6) (101.8)

(2.0) (148.2) (1.4) (138.1) (1.9) (149.1) (1.4)

Chg (%)

(2.4) (289.7) 11,571 (2.2) (245.4) 10,978 (83.6)

(Pts)

1.2 1.8 0.8 0.1 0.0 (0.5) 0.1

Chg (%)

160.9 13,242 54.7 47.8 3,123 5,903

Markets Today

The trend deciding level for the day is 17,151 / 5,211 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,280 17,506 / 5,248 5,311 levels. However, if NIFTY trades below 17,151 / 5,211 levels for the first half-an-hour of trade then it may correct up to 16,924 16,795 / 5,148 5,111 levels.

Indices SENSEX NIFTY S2 16,795 5,111 S1 16,924 5,148 PIVOT 17,151 5,211 R1 17,280 5,248 R2 17,506 5,311

6.8 10,018 0.1 20,669 (15.6) 1.1

(Pts)

2,975 2,351

(Close)

Indian ADRs

INFY WIT IBN HDB

Advances / Declines Advances Declines Unchanged

0.7 0.3 (2.0) 0.8

0.4 0.0 (0.7) 0.3

BSE

$57.4 $10.7 $35.1 $33.6

NSE

News Analysis

Proposed hike in stamp duty by Maharashtra govt. to have a negative impact on the real estate sector Reliance Industries BP to jointly work on KG-D6

detailed news analysis on the following page

919 1,955 113

328 1,137 48

Net Inflows (March 22, 2012)

` cr FII MFs Purch 4,941 374 Sales 4,611 286 Net 330 88 MTD 8,797 (1,080) YTD 45,094 (5,107)

Volumes (` cr) BSE NSE

3,801 10,690

FII Derivatives (March 26, 2012)

` cr

Index Futures Stock Futures

Purch 3,102 5,129

Sales 4,536 5,289

Net (1,435) (160)

Open Interest 17,561 30,182

Gainers / Losers

Gainers Company

Max India Jaiprakash Asso Mphasis Dish TV India Thermax

Losers Company

Manappuram Opto Circuits Shree Renuka Sug HDIL IRB Infra

Price (`)

178 82 429 59 483

chg (%)

3.9 2.6 2.3 2.3 1.8

Price (`)

32 255 30 89 180

chg (%)

(11.0) (7.3) (7.3) (7.0) (6.9)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Proposed hike in stamp duty by Maharashtra govt. to have a negative impact on the real estate sector

The Maharashtra state government has proposed to increase stamp duty on residential and commercial leave and license agreements according to Times of India. The proposed plan is to increase stamp duty to 0.1% on residential properties from a maximum of `25,000 paid currently for 60 months and 0.4% on commercial properties from a maximum of `50,000 paid currently for 60 months. The commercial and residential segments, which were already witnessing a significant decline in demand from end-users due to high prices and interest rates, have been witnessing an increase in leasing activity since the past one year. If this plan is implemented, it will further affect the leasing segment negatively, as it will push up the overall leasing cost. Stamp duty is paid by the end-user and, thus, developers would not be impacted directly but would find it difficult to increase rents and could witness a decline in demand. This move may affect companies that have a high exposure to the leasing segment in Maharashtra. We continue to remain Neutral on the real estate sector.

Reliance Industries BP to jointly work on KG-D6

Reliance Industries (RIL) and its partner BP are expected to submit an integrated development plan to increase natural gas from all the 18 discoveries in the KGD6 block to the government by October 2012. Both the companies are projected to commence production from R-Series, the third largest gas find in the eastern offshore KG-D6 block, from CY2015 and production from satellite fields from CY2016. KG-D6 gas block had hit an all-time low production of 28mmscmd, as RIL had shut six wells due to water and sand ingress during the week ending March 4, 2012. Further, Dhirubhai 1 and 3 gas fields in the eastern offshore KGDWN-98/3 output had plummeted to 28mmscmd during the same week. Including the gas production of 6.5mmscmd from MA fields, total production from KG-D6 block averaged 35mmscmd (significantly below the field development plan of 70mmscmd approved during 2006) during the same week. We continue to await further clarity on the issue. Meanwhile, we maintain our Buy recommendation on the stock with a target price of `923.

March 27, 2012

Market Outlook | India Research

Economic and Political News

Govt. allows 1mn tonnes of extra sugar exports Power companies lost 8.7bn units due to coal shortages: govt. Interest rates on post-office operated small savings scheme hiked up by 0.5%

Corporate News

Car making operations at Gurgaon plant will continue: Maruti Bank of Maharashtra get shareholders nod for `995cr pref. issue Gammon Infra bags `935 cr road project from NHA

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

March 27, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

March 27, 2012

You might also like

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 6th January 2012Document4 pagesMarket Outlook 6th January 2012Angel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Market Outlook 10th January 2012Document4 pagesMarket Outlook 10th January 2012Angel BrokingNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 12th January 2012Document4 pagesMarket Outlook 12th January 2012Angel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 7th December 2011Document4 pagesMarket Outlook 7th December 2011Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Marudyog 20110607Document3 pagesMarudyog 20110607hemen_parekhNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 16th February 2012Document4 pagesMarket Outlook 16th February 2012Angel BrokingNo ratings yet

- Market Outlook 26th December 2011Document4 pagesMarket Outlook 26th December 2011Angel BrokingNo ratings yet

- Market Outlook 7th March 2012Document4 pagesMarket Outlook 7th March 2012Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 24th February 2012Document4 pagesMarket Outlook 24th February 2012Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Document4 pagesDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 17th February 2012Document4 pagesMarket Outlook 17th February 2012Angel BrokingNo ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- 2013-7-9 DBS Lim&TanDocument6 pages2013-7-9 DBS Lim&TanphuawlNo ratings yet

- Market Outlook 07.07Document3 pagesMarket Outlook 07.07Nikhil SatamNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17158) / NIFTY (5205)Document4 pagesDaily Technical Report: Sensex (17158) / NIFTY (5205)angelbrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingNo ratings yet

- Mid-Quarter Monetary Policy ReviewDocument3 pagesMid-Quarter Monetary Policy ReviewAngel BrokingNo ratings yet

- Market Outlook 20th December 2011Document4 pagesMarket Outlook 20th December 2011Angel BrokingNo ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- A Complete Mowing & Lawn Care Business Plan: A Key Part Of How To Start A Mowing BusinessFrom EverandA Complete Mowing & Lawn Care Business Plan: A Key Part Of How To Start A Mowing BusinessNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Autochartist Intro GuideDocument42 pagesAutochartist Intro GuidemartianabcNo ratings yet

- Difference Between Product and BrandDocument26 pagesDifference Between Product and Brandgastro8606342No ratings yet

- Parcor Finals Summer 17 Set CDocument2 pagesParcor Finals Summer 17 Set CSheena CalderonNo ratings yet

- Life Insurance Product Pricing in Rural OdishaDocument7 pagesLife Insurance Product Pricing in Rural OdishaAbdul LathifNo ratings yet

- Accounting Quiz 09 PDFDocument4 pagesAccounting Quiz 09 PDFTina AntonyNo ratings yet

- FIN 3331 Critical Thinking AssignmentDocument3 pagesFIN 3331 Critical Thinking AssignmentHelen Joan BuiNo ratings yet

- 001 2017 4 BDocument154 pages001 2017 4 BDean ChamierNo ratings yet

- Cap Budget - Add PracticeDocument2 pagesCap Budget - Add PracticeAnjit Singh100% (1)

- Gainesboro Machine ToolsDocument2 pagesGainesboro Machine ToolsedselNo ratings yet

- Strat Sourcing StrategyDocument4 pagesStrat Sourcing StrategySagar DorgeNo ratings yet

- Partnership Practice Manual PDFDocument47 pagesPartnership Practice Manual PDFanupNo ratings yet

- Management and Engineering Economics: Technical Seminar On Gross Domestic ProductDocument19 pagesManagement and Engineering Economics: Technical Seminar On Gross Domestic ProductBaibhav KumarNo ratings yet

- Growth Equity Case Study SlidesDocument13 pagesGrowth Equity Case Study SlidesShrey JainNo ratings yet

- Project Report ReadymadeDocument13 pagesProject Report Readymademayank malikNo ratings yet

- IFDocument18 pagesIFKiran MehfoozNo ratings yet

- Statement of PurposeDocument5 pagesStatement of PurposeShalini SinghNo ratings yet

- Chemicals Industry PDFDocument19 pagesChemicals Industry PDFMelih AltıntaşNo ratings yet

- Advanced Option Trading - The Modified Butterfly Spread - InvestopediaDocument11 pagesAdvanced Option Trading - The Modified Butterfly Spread - InvestopediaSingh SudipNo ratings yet

- Choice Securities Final ProjectDocument72 pagesChoice Securities Final Projectdevendra reddy GNo ratings yet

- Fixed Asset Register SampleDocument55 pagesFixed Asset Register SampleClarisse30No ratings yet

- IFRS 6 - Exploration For and Evaluation of Mineral ResourcesDocument2 pagesIFRS 6 - Exploration For and Evaluation of Mineral ResourcesLoui BayauaNo ratings yet

- Group 4 Basic Long-Term Financial ConceptsDocument28 pagesGroup 4 Basic Long-Term Financial ConceptsHazel Becbec Labadia89% (9)

- Impact in The Effectiveness of The Supply Chain Integration of HULDocument64 pagesImpact in The Effectiveness of The Supply Chain Integration of HULsiraNo ratings yet

- Internal Environment of Air AsiaDocument6 pagesInternal Environment of Air AsiaAsmil RoslanNo ratings yet

- Fa GB Send Money FormDocument3 pagesFa GB Send Money FormJAIMANIKANDANo ratings yet

- Synopsis Vasu ProjectDocument7 pagesSynopsis Vasu ProjectRockyLagishettyNo ratings yet

- Mortgage Backed Securities ExplainedDocument3 pagesMortgage Backed Securities Explainedmaria_tigasNo ratings yet

- BOB General Socio-Economic & Banking Awareness QuestionsDocument7 pagesBOB General Socio-Economic & Banking Awareness QuestionsNishant DeoNo ratings yet

- Fibo TradingDocument417 pagesFibo TradingAnonymous 2HXuAeNo ratings yet