Professional Documents

Culture Documents

Yukon Nevada Gold Oct 2011

Uploaded by

PENG UINCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yukon Nevada Gold Oct 2011

Uploaded by

PENG UINCopyright:

Available Formats

Monday, October 10, 2011

Hallgarten & Company

Coverage Update

Christopher Ecclestone cecclestone@hallgartenco.com

Yukon-Nevada Gold (TSX:YNG, FFT:NG6) Strategy: Long

Key Metrics Price (CAD) 12-Month Target Price (CAD) Upside to Target 12mth hi-low CAD Market Cap (CAD mn) Shares Outstanding (mns) Fully Diluted (mns) Consensus EPS Hallgarten EPS Actual EPS P/E Dividend Yield $ $ 0.34 1.50 348% $0.19 - 0.95 $ 276.9 826.6 849.8 FY09 FY10e n.a ($0.13) n/a 0.00 n/a FY11e n.a $0.02 14.1 0.00 n/a FY12e n.a $0.08 4.0 0.02 6.0%

($0.130) n/a 0.00 n/a

Hallgarten & Company

60 Madison Ave New York, NY 10010

T 973-889-1136

Monday, October 10, 2011

Yukon-Nevada Gold

Leaving Its Travails Behind

+ + + + Recent financing initiatives have set the company on a sound financial footing enabling vital capex and providing a cushion of working capital. Production should ramp up again after a September slowdown to implement long-overdue winterising of the mill facilities. The board is planning to rebalance with the Swiss investors destined to become a minority The company's excess mill capacity has been used to process bought-in feedstock from Newmont at marginal profitability. The strengthened financial position of the company will put the boot on the other foot in these types of transactions. The companys Ketza mine in the Yukon has been signaled to be spun off into a Newco. The production debacle (i.e. wet ore clogging the mill) during the winter was avoidable and it took surprisingly long for the company to seek out a responsible party to chastise. The message on the Ketza spin-off is garbled and incoherent. The opportunity to do this transaction in a fashion that would have rewarded shareholders for their sufferings was let pass. Yukons stock desperately needs to be consolidated. It has way too many units on issue (or potentially on issue).

Producing and Near-Producing Yukon-Nevada Gold Corp. (TSX: YNG, Frankfurt: NG6) is a North American gold company that has as it main assets a producing mine in Nevada and a potentially producing mine in the Yukon Territory. In its current form the company was created via a merger in May 2007, between Yukon Gold Corp (YGC, as it then was) and Queenstake Resources Ltd. to create Yukon-Nevada Gold Corp. As a result of the combination of the businesses and assets of the two companies, Queenstake became a wholly-owned subsidiary of YGC, and YGC changed its name to the current Yukon-Nevada Gold Corp. This created a broader North American focused mining entity. Queenstakes prime asset was the Jerritt Canyon mine in Nevada where the gold was first discovered in 1972. The Jerritt Canyon property is virtually an entire district of its own with various producing, mothballed and past producing mines. Its asset base includes one of only three refractory roasting facilities in Nevada, a very strategic playing piece. Open pit mining occurred between 1981 and 1999 with the first gold poured in July 1981. Like many other miners at that time, the fluctuating gold prices put paid to the open-pit operations without the pits having been fully mined out or their full potential exploited. Portal-accessed, underground mining commenced in 1993 with the SSX-Steer Complex and the Smith mine. Since mining began, Jerritt Canyon has produced over seven million ounces of gold largely under the management of Anglogold (and Meridian Gold) up until 2003. In its last full year of production (2002) under Anglogold, it produced 338,000 ozs of gold. After Queenstake's travails precipitated a closure of the operations yet again in

Portfolio Investment Strategy 5

Monday, October 10, 2011

August 2008, environmental problems relating to mercury emissions kept the mine shut until mining at the site recommenced in the second half of 2010. From then on, the mill has been primarily engaged in processing the mined materials, some stockpiled ore and substantial quantities of ore bought in from Newmont. Recent Travails At the start of the second quarter of 2011, YNG found itself in an extremely precarious financial situation. The alarm bells had sounded with the announcement of the December 2010 financial production and results which showed that something was seriously wrong with the production model. Moreover the production that was occurring came at a hefty loss for the company, and cash was rapidly draining away. This revelation, after months of projecting bullish scenarios and focusing on the shortlived Off-balance sheet acquisition funding (instead of fire-fighting the production SNAFUs), left investors deeply dismayed and made Yukons financing task well-nigh impossible. What Went Awry It is sometimes said that the flapping of a butterflys wings on one side of the plant can create a hurricane on the other side of the globe. We have been somewhat dubious of this claim since first hearing it, but Yukon Nevadas experience over the last twelve months shows that small actions can have massive consequences. To synthesize the essence of the problem we would say that: The company made a major mistake in ignoring the urging of outside investors in 3Q10 for a financing. The majority shareholders of the company at that time eschewed all offers that might have resulted in dilution of their stake. Instead, they latched onto an unattractive gold loan deal that, in any case, made for insufficient funds for operations. As a result of this, the company began production without having winterized the plant. In this respect an avoidable dilemma was charged at full head-on and the dilemma won. Production plunged as soon as the non-winterised plant ran into highly foreseeable problems with the first dispatches of wet ore. The company started hemorrhaging cash.

The essence of the production problem was wet ore being stuck in the screens and cone crushers. Originally the version that went around alluded to a record cold winter, but we were initially dubious of this when we heard that the problem was wet ore rather than frozen ore. When we inquired we were told this had happened in the past. This raised the issue of why the mill was ever restarted without the basic reorganisation of the mill process to avoid this problem. The solution was as simple as a $6mn installation of a new larger dryer which involved moving the dryer closer to the start of the ore-sorting process. An added improvement would have been the enclosure of the whole facility in a more encompassing structure. The latter would have cost $25mn, but was not as critical as the dryer-move. Apportioning blame is not immensely useful post-facto, but ensuring that the same (or similar) mistakes are not made in the future is vital. Thus Chief Operating Officer of the time, Graham Dickson, was

Portfolio Investment Strategy 5

Monday, October 10, 2011

replaced by Randy Reichert in late June 2011 in a move that we welcomed. The damage had however been done with the company losing fans in the institutional space, losing ground share price-wise, losing a year of earnings potential (and instead engaging in unprofitable production) and burning through cash. On the positive side we would note that the debacle spurred a reassessment of Ketzas role, resulted in a new COO, saw the Swiss directors reduced to a minority, tossed overboard the SPV scheme and left the mill poised for profitable production once the mill-flow reorganization is completed. Jerritt Canyon The complex that YNG controls at Jerritt Canyon consists of an array of open-pit and underground mines (plus virgin prospects) that have been exploited over the last 30 years. None of the Jerritt Canyon mines exceed 1,000 feet in depth measured from the elevations at their portals. The Jerritt Canyon deposits are typical of the Carlin-type deposit of micron to submicron-sized gold particles hosted primarily by carbonaceous, Paleozoic calcareous and sulfidic sedimentary rocks. Lesser amounts of ore are hosted by intermediate to mafic intrusive rock. Gold in the Jerritt Canyon ore deposits occurs as free particles of intergranular, native gold, on or within pyrite, or in association with sedimentary carbonaceous material. Due to the sulfide and carbonaceous affinities, most of the gold deposits at Jerritt Canyon require fine grinding and oxidation to permit the gold particles to be liberated by standard, carbon-in-leach cyanidation.

The map above shows the core part of the district (Starvation Canyon though is off the map). Pits are in the valleys, and the mines tend to be in the hills (as can be seen in the aerial view below). The current focus is the Smith mine to the East with the Steer/SSX underground complex at the western edge of the

Portfolio Investment Strategy 5

Monday, October 10, 2011

map being the secondary target for reactivation.

After the environmental travails of the company began (which were in the processing rather than the mining part of the complex), the company continued mining and thus accumulated significant ore stocks (to the detriment of its finances and cashflow). The stockpile (as at last January) contained 902,000 tons of ore at an average grade of 0.073 opt Au for a total of 65,900 ounces of Au. This stockpile has been milled, in a rather small way, over the last year along with ore being produced from SSX/Steer Mine. The Measured, Indicated and Inferred resources shown below were published in the 2011 NI 43-101 compliant report prepared by Mark Odell and Karl Swanson and published in June 2011. This was constructed using a $1,100 per oz Au price.

JERRITT CANYON RESOURCES as at January 2011 Deposit/mine Measured K tons 155.8 0 2358.5 99.6 1982.8 5.5 0 0 4602.2 Inferred K tons 90.4 61.6 479.1 201.7 1157.3 256.3 19 2265.4 Indicated K oz K tons 48.3 -0 533.4 25.7 470 2 -0 0 1079.4 Measured and Indicated K oz K tons oz/t K oz 7.1 58.5 365.8 123 513.7 141.1 15.2 65.9 1290.3 182.4 0.304 210.9 0.277 4012.4 656 4186.2 502.4 97.8 0.224 0.227 0.235 0.285 0.156 55.4 58.5 899.2 148.7 983.7 143.1 15.2 65.9 2369.7

oz/t 0.31 -0 0.226 0.258 0.237 0.365 0 0 0.28

oz/t

Murray Murray Zone 9 SSX/Steer Saval Smith Starvation Wright Window Stockpiles Total

26.6 0.269 210.9 0.277 1653.9 556.4 2203.4 496.9 97.8 0.221 0.221 0.233 0.284 0.156

902.2 0.073 6148.1 0.35

902.2 0.073 10750.3 0.36

Murray Murray Zone 9 SSX/Steer Saval Smith Starvation Wright Window Total Inferred

oz/t 0.228 0.209 0.194 0.209 0.195 0.276 0.229 0.22

K oz 20.6 12.9 93.2 42.2 226 70.7 4.3 469.9

We took the liberty of excising the minimal amounts of resource (a few tens of thousands of ounces) in

Portfolio Investment Strategy 5

Monday, October 10, 2011

the open pits from this resource statement. The current M&I Au resource at 2.3mn ozs is not unrespectable by any measure however the parts of the district that are likely to be producing in the near term are only SSX/Steer and Smith and they total less than 1.9mn ozs. Again a sizable resource by any comparison but the overly anxious are concerned that this only represents six years of minelife. Since 2008 new management team has been compiling historic drilling data to provide an overall view of how the various ore bodies on the property are related, with the goal of enhancing Reserve and Resource calculation through this broader overview. The former operators did not consolidate drill data. The NI 43-101 compliant resource published in June superseded one prepared by SRK back in 2008. It is examining the potential of reactivating gold production from mines (open pits & underground) that were decommissioned at much lower gold prices. The exploration effort thus far in 2011 has been minimal due to the cash crisis, but now that funds are available there should be an aggressive exploration campaign with a particular focus on the old openpits where some step-out drilling is believed to hold the potential of uncovering material to justify reactivation of mining the pits. Reactivation of Underground Mining In recent weeks, the company announced the long-awaited reactivation of the SSX/Steer deposit. The SSX deposit was discovered in the early 1990s, and mining commenced in 1997. The deposit occurs 450 to 1,000 feet below the surface. It was, in the recent years, the main gold producer at Jerritt Canyon. The drift connecting the SSX and Steer mines was completed in late 2005, and the two mines are now referred to as the SSX-Steer Complex. By providing a secondary escape way and ventilation, this connection allowed commercial production from Steer to begin in 2005. The drift allowed the SSX-Steer deposits to share infrastructure in order to optimize production. The SSX- Steer connection also enables drill platforms to explore this prospective corridor.

Measured Au Grade Cutoff (opt) 0.125 Ktons 2,358.5 Au Grade Contained Au (opt) (oz) 0.226 533,400 Ktons 1,653.9 Indicated Au Grade Contained (opt) Au (oz) 0.221 365,800 Measured + Indicated KTons 4,012.4 Au Grade Contained (opt) Au (oz) 0.224 899,200

The M&I resource of the mine from the NI43-101 published in June 2011 is shown in the table above with an additional Inferred resource at SSX consisting of 479,100 tons averaging 0.194 opt gold containing 93,200 oz Au. The complex was shuttered with the generalized problems at the Jerritt Canyon site back in 2008. This mine will restart at an average of 300 tpd and will ramp up to 800 tpd by the end of 2011 as additional equipment is delivered to the site. Ramp up to the ultimate production target of 1,200 tpd will be complete by the end of 1Q12. Production Goals

Portfolio Investment Strategy 5

Monday, October 10, 2011

There are two components to the production revival at the Jerritt Canyon mine complex in Nevada, at least for the near future. The company has both the existing Smith mine and the million tons of stockpiled ore with which to work. By milling a combination of available stock piles and recommencing mining activity, Yukon Nevada was targeting a total production of 150,000 ounces of gold in the first full year of production at a cash cost of US$465 per ounce after re-start of operations and after the mill established steady state operation. The steady state production was achieved in August of 2010. However the cash-cost was way higher (amongst other things climatic issues impacted) and the company was only a marginal earner in the second half of FY10, though the last quarter of the year was firmly in the black. The company recommenced underground operations in February 2010 at the Smith Mine with the rate of 1,000 tpd (at 0.223 opt) being achieved in September 2010. Expansion is scheduled with the reactivation of the SSX/Steer underground mine in the first quarter of 2011 which should add another 1,200-1,400 tpd of ore for processing. The delay here has been due to a lack of underground rolling stock, a side-effect of the generalized mining boom. The planned ramp-up of the mill as stated to us in mid-2010, was to produce up to 250,000 ozs per annum within 12-18 months and 400,000 ozs per annum within 24-36 months. Stockpile Processing The spare capacity at the refractory mill opened up the possibility of the company treating ore from other miners. Doing this on a tolling basis was not of interest to YGN so it hoped to purchase ore to put through its mill that would make the output countable as YNGs gold, a situation that would not exist for tolled ore. The target suppliers in the first instance were Barrick and Newmont. The reality was that both companies are at full capacity at their refractory mills in Nevada and cannot add capacity. Thus they have been focusing on processing 0.4-0.5 opt ore point and stockpiling the lower grade material. As a result, Newmont alone has accumulated a stockpile of unprocessed low-grade ore (mainly below 0.1 opt) that amounts to 53 millions tons. It makes sense that it should want to on-sell its low-grade ore because if it processes the ore itself, the ore will pull down its headline grades and bring attention to its logistical problems in Nevada. Thus selling the ore at around $400 per contained oz to Yukon Nevada would have brought cashflow without corrupting the average grades of the majors gold output. The issue of why sell? when these majors can retain the ore and process it after their mines are eventually exhausted is answered by the sheer scale of the ore that is mounting up and the environmental considerations from letting excavated sulphide ores lie around in large piles. Even selling 3,600 tpd of ore to Yukon Nevada is a mere drop in the bucket when one has the amount of stockpiled ore that these two gold majors control. However when it came down to it, YNG's hopes on this score were dashed in 2010 (and through 2011) with Newmont adamantly refusing to do anything on terms that YNG set. The end result was that YNG ended up effectively processing the ore (grading 0.09 opt or 2.75g/t) on the thinnest of margins and this only served to distort YNG's own cash-cost. Newmont had clearly perceived a weakness here on YNG's part and took advantage of it.

Portfolio Investment Strategy

Monday, October 10, 2011

Now that YNG has got its financial house in order (and more able to fill its own production pipeline) Newmont is going to lose its power to call the shots. It is highly likely then that whatever remnants of relations there are with Newmont's excess supply will be on a tolling basis, which YNG had already eschewed. This is an example of finally getting real in the long run after a major faux pas on this thirdparty ore concept. In theory, Yukon Nevada is excellently positioned with spare capacity in refractory milling when it is unlikely that refractory mills will ever see any capacity increase (or new facilities) in Nevada due to environmental issues. The Open Pits The company has a series of old open pits from which (largely) oxide ore was extracted up until the start of the last decade to feed the now-mothballed wet mill. These pits fell victim to low prevailing gold prices and were thus not abandoned due to exhaustion. The plan now is that at least half of the drilling budget will be focused on step-out drilling around the open-pits with a view towards reactivating them, sequentially, to provide mill feedstock. The aerial photo on the next page shows the intense pattern of pits that exists at the core of the Jerritt Canyon deposit.

In recent days the company made a surprise announcement (in being earlier than many had expected) that preliminary engineering work towards advancement of open-pit mining at Burns Basin pit (which is shown front-centre in the photo above) had commenced. Historical mining from Burns Basin from 1988 to 1998 extracted 412,328 ounces from 2.4 million short tons averaging 0.169 opt gold based on internal mine records. This pit is located around 0.9 miles west from the active SSX-Steer underground mine and has existing haul road access. Anticipated startup for the Burns Basin open pit mining operation is in 4Q12, thus still some way off, with daily production of 2,000 ore tons per day. A preliminary mine plan has recently been completed for the Burns Basin resource totaling 241,320 of contained ounces of gold in the Measured and Indicated category and is listed in the table below. Burns Basin now has a Measured resource of 27,828 ounces at an average grade of 0.163 opt gold and an Indicated resource of 213,492 ounces at an average grade of 0.104 opt gold. The resource is not a

Portfolio Investment Strategy 5

Monday, October 10, 2011

stunning one but in light of the relatively minimal effort required to reactivate the pit and with all the milling facilities available, it is eminently sensible to kickstart this pit (and the others). It is a shame that this goal was not actually pursued earlier. Burns Basin Open-Pit Resource at a Gold Price cut/off of $1,400 Measured Indicated Measured + Indicated Au Grade Au Au Au Contained Au Contained Contained Cutoff Ktons Grade Ktons Grade KTons Grade (oz) Au (oz) Au (oz) (opt) (opt) (opt) (opt) 0.036 0.052 0.054 2,815 1.080 0.151 163,168 1.133 0.147 165,983 0.07 0.118 0.212 25,013 0.982 0.051 50,324 1.100 0.068 75,337 Total 0.170 0.163 27,828 2.062 0.104 213,492 2.233 0.108 241,320 Notes: The Burns Basin resource is based on a Lerchs-Grossman pit determination using a new 20 x 20 x 20 block model, current mining costs, a 2,000 ore ton per day production schedule, and a $1,400 Au price which is a three-year trailing average price + 10 percent. The stripping ratio for this Burns Basin resource is 10.8: 1 (waste:ore). The preliminary mine plan at Burns Basin is based on work carried out subsequent to the completion of the former NI 43-101 Technical Report on the property. The mine plan was conducted by mining consultants Mark Odell and Karl Swanson under the supervision of Todd Johnson, Vice President of Exploration for YNG. As Burns Basin shall be the first pit reactivated, YNG has prioritised funds from the aforementioned exploration budget on the open-pits for further drilling at Burns Basin to confirm and expand the resource, and enable detailed mine planning.

Portfolio Investment Strategy

Monday, October 10, 2011

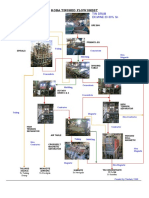

Source: YNG The company has stated that preliminary plans are in progress for the open-pit mines at Steer and Saval Canyon, Mill Creek, West Generator, and Wright Window. The table above shows the amounts of ore and gold that historically has been extracted from these open pits. Drilling has already been authorized and is currently in progress for some of these areas to ascertain their suitability for reactivation. Combined Production Projections Our projections (shown in graphic form below) are for years 2010 to 2012, and after that the projections are from the company, though these do not have the recent open-pit announcement factored in.

Portfolio Investment Strategy

Monday, October 10, 2011

YNG - Targeted Production Oz Gold

350,000

300,000

Bought In YNG Mines

250,000

200,000

150,000

100,000

50,000

0 2010

Source: Hallgarten/YNG

2011e

2012e

2013e

2014e

2015e

Starvation Canyon Next Up? Yukon Nevada now has both the Smith and SSX/Steer mines in operation and will be looking to expand the potential of the oxide ore around the old open pits. Beyond that, though, it views Starvation Canyon as having the most potential to add sizeable new resources and production. The deposit is located on private land owned by Yukon Nevada in the southwestern part of the Jerritt Canyon District. The discovery of high-grade mineralization at Starvation Canyon was the first substantial gold deposit found in the southern part of the district, an area considered to have similar geologic structures as the mines in the northern part. Drilling has identified a prospective 4 1/2-mile mineralized trend that includes Starvation Canyon and mineralized targets at Waterpipe II and Pie Creek. The northwest structure that appears to be the primary control for the Starvation Canyon resource could hold potential for additional clusters of mineralization both to the northwest and southeast.

Portfolio Investment Strategy

Monday, October 10, 2011

The gold mineralized zone (shown above) lies above the water table in the area of steep topography and could be easily accessed by portal from the hillside.

The mineralized zones that host the Starvation Canyon deposit are mostly classified as indicated resources in the December 2007 reserve estimate with probable reserves of 571,600 tonnes grading at 0.282 opt giving 161,300 ozs Au. The Indicated Resource is 697,000 tonnes grading at 0.287 opt yielding 200,000 ozs Au. The grade is good and the resource is not enormous. However this should be put in the context of most of the infrastructure being already in place in close proximity. History at Jerritt Canyon has shown that the underground resources have excellent replacement as the mine advances. Thus far, drilling has indicated that the thickness and grade of mineralization are comparable to that found previously at Jerritt Canyon. However, with the various crises besetting the company in 2008 and 2009, drilling any part of the property was a low priority. Thus the last meaningful announcements were in 2007 when the company announced one drill hole intersecting 45 feet of 0.33 ounce of gold per ton (opt) or 13.7 meters at 11 grams per tonne (gpt). Interestingly this was outside the area of the preexisting resource calculation. Investment Plan Beyond changes to the processing plant which were carried out during a shutdown for the whole month of September 2011, while previously the company completed, in 2010, a number of tailings reclamation projects, including Seepage Pond reclamation and upgrades of fluid conduit and pumps. Now the capacity of the existing tailings pond will be sufficient for three years. Plans are in place for a new 50mn ton fully-lined tailings storage facility with construction starting in late 2011 (though ground breaking

Portfolio Investment Strategy 5

Monday, October 10, 2011

was originally scheduled for late summer 2010). Ketza River a Confusing Exit Scenario The Ketza River Project is in the same location as the historic Ketza River Mine, which produced 98,000 oz of gold and byproduct silver between 1988 and 1990. The current gold Resource (dating from June 2011) includes: 29,000 oz Measured in 167,800 tonnes grading 5.38 gpt and 388,700 oz, Indicated in 2,212,300 tonnes grading 5.46 gpt. A further 67,300 oz in 453,700 tonnes grading 4.62 gpt is present in the Inferred category. This asset consists of two properties (Ketza River & Silver Valley) in the Yukon in Canada. Unlike many of the more isolated mining projects in the Yukon, these properties are connected by an 82 km all-weather road to Ross River. Some 41% of the measured and indicated recoverable resource ounces are hosted in oxide ores which have a gold recovery of 90%. The remaining 59% of the measured and indicated recoverable resource ounces are hosted in sulfide or mixed sulfide+oxide ores that generally have gold recoveries of 70%. In early March 2011, the company decided to transfer the Ketza River property to a separate corporate entity, Newco, which will be, at least at the beginning, a wholly-owned subsidiary, and will own 100% of the shares of Ketza River Holdings Ltd., the Yukon domiciled company which holds the Ketza River assets. YNG indicated that it would make a public distribution of approximately 25% of its shares to fund the pre-production costs of the Ketza River assets. Yukon Nevada would supposedly retain the remaining approximate 75% of the issued shares of

Portfolio Investment Strategy 5

Monday, October 10, 2011

Newco. It is the intention that Newco will make application for a listing of its shares on a recognized stock exchange. Nothing is set in stone though and the first announcement seems to have been a kite-flying expedition to see if a potential acquirer, or a merger partner for the Newco was flushed out. The proposed transaction remains subject to further review and approval by the company's Board of Directors. This transaction is another example of the companys past tendency to announce first and think later. In considering how much the entire spin-off might be worth in market capitalization terms, we would not be surprised to see the Newco entity debut with a market valuation of around $100mn if this transaction is carried out in an intelligent and market savvy fashion. Frankly, we would prefer to see the whole of the Newcos shares distributed to existing shareholders as a reward for their perseverance with YNG through its recent tribulations. With a vibrant funding environment at the time that this separation was announced, we saw no reason why the spinoff shouldnt receive a robust reception from investors. Now of course markets are not nearly as bustling and a lot of IPOs have gone back into the freezer, though the Yukon province still manages to generate more excitement than other gold mining districts. In late September 2011, Yukon-Nevada announced that it had submitted its Yukon Environmental and Socio-economic Assessment Application for the Ketza River Project to the Executive Committee of the Yukon Environmental and Socio-Economic Assessment Board. An assessment is a first step in gaining the necessary approvals in order to bring the Ketza River Mine back into production. The timeline for review is a minimum of one year from the date of submission. The planned mine includes nine open pits and two underground declines with 83% of the ounces to be mined from open pits. There is still a mill at the site and there is also a fully equipped camp and facilities. Yukon Nevada has targeted production from Ketza River at an estimated 60,000 opa Au, though this could be pushed higher with expansion of the resource. Ketza - Past and Planned Work Baseline studies for the Ketza River Project began in 2008. Concurrently, geotechnical and hydrogeology drilling programs were initiated, metallurgy drilling and testing programs developed and upper tailings site identified and drilled. During 2009 and 2010, YNG conducted geophysical surveys, soil surveys, exploration drilling, additional geotechnical and hydrogeology drilling in the proposed resource areas, and geotechnical characterization of the lower tailings site. Current work at Ketza includes the following activities: Drill program for 2011 includes > 6,100m of drilling, Installation of a replacement camp (completed August 2011), Drilling of a new water well for use at the camp and the new mine facilities, Community and First Nations consultation meetings, and Obtaining a type A water license for the existing tailings facility. A CAD$9mn Flow-through financing was completed in May 2010 to fund an expanded exploration

Portfolio Investment Strategy 5

Monday, October 10, 2011

program. However in reality, it seems that this money might actually have been consumed by YNG's other more pressing needs. However, now that substantial financing is at hand the flow-through cash can once again be applied, particularly with it appearing like Ketza River might be the exit hatch for the former COO (who brought this mine to the merged entity originally). As a result of the current uncertainty surrounding Ketzas fate, we have not factored any production or income from this mine into our revenue model at this point but this could, in theory, start contributing in late FY12 and/or FY13. Financing & Share Capital The company has a truly prodigious number of shares on issue at the current time with a steady potential flow of warrants (most of which are in the money), coming down the pike. Below can be seen the current shares on issue and potential dilution. Share Structure (as of 12 August, 2011) Shares issued: Warrants: Options: Shares Fully Diluted:

960,639,301 90,424,092 56,549,514 1,077,612,907

And yet, the companys trading in relatively thin (averaging three-quarters of one million shares per day over the last three months) compared to other companies of similar size. This large number of shares on issue is a result of a number of events over the last few years. The first of these was the merger with Queenstake. The second being the rescue financing largely funded by the Swiss investors in December 2008 and the third being the issue of inducement warrants in late 2009 and most recently a series of smaller financings including a flow-through financing that raised money to move the Yukon project forward and the massive warrant conversion in May 2011. Not to mention recent shares issued in the legal settlement with Golden Eagle. In August 2009 the company held a non-brokered private placement in which some $4mn was raised via the issue of 40 million units at a price of $0.10 per Unit. Each unit consisted of one common share and one share purchase warrant. The warrant was exerciseable to purchase one additional common share at a price of $0.125 per share within 30 months of closing of the private placement. In late March 2010, Yukon Nevada closed a CAD$5mn non-brokered private placement for a total of 22,727,272 common shares at a price of $0.22 per share and, just after that, in late April 2010, the company held a brokered private placement for gross proceeds of around $10mn through the sale of 36.4mn flow-through common shares at $0.275 per FT Share. As this money has to be dedicated to projects within Canada, this has been earmarked towards getting the Keska River project (discussed later) moving forward. If one thing is clear after all this process, it is that the company is seriously in need of a stock consolidation of at least 1:5 to get the number of shares down and make the company more acceptable to an institutional base. Such a move would also make the stock eligible for an NYSE listing.

Portfolio Investment Strategy 5

Monday, October 10, 2011

The Deutsche Bank Gold Deal Gold loans have a bad reputation and well they might as most of the gold loans we have seen have been at exceptionally punitive purchase prices. However having said that we have not seen many of them lately and the most egregious ones that crossed our radar were perpetrated at the worst of the financing slump in the wake of the 2008 slump when financing could not be had for love nor money (though gold was a preferred alternative). As financing improved companies on the verge of production steered a wide berth around the gold loan banks and thus few transactions took place. Thus, when we first heard that Yukon Nevada was pondering a gold loan proposal we went into wary mode. The transaction that transpired was a gold loan in the third quarter of 2010 with the Sprott grouping of Toronto. This Senior Secured Note had a US$25mn principal and 25mn common share purchase warrants. Each warrant entitled Sprott to purchase one common share of YNG at a price of $0.40 per share for a period of three years following closing. Those (now redeemed) Notes had a maturity date of December 31, 2012 and were secured by a charge over all the assets of the company's wholly-owned subsidiaries that contained the Jerritt Canyon mines and assets. The Notes were intended to be repaid through monthly cash installments based on a notional amount of approximately 284,114 shares of SPDR GLD Gold Shares beginning September 2010. YNG guaranteed a minimum rate of return of 5% per annum on the aggregate principal amount over the term of the Notes. All in all, this was a very sweet deal for Sprott. In retrospect, the annoying thing here is that institutional holders were panting to get more equity at that time and the company could have done a very attractive equity financing. Instead, because of an aversion to dilution by the then-majority shareholders of the company, the board opted for this highly unattractive debt financing with Sprott. This transaction was unwound mid-2011 using the proceeds of the warrant exercise at a cost of around $29mn. Almost one year later the company then closed yet another gold loan, but how the times had changed. In mid-August 2011, the company advised that it had closed a Forward Gold Purchase Agreement with Deutsche Banks London Branch. This consisted of a US$120 million prepaid gold forward facility to Queenstake Resources USA, the wholly-owned subsidiary which owns the Jerritt Canyon assets. Under the facility (which is technically a forward contract) YNG shall deliver 173,880 ounces of gold over a 48-month term. The schedule of gold payments is: during the first six months of the term, 1,000 ounces per month; for the next six months of the term, 2,000 ounces per month; for the final 36 months of the term, 4,330 ounces per month. The 173,880 ounces of gold that have been committed under this gold facility represent approximately 24.3% of the gold reserves or 5.1% of the total gold resources at the Jerritt Canyon property. Subsequent to the receipt of the US$120 million prepayment, the remainder of the purchase price for the gold will be paid to Queenstake against the monthly gold deliveries to Deutsche Bank and will be equal to the amount that the gold price exceeds US$850 up to a maximum gold price of US$1,950. By

Portfolio Investment Strategy 5

Monday, October 10, 2011

our calculations this implies that YNG receives a prepaid $690 per oz plus the top-up for exceeding $850. Thus the discount the company is taking is a rather modest $160 per oz. This only starts to really hurt should gold hurtle through $1,950 for an extended period of time. All in all though this looks like one of the most attractive gold loan transactions we have seen. The company claimed that the use of proceeds from the Gold Facility included repayment of senior secured notes issued to note holders led by Sprott Asset Management, but our understanding was that this has previously been liquidated using the proceeds of the warrant issue. Earnings Outlook The model that follows lays out our thoughts on how earnings may evolve over the next few fiscal years. Prime considerations in constructing this model include: We are presuming an average price of Au of $1,500 for the second half of FY11, $1,350 for FY12 and $1,250 for FY13 We have not factored in any Ketza production We have not factored in any production that may come from oxide material being put through the revived wet mill Our key metrics are shown below but the cost of ore from the SPV source is an imponderable.

Key Metrics Revenue - Mine Tolling Stockpile - purchased Total Revenue Cost of Revenue -mined Cost of Revenue -own stockpiles Cost of Revenue - bought stockpiles Gross Profit on definable ops Ozs of Au Mined Ozs of Au Milled (own stockpile) Ozs of Au Milled (bought in) Ore to be tolled Mill throughput (tpd) Utilisation Cash cost - mined oz Cash cost - purchased ore - oz FY13e $241.50 $0.00 $241.50 $134.27 $0.00 $107.23 193,200 FY12e $172.80 $27.00 $0.00 $199.80 $120.96 $0.00 $78.84 128,000 20,000 2H11e $34.50 $0.00 $15.45 $49.95 $30.36 $36.72 -$17.13 23,000 10,300 1H11 $47.23 $0.00 $47.23 $63.08 FY10 $71.37 $0.00 $71.37 $28.00 $10.85 $19.36 $13.16 65,104 19,802

-$15.85 7,898 24,093

6,000 100% $695 $747

4,800 100% $945 $747

2,592 60% $1,320 $747

1,728 40% $1,466 $747

Portfolio Investment Strategy

Monday, October 10, 2011

Yukon Nevada Gold

USD mns

FY13e Revenue - Mine Tolling fees Stockpile - purchased Total Revenue Cost of Revenue -mined Cost of Revenue -stockpiles Gross Profit Selling/General/Admin. Expenses Stock Based Compensation Depreciation/Amortization Exploration Unusual Expense (Income) Other Operating Expenses Total Operating Expense Operating Income Interest Income(Expense) Forex Loss Warrants valuation/costs Income Before Tax Tax Income After Tax Weighted Average Shares EPS Diluted Weighted Average Shares Diluted EPS Ozs of Au Produced Ozs of Au Milled (own stockpile) Ozs of Au Milled (bought in) Ozs of Au Sold Cash cost overall oz Cash cost - purchased ore - oz 241.50 241.50 130.41 0.00 111.09 4.40 6.00 28.98 2.00 0.00 0.50 172.29 69.21 -1.00 0.00 68.21 0.00 68.21 837 0.08 1013 0.067 193,200 $465 FY12e 172.80 27 199.80 95.36 104.44 4.40 6.00 20.74 2.00 0.00 0.50 129.00 70.80 -1.00 0.00 69.80 0.00 69.80 833 0.08 1013 0.069 128,000 20,000 $465 $747 FY11e 81.73 2Q11 28.26 28.26 30.19 -1.933 3.36 1.59 0.25 1Q11 18.973 18.973 32.89 -13.917 1.364 1.549 0.303 1.508 37.61 -18.64 1.00 0.679 50.99 30.091 1.145 28.946 691.128 0.042 837.359 0.035 14,477 7,718 13,650 $1,390 FY10 71.37 71.37 83.38 -12.00 2.56 4.11 5.43 0.963 1.63 98.07 -26.69 -19.74 -1.21 -44.11 -94.64 -1.55 -93.10 690.302 -0.13 1001.68 -0.093 65,104 19,802 45,302 56,414 $1,265 $422 4Q10 29.896 29.896 38.32 -8.424 -0.066 0.531 -0.690 3Q10 19.466 19.466 18.043 1.423 0.93 2.81 2.021 0.208 2Q10 11.85 11.85 13.542 -3.31 0.69 0.545 2.088 1Q10 10.16 10.16 13.47 -3.31 1.006 0.226 2.009 0 0 16.71 -6.55 0.1 -0.74 -44.11 -51.41 0 -51.41 578.8 -0.09 FY09 9.91 9.91 26.05 -16.14 3.92 6.27 11.2 2.89 50.34 -40.42 -0.01 0 -42.8 -0.14 -42.66 338.97 -0.13 4Q09 5.12 5.12 18.55 -13.42 1.3 1.7 1.11 0.73 23.39 -18.27 0.46 0 -18.31 -0.24 -18.07 405.49 -0.04 3Q09 0 0 1.35 -1.35 1.31 1.53 5.18 0.72 10.08 -10.08 -0.41 0 -11.67 0.01 -11.68 355.22 -0.03 2Q09 4.79 4.79 6.09 -1.3 0.49 1.55 2.46 0.72 11.3 -6.52 -0.14 0 -7.69 0 -7.69 311.96 -0.02 1Q09 0 0 0.07 -0.07 0.83 1.5 2.45 0.72 5.56 -5.56 FY08 48.98 48.98 58.74 -9.76 5.15 9.28 94.01 2.12 169.29 -120.31 4.63 -1.9 -117.44 -12.08 -105.36 185.12 -0.57 FY07 64.46 64.46 48.22 16.24 9.11 5.73 0 1.08 64.14 0.32 2.5 -4.32 -0.93 0.97 -1.9 121.43 -0.02 FY06 0.41

81.73 130.16 -48.43 7.40 6.80 1.10 0.00 0.40 145.86 -64.13 3.00 0.95 77.00 16.82 -2.00 18.82 792.769 0.02 1006 0.019 67,000 31,000 65,000 $1,410

0.41 0 0 1.63 0.02 0 0.16 1.8 -1.39

35.39 -7.13 2.89 0.22 33.38 23.146 0.011 23.135 826.649 0.028 849.77 0.027 22,168 16,375 18,341 $1,541

38.10 -8.20 -0.551 -20.39 -1.55 -18.84 685.616 -0.027

24.01 -4.55 -12.567 -0.821 -17.93 0 -17.93 667.823 -0.027

16.87 -5.02 -0.80 0.902 -4.91 0.001 -4.91 652.52 -0.008

0 -5.14 0.08 -5.22 283.19 -0.02

0 -1.39 -0.11 -1.28 53.15 -0.02

18,770 16,905 21,883 $1,366

18,636

18,440

9,258

9,770

4,590

5,180

44,732

15,547 $1,252

9,876 $1,200

9,108 $1,116

9,770 $1,015

$1,117

$924

Portfolio Investment Strategy

Monday, October 10, 2011

We foresee production (finally) starting to ramp up from October onwards after what has essentially been a lost (and losing) twelve months. Almost surprisingly SSX-Steer has come on line and the openpits now seem like they are moving forward. Stockpiled or bought-in ore is now going to be a swing factor for filling the production pipeline rather than a crucial element of the big plan. Using the aforementioned price parameters and assumptions and the production metrics we have expounded upon, our outlook is: a small profit of around $18mn in FY11, being primarily the result of the accounting gain from the warrant exercise production leap to 128,000 ozs in FY12 net earnings of $69.8mn or EPS of 8 cts per share production of 193,000 ozs in FY13 Net earnings of US$68.2mn or EPS of 8 cts per share However, with a current market capitalization of around US$243mn, a net profit of nearly US$70mn in FY12 is indeed impressive, and we are only conjecturing one year out to achieve this goal. We also suspect that the Swiss investors will want a dividend at some point and the company should be in a good position, in our view, to start a regular payout from FY13. Management/Board Changes We must confess to have been initially dismayed that heads did not roll for the Winter Debacle but as time has worn on the Grim Reaper has claimed a number of victims in management and on the board. Randy Reichert stepped into the Chief Operating Officer's position once Graham Dickson had been shifted to corporate development. Reichert has 23 years' experience from his international work at various operating mines and process facilities. Most recently he was President and COO for Colossus Minerals (TSX:CSI) responsible for the development of its Serra Pelada project in Brazil. Prior to this he was COO of Oriel Resources plc and Orsu Metals Corp. He spent over five years in Russia with Bema Gold, and subsequently Kinross Gold Corporation. Within those five years he held the position of General Manager, Operations of the Kupol gold mine in Chukotka, Russia and General Manager for the Julietta gold mine in Magadan, Russia. He has also held positions within various mining operations with Cominco Limited, now Teck, prior to working for Bema Gold. He is a professional engineer with a Mining Engineering degree from the University of British Columbia, a Masters in Rock Mechanics from Queens University and a GDBA from Simon Fraser University. Reicherts role will be focused on the Jerritt Canyon Mine. Graham Dickson is now the senior vice president of acquisitions and corporate development. Dicksons new role involved traveling between Vancouver, where Yukon-Nevada is based, Elko and the Yukon, where the company has exploration projects. This sounds to us like he is being groomed to take over the helm again at the spun-off Ketza River, which was originally his bailiwick pre-merger with Queenstake. Dickson had worked in mining in North America for the last 24 years. On the practical side, he was the general manager of a turnkey construction company for gold milling facilities in remote locations, including the Snip Mill for Cominco, Golden Patricia Mill for Bond Gold and Seabee Mill for Claude

Portfolio Investment Strategy 5

Monday, October 10, 2011

Resources. Before joining YNG, he served in various capacities with BYG Natural Resources Ltd., which had an operating gold mine in the Yukon Territory. Further afield, he completed the surface facilities for Bema Gold's Julietta mine in Far East Russia. He was the CEO of Yukon Gold when it merged with Queenstake to create Yukon Nevada in 2007. However, the main driver at Yukon Nevada remains clearly Bob Baldock, and this even more the case now that the former COO Graham Dickson has moved on. Baldock was originally drafted in as President, CEO and as a Director in the wake of the chaotic situation after the debacle of 2008. He had a track record in more recent years as a mining executive as well as being a veteran accountant with over 30 years of bankruptcy, administration (in the Chapter 11 sense) and turnaround experience of public and private corporations across a wide range of industries, but with a focus on the mining industry, in particular. He was the co-founder and Managing Director and subsequently Executive Chairman of Golconda Minerals group of mining companies listed on the ASX, NASDAQ and Stuttgart Stock Exchanges. He was also President of a controlled subsidiary, Nevada Goldfields Corporation, listed on the TSX, Toronto, NASDAQ, USA and Stuttgart Stock Exchanges. His roles with the Golconda Group also included being Managing Director of Duketon Exploration Limited, listed on the ASX. During his period of tenure he had responsibility for capital raising to oversee the design, construction, commission and operation of six mineral processing plants and gold producing projects (including the Kingston and Aurora mines in Nevada). The other restructuring play he is involved in at the current time is Monument Mining (TSXV:MMY), a gold producing company in Malaysia, where he is the President & CEO. Valuation Issues The trend in investor questioning in recent months, though more around the time of the company's financial crunch in May/June, was focused on residual value should the mining concept not work. Thus the sale value of the mill was a crucial factor in many of the inquiries we fielded. The mill is unique (if one takes that the Newmont and Barrick refractory mills are not on the market) and provides a highly strategic playing piece for any gold company of reasonable size with a refractory ore problem. From our discussions, investors were bemused as to why Newmont did not move on the company when YNG was so beaten down in price in May. We had no logical answer to that except that majors always let an opportunity to pick up something cheap pass them buy. Why buy low now, their logic goes, when you can pay more later? Scrap value of any mine is a few million dollars at best, so how to find a valuation metric? Where else is there a refractory mill, with many potential customers in relative proximity, with a clean environmental bill of health and spare capacity? This is a rara avis, indeed. As for valuation, its less a case of what such a mill would go for on Ebay or Craigslist but rather, what is it worth to you? Thus to Newmont or Barrick it would be worth whatever they value the being able to clear out stockpiles of old unmilled ore. To other buyers (probably owners of deposits in Northern Nevada, it would be a case of what would it cost for them to build an equivalent mill to get their mines into operation? The latter may be a moot point if one believes the accepted wisdom that it is unlikely that the State is ready to license new refractory mills, and that even if it was, the process would be long and arduous. Thus the time value of money and opportunity cost come into the calculation for wannabe producers. To pick a number out of thin air, one must make a blend of these disparate factors and throw in some X Factor for the individual attraction/need to/of different parties. Thus to hazard a valuation, we

Portfolio Investment Strategy 5

Monday, October 10, 2011

would settle for a minimum value of US$500mn though for a while in May, Newmont could have picked up the whole of YNG for less than that amount. This implies that the current market capitalisation has nothing in it for the value of the gold in the ground, the mine infrastructure or for Ketza River. Thus the mill provides a sort of bottom line from which valuations can be solidly grounded. Risks Laying out the risks over the past two years would have been an expansive task, but now the list has been whittled down quite significantly. Old problems like financing risk and environmental risk while mine viability in currently being dealt with. The chief pitfalls that might await the company are: Not being able to achieve budgeted cash costs per ounce Inability to get production near to the ambitious targets of which the company has spoken Further problems with the environmental issues Remaining in some large investors too hard baskets because it will not consolidate it shares Inability to negotiate sufficiently attractive terms for processing ore from Newmont and/or Barrick Missing the opportunity to capitalize on the Yukon asset in the current fevered attention on that zone The main challenge is to deliver upon the production promises while establishing a cash-cost that can stand up to scrutiny versus peers. Recent experience has not been good on cash costs and the improvement required is quite literally a quantum leap downwards in costs. The environmental issues appear to be behind the company, but being the U.S. anything can happen from unexpected quarters. On the bought-in ore issue, we would note that the massive amounts of ore held by these parties are above and beyond any amount that they could conceivably process in any scenario except one in which their mines close and thus their mills are freed up to work exclusively on their stockpiles. The plan as it stands is a win-win for both sides. While Newmont has played tough so far any success with the rehab of the mill (and reactivation of the second underground mine) would signal an approaching end to YNGs negotiating from a position of perceived inferiority to the majors. Conclusion Yukon Nevada is still a work in progress. It muddied the waters for investors by speaking too soon of its planned off-balance sheet financing vehicle and then was not able to deliver either on that rather grandiose plan or on the more basic aspect of making the mill run through the winter. Expectations could have been managed better (or not raised at all). Likewise the announcement of the Ketza spinoff was most welcome but could have done with a little more baking before exposure to the critical eye of the market. It would have given shareholders a relatively instantaneous payday when it started trading, but the lack of follow-on news means that it is

Portfolio Investment Strategy 5

Monday, October 10, 2011

just another piece of unwelcome uncertainty surrounding the companys future look. The things that separate YNG out from the pack of miners, with similar sub-$500mn market capitalizations, are firstly that it is a producer and secondly that it has in its possession one of the few refractory mills in the state of Nevada. With the preponderance in Nevada of sizable sulphide ore projects the ownership of, or access to, a mill capable of processing refractory ores would be a key factor. Not only does Yukon Nevada have the prospect of having three mines in operation on its Jerritt Canyon site within three years, but it has a stranglehold on the only spare capacity in the refractory mill sphere in Nevada. This sounds like the fruit machine has potential to ring up all the right fruit for the company. Yukon Nevada is most likely overlooked by analysts and investors who obsess over NI 43-101 reserves as the company adheres more to the mine it philosophy followed in the Australian mining space (from which its CEO hails). The logic of focusing upon the companys milling advantage (and downplaying resource as a metric) is rooted in one of the companys main advantages as a hired gun in the milling industry. It is not a concept that is too hard to understand for parties that understand the tolling and refining business model that is more common in the base metal space. YNG has been a whirlwind of activity over the last 18 months making identifying the moving parts of relevance into a task beyond most investors and analysts. However getting the arms around the company has been a challenge for a management that became distracted by the chimeric pursuit of the SPV concept just as its wheels were falling off the production effort in 4Q10. However, application to revisiting the company should be well-rewarded as the companys current valuation is well underpinned by the unique franchise that its refractory mill represents and includes none of the upside yet for the relative near future (or for the value realizable through some sort of Ketza spin-off). Thus, we are reiterating our Long rating on Yukon-Nevada and the twelve-month target price remains at $1.50. This represents a prospective P/E of 14 times in FY11 and a mere four times our estimated EPS in FY12.

Portfolio Investment Strategy

Monday, October 10, 2011

Portfolio Investment Strategy

Monday, October 10, 2011

Important disclosures

I, Christopher Ecclestone, hereby certify that the views expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or view expressed in this research report. Hallgartens Equity Research rating system consists of LONG, SHORT and NEUTRAL recommendations. LONG suggests capital appreciation to our target price during the next twelve months, while SHORT suggests capital depreciation to our target price during the next twelve months. NEUTRAL denotes a stock that is not likely to provide outstanding performance in either direction during the next twelve months, or it is a stock that we do not wish to place a rating on at the present time. Information contained herein is based on sources that we believe to be reliable, but we do not guarantee their accuracy. Prices and opinions concerning the composition of market sectors included in this report reflect the judgments of this date and are subject to change without notice. This report is for information purposes only and is not intended as an offer to sell or as a solicitation to buy securities. Hallgarten & Company or persons associated do not own securities of the securities described herein and may not make purchases or sales within one month, before or after, the publication of this report. Hallgarten policy does not permit any analyst to own shares in any company that he/she covers. Additional information is available upon request. 2011 Hallgarten & Company, LLC. All rights reserved. Reprints of Hallgarten reports are prohibited without permission. Web access at: Research: www.hallgartenco.com 60 Madison Ave, 6th Floor, New York, NY, 10010

Portfolio Investment Strategy

You might also like

- Dynacor: Corporate Presentation April 2013Document27 pagesDynacor: Corporate Presentation April 2013Dynacor Gold Mines Inc.No ratings yet

- YNG The Drama Is About To End November 27 2011Document16 pagesYNG The Drama Is About To End November 27 2011Mariusz SkoniecznyNo ratings yet

- YNG The Drama Is About To End November 27 2011Document16 pagesYNG The Drama Is About To End November 27 2011Mariusz SkoniecznyNo ratings yet

- Billionaire Backed Tiny Explorer Drilling for Giant IOCG DepositsDocument31 pagesBillionaire Backed Tiny Explorer Drilling for Giant IOCG DepositsUltrichNo ratings yet

- The Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008Document10 pagesThe Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008LuisMendiolaNo ratings yet

- GOLD - Selected Specific Company TakeawaysDocument3 pagesGOLD - Selected Specific Company TakeawaysBlake WhealeNo ratings yet

- Bull Is 2001sdfsdfsdfsdfDocument8 pagesBull Is 2001sdfsdfsdfsdfFrank Kleber García YaretaNo ratings yet

- Trevali Mining On The Path To ProductionDocument16 pagesTrevali Mining On The Path To ProductionOld School ValueNo ratings yet

- Raymond James - Analysis of Monterey ShaleDocument9 pagesRaymond James - Analysis of Monterey ShaleSteveLangNo ratings yet

- Record December Monthly Cash Costs. Cash Costs at The Choco 10 Mill Were A Record Low For December at US$347 Per Ounce ofDocument3 pagesRecord December Monthly Cash Costs. Cash Costs at The Choco 10 Mill Were A Record Low For December at US$347 Per Ounce ofJESUSNo ratings yet

- YNG Presentation Feb 2012Document36 pagesYNG Presentation Feb 2012MariuszSkoniecznyNo ratings yet

- Musselwhite Gold Mine, CanadaDocument14 pagesMusselwhite Gold Mine, CanadaalizzzzzzzzzzzzNo ratings yet

- Selected Gold Equities Indaba — February 2011Document56 pagesSelected Gold Equities Indaba — February 2011gpperkNo ratings yet

- Orporate ResentationDocument25 pagesOrporate ResentationRayanNo ratings yet

- EY Oints: Roduction IghlightsDocument16 pagesEY Oints: Roduction Ighlightsreine1987No ratings yet

- Business Plan MagnetiteDocument45 pagesBusiness Plan MagnetiteJuliano ConstanteNo ratings yet

- Global Mining Observer March 2015 Issue Highlights Osisko, Diamoncorp, and Hummingbird DevelopmentsDocument1 pageGlobal Mining Observer March 2015 Issue Highlights Osisko, Diamoncorp, and Hummingbird DevelopmentsOwm Close CorporationNo ratings yet

- Mineral Exploration Requires Innovation to Sustain IndustryDocument9 pagesMineral Exploration Requires Innovation to Sustain IndustryPat SimonNo ratings yet

- Cash Cost in MiningDocument7 pagesCash Cost in Miningbatman_No ratings yet

- Ecuador Gold & Silver Mining Projects and Key PlayersDocument25 pagesEcuador Gold & Silver Mining Projects and Key PlayersArthur OppitzNo ratings yet

- Clean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeFrom EverandClean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeRating: 4 out of 5 stars4/5 (1)

- Geopacific Resources NL - ASX Annual Report FYE Dec 2007 - Nabila Gold ProjectDocument71 pagesGeopacific Resources NL - ASX Annual Report FYE Dec 2007 - Nabila Gold ProjectIntelligentsiya HqNo ratings yet

- Business Summary Kat Gold Holding Corp BVIGDocument50 pagesBusiness Summary Kat Gold Holding Corp BVIGKen StoreyNo ratings yet

- Rare Earth Report 1Document9 pagesRare Earth Report 1andre313No ratings yet

- Hannans Annual Report 2009Document67 pagesHannans Annual Report 2009Hannans Reward LtdNo ratings yet

- Byron KnelsonDocument8 pagesByron KnelsonJuan Carlos Quintuna EspinNo ratings yet

- KPG Research Report On Nova Minerals LimitedDocument24 pagesKPG Research Report On Nova Minerals LimitedEli BernsteinNo ratings yet

- 0275 - IBG Ironbark Zinc Presentation June 2012 (20 06 12)Document22 pages0275 - IBG Ironbark Zinc Presentation June 2012 (20 06 12)poitan2100% (1)

- 6a947114 YrlDocument44 pages6a947114 YrlLong HuynhNo ratings yet

- RMG Mineral InvestDocument17 pagesRMG Mineral Investajitkumar16No ratings yet

- Recent trends in gold discovery analysisDocument19 pagesRecent trends in gold discovery analysisjavicol70No ratings yet

- Mines in AregentinaDocument6 pagesMines in AregentinaMANUELA MARIA ROMERO VICTORICANo ratings yet

- Diavik Fact BookDocument20 pagesDiavik Fact BookfiseradaNo ratings yet

- GK Executive Summary 1.2Document7 pagesGK Executive Summary 1.2kingdomtruck1No ratings yet

- Dubbo Zirconia ProjectDocument9 pagesDubbo Zirconia ProjectsangjuraganNo ratings yet

- OF4895Document271 pagesOF4895Cristina RamosNo ratings yet

- MPS Research - 117363-Asx-Nva-Research-20230628Document42 pagesMPS Research - 117363-Asx-Nva-Research-20230628tgitoenebNo ratings yet

- Lamaque Mine Due Diligence ReportDocument51 pagesLamaque Mine Due Diligence ReportkamaraNo ratings yet

- 10 Gold The Next Dramatic Step Would Be Cutting Back On MinesDocument2 pages10 Gold The Next Dramatic Step Would Be Cutting Back On MinesJoao Espinoza SanchezNo ratings yet

- Asw Profile Jun08Document2 pagesAsw Profile Jun08MattNo ratings yet

- ADN Company Presentation SM PDFDocument30 pagesADN Company Presentation SM PDFakmal_gundooNo ratings yet

- Canadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjDocument4 pagesCanadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjIntelligentsiya HqNo ratings yet

- Nautilus signs new offtake agreement with Tongling for Solwara 1 projectDocument3 pagesNautilus signs new offtake agreement with Tongling for Solwara 1 projectonibabaNo ratings yet

- SumitomoDocument23 pagesSumitomovic2clarionNo ratings yet

- Grade Control in MinesDocument5 pagesGrade Control in Minesa4agarwalNo ratings yet

- Wealth Letter: West Mining Corp Analyst Report - March 2021Document9 pagesWealth Letter: West Mining Corp Analyst Report - March 2021James HudsonNo ratings yet

- North of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthDocument4 pagesNorth of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthAndrewNo ratings yet

- EY Oints: Roduction IghlightsDocument12 pagesEY Oints: Roduction Ighlightsreine1987No ratings yet

- Case Study: Private Bond Issue - Mining JournalDocument5 pagesCase Study: Private Bond Issue - Mining JournalOwm Close CorporationNo ratings yet

- Total Deep Offshore (Brochure)Document12 pagesTotal Deep Offshore (Brochure)dhruvarora0% (1)

- The Challenger Gold MineDocument10 pagesThe Challenger Gold MinegeolukeNo ratings yet

- Review of Pit Slope at Valehaichichi PitDocument16 pagesReview of Pit Slope at Valehaichichi PitAdrian ZhangNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Going for Gold: The History of Newmont Mining CorporationFrom EverandGoing for Gold: The History of Newmont Mining CorporationRating: 5 out of 5 stars5/5 (1)

- Nova Minerals Research Report by MPSDocument23 pagesNova Minerals Research Report by MPSEli BernsteinNo ratings yet

- Myb1-2006-Nickel by Peter H. KuckDocument27 pagesMyb1-2006-Nickel by Peter H. KuckAhmad AshariNo ratings yet

- Energy & Tech Stocks: Golden Goliath Resources LTDDocument4 pagesEnergy & Tech Stocks: Golden Goliath Resources LTDapi-180363539No ratings yet

- The Business of Mining A brief non-technical exposition of the principles involved in the profitable operation of minesFrom EverandThe Business of Mining A brief non-technical exposition of the principles involved in the profitable operation of minesNo ratings yet

- 12-012 LTR To Monument MiningDocument2 pages12-012 LTR To Monument MiningMariusz SkoniecznyNo ratings yet

- Ver Is Gold February 2013 PresentationDocument24 pagesVer Is Gold February 2013 PresentationMariusz SkoniecznyNo ratings yet

- July Issue of Ultimate Value FinderDocument27 pagesJuly Issue of Ultimate Value FinderMariusz SkoniecznyNo ratings yet

- Monument Reminder LetterDocument2 pagesMonument Reminder LetterMariusz SkoniecznyNo ratings yet

- YNG Edison 07 12 2012Document12 pagesYNG Edison 07 12 2012Mariusz SkoniecznyNo ratings yet

- Notice of Special Meeting of ShareholdersDocument7 pagesNotice of Special Meeting of ShareholdersMariusz SkoniecznyNo ratings yet

- What Do Investors Want From A Gold Mining Stock?Document35 pagesWhat Do Investors Want From A Gold Mining Stock?Mariusz SkoniecznyNo ratings yet

- Letter To Monument Mining ManagementDocument2 pagesLetter To Monument Mining ManagementMariusz Skonieczny100% (1)

- Eric Sprott NY Hard Assets 2012Document27 pagesEric Sprott NY Hard Assets 2012Mariusz SkoniecznyNo ratings yet

- Attack On The For Profit IndustryDocument13 pagesAttack On The For Profit IndustryMariusz SkoniecznyNo ratings yet

- Hera Interview John EmbryDocument6 pagesHera Interview John Embryrichardck61No ratings yet

- Bigger Is Better For Aur Can ADocument3 pagesBigger Is Better For Aur Can AMariusz SkoniecznyNo ratings yet

- Eresearch Nov 27 2007Document7 pagesEresearch Nov 27 2007Mariusz SkoniecznyNo ratings yet

- Edison Investment Research August 17 2011Document12 pagesEdison Investment Research August 17 2011Mariusz SkoniecznyNo ratings yet

- Monument Mining Investor Presentation Nov 2010Document28 pagesMonument Mining Investor Presentation Nov 2010Mariusz SkoniecznyNo ratings yet

- Fundamental Research Corporation Sept 15 2008Document19 pagesFundamental Research Corporation Sept 15 2008Mariusz SkoniecznyNo ratings yet

- Sprott On OilDocument10 pagesSprott On OilMariusz Skonieczny100% (1)

- The Northern Miner Dec 20 2010Document4 pagesThe Northern Miner Dec 20 2010Mariusz SkoniecznyNo ratings yet

- Fundamental Research Corporation April 7 2009Document8 pagesFundamental Research Corporation April 7 2009Mariusz SkoniecznyNo ratings yet

- Byron Capital Markets Oct 22 2010Document27 pagesByron Capital Markets Oct 22 2010Mariusz SkoniecznyNo ratings yet

- Fundamental Research Corporation Feb 24 2011Document9 pagesFundamental Research Corporation Feb 24 2011Mariusz SkoniecznyNo ratings yet

- Byron Capital Markets March 3 2011Document3 pagesByron Capital Markets March 3 2011Mariusz SkoniecznyNo ratings yet

- Monument Mining Investor Presentation Nov 2010Document28 pagesMonument Mining Investor Presentation Nov 2010Mariusz SkoniecznyNo ratings yet

- DGLY Rpt-Sidoti 02-09-111Document2 pagesDGLY Rpt-Sidoti 02-09-111Mariusz SkoniecznyNo ratings yet

- Sub Level Caving Engineered To PerformDocument4 pagesSub Level Caving Engineered To PerformFofana KarambaNo ratings yet

- DocdtrDocument65 pagesDocdtrABDULLAH MOHAMED YAASEENNo ratings yet

- Joy Alukkas Organisation Study Project PDFDocument108 pagesJoy Alukkas Organisation Study Project PDFJayashree Menon0% (1)

- Performance Prediction of Raise Boring MachinesDocument95 pagesPerformance Prediction of Raise Boring Machinescondor IPAENo ratings yet

- Independent Engineer / Due Diligence Reviews: CalendarDocument4 pagesIndependent Engineer / Due Diligence Reviews: CalendarbriveravNo ratings yet

- NewsDocument31 pagesNewsAnatheaAcabanNo ratings yet

- Mining Report LowDocument202 pagesMining Report Lowpvanheus100% (2)

- Mine Machinery-1 SyllabusDocument3 pagesMine Machinery-1 SyllabusrrathoreNo ratings yet

- 1996 Cablebolting in Underground MinesDocument417 pages1996 Cablebolting in Underground MinesMiguel ColinaNo ratings yet

- Tinshed Flow SheetDocument1 pageTinshed Flow SheetEzra BellaNo ratings yet

- Mineral Resources - Lesson Plan GeographyDocument2 pagesMineral Resources - Lesson Plan GeographyetwinningNo ratings yet

- Corte E Aterro Corte E Enchimento: Cut and Fill Cut and FillDocument16 pagesCorte E Aterro Corte E Enchimento: Cut and Fill Cut and FillRaoni AdãoNo ratings yet

- Revisi-4 Marau Solomon WordDocument34 pagesRevisi-4 Marau Solomon WordfaidzilchabibcNo ratings yet

- Mining of Precious Metals and Minerals - August 2018Document220 pagesMining of Precious Metals and Minerals - August 2018Marcus HowardNo ratings yet

- Basic Concepts of Surface Mining PDFDocument56 pagesBasic Concepts of Surface Mining PDFHarikrishnaNo ratings yet

- Mine SurveyingDocument57 pagesMine SurveyingPatrick Menchero Soriaga100% (2)

- Mineral Resources of Nepal and Their Present StatusDocument26 pagesMineral Resources of Nepal and Their Present StatusSanjay KarkiNo ratings yet

- CMR 1957Document90 pagesCMR 1957Vidya SagarNo ratings yet

- Partial Glossary of Spanish Geological TermsDocument159 pagesPartial Glossary of Spanish Geological TermsNelly Paniagua100% (2)

- HSEC-B-20: Group Standard D1 - Underground SafetyDocument20 pagesHSEC-B-20: Group Standard D1 - Underground SafetyAngel Juárez D.No ratings yet

- RjgoldDocument26 pagesRjgoldSahaj Goel 576643No ratings yet

- Odisha Mining Corporation Limited (Omcl) Job 31Document7 pagesOdisha Mining Corporation Limited (Omcl) Job 31ravi kumarNo ratings yet

- Eskom Statement On Coal ContractDocument4 pagesEskom Statement On Coal ContractCityPressNo ratings yet

- Spontaneous Combustion GuidelinesDocument134 pagesSpontaneous Combustion GuidelinesMukeshVikram100% (2)

- Newmont Gold Minera-YANACOCHADocument4 pagesNewmont Gold Minera-YANACOCHAeditoteribleNo ratings yet

- Explosives & BlastingDocument7 pagesExplosives & BlastingRudianto SitanggangNo ratings yet

- Honey Agarwal ResumeDocument2 pagesHoney Agarwal ResumeHoneyNo ratings yet

- AntSentry Operating ManualDocument25 pagesAntSentry Operating ManualAbzal KinayatovNo ratings yet

- List of LawsDocument1 pageList of LawsNicola ViradorNo ratings yet

- Mining-Terms - 1Document2 pagesMining-Terms - 1KrishNo ratings yet