Professional Documents

Culture Documents

Duties of Directors of Jersey Companies

Uploaded by

Fuzzy_Wood_PersonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Duties of Directors of Jersey Companies

Uploaded by

Fuzzy_Wood_PersonCopyright:

Available Formats

page 1 of 8

forward

contact us

www.careyolsen.com

Corporate

Duties of Directors of Jersey Companies

August 2010

p 2 of 8

forward

back

home

contact us

www.careyolsen.com

This article summarises the duties of directors of Jersey companies, addresses directors' indemnities, outlines some dangers for directors of insolvent or near-insolvent companies and provides some practical advice to directors of such companies to mitigate the risks.

1. good faith Under Jersey customary law directors have a duty to act bona fide in the best interests of the company. This is not a purely objective test. It imports the idea of what the particular director considered to be in the best interests of the company. This duty is reflected in Article 74(a) of the Companies Law. This duty is owed to the company and not to any other person, such as a shareholder, even a majority shareholder. 2. proper purpose Even if directors act in good faith and in the interests of the company, they must still use their powers for a proper purpose. An oft-quoted example of a situation where directors have used their powers for an improper purpose is where directors issue shares, but do so to maintain or obtain personal control of the company in their capacity as shareholders. 3. conflict between duty and interests The duty to avoid conflicts between personal interests and the duty to the company has largely been overtaken by statute. Article 75 of the Companies Law requires disclosure of direct or indirect interests in transactions entered into or proposed to be entered into by the company or by a subsidiary which to a material extent conflict or may conflict with the interests of the company. The director must disclose at the first opportunity. You should also check the Articles because your company may have specific rules permitting or prohibiting interested directors from forming a part of a quorum or from voting on a matter in respect of which they have a conflict. It is worth noting that if a director fails to disclose an interest then under Article 76 the company or member of the company can apply for an order setting aside the transaction

Who is a director?

The Companies (Jersey) Law 1991 (the "Companies Law") states that a director is: "a person occupying the position of director, by whatever name called". Accordingly, you need not be formally appointed as a director to the company in order to owe the duties of a director. Alternate directors, shadow directors and "other persons occupying the position of a director" are subject to the duties and liabilities of being such, despite not being formally appointed.

What duties do I owe as a director, and to whom?

Companies (Jersey) Law 1991 and Customary Law Articles 74, 75 and 76 All discussions about directors' duties in Jersey begin with Article 74 of the Companies Law. This requires that in exercising their powers and discharging their duties directors shall: (a) act honestly and in good faith with a view to the best interests of the company; and (b) exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. This is essentially an attempt to encapsulate the customary/common law-derived fiduciary duties of directors, but which also remain relevant today. These include:

p 3 of 8

forward

back

home

contact us

www.careyolsen.com

concerned. The director can also be ordered to account to the company for any profit or gain realised. This leads us to the next customary duty: 4. accounting for profits A director's fiduciary position prohibits him from taking a personal profit from any opportunities arising from his directorship, even if he is acting honestly and for the good of the company. In such circumstances, profits made by the director on a transaction with the company or with a third party need to be paid over to the company. This is the case even if it can be shown that the profit would not have accrued to the company. If the opportunity for the profit arose through the directorship then he must account to the company for it. Directors are only permitted to receive remuneration and payment of expenses if the Articles permit. Prospectuses The Companies Law in effect provides that anyone who fails to comply with the General Provisions Order (the "Order") issued under Article 29(3) of the Companies Law (and, where the offence is committed by a body corporate, every officer of the body corporate which is in default) is guilty of an offence punishable by imprisonment for a term not exceeding 2 years or a fine, or both. The Order provides (among other things) that no person shall circulate a prospectus in Jersey (and no Jersey company may circulate a prospectus outside of Jersey) unless certain conditions are complied with. Civil and criminal liability can also arise under the Companies Law for material statements in a prospectus that are untrue or misleading and also may arise as a result of material omissions from a prospectus. Criminal penalties include imprisonment for a term of up to 10 years or a fine, or both.

Financial Services (Jersey) Law 1998 There are other offences that fall outside of the scope of this note, but they include sanctions for market manipulation and insider dealing. There is currently no Jersey authority on actions based upon negligent misstatement, but Jersey law may recognise such an action. In reality though, if directors abide by the provisions of the Companies Law it is unlikely that common/customary law liability will arise.

Miscellaneous other duties of a company under CJL There are a variety of other statutory duties placed upon Jersey companies and the directors are responsible for ensuring these are met. These include: 1. 2. 3. 4. 5. 6. keeping registers of members, directors and secretary keeping of minutes of meetings holding of general meetings keeping of accounts appointment of auditors filing of annual returns and special resolutions

Solvency Statements Redemption of Shares: Redeemable limited shares of par value and no par value companies (not being open-ended investment companies) are capable of being redeemed from any source, but only if they are fully paid up and provided that all the directors of the company who authorise the redemption make a statement that they have formed the opinion: (a) that, immediately following the date on which the payment is proposed to be made, the company will be able to discharge its liabilities as they fall due; and

p 4 of 8

forward

back

home

contact us

www.careyolsen.com

(b) that, having regard to: i) the prospects of the company and to the intentions of the directors with respect to the management of the company's business; and

statement as that referred to above (incorporating the 12-month solvency look-forward) must be made by all of the directors who are to authorise the distribution. Directors should note that each of the redemption of shares, purchase of shares and distributions processes require directors to form an opinion on the company's solvency. That opinion is required by law to be based upon the companys prospects, the directors' plans for the business and the amount and character of the financial resources available to the company. The opinion must be a reasonable one. The amount of due diligence directors need to do in order to form their opinion will depend on the facts and circumstances of the particular company concerned. However, by ensuring that the corporate governance, accounting, audit and treasury management functions are carried out appropriately, directors should have the raw data and information they need on which to base their opinion.

ii) the amount and character of the financial resources that will in their view be available to the company, the company will be able to: (A) continue to carry on business; and (B) discharge its liabilities as they fall due, until the expiry of the period of 12 months immediately following the date on which the payment is proposed to be made or until the company is dissolved pursuant to summary winding up, whichever first occurs. A director who makes such a statement without having reasonable grounds for the opinion expressed in the statement is guilty of an offence punishable by up to 2 years imprisonment or a fine, or both. Purchase of Shares: The same solvency statement is required (and same offence applies) with respect to the decision of a company to purchase its own limited shares under Article 57 of the Companies Law. Distributions: Under Part 17 of the Companies Law a "distribution" means "every description of distribution of the company's assets to its members as members, whether in cash or otherwise" but does not include a distribution by way of issue of shares as bonus shares, redemption or purchase of the company's shares (because they are dealt with under Articles 55 and 57), reduction of capital (because they are governed by Part 12) or a distribution to members on winding up. An almost identical solvency

Warranty of Authority

The doctrine of (external) ultra vires has been abolished in its application to Jersey companies. This means that a Jersey company cannot avoid liability to a third party under a contract entered into on its behalf by one of its directors simply by pointing to the fact that the company's memorandum or articles did not permit it to enter into such a contract. Nevertheless, directors remain under an obligation to the company to conduct the business of the company in accordance with the memorandum and articles (internal ultra vires). Where a director exceeds his actual authority (but acts within his ostensible or apparent authority): a) the company will be bound by the director's actions; and b) the company may have a claim against the director for damages for breach of authority.

p 5 of 8

forward

back

home

contact us

www.careyolsen.com

If the director exceeds both his actual and his ostensible authority: a) the company will not be bound by the director's actions; but b) the director may still be liable for breach of warranty of authority to the third party; and c) he may also liable to the company itself for breach of authority.

Reliance on Co-Directors and Officers

A director is not expected to attend every board meeting unless the articles specify this, but he ought to attend when able. Persistent nonattendance, however, is a breach of duty. A director must give a reasonable amount of attention to the company's affairs. What that means in any particular case will depend upon a number of factors, including the number of directors on the board (responsibility of an individual on a smaller board is greater) and on the extent to which areas of responsibility have been allocated among directors. Directors are not expected to be experts in an area of business unless they are appointed because of their special qualifications. A director should be entitled to rely upon the advice of a fellow director as to matters on which that fellow director is regarded as being an expert. However, this does not mean that a director can vacate responsibility for (for example) accounting issues, claiming that it is not his or her area of expertise. Also, English case law shows that non-executive directors cannot simply leave management of a company to executive directors: non-executive directors pre-signed cheques for the use of an executive director and in that case all of the non-executive directors were held liable for negligence. Directors must demonstrate such skill and care as may be reasonably expected from persons of their knowledge and experience, take such care as an ordinary person might be expected to in the conduct of their own affairs and exercise any and all powers in good faith in the best interests of the company.

As we set out below, all directors must take steps to inform themselves of the affairs of the company to a degree sufficient to enable him or her to discharge his fiduciary duty to act in the best interests of the company. There are also specific duties to which a grasp of the financial circumstances of the company is crucial, including the approval of the accounts and the making of solvency statements such as those mentioned above where a company seeks to redeem shares, purchase its own shares, or make a distribution.

Indemnities for Directors

There are limits on the indemnities that a company can provide to its directors. Article 77 of the Companies Law prohibits a company providing an indemnity to its directors, although there are exceptions: i) for liabilities incurred in defending civil or criminal proceedings where the director is successful or acquitted;

ii) for liabilities incurred otherwise than to the company where the director acted in good faith with a view to the best interests of the company; iii) for liabilities incurred in connection with an application (which is successful) under Article 212 (power of court to relieve director from liability); and iv) for liabilities normally insured against for persons other than directors (conventional "D&O" insurance).

Duties and Offences in Circumstances of Insolvency

The topic of directors' duties becomes more complicated in the context of a company that is, or is near to becoming, insolvent. Directors of such a company are subject to additional duties and potential liabilities and may be required to take steps to safeguard the interests of the company's creditors. Failure to do so may lead to personal liability.

p 6 of 8

forward

back

home

contact us

www.careyolsen.com

Wrongful Trading Article 177 Companies Law The two main risks in an insolvency are wrongful trading and fraudulent trading. If you, as a director of a company, knew at a time prior to the date of commencement of a creditors' winding up (the "Winding Up") (or prior to the date of declaration of en dsastre (the "Declaration")) that there was no reasonable prospect that the company would avoid such Winding Up or Declaration or on the facts known to you were reckless as to whether it would avoid it, then you may be held responsible (without limitation of liability) for all or any of the debts or other liabilities of the company arising after the time you had that knowledge. This offence is sometimes called "trading whilst insolvent", but the wording is crucial: It is not the mere fact of insolvency (meaning an inability to meet ones liabilities as they fall due) that is crucial, it is the point at which you knew that there was no reasonable prospect of the company avoiding a Winding Up or Declaration. Fraudulent Trading Article 178 Companies Law If it is shown that the business of a company is carried on with intent to defraud creditors of the company or of another person, or for a fraudulent purpose, the court may order that persons knowingly party to the carrying on of the business in that manner are liable to contribute to the company's assets as the court thinks proper. If that person is a creditor the court may direct that the whole or part of the debt owed is subordinated so that it ranks in order of payment after all other debts of the company. This is without prejudice to the fact that the director may also be found criminally liable for the wrongful trading and fraudulent trading offences. Transactions at an Undervalue The liquidator of a company and the Viscount (appointed under the Bankruptcy Dsastre (Jersey) Law 1990) can also challenge transactions

entered into by a company at an undervalue. This is designed to target the dispersal of assets at nil or less than market value in the lead-up to insolvency proceedings either to related or unrelated entities. The period of time before the Winding Up or Declaration during which transactions are liable to such challenge is 5 years. Preferences Transactions that take place in the period of 12 months preceding a Winding Up or a Declaration may also be challenged by the liquidator or Viscount as a preference. The giving of a preference takes place where the company does anything or suffers anything to be done that has the effect of putting a creditor/surety/guarantor into a position which (in the event that the company is wound up) will be a better position than the one it would have been in if it had not taken place. The typical preference is where a distressed debtor provides security over its assets for a previously unsecured debt, or the payment of one unsecured creditor in priority over another.

Practical Steps

A director who exercises reasonable diligence and honesty is not going to find himself or herself liable for wrongful or fraudulent trading under Article 177 or Article 178 of the Companies Law. However there are a number of specific actions directors can take to try to mitigate risks: 1. Obtain professional accounting and legal advice. Document it. 2. Hold regular board meetings. Make sure minutes are taken and circulated, and that you as a director review minutes and correct anything you regard as requiring correction. 3. Actively take steps to ensure you receive regular, up-to-date financial information.

p 7 of 8

forward

back

home

contact us

www.careyolsen.com

4. Article 177 looks to the moment in time at which directors knew the company no longer had a reasonable prospect of avoiding winding-up/dsastre. To address this, directors should ensure that board minutes clearly document all potential sources of finance and options explored by the board, and put relevant dates against each such effort. 5. The board may elect to set some milestones by which to measure the companys progress in trying to avoid a winding-up, such as by securing the payment of outstanding debtors or improvements in efficiency. 6. The board should not incur substantial additional liabilities until other finance is secured. 7. Directors ought to bring concerns to the attention of other board members and insist that steps are taken to minimise potential loss to creditors (Article 177(3)).

Please note that this briefing is only intended to provide a very general overview of the matters to which it relates. It is not intended as legal advice and should not be relied on as such. c Carey Olsen 2010

p 8 of 8

back

home

www.careyolsen.com

Contact us

Alex Ohlsson, Partner

alex.ohlsson@careyolsen.com Telephone: +44 (0)1534 822251

For further information or professional advice please contact our lawyers below. 47 Esplanade St Helier Jersey JE1 0BD Tel: +44 (0)1534 888900 Fax: +44 (0)1534 887744

Robin Smith, Partner

robin.smith@careyolsen.com Telephone: +44 (0)1534 822264

Nicholas Crocker, Partner

nicholas.crocker@careyolsen.com Telephone: +44 (0)1534 822409

Simon Marks, Partner

simon.marks@careyolsen.com Telephone: +44 (0)1534 822252

Mike Jeffrey, Partner

mike.jeffrey@careyolsen.com Telephone: +44 (0)1534 822370

Robert Milner, Partner

robert.milner@careyolsen.com Telephone: +44 (0)1534 822336

Alan Stevens, Group Partner

alan.stevens@careyolsen.com Telephone: +44 (0)1534 822422

Peter German, Partner

peter.german@careyolsen.com Telephone: +44 (0)1534 822372

Guy Coltman, Partner

guy.coltman@careyolsen.com Telephone: +44 (0)1534 822289

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Prospects and Opportunities For Rural Land Management On The Crown EstateDocument118 pagesProspects and Opportunities For Rural Land Management On The Crown EstateFuzzy_Wood_PersonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Freeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingDocument24 pagesFreeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingRockyNo ratings yet

- RAF Oakington Vol 1Document198 pagesRAF Oakington Vol 1Fuzzy_Wood_Person80% (5)

- 1803 Hector Berlioz - Compositions - AllMusicDocument6 pages1803 Hector Berlioz - Compositions - AllMusicYannisVarthisNo ratings yet

- FraudDocument77 pagesFraudTan Siew Li100% (2)

- Veterinary Medicines Regulations 2013Document112 pagesVeterinary Medicines Regulations 2013Fuzzy_Wood_PersonNo ratings yet

- Bo's Coffee AprmDocument24 pagesBo's Coffee Aprmalliquemina100% (1)

- American Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsDocument2 pagesAmerican Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsFoxtrot Alpha100% (1)

- Gosling - V - Secretary of State For The Home DepartmentDocument28 pagesGosling - V - Secretary of State For The Home DepartmentFuzzy_Wood_PersonNo ratings yet

- House & Garden - November 2015 AUDocument228 pagesHouse & Garden - November 2015 AUHussain Elarabi100% (3)

- Relevant Electrical Standards (Issue 1)Document223 pagesRelevant Electrical Standards (Issue 1)smcraftNo ratings yet

- Exeter and District BNP Newsletter (January 2014)Document20 pagesExeter and District BNP Newsletter (January 2014)Fuzzy_Wood_PersonNo ratings yet

- Chlamydia Screening PolicyDocument12 pagesChlamydia Screening PolicyFuzzy_Wood_PersonNo ratings yet

- UGLE - V - Commissioners For HMRCDocument33 pagesUGLE - V - Commissioners For HMRCFuzzy_Wood_PersonNo ratings yet

- Mary Tavy Hydro-Electric Power StationDocument4 pagesMary Tavy Hydro-Electric Power StationFuzzy_Wood_PersonNo ratings yet

- A Brief History of IslamismDocument20 pagesA Brief History of IslamismFuzzy_Wood_PersonNo ratings yet

- Ogwell Parish Newsletter, Spring 2013Document12 pagesOgwell Parish Newsletter, Spring 2013Fuzzy_Wood_PersonNo ratings yet

- Ogwell Parish Newsletter (Autumn 2013)Document12 pagesOgwell Parish Newsletter (Autumn 2013)Fuzzy_Wood_PersonNo ratings yet

- The Balance of Islam in Challenging ExtremismDocument20 pagesThe Balance of Islam in Challenging ExtremismFuzzy_Wood_PersonNo ratings yet

- Exeter and District BNP Newsletter (October 2013)Document20 pagesExeter and District BNP Newsletter (October 2013)Fuzzy_Wood_PersonNo ratings yet

- The Queen - V - D (R) (2013)Document36 pagesThe Queen - V - D (R) (2013)Fuzzy_Wood_PersonNo ratings yet

- Exeter and District BNP Newsletter (June 2013)Document15 pagesExeter and District BNP Newsletter (June 2013)Fuzzy_Wood_PersonNo ratings yet

- Five Independent Reports Obstetrics Gynaecology Service RCHT Feb 2013Document102 pagesFive Independent Reports Obstetrics Gynaecology Service RCHT Feb 2013Fuzzy_Wood_PersonNo ratings yet

- UK Government Guide To GiltsDocument32 pagesUK Government Guide To GiltsFuzzy_Wood_PersonNo ratings yet

- Non-Medical Prescribing PolicyDocument20 pagesNon-Medical Prescribing PolicyFuzzy_Wood_PersonNo ratings yet

- Badgers and Bovine TBDocument4 pagesBadgers and Bovine TBFuzzy_Wood_PersonNo ratings yet

- Exeter and District BNP Newsletter (March 2013)Document16 pagesExeter and District BNP Newsletter (March 2013)Fuzzy_Wood_PersonNo ratings yet

- Exeter and District BNP Newsletter (August 2013)Document16 pagesExeter and District BNP Newsletter (August 2013)Fuzzy_Wood_PersonNo ratings yet

- A Private Investor's Guide To GiltsDocument36 pagesA Private Investor's Guide To GiltsFuzzy_Wood_PersonNo ratings yet

- London: Garden City? From Green To Grey Observed Changes in Garden Vegetation Structure in London 1998-2008Document50 pagesLondon: Garden City? From Green To Grey Observed Changes in Garden Vegetation Structure in London 1998-2008Fuzzy_Wood_PersonNo ratings yet

- Exeter and District BNP Newsletter (April 2013)Document24 pagesExeter and District BNP Newsletter (April 2013)Fuzzy_Wood_PersonNo ratings yet

- Control of Noise (Code of Practice On Noise From Ice-Cream Van Chimes Etc.) Order 2013Document2 pagesControl of Noise (Code of Practice On Noise From Ice-Cream Van Chimes Etc.) Order 2013Fuzzy_Wood_PersonNo ratings yet

- Addenbrooke's Kidney Patients Association HandbookDocument16 pagesAddenbrooke's Kidney Patients Association HandbookFuzzy_Wood_PersonNo ratings yet

- University of Cambridge Museums, Strategic Plan 2013 - 2016Document11 pagesUniversity of Cambridge Museums, Strategic Plan 2013 - 2016Fuzzy_Wood_PersonNo ratings yet

- Cambridge University Press Annual Report 2012Document27 pagesCambridge University Press Annual Report 2012Fuzzy_Wood_PersonNo ratings yet

- RLUK Hidden CollectionsDocument57 pagesRLUK Hidden CollectionsFuzzy_Wood_PersonNo ratings yet

- Verbos Regulares e IrregularesDocument8 pagesVerbos Regulares e IrregularesJerson DiazNo ratings yet

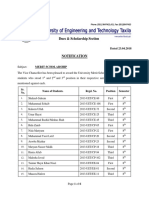

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDNo ratings yet

- Experiment No. 11 Fabricating Concrete Specimen For Tests: Referenced StandardDocument5 pagesExperiment No. 11 Fabricating Concrete Specimen For Tests: Referenced StandardRenNo ratings yet

- Future42 1675898461Document48 pagesFuture42 1675898461Rodrigo Garcia G.No ratings yet

- Com 10003 Assignment 3Document8 pagesCom 10003 Assignment 3AmandaNo ratings yet

- Executive Support SystemDocument12 pagesExecutive Support SystemSachin Kumar Bassi100% (2)

- Dwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFDocument35 pagesDwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFrainbow.basque1cpq100% (10)

- Friday August 6, 2010 LeaderDocument40 pagesFriday August 6, 2010 LeaderSurrey/North Delta LeaderNo ratings yet

- Lcolegario Chapter 5Document15 pagesLcolegario Chapter 5Leezl Campoamor OlegarioNo ratings yet

- Plo Slide Chapter 16 Organizational Change and DevelopmentDocument22 pagesPlo Slide Chapter 16 Organizational Change and DevelopmentkrystelNo ratings yet

- Group Assignment Topics - BEO6500 Economics For ManagementDocument3 pagesGroup Assignment Topics - BEO6500 Economics For ManagementnoylupNo ratings yet

- Concepts of Human Development and Poverty: A Multidimensional PerspectiveDocument3 pagesConcepts of Human Development and Poverty: A Multidimensional PerspectiveTasneem Raihan100% (1)

- 02 Activity 1 (4) (STRA)Document2 pages02 Activity 1 (4) (STRA)Kathy RamosNo ratings yet

- Platform Tests Forj Udging Quality of MilkDocument10 pagesPlatform Tests Forj Udging Quality of MilkAbubaker IbrahimNo ratings yet

- History of Philippine Sports PDFDocument48 pagesHistory of Philippine Sports PDFGerlie SaripaNo ratings yet

- Hand Infection Guide: Felons to Flexor TenosynovitisDocument68 pagesHand Infection Guide: Felons to Flexor TenosynovitisSuren VishvanathNo ratings yet

- MES - Project Orientation For Night Study - V4Document41 pagesMES - Project Orientation For Night Study - V4Andi YusmarNo ratings yet

- Criteria For RESEARCHDocument8 pagesCriteria For RESEARCHRalph Anthony ApostolNo ratings yet

- MAS-06 WORKING CAPITAL OPTIMIZATIONDocument9 pagesMAS-06 WORKING CAPITAL OPTIMIZATIONEinstein Salcedo100% (1)

- Statement of Purpose EitDocument3 pagesStatement of Purpose EitSajith KvNo ratings yet

- Robots Template 16x9Document13 pagesRobots Template 16x9Danika Kaye GornesNo ratings yet

- Puberty and The Tanner StagesDocument2 pagesPuberty and The Tanner StagesPramedicaPerdanaPutraNo ratings yet

- Specification Table - Stocks and ETF CFDsDocument53 pagesSpecification Table - Stocks and ETF CFDsHouse GardenNo ratings yet

- jvc_kd-av7000_kd-av7001_kd-av7005_kd-av7008_kv-mav7001_kv-mav7002-ma101-Document159 pagesjvc_kd-av7000_kd-av7001_kd-av7005_kd-av7008_kv-mav7001_kv-mav7002-ma101-strelectronicsNo ratings yet