Professional Documents

Culture Documents

ETV - Portugal's Austerity Measures and The Impact On Business Innovation

Uploaded by

Hugo Mendes DomingosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ETV - Portugal's Austerity Measures and The Impact On Business Innovation

Uploaded by

Hugo Mendes DomingosCopyright:

Available Formats

Portugals austerity measures and the impact on business innovation Measures announced On 7 September 2012, the Portuguese Government

announced new austerity measures that include an increase (of 7 percentage points) in the contribution of workers towards social security together with a decrease (of 5,25 percentage points) in the contribution of companies. This would place Portugal broadly in line with Germany. The first measure was aimed at fighting the increased cost with social security and generally to help achieve the new deficit goal, agreed with the ECB, EU Commission and IMF. The second measure taken was aimed at providing companies with sufficient funds (savings from the tax break) to keep jobs and foster employment. Impact on the economy This measure should help support the social security accounts that are suffering badly from the rise in unemployment. Moreover, the Government expects that this measure will support employment and increase competitiveness for firms (according to finance minister Vitor Gaspar, this measure will create 1 to 2% employment by 2015), as a result of lower costs for employers. However, these effects are unlikely to have a significant impact in the short run. A recent study by four economists from the University of Minho revealed that the net effect of measures will actually increase the unemployed by 68 thousand. The economic outlook remains sharply recessionary for Portugal, and cloudy for most of Portugals trading partners. This scenario is not favorable for the predictions made by the government. Reactions Reactions to the announcement of these austerity measures were widespread and predominately negative. In Portugal, business leaders rose against the measures saying they were unnecessary and will not benefit their companies. Paulo de Azevedo from Sonae, one of the largest business groups in Portugal, claimed that these measures would be harmful for nonexporting companies. The announcement also shook the political sphere with the opposition and even some members of the Government party (PPD/PSD) opposing and criticising the measures. The coalition that enabled the government to have majority in the Portuguese parliament was weakened with the head of CDS/PP publicly admitting to be against the measures.

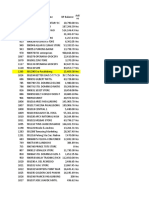

Source: Bloomberg Investors reaction was ambiguous or indifferent as we can see that from the chart above. It shows the yield to maturity of Portuguese 10 year government bonds and its evolution last month. The first drop which occurred on 5 of September was an obvious positive reaction to the ECBs announcement of its intention to purchase sovereign debt from struggling countries. However, the reaction after the announcement of these measures (on 7 September) was negative, at first glance. However, it is hard to isolate the effect, due to a high number of relevant events that might have also affected the yield. It is unclear whether the markets are factoring in one of the largest demonstrations in the history of the country having taken place during the weekend. The European Commission admitted that the government could drop the measures if it could come up with an alternative to fulfill the adjustment programmes goals as agreed with the IMF. A year ago, IMF representatives alerted to the risks of these measures and their intended purpose. The delegates believed that it is not obvious that promoting employment is a good substitute for increased efficiency. Moreover, the head of the IMF delegation, Adebe Salassi, recently stated that these measures were not enforced by the delegation and were solely an initiative of the Portuguese government. As these measures are likely to affect the contributions to social security in Portugal, we find it relevant to compare these with other European countries. Looking at the overall map of aggregate contributions of employees and employers for the European Union countries as a percentage of GDP until 2010, we find that Portugal is below other countries in terms of contributions and is closer to the UK than to other southern European countries such as Spain or Italy, for example.

20.00 18.00 16.00 14.00 12.00 10.00 8.00 6.00 4.00 2.00 .00 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 EU (12,9%) Portugal (9%) Spain (12,3%) UK (7,8%) Italy (13,4%) France (16,7%) Greece (10,9%)

Source: Eurostat Innovation Models insight Here at innovation models, our opinion/reaction about this measure is also mixed. Had Government announced that the proceeds from the reduction in employer contributions were directed at developing innovative projects that might foster employment in the long run, we would consider these measures as positive. This would have been difficult to implement anyway. We believe that the source of the economic difficulties in Portugal has not been addressed yet. This matter was discussed in ETVs Closing Bell programme on 18 September (in Portuguese): Youtube link - http://www.youtube.com/watch?v=S6UN9k8lUtI&feature=plcp

You might also like

- Post Brooking's StudyDocument2 pagesPost Brooking's StudyHugo Mendes DomingosNo ratings yet

- Chapter 8 - Im - TeaserDocument3 pagesChapter 8 - Im - TeaserHugo Mendes DomingosNo ratings yet

- Chapter 7 - Ep - TeaserDocument4 pagesChapter 7 - Ep - TeaserHugo Mendes DomingosNo ratings yet

- Chapter4 - Modelling Innovation - TeaserDocument8 pagesChapter4 - Modelling Innovation - TeaserHugo Mendes DomingosNo ratings yet

- Chapter 3 - Modelling Innovation - TeaserDocument6 pagesChapter 3 - Modelling Innovation - TeaserHugo Mendes DomingosNo ratings yet

- Chapter 6 - Modelling Innovation - TeaserDocument8 pagesChapter 6 - Modelling Innovation - TeaserHugo Mendes DomingosNo ratings yet

- Top 5 Posts - HMDDocument1 pageTop 5 Posts - HMDHugo Mendes DomingosNo ratings yet

- Paper Contraditório - Private Equity - Transactions in PortugalDocument33 pagesPaper Contraditório - Private Equity - Transactions in PortugalHugo Mendes DomingosNo ratings yet

- Chapter 2 - Modelling Innovation - TeaserDocument2 pagesChapter 2 - Modelling Innovation - TeaserHugo Mendes DomingosNo ratings yet

- ETV - Bad Loans, ECB Intervention and Competitive AdvantagesDocument3 pagesETV - Bad Loans, ECB Intervention and Competitive AdvantagesHugo Mendes DomingosNo ratings yet

- ETV - Company Insolvency and InnovationDocument3 pagesETV - Company Insolvency and InnovationHugo Mendes DomingosNo ratings yet

- Morals and The Takeover Code Do Not Always Mix 20110925Document2 pagesMorals and The Takeover Code Do Not Always Mix 20110925Hugo Mendes DomingosNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Efficient Three Phase X3-Max Inverters from SolaX for Industrial and Residential UseDocument2 pagesEfficient Three Phase X3-Max Inverters from SolaX for Industrial and Residential UseMuhammad FaruqNo ratings yet

- Verilog HDL Lab ManualDocument68 pagesVerilog HDL Lab ManualParag Parandkar80% (25)

- Hand Sanitizer Solution: Sanipure: "Safe, Effective, Innovative"Document19 pagesHand Sanitizer Solution: Sanipure: "Safe, Effective, Innovative"Daniel Mariano LeãoNo ratings yet

- Traning Modul Huawei MBTS 3900 and 3900ADocument113 pagesTraning Modul Huawei MBTS 3900 and 3900AEric HerreraNo ratings yet

- Minimize audit risk with pre-engagement activitiesDocument2 pagesMinimize audit risk with pre-engagement activitiesAnonymityNo ratings yet

- 2 - SM Watches Father's Day Promotion - June 2023Document11 pages2 - SM Watches Father's Day Promotion - June 2023Shekhar NillNo ratings yet

- Catalogue: See Colour in A Whole New LightDocument17 pagesCatalogue: See Colour in A Whole New LightManuel AguilarNo ratings yet

- Comparator: Differential VoltageDocument8 pagesComparator: Differential VoltageTanvir Ahmed MunnaNo ratings yet

- Pizza Crust Menu in Karachi - Restaurant Online Ordering PakistanDocument2 pagesPizza Crust Menu in Karachi - Restaurant Online Ordering PakistanSyed Rafay HashmiNo ratings yet

- PDF Online Activity - Gerunds and InfinitivesDocument3 pagesPDF Online Activity - Gerunds and InfinitivesJORDY ALEXANDER MONTENEGRO ESPEJONo ratings yet

- Best Practices in Non-Revenue Water en FinalDocument96 pagesBest Practices in Non-Revenue Water en FinalEddiemtonga100% (1)

- NGT 1021 8 17 - 2Document10 pagesNGT 1021 8 17 - 2markpestell68No ratings yet

- Doctrine of Repugnancy ExplainedDocument13 pagesDoctrine of Repugnancy ExplainedAmita SinwarNo ratings yet

- ImcfDocument64 pagesImcfHʌɩɗɘʀ AɭɩNo ratings yet

- Fundamental analysis of ACC Ltd and India's cement industryDocument5 pagesFundamental analysis of ACC Ltd and India's cement industryDevika SuvarnaNo ratings yet

- 26-200 kVA BrochureDocument16 pages26-200 kVA Brochureargo kuncahyoNo ratings yet

- Infrared Spectroscopy of FAME in Biodiesel Following DIN 14078 PDFDocument2 pagesInfrared Spectroscopy of FAME in Biodiesel Following DIN 14078 PDFPedro AluaNo ratings yet

- Deckers v. Comfy - Minute OrderDocument2 pagesDeckers v. Comfy - Minute OrderSarah BursteinNo ratings yet

- Approved Term of Payment For Updating Lower LagunaDocument50 pagesApproved Term of Payment For Updating Lower LagunaSadasfd SdsadsaNo ratings yet

- Municipal Tax Dispute Over Petroleum Refinery in PilillaDocument5 pagesMunicipal Tax Dispute Over Petroleum Refinery in PilillaDaphne Jade Estandarte PanesNo ratings yet

- Assessment of Cellular Planning Methods for GSMDocument5 pagesAssessment of Cellular Planning Methods for GSMradebasicNo ratings yet

- Page 34-45 BLK PicDocument12 pagesPage 34-45 BLK PicMihir MehraNo ratings yet

- Permits & Inspections - Food Establishment Inspections - Suffolk County Department of Health ServicesDocument10 pagesPermits & Inspections - Food Establishment Inspections - Suffolk County Department of Health ServicesHortense AllensworthNo ratings yet

- AR15 Forging ReceiverDocument105 pagesAR15 Forging ReceiverNO2NWO100% (10)

- Cepej Report 2020-22 e WebDocument164 pagesCepej Report 2020-22 e WebGjorgji AndonovNo ratings yet

- Stellarisware Release Notes: Sw-Rln-6852Document160 pagesStellarisware Release Notes: Sw-Rln-6852Akio TakeuchiNo ratings yet

- Antipsychotic DrugsDocument23 pagesAntipsychotic DrugsASHLEY DAWN BUENAFENo ratings yet

- 00 2 Physical Science - Zchs MainDocument4 pages00 2 Physical Science - Zchs MainPRC BoardNo ratings yet

- Literature Review Economics SampleDocument8 pagesLiterature Review Economics Sampleafmzynegjunqfk100% (1)

- III International Congress on Teaching Cases Related to Public and Nonprofit Marketing: Nestlé's CSR in Moga District, IndiaDocument8 pagesIII International Congress on Teaching Cases Related to Public and Nonprofit Marketing: Nestlé's CSR in Moga District, IndiaIshita KotakNo ratings yet