Professional Documents

Culture Documents

Asian Hotels

Uploaded by

Stone ColdOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asian Hotels

Uploaded by

Stone ColdCopyright:

Available Formats

An Assignment ON Stock Price Analysis of ASIAN HOTELS

SUBMITTED TO: PROF. SUSMITA SARKAR FINANCE FACULTY DSBS

SUBMITTED BY: Pradeep Singha PGDMA-1135

Dayananda Sagar Business School Shivage Malleshwara Hills Kumaraswamy Layout, Bangalore, Karnataka 560078

Company Profile:-

The Company was incorporated as Asian Hotels Limited (the Company) under the Companies Act, 1956, on 13th November, 1980, as a Public Limited Company. It was promoted by Mr. R.K. Jatia, Mr. R.S. Saraf and Late Mr. Chaman Lal Gupta, three Non-resident Indians together with Mr. Shiv Jatia and Mr. Sushil Gupta, their Indian associates.

On incorporation, the immediate object of the Company was to set up a five star deluxe hotel of international standards in Delhi. Hence Hyatt Regency Delhi came into existence. After soft opening in 1982 for the Asian Games, it became fully operational in the year 1983. Later the Company set up two more five star deluxe hotels - at Mumbai and Kolkata. While Hyatt Regency Kolkata was operational effective 1st January, 2003, Hyatt Regency Mumbai commenced operations effective 1st April, 2003.

In 2010, through a Scheme of Arrangement and De-merger sanctioned by the High Court of Delhi vide Order dated 13th January, 2010, the Mumbai Undertaking and Kolkata Undertaking of the Company primarily comprising Hyatt Regency Mumbai and Hyatt Regency Kolkata respectively, were transferred to and vested in two separate companies with effect from 31st October, 2009.

Consequently, post de-merger the Company, now known as Asian Hotels (North) Limited, has only one operational property namely Hyatt Regency Delhi.

In August 2010, after due regulatory notifications, the main promoter groups namely the R. K. Jatia & Shiv Jatia Group, Gupta Group and Saraf Group transferred their respective shareholding inter-se in the three de-merged entities. Resultantly, the R. K. Jatia & Shiv Jatia Group acquired shares held in the Company by the other two promoter groups named above.

In October 2010, the Company made a strategic investment by acquiring majority stake in Fineline Hospitality & Consultancy Pvt. Ltd., Mauritius; and through its subsidiaries namely Most Prof Hospitality & Consultancy Pvt. Ltd., Mauritius and Lexon Ventures Pte. Ltd., BVI

acquired a controlling interest in Magus Estates and Hotels Limited, which owns and operates Four Seasons hotel in Mumbai.

Presently the Company, in addition to expanding its existing facilities, is in the process of constructing a new tower, comprising of serviced apartments and commercial space as part of the expansion at Hyatt Regency Delhi. They operate three 5 star deluxe category hotels. Locations: Delhi, Mumbai & Kolkata. They operate the Hyatt Regency brand on the above three locations.

Address:Asian Hotels (North) Limited Hotel Hyatt Regency Delhi Bhikaiji Cama Place, M. G. Marg, New Delhi - 110066, India Telephone (Hotel Operator): +91-11-26791234 Fax : +91-11-26791033 Website : www.asianhotelsnorth.com

Stock Share Price:-

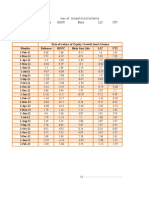

Date

08/11/2012 09/11/2012 12/11/2012 13/11/2012 15/11/2012 16/11/2012 19/11/2012 20/11/2012 21/11/2012 22/11/2012 23/11/2012 26/11/2012 27/11/2012 29/11/2012 30/11/2012 03/12/2012 04/12/2012 05/12/2012 06/12/2012 07/12/2012

Opening Price

190.35 190.00 185.15 189.95 188.85 190.00 181.00 181.00 176.00 175.35 176.00 175.10 179.00 177.00 175.00 176.00 179.90 176.00 185.00 178.00

Highest Price

193.90 192.90 189.95 189.95 188.85 190.00 185.65 181.00 177.95 179.90 179.50 183.95 179.00 177.00 175.50 179.00 179.90 182.95 185.00 178.00

Lowest Price

189.35 185.00 185.00 189.95 181.00 180.55 181.00 177.95 175.00 175.35 175.55 172.30 171.00 172.00 172.50 176.00 179.90 174.00 185.00 176.70

Closing Price Volume

193.90 192.50 189.95 189.95 181.10 181.00 181.00 179.95 175.15 176.40 179.50 172.30 174.80 177.00 175.00 178.60 179.90 182.95 185.00 177.85 340 609 26 00 432 377 18 1157 254 16 255 86 1028 30 227 146 22 144 3 792

160 200 400 600 800 0 8/11/2012 9/11/2012 12/11/2012 13/11/2012 15/11/2012 16/11/2012 19/11/2012

165

170

175

180

185

190

195

200

1000

1200

1400

Graph:-

8/11/2012

9/11/2012

1- Volume

12/11/2012

13/11/2012

15/11/2012

16/11/2012

19/11/2012 20/11/2012

21/11/2012 22/11/2012 23/11/2012 26/11/2012

20/11/2012

21/11/2012

22/11/2012

23/11/2012

2- Opening Price and Closing Price

Volume

26/11/2012

27/11/2012

29/11/2012 30/11/2012 3/12/2012 4/12/2012 5/12/2012 6/12/2012 7/12/2012

27/11/2012

29/11/2012

30/11/2012

3/12/2012

4/12/2012

5/12/2012

6/12/2012

7/12/2012

Volume

OP. Price

Clo. Price

3- Highest Price and Lowest Price

200 195 190 185 180 175 170 165 160 155 H. Price L. Price

4- Graph as per Opening, Closing, High Price, Lowest Price.

200 195 190 185 180 175 170 165 160 155 Opening Closeing Low.Price Hig.Price

3/12/2012

8/11/2012

9/11/2012

4/12/2012

5/12/2012

6/12/2012

12/11/2012

13/11/2012

15/11/2012

16/11/2012

19/11/2012

20/11/2012

21/11/2012

22/11/2012

23/11/2012

26/11/2012

27/11/2012

29/11/2012

30/11/2012

7/12/2012

Analysis:The stock is still undervalued based on the following logics The three hotels i.e. at Delhi, Mumbai & Kolkata will get listed separately. So a shareholder holding 3 shares of Asian Hotels currently will get 1 share each of each of the separate entity. Since long Asian Hotels hasnt expanded its hotel base. It is said that there were conflicts between the promoters and hence the company wasnt aggressive. With the demerger, the negative synergy should be remove The unlocking of the hidden value for the current shareholders can be expected with this demerger. The hotel sector is also recovering with the upturn in the economy. Going by the latest newspaper headlines, occupancies are back to 85% though ARRs are still 10-20% below normal peak levels. Hotels stocks are still down more than 50% below the crash levels. Asian Hotels is one of the most aggressive company of the existing 3. I expect the stock to list at 175+ openings price If anyone had invested to take benefit, he should book profits above these levels.

You might also like

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Indian Hotels Industry to Finish 2011-12 on Weaker Note: ICRADocument13 pagesIndian Hotels Industry to Finish 2011-12 on Weaker Note: ICRASonu Antony NjaravelilNo ratings yet

- Hotel Leela ProjectDocument58 pagesHotel Leela ProjectShobha J ChandranNo ratings yet

- Kamat HotelsDocument6 pagesKamat HotelsVani Madhavi AvasaralaNo ratings yet

- Business CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersFrom EverandBusiness CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersNo ratings yet

- Luxury Indian Hospitality ChainDocument25 pagesLuxury Indian Hospitality ChainShagun Jain0% (1)

- Taj PalaceDocument52 pagesTaj PalaceAnirudh SinghNo ratings yet

- Leela Venture LTDDocument9 pagesLeela Venture LTDSubhankar GhoshNo ratings yet

- International Business Strategy: Assignment On History and DevelopmentDocument9 pagesInternational Business Strategy: Assignment On History and DevelopmentChithra KrishnanNo ratings yet

- How Chander Baljee Built Royal Orchid Hotels from Humble BeginningsDocument25 pagesHow Chander Baljee Built Royal Orchid Hotels from Humble Beginningsvikasbembi1864No ratings yet

- Maxim Infrastructure - NoteDocument2 pagesMaxim Infrastructure - NoteShriya Vikram ShahNo ratings yet

- Grand Hyatt Goa Hotel History and OverviewDocument16 pagesGrand Hyatt Goa Hotel History and OverviewYashavantha AikalaNo ratings yet

- Hotel Management Hospitality and Reservation FIVT (4) (AutoRecovered)Document16 pagesHotel Management Hospitality and Reservation FIVT (4) (AutoRecovered)Elida Castelino87% (15)

- Study Recruitment and Selection at The TAJ Hotels: A Comprehensive Project Report OnDocument35 pagesStudy Recruitment and Selection at The TAJ Hotels: A Comprehensive Project Report OnPRAFULKUMAR PARMAR100% (1)

- Taj Hotels RestoresDocument9 pagesTaj Hotels RestoresShivagami KarunanidhiNo ratings yet

- Amity Global Business School MumbaiDocument15 pagesAmity Global Business School MumbaiHimankshi KamleshNo ratings yet

- Hotel Leela Ventures Equity ReportDocument10 pagesHotel Leela Ventures Equity ReportNikhil JoshiNo ratings yet

- P&G ProjectDocument24 pagesP&G Projectemil mathew josephNo ratings yet

- History and Growth of TajDocument6 pagesHistory and Growth of TajNikhil Karamchandani0% (1)

- Delta Corp LTD 1Document3 pagesDelta Corp LTD 1Suman BarellaNo ratings yet

- Operations Management Mini ProDocument10 pagesOperations Management Mini Prokrishnachaithanya87No ratings yet

- Top 10 CompaniesDocument8 pagesTop 10 CompaniesShweta SinghNo ratings yet

- HospitalityDocument10 pagesHospitalityKishan PrajapatiNo ratings yet

- KHIL Hotels Buy Recommendation at Rs.154 Target Rs.250Document16 pagesKHIL Hotels Buy Recommendation at Rs.154 Target Rs.250Mga PartsNo ratings yet

- Hotel Leela Venture expansion plansDocument10 pagesHotel Leela Venture expansion planssuhaib1282100% (1)

- Strategic Assignment FullDocument50 pagesStrategic Assignment FullFitriana AnnisaNo ratings yet

- History of Indian HotelsDocument14 pagesHistory of Indian HotelsA Funny Person who understands sarcasm100% (1)

- 2) Taj Hotels, Resorts, & PalacesDocument10 pages2) Taj Hotels, Resorts, & PalacesRituraj SpringNo ratings yet

- Oberoi Hotel ReportDocument18 pagesOberoi Hotel ReportRishibhogal11100% (1)

- Introduction & Growth of Hotel Industry in IndiaDocument6 pagesIntroduction & Growth of Hotel Industry in IndiadeepekaNo ratings yet

- Eih FFFDocument5 pagesEih FFFBrijesh PatelNo ratings yet

- Hospitality - 01Document15 pagesHospitality - 01M.Kishore Kumar67% (3)

- Gunjan 2Document84 pagesGunjan 2Naruto UzumakiNo ratings yet

- Royal Orchid HotelsDocument12 pagesRoyal Orchid HotelsanujahujaNo ratings yet

- Maintaining Service Quality as Shangri-La Hotel Expands Globally (38 charactersDocument4 pagesMaintaining Service Quality as Shangri-La Hotel Expands Globally (38 charactersEmy Cabunducan100% (1)

- Hospitality-1 Assignments Written SreejithDocument6 pagesHospitality-1 Assignments Written SreejithRohitNo ratings yet

- Industrial Exposure Training ProjectDocument31 pagesIndustrial Exposure Training ProjectLouis rajNo ratings yet

- History of AXIS BankDocument47 pagesHistory of AXIS Banksnehalcp48No ratings yet

- Industrial Training ReportDocument15 pagesIndustrial Training Reportchintan bhansali0% (1)

- Hospitality AssignmentDocument8 pagesHospitality AssignmentPriyanshu JhaNo ratings yet

- Group 13 Entrepreneur Report Das Abdul GlobalDocument25 pagesGroup 13 Entrepreneur Report Das Abdul GlobaldanialdurraniNo ratings yet

- Employee Engagement: Summer Internship Project Report OnDocument51 pagesEmployee Engagement: Summer Internship Project Report OnRahul AngrishNo ratings yet

- Major Hotel Chains (India) IHCL (Indian Hotels Company LTD.) - Taj Group of HotelsDocument11 pagesMajor Hotel Chains (India) IHCL (Indian Hotels Company LTD.) - Taj Group of HotelsVidit AgarwalNo ratings yet

- Presented By:-: Abhishek Anand Abhishek Upadhyay Avijit Das Nikhil Raj Pranay Vashistha Shailendra TripathiDocument33 pagesPresented By:-: Abhishek Anand Abhishek Upadhyay Avijit Das Nikhil Raj Pranay Vashistha Shailendra TripathihjiyoNo ratings yet

- THM 351 ReportDocument14 pagesTHM 351 Reportsafin chowdhuryNo ratings yet

- CV Career DubaiDocument5 pagesCV Career Dubairasik fareed Jafarulla khanNo ratings yet

- Taj Hotels Rvxdfbbcvbxesorts and PalacesDocument11 pagesTaj Hotels Rvxdfbbcvbxesorts and PalacesbkaaljdaelvNo ratings yet

- Bestech LTDDocument4 pagesBestech LTDBhavya ShahNo ratings yet

- Project On Royal Orchid Hotels Ltd. (Stock Analysis)Document4 pagesProject On Royal Orchid Hotels Ltd. (Stock Analysis)Stany D'melloNo ratings yet

- Exe SummaryDocument4 pagesExe SummaryRajatGinodiaNo ratings yet

- Pioneers of Hospitality Industry 1. Leela Hotels.: C P Krishnan NairDocument3 pagesPioneers of Hospitality Industry 1. Leela Hotels.: C P Krishnan Nairnitish lanjekarNo ratings yet

- LJLKLK OpppDocument18 pagesLJLKLK OpppNaveen KumarNo ratings yet

- Introduction & Growth of Hotel Industry in India Unedited 2015Document7 pagesIntroduction & Growth of Hotel Industry in India Unedited 2015Srinibas JenaNo ratings yet

- Hotel Training Report SubmissionDocument70 pagesHotel Training Report SubmissionAtharv suryawanshiNo ratings yet

- Working Capital Management at Taj Residency, NashikDocument61 pagesWorking Capital Management at Taj Residency, NashikJignesh V. Khimsuriya100% (1)

- Hotel Brands: Pankaj DesaiDocument22 pagesHotel Brands: Pankaj DesaiLinganagouda PatilNo ratings yet

- Kamat HotelsDocument4 pagesKamat Hotelswww_surajgpatil143No ratings yet

- Lemon Tree Hotels founder's vision to own 8,000 hotel rooms by 2020Document6 pagesLemon Tree Hotels founder's vision to own 8,000 hotel rooms by 2020AnandDasNo ratings yet

- A Project Report On " Conducted At: Study of Vruksh E-Business Suit Systems"Document45 pagesA Project Report On " Conducted At: Study of Vruksh E-Business Suit Systems"Stone ColdNo ratings yet

- Internet AdvertisingDocument35 pagesInternet AdvertisingStone Cold0% (1)

- Bibliography AnnexureDocument7 pagesBibliography AnnexureStone ColdNo ratings yet

- A Project Report On " Conducted At: Study of Vruksh E-Business Suit Systems"Document45 pagesA Project Report On " Conducted At: Study of Vruksh E-Business Suit Systems"Stone ColdNo ratings yet

- Months Reliance HDFC Birla LIC UTIDocument28 pagesMonths Reliance HDFC Birla LIC UTIStone ColdNo ratings yet

- Project On Zensar TechnologiesDocument56 pagesProject On Zensar TechnologiesStone ColdNo ratings yet

- McDonalds Believe That Good Customer Service Is The Responsibility of Everybody in The CompanyDocument13 pagesMcDonalds Believe That Good Customer Service Is The Responsibility of Everybody in The CompanyStone ColdNo ratings yet

- Single IncomeDocument1 pageSingle IncomeStone ColdNo ratings yet

- What Is Sales ManagementDocument44 pagesWhat Is Sales ManagementProfessor Sameer Kulkarni99% (188)

- Final NAvDocument45 pagesFinal NAvStone ColdNo ratings yet

- It ProjectDocument38 pagesIt ProjectStone ColdNo ratings yet

- SCMDocument13 pagesSCMStone ColdNo ratings yet

- Internet AdvertisingDocument35 pagesInternet AdvertisingStone Cold0% (1)

- The Performance Appraisals Are Essential For The Effective Management and Evaluation of StaffDocument2 pagesThe Performance Appraisals Are Essential For The Effective Management and Evaluation of StaffStone ColdNo ratings yet

- Final Equity Scheme NAVDocument119 pagesFinal Equity Scheme NAVStone ColdNo ratings yet

- SCMDocument13 pagesSCMStone ColdNo ratings yet

- Organisational Change PrintDocument18 pagesOrganisational Change PrintStone ColdNo ratings yet

- A Project Report On Big BazarDocument10 pagesA Project Report On Big BazarStone ColdNo ratings yet

- Reducing Child Labour Throionugh EducationDocument41 pagesReducing Child Labour Throionugh EducationStone ColdNo ratings yet

- Question N AreDocument2 pagesQuestion N AreStone ColdNo ratings yet

- Compensation MGMT - Introduction-1Document17 pagesCompensation MGMT - Introduction-1Stone ColdNo ratings yet

- Theories of Wages & Wage LegislationDocument35 pagesTheories of Wages & Wage LegislationStone ColdNo ratings yet

- Organizational Development InterventionsDocument15 pagesOrganizational Development InterventionsStone ColdNo ratings yet

- Reducing Child Labour Throionugh EducationDocument41 pagesReducing Child Labour Throionugh EducationStone ColdNo ratings yet

- Project Report On Big BazaarDocument77 pagesProject Report On Big BazaarPbawal85% (46)

- Project Report On Big BazaarDocument77 pagesProject Report On Big BazaarPbawal85% (46)

- SWOT Analysis of Suzuki AutomobilesDocument4 pagesSWOT Analysis of Suzuki AutomobilesStone ColdNo ratings yet

- Project On Perception Towards Mutual FundDocument71 pagesProject On Perception Towards Mutual FundSanjeet Kumar80% (55)

- Insurance MaterialDocument180 pagesInsurance MaterialVikas TiwariNo ratings yet

- Customer Perception MFDocument6 pagesCustomer Perception MFStone ColdNo ratings yet

- ChinnamastaDocument184 pagesChinnamastaIoan Boca93% (15)

- #4 Lacurom vs. Tienzo 535 SCRA 253, Oct 9 2007 FactsDocument12 pages#4 Lacurom vs. Tienzo 535 SCRA 253, Oct 9 2007 FactsDana Denisse RicaplazaNo ratings yet

- Frequently Asked Questions: For ResidentsDocument6 pagesFrequently Asked Questions: For ResidentsShuvajit NayakNo ratings yet

- Different Agro Ecological Zones in IndiaDocument7 pagesDifferent Agro Ecological Zones in Indiapawan100% (1)

- Palarong Pambansa: (Billiard Sports)Document10 pagesPalarong Pambansa: (Billiard Sports)Dustin Andrew Bana ApiagNo ratings yet

- Chapter - 6. MCQDocument10 pagesChapter - 6. MCQgamergeeeNo ratings yet

- 3CO02 Assessment Guidance 2022Document5 pages3CO02 Assessment Guidance 2022Gabriel ANo ratings yet

- Sd-Wan Zero-to-Hero: Net Expert SolutionsDocument11 pagesSd-Wan Zero-to-Hero: Net Expert SolutionsFlorick Le MahamatNo ratings yet

- Vce Svce 2017 Notes STUDENT Yr12 Unit 3 English FINALDocument44 pagesVce Svce 2017 Notes STUDENT Yr12 Unit 3 English FINALlngocnguyenNo ratings yet

- History of Travel and TourismDocument28 pagesHistory of Travel and TourismJM Tro100% (1)

- Make My Trip SRSDocument24 pagesMake My Trip SRSAbhijeet BhardwajNo ratings yet

- MBA CURRICULUM AND Detailed SyllabiDocument72 pagesMBA CURRICULUM AND Detailed SyllabiRock RockyNo ratings yet

- Fair Value Definition - NEW vs. OLD PDFDocument3 pagesFair Value Definition - NEW vs. OLD PDFgdegirolamoNo ratings yet

- Chandigarh Shep PDFDocument205 pagesChandigarh Shep PDFAkash ThakurNo ratings yet

- All You Need Is LoveDocument2 pagesAll You Need Is LoveSir BülowNo ratings yet

- Arshiya Anand Period 5 DBQDocument3 pagesArshiya Anand Period 5 DBQBlank PersonNo ratings yet

- WHO TRS 999 Corrigenda Web PDFDocument292 pagesWHO TRS 999 Corrigenda Web PDFbhuna thammisettyNo ratings yet

- Ventana Research S&OP Study Results For Oliver WightDocument31 pagesVentana Research S&OP Study Results For Oliver WightDavid RennieNo ratings yet

- Newsletter No 3 - 5 May 2017Document3 pagesNewsletter No 3 - 5 May 2017Kate SpainNo ratings yet

- Role of Judiciary in Protecting The Rights of PrisonersDocument18 pagesRole of Judiciary in Protecting The Rights of PrisonersArjun GandhiNo ratings yet

- Digital Citizen and NetiquetteDocument10 pagesDigital Citizen and NetiquetteKurt Lorenz CasasNo ratings yet

- Some Common Abbreviations in Newspapers and TestsDocument2 pagesSome Common Abbreviations in Newspapers and TestsIrfan BalochNo ratings yet

- 40 Rabbana DuasDocument3 pages40 Rabbana DuasSean FreemanNo ratings yet

- GR 244587 2023Document22 pagesGR 244587 2023marvinnino888No ratings yet

- JMM Promotion and Management vs Court of Appeals ruling on EIAC regulation validityDocument6 pagesJMM Promotion and Management vs Court of Appeals ruling on EIAC regulation validityGui EshNo ratings yet

- JENESYS 2019 Letter of UnderstandingDocument2 pagesJENESYS 2019 Letter of UnderstandingJohn Carlo De GuzmanNo ratings yet

- Lecture-1 (General Introduction) Indian Penal CodeDocument12 pagesLecture-1 (General Introduction) Indian Penal CodeShubham PhophaliaNo ratings yet

- Gcse History Coursework ExamplesDocument4 pagesGcse History Coursework Examplesf1vijokeheg3100% (2)

- Simbisa BrandsDocument2 pagesSimbisa BrandsBusiness Daily Zimbabwe100% (1)

- JordanugaddanDocument2 pagesJordanugaddanJordan UgaddanNo ratings yet