Professional Documents

Culture Documents

Pricing Methods

Uploaded by

Akanksha VermaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pricing Methods

Uploaded by

Akanksha VermaCopyright:

Available Formats

Customer Oriented or Perceived Value Pricing There is an increasing trend to price the product on the basis of the customers

perception of its value. This method takes into account all elements of marketing mix and the positioning strategy of the firm. This method helps the firm in reducing the threat of price wars. But the key to this method is to correctly understand customers perception of product value and not to overestimate the firms product value. Marketing research can play an important role here. Geographic Pricing Strategy This strategy seeks to exploit economies of scale by pricing the product below the competitors in one market and adopting a penetration strategy in the other. The former is termed as second market discounting. This method is a part of the differential pricing strategy where the firm either dumps or sells below its cost in the market to utilize its existing surplus capacity. So in geographic pricing strategy, a firm may charge a premium in one market, penetration price in another market and a discounted price in the third. Pricing of Multiple Products In a multi-product corporation, production decisions relating to one product may affect the manufacturing or marketing costs of other related products. The product may be interrelated or independent. For evolving price policy for multi-product firm, certain basic considerations involved in decision making are: 1. Price and Cost relationship in product line. 2. Demand relationship in product line. Competitive differences 1. Price and Cost relationship in product line. Cost conditions determines price of the product. Therefore cost estimates should be correctly made. Although a firm must cover its common costs. Proper pricing does requires, that prices at least cover the incremental cost of producing each good. As long as the price of a product exceeds its incremental costs, the firm can increase total profit by supplying that product. 2. Demand relationship in product line. Competitive differences . Inter-relation of Demand for multi product.

Demand inter-relationship arise because of competition in which case they may become substitutes or complementary goods. Sale of one product may affect the sale of another product. Different demand elasticity of different consumers may allow the firm to follow policies of price discrimination in different market segments. In such a situation, pricing of the multi-product will have to done in such a way that maximum return could be obtained from each market segments by selling maximum products. 1. Competitive differences. 2. 3. Competitive differences. 3. For making pricing decisions for a product line, assessment of degree of competitiveness has to be considered. Such an assessment will set up market share for each product. A product having large market share can stand a high mark-up and can contribute to bear the losses. Transfer Pricing It refers to the determination of the price of the intermediate products sold by one semi autonomous division of the same firm. It is essential in determining the optimal output of each division and of the firm as a whole and in evaluating divisional performance. The correct transfer price for an intermediate product for which there is no external market is the marginal cost of production. When a perfectly competitive market for the intermediate product exists, the transfer price for intra-company sales of the intermediate product is given by the external competitive price for the intermediate products. When an intermediate product can be sold in an imperfect competitive market, the transfer price of the intermediate product is given at the point where MR=MC. For determining transfer price there are three alternative methods: 1. Market price basis: The suitable system of transfer of goods from one division to another under the same management to another company is the market price basis. The market price should be the transfer price. This method definitely avoids the possibility of passing the inefficiencies of one department to the other department. 2. Cost Basis: In case the product produced by a division of the firm can be sold only to another division of the firm, the inter divisional transfer should be priced at the level of the actual cost of production. 3. Cost plus Basis: Under this method the goods and services of each department are charged on the basis of actual cost plus a margin by way of profit. The major defect of this method is that the transferring department may add a high margin so as to raise the profit of the department.

Product Line Pricing Strategies These are a set of price strategies, which a multi-product firm can usefully adopt. In case of multi-product and fluctuating demand, the firm may adopt a combination of the following strategies to effectively manage its product line or maximize its profits across the product line. 1. Price Bundling: This strategy is used by a firm to even out the demand for its product. This is useful strategy for perishable and time bound products like food, hotel room or seat on a flight. Off season discounts and season tickets for music festivals are examples of price bundling strategy. This is a passive strategy aimed at correctly bundling the prices of related items so that the firm is able to maximizing its profits 2. Premium Pricing: This strategy is used by a firm that has heterogeneity of demand for substitute products with joint economies of scale. For e.g. Color television set. There are different models available with different features like the one with a remote control and another without it. Both are substitutable and satisfy the customer needs. But the firm may opt to premium price the first model and position it as the top product in the line for high income or upper income group of customers 3. Image Pricing: This strategy is used when consumers infer quality from the prices of substitute models or competing products. The firm varies its prices over different brands of the same product line. This is commonly used in cosmetics, toilet soaps and perfumes 4.

You might also like

- BA 328 - Ch5 - Process Selection, Design, and AnalysisDocument16 pagesBA 328 - Ch5 - Process Selection, Design, and AnalysisBeboy TorregosaNo ratings yet

- Backflush Costing, Kaizen Costing, and Strategic CostingDocument9 pagesBackflush Costing, Kaizen Costing, and Strategic CostingShofiqNo ratings yet

- Demand ForecastingDocument36 pagesDemand Forecastingkcdelacruz.knowledgeNo ratings yet

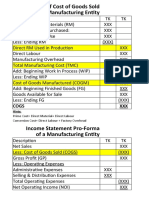

- Statement of Cost of Goods Sold of A Manufacturing Entity: Cogs XXXDocument1 pageStatement of Cost of Goods Sold of A Manufacturing Entity: Cogs XXXCasanovicNo ratings yet

- BCOM 3rd and 4th Sem Syallbus NEPDocument37 pagesBCOM 3rd and 4th Sem Syallbus NEPgfgcw yadgirNo ratings yet

- Kuratko 9 e CH 01Document36 pagesKuratko 9 e CH 01lobna_qassem7176No ratings yet

- Target Return PricingDocument3 pagesTarget Return PricingChayan Ard100% (1)

- Working Capital ManagementDocument59 pagesWorking Capital ManagementjuanferchoNo ratings yet

- Integrated Marketing Communications Unit One NotesDocument6 pagesIntegrated Marketing Communications Unit One NotesMohd SabirNo ratings yet

- Marginal Costing PDFDocument26 pagesMarginal Costing PDFMasumiNo ratings yet

- Redesigning Cost Systems: Is Standard Costing Obsolete?Document10 pagesRedesigning Cost Systems: Is Standard Costing Obsolete?SillyBee1205No ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- 412 33 Powerpoint-Slides Chapter-1Document18 pages412 33 Powerpoint-Slides Chapter-1Kartik KaushikNo ratings yet

- Price Level Accounting by Rekha - 5212Document30 pagesPrice Level Accounting by Rekha - 5212Khesari Lal YadavNo ratings yet

- Introduction To Management Accounting: Asst Prof. Jonlen DesaDocument22 pagesIntroduction To Management Accounting: Asst Prof. Jonlen DesaAryanSainiNo ratings yet

- Competitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument39 pagesCompetitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationnuggsNo ratings yet

- CRM SyllabusDocument1 pageCRM SyllabusNitu KumariNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- CVP AnalysisDocument24 pagesCVP AnalysisUditha Muthumala100% (2)

- Strategic Pricing ObjectivesDocument19 pagesStrategic Pricing ObjectivesSarahjane TerradoNo ratings yet

- Efficient Facility Layout DesignDocument6 pagesEfficient Facility Layout DesignOckouri BarnesNo ratings yet

- Strategic Cost Management: Absorption vs Variable CostingDocument3 pagesStrategic Cost Management: Absorption vs Variable CostingMarites AmorsoloNo ratings yet

- 2009-02-05 171631 Lynn 1Document13 pages2009-02-05 171631 Lynn 1Ashish BhallaNo ratings yet

- Direct Product ProfitDocument5 pagesDirect Product Profitahmed_23zulfiqarNo ratings yet

- Balanced Scorecard and Responsibility AccountingDocument7 pagesBalanced Scorecard and Responsibility AccountingMonica GarciaNo ratings yet

- Technical Appraisal in Project FinanceDocument7 pagesTechnical Appraisal in Project FinanceBlesson PerumalNo ratings yet

- Chapter 05 TestbankDocument81 pagesChapter 05 TestbankNihal Navneet100% (2)

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Absorption Costing (Or Full Costing) and Marginal CostingDocument11 pagesAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiNo ratings yet

- Designing and Managing Global Marketing StrategiesDocument23 pagesDesigning and Managing Global Marketing StrategiesShreekānth DāngiNo ratings yet

- Additional Aspects of Costing SystemsDocument28 pagesAdditional Aspects of Costing SystemsKağan GrrgnNo ratings yet

- Market Efficiency PDFDocument17 pagesMarket Efficiency PDFBatoul ShokorNo ratings yet

- Components of Logistics Management: Supportive Component: ProcurementDocument2 pagesComponents of Logistics Management: Supportive Component: ProcurementNaveen KaranNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- Unit 4Document52 pagesUnit 4tempacc9322No ratings yet

- What Is Operational Research?: Why Is OR Needed?Document3 pagesWhat Is Operational Research?: Why Is OR Needed?Suvidha DixitNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsJatin SunejaNo ratings yet

- Unit 1 Marketing ManagementDocument33 pagesUnit 1 Marketing Managementpragya dwivediNo ratings yet

- Chapter-2 Material CostDocument32 pagesChapter-2 Material CostAdi PrajapatiNo ratings yet

- Operations ManagementDocument2 pagesOperations ManagementAli ArnaoutiNo ratings yet

- Introduction To Marketing PDFDocument56 pagesIntroduction To Marketing PDFShorelyn Suerte CapurasNo ratings yet

- Rizal Tech University Discusses Inventory Management ModelsDocument10 pagesRizal Tech University Discusses Inventory Management ModelsMary Rose ArguellesNo ratings yet

- ENTREP213 - Module 1 - Market Research and Understanding Consumer BehaviourDocument5 pagesENTREP213 - Module 1 - Market Research and Understanding Consumer BehaviourMelissa MelancolicoNo ratings yet

- TRADITIONAL VS ABC COSTING FOR TWO PRODUCTSDocument16 pagesTRADITIONAL VS ABC COSTING FOR TWO PRODUCTSrsalicsicNo ratings yet

- Chapter 3 ForecastingDocument40 pagesChapter 3 ForecastingLuarn WeiNo ratings yet

- Allocation and ApportionmentDocument11 pagesAllocation and ApportionmentpRiNcE DuDhAtRa100% (2)

- Ba9221 Operations ManagementDocument2 pagesBa9221 Operations ManagementSonuSwathi0% (1)

- Flexible Budgets, Variances, and Management Control: I: Learning ObjectivesDocument14 pagesFlexible Budgets, Variances, and Management Control: I: Learning ObjectivesKelvin John RamosNo ratings yet

- Cost Accounting UNIT I Theroy (1) New PDFDocument18 pagesCost Accounting UNIT I Theroy (1) New PDFyogeshNo ratings yet

- Ch22 Management Control SystemsDocument13 pagesCh22 Management Control SystemsChaituNo ratings yet

- Marketing Strategy to Boost ISL ViewershipDocument7 pagesMarketing Strategy to Boost ISL ViewershipAkanksha HandooNo ratings yet

- Understanding Cost Behavior and Analysis TechniquesDocument65 pagesUnderstanding Cost Behavior and Analysis TechniquesGabai AsaiNo ratings yet

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadeNo ratings yet

- BCOM Management ConceptsDocument44 pagesBCOM Management ConceptsAkshay K RNo ratings yet

- Pricing and Costing Final Examination Key To CorrectionDocument8 pagesPricing and Costing Final Examination Key To CorrectionSherwin Francis MendozaNo ratings yet

- Brewer 6e Practice Exam SolutionsDocument4 pagesBrewer 6e Practice Exam Solutionsreal johnNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Cost Sheet Prepation-NotesDocument12 pagesCost Sheet Prepation-NotesSunita BasakNo ratings yet

- Organizational behavior management A Complete Guide - 2019 EditionFrom EverandOrganizational behavior management A Complete Guide - 2019 EditionNo ratings yet

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Business EnvironmentDocument6 pagesBusiness EnvironmentAkanksha VermaNo ratings yet

- Artificial NeuronDocument33 pagesArtificial NeuronAkanksha VermaNo ratings yet

- Indian Contract Act, 1872Document47 pagesIndian Contract Act, 1872Akanksha Verma100% (1)

- Indian Contract Act, 1872Document47 pagesIndian Contract Act, 1872Akanksha Verma100% (1)

- .Introduction of Artificial Neural NetworkDocument24 pages.Introduction of Artificial Neural NetworkAkanksha VermaNo ratings yet

- 3.pattern RecognitionDocument40 pages3.pattern RecognitionAkanksha VermaNo ratings yet

- Genetic AlgorithmDocument14 pagesGenetic AlgorithmAkanksha VermaNo ratings yet

- 1.history (Morden Neuro Science)Document17 pages1.history (Morden Neuro Science)Akanksha VermaNo ratings yet

- Strategic Marketing PlanningDocument16 pagesStrategic Marketing PlanningAshokNo ratings yet

- Computers NotesDocument29 pagesComputers NotesAkanksha VermaNo ratings yet

- Network TopologyDocument14 pagesNetwork TopologyAkanksha VermaNo ratings yet

- Suggested Readings:: Fragasso, P. M., & Israelsen, C. L. (2010) - Your Nest Egg Game Plan: How To Get YourDocument3 pagesSuggested Readings:: Fragasso, P. M., & Israelsen, C. L. (2010) - Your Nest Egg Game Plan: How To Get YourLisa BlairNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- White Rust Removal and PreventionDocument17 pagesWhite Rust Removal and PreventionSunny OoiNo ratings yet

- Product Portfolio AnalysisDocument30 pagesProduct Portfolio AnalysisShakti Dash25% (4)

- Director Client Customer Operations in Chicago IL Resume Jill MazurcoDocument2 pagesDirector Client Customer Operations in Chicago IL Resume Jill MazurcoJillMazurcoNo ratings yet

- Dubai Sme DefinitionDocument28 pagesDubai Sme DefinitionLallan SharmaNo ratings yet

- UltraTech Cement Fundamental Report with Financial AnalysisDocument6 pagesUltraTech Cement Fundamental Report with Financial AnalysisMohd HussainNo ratings yet

- Ecbwp 1507Document55 pagesEcbwp 1507Anonymous KkhWPL3No ratings yet

- Grade 11 Economics Unit #3: Government Intervention Practice Test and Answer KeyDocument8 pagesGrade 11 Economics Unit #3: Government Intervention Practice Test and Answer KeyWayne TeoNo ratings yet

- SBI SME SBI - Franchise Product PropositionDocument12 pagesSBI SME SBI - Franchise Product PropositiongunjaanthakurNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- IntegralBusi Kingsford MarketingPlanDocument29 pagesIntegralBusi Kingsford MarketingPlanTaimoor Ul HassanNo ratings yet

- Ms Anuradha Bhatia Dit TP 1 MumbaiDocument28 pagesMs Anuradha Bhatia Dit TP 1 MumbaiamolkhareNo ratings yet

- Assignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144Document3 pagesAssignment ON Case Analysis of Harnischfeger Corporation: Submitted To Submitted by Dr. Shikha Bhatia Shreya PGFB1144simplyshreya99No ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- Burger and Fries Ingredients Burgers: Fries: KetchupDocument5 pagesBurger and Fries Ingredients Burgers: Fries: KetchupNobody2222No ratings yet

- Successful Sales and Marketing Letters by Dianna BooherDocument554 pagesSuccessful Sales and Marketing Letters by Dianna Boohersungmin83% (6)

- HR Audit CaseDocument9 pagesHR Audit CaseAnkit JainNo ratings yet

- China Soap Synthetic Detergent Market ReportDocument10 pagesChina Soap Synthetic Detergent Market ReportAllChinaReports.comNo ratings yet

- 1 - Patent - Intro & Requirements - Novelty-Non ObviousnessDocument58 pages1 - Patent - Intro & Requirements - Novelty-Non ObviousnessBernard Nii Amaa100% (2)

- Mr. WegapitiyaDocument10 pagesMr. WegapitiyaNisrin Ali67% (3)

- Real Estate Mortgage-JebulanDocument2 pagesReal Estate Mortgage-JebulanLee-ai CarilloNo ratings yet

- HourglassDocument2 pagesHourglassAmber McCartyNo ratings yet

- Product DiffrentiationDocument26 pagesProduct Diffrentiationoptimistic07100% (1)

- Price/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Document2 pagesPrice/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Pratik ChourasiaNo ratings yet

- Port Pricing Final PresentationDocument13 pagesPort Pricing Final PresentationRomnic CagasNo ratings yet

- Ms ASE20104Document16 pagesMs ASE20104Aung Zaw HtweNo ratings yet

- Louis Dixon Pediatric Dentistry Trial Balance ReportDocument4 pagesLouis Dixon Pediatric Dentistry Trial Balance ReportNabeelAhmedNo ratings yet

- Bayfield Mud CompanyDocument3 pagesBayfield Mud CompanyMica VillaNo ratings yet