Professional Documents

Culture Documents

Tally Exercise

Uploaded by

aryanboxer786Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tally Exercise

Uploaded by

aryanboxer786Copyright:

Available Formats

Download Iorm http://www.scribd.

com/doc/19637252/Tally

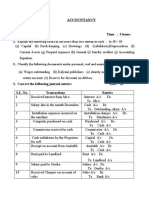

TALLY EXERCISE 1.1

1. ClassiIy The Iollowing into Income, Expenditure, Assets and Liabilities (Put Tick

mark in the appropriate column)

Income Expenditure Asset Liability

1 Cash in Hand

2 Salaries

3 Wages

4 Rent paid

5 Land

6 Buildings

7 Bank Balance

8 Over draIt

9 Traveling

10 Dividend received

11 Interest paid

12 Sundry Debtors

13 Sundry Creditors

14 Loans and Advances (dr)

15 Capital

16 Reserves and Surplus

17 Income tax

18 Provisions

19 Bills Receivable

20 Furniture and Fittings

21 Indian Bank Deposits

22 Printing and Stationery

23 Telephones bills

24 Computer

25 Scooter

2.ClassiIy The Iollowing into Income, Expenditure, Assets and Liabilities (Put Tick mark

in the appropriate column)

Income Expenditure Asset Liability

1 Cash at Bank

2 Factory Rent

3 Lighting

4 Interest paid

5 Tools

6 Furniture

7 Bank Balance

8 Over draIt

9 Bills Payable

10 Dividend earned

11 Interest paid

12 Sundry Debtors

13 Sundry Creditors

14 Loans and Advances (dr)

15 Sheeja Capital

16 Provisions and Reserves

17 Sales tax

18 Land and Buildings

19 Bills Receivable

20 Fittings

21 IOB Deposits

22 Pooja Expenses

23 Telephones bills

24 Computer

25 Van

TALLY EXERCISE 1.2

1.Find the nature oI the Iollowing entries (Please put tick mark in the appropriate

column)

RECEIPT PAYMENT CONTRA

1 Electricity bill paid

2 Wages paid

3 Interest received

4 Discount allowed

5 Purchases

6 Sales

7 Furniture purchased

8 Scooter purchased

9 Computer Purchased

10 Salaries paid

11 Telephone expenses

12 Dividend income

13 Amount deposited into IOB

14 Money transIerred Irom IOB

TO Indian Bank

15 Amount received Irom Sundry

Debtors

16 Amount paid to creditors

17 Money deposited into Canara

Bank

18 Money transIerred Irom Canara

bank to Indian Bank

19 Machinery purchased

20 Loan amount received Irom

Raman

TALLY Exercise 1.3

1. Prepare Trial balance oI MM Associates :

Balances Amount (Rs.)

Capital 50000

Cash 15760

Bank 12800

Purchases 27100

Sales 27000

Furniture 15000

I Opening stock 1800

Brokerage 40

Typewriter 2100

Rent paid 1000

Salary Account 1500

Return inwards 100

Return outwards 1100

Debtors 4400

Travelling 100

Sundry Creditors 4200

Discount allowed 100

Telephone 500

2. Prepare Trial Balance Ior the Iollowing balances taken Irom the books oI MM Traders:

Balances Amount (Rs.)

Capital 40000

Creditors 13000

Salaries 7200

Bills Receivable 15800

Bills Payable 8700

Debtors 28000

Sales 144000

Insurance 1200

Miscellaneous Expenses 600

Land and Buildings 23000

Discount paid 900

Commission received 800

Sales returns 3400

Purchase returns 2400

Carriage inwards 1400

Purchases 97500

Stock Opening 29900

3. Prepare the trial balance Ior the Iollowing balances taken Irom the books oI MM Agency.

Balances Amount (Rs.)

Opening stock 9300

Repairs 310

Machinery 12670

Furniture 1330

OIIice Expenses 750

Trading Expenses 310

Land and Buildings 15400

Bank Charges 50

Mis. Income 200

Purchases 15450

Purchase Returns 440

Sales Returns 120

Sundry Creditors 12370

Advertisement 500

Cash in Hand 160

Cash at Bank 5870

Sales 20560

Sundry Expenses 150

Insurance 500

Travelling Expenses 200

Capital 24500

Loan 5000

4. Prepare Trial Balance Ior the Iollowing balances taken Irom the books MM General

Merchants:

Balances Amount (Rs.)

Capital 180000

Drawings 3200

Opening Stock 9000

Purchases 64500

Sales Returns 2000

Sales 119000

Wages 16000

Insurance paid 1500

Duty paid 10,000

Packing expenses 2000

Carriage outwards 8000

Postage 100

Advertisement 1000

Miscellaneous expenses 300

Discount received 500

Bills Payable 9000

Bank over draIt 3000

Land 90000

Plant 70000

Furniture 1000

Debtors 25400

Creditors 42000

Cash 40500

Deposits 9000

TALLY EXERCISE 1.4

(1)

(a) Journalise the Iollowing transactions:

1. Malini started business with Rs.50,000

2. Opened current account with Indian overseas Bank with Rs.5,000

3. Bought goods Irom Latha Rs.40,000

4. Paid to Latha Rs.25,000

5. Sold goods to Kumar Rs.36,000

6. Kumars account was settled .

(b)Write the above entries in the Iollowing manner:

Account to Debited Account to be credited

Malini started business with Rs.50,000

Opened current account with Indian overseas

Bank with Rs.5,000

Bought goods Irom Latha Rs.40,000

Paid to Latha Rs.25,000

Sold goods to Kumar Rs.36,000

Kumars account was settled .

(c)List the ledger accounts to be opened Ior the above said transactions.

(2).

(a) Journalize the Iollowing transactions:

3.2.2003 Bought goods Ior cash Rs.14,500

7.2.2003 Sold goods to Laxhmi on credit Rs.5,000

9.2.2003 Received Commission Rs.300

10.2.2003 Cash sales Rs.29,000

12.2.2003 Bought goods Irom Meenakshi on credit Ior Rs.6,000

15.2.2003 Received Iive chairs Irom Saravana Trader at Rs.300 each.

20.2.2003 Paid Cash to Saravana Stores.

28.2.2003 Paid Salaries Rs.1,000

28.2.2003 Paid Rent Rs.500

(b) Write the above entries in the Iollowing manner:

Account to be Debited Account to be Credited

Bought goods Ior cash Rs.14,500

Sold goods to Laxhmi on credit Rs.5,000

Received Commission Rs.300

Cash Sales Rs.29,000

Bought goods Irom Meenakshi on credit Ior

Rs.6,000

Received Iive chairs Irom Saravana Trader at

Rs.300 each.

Paid Cash to Saravana Stores.

Paid Salaries Rs.1,000

Paid Rent Rs.500

(c)List out the ledger accounts to be opened Ior the above said transactions

(3) (a)Journalise the Iollowing Transactions:

1. Mani started business with the capital oI Rs.50 Lakhs

2. Land Purchased Ior Rs.2lakhs

3. Goods Purchased Irom Raju Rs.2500000 on cash.

4. Goods Purchased Irom Raghu Rs.1,00,000 on credit

5. Goods sold on cash Rs.15 lakhs

6. Goods sold on credit to Raja Rs.20 lakhs.

7. Salaries paid Rs.10,000

8. Carriage inwards paid Rs.25000

9. Interest received Rs.25000

10. Computer purchased Rs.25,000

11. Money collected Irom Raja Rs.50,000

12. Cash paid to Raghu Rs.10,000

13. Money deposited into Indian Bank Rs.2,00,000

14. Amount transIerred to Canara Bank Irom Indian Bank Rs.35,000

15. Payment made to Raghu by Indian Bank Cheque Ior Rs.1,00,000

16. Telephone expenses paid Rs.2000

17. Goods sold Ior cash Rs.5,00,000

18. Goods sold on Credit to Radha Rs.50,000

19. Goods purchased Irom Amar Ior Rs.2lakhs on credit

20. Cash purchases made Rs.25,000

21.Additionl Capital introduced by Mani Rs.10,00,000

22. Money deposited into Indian Bank Rs.2,50,000

23. Ten tables are purchased Irom Wood world each Rs.1,000

24. Payment made to Wood World by Indian Bank

25 Goods purchased Irom Lal and co on Credit Rs.35,000

3(b) Write the above transactions in the Iorm oI accounts to be debited and

credited.

3(c) List out the ledger accounts to be opened Ior the above said transactions

ACCOUNTING VOUCHERS

Procedure:

1. II the tally package was present in the desk top window double click the icon to open it.

2. In company inIormation select create company-~ to create a new company.

3. Creation oI Ledger Accounts:

In Gate way Tally select Account inIormation

Select Ledger Select single ledger create

Then type all the ledger accounts required based on the transactions.

Control A to save-enter-press escape yes-press escape up to getting gateway tally

menu.

4. Creation oI Inventories:

In gate way tally select inventory inIormation

Select stock group-select single stock group

Then type all the stock groups under Primary

Control A to save & escape to reach the gate way tally screen.

5. Settings:

Gateway Tally (Master)-~Select Account inIormation enter

Press F11-~Set the Account Ieatures as:

Maintain bill wise details YES

Control A Press escape up to Gate way Tally (Master)

Select Inventory inIormation enter

Press F12-~it goes to conIiguration

Select Acc/Inv inIormation

Set the Choice as

Allow Standard Rates Ior Stock items YES

Control A to save -~ ConIiguration

Select voucher entry enter set the choice as

Use Single entry

NO

Use Dr/Cr instead oI To/By

YES

Control A to save

Press Escape up to Gate way Tally

6. Create Units oI Measure:

In gate way tally screen Select Units oI Measure

Type Symbol as Nos and Formal name as Numbers

7. Creation oI Stock Items:

In Gate way Tally Screen select Inventory inIormation

Select stock items & Select single stock item create

Name: Sony 10 Kg

Under: Washing Machine

Units: Nos

Allow Std. Rates: Yes -~ enter

Fill standard cost (purchase price) and Selling Price

Control A to save Press escape up to getting Gate way Tally Screen.

8. Entering the Transactions:

In Gat way Tally Screen select accounting vouchers

F4

Contra F5 Payments

F6

Receipts

F8

Sales

F9 Purchases

Note:1. While entering the transaction iI any new ledger to be created use Alt

C

2. Save every entry by control A.

TALLY QUESTION BANK

PART A

1. DeIine the term Accounting`.

2. What is the need Ior Accounting to the Business Organizations?

3. Name the Iew important terms in accounting.

4. What is Accounting Cycle?

5. List out the usual transactions in a Business.

6. What are the three types oI accounts maintained Ior transactions?

7. How do you classiIy the business organizations based on its transactions?

8. What is service organization?

9. What is manuIacturing organization?

10. What is Trading organization?

11. State the concepts in oI accounting.

12. What is Book Keeping?

13. Explain single entry system oI book keeping.

14. Explain Double entry system oI book keeping.

15. What is Real Accounts?

16. What is Personal Accounts?

17. What is Nominal Accounts?

18. State the rules Ior Personal Account.

19. State the rules Ior Real Account.

20. State the rules Ior Nominal Account.

21. What is a Journal?

22. What is a compound Journal Entry?

23. What is voucher?

24. What is a trial balance?

25. State the advantages oI trial balance.

26. State the purpose oI preparing the trading account.

27. List out the purposes oI preparing ProIit and Loss account.

28. What is a Balance Sheet?

29. Explain the term ASSETS.

30. Explain the term LIABILITIES.

31. How can be assets classiIied?

32. How can be liabilities classiIied?

33. State any Iour Ieatures oI Tally Package.

34. How do you create company details in Tally?

35. How do you select the company in Tally?

36. How do you delete the company in Tally?

37. Name the Iew Iunctional keys in Tally?

38. What are groups?

39. Mention any Iour primary groups in Tally.

40. Mention any Iour-sub groups in Tally.

41. What is ledger?

42. How do you create ledgers in tally?

43. How do you classiIy the accounting transactions while working in Tally?

44. What do you reIer as Contra Entry?

45. Mention any Iour components oI company creation screen.

46. State the beneIits oI accounting on computers.

47. How can you view the trial balance in Tally?

PART B

51. Discuss the diIIerent concepts and conventions oI Accounting.

52. Describe the Ieatures oI TALLY Package.

53. Elucidate the needs oI Accounting Ior Business Organizations.

54. How do you classiIy the business organizations based on its transactions and explain them in

detail.

55.Compare and Contrast Computerized Vs Manual Accounting.

56. What are the advantages and limitations oI Double Entry System oI Book Keeping?

57. Describe the nature oI a Balance sheet and give the Iormat oI a Balance Sheet.

58. Distinguish between a Trial Balance and Balance Sheet.

59. Draw the Ilow chart Ior company creation and company alteration details in Tally.

60. State any twenty Iunctional keys and its purpose while using the Tally.

TALLY

PART A

Accounting DeIinition:

Accounting is the art oI recording, classiIying and summarizing the business transactions

in a signiIicant manner.

Need Ior Accounting:

To know the results oI operations.

To know the Iinancial position as on date.

To know the liquidity position

For business acquisition.

For statutory compliance.

Few Important terms in Accounting:

T r ansact io ns

Acco u nt

V o u cher

Capital

Purchases and Sales

Stock etc.

Accounting Cycle:

The accounting cycle is a complete sequence oI accounting procedures, which are

repeated in the same order during accounting period.

Usual Transactions involved in Business:

Purchase oI goods

Payment Ior Expenses

Sale oI goods or services

Receipts etc.

Types oI Accounts maintained Ior Transactions:

Real Accounts

Personal Accounts

Nominal Accounts

ClassiIication oI Business Organizations based on transactions:

Trading organization

ManuIacturing organizations

Service organizations

Service Organization:

An organization providing services is called as service organization.

Trading organization:

An organization involved in the process oI buying and selling is called as trading

organization.

ManuIacturing Organization:

An organization in the process oI transIorming raw materials into Iinished goods Ior

consumers, or Ior Iurther processing by others is called manuIacturing organization.

Concepts in Accounting;

Entity concept

Dual Aspect concept

Going concern concept

Accounting period concept

Money measurement.

Book Keeping:

Art oI recording in a systematic manner in the books oI accounts. Single Entry system oI Book

Keeping: It reIers the system where only the personal and cash aspects oI the transaction are

recorded in the books. Double Entry system:

It is the most common system oI book keeping whereby the two aspects oI every transaction i.e.

the receiving aspect and the giving aspect are recorded in the books oI accounts.

Real Account:

Real Account reIers the visible and real items. E.g. cash, bank etc

Personal Account:

Personal Account reIers the person with whom the company has dealings. E.g. customers

and suppliers.

Nominal Account:

It reIers the expenses and income accounts. E.g. salaries , rent received

Journal:

A journal may be deIined as the book oI original or prime entry containing a record oI

transactions Irom which the posting is done to the ledger.

Voucher:

A voucher is a document containing the details oI Iinancial transactions. E.g., Sales

invoice, purchase invoice, pay slip etc.

Trial Balance:

Trial balance can be deIined as a list oI balances standing on the ledger accounts and cash

book oI a concern.

Advantages oI Trial Balance:

It is a consolidated statement oI all the balances.

It helps to veriIy the accuracy oI the entries made in the ledger.

It helps to prepare the Iinal accounts. Purposes oI Preparing the Trial Balance:

To veriIy the accuracy oI the entries made in the ledger.

To prepare the Iinal accounts.

Purpose oI preparing the Trading Account:

To Iind the margin over purchase and sale oI goods.

Purpose oI Preparing the ProIit and Loss Account:

It is the statement prepared to compare the incomes and expenses and Iinally reports

whether Net ProIit or Net Loss incurred during the accounting period.

Balance sheet:

A statement which sets out the Assets and Liabilities oI a business Iirm and which serves

to ascertain the Iinancial position oI the same on any particular date.

Assets:

Assets represent everything, which a business owns and has money value.

Liabilities:

It represents the responsibility oI the business to repay in terms oI Rupees.

ClassiIication oI Assets:

Fixed Assets

Current Assets

Tangible Assets

Fictitious Assets

ClassiIication oI Liabilities:

Long term liabilities

Current liabilities

Contingent liabilities.

Features oI Tally Package:

Maintain complete range oI accounts.

Provided multiple reports.

Various options

Allows accounts oI multiple companies simultaneously.

Creaton oI Company in Tally:

Go to Gateway Tally ~ Company inIo ~Create Company

Alteration oI Company Details in Tally:

From Gateway Tally -~ Company inIormation menu ~ Select Alter ~ Enter.

(To go to company inIormation Alt F3)

Selection oI Company in Tally:

From Gate way oI Tally -~ Company inIormation menu -~ Select Company (enter).Tally

displays the name oI the company screen. Select the company as you wish.

Deleting a Company:

Follow the same path as that used Ior Alter company to display company alteration screen. Here

use Alt D key and Tally displays a message Delete` Yes or No. By pressing yes or enter key .

Tally displays another message Are you sure?` Yes or No. By pressing yes company will be

deleted.

Functional Keys in Tally:

F1 To select company.

AltF1 To shut company.

F2 To change Date

Alt F2 To change period

Alt F3 To get into company inIo screen

Control A to save the screen.

Groups:

Collection oI ledgers based on similar nature oI ledgers are known as groups.

Primary Group:

Primary Groups are the main groups which will be useIul at the time oI reporting

Sub-Groups:

Sub groups are the secondary groups, which is based on the primary Group.

Primary Groups:

Capital Accounts

Current Assets

Current Liabilities

Fixed Assets

Loans and liabilities etc.

Sub Groups:

Cash in hand

Cash at Bank

Sundry Debtors

Provisions etc.,

Ledger:

Ledger is an accounting head which is used to enter the transaction and identiIy the same.

Creation oI Ledger in Tally.

Gate way oI Tally -~ Accounts inIormation -~ ledgers -~ create.

Contra Entry:

Contra entry is a transaction indicating transIer oI Iunds Irom cash account to bank

account / bank account to cash account / one bank account to another bank account.

BeneIits oI Accounting in computers:

Multiple reports available in short time

Accuracy

Enables Iaster decision-making.

Components oI Company creation Screen:

Directory

N a me

Mailing Name

Address and State

Email Address

Use Indian VAT

Currency symbol etc.

View oI Trial Balance in Tally:

Gate way oI Tally ~ Display ~ Trial balance.

Financial Reports Available in Tally:

Balance Sheet

ProIit and Loss Account

Trial Balance

Account Books

Day Books

Day Book:

The day book is a list oI all transactions Ior a particular day.

Tally Financial Accounting CertiIication:

The tally Iinancial accounting certiIication is an online test Ior business accounting Tally.

Once certiIied you will join the global community oI Tally CertiIied ProIessionals.

PART B

Business organizations perIorm a variety oI transactions and can be classiIied as Iollows:

Service Organizations

Trading Organizations

ManuIacturing Organizations.

Service Organizations:

Meaning: An organization providing services is called service organizations.

Nature:

Service organizations provide their services at the point oI consumption by the

customer . Thus, such organizations could be severely hit on price iI there is

demand dip at the time Ior production.

Services are perishable, So the pressure on the service organization to provide

services is more than that on a manuIacturing organization or a trading

organization.

Customer interaction is greater in service organizations than in manuIacturing

or trading organizations.

In service organization, services are usually provided by people, not

machines. So, service organizations are more labour intensive than

manuIacturing organizations.

Customer goodwill is an intangible asset Ior service organizations, which can

be destroyed quickly.

Accounting in a Service Organization

:The organization maintains regular books oI account. Most service organizations do

not deal in inventory and thereIore, do not need to maintain inventory records. They

do not Iollow a standard pricing policy Ior all customers, at all times.

Dr. S. Muthumani/Management Studies/Sathyabama University. Trading Organization: Meaning: An organization

involved in the process oI buying and selling is called Trading Organization. Nature:

The actual market price is established and valid Ior a short based on the current supply and demand.

The value oI the product is determined by the customers expectations oI quality.

A trading organization has to continually keep track oI market demand and ensure that inventory planning is

done to take advantage oI demand whenever it arises.

DiIIerent customers may be charged diIIerent prices by varying the percentage oI discount on the price list.

Accounting in a Trading Organization:

The trader must keep track oI stock availability, customer requirement, cost oI procurement and market changes.

The accountant in trading organization has to maintain updated inventory records apart Irom regular accounting.

A company needs to account Ior inventories like raw materials, work in

progress and Iinished goods to arrive at the proIit made Ior the period.

Changes in the inventory valuation method change the proIits made during the period.

CuS1CML8

aymenL of bllls Servlces

Servlce CrganlzaLlon

CollecLlons

1radlng organlzaLlon CusLome0072

lnvenLory based on cusLomer demand

uemand

Arrlval of sLock Sale

Accounting in manuIacturing organizations requires more planning, preparation and

scheduling as compared to accounting in trading and service organizations.

FEATURES OF TALLY PACKAGE:

A leading accounting package: The Iirst version oI Tally was released in 1988 and through

continuous development, is now recognized as one oI the leading accounting packages across the

globe, with over quarter million customers. Tally`s market share is more than 90 NO

Accounting codes: Unlike other computerized accounting packages that require numeric codes,

Tally pioneered the no accounting codes concept. Tally users have the Ireedom to allocate

meaningIul names in plain English to their date items in the system.

Complete business solution: Tally provides a comprehensive solution to the accounting and

inventory needs oI business. The packages comprises oI Iinancial accounting and book-keeping

and inventory accounting.

Flexible and easy to use: Tally is very Ilexible. It minimize the human thought process, which

means that Tally can adapt to any business need, rather than the user trying to change the way

the business is run to adopt to the package.

Versatility: Tally is suitable Ior a range oI organizations Irom small grocery stores to large

corporations with international locations and operations.

Multi-PlatIorm availability: Tally is available on Windows 95, 98, ME, 2000 and NT. It runs on

a single PC or a network , supports access via any combination oI platIorms.

Simple and rapid installation: Tally has a simple, menu-driven installation procedure. The user

can install the program Iiles on any drive, iI the hard disk has partitions.

Unlimited multi-user support: A multi-user version oI Tally can be installed on a net work

having any number oI computers with diIIerent operation systems like Win 95, 98, NT 2000, XP

and Linux. Internal back up/restore: Tally has in built, user Iriendly back up and restores option.

Tally helps the user to take back ups oI one or more companies or all companies in a single

directory in the local hard disk or in any external media.

Tally Audit: The Tally audit Ieature provides the user with administrator rights, a capability to

check the correctness oI the entries made by the authorized users and alter these entries, iI

necessary. Once the entries are audited, Tally displays the altered entries, iI any, along with the

name oI the user who has altered the entry and the date and time oI the alteration.

Multi-directory Ior company management: The user can create multiple directories where he can

store data. The data stored in these directories can be accessed directly in Tally by speciIying the

path

FUNCTIONAL KEYS IN TALLY:

F2 - To change Date

Control A - To save

Control Q - Exit

Alt F2 - To change period

F4 - Contra

F6 - Receipts

F8 - Sales

F9 - Purchase

F 11 - To set Ieatures

F 12 - To set conIiguration

Esc - To go back to the previous screen

F1 - Select company

Alt C - To create new ledgers, settings etc.

Alt F2 - To shut the company

You might also like

- Tally ExerciseDocument16 pagesTally ExercisePavanSyamsundarNo ratings yet

- Tally exercise downloadDocument16 pagesTally exercise downloadsbnikte73% (11)

- Accounting IGCSE Past PaperDocument20 pagesAccounting IGCSE Past PaperMaham NasimNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- Question Bank BKDocument8 pagesQuestion Bank BKVivek JaiswarNo ratings yet

- CLASS TEST-I ACCOUNTANCY EXAM REVIEWDocument4 pagesCLASS TEST-I ACCOUNTANCY EXAM REVIEWshaurya kapoorNo ratings yet

- BM102TDocument25 pagesBM102TMariamma KuriakoseNo ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- SummerAssignmentClass11th (2014 15)Document18 pagesSummerAssignmentClass11th (2014 15)Niti AroraNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- 2015 Accountancy Question PaperDocument4 pages2015 Accountancy Question PaperJoginder SinghNo ratings yet

- NCERT solutions, CBSE sample papers, notes for classes 6 to 12Document4 pagesNCERT solutions, CBSE sample papers, notes for classes 6 to 12NameNo ratings yet

- Accounting Practice Paper InsightsDocument3 pagesAccounting Practice Paper InsightsSameer Hussain100% (1)

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- AC PaperDocument2 pagesAC Paperpiyush kumarNo ratings yet

- Unity University Group Accounting AssignmentDocument2 pagesUnity University Group Accounting AssignmenttotiNo ratings yet

- Record Transactions and Apply Accounting ConceptsDocument20 pagesRecord Transactions and Apply Accounting ConceptscalebNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- BEFA IMPORTANT QUESTIONS UNIT WISE FOR MID-II JULY-2021Document4 pagesBEFA IMPORTANT QUESTIONS UNIT WISE FOR MID-II JULY-2021ravi tejaNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- Humanities I and II Year MQPDocument108 pagesHumanities I and II Year MQPKishore VNo ratings yet

- 11th Accountancy 80 MarksDocument5 pages11th Accountancy 80 Marksyuktaagrawal017No ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Question Bank For AccountsDocument12 pagesQuestion Bank For AccountsSwati DubeyNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- UTAR BBA Finance Semester 1 Accounting TutorialDocument6 pagesUTAR BBA Finance Semester 1 Accounting TutorialGoh Koon LoongNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- Recording of Financial TransactionsDocument8 pagesRecording of Financial TransactionsbarakaNo ratings yet

- Accounts (A)Document3 pagesAccounts (A)Sameer Gupta100% (1)

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- SInversions T2 1 Part1 Exercicis PreguntesDocument9 pagesSInversions T2 1 Part1 Exercicis PreguntesjoanNo ratings yet

- (ACCT2010) (2012) (F) Midterm Icizkjdd 44112Document22 pages(ACCT2010) (2012) (F) Midterm Icizkjdd 44112Tsui KelvinNo ratings yet

- ACCOUNTANCY CLASS NOTESDocument8 pagesACCOUNTANCY CLASS NOTESpraveenpv7No ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Accounting ProcessesDocument80 pagesAccounting ProcessesTikMoj Tube100% (1)

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- UT 1 AccountsDocument4 pagesUT 1 Accountskarishma prabagaranNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- Dlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DDocument16 pagesDlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DIqra HanifNo ratings yet

- Day Books FA1Document3 pagesDay Books FA1amirNo ratings yet

- Osmania University B.Com Practical Question Bank on Computerized AccountingDocument19 pagesOsmania University B.Com Practical Question Bank on Computerized AccountingrpraveenkumarreddyNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- CBSE Class 11 Accountancy Worksheet - Question Bank (1)Document17 pagesCBSE Class 11 Accountancy Worksheet - Question Bank (1)Umesh JaiswalNo ratings yet

- 1 Financial Statements Exercises 2022Document9 pages1 Financial Statements Exercises 2022Alyssa TolcidasNo ratings yet

- EFIN1614 TEST 1 Question Paper 2021Document15 pagesEFIN1614 TEST 1 Question Paper 2021nhlonipho.rikhotsoNo ratings yet

- Sample Paper Xi Acc 2022 23Document7 pagesSample Paper Xi Acc 2022 23rehankatyal05No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet

- Logo Lesson 1: TBE 540-40 Fall 2004 Farah FisherDocument35 pagesLogo Lesson 1: TBE 540-40 Fall 2004 Farah FisherrefugeehNo ratings yet

- Tally Erp-9 GuideDocument227 pagesTally Erp-9 GuideNitin Vishwakarma0% (2)

- Molla Nasiruddiner Golpo by Satyajit RayDocument51 pagesMolla Nasiruddiner Golpo by Satyajit RayrefugeehNo ratings yet

- Objective Questions Sybcom SEM IIIDocument25 pagesObjective Questions Sybcom SEM IIIrefugeeh100% (1)

- Central Min-01-04-14 PDFDocument18 pagesCentral Min-01-04-14 PDFankit_kheradiNo ratings yet

- Tally - Erp 9 - Auditors EditionDocument16 pagesTally - Erp 9 - Auditors EditionrefugeehNo ratings yet

- TALLY ERP9 EnglishEditionDocument31 pagesTALLY ERP9 EnglishEditionManjunathreddy Seshadri70% (10)

- Income Tax Calculator AY 2014-15 - IndividualsDocument2 pagesIncome Tax Calculator AY 2014-15 - IndividualsrefugeehNo ratings yet

- ... ' - Bangla KobitaDocument3 pages... ' - Bangla KobitarefugeehNo ratings yet

- TALLY MODEL COMPANY TRAININGDocument39 pagesTALLY MODEL COMPANY TRAININGKingg2009100% (1)

- Introduction Access 2007Document62 pagesIntroduction Access 2007Владимир СтојановићNo ratings yet

- Studentbook QuickbookDocument378 pagesStudentbook Quickbookamirhdl100% (3)

- TallyDocument23 pagesTallyrefugeehNo ratings yet

- Self Learning TallyERP 9Document7 pagesSelf Learning TallyERP 9Sanjay ChaukekarNo ratings yet

- RelationalDocument112 pagesRelationalthisisghostactualNo ratings yet

- Microsoft Access For BeginnersDocument25 pagesMicrosoft Access For Beginnersfay3vNo ratings yet

- New Pension Scheme - Investment GuidelinesDocument5 pagesNew Pension Scheme - Investment GuidelineskpugazhNo ratings yet

- SAP FICO THEORY-newDocument68 pagesSAP FICO THEORY-newBaira Reddy0% (1)

- SAP FICO Support Consultant DocumentDocument35 pagesSAP FICO Support Consultant DocumentRapalli Rams100% (4)

- Sap FicoDocument36 pagesSap FicogeorgebabycNo ratings yet

- Quick BooksDocument21 pagesQuick BooksrefugeehNo ratings yet

- SAP FICO THEORY-newDocument68 pagesSAP FICO THEORY-newBaira Reddy0% (1)

- 15H FormDocument2 pages15H Formkum_popNo ratings yet

- Form ADocument4 pagesForm AgarvmonuNo ratings yet

- Ms Excel ComaDocument4 pagesMs Excel ComarefugeehNo ratings yet

- Principles of Risk Management and Insurance FDocument125 pagesPrinciples of Risk Management and Insurance Fkhush36100% (5)

- Subjects For Study: Group IDocument19 pagesSubjects For Study: Group IanupangarkarNo ratings yet

- Armenia and The Armenians, The National Geographic Magazine, Vol. 28, No. 4., P. 329 (1915, October)Document34 pagesArmenia and The Armenians, The National Geographic Magazine, Vol. 28, No. 4., P. 329 (1915, October)ԳԵդիգարյանNo ratings yet