Professional Documents

Culture Documents

Despite The Hue and Cry It Created The Indian Income

Uploaded by

Chetanya MundachaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Despite The Hue and Cry It Created The Indian Income

Uploaded by

Chetanya MundachaliCopyright:

Available Formats

Despite the hue and cry it created the Indian Income-tax authorities as well as s several tax professionals specilising

in international taxation believe that the Tranfer Pricing order on Shell India, alleging that Rs 15,000 cr escaped taxnet. Section 92 and the amendmenst in this section vest power on the tax authorities make such a demand. It says it

The primary objective of countries putting in place Transfer Pricing Rules is to check possible erosion of revenue with the increasing number of cross-border transaction happening between associate enterprises. Transfer Pricing Rules were introduced in India in 2001, much after several countries had successfully experimented with it and systemised the comparatively novel fiscal tool. With the increasing global trade between associate enterprises, which at present is over 60 % of the total trade happenign worldover, more and more countries are exploring the feasibility of Transfer Pricing legislation in their own backyard. Taxmen usually ruffle feathers, espeially when they try to be innovative. They were taught to collect not a penny more not a penny less. It is a thin line taxmen tread, T P Rules incorproated in 2001 budget had not been a concern for tax professionals and companies except the volumninous documents T P regime expect the companies to furnish. But that was until two years ago when companies raised their voices, against taxing income that has not been received, . Or taxing a transactiosn that had not happened. Levying tax on intangibles, such as expenses for enhancing the brand equity, by introducing the concept of deemed receipts etc. Taxmen go through the legality of every measure oin an exercise to firtify themselves against the fallout of each meausre.Corproates cried foul. But a recent Special Bench order in the case of L G Electronics ratified the line of the taxmen. In the L G Electronics case. a Special Bench of Income-tax Appellate held taxing inta ngibles is in tune with the existing laws.

Then the tax demand on Shell India, of about Rs 15,000 cr founded on a share transaction with its own subsidiaries.There are several firsts in this demnd, besides the huge size of the amount. This is the first time i India share transactions are brought under the transfer pricing net. Tranfer pricing , according to critics, is an exercise in valuation of godds and services and share tramnsactions do not fall within its ambit. Secondly, the FDI issue. Shell has reportedly alleged that taxing money from foreigm direct investment is in fact a tax o FDI Shell India believes T P orde was based on injcorrect interpreatation of Transfer Pricing Rules.

Shell India has alleged that the order was based on incorrect interpretation of Indian transfer pricing laws. In fact, Shell believes that taxing the money received by Shell India is, in effect, a tax on foreign direct investment. Shell believes that this is not only in violation of Indian law but also giving a bad signal to the international FDI community. Considering the tax evasion reports as baseless, Shell India is now planning to challenge the order of income tax authorities strongly and is evaluating all options for redress. The company is confident of its stand as the valuation of the shares was undertaken by a certified independent valuer who assessed the value to be below Rs 10 per share and the issue was made at Rs 10 per share. Shell claims that such valuation is in accordance with the foreign investment and exchange control laws. The valuation certificates were also filed with the regulatory authorities. At Perry4Law and Perry4Laws Techno Legal Base (PTLB) we believe that the transfer pricing laws and valuation of the unlisted company needs further clarification from our legislature. Otherwise, litigations would keep on surfacing unnecessary. In a listed company, the valuation is based on Securities and Exchange Board of India (SEBI) formula, which is the average of six-month or two-week share price, whichever is higher. But in unlisted companies, the valuation can be based on fair market price, or book value, or returns on share based on a certification by an independent valuer. Source: Corporate Laws In India. This entry was posted in Uncategorized. Bookmark the permalink. ? Transfer Pricing Laws In India, International Transaction And Arms Length PriceNokia Accused Of Violating Income Tax And Transfer Pricing Laws Of India ? One Response to Shell India Received Transfer Pricing Order From Indian Tax Authorities

Pingback: Perry4Law Organisations Blog An Exclusive And Global Techno Legal Knowledge Base Blog Archive Transfer Pricing Laws And Regulations In India Need Clarification Recent Posts

You might also like

- INS Viraat - Decommissioned To DestructionDocument3 pagesINS Viraat - Decommissioned To DestructionChetanya MundachaliNo ratings yet

- Vidyalankar Institute of Technology MMS Dept. Semester I Final Examination - December 2015Document2 pagesVidyalankar Institute of Technology MMS Dept. Semester I Final Examination - December 2015Chetanya MundachaliNo ratings yet

- Mrityunjay LetterDocument3 pagesMrityunjay LetterChetanya MundachaliNo ratings yet

- 16 Secret Wishfulfilling Mantras of Lord HanumanDocument17 pages16 Secret Wishfulfilling Mantras of Lord HanumanChetanya Mundachali100% (2)

- MARCOMDocument2 pagesMARCOMChetanya MundachaliNo ratings yet

- Dear MR ChhabriaDocument1 pageDear MR ChhabriaChetanya MundachaliNo ratings yet

- Entrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandDocument26 pagesEntrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandJawwad HussainNo ratings yet

- BombDocument1 pageBombChetanya MundachaliNo ratings yet

- 7 Keys to Defeating Your Giants Like David Defeated GoliathDocument10 pages7 Keys to Defeating Your Giants Like David Defeated GoliathChetanya MundachaliNo ratings yet

- Vodafone FUTI4308926390Document1 pageVodafone FUTI4308926390Chetanya MundachaliNo ratings yet

- While The Government Is All SetDocument3 pagesWhile The Government Is All SetChetanya MundachaliNo ratings yet

- A8 The Midas Touch SDocument25 pagesA8 The Midas Touch SChetanya Mundachali100% (3)

- BMC Land Parcels Approved For Third MetroDocument1 pageBMC Land Parcels Approved For Third MetroChetanya MundachaliNo ratings yet

- 232014343P1G001Document1 page232014343P1G001Chetanya93No ratings yet

- Joker ScriptDocument6 pagesJoker ScriptSerasIshikawa77% (22)

- QualifyDocument5 pagesQualifyruling_geminiNo ratings yet

- NGO Helplines For Catching SnakesDocument1 pageNGO Helplines For Catching SnakesChetanya MundachaliNo ratings yet

- Yo GasDocument3 pagesYo GasRanjan G HegdeNo ratings yet

- Guidance On Firearms Licensing Law v13Document259 pagesGuidance On Firearms Licensing Law v13Chetanya MundachaliNo ratings yet

- 23 04 14 ManasDocument5 pages23 04 14 ManasChetanya MundachaliNo ratings yet

- KungfuDocument25 pagesKungfuPreeti Gunthey DiwanNo ratings yet

- Issues and Themes-Draft Syllabus Under Autonomy-Semester IVdocxDocument3 pagesIssues and Themes-Draft Syllabus Under Autonomy-Semester IVdocxChetanya MundachaliNo ratings yet

- VajramushtiDocument4 pagesVajramushtiChetanya MundachaliNo ratings yet

- Leaveandlicenseagreement ResidentialDocument7 pagesLeaveandlicenseagreement ResidentialRohit GadekarNo ratings yet

- Report On Self DefenceDocument9 pagesReport On Self DefenceChetanya MundachaliNo ratings yet

- Top 20 Construction Companies in India NewDocument33 pagesTop 20 Construction Companies in India NewChetanya MundachaliNo ratings yet

- Mhada Noc For ShivkrupaDocument10 pagesMhada Noc For ShivkrupaChetanya MundachaliNo ratings yet

- Hindustan Construction CompanyDocument18 pagesHindustan Construction CompanySudipta BoseNo ratings yet

- Hitman AbsolutionDocument172 pagesHitman AbsolutionChetanya MundachaliNo ratings yet

- 23 04 14 ManasDocument5 pages23 04 14 ManasChetanya MundachaliNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CSR-Policy of Tata Steel Company 2014-15 PDFDocument98 pagesCSR-Policy of Tata Steel Company 2014-15 PDFGreatAkbar1No ratings yet

- Technical Report 2014 0055Document25 pagesTechnical Report 2014 0055Trisno SupriyantoroNo ratings yet

- IMAC Budgeting Project Semester 2 2021Document4 pagesIMAC Budgeting Project Semester 2 2021TashaNo ratings yet

- Caltex Philippines, Inc. V COA (1992)Document3 pagesCaltex Philippines, Inc. V COA (1992)Anonymous wD8hMIPxJNo ratings yet

- HRMS FAQ - Manage Employees, Payroll, Leave & MoreDocument44 pagesHRMS FAQ - Manage Employees, Payroll, Leave & Morerespprincipal100% (1)

- FinanceDocument45 pagesFinanceelleNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- ROMANIAN Chart of AccountsDocument9 pagesROMANIAN Chart of AccountsMarina VoiculescuNo ratings yet

- Adjusting Process ExplainedDocument3 pagesAdjusting Process ExplainedMaria Cristina ArcillaNo ratings yet

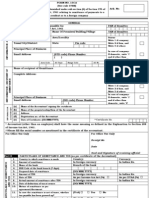

- 15CADocument2 pages15CAShant NagChaudhuriNo ratings yet

- Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesDocument3 pagesUniversiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesPutri Naajihah 4GNo ratings yet

- Investing in Equities: Topic 6Document58 pagesInvesting in Equities: Topic 6bulacanhomesiteNo ratings yet

- Accounting & Financial Management: Prof. Dr. R.A KhanDocument40 pagesAccounting & Financial Management: Prof. Dr. R.A KhanMF YousufNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Hotel Topics 12Document16 pagesHotel Topics 12Raffiai AbdullahNo ratings yet

- Crochet Love Financial PlanDocument2 pagesCrochet Love Financial PlanJaztine CaoileNo ratings yet

- BR100 General Ledger CompleteDocument28 pagesBR100 General Ledger Completebkishorec75% (4)

- Al-Azizia and Flagship ReferenceDocument53 pagesAl-Azizia and Flagship ReferenceAnonymous 1v4Rz6No ratings yet

- Marketing Strategies of AIM India Pvt LtdDocument55 pagesMarketing Strategies of AIM India Pvt LtdYash Batra100% (1)

- Land and LabourDocument44 pagesLand and LabourEd JoyceNo ratings yet

- Allied Bank Internship Report SummaryDocument79 pagesAllied Bank Internship Report Summarywamiq noorNo ratings yet

- OM MATERIALS (SARAWAK) SDN BHD/915304-H PAYSLIPDocument1 pageOM MATERIALS (SARAWAK) SDN BHD/915304-H PAYSLIPMary TiewNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- Johnny Rockets Pakistan's Strategic Mistakes and Opportunity in A Growing MarketDocument22 pagesJohnny Rockets Pakistan's Strategic Mistakes and Opportunity in A Growing MarketSamiullah SarwarNo ratings yet

- BritanniaDocument25 pagesBritanniamishori200850% (2)

- SNVM Unit 3Document21 pagesSNVM Unit 3Megha PatelNo ratings yet

- Kertas Kerja Perusahaan Dagang - Ahmad Andika Saputra (1810313210035)Document65 pagesKertas Kerja Perusahaan Dagang - Ahmad Andika Saputra (1810313210035)Daffa Permana PutraNo ratings yet

- Account Sales ReportDocument12 pagesAccount Sales Reportsamuel debebeNo ratings yet

- 5038 - Assignment 2 Brief 2022Document8 pages5038 - Assignment 2 Brief 2022Hương ĐỗNo ratings yet

- Bus-Math 11 Q2 WK3Document4 pagesBus-Math 11 Q2 WK3Symphony DiazNo ratings yet