Professional Documents

Culture Documents

Construction Companies Mint Q3 Report

Uploaded by

Abhimanyu PuriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Companies Mint Q3 Report

Uploaded by

Abhimanyu PuriCopyright:

Available Formats

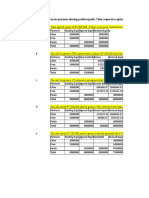

mint money

CONSTRUCTION

NAGARJUNA

CONSTRUCTION

BSE code: 500294

NSE symbol: NAGARCONST

Price as on 11 February

R97.95

MARKET CAPITALIZATION

R2,513.24 crore

Quarter ended

Net sales/income from operations

Expenditure

Gross profit

Other income

PBDIT

Dec 10

Sep 10

Jun 10

Mar 10

1,335.50

1,201.32

1,086.50

1,522.71

1,207.90

1,077.95

980.74

1,369.98

127.60

123.37

105.76

2.30

5.44

129.90

128.81

Dec 09

Q3 REPORT

BSE code: 532693

NSE symbol: PUNJLLOYD

Price as on 11 February

R71.05

PUNJ LLOYD

MARKET CAPITALIZATION

R2,359.54 crore

Dec 10

Sep 10

1,187.04

Quarter ended

Net sales/income from operations

Jun 10

Mar 10

Dec 09

1,103.17

1,068.98

Expenditure

1,005.22

1,052.51

1,115.52

1,296.46

2,126.34

933.26

1,026.17

1,434.75

152.73

118.06

Gross profit

1,849.91

97.95

119.25

89.35

-138.29

1.27

1.24

1.37

Other income

276.43

11.55

2.74

4.62

0.70

107.03

153.97

119.43

PBDIT

12.97

109.50

121.99

93.97

-137.59

289.40

Depreciation

17.49

16.85

15.63

13.65

13.30

Depreciation

39.53

39.20

37.65

34.08

33.23

PBIT

112.41

111.96

91.40

140.32

106.13

PBIT

69.97

82.79

56.32

-171.67

256.17

Interest

43.82

37.46

29.35

34.81

30.57

Interest

75.38

78.64

70.21

64.22

77.09

PBT before exceptional items

68.59

74.50

62.05

105.51

75.56

PBT before exceptional items

-5.41

4.15

-13.89

-235.89

179.08

Exceptional items

0.00

0.00

0.00

0.00

0.00

Exceptional items

0.00

0.00

0.00

0.00

0.00

PBT after exceptional items

68.59

74.50

62.05

105.51

75.56

PBT after exceptional items

-5.41

4.15

-13.89

-235.89

179.08

Tax

28.15

28.52

20.66

52.45

27.70

Tax

-3.14

2.90

4.60

-64.11

61.60

Profit after tax

40.43

45.98

41.39

102.62

47.86

Profit after tax

-2.27

1.25

-18.49

139.31

117.48

Extraordinary items

Net profit

0.00

0.00

0.00

0.00

0.00

Extraordinary items

0.00

0.00

0.00

0.00

0.00

40.43

45.98

41.39

102.62

47.86

Net profit

-2.27

1.25

-18.49

139.31

117.48

Earnings per share (R)

1.58

1.79

1.61

4.00

1.87

Earnings per share (R)

0.00

0.04

0.00

4.19

3.54

Face value (R)

2.00

2.00

2.00

2.00

2.00

Face value (R)

2.00

2.00

2.00

2.00

2.00

Equity capital

51.32

51.32

51.32

51.32

51.32

Equity capital

66.42

66.42

66.42

66.42

66.41

Percentage of public shareholding

79.94

79.87

79.82

79.79

79.75

Percentage of public shareholding

62.85

62.88

62.88

62.88

PBDIT: profit before depreciation , interest and tax; PBIT: profit before interest and tax; PBT: profit before tax; figures in R cr unless mentioned

QUICK TAKES

SECTOR STATISTICS

Company

Price (R)

EPS (adj, R)

Ahluwalia Contracts

130.65

13.03

9.88

ARSS Infrastructure

565.90

70.48

6.86

69.40

5.06

12.51

0.20

Atlanta

BL. Kashyap

P-E

DPS (ann, R)

0.80

RoE

P/BV M cap (R cr)

32.32

3.24

819.99

26.65

2.49

839.98

14.89

2.08

565.61

464.29

22.60

2.04

10.23

0.10

7.83

0.91

157.00

32.20

7.22

2.75

11.69

0.69

367.21

53.00

5.06

10.69

0.50

15.54

1.66

979.32

109.90

10.72

18.36

0.85

7.44

0.77

1,491.77

33.60

1.40

22.22

0.40

5.37

1.34

2,037.95

IL&FS

222.55

19.97

11.68

3.00

20.10

2.52

4,323.43

IRB Infrastructure

171.45

11.60

11.59

1.50

18.89

2.79

5,698.38

ITD Cementation

199.65

40.99

1.00

1.53

0.65

229.91

IVRCL Infra

66.60

7.91

9.91

0.80

11.34

0.96

1,778.29

J Kumar Infra

136.90

29.04

4.91

2.25

22.46

1.22

380.60

KNR Constructions

129.40

23.45

5.52

2.00

20.18

1.13

363.92

Man Infra

142.70

19.97

8.80

2.70

18.92

1.52

706.37

Marg

110.30

30.10

4.39

2.00

18.34

1.25

712.95

Nagarjuna Constructions

97.95

9.50

4.07

1.30

10.44

1.60

2,513.24

Punj Lloyd

71.05

-0.52

0.15

-3.58

0.78

2,359.54

Sadbhav Engg

98.80

4.21

21.10

0.40

13.21

3.70

1,334.32

Unity Infra

62.05

11.49

5.09

1.00

15.12

0.81

459.71

Valecha Engg

94.10

16.49

9.99

1.50

7.17

0.76

183.78

Vascon Engineers

97.55

6.71

18.55

0.00

7.90

1.33

878.11

C&C Construction

Consolid Construction

Gammon India

Hindustan Construction

P-E: price-earnings; EPS: earnings per share; DPS: dividend per share; RoE: return on equity; P/BV: price-to-book value; M cap: market capitalization

14 | FEBRUARY, 2011 www.livemint.com

PBDIT: profit before depreciation , interest and tax; PBIT: profit before interest and tax; PBT: profit before tax; figures in R cr unless mentioned

Punj Lloyd faces consolidated net loss

Punj Lloyd Ltd is engaged in

providing integrated design,

engineering procurement,

construction and project management services for energy

and infrastructure sector. Punj

Lloyd operates in four segments: energy, civil and infrastructure, power and renewables. During the quarter ended

December 2010, the companys consolidated revenue was

down 27.4% at R2,119 crore

against R2,918 crore year-onyear. Its net loss was at R62.13

crore against net profit of

R12.48 crore from a year ago

period. The company's earnings before interest, tax,

depreciation and amortization

was at R104 crore against R228

crore on a yearly basis. Order

cancellations, deteriorating

working capital intensity and

concerns of failure in an arbitration proceeding are the factors working against the company. With new orders worth

R9,238 crore won during FY11,

its order backlog stands at

R27,780 crore.

NCC Q3 consolidated net at R52.10 cr

Nagarjuna Constructions Co.

Ltd (NCC) is a Hyderabadbased company and is in the

business of engineering and

construction. It provides services in the areas of housing,

transportation, electricity,

water and environment, irrigation and hydropower and

commercial buildings. For the

quarter ended December

2010, the consolidated net

profit of the company was

down at R52.10 crore against

R55.80 crore year-on-year

(y-o-y). Its consolidated revenues were, however, up at

R1,599 crore against R1,466

crore y-o-y.

HCC Q3 profit nearly halves

Hindustan Construction Co.

Ltd (HCC) posted a 46% fall in

third quarter profit. The company said several project

orders had been deferred.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Principles of Accounting Chapter 13Document43 pagesPrinciples of Accounting Chapter 13myrentistoodamnhigh100% (1)

- Pidilite Industries Company ValuationDocument39 pagesPidilite Industries Company ValuationKeval ShahNo ratings yet

- Advanced Accounting Chapter 9Document22 pagesAdvanced Accounting Chapter 9Ya LunNo ratings yet

- Goldman Sachs: Banking and FinanceDocument3 pagesGoldman Sachs: Banking and FinancebiatcchNo ratings yet

- Singer Annual Report 2010Document46 pagesSinger Annual Report 2010Ashef AnikNo ratings yet

- Ratio AnalysisDocument79 pagesRatio Analysisanjali dhadde100% (1)

- Company Guide 2016 PDFDocument302 pagesCompany Guide 2016 PDFDharmendra SinghNo ratings yet

- Supreme Court Judgment on Privatization of Pakistan Steel MillsDocument79 pagesSupreme Court Judgment on Privatization of Pakistan Steel MillsAsim Bashir KhanNo ratings yet

- Asian Paints-Capital StructureDocument13 pagesAsian Paints-Capital StructurePalak GoelNo ratings yet

- FM Final ExamDocument5 pagesFM Final ExamMarites ArcenaNo ratings yet

- Distinguish Between Cash Flow and Fund Flow StatementDocument3 pagesDistinguish Between Cash Flow and Fund Flow StatementSachin GodseNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- Fin ManDocument12 pagesFin ManMarinella LosaNo ratings yet

- Cooperative Performance Questionnaire 1132013Document40 pagesCooperative Performance Questionnaire 1132013Susan Pascual67% (3)

- AQUINO Blake and Scott Fs AnalysisDocument66 pagesAQUINO Blake and Scott Fs AnalysisPinky DaisiesNo ratings yet

- Fra - Financial Statement Analysis-An IntroducitonDocument23 pagesFra - Financial Statement Analysis-An IntroducitonSakshiNo ratings yet

- Assignment 11 Partnership Dissolution Part 2Document23 pagesAssignment 11 Partnership Dissolution Part 2Sova ShockdartNo ratings yet

- Statement of The ProblemDocument24 pagesStatement of The ProblemLia AmmuNo ratings yet

- Dhis Special Transactions 2019 by Millan Solman PDFDocument158 pagesDhis Special Transactions 2019 by Millan Solman PDFQueeny Mae Cantre ReutaNo ratings yet

- Examination About Investment 2Document2 pagesExamination About Investment 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Opening Day Balance SheetDocument1 pageOpening Day Balance SheetCoTrios Health ChainsNo ratings yet

- Business Financed PascoDocument41 pagesBusiness Financed Pascoedadzie338No ratings yet

- Final LKFS BNI - Bilingual - 31 - DES - 2021Document274 pagesFinal LKFS BNI - Bilingual - 31 - DES - 2021Jefri Formen PangaribuanNo ratings yet

- Managerial Accounting1Document33 pagesManagerial Accounting1MM-Tansiongco, Keino R.No ratings yet

- 123Document13 pages123Nicole Andrea TuazonNo ratings yet

- #DiwaliPicks SBI Capital SecuritiesDocument15 pages#DiwaliPicks SBI Capital SecuritiesVenkatpradeepManyamNo ratings yet

- Annual financial report and resort menu for Cora Vergel ResortDocument16 pagesAnnual financial report and resort menu for Cora Vergel ResortAnn Jalene Soterno AguilarNo ratings yet

- Athleta DCF and VC Model V1 DraftDocument19 pagesAthleta DCF and VC Model V1 Draftuygh g100% (1)

- CH 03Document51 pagesCH 03Lộc PhúcNo ratings yet

- Morgan StanleyDocument15 pagesMorgan StanleyDayavantiNo ratings yet