Professional Documents

Culture Documents

Bulgari Group Q1 2011 Results: May 10th 2011

Uploaded by

sl7789Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bulgari Group Q1 2011 Results: May 10th 2011

Uploaded by

sl7789Copyright:

Available Formats

BULGARI GROUP Q1 2011 Results

May 10th 2011

1

KEY MESSAGES

Strong double digit top line growth Tight control of costs, capex, inventory Strong improvement of profitability Strong double digit sales growth in April Successful BaselWorld: watch orders up 56%

REVENUES BY PRODUCT CATEGORY Q1 2011

Q1 2011

Q1 2011/Q1 2010 REPORTED AT COMP.FX

PRODUCT CATEGORY JEWELRY WATCHES PERFUME & COSMETICS ACCESSORIES HOTEL & REST. ROYALTIES AND OTHER TOTAL

EUR M. 114.0 50.6 60.1 20.7 4.2 5.1 254.7

% ON TOTAL SALES 44.8% 19.9% 23.6% 8.1% 1.6% 2.0% 100% +29.3% +21.9% +32.9% +19.0% +14.3% +61.3% +27.9%

% DELTA +23.3% +16.4% +30.3% +11.3% +22.7%

REVENUES BY GEOGRAPHICAL AREA Q1 2011

Q1 2011/Q1 2010 Q1 2011 GEOGRAPHICAL AREA EUROPE Of which Italy AMERICAS ASIA Of which Japan Of which Rest of Asia MIDDLE EAST/ OTHER TOTAL EUR M. 79.1 25.3 33.1 122.6 39.5 83.2 19.8 254.7 % ON TOTAL SALES 31.0% 9.9% 13.0% 48.2% 15.5% 32.7% 7.8% 100% % DELTA REPORTED +16.0% +9.1% +22.0% +33.9% +10.7% +48.7% +63.1% +27.9% AT COMP.FX +20.9% +25.8% -0.1% +43.5% +22.7%

GREATER CHINA GREW BY 77.0% AT REPORTED EXCHANGE RATES AND BY 70.6% AT COMPARABLE EXCHANGE RATES IN THE LAST QUARTER AGAINST VERY STRONG COMPS (RESP.+30.4% AND +38.4%). 2011 WILL BE THE YEAR OF CHINA AT BULGARI.

Q1 2011 - FINANCIAL HIGHLIGHTS

EUR M.

Q1 2011 EUR M.

Q1 2010 EUR M. 199.1 126.9 63.8% (127.2) 16.3 (0.3) (8.3)

Q1 11/Q1 10 % DELTA REPORTED FX 27.9% 27.2% 17.2% 78.6%

REVENUES CONTRIBUTION MARGIN TOTAL OPERATING EXPENSES EBITDA EBIT NET RESULT

254.7 161.4 63.4% (149.1) 29.1 12.3 9.3

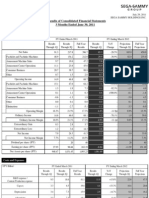

Q1 2011 - GROUP PROFIT & LOSS

EUR M. Q1 2011 EUR M. REVENUES CONTRIBUTION MARGIN % on Sales VARIABLE SELLING EXPENSES PERSONNEL COSTS OTHER GENERAL EXPENSES AMORTIZATION AND DEPRECIATION ADVERTISING AND PROMOTION A&P % on Sales TOTAL OPERATING EXPENSES EBITDA % on Sales EBIT % on Sales TOTAL FINANCIAL COSTS of which FX Gain (Loss) Financial costs CURRENT AND DEFERRED TAXES MINORITY INTEREST NET RESULT 254.7 161.4 63.4% (10.9) (48.1) (44.5) (16.8) (28.7) 11.3% (149.1) 29.1 11.4% 12.3 4.8% (0.4) 3.2 (3.5) (2.6) 0 9.3 3.7% Q1 2010 EUR M. 199.1 126.9 63.8% (8.3) (43.8) (39.2) (16.3) (19.6) 9.8% (127.2) 16.3 8.2% (0.3) (8.6) (4.9) (3.7) 0.6 0 (8.3) Q1 11/Q1 10 % DELTA REPORT. 27.9% 27.2% Q1 11/Q1 10 % DELTA COMP.FX 22.7%

31.7% 10.0% 13.4% 2.9% 46.7% 17.2% 78.6%

24.7% 4.4% 8.3% (2.3%) 37.7% 11.3%

Q1 2011 - NET WORKING CAPITAL

EUR M. End of March 2010 125.4 656.7 (141.8) 6.0 646.3 End of Dec 2010 195.2 655.5 (193.0) 0.1 657.8 End of March 2011 154.9 683.8 (186.1) 3.5 656.1

RECEIVABLES INVENTORY PAYABLES OTHER RECEIVABLES AND PAYABLES TOT NWC

WORKING CAPITAL ROT. DAYS INVENTORY ROT. DAYS Inv./Rev

246 250

222 221

210 219

CASH FLOW

EUR M. NET INDEBTEDNESS AT BEGINNING PERIOD CASH FLOW from P&L CHANGE in WORKING CAPITAL CASH FLOW from INVESTING ACTIVITY

CAPITAL EXPENDITURE ACQUISITION OF COMPANIES GUARANTEE DEPOSIT OTHER

MARCH 2011 (135.3) 26.4 1.6

6.9 (7.4) 6.1 (0.4) 8.5

MARCH 2010 (216.8) 9.3 (29.0)

(22.5) (9.9) 0 (0.2) (12.4)

DIVIDENDS OTHER TOTAL NET INDEBTEDNESS AT ENDING PERIOD

0 (32.0) 2.8 (132.4)

0 20.2 (21.9) (238.7)

Q1 2011 - NET INDEBTEDNESS

37%

GEARING AS OF END OF PERIOD

28%

14%

14%

304

217 135 132

31.12.08

31.12.2009

31.12.2010

31.03.2011

DISCLAIMER

This document is for institutional investors only and is not available to private customers. This document is being supplied to a limited number of recipients and it may not be distributed, published or reproduced in whole or in part or disclosed by recipients to any other person. Under no circumstances shall this document constitute an offer to sell, an invitation to acquire or the solicitation of an offer to buy securities in any jurisdiction. Each investor contemplating purchasing securities issued by Bulgari S.p.A or any of its subsidiaries should make its own independent investigation of the financial condition and affairs, and its own appraisal of the creditworthiness, of Bulgari S.p.A or any of its subsidiaries and should carefully consider the high risks involved in purchasing these securities. This document contains certain forward looking statements and key financial goals which reflect managements current views, estimates, and objectives. The forward looking statements and key financial goals involve certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward looking statements and key financial goals. Potential risks and uncertainties include, amongst other things, internal, industry and external factors, such as general economic conditions

10

You might also like

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Analyst Presentation 9M 2011Document18 pagesAnalyst Presentation 9M 2011gupakosNo ratings yet

- Presentation - 4Q11 and 2011 ResultsDocument14 pagesPresentation - 4Q11 and 2011 ResultsLightRINo ratings yet

- First Global: DanoneDocument40 pagesFirst Global: Danoneadityasood811731No ratings yet

- An adventure of enterprise: PPR's 2008 results and outlookDocument47 pagesAn adventure of enterprise: PPR's 2008 results and outlooksl7789No ratings yet

- Fact Sheet Qu1 2006Document8 pagesFact Sheet Qu1 2006javierdb2012No ratings yet

- Selecta Group 2021 Annual ReportDocument89 pagesSelecta Group 2021 Annual ReportCarissa May Maloloy-onNo ratings yet

- 23KODocument3 pages23KOHatim BaraNo ratings yet

- Bulgari Group Reports 23.1% Revenue Decline in Q1 2009Document38 pagesBulgari Group Reports 23.1% Revenue Decline in Q1 2009sl7789No ratings yet

- Rezultate OTP BankDocument55 pagesRezultate OTP BankCiocoiu Vlad AndreiNo ratings yet

- Pushpendra Nokia StatementDocument102 pagesPushpendra Nokia StatementPushpendra SengarNo ratings yet

- Press Release Sony Ericsson Reports Second Quarter Results: July 16, 2009Document11 pagesPress Release Sony Ericsson Reports Second Quarter Results: July 16, 2009it4728No ratings yet

- 4Q2013 DefDocument24 pages4Q2013 DefcoccobillerNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Prelio SDocument55 pagesPrelio Sjohnface12No ratings yet

- Signify Third Quarter Results 2022 ReportDocument19 pagesSignify Third Quarter Results 2022 Reportsumanthsumi2023No ratings yet

- Presentation 1Q13Document17 pagesPresentation 1Q13Multiplan RINo ratings yet

- 2009 24446 ArDocument60 pages2009 24446 ArnnasikerabuNo ratings yet

- Results Conference CallDocument15 pagesResults Conference CallLightRINo ratings yet

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Document5 pagesOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerNo ratings yet

- BASF Report 2010Document0 pagesBASF Report 2010ilijavujovicNo ratings yet

- Slide Annual ReportDocument10 pagesSlide Annual ReportUmmu ZubairNo ratings yet

- Conf Call FY2011Document12 pagesConf Call FY2011PiaggiogroupNo ratings yet

- Bajaj Electricals: Pinch From E&P To End SoonDocument14 pagesBajaj Electricals: Pinch From E&P To End SoonYash BhayaniNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620No ratings yet

- 2011 Results Presentation SlidesDocument56 pages2011 Results Presentation SlidesTarun GuptaNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Nokia Q2 Report Shows Profitability Across DivisionsDocument44 pagesNokia Q2 Report Shows Profitability Across DivisionsSushil GhadgeNo ratings yet

- Presentation - 1st Quarter 2010 ResultsDocument10 pagesPresentation - 1st Quarter 2010 ResultsPiaggiogroupNo ratings yet

- Nokia in 2006 ReportDocument92 pagesNokia in 2006 ReportammanfadiaNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- Ucb (Report)Document3 pagesUcb (Report)Shruti VasudevaNo ratings yet

- Half-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitDocument15 pagesHalf-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitMan Tan CheongNo ratings yet

- Deutsche LufthansaDocument2 pagesDeutsche LufthansasandlegionNo ratings yet

- Burelle, A Growing Euro For 50 CentsDocument8 pagesBurelle, A Growing Euro For 50 CentsAlex VzquezNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- MANDO.2Q11 Earnings PresentationDocument8 pagesMANDO.2Q11 Earnings PresentationSam_Ha_No ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Press Publication 2010 Annual Report UkDocument244 pagesPress Publication 2010 Annual Report Ukbwalya_kakosa5613No ratings yet

- Quarterly Report at March 31, 2006Document54 pagesQuarterly Report at March 31, 2006PiaggiogroupNo ratings yet

- Preliminary Q1 2016Document5 pagesPreliminary Q1 2016mathez11No ratings yet

- MG Group Merck Ar21Document10 pagesMG Group Merck Ar21TEST SENo ratings yet

- Bittium Corporation Half Year Financial Report 1H2023Document29 pagesBittium Corporation Half Year Financial Report 1H2023robertlinonNo ratings yet

- Presentation - Full Year 2008 ResultsDocument11 pagesPresentation - Full Year 2008 ResultsPiaggiogroupNo ratings yet

- Result Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Document6 pagesResult Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Gautam GokhaleNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- GfiDocument17 pagesGfiasfasfqweNo ratings yet

- Beta SecuritiesDocument5 pagesBeta SecuritiesZSNo ratings yet

- Wienerberger AR 11 EngDocument172 pagesWienerberger AR 11 Eng0730118008No ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- McDonald's (MCD) - Earnings Quality ReportDocument1 pageMcDonald's (MCD) - Earnings Quality ReportInstant AnalystNo ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- Conference CallDocument13 pagesConference CallLightRINo ratings yet

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- TiffanyDocument22 pagesTiffanyjamesburden100% (1)

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Earnings Conference Call: Q2 Fiscal Year 2021Document24 pagesEarnings Conference Call: Q2 Fiscal Year 2021sl7789No ratings yet

- 2020 Global Ma Outlook Report PDFDocument15 pages2020 Global Ma Outlook Report PDFsl7789No ratings yet

- Earnings Conference Call: Q4 Fiscal Year 2021Document25 pagesEarnings Conference Call: Q4 Fiscal Year 2021sl7789No ratings yet

- Forward-Looking Statements and Financial HighlightsDocument24 pagesForward-Looking Statements and Financial Highlightssl7789No ratings yet

- Goldman Sachs Investor Day Strategic Roadmap and GoalsDocument263 pagesGoldman Sachs Investor Day Strategic Roadmap and GoalsZsuzsanna TuruczNo ratings yet

- LAZ 2020 Q3 Investor Deck - Final - v02Document54 pagesLAZ 2020 Q3 Investor Deck - Final - v02sl7789No ratings yet

- Payables Automation - BLDG BLK - August 2009Document16 pagesPayables Automation - BLDG BLK - August 2009sl7789No ratings yet

- Earnings Call Highlights Q1 Fiscal Year 2021Document24 pagesEarnings Call Highlights Q1 Fiscal Year 2021sl7789No ratings yet

- CRWD Investor Presentation Dec2020Document44 pagesCRWD Investor Presentation Dec2020sl7789No ratings yet

- FY21 Investor Day Finance Review PDFDocument44 pagesFY21 Investor Day Finance Review PDFsl7789No ratings yet

- Credit Suisse Nice Report - Payments Processors FinTech USA PDFDocument261 pagesCredit Suisse Nice Report - Payments Processors FinTech USA PDFAnand ArgNo ratings yet

- Q3 2020 Earnings ReleaseDocument11 pagesQ3 2020 Earnings Releasesl7789No ratings yet

- Factor Report: Lazard Asset ManagementDocument5 pagesFactor Report: Lazard Asset Managementsl7789No ratings yet

- Accountingsoftwareforcontracts 191019160840Document46 pagesAccountingsoftwareforcontracts 191019160840sl7789No ratings yet

- CRM Q3 FY21 Earnings Presentation PDFDocument17 pagesCRM Q3 FY21 Earnings Presentation PDFsl7789No ratings yet

- 606 Investor Deck Vfinal PDFDocument25 pages606 Investor Deck Vfinal PDFsl7789No ratings yet

- Salesforce Announces Strong Third Quarter Fiscal 2021 ResultsDocument19 pagesSalesforce Announces Strong Third Quarter Fiscal 2021 Resultssl7789No ratings yet

- Salesforce Boss Says US$27.7bn Slack Deal Is A "Match Made in Heaven"Document3 pagesSalesforce Boss Says US$27.7bn Slack Deal Is A "Match Made in Heaven"sl7789No ratings yet

- Credit Suisse Nice Report - Payments Processors FinTech USA PDFDocument261 pagesCredit Suisse Nice Report - Payments Processors FinTech USA PDFAnand ArgNo ratings yet

- Investor Perspectives On Asc 606 For Software and SaasDocument3 pagesInvestor Perspectives On Asc 606 For Software and Saassl7789No ratings yet

- 606 Investor Deck Vfinal PDFDocument25 pages606 Investor Deck Vfinal PDFsl7789No ratings yet

- BDO Knows FASB Topic 606 - 8 17 PDFDocument44 pagesBDO Knows FASB Topic 606 - 8 17 PDFsl7789No ratings yet

- United States Securities and Exchange Commission FORM 10-Q: Washington, D.C. 20549Document81 pagesUnited States Securities and Exchange Commission FORM 10-Q: Washington, D.C. 20549sl7789No ratings yet

- The Bank of The Future PDFDocument124 pagesThe Bank of The Future PDFsubas khanal100% (1)

- FISCAL 2021 Q2 Earnings: NOVEMBER 5, 2020Document25 pagesFISCAL 2021 Q2 Earnings: NOVEMBER 5, 2020sl7789No ratings yet

- SoftwareDocument91 pagesSoftwaresl7789No ratings yet

- Salesforce to Acquire Slack in $27.7B DealDocument16 pagesSalesforce to Acquire Slack in $27.7B Dealsl7789No ratings yet

- Earnings Graphs 100119 - V11 PDFDocument18 pagesEarnings Graphs 100119 - V11 PDFsl7789No ratings yet

- Twilio Signs Definitive Agreement To Acquire Segment: October 12, 2020Document18 pagesTwilio Signs Definitive Agreement To Acquire Segment: October 12, 2020sl7789No ratings yet

- BDO Knows FASB Topic 606 - 8 17 PDFDocument44 pagesBDO Knows FASB Topic 606 - 8 17 PDFsl7789No ratings yet

- Freund - Picht - Competition Law in The Era of Algorithms - 39 - ECLR - 2018 - 403ffDocument8 pagesFreund - Picht - Competition Law in The Era of Algorithms - 39 - ECLR - 2018 - 403ffaaryaparihar24No ratings yet

- Paper 3 Workbook Answers - EconomicsDocument65 pagesPaper 3 Workbook Answers - EconomicsNihaarika GopinathNo ratings yet

- 4 Reporting and Analyzing Merchandising OperationsDocument45 pages4 Reporting and Analyzing Merchandising OperationsAngelica AllanicNo ratings yet

- Ukraine Agricultural ProjectDocument93 pagesUkraine Agricultural ProjectIzabela MugosaNo ratings yet

- Virtual LogisticsDocument27 pagesVirtual LogisticsDragan CisicNo ratings yet

- 01-02. MS-401 E-Business - Lecture 01 Introductory Concepts in E-Business and E-CommerceDocument32 pages01-02. MS-401 E-Business - Lecture 01 Introductory Concepts in E-Business and E-CommerceAnonymous gOpy6q4No ratings yet

- Retail Management: A Strategic Approach: Promotional StrategyDocument32 pagesRetail Management: A Strategic Approach: Promotional StrategySumaiyah AlifahNo ratings yet

- RGESS Tax Scheme ExplainedDocument16 pagesRGESS Tax Scheme Explainednil sheNo ratings yet

- Evolution of Financial EconomicsDocument38 pagesEvolution of Financial EconomicsSoledad PerezNo ratings yet

- Integrated Marketing CommunicationDocument26 pagesIntegrated Marketing Communicationanamikasharma1970No ratings yet

- Investment ManagementDocument82 pagesInvestment ManagementSabita LalNo ratings yet

- Sim92562 ch03 PDFDocument48 pagesSim92562 ch03 PDFSreekumar RajendrababuNo ratings yet

- BA500 MarketingDocument32 pagesBA500 Marketingarshdeep1990No ratings yet

- Juniper Research Buy Now Pay Later The Future of ECommerce WhitepaperDocument7 pagesJuniper Research Buy Now Pay Later The Future of ECommerce WhitepaperRishabh DaadNo ratings yet

- Walmart's Cost of Capital and Investment DecisionsDocument1 pageWalmart's Cost of Capital and Investment Decisionskessa thea salvatoreNo ratings yet

- Pengaruh Bauran Pemasaran, Dan Orientasi Pasar Terhadap Keunggulan Bersaing Dalam Meningkatkan Kinerja Pemasaran Pada Perusahaan Batik Di SurakartaDocument88 pagesPengaruh Bauran Pemasaran, Dan Orientasi Pasar Terhadap Keunggulan Bersaing Dalam Meningkatkan Kinerja Pemasaran Pada Perusahaan Batik Di Surakartastream steamNo ratings yet

- Chapter Six: Social Cost Benefit Analysis (Scba)Document47 pagesChapter Six: Social Cost Benefit Analysis (Scba)yimer100% (1)

- Vanraj Case StudyDocument5 pagesVanraj Case StudyrohitdhallNo ratings yet

- Module 4 Pricing and Marketing ChannelsDocument8 pagesModule 4 Pricing and Marketing ChannelsSonal GowdaNo ratings yet

- Titan Case StudyDocument42 pagesTitan Case StudyManan Rawal100% (1)

- Valuation of Bonds PDFDocument6 pagesValuation of Bonds PDFMoud KhalfaniNo ratings yet

- Toma GrozavescuDocument35 pagesToma Grozavescupopa madalinaNo ratings yet

- Chapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionDocument9 pagesChapter 1: Introduction To Accounting: Activity 1: A Chapter DiscussionFaith ClaireNo ratings yet

- MBA Research Proposal 2011Document12 pagesMBA Research Proposal 2011Obert Sanyambe100% (1)

- Advance Financial Accounting and Reporting: Franchise IAS 18Document4 pagesAdvance Financial Accounting and Reporting: Franchise IAS 18Roxell CaibogNo ratings yet

- Banks Rating Assessment CircularDocument126 pagesBanks Rating Assessment CircularMuh Rizki Gus SofwanNo ratings yet

- Receipt: MRS Astrid Hairasani MakkarumpaDocument1 pageReceipt: MRS Astrid Hairasani MakkarumpaAzhari NugrahaNo ratings yet

- Case Analysis – Sales Force Integration Strategies at FedExDocument2 pagesCase Analysis – Sales Force Integration Strategies at FedExDheeraj singhNo ratings yet

- Money Market InstrumentsDocument6 pagesMoney Market InstrumentsPooja ChavanNo ratings yet

- MGT 1115 REVIEW PROBLEM SETS CHAPTERS 10-17Document11 pagesMGT 1115 REVIEW PROBLEM SETS CHAPTERS 10-17Maryrose Sumulong100% (2)