Professional Documents

Culture Documents

Dynamic Trading Tools

Uploaded by

mr12323Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dynamic Trading Tools

Uploaded by

mr12323Copyright:

Available Formats

Dynamic Trading Tools

Profiting with Support, Resistance & Trendline Breakouts

For MetaStock 7.0 (and higher)

User’s Manual

Version 2.0

All Rights Reserved

Copyright 1998-2004

Printed in the U.S.A.

Equis International, Inc.

90 South 400 West

Suite 620

Salt Lake City, UT 8410

Equis and MetaStock are registered trademarks of Equis International. Microsoft Windows, Microsoft Windows 95,

and Microsoft Explorer are trademarks of Microsoft Corporation. All other product names or services mentioned are

trademarks or registered trademarks of their respective owners.

Contents

Getting Started 1

Welcome ....................................................................................................................................1

Installation..................................................................................................................................2

Why Support and Resistance Develop .......................................................................................3

Why Trends Develop .................................................................................................................4

How to Use the Tools 5

Drawing the Lines Automatically with the Custom Indicators ..................................................5

Filtering Securities that have Broken Out ..................................................................................7

Getting More Info with the Expert Advisors .............................................................................8

Creating and Applying Templates for Easy Formatting.............................................................9

A Sample Strategy 11

Run the Exploration .................................................................................................................11

Study the Charts and Indicators ...............................................................................................12

Look at the Expert Commentary ..............................................................................................12

The Decision ............................................................................................................................14

Troubleshooting 17

Frequently Asked Questions ....................................................................................................17

Dynamic Trading Tools Contents • i

Getting Started

Welcome

Trendlines and Support/Resistance lie at the very heart of technical

analysis. As Steve Achelis (Founder of Equis International) said in his

book Technical Analysis from A to Z, “Wise investments aren’t made

with Ouija boards, they are made using logical approaches that minimize

risks and maximize opportunities. Most investors spend their time

looking for easy money (which is not an easy search) instead of learning

the key factors to security prices—supply and demand.”

Because technical analysis in general and particularly the drawing of

trendlines and support/resistance levels are considered somewhat of an

art, it is difficult for a computer algorithm to exactly draw the lines as a

human would. In fact, given the same chart, and two people, each person

would likely draw these lines in different places.

We have made every attempt to calculate and draw these lines as

accurately as possible. In most instances you will find them to be very

accurate. In some case, you may find the accuracy of the lines to be

adversely affected by extreme volatility.

The tools for drawing the automatic versions of the lines include a

“dynamic” variable that allows them to be drawn on any type of security,

be it a stock, bond, future, mutual fund, or index.

Your package includes the following:

• Four Support/Resistance custom indicators: Support (longer

term), Support (shorter term), Resistance (longer term),

Resistance (shorter term). There are <auto> and <manual>

versions of each of these.

• Four Trendline custom indicators: Trndline Up (longer term),

Trndline Up (shorter term), Trndline Dn (longer term), Trndline

Dn (shorter term). There are <auto> and <manual> versions of

each of these.

• Two Support/Resistance explorations: Equis – Support &

Resistance (longer) and Equis – Support & Resistance (shorter).

• Two Trendline explorations: Equis – Trendline Breakouts

(longer) and Equis – Trendline Breakouts (shorter).

Dynamic Trading Tools Getting Started • 1

• Two Support/Resistance expert advisors: Equis – Support &

Resistance (longer) and Equis – Support & Resistance (shorter).

• Two Trendline expert advisors: Equis – Trendline Analysis

(longer) and Equis – Trendline Analysis (shorter).

• One MetaStock DLL: This is a program file containing the

mathematical logic used in these tools. During installation, this

file is copied to the “External Function DLLs” folder beneath

the MetaStock folder.

Installation

To install the Support/Resistance and Trendline tools:

1. Insert the Program CD into your drive. The setup starts

automatically.

Or if the auto-run feature of Windows isn’t enabled on your

system, click the Start button and choose the Run command.

Type “D:\SETUP.EXE” in the Open box and click the OK

button. (Note that “D” represents the letter assigned to your

CD-ROM drive. If your drive is assigned a different letter, use

it instead of “D”.)

2. Carefully follow the on-screen instructions.

2 • Getting Started Dynamic Trading Tools

Why Support and Resistance Develop

There is nothing “magical” about the effectiveness of trendlines and

support/resistance. These fundamental tools of technical analysis are

based on the widely accepted economic principles of supply and demand.

Support levels occur when buyers and sellers have repeatedly (two or

more times) agreed that the price will not move lower. At a support

level, prices are unable to move lower since fewer traders are willing to

sell at the lower price. Not surprisingly, the number of buyers (supply)

increases at the low price. To equalize these forces of decreased supply

(sellers) and higher demand (buyers), prices move up thereby forming a

trough on the chart.

Resistance levels occur when buyers and sellers have repeatedly (two or

more times) agreed that the price will not move higher. Prices are unable

to move higher since fewer traders are willing to pay the high price. Not

surprisingly, the number of sellers (supply) increases at the high price.

To equalize these forces of increased supply and lower demand, prices

move down thereby forming a peak on the chart.

Horizontal lines, called Support and Resistance lines, are drawn near the

levels (peaks and troughs) at which prices repeatedly bounce.

The following chart shows how the custom indicators named “Support

(longer term) <auto>” and “Resistance (longer term) <auto>” are plotted

on a chart of McDonalds. Note that the lines automatically adjust several

times during the period. This illustrates the “dynamic” characteristic of

these lines. As new data comes in, the lines dynamically adjust to reflect

changing support and resistance (i.e., supply and demand levels).

Dynamic Trading Tools Getting Started • 3

When support or resistance When the expectations of these buyers and sellers change, support and

is broken and prices quickly resistance levels are penetrated and prices often move rapidly to adjust to

move away, then come back new expectations of supply and demand. In the chart of McDonalds, this

and bounce off the support occurred in late March as increasing numbers of buyers overpowered the

or resistance level, it is

called “trader’s remorse.”

weaker sellers and resistance at $48 was penetrated. Notice too, how this

resistance level at $48 later provided support in April, June, and July.

This is a common phenomenon.

Why Trends Develop

A trend is defined as successively higher or lower prices. An uptrend can

be defined as a rising support level—the bulls are in control and pushing

prices higher. Conversely, during a downtrend, resistance levels are

falling and the bears are in control, pushing prices lower. Straight lines

(called trendlines) can be drawn along the peaks and valleys to help

visualize the trend. An up trendline is drawn along the valleys, whereas a

down trendline is drawn along the peaks.

As Steve Achelis notes in his book, Technical Analysis from A to Z, “A

trend represents a consistent change in prices (i.e., a change in investor

expectations). Trends differ from support/resistance levels in that trends

represent change, whereas support/resistance levels represent barriers to

change.”

The following chart shows how the custom indicators named “Trndline

Up (longer term)” and “Trndline Dn (shorter term)” are plotted on a chart

of Proctor & Gamble.

Securities trend because there is an overwhelming consensus of

expectations about the value of the security—either bullish or bearish.

However, when these expectations change, as was the case in April in the

chart of Proctor & Gamble, the trendline is penetrated and prices often

reverse and begin a trend in the opposite direction.

4 • Getting Started Dynamic Trading Tools

How to Use the Tools

This plug-in includes custom indicators, explorations, and expert

advisors that focus on drawing, finding, and explaining support &

resistance levels and trendlines. All of the tools are based on the same

underlying algorithms, yet each provides a unique way of analyzing the

results.

Drawing the Lines Automatically with the Custom Indicators

The custom indicators are used to plot the lines on the chart. MetaStock

is able to automatically determine (using sophisticated pattern

recognition techniques), where support and resistance may exist, and

where current trendlines should be drawn.

To plot the lines on your charts:

1. Open a chart.

2. Click the Indicator QuickList on the toolbar and scroll the list

until either the “Support,” “Resistance” or “Trendline” custom

indicators appear. Note that custom indicators are sorted

alphabetically at the bottom of the QuickList (after the pre-

defined indicators).

You can plot multiple 3. Position your mouse pointer over the small icon to the left of the

indicators simultaneously desired indicator. Note how the mouse pointer changes to a

by choosing Indicators from hand.

the Insert menu.

4. Click and hold the left mouse button and drag the indicator until

you have it positioned on the chart’s price inner window. The

color of the price bars will change to inform you that they will

be used to calculate the indicator.

Dynamic Trading Tools How to Use the Tools • 5

5. Drop the indicator by releasing the left mouse button.

6. When the Scaling Options dialog appears, choose either Merge

with Scale on Right or Merge with Scale on Left.

If nothing appears on the chart when you plot one of the indicators, this

simply means that no current trend or support/resistance level was found.

If the y-axis of your chart is scaled in semi-log, your trendlines may

curve, particularly if the trend is steep and covers a wide price range.

Typically, you will find that the most currently detected support level is

below the most currently detected resistance level; however this is not

always the case as can be seen in the following chart.

For the first two-thirds of the chart, support is below resistance (as

expected), however, in April the support level moved above the

resistance level. Exxon had extended its breakout from the previous

November and entered a trading range with detected support around 50.

Later, in July, the lines got back into a normal mode as a new resistance

level was detected around 65.

As you would expect, the shorter term support and resistance levels,

represented by the dashed lines, responded more quickly to the changing

conditions.

6 • How to Use the Tools Dynamic Trading Tools

Filtering Securities that have Broken Out

The explorations are used to search through your securities and report on

the status of the current price in relation to support/resistance and

trendlines. The explorations filter securities that have broken through a

support/resistance line or trendline. The number of time periods that

have passed since the breakout is provided, along with the change in

volume on the day of the breakout.

To filter your securities for breakouts:

1. Choose The Explorer from the Tools menu.

2. Click the Options button and make sure Load Minimum

Records is selected.

3. Choose the exploration to run (e.g., Equis – Trendline Breakouts

(longer) ).

4. Click the Explore button.

5. Choose the folder of securities you wish to explore from the

Select Securities dialog and click the OK button.

After your exploration is complete, display the report to view the results.

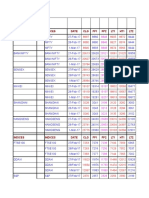

You can easily sort a report The report for Support & Resistance (longer) is shown in the following

by clicking directly on the illustration. The report for Trendlines is similar. You may find it helpful

column heading. to sort the report on the “Break Up” or “Break Dn” columns so that the

securities that have broken out more recently are listed first.

An “N/A” in the report means that the corresponding trendline or

support/resistance level was never found. A “0.00” value means that it

was found, but the breakout condition is no longer true. In other words,

Dynamic Trading Tools How to Use the Tools • 7

the breakout did occur, but the closing price has since moved back

above/below the line, invalidating the breakout.

Getting More Info with the Expert Advisors

The commentary in the experts explains the status of your chart in

regards to its trendlines and support/resistance levels. Note that the

commentary is the only active component of the experts. It does not

include expert trends, highlights, or symbols. Therefore, your chart will

not change appearance when you attach the experts.

Note: Due to the complexity of the calculations, the commentary reflects

the last day loaded on the chart , even if you have selected a different

bar to analyze.

To display a chart’s expert commentary:

1. Open a chart.

2. Right-click anywhere within the chart’s inner window. The

chart’s shortcut menu appears.

3. Choose Expert Advisor and then Attach.

4. Choose one of the Trendline or Support/Resistance experts.

Click the OK button.

5. To quickly display the commentary for the attached expert,

right-click on the chart, choose Expert Advisor and then

Commentary.

8 • How to Use the Tools Dynamic Trading Tools

Creating and Applying Templates for Easy Formatting

You may find it convenient to create templates that automatically plot

A template is a file that and format the lines to your liking. For example, you may want to create

contains reusable chart a template that plots the four types of trendlines, using one color or line

attributes, such as style for the shorter term and another for the longer term.

indicators, scaling, colors,

etc. The chart below shows Proctor & Gamble with a template applied. Note

that the longer term trendlines are solid and thick and the shorter term

trendlines are thin and dashed.

The chart below shows a template applied to a chart of the British Pound

that plots the support and resistance custom indicators.

To create a template:

1. Choose Open from the File menu.

2. Select a security and click the Open button.

Dynamic Trading Tools How to Use the Tools • 9

3. Plot the four trendline custom indicators or the four support &

resistance custom indicators.

4. Modify the color and/or line styles of the lines to your liking.

5. Choose Save As from the File menu.

6. Choose Template from the Save as Type drop-list.

7. Type a name for the template (i.e., Trendlines, Support &

Resistance, etc.).

8. Click the Save button.

To apply a template to a chart:

1. Right-click on the chart.

2. Choose Apply Template from the shortcut menu.

3. Choose the desired template from the Apply Template dialog.

To click through your charts:

Once you have your templates created, a great way to visually scan

through your charts and look at the support/resistance levels and

trendlines on each, is to use the Change Security commands.

1. Display the first security in your folder and apply the newly

created template.

2. Choose Options from the Tools menu.

3. Make sure that the Use Smart Charts checkbox is unchecked in

the Chart Options page of the Application Properties dialog.

You can also change from 4. Now click the Next Security button on the chart toolbar to

chart to chart by pressing quickly change from one chart to the next.

ALT+Right Arrow.

10 • How to Use the Tools Dynamic Trading Tools

A Sample Strategy

Run the Exploration

For our example, let’s assume that we are bullish on the market as a

whole and therefore are looking to establish a longer term position in a

highly capitalized stock, such as a stock belonging to the S&P 100.

1. First we want to make sure that the data we are working with is

updated and clean.

2. Now we’ll run the “Equis – Support & Resistance (longer)”

exploration on a folder containing the 100 stocks in the S&P

100 index.

3. The report below shows the results for 11/28/97. Note that the

report has been sorted on the “Break Up” column in ascending

order.

Since the most reliable breakouts are accompanied with

significantly increased volume, we will concentrate our focus on

two stocks from this report– on Wal Mart and Johnson &

Johnson. Although it’s been a while since these stocks broke

out (nine days, as indicated in the “Break Up” column), they

both broke out on fairly heavy volume of 46 and 54.96 percent

above normal (as indicated in the “Up Vol%” column).

Dynamic Trading Tools A Sample Strategy • 11

Study the Charts and Indicators

4. The next step is to examine the charts of these two securities.

Select both “Wal Mart” and “Johnson & Johnson” in the report

and click the Open Chart button.

5. Now let’s plot the custom indicators named “Support (longer)

<auto>” and “Resistance (longer) <auto>.”

6. Let’s also plot the custom indicators named “Trndline Up

(longer) <auto>” and “Trndline Dn (longer) <auto>”.

The chart of Johnson & Johnson is shown below.

Note that the upside breakout of the resistance line at 62.125

coincided closely with the upside breakout of the down trendline.

This adds even more validity to the breakout.

Look at the Expert Commentary

7. Now let’s look at what the Expert Advisor has to add. Choose

Expert Advisor from the Tools menu.

8. Select the expert named “Equis – Support & Resistance

(longer)” and click the Commentary button.

12 • A Sample Strategy Dynamic Trading Tools

The expert commentary confirms what the exploration reported,

namely that an upside breakout occurred nine days ago on above

average volume. We are also reminded that this broken

resistance level may now provide downside support. It also

suggests that a protective stop loss should be placed just below

the 62.13 resistance level if we decide to trade.

9. Now let’s look at the other stock, Wal Mart. Since we have

already opened the chart, we simply need to activate it by

choosing it from the Windows menu.

Repeat steps 5 through 8 (above) for Wal Mart.

The expert commentary for Wal Mart is shown below.

Dynamic Trading Tools A Sample Strategy • 13

Like the expert commentary for Johnson & Johnson, the

commentary for Wal Mart reports that upside resistance was

broken nine days ago on above average volume and that the

previous resistance may now provide support. A protective stop

is also suggested.

The Decision

If we are forced to make a decision on which of these two stocks to buy

based strictly on the analysis so far, the edge would have to go to

Johnson & Johnson. Johnson & Johnson’s breakout is impressive since it

coincided with a trendline breakout. In addition, the volume on the

breakout was a bit heavier than Wal Mart’s.

Interestingly, the most recent resistance level for Johnson & Johnson

coincides with the left and right shoulders of a classic head & shoulders

pattern, with the left shoulder forming in May, the head in June, and the

right shoulder in October.

14 • A Sample Strategy Dynamic Trading Tools

The breakdown of the head & shoulders topping formation gives us

further confidence in making the trade. When placing the trade, we will

place a protective stop just below the resistance level at 59.50. This

provides some room for prices to retreat down to the broken resistance

level (which now serves as support).

Dynamic Trading Tools A Sample Strategy • 15

Troubleshooting

Frequently Asked Questions

Q: Nothing plots when I drop the indicators on the chart. Why?

A: The most likely reason is that the indicators were not able to find any

current support, resistance, or trends. Remember, even though the

algorithms for determining line placement are quite good, they will not

exactly duplicate where you may think the lines should be drawn.

Q: Prices are currently far above the most recently drawn Resistance

line. Why is this line still called “Resistance”?

A: The chart below shows a good example of this. In the August to

October time frame, prices were far above the most recently determined

Resistance line near 41.50. Yet MetaStock continues to extend the

Resistance line out since it is the most recent one. This has its

advantages, since a common occurrence is for a penetrated Resistance

line to later provide Support. This Resistance line (although penetrated

in June) provides Support later in October and November.

Q: I can plainly see where a support/resistance line should be drawn on

my chart, yet nothing is drawn. Why?

Dynamic Trading Tools Troubleshooting • 17

A: There are two basic factors in the formulas used for drawing the

support/resistance lines--the peaks and troughs and their proximity

(price-wise) to each other. In the case of Resistance lines, the most

recent peak is compared to the second and third most recent peaks. If

two of these peaks are relatively close to each other (price-wise) then

they will likely qualify for use in determining the resistance line.

However, what the computer is able to qualify as a “peak” or “trough”

can sometimes differ from your own determination. The computer only

considers a peak to be a “peak” if the percent move is a certain minimum.

This percent move is automatically determined in the case of the

“<auto>” indicators based on a formula that analyzes the price volatility.

The “<manual>” indicators allow you to adjust this percent factor.

Q: My exploration sometimes shows an “N/A” or a “0.00” in the

columns. What do these mean?

A: An “N/A” in the report means that the corresponding trendline or

support/resistance level was never found. A “0.00” value means that it

was found, but the breakout condition is no longer true. In other words,

the breakout did occur, but the closing price has since moved back

above/below the line, invalidating the breakout.

Q: The trendlines and support/resistance indicators have “longer” and

“shorter” versions. What is the difference?

A: The “longer” versions require bigger percent price moves when

determining the peaks and troughs. And since bigger peaks and troughs

take longer to form, we call these “longer.” Conversely, the “shorter”

versions require smaller percent moves. Therefore, these are called

“shorter”.

Q: After attaching an expert to my chart, the commentary window does

not change to reflect the new bar that I have selected. Why?

A: This is due to the complexity of the calculations. The commentary

only reflects the last day loaded on the chart , even if you have selected a

different bar to analyze.

18 • Troubleshooting Dynamic Trading Tools

You might also like

- MARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisFrom EverandMARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisRating: 2 out of 5 stars2/5 (2)

- MetaStock Codes For DPTSDocument1 pageMetaStock Codes For DPTSTerence ChanNo ratings yet

- Trend Qualification and Trading: Techniques To Identify the Best Trends to TradeFrom EverandTrend Qualification and Trading: Techniques To Identify the Best Trends to TradeRating: 2 out of 5 stars2/5 (1)

- Meta Stock Trading SystemsDocument25 pagesMeta Stock Trading Systemshoaianus9No ratings yet

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- Free Metastock Indicators Formula PDFDocument11 pagesFree Metastock Indicators Formula PDFbenNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Metastock Breakout FormulasDocument5 pagesMetastock Breakout FormulasEd MartiNo ratings yet

- ATEEQ Metastock FormulasDocument42 pagesATEEQ Metastock FormulasAteeque Mohd0% (1)

- MetaStock Gann Swing FormulaDocument6 pagesMetaStock Gann Swing FormulaFrancis Singapore100% (2)

- Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersFrom EverandForex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersNo ratings yet

- Metastock FormulaeDocument237 pagesMetastock FormulaeAggelos Kotsokolos100% (5)

- Metastock FormulaDocument13 pagesMetastock Formulajayeshcsls11No ratings yet

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

- (Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)Document6 pages(Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)sivakumar_appasamyNo ratings yet

- HeikinAshi CandleStick Formulae For MetaStockDocument4 pagesHeikinAshi CandleStick Formulae For MetaStockRaviteja sNo ratings yet

- Metastock Breakout FormulasDocument5 pagesMetastock Breakout FormulassterisathNo ratings yet

- Building A SystemDocument24 pagesBuilding A SystemchowhkNo ratings yet

- Trading With The Heikin Ashi Candlestick OscillatorDocument7 pagesTrading With The Heikin Ashi Candlestick OscillatorDarren TanNo ratings yet

- Focus On Kase Studies, Analytics and Forecasting: Presented byDocument141 pagesFocus On Kase Studies, Analytics and Forecasting: Presented byMichael Martin100% (1)

- Macd Histogram Divergence Kit V10 For Metastock: Please Note: PortionsDocument28 pagesMacd Histogram Divergence Kit V10 For Metastock: Please Note: PortionsswandyNo ratings yet

- MasteringMetastockManual PDFDocument84 pagesMasteringMetastockManual PDFvkumaran100% (1)

- KKDocument34 pagesKKgoud mahendharNo ratings yet

- Metastock Fomula Language - AnhDocument57 pagesMetastock Fomula Language - AnhNuriNo ratings yet

- Bollinger Bands & ADX: This Lesson Is Provided byDocument4 pagesBollinger Bands & ADX: This Lesson Is Provided bymjmariaantonyrajNo ratings yet

- Ema Macd Rsi ExploreDocument3 pagesEma Macd Rsi Explorebharatbaba363No ratings yet

- ZSCOREDocument9 pagesZSCORENitin Govind BhujbalNo ratings yet

- Trading+With+MACD+ +a+Lesson+on+DivergenceDocument10 pagesTrading+With+MACD+ +a+Lesson+on+DivergenceAndrea PedrottaNo ratings yet

- Hidden Divergence: New TechniquesDocument5 pagesHidden Divergence: New Techniquesbrijendra singhNo ratings yet

- The Wyckoff Method of Trading: Part 15: Market StrategyDocument9 pagesThe Wyckoff Method of Trading: Part 15: Market Strategysatish sNo ratings yet

- Children of The Journey Sangha - Teachings On The Use of The Sangha Trading SystemDocument13 pagesChildren of The Journey Sangha - Teachings On The Use of The Sangha Trading SystemThe Children of the Journey SanghaNo ratings yet

- Stochastic RSI - StochRSI DefinitionDocument9 pagesStochastic RSI - StochRSI Definitionselozok1No ratings yet

- Adx PDFDocument32 pagesAdx PDFPrashantPatilNo ratings yet

- Peter Aan - RSIDocument4 pagesPeter Aan - RSIanalyst_anil14100% (1)

- Relative Strength Index: HistoryDocument4 pagesRelative Strength Index: HistoryAnonymous sDnT9yuNo ratings yet

- Volume IndicatorsDocument6 pagesVolume IndicatorsJonathan SohNo ratings yet

- Adaptive CciDocument38 pagesAdaptive CciFábio TrevisanNo ratings yet

- ADX - The Trend Strength IndicatorDocument7 pagesADX - The Trend Strength IndicatorDat TranNo ratings yet

- Adaptive Cyber Cycle IndicatorDocument1 pageAdaptive Cyber Cycle IndicatordocbraunNo ratings yet

- Williams %R OscillatorDocument1 pageWilliams %R OscillatorLarry ShipmanNo ratings yet

- Catalogue V 20Document18 pagesCatalogue V 20percysearchNo ratings yet

- 192verv 1 PDFDocument5 pages192verv 1 PDFcasierraNo ratings yet

- MACD RulesDocument1 pageMACD RulesJafrid NassifNo ratings yet

- Trend Alert! With The C: Determine The Beginning and The EndDocument6 pagesTrend Alert! With The C: Determine The Beginning and The Endmodis777No ratings yet

- Trend Vs No TrendDocument3 pagesTrend Vs No TrendpetefaderNo ratings yet

- Chapter 5 - Rate of ChangeDocument37 pagesChapter 5 - Rate of ChangeNAJWA SYAKIRAH MOHD SHAMSUDDINNo ratings yet

- Anchored Momentum Indicator Study by Rudy StefenelDocument10 pagesAnchored Momentum Indicator Study by Rudy StefenelSimon RobinsonNo ratings yet

- Combine MACD and Relative Strength To Time TradesDocument3 pagesCombine MACD and Relative Strength To Time Tradesemirav2No ratings yet

- ADXDocument4 pagesADXdharmeshtrNo ratings yet

- Ttajan2010 7063Document52 pagesTtajan2010 7063Anonymous JrCVpuNo ratings yet

- IFTA Journal article summarizes Volume Zone Oscillator trading indicatorDocument15 pagesIFTA Journal article summarizes Volume Zone Oscillator trading indicatorRoberto Rossi100% (1)

- Dynamic Zone RSIDocument2 pagesDynamic Zone RSIMiner candNo ratings yet

- Hidden Divergence Reveals Profitable Trading PatternsDocument12 pagesHidden Divergence Reveals Profitable Trading PatternsSubrata PaulNo ratings yet

- (Trading) TD Early Trend Identification (John Ehlers, 2004, Stocks & Commodities)Document9 pages(Trading) TD Early Trend Identification (John Ehlers, 2004, Stocks & Commodities)Claudiu MaziluNo ratings yet

- Curso at - Credit SuisseDocument32 pagesCurso at - Credit SuisseseehariNo ratings yet

- Andy BushkDocument2 pagesAndy Bushklaxmicc67% (3)

- 2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesDocument3 pages2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesBudi MulyonoNo ratings yet

- HEAVEN AND THE ANGELS by H.A. BakerDocument138 pagesHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- The Revelation of HellDocument18 pagesThe Revelation of HellEric Dacumi100% (12)

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323No ratings yet

- Chifbaw Oscillator User GuideDocument12 pagesChifbaw Oscillator User GuideHajar Aswad KassimNo ratings yet

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323No ratings yet

- Nifty Super Trend Back Test Results 2008 To 2013Document176 pagesNifty Super Trend Back Test Results 2008 To 2013mr12323No ratings yet

- The Power of Habit - Charles DuhiggDocument5 pagesThe Power of Habit - Charles DuhiggmanargyrNo ratings yet

- Daily stock market indices and bank stocks dataDocument34 pagesDaily stock market indices and bank stocks datamr12323No ratings yet

- Revision of Pension (c116063)Document1 pageRevision of Pension (c116063)mr12323No ratings yet

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323No ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323No ratings yet

- At ActiveDocument3 pagesAt Activemr12323No ratings yet

- Tims Trading MaximsDocument1 pageTims Trading Maximsmr12323No ratings yet

- GN 5 41Document1 pageGN 5 41mr12323No ratings yet

- ProFx 4 User Manual PDFDocument20 pagesProFx 4 User Manual PDFMelque ResendeNo ratings yet

- 0510 ColeDocument21 pages0510 Colemr12323No ratings yet

- F9D1 ManualDocument18 pagesF9D1 Manualmr12323No ratings yet

- Astro PreditDocument1 pageAstro Preditmr12323No ratings yet

- Scope of AnatomyDocument25 pagesScope of Anatomymr12323No ratings yet

- GN 5 38Document1 pageGN 5 38mr12323No ratings yet

- BitcoinsDocument45 pagesBitcoinsSwadhin Sonowal100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Tradeonix 2.0: (An Updated Version of Tradeonix)Document17 pagesTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- Cyprus financial crisis impacts banking system tradingDocument1 pageCyprus financial crisis impacts banking system tradingmr12323No ratings yet

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Cheatsheet Fib ElliottDocument12 pagesCheatsheet Fib ElliottYano0% (1)

- Traders World 20101Document10 pagesTraders World 20101satish sNo ratings yet

- Barclay and Hendershott-Price Discovery and Trading After HoursDocument33 pagesBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelNo ratings yet

- Profit from Financial Markets with PZ Trend Following SuiteDocument24 pagesProfit from Financial Markets with PZ Trend Following Suitemr12323No ratings yet

- Wolfe Wave Dashboard Install GuideDocument4 pagesWolfe Wave Dashboard Install Guidemr12323No ratings yet

- Chapter5 - Data Storage FullDocument16 pagesChapter5 - Data Storage FullPhan Minh TríNo ratings yet

- Decision TreeDocument4 pagesDecision TreeGurushantha DoddamaniNo ratings yet

- DM 0903 Data Stage Slowly Changing PDFDocument32 pagesDM 0903 Data Stage Slowly Changing PDFsirishdahagamNo ratings yet

- Comfortpoint Open System: Cp-Hmi (Panel Pc/Touch Panel Interface)Document4 pagesComfortpoint Open System: Cp-Hmi (Panel Pc/Touch Panel Interface)Victor AponteNo ratings yet

- Question 1:-Answer True or False For The Following StatementsDocument5 pagesQuestion 1:-Answer True or False For The Following StatementsMony JosephNo ratings yet

- JNTUK B.Tech 2-2 Sem (R20) 1st Mid Exam Time Table April 2022Document6 pagesJNTUK B.Tech 2-2 Sem (R20) 1st Mid Exam Time Table April 2022LOKESH B NNo ratings yet

- IBM 3500 M2 User's GuideDocument126 pagesIBM 3500 M2 User's GuidekelvislonghiNo ratings yet

- Auditing In: Computerised EnvironmentDocument6 pagesAuditing In: Computerised EnvironmentVarinder AnandNo ratings yet

- Python Course Brochure PDFDocument18 pagesPython Course Brochure PDFanju vemulaNo ratings yet

- Install Ulang RT1904Document10 pagesInstall Ulang RT1904ChandraNo ratings yet

- Mcq4 Questions on Spring Boot, Spring MVC, Microservices and REST APIsDocument40 pagesMcq4 Questions on Spring Boot, Spring MVC, Microservices and REST APIsAbcdNo ratings yet

- MIS Chapter 01Document29 pagesMIS Chapter 01Moiz Ahmed100% (1)

- Rashid Beach Resort Online Reservation SystemDocument13 pagesRashid Beach Resort Online Reservation SystemJohn Joseph PasawaNo ratings yet

- Samsung LTE ENB Alarm Manual For PKG 5 0 0 v1 0 PDFDocument356 pagesSamsung LTE ENB Alarm Manual For PKG 5 0 0 v1 0 PDFVivek KumarNo ratings yet

- Android Based Object Detection Application For Food ItemsDocument6 pagesAndroid Based Object Detection Application For Food ItemsHafza GhafoorNo ratings yet

- Sybex CCNA 640-802 Chapter 04Document19 pagesSybex CCNA 640-802 Chapter 04xkerberosxNo ratings yet

- Amv01 3928375Document2 pagesAmv01 3928375Oscar RamirezNo ratings yet

- CCNA 1 (v5.1 + v6.0) Chapter 1 Exam Answers Quiz#1Document2 pagesCCNA 1 (v5.1 + v6.0) Chapter 1 Exam Answers Quiz#1Alan Dela CruzNo ratings yet

- Java Generics TutorialDocument2 pagesJava Generics TutorialManoj Kumar GNo ratings yet

- This OVF Package Requires Unsupported Hardware .Virtualbox-2.2Document5 pagesThis OVF Package Requires Unsupported Hardware .Virtualbox-2.2bakieNo ratings yet

- Et200s 2ao U ST Manual en-USDocument22 pagesEt200s 2ao U ST Manual en-USsurendra n patelNo ratings yet

- Data StructureDocument476 pagesData Structuredaman khuranaNo ratings yet

- The Squeakquel Pt2Document33 pagesThe Squeakquel Pt2Adam FitzgeraldNo ratings yet

- ALE IDOC Interview Questions PDFDocument4 pagesALE IDOC Interview Questions PDFpearl042008No ratings yet

- OS Quiz 1 (Chapters 1-3) Flashcards - QuizletDocument12 pagesOS Quiz 1 (Chapters 1-3) Flashcards - QuizletA NNo ratings yet

- Nymble:: Blocking Misbehaving Users in Anonymizing NetworksDocument10 pagesNymble:: Blocking Misbehaving Users in Anonymizing Networkschaithra580No ratings yet

- Mini Project ReportDocument14 pagesMini Project ReportPAVAN KUMAR BHEESETTINo ratings yet

- Cvi Upgrade Check ResolveDocument10 pagesCvi Upgrade Check ResolvesyedshoebhussainiNo ratings yet

- Dh55hc and Dh55tc Media BriefDocument4 pagesDh55hc and Dh55tc Media BriefjaswanthNo ratings yet

- Virtuoso Foundation IP Characterization PDFDocument7 pagesVirtuoso Foundation IP Characterization PDFMike CainNo ratings yet

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobFrom EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobRating: 4.5 out of 5 stars4.5/5 (36)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The First Minute: How to start conversations that get resultsFrom EverandThe First Minute: How to start conversations that get resultsRating: 4.5 out of 5 stars4.5/5 (55)

- The 7 Habits of Highly Effective PeopleFrom EverandThe 7 Habits of Highly Effective PeopleRating: 4 out of 5 stars4/5 (2564)

- The Introverted Leader: Building on Your Quiet StrengthFrom EverandThe Introverted Leader: Building on Your Quiet StrengthRating: 4.5 out of 5 stars4.5/5 (35)

- Spark: How to Lead Yourself and Others to Greater SuccessFrom EverandSpark: How to Lead Yourself and Others to Greater SuccessRating: 4.5 out of 5 stars4.5/5 (130)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsFrom EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsRating: 4.5 out of 5 stars4.5/5 (52)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverFrom EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverRating: 4.5 out of 5 stars4.5/5 (186)

- The ONE Thing: The Surprisingly Simple Truth Behind Extraordinary Results: Key Takeaways, Summary & Analysis IncludedFrom EverandThe ONE Thing: The Surprisingly Simple Truth Behind Extraordinary Results: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (124)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthFrom Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthRating: 5 out of 5 stars5/5 (51)

- Leadership Skills that Inspire Incredible ResultsFrom EverandLeadership Skills that Inspire Incredible ResultsRating: 4.5 out of 5 stars4.5/5 (11)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (410)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0No ratings yet

- The Effective Executive: The Definitive Guide to Getting the Right Things DoneFrom EverandThe Effective Executive: The Definitive Guide to Getting the Right Things DoneRating: 4.5 out of 5 stars4.5/5 (468)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersFrom EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersRating: 4.5 out of 5 stars4.5/5 (94)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowFrom EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowRating: 4.5 out of 5 stars4.5/5 (27)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tFrom EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tRating: 4.5 out of 5 stars4.5/5 (63)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceFrom EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceRating: 5 out of 5 stars5/5 (22)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsFrom EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsRating: 4.5 out of 5 stars4.5/5 (47)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (90)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)