Professional Documents

Culture Documents

List of Contents: Rayalaseema Hypo Hi-Strength

Uploaded by

Shams SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of Contents: Rayalaseema Hypo Hi-Strength

Uploaded by

Shams SCopyright:

Available Formats

RAYALASEEMA HYPO HI-STRENGTH

LIST OF CONTENTS Chapter no Topic name

01

Introduction Working capital management

02

Research methodology Objectives Company profile

03 04

Analysis and interpretation Findings and suggestions

RAYALASEEMA HYPO HI-STRENGTH

CHAPTER I

INTRODUCTION

RAYALASEEMA HYPO HI-STRENGTH

WORKING CAPITAL

When facing volatile economic conditions it is still important for companies to enhance shareholders value, but this is difficult to achieve in periods of near zero growth. By re-engineering their internal process to increase the efficiency of working capital, corporations can achieve significant results that will keep their shareholders happy. The viability of every business activity rest on daily changes in receivables, inventory and payable. Its the life hood of the business and every mangers primary task is to keep it moving and put shareholders capital to work efficiently and effectively. Lack of Working Capital may lead a business to Technical Insolvency and ultimately liquidation. The faster a business expands the more cash it will need for Working Capital and investment. Good management of working capital will generate cash, help to improve profits solidify relationships with suppliers and customers and reduce risks. When it come to managing working capital. If you can get money to move faster-speed the cash conversion cycle, by say reducing the amount of money tied up in inventory or accounts receivables the liquidity of the business increases the internal cash flow can be generated. Likewise, the business may be able to reduce its debt and interest expenses. If one can negotiate improved terms with suppliers. E.g. obtain longer terms; one can leverage financial resources in new ways. Money trapped in working capital is money no being used to grow. Working Capital management involves decisions relating to current assets including decisions about how these assets have its own importance, but the question of financing is, in fact, the key area of working capital management. Therefore, it is pertinent to estimate the financing pattern of working capital. Capital requirement of a business can be divided into two main categories. Viz.

RAYALASEEMA HYPO HI-STRENGTH

1. 2.

Fixed Capital Requirement Working Capital Requirement

The capital which is required for the acquisition of fixed assets is known as Fixed Working Capital, where as the capital which is required to meet day to day obligations is know as working Capital.

Concept of Working Capital:On the basis of concept, Working Capital can be classified into two types as under. 1. 2. Gross Working Capital Net Working Capital

Gross Working Capital:It refers to the firms investment in total current assets.

Net Working Capital:It represents excess of current assets over current liabilities. The extent to which the sum of current assets exceeds to the sum of current liabilities is known as Net Working Capital.

RAYALASEEMA HYPO HI-STRENGTH

On the basis of gross concept the working capital is to be either positive or zero. But on the basis of net concept, the working capital is to be either positive or negative.

Types of Working Capital:Working capital can be divided into two categories on the basis of naature as under.

1. Permanent Working Capital:This refers to the minimum amount of investment in all current assets, which is required at all times to carry out minimum level of activities. This is also known as Core Working Capital

2. Temporary Working Capital:The amount of working capital, which is difference between maximum working capital and minimum working capital. This capital keeps on fluctuating from time to time on the basis of business activities.

Estimating Requirement of Working Capital:In order to determine the amount of Working Capital required, no of factors to be considered by the finance manager. The following are different techniques for assessment of Working Capital.

1. Percentage of Sales Method:

This is traditional and simple method of estimating Working Capital requirements. According to this method, on the basis of cost experience between sales and Working Capital requirements, a ratio can be determined for estimating the Working Capital requirements in future.

5

RAYALASEEMA HYPO HI-STRENGTH

2 Estimation of Components of Working Capital Method:

This method is based on the various figures of Balance Sheet since, Working Capital is the excess of current assets over current liabilities estimating amount of different constituents can make an assessment of Working Capital requirements of Working Capital, i.e. accounts receivables, cash balances and bills payable.

3. Operating Cycle Method:According to this approach, the requirements of Working Capital depend upon the operating cycle of business. The operating cycle begins with the acquisition of raw materials and ends with collection of receivables. It many be broadly classified into the following four stages. 1. Raw Material Storage Stage 2. Work in Process Stage 3. Finished Goods Inventory Stage. 4. Receivables Collection Stage. The duration of the operating Cycle for the purpose of estimating requirements of Working Capital is equalant to the sum of the durations of each of these stages less the credit period allowed by the suppliers of goods.

RAYALASEEMA HYPO HI-STRENGTH

Symbolically, the duration of the Working Capital cycle can be put as follows. O=R+W+F+D-C Where, O=Operating Cycle R=Raw Material Storage Period W=Work In Process Period F=Finished Goods Inventory Storage Period D=Debt Collection Period C=Credit Payment Period Each of the above can be classified as follows. R = Average Stock of Raw Material

Average Stock of Raw Material Consumption per Day W = Average Work In Progress Inventory Average Cost of Production per Day F = Average Finished Stock Average Cost of Goods Sold per Day D = Average Debtors Average Credit Sales per Day

7

RAYALASEEMA HYPO HI-STRENGTH

Average Creditors Average Credit Purchases per Day

After computing the period of one operating cycle, the total number of operating cycles that can be completed during a year can be completed by dividing 365 days with number of operating days in a cycle. The total operating expenditure in the year when divided by the number of operating Cycles in a year will give the average amount of Working Capital requirement.

Maximum Permissible Bank Finance

Regarding Tandon Committee:The Reserve Bank of India constituted a study group to frame guidelines for follow up of bank credit under the chairmanship of P L Tandon in 1974. The report submitted by the committee in August, 1975 is popularly known as Tandon Committee Report. The following are various approaches recommended by the committee 1. As a lender, the bank should only supplement the borrower resources or carrying a reasonable level of current assets in relation to his production requirements.

8

RAYALASEEMA HYPO HI-STRENGTH

2. The difference between the total current assets and the current liabilities other than bank borrowings is termed as Working Capital Gap. The Bank should finance a part of Working Capital gap and balance should be financed through long-term sources.

Method-1

Under this method, bank may provide 75% of Working Capital gap and the customer should provide the balance 25% from long-term sources.

Method-2

According top this method, the borrower should be required to provide through long-term sources to the extent of 25% of the gross current assets. While the balance should be provided by trade creditors and current liabilities as also banks.

Method-3

This method is similar to method-2. But it further requires that even out of gross current assets, the core current assets should be determined and separately funded from long-term resources. The committee recommended that, if any borrowers case, the limit under the particular methods exceeds, the excess should be converted into a funded debt and liquidated within agreed period. It was also suggested that. That change over should

RAYALASEEMA HYPO HI-STRENGTH

be gradual i.e., a borrower is first brought into the method- then after method-2 and finally to method-3.

Turnover Method:In the year 2005-06 turnover was Rs, 2970709/- Hence, anticipated turnover for forthcoming year may be Rs.3000000. Therefore, MPBF should be Rs.600000. I.e. 20% of Rs.3000000.

Companys Method:SRHH Ltd generally computes the MPBF as given under o 30% on Debtors o 20% on Stores and Spares

Financial Ratio Analysis

Introduction:Financial Analysis is the process of identifying the financial strengths and weaknesses of the firm by the properly establishing relationships between he items of the Balance Sheet and the Profit and Loss Account. Financial Statement Analysis is managerial interpretation of financial statements for parties demanding financial information.

10

RAYALASEEMA HYPO HI-STRENGTH

Ratio Analysis

Meaning and Scope:Ratio Analysis is a widely used tool in financial analysis. The term ratio in it refers to the relationship expressed in mathematical terms between two individual figures or group of figures connected with each other in some logical manner and are selected from Financial Statements of the concern. A financial Ratio helps to express the relationship between two accounting figures in such a way that users can draw conclusions about the performance, strength and weaknesses of a firm. A ratio reflecting a quantitative relationship helps to from a qualitative judgment. A single ratio does not convey much meaning and has to be compared with some standard. Standard of comparison may consist of: I. II. III. IV. Past Ratios Projected Ratio Competitors Ratios Industry ratios

Time Series Analysis:When financial ratios over a period are compared, it is known as the time series analysis. The performance of a firm is evaluated by comparing its present ratios with past ratios.

11

RAYALASEEMA HYPO HI-STRENGTH

Cross-sectional Analysis:Comparing the ratios of one firm with some selected firms in the same industry at the same point of time is known as the cross-sectional analysis.

Proforma Analysis:The comparison of current (or) past ratios with future ratios is projected analysis or proforma analysis. It shows the firms relative strengths and weaknesses in the past and future. Future ratios can be developed from the projected or pro forma, financial statements.

Utility of Ratio Analysis

The Ratio analysis is the most powerful tool of financial analysis with the help of ratios one can determine: funds; The efficiency with which of the firm is utilizing its assets in generating sales The overall operating efficiency and performance of the firm revenue, and The ability of the firm to meet its current obligations; The extent to which the firm has used its long-term solvency by borrowing

12

RAYALASEEMA HYPO HI-STRENGTH

Performance analysis:

A short term creditor will be interested in the current financial position of the firm, while a long-term creditor will pay more attention to the solvency of the firm. He will also be interested in the profitability of the firm. The equity shareholders are generally concerned with their return and also about the financial conditions only when their earnings are depressed.

Credit Analysis:

In credit analysis, the analyst will usually select a few important ratios. He may use the current ratio or quick-ratio to judge the firms liquidity or debt-paying ability; debt-equity ratio to determine the stake of the owners in the business and the firms capacity to survive in the long run and any one of the profitability ratios.

Security Analysis:

The ratio analysis is also useful in security analysis. The major focus in security analysis is on the long-term profitability. The detailed analysis of the earning power is important for security analysis.

13

RAYALASEEMA HYPO HI-STRENGTH

Comparative Analysis:

The ratio of a firm by themselves does not reveal anything. For meaningful interpretation, the ratios of a firm should be compared with the ratios of similar firms and industry. This comparison will reveal whether the firm is significantly out of line with its competitors. If it is significantly out of line, the firm should undertake a detailed analysis to spot out the trouble areas.

Trend Analysis:

Trend analysis of the ratios adds considerable significance to the financial analysis because it studies ratios of several years and isolates the exceptional instances occurring in one or two periods. Although the trend analysis of the companys ratios itself is informative, but it is more informative to compare the trends in the companys ratios with the trends in industry ratios. Management has to protect the interest of all the conditional parties, creditors, owners, and others. They have to ensure some minimum operating efficiency and keep the risk of the firm at a minimum level. Their survival depends upon their operating performance.

14

RAYALASEEMA HYPO HI-STRENGTH

Objectives (or) Purpose of Ratio Analysis

The nature of analysis will differ depending on the purpose of the analyst. It can be undertaken by management of the firm, or by parties outside the firm namely owners, creditors, investors and others.

Trade Creditors:They are interested in firms ability to meet their claims over a very short

period of time. Hence their analysis is confined to evaluation of the firms liquidity position.

Suppliers of long-term debt:They are concerned with firms long-term solvency and survival. They

analyze the firms profitability over time, its ability to generate cash to be able to pay interest and repay principal and the relationship between various sources of funds.

Investors:They are most concerned about the firms earnings. They are also interested

in every aspect of the firms financial structure to the extent it influences the firms earnings ability and risk.

Management :They would be interested in every aspect of Financial Analysis. It is their

overall responsibility to see that the resources of the firm are used most effectively and efficiently, and that the firms financial condition is sound

15

RAYALASEEMA HYPO HI-STRENGTH

Limitations of Ratio Analysis

The ratio analysis is a widely used technique to evaluate the financial position and performance of business. Yet it suffers from various limitations. o It is difficult to decide on proper basis of comparison. o The company is rendered difficult because of differences in situations of two companies or of one company over years. o The price level changes make the interpretation of ratios invalid. o The differences in the definitions of items in the Balance Sheet and the Profit and Loss Statement make the interpretation of ratios difficult. o The ratios calculated at a point of time are less informative and defective as they suffer from short-term changes. o The ratios are generally calculated from past financial statements and, thus are no indicators of future.

16

RAYALASEEMA HYPO HI-STRENGTH

CHAPTER II

Research Methodology, Objectives & Company profile

17

RAYALASEEMA HYPO HI-STRENGTH

RESEARCH METHODOLOGY

To analyze the Working Capital, trends for the purpose of ratio analysis has to carried out financial analysis is the analysis and interpretation of financial statements and a proper financial analysis can be give the user better insight about financial strengths and weakness of the firm. Financial analysis is the starting point for making plans before using any sophisticated forecasting and planning procedures For the purpose, first the required information has to get collected like ratio analysis, Working Capital and management analysis, income statement, trading and profit and loss, etc. are to be collected then, the data in statements is to properly organized and arranged and then relationship is to be established between financial statements and finally conclusions are to be drawn from the interpreted information and presented form of report. Research involves getting tools, ideas from texts, journals, books, records, and websites. The collection of data is an important aspect of Research. The sources of information fall under two categories.

Internal Sources:

18

RAYALASEEMA HYPO HI-STRENGTH

Every company keeps certain records such as accounts, records, reports, etc; these records provide simple information for research.

External Sources:

When internal records are insufficient and required information is not available, then the organization depends on external sources. The external sources of data are 1. 2. Primary Data Secondary Data

Primary Data

The data collected for the purpose in original and for the first time is known as Primary data. The researcher himself to study a particular problem collects the data. The primary of the study is collected through interaction and discussion with the officials and staff at Rayalaseem Hi-Strenth Hypo Ltd, Kurnool.

Secondary Data:

The data collected from the published sources i.e. not for the first time is called Secondary Data. The secondary data for the study is collected from o o Annual Reports of the company from the year 2002-06 Accounting journals and manuals.

19

RAYALASEEMA HYPO HI-STRENGTH

Register of Companies (R O C) Websites.

Data Analysis:Data Analysis is by implementing various tools like Ratio Analysis, Trend Analysis, etc

Objectives of the Study

The present Study in Sri Rayalaseem Hi-strenth Hypo Ltd, Kurnool is undertaken to evaluate the working capital strategy in the organization by establishing the following objectives. 1) To identify the amount of Gross and Networking Capital of In Rayalaseem Hi-strenth Hypo Ltd, Kurnool over the study period. 2) To study the changes in Net Working Capital during the study period. 3) To design the Operating Cycle and to find the duration for each cycle. 4) To understand the impact on Liquidity management on the Shareholders Profitability. 5) To give viable suggestions based on the findings to improve the Liquidity progress of Rayalaseem Hi-strenth Hypo Ltd,

20

RAYALASEEMA HYPO HI-STRENGTH

To various objectives are interrelated and it is clear that the analysis and interpretation of these objectives are helpful to different users for different purposes.

Need for the study

The need for the study is to find out the effective means of Working capital management followed this path with focused strategies for improving corporate liquidity, investment optimization and the flow of financial information across the value chain. This involved discussing the drivers of the superior Working Capital performance because it is a barometer for the underlying business behavior. The prime focus is to gain and develop a common language that will be used within the organization to talk about communicate and set targets for Working Capital. The objective is to better assess the true potential of the company and its ability to achieve sustainable results from this potential.

21

RAYALASEEMA HYPO HI-STRENGTH

Scope of the Study

The scope of the study is defined below in terms of concepts adopted and period under focus: First the study management or working capital is confined only to the Rayalaseem Hi-strenth Hypo Ltd, Kurnool. Secondly, the concepts of working capital i.e. Gross and Net is used in measuring profitability and liquidity respectively and also to arrive at various objectives of the study. Thirdly, the study is based on the annual reports of the company for a period of four years form 2002-2006. The reason for restricting the study of this period is due to time. Thus on the whole the purpose of the project is to analyze the past and present performance of company on various financial areas like

22

RAYALASEEMA HYPO HI-STRENGTH

1. Working Capital Management 2. Inventory Management 3. Receivables Management Since the past performance will be the essential yard stick or data for predicting.

Limitations of the Study

1. The information provided in the company balance sheet is only the data source available. 2. Some required secondary data which is not provided by company. 3. The information available in the balance sheets has taken from the published annual report, so it has only limitations. 4. Since financial matters are sensitive in nature the same could not be acquired easily. 5. There is only two months period to finish the project, due to lack of time in depth of financial matters have not been touched.

23

RAYALASEEMA HYPO HI-STRENGTH

Company Profile

Sree Rayalaseema HI-Strength Hypo Ltd (SRHHL) was incorporated on 24 th October, 1986 as a public limited company and obtained its certificate commencement of business on 30th October, 1986. Initially the company has set up facilities for manufacture of chemicals and later on the company has diversified into generation of power through wind turbines and biomass.

Promotions:

Mr. T G Venkatesh, who hails from an industrial family promoted SRHHL. He is bestowed with rich experience in the art of industrial management. Since its inception, he bestowed all the devotion and hard work and ensured that the company worked at optimum capacity and post a stellar performance, both in financial and technical areas.

Technology:

24

RAYALASEEMA HYPO HI-STRENGTH

The company has very strong Research and Development team. They have won national level awards in Research and Development. They are only manufactures of Calcium Hypochlorite in India using the Sodium process. There are very few companies in the world with this level of technology. Other division benefit from the cutting edge research.

Main Products:

The main products include Sulphuric Acid, Oleum, Chloro Sulphonic Acid, Calcium Hypochlorite, Stable Bleaching powder, Monochloro Acetic Acid, Bleach Liquor, MCA, Sodium Hypo, Hydrochloric Acid and Non-Ferric alum.

Geared Up For Exports:

Sree Rayalaseema Hi-Strength Hypo Ltd, the torch bearer of the conglomerate, is only India manufacturer of Calcium Hypochlorite, and one of the very few in the world. A state of the art sodium process technology developed through in house Research and Development efforts helps the company in manufacturing the product with a chlorine content of 65% to 70%. Sree Rayalaseema Hi-Strength Hypo Ltd, exports Calcium Hypochlorite to countries all across the globe Viz. Australia, Bangladesh, Belgium, Brunei, China, Colombia, Cyprus, Durban, England, France, Germany, Hungary, Iran, Kenya, Korea, Malaysia, Mauritius, Netherlands, Oman, Peru, Philippines, Sri Lanka, Saudi Arabia, Singapore, Tanzania, Thailand, USA, Vietnam, etc. The certificate of Merit awarded by CHEMEXCIL for outstanding export performance reinforces its status as a recognized export house.

25

RAYALASEEMA HYPO HI-STRENGTH

Calcium Hypoclorite touches vital facets of human existence and its of proven importance in many areas of day-to-day activity. Sree Rayalaseema HiStrength Hypo Ltd, has distinctive edge in the maucfacture of this product, thanks to the twin advantages of indigenous raw materials availability and supply of some specialized chemicals by Sree Rayalaseema Alkalis and Allied Chemicals Ltd. The company is also a front-ranking producer of Monochloro Actic Acid. Manufactured by the scientific Crystallizer technology, the product meets international quality standards. All leading manufactures of Non-Seroid AntiInflammatory Drugs, other pharmaceuticals, pesticides, organ chemicals, etc use Monochloro Acetic Acids.

Product Range and Applications:

o Calcium Hypochlorite (Gramules and Tablets) o Stable Bleaching Powder o Monochloro Acetic Acid o Chloro Sulphonic Acid o Oleum 23% and 65% o Bromine

26

RAYALASEEMA HYPO HI-STRENGTH

o Battery and Commercial grades Sulphuric acid

Calcium Hypoclorite is used extensively in aquaculture, textile, leather, Paper and Sugar Industries. Stable Bleaching powder has taker in sanitization, water treatment, and aquaculture and pesticide makers. Chloro Sulphonic Acid Caters to the Pharmaceutical, and dyes & Intermediaries industry. Producers of dyes & intermediaries, soaps and dtergetns, explosives and others use oleum. Bromine, manufactured by a proven indigenous technology, finds application in various industries including petrochemicals, dye intermediates photography, pesticides, pharmaceuticals, bleaching of paper, pulp and others. Sulphuric Acid finds widespread usage in sulphonation, fertilizer industry, as an intermediary in pharmaceutical industry amongst others.

Production Capacity:

Product Installed Capacity (Tons Per annum) Calcium Hypoclorite 6600

27

RAYALASEEMA HYPO HI-STRENGTH

Stable Bleaching Powder Monochloro Acetic Acid Sulphuric Acid Chloro Sulphonic Acid Bromine

9900 2400 49500 33000 65

Sree Rayalaseema Hi-Strength Hypo Ltd has provided capacitors and also uses steam for refrigeration to conserve energy. Brick lined CSA operating efficiencies. A 9 MW biomass powder project at Kurnool cater to the companys growing power requirements. Sree Rayalaseema Hi-Strength Hypo Ltd adheres to all international standards of quality. The ISO 14001 certification for Environmental Management and the ISO 9002 certification for Quality systems bear out the companys commitment to ensuring quality of implacable standards.

Sree Rayalaseema Dutch Kassenbouw Limited Purifying Water for Health.

Sree Rayalaseema Dutch Kassenbouw Limited is a leading producer of premium Stable Bleaching Powder (tropical chloritde of lime) under the brand name Rayalaseema Stable Bleaching Powder. The state of the art manufacturing facility has an output capacity of 15 TPD. The company specializes in the production of approved ISI Grade-I, Grade-II and TGV Super-9 brands of leaching powder.

28

RAYALASEEMA HYPO HI-STRENGTH

The company has the credit of contributing hygienic water to all the surrounding areas. Stable Bleaching Powder manufactured by the Rheinfedlens bleaching powder process, is an effective disinfectant, bactericide, algaecide, fungicide and bleaching agent. It is widely used by municipalities, hospitals, railways, aqua culturists, textile manufactures, bleachers and others.

Weighted Operating Cycle:2002-03 Duration of Various Stage 1.Raw Material 2.Finished Goods 3.Debtors 4.Creditors Weights of Various Stage 5.Raw Material 6.Finished Goods 7.Debtors 8.Creditors Weighted Operating Cycle 244.50 18.46 80.7 56.1 0.30 0.66 1.00 0.30 149 Days 2003-04 221.67 8.61 68.77 64.17 0.30 0.71 1.00 0.30 123 Days 2004-05 225.00 3.00 44.67 69.92 0.30 0.76 1.00 0.30 94 Days 2005-06 107.23 1.17 22.17 88.58 0.41 0.80 1.00 0.30 31 Days

(1*5)+(2*6)+(3*7)+(4*8)

29

RAYALASEEMA HYPO HI-STRENGTH

Summary of Performance

S No 01 02 03 04 05 06 Particulars Working Capital Gap Current Ratio Debt-Equity Ratio Operating Profit Profit from Previous years Total Balance of P&L A/c 2002-03 1984.62 2.90:1 0.54 231.38 1167.77 1366.66 2003-04 2064.68 2.91:1 0.56 222.58 1366.66 1548.62 2004-05 1671.25 2.24:1 0.54 183.69 1548.64 1612.81 2005-06 653.66 7.34:1 0.25 8.84 1612.81 1620.91

The main purpose of Working Capital Ratio Analysis is To indicate Working Capital management performance and ; To assist in identifying areas requesting closer management

30

RAYALASEEMA HYPO HI-STRENGTH

Key points have been taken into consideration while analyzing financial ratios. They are as under. The results are based on highly summarized information.

Consequently, situations which require might not be apparent, or situations which dont warrant significant effort, might be unnecessarily highlighted. Different departments face very different situations. Comparisons among them, or with Global ideal ratio values, can be misleading. Ratio analysis is somewhat one-sided, favorable results mean little, whereas, unfavorable results are usually significant.

31

RAYALASEEMA HYPO HI-STRENGTH

Theoretical background of the study

Financial analysis is helpful in assessing the financial position and profitability of a company. It is the process of identifying the financial strengths of the balance sheet and profit and loss account. It can be under taken by the management of the firm. Or by parties outside the firm, viz., owners creditor, investors and others. Introduction to the ratio analysis: Nature of ratios: Ratio analysis is a powerful tool of financial analysis. A ratio is defined as the indicated quotient of two mathematical expressions and as the relationship between two or more things. In financial analysis, a ratio is used as an index or yardstick for evaluating the financial position and performance of affirm. The relationship between two accounting figure, expressed mathematically, is known as a financial a ratio. Ratios help to summarize the large quantities of financial data and to make qualitative judgement about the firms financial position. The greater ratio, the greater firms liquidity and vice versa. The point to note is that a ratio indicates a quantitative relationship, which can be in turn, used to make a qualitative judgement. Such is in the nature of all financial ratios.

32

RAYALASEEMA HYPO HI-STRENGTH

Ratio analysis gives the efficiency and effectiveness of the companys performance on many parameters. Ratio analysis is done to develop meaning full relationship between individual items and group of items usually shown in the periodical financial statements published by the concern. An accounting ratio shows the relationship between the two interrelated accounting figures as gross profit to sales etc.,

REQUISITE FOR RATIO ANANLYSIS:

more confidence in those firms that shows steady growth in earnings as such, they concentrate on the analysis of the firms present and future profitability. They are also interested in the firms financial position to the extent it influences the firms earnings ability. Owners are investors desire primarily a basis for estimating capacity. 1. Creditors: Creditors are concerned primarily with liquidity and ability to pay interest on redeem loan with in a specific period. 2. Long term creditors: The requisite of ratio analysis to come in to being caused by the following facts. 1. Business facts displayed in balance sheet and profit and loss account do not convey any pompous individually. Their significance likes in the fact that they are interrelated. From this time onward, there is need for fixing relationship between various related items.

2. Ratio analysis a tool for the interpretation of financial statements is also important because ratios helps the analysis to have a profound

33

RAYALASEEMA HYPO HI-STRENGTH

cautiously in to the data given statements figure in their peremptory forms shown in financial statements are neither significant nor to enable to be compared. Users of ratio analysis: The nature of ratio analysis will differ depending on the purpose of analyst. Ratio analysis the starting point for making plans before using any sophisticated forecasting and budgeting procedures. The ratio analysis is useful for the following persons; 3. share holders and investors: Investors and shareholders, who have invested their money in the firms,. Shares are most concerned about the firms earnings. They restore The long-term creditors are interested in firms long-term solvency and survival. They analyses about the firms future solvency and profitability overtime, its ability to generate cash, to be able to pay interest and repay principal and relationship between various sources of funds. 4. Employees: The employees are also interested in the financial position of the concern especially profitability. There wages increase the amount of fringe benefits are related to the volume of profits earned by the concern. The employees make use of information available in financial statements. 5. Government : Government is also interested to know the strength and weakness of the firm. Government makes the future plans, policies on the basis of financial information available from various units of the company. 6. Management: Finally, management of the firms or executives would be interested in every aspect of the fianancial analysis. It is their overall responsibility to see at the resources of the are used, most effectively and efficiently, and that the firms financial condition is should. Through the financial analysis they try to seek answers to the following questions.

34

RAYALASEEMA HYPO HI-STRENGTH

1. Is the firm in a position to meet its current obligations? 2. What sources of long term finance are employed by the firm and what is the relationship between them? Is there any danger due to the employment of excessive debt? 3. How efficiently does the firm use its assets? 4. Are the earnings of the firm adequate? 5. Do investors consider the firm profitable and safe for the purpose of investing their money in the shares of the firm? Financial analysis may not provide exact answers to these questions, but it does indicate what can be expected in the future. Standards of comparisons: A single ratio in itself does not indicate favorable or unfavorable condition. It should be compared with some standard. Standards of comparison may consist of : 1. Ratios calculated from past financial statements of the same firm. 2. Ratios developed using the projected or performed financial statements of the same firm. 3. Ratios of some selected firm, especially the most progressive and successful at the same point in time. 4. Ratios of the industry to which the firm belongs. The easiest way to evaluate the performance of a firms is to compare its present ratios with past ratios. When financial ratios over a period of time are compared it gives an indication of the direction of change and reflects whether the firms financial position and performance has improved, deteriote or remained constant over time. This kind of comparison is valid only when the firms accounting policies and procedures have not changed over time.

35

RAYALASEEMA HYPO HI-STRENGTH

Some times future ratio are used as the standard comparison. Future ratios can be developed from the projected or performed financial statements. The comparisons strengths and weaknesses in the past and the future. If the future ratios indicate weak financial position, corrective actions should be initiated. Another way of comparison is to compare the ratio of one firm with some related firms in the same industry at the same point of time. In most of the cases, it is more useful to compare the firms ratios of a few carefully selected competitors indicates the relative financial position and performance of the firm. A firm can easily resort to such a comparison, as it is not difficult to get the published financial statements of the similar firms to determine the financial conditions and performance of a performance of a firm its may be compared with average ratios of the industry of which the firm in a member, industry ratios are important standards in view of the fact that each industry, as its characteristics which influences the financial and operating relationships. But there are certain practical difficulties in using the industry ratios. 1. It is difficult to get ratio for the industry. 2. Even if industry ratios are available, they are averages of the ratios of strong and weak firms. Some times the spread may is wide that the average may not be little utility. 3. The averages will meaningless and the comparison futile. If the firm within the same industry widely differ in their accounting policies and practices. 4. It is possible to extremely strong and extremely weak firms, the industry and eliminate extremely6 strong and extremely weak firms, the industry ratios will prove to be useful in evaluating the fianancial conditions and performance of a firm.

36

RAYALASEEMA HYPO HI-STRENGTH

Utility of ratio analysis: It is most important tool of financial analysis. Many diverse groups people are illustrated in analyzing the financial information to indicate the operating and financial efficiency and growth of the firm. The people use ratios to determine those financial characterics of the firm in which they are interested with the help of ratio one can determine.

The ability of the firm to meet its current obligations. 1. the extent which the firm has used its long-term solvency by borrowing funds. 2. The efficiency to which the firm is utilizing its assets ingenerating its sales revenue and 3. The overall operating efficiency and performance. Types of ratios: Several ratios can be calculated from the accounting data contained in the fianancial statements. These ratios can grouped in to various claases accoarding tyo the fianancialactivity or function to evaluated. As stated earlier, the parties, which generally undertake financial analysis, or short-term creditors, long term creditors, owners and management. Short-term creditors main interest is in the liquidity position of the short-term solvency of the firm. Long term creditors on other hand, are more interested in the long-term solvency and profitability analysis and the analysis of the firms financial conditions. Management is interested in evaluating every activity of the firm. They have to protect the interests of all parties and see that the firm goes profitability. In view of the requirements of the user of the ratios, we may classify them as follows:

37

RAYALASEEMA HYPO HI-STRENGTH

Traditional classification: 1. Balance sheet ratios: balance sheet ratios deal with the relationship between two balance sheet items must however pertain to same balance sheet ex: current ratios. 2. Profit and loss account ratios: This ratios deal with the relation ship between the two profit and loss account items. Both the items must belong to the same profit and loss account. Ex: current ratios. 3. Composite or mixed ratios: These ratios are exhibit statement items and balance sheet items. Ex. Stock turn over ratios.

Functional classification 1. Liquidity ratios: It is extremely essential for a firm to able to meet its obligations as they become due liquidity ratios measure the ability of the firm to meet its current obligations. In fact, analysis of liquidity needs the preparation of cash budgets and cash flows statements. But liquidity ratios by estabuilishing and relation ship between cash flow statements. But liquidity ratios by establishing a relation ship between cash and other current assets to currents obligations provide quick measure of liquidity. Also that is not too much meets its obligations. Due to lack of sufficient liquidity will result in bad credit rating, loss of creditors confidence our even in law suits resulting in the closure of the company. A view high degree of liquidity is also bad. Therefore it is necessary to strike a proper balance between liquidity and lack of liquidity. The most common ratios which indicates the extent of liquidity or lack of it are; current ratio and quick ratio.

38

RAYALASEEMA HYPO HI-STRENGTH

2. Leverage ratio: The long term creditors, like debenture holders, financial institutions etc. Are more concerned with the firms long term financial position of the firm. Leverage of capital structure ratios is calculated. The ratios indicate the funds provide by the owners and creditors as a general; there should be and appropriate mix of debt and owners equity in financing the firms assets. 3. Activity ratios: The funds of creditors and owners are invested in various kinds of assets to generate sales and profits. The better in management of assets. The larger the amount of sales. Activity ratios are employed to evaluate the efficiency with which the firm managers and utilizes its assets. These ratios are also called turn over ratios because they indicate the speed with which assets are being converted or turned power in to sales activity ratios, thus involve a relation ship between sales and the various assets. A p[roper balance between sales assets generally reflects that assets are managed well. 4.Profitability ratios: A company should earn profits to survive and grow over a long period of time. Profits are essential, but it would be wrong to assume that every action initiated by management of company should be aimed at maximizing profits. Irrespective of social consequences. Profits are difference between total revenues and total expenses over period of time. Profits are the ultimate output of the company and it will have no future if it falls to make sufficient profits. The profitability ratios are calculated to measure the operating efficiency of the company. Creditors and owners are also interestred in the profitability of the firm.

39

RAYALASEEMA HYPO HI-STRENGTH

Limitations of ratio analysis:

The ratio is a widely used technique to evaluate the financial position and performance of a business. But there are problems in using ratios. The analyst should be aware of these problems. The following are the limitations of the ratio analysis. 1. It is difficult decide on paper for comparison. 2. The comparison is rendered difficult because of differences in situations of two companies or one of the companies over years. 3. The price level changes make the interpretations of ratios invalid. 4. The ratios calculated at a point of time or less informative and defective and they suffer from short term changes. 5. A single ratio usually, does not convey much sense. 6. The differences in the definitions of items in the balance sheet and profit and loss statement make the interpretation of ratios difficult. 7. The ratios are generally calculated from past financial statements and, thus are indicators of future. 8. Ratios are only means of financial analysis and an end in itself. Ratios have to be interpretated and difficult people may interpret the same in different ways.

40

RAYALASEEMA HYPO HI-STRENGTH

LIQUIDITY RATIOS

Liquidity refers to the ability of a concern to meet its current debt obligations. The short term expenses or current liabilities are met by realizing amounts from current assets. The current assets should be either liquid or near liquidity. These should be convertible into cash for meeting the current debt obligations. If current assets can pay off current liabilities, then liquidity position is said to be satisfactory. If the liabilities are less, then the current assets cannot be met from them, then the liquidity position is considered bad. The bankers, suppliers of the goods and other short term creditors are interested in the liquidity position of a business concern. They extend the credit only if they are sure that current assets are adequate to pay out the obligations. To measure the liquidity position of a business concern, the following ratios can be calculated. A. Current Ratio. B. Quick Ratio. Current Ratio Current ratio may be defined as the relationship between current assets and current liabilities. In other words, it is the ratio of current assets and current liabilities. The ratio is also known as working capital ratio. It is measure of general liquidity and is most widely used to make the analysis of a short term financial position or liquidity of a business enterprise. The two basic components of the ratio are: current assets and current liabilities. The following table gives the details of the items constituting these two elements.

41

RAYALASEEMA HYPO HI-STRENGTH

Components of Current Ratio

CURRENT ASSETS . Bills receivables . Cash at bank . Cash in hand . Inventories .Sundry debtors .Work in progress .Prepaid expenses

Current ratio= Current assets Current liabilities

CURRENT LIABILITIES . Income tax payable . Bills prepaid . Out standing expenses . Bank overdraft .Sundry creditors. .Dividend payable

particulars Current assets (Rs in lakhs) Current liabilities (Rs in lakhs) Current ratio

2004 3149015.77 1083661.19 2.90:1

2005 2006 2007 2008 2991760.4 3578910.4 4198691 4053543.7 0 9 .79 7 135237.59 1928977.6 1550552 2108740.7 5 .76 2 2.21:1 1.85:1 2.70:1 1.92:1

42

RAYALASEEMA HYPO HI-STRENGTH

4500000 4000000 3500000 3000000 2500000 2000000 1500000 1000000 500000 0

Current assets Current liabilities Current ratio

2004 2005 2006 2007 2008

INTERPRETATION: The current ratio of the firm measures in short term solvency. The accepted standard ratio is 2:1. The current ratio of the firm was not good in the year 2006 and 2008 current ratio was not satisfactory. Because having less than 2:1 ratio. However, the company needs to improve its short term financial position.

43

RAYALASEEMA HYPO HI-STRENGTH

A Quick ratio/acid test ratio/liquid ratio

The term liquidity refers to the ability of a business enterprise to pay its short term liabilities. Quick ratio may be defined as the relationship between quick assets and current liabilities. As assets is said to be liquid, it can be converted in to cash with in a short period.

Components of quick ratio:

Quick assets . Cash on hand . Cash at bank . Bills receivable . Sundry debtors . marketable securities

Quick ratio= Quick assets Current liabilities Particulars Quick assets Current liabilities Quick ratio 2004 2005 2006 2932398.49 1928977.65 1.52:1 2007 3565590.54 1550552.76 2.30:1 2008 2926053.48 2108740.72 1.39:1

Quick liabilities . Out standing expenses . Bills payable . Sundry creditors . Dividend payable . Bank over draft

2653175.0 2533610.34 7 1083661.1 1352237.59 9 2.44:1 1.87:1

44

RAYALASEEMA HYPO HI-STRENGTH

4000000 3500000 3000000 2500000 2000000 1500000 1000000 500000 0

All current assets, except stock and prepaid expenses are quick assets. A quick ratio of 1 is considered as ideal, a quick ratio less than 1, indicates inadequate liquidity of the firm. INTERPRETATION:The position. Quick ratio is more than the standard of 1:1, the company

Quick assets Current liabilities Quick ratio 3-D Column 4

had excess liquid assets. This indicates company extremely had high liquidity

45

RAYALASEEMA HYPO HI-STRENGTH

Super Quick Ratio/ Absolute Ratio: The cash Ratio measure the absolute liquidity of the business. This ratio considers only the absolute liquidity available with the firm. This ratio is calculated as; Cash + Marketable Securities ______________________________ Current Liabilities

(Rs. Inlakhs) Particulars 2004 2005 2006 2007 2008 Super Quick Current Liabilities Assets(A) (B) 91973.21 1083661.19 71150.60 1352237.59 113171.38 1928977.65 195291.02 1550552.76 276745.26 2108740.72 Ratio (A/B) 0.08 0.05 0.06 0.13 0.13

Cash Ratio =

46

RAYALASEEMA HYPO HI-STRENGTH

0.14

0.12

0.1

0.08

Super Quick Ratios Ratios (A/B)

0.06

0.04

0.02

0

1 2 3 2004-2008 4 5

INTERPRETATION: The Universal Standard is 0.50:1 so, Company almost all years had less super liquid Assets. This Indicates Company had huge balances in debtors besides their collection period was very high. So, company was not easy to meet quick obligations immediately.

47

RAYALASEEMA HYPO HI-STRENGTH

ACTIVITY RATIOS:

The funds of creditors and owners are invested in various kinds of assets to generate sales and profits. The better the management of assets, the larger the amount of sales. Activity ratios are employed to evaluated the efficiency with which the firm managers and utilizes its assets. These ratios are also called turn over ratios because they indicate the speed with which assets are being converted or turned or turned over into sales. Active ratios, thus involve a relationship between sales and various assets. And presume that there exists an appropriate balance between sales and various assets generally reflect that assets are managed well.

Some of the activity ratios are given under: Inventory turnover ratio= Sales Inventory Debtors turnover ratio= Sales Debtors Assets turnover ratio=Sales Net assets Total asset turnover ratio=Sales Total assets Fixed asset turnover ratio=Sales Net fixed assets

48

RAYALASEEMA HYPO HI-STRENGTH

Inventory turnover ratio:

This ratio is indicated the efficiency of the firm in selling its products. It is calculated by dividing the sales by average inventory or the year ended inventory. This ratio measures how quickly inventory is sold, a test of efficient management. Usually a high inventory turn over ratio indicates efficient management of inventory because more frequently the stocks are sold. The lesser amount of money is required to finance the inventory. This implied under investment in or very low level of inventory. Low turn over implies over investment in inventories, dull business. Inventory turnover ratio= Sales Inventory

Particulars Sales Inventory

2004

4544096.08 155096.08

2005

4117146.88 130849.92 31.46(times)

2006

5998742.15 404966.54 14.81(times )

2007

6563134.94 227862.78 28.80(times)

2008

6875918.22 226460.78 30.36(times)

Inventory 29.30 (times) turn over ratio

49

RAYALASEEMA HYPO HI-STRENGTH

7000000 6000000 5000000 4000000 3000000 2000000 1000000 0 2004 2006 2008 Inventory Inventory turnover ratio Sales

INTERPRETATION: This ratio measures the rapidity with which stock is turning into receivables through sales company produces good very quickly rest of year. However, the company produces goods quickly. This indicates company had a strong production capacity.

50

RAYALASEEMA HYPO HI-STRENGTH

Debtors turn over ratio

Debtors turn over ratio is the relationship between the credit sales and debtors of the firm. Debtors turn over ratio= Sales Debtors

Particulars Sales

2004

2005

5661902.9 2 604498.36 9.36 (times)

2006

8309824.99 817828.04 10.16 (times)

2007

11941052.77 71928655 16.60 (times)

2008

11755303.2 8 919879.62 18.96(times)

5884308.6 5 Debtors 604128.58 Debtors turn over 9.74 ratio (times)

12000000 10000000 8000000 6000000 4000000 2000000 0 2004 2006 2008 Sales Debtors Debtors turn over ratio

INTERPRETATION: Debtors turnover ratio measures the collection period of debtors. Here sales were so rapidly converting into cash. This so good to Company. Year 2007-08 was little bit high rather than rest of years.

51

RAYALASEEMA HYPO HI-STRENGTH

Asset turn over ratio

Asset turn over ratio is also known as Investment turn over ratio. It is based on the relationship between the cost of goods sold (sales) and the assets of the firm. Asset turn over ratio=Sales Net assets

Particulars Sales Net assets Assets turn over ratio

2004

5884308.65 9040038.01 0.6:1

2005

5661902.92 8769273.84 0.64:1

2006

8309824.99 7723318.16 1.07:1

2007

11941052.27 8875816.43 1.34:1

2008

11755303.28 9419328.67 1.25:1

Note: Net assets = net fixed assets + net current assets.

12000000 10000000 8000000 6000000 4000000 2000000 0 2004 2005 2006 2007 2008 Sales Net assets Assets turn over ratio 3-D Column 4

INTERPRETATION: This ratio measures the net assets capacity with turnover. Here, net assets are not sufficient for production of goods. However, company should concentrate on more fixed assets rather than current assets.

52

RAYALASEEMA HYPO HI-STRENGTH

Fixed asset turn over ratio

Fixed asset turn over ratio= Sales Net fixed assets

Particulars Sales Net assets

2004

2005

2006

8309824.99 4144407.67 2:1

2007

2008

58843089.65 5661902.92 fixed 591022.24 5777513.44 0.98:1

11941052.27 11755303.28 4677124.64 5365784.90 2.55:1 2.19:1

Fixed asset 1:1 turn over ratio

12000000 10000000 8000000 6000000 4000000 2000000 0 2004 2005 2006 2007 2008 Sales Net fixed assets Fixed asset turn over ratio

INTERPRETATION: This ratio measures fixed assets capacity with turnover. Here, fixed assets sufficient for production of goods. However, company should concentrate on more fixed assets rather than currents assets.

53

RAYALASEEMA HYPO HI-STRENGTH

FINDINGS

Weighted operating cycle analysis helps in estimating the amount of funds that are required for the various stages of the cycle. It is a method of estimating working capital requirement for SRHH Ltd in the year 2002-03 was only 31 days. Operating statement of SRHH Ltd clearly indicates the heavy operating expenses. Thats why they are getting less profits. The liquidity ratio such as current ratio, Quick ratio, etc is satisfactory. The current ratio is more than 2:1 and quick ratio is more than 1:1 which is acceptable. Movement of accounts payable is shown an decrease trend. This indicates company is able to generate credit at liberal terms and generate revenues at other cost. Company was able to manage with lower working capital borrowings because of short-term loans and outstanding creditors. The inventory turnover ratio is continuously declining The activity ratios are employed to know the efficiently of firm in managing and utilizing the assets.

54

RAYALASEEMA HYPO HI-STRENGTH

SUGGESTIONS

o The company must try to maintain an optimum level of inventory and develop the strategy of investing excess cash balance. o The company should improve profits by reducing indirect or operating expenses. o SRHH Ltd should develop optimum credit policy o SRHH Ltd should determine the maximum length of trade-credit period with the help of following formula M=m+N/N-W*(n-m) o Company concentrate only shareholders funds it was so, expensive than other funds. o Year 2005-06 Companys turnover was very poor. Company management must take necessary actions for forthcoming years. o Companys had a more inventory. Management should adopt necessary inventory policies like ABC Analysis, EOQ, etc

55

RAYALASEEMA HYPO HI-STRENGTH

CONCLUSIONS

The Management of Sri Rayalaseema Hi-Strength Hypo-Ltd, Kurnool is well aware of taking necessary step in making of effective decisions. Still, some time some decisions cant be put into practice due to some other influences, which cant be prevented within their scope.

56

RAYALASEEMA HYPO HI-STRENGTH

BIBLIOGRAPHY

Financial Management Management Accountancy : Research Methodology Company Profile Financial Analysis : : : : Khan & Jain, I M Pandy S N Maheswari C R Kothari Manual of SRHH Ltd Balance Sheets, Profit & Loss Accounts of SRHH Ltd from 2004 to 2008

57

You might also like

- Employee Motivation QuestionnaireDocument2 pagesEmployee Motivation QuestionnaireShams S89% (9)

- Employee Motivation QuestionnaireDocument2 pagesEmployee Motivation QuestionnaireShams S89% (9)

- Guide To Producing A Fashion Show, 3rd EditionDocument39 pagesGuide To Producing A Fashion Show, 3rd EditionChris Laurence Balintona100% (1)

- Horlicks ProjectDocument56 pagesHorlicks ProjectShams S82% (34)

- Employee MotivationDocument78 pagesEmployee MotivationShams SNo ratings yet

- Noor Mohamed - Working Capital Management-Full ReportDocument94 pagesNoor Mohamed - Working Capital Management-Full ReportananthakumarNo ratings yet

- 2024 Becker CPA Financial (FAR) NotesDocument51 pages2024 Becker CPA Financial (FAR) NotescraigsappletreeNo ratings yet

- Training Need AssessmentDocument90 pagesTraining Need AssessmentShams S100% (1)

- Non Fund Based Activities of BankDocument53 pagesNon Fund Based Activities of BankAKSHAT MAHENDRANo ratings yet

- A Questionnaire On Quality of Work Life Name: Designation: AgeDocument3 pagesA Questionnaire On Quality of Work Life Name: Designation: AgeShams SNo ratings yet

- Management-of-Working-Capital-Notes SAUDocument104 pagesManagement-of-Working-Capital-Notes SAUSaurav MedhiNo ratings yet

- A Study On Overall Financial Performance AnalysisDocument104 pagesA Study On Overall Financial Performance Analysisaarasu007100% (2)

- Capital Budgeting or Capital ExpenditureDocument18 pagesCapital Budgeting or Capital ExpenditurePooja VaidyaNo ratings yet

- Summary of Chapter 9 Budget Preparation - Erlinda Katlanis 1081002089Document9 pagesSummary of Chapter 9 Budget Preparation - Erlinda Katlanis 1081002089Linda Katlanis100% (1)

- Financial Performance Analysis of RAIDCODocument92 pagesFinancial Performance Analysis of RAIDCOATHIRA RNo ratings yet

- Working Capital Management of JK BankDocument98 pagesWorking Capital Management of JK BankAkifaijaz100% (1)

- Lenovo Cust Satisfaction ProjDocument58 pagesLenovo Cust Satisfaction ProjShams S71% (7)

- Working Capital Management and Its Impact On Profitability Evidence From Food Complex Manufacturing Firms in Addis AbabaDocument19 pagesWorking Capital Management and Its Impact On Profitability Evidence From Food Complex Manufacturing Firms in Addis AbabaJASH MATHEWNo ratings yet

- Working Capital Management ProjectDocument45 pagesWorking Capital Management ProjectBarkhaNo ratings yet

- Research Paper On Working CapitalDocument7 pagesResearch Paper On Working CapitalRujuta ShahNo ratings yet

- Optimize Working Capital ManagementDocument8 pagesOptimize Working Capital ManagementAnnapurna VinjamuriNo ratings yet

- Chaitanya Chemicals - Capital Structure - 2018Document82 pagesChaitanya Chemicals - Capital Structure - 2018maheshfbNo ratings yet

- Working Capital ManagementDocument78 pagesWorking Capital ManagementDrj Maz50% (2)

- Working Capital Project ReportDocument87 pagesWorking Capital Project ReportPranay Raju RallabandiNo ratings yet

- Dimensions of Working Capital ManagementDocument22 pagesDimensions of Working Capital ManagementRamana Rao V GuthikondaNo ratings yet

- Prime Bank LTD Ratio AnalysisDocument30 pagesPrime Bank LTD Ratio Analysisrafey201No ratings yet

- Financial Performence of KesoramDocument97 pagesFinancial Performence of KesoramBasinepalli Sathish ReddyNo ratings yet

- Working Capital TheoryDocument24 pagesWorking Capital TheoryDivya SharmaNo ratings yet

- Banking & FinanceDocument15 pagesBanking & FinanceRiya ThakkarNo ratings yet

- Askari Bank Ratio AnalysisDocument32 pagesAskari Bank Ratio Analysis✬ SHANZA MALIK ✬No ratings yet

- Working CapitalDocument40 pagesWorking CapitalSupriya RajmaneNo ratings yet

- Working Capital ManagementDocument60 pagesWorking Capital ManagementyadNo ratings yet

- A Study of Capital Structure ManagementDocument94 pagesA Study of Capital Structure ManagementBijaya DhakalNo ratings yet

- Mba Project ReportDocument15 pagesMba Project ReportPreet GillNo ratings yet

- WORKING CAPITAL MANAGEMENTDocument70 pagesWORKING CAPITAL MANAGEMENTAnand SudarshanNo ratings yet

- A Study On "Portfolio Management"Document74 pagesA Study On "Portfolio Management"balki123No ratings yet

- Funds Flow Statement LancoDocument86 pagesFunds Flow Statement Lancothella deva prasadNo ratings yet

- Impact of Working Capital Management On The Profitability of The Food and Personal Care Products Companies Listed in Karachi Stock Exchange (Finance)Document41 pagesImpact of Working Capital Management On The Profitability of The Food and Personal Care Products Companies Listed in Karachi Stock Exchange (Finance)Muhammad Nawaz Khan Abbasi100% (1)

- "Working Capital of Management": A Project Report ONDocument31 pages"Working Capital of Management": A Project Report ONRohit BhorNo ratings yet

- REPORT On Venture CapitalDocument54 pagesREPORT On Venture Capitalakshay mouryaNo ratings yet

- Project On Working Capital ManagementDocument59 pagesProject On Working Capital ManagementMotasim ParkarNo ratings yet

- Project Report on Working Capital ManagementDocument35 pagesProject Report on Working Capital Managementomprakash shindeNo ratings yet

- Project ReportDocument57 pagesProject ReportPAWAR0015No ratings yet

- Assets Andliability Management at Icici Bank-1Document73 pagesAssets Andliability Management at Icici Bank-1akshuNo ratings yet

- Comparative Study On Working Capital Management. at Bhilai Steel by Anil SinghDocument86 pagesComparative Study On Working Capital Management. at Bhilai Steel by Anil Singhsattu_luvNo ratings yet

- A Study On Cash Mangement at Dabur India PVT LTDDocument25 pagesA Study On Cash Mangement at Dabur India PVT LTDSanthu SaravananNo ratings yet

- Merger & Acquisition PROJECTDocument49 pagesMerger & Acquisition PROJECTYUSUF DABONo ratings yet

- Risk Return Analysis Analysis of Banking and FMCG StocksDocument93 pagesRisk Return Analysis Analysis of Banking and FMCG StocksbhagathnagarNo ratings yet

- Capital Structure of Banking Companies in IndiaDocument21 pagesCapital Structure of Banking Companies in IndiaAbhishek Soni43% (7)

- Working Capital ManagementDocument78 pagesWorking Capital ManagementPriya GowdaNo ratings yet

- HDFC Bank CAMELS AnalysisDocument15 pagesHDFC Bank CAMELS Analysisprasanthgeni22No ratings yet

- Employee Job Satisfaction at Ellaquai Dehati BankDocument64 pagesEmployee Job Satisfaction at Ellaquai Dehati BankSwyam DuggalNo ratings yet

- Critical Review of Working Capital ManagementDocument99 pagesCritical Review of Working Capital ManagementSTAR PRINTINGNo ratings yet

- IFRS Standards OverviewDocument12 pagesIFRS Standards OverviewJeneef JoshuaNo ratings yet

- A Project Report On Financing SsiDocument70 pagesA Project Report On Financing SsihirwanithakurNo ratings yet

- Working Capital MGTDocument61 pagesWorking Capital MGTDinesh Kumar100% (1)

- Akash 123Document44 pagesAkash 123praveshNo ratings yet

- Mergers and Acquisitions in Indian Banking SectorDocument68 pagesMergers and Acquisitions in Indian Banking SectorPooja gawaiNo ratings yet

- Comparing Working Capital Management of Chemical and Medicine CompaniesDocument17 pagesComparing Working Capital Management of Chemical and Medicine CompaniesEmi KhanNo ratings yet

- Working Capital Management of SectrixDocument50 pagesWorking Capital Management of SectrixsectrixNo ratings yet

- 3.2 Components of Working CapitalDocument24 pages3.2 Components of Working CapitalShahid Shaikh100% (1)

- Working Capital OriginalDocument53 pagesWorking Capital Originalaurorashiva1100% (1)

- Review of Literature PriyaDocument3 pagesReview of Literature Priyadeepusrajan75% (4)

- Project Report ON Working Capital Management IN Bharti Airtel LTDDocument84 pagesProject Report ON Working Capital Management IN Bharti Airtel LTDRam LalNo ratings yet

- Cash Conversion CycleDocument18 pagesCash Conversion CycleRashidul HasanNo ratings yet

- Fsa - IciciDocument85 pagesFsa - IciciMOHAMMED KHAYYUMNo ratings yet

- Project Report Accounting & Finance Under The University of Calcutta)Document49 pagesProject Report Accounting & Finance Under The University of Calcutta)Rakesh SahNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Pepsi Project ReportDocument74 pagesPepsi Project ReportShams SNo ratings yet

- Data Analysis QWLDocument40 pagesData Analysis QWLShams SNo ratings yet

- DerivativesDocument75 pagesDerivativesDowlathAhmedNo ratings yet

- Samsung Galaxy Brand ImageDocument63 pagesSamsung Galaxy Brand ImageShams SNo ratings yet

- Questionnaire OlayDocument1 pageQuestionnaire OlayShams S100% (1)

- Hero Satisfaction ProjDocument59 pagesHero Satisfaction ProjShams S100% (2)

- Ratio AnalysisDocument64 pagesRatio AnalysisShams SNo ratings yet

- Mouryaa Inn ProfileDocument9 pagesMouryaa Inn ProfileShams SNo ratings yet

- Recruitment QuestionnaireDocument2 pagesRecruitment QuestionnaireShams SNo ratings yet

- Loans and AdvancesDocument64 pagesLoans and AdvancesShams SNo ratings yet

- Types of LoansDocument5 pagesTypes of LoansShams SNo ratings yet

- Advance Spoken EnglishDocument1 pageAdvance Spoken EnglishShams SNo ratings yet

- Factors Influencing Deposit Mobilisation in Rural AreasDocument2 pagesFactors Influencing Deposit Mobilisation in Rural AreasShams SNo ratings yet

- Nokia Cust Rela MGMTDocument71 pagesNokia Cust Rela MGMTShams SNo ratings yet

- Andhra Pragathi Grameena BankDocument1 pageAndhra Pragathi Grameena BankShams SNo ratings yet

- Tata Gluco PlusDocument9 pagesTata Gluco PlusShams S100% (1)

- Cust Satisfaction ArielDocument32 pagesCust Satisfaction ArielShams SNo ratings yet

- Honda Activa MileageDocument7 pagesHonda Activa MileageShams SNo ratings yet

- Findings and SuggestionsDocument2 pagesFindings and SuggestionsShams SNo ratings yet

- LG LED TVs ProjDocument62 pagesLG LED TVs ProjShams S100% (1)

- Hero Satisfaction ProjDocument59 pagesHero Satisfaction ProjShams S100% (2)

- Cust Satisfaction ArielDocument32 pagesCust Satisfaction ArielShams SNo ratings yet

- Customer Satisfaction Towards Nokia MobilesDocument49 pagesCustomer Satisfaction Towards Nokia MobilesShams S100% (1)

- FY 2022 April 20 2022 Comptroller LetterDocument18 pagesFY 2022 April 20 2022 Comptroller LetterHelen BennettNo ratings yet

- Government Budgeting and Accounting ClassificationDocument4 pagesGovernment Budgeting and Accounting ClassificationAndini OleyNo ratings yet

- Components of Government BudgetDocument7 pagesComponents of Government BudgetAditi MahaleNo ratings yet

- Chapter 3 FinmanDocument11 pagesChapter 3 FinmanJullia BelgicaNo ratings yet

- Financial Statement Analysis of SonyDocument13 pagesFinancial Statement Analysis of SonyJOHN VL FANAINo ratings yet

- Chapter-3: Restructuring & Responsibility Matrix in BSNLDocument13 pagesChapter-3: Restructuring & Responsibility Matrix in BSNLsfdwhjNo ratings yet

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Document8 pagesO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranNo ratings yet

- Manual on New Government Accounting System for LGUsDocument107 pagesManual on New Government Accounting System for LGUsJhopel Casagnap Eman100% (1)

- Feedback:: Financial StatementsDocument9 pagesFeedback:: Financial StatementsMlndsamoraNo ratings yet

- FINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inDocument5 pagesFINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inQueen ValleNo ratings yet

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- A1119166710 24805 14 2019 RatioAnalysisDocument96 pagesA1119166710 24805 14 2019 RatioAnalysisAshish kumar ThapaNo ratings yet

- Chapter - 1-Accounting For InventoriesDocument40 pagesChapter - 1-Accounting For InventoriesWonde BiruNo ratings yet

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- Lesson 4 Financial Ratio AnalysisDocument22 pagesLesson 4 Financial Ratio AnalysisLyza Jayne OliquianoNo ratings yet

- Project Report On Vimal Oils and Foods Ltd.Document62 pagesProject Report On Vimal Oils and Foods Ltd.yash0% (2)

- NDNE Retailer Guidelines For Uploading 121011Document17 pagesNDNE Retailer Guidelines For Uploading 121011Raghavendra K GowdaNo ratings yet

- Corporate Finance Week 5 Slide SolutionsDocument3 pagesCorporate Finance Week 5 Slide SolutionsKate BNo ratings yet

- ch01 PDFDocument59 pagesch01 PDFsaad bin saadaqatNo ratings yet

- A Critical Review in Constructal Theory PDFDocument12 pagesA Critical Review in Constructal Theory PDFRui GalvaniNo ratings yet

- China Wire Cable Market ReportDocument10 pagesChina Wire Cable Market ReportAllChinaReports.comNo ratings yet

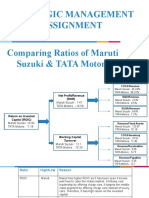

- Strategic Management Assignment Comparing Ratios of Maruti Suzuki & TATA MotorsDocument4 pagesStrategic Management Assignment Comparing Ratios of Maruti Suzuki & TATA MotorsNamanNo ratings yet

- 14 A Study On Financial Performance of Ponlait, PuducherryDocument69 pages14 A Study On Financial Performance of Ponlait, PuducherrySaravanan Sankari40% (5)

- LRWC Press Statement: Leisure and Resorts World CorporationDocument3 pagesLRWC Press Statement: Leisure and Resorts World CorporationJun GomezNo ratings yet

- f2 Financial Accounting April 2016Document20 pagesf2 Financial Accounting April 2016Edson Jorge MandlateNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienNo ratings yet