Professional Documents

Culture Documents

Revire Execise

Uploaded by

Fitz Gerald BalbaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revire Execise

Uploaded by

Fitz Gerald BalbaCopyright:

Available Formats

Review Exercise 1. Moore Company estimates its annual warranty expense as 2% of annual net sales.

The following data relate to the calendar year 2004: Net sales Warranty liability account Balance, Dec. 31, 2004 Balance, Dec. 31, 2004 $1,800,000 $ 6,000 30,000 debit before adjustment credit after adjustment

Which one of the following entries was made to record the 2004 estimated warranty expense? a. Warranty Expense .............................................................. 36,000 Retained Earnings (prior-period adjustment) ............ 6,000 Warranty Liability ...................................................... 30,000 b. Warranty Expense .............................................................. 30,000 Retained Earnings (prior-period adjustment) ...................... 6,000 Warranty Liability ...................................................... 36,000 c. Warranty Expense .............................................................. 24,000 Warranty Liability ...................................................... 24,000 d. Warranty Expense .............................................................. 36,000 Warranty Liability ...................................................... 36,000 1. In 2004, Slimon Corporation began selling a new line of products that carry a two-year warranty against defects. Based upon past experience with other products, the estimated warranty costs related to dollar sales are as follows: First year of warranty 2% Second year of warranty 5% Sales and actual warranty expenditures for 2004 and 2005 are presented below: 2004 2005 Sales $600,000 $800,000 Actual warranty expenditures 20,000 40,000 What is the estimated warranty liability at the end of 2005? a. $38,000. b. $58,000. c. $98,000. d. $16,000. 2. On January 1, 2004, Bleeker Co. issued eight-year bonds with a face value of $2,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are: Present value of 1 for 8 periods at 6% .......................................... Present value of 1 for 8 periods at 8% .......................................... Present value of 1 for 16 periods at 3% ......................................... Present value of 1 for 16 periods at 4% ......................................... Present value of annuity for 8 periods at 6% ................................. Present value of annuity for 8 periods at 8% ................................. Present value of annuity for 16 periods at 3% ............................... Present value of annuity for 16 periods at 4% ............................... .627 .540 .623 .534 6.210 5.747 12.561 11.652

The present value of the principal is a. $1,068,000. b. $1,080,000. c. $1,246,000. d. $1,254,000. The present value of the interest is a. $689,640. b. $699,120. c. $745,200. d. $753,660. The issue price of the bonds is a. $1,767,120. b. $1,769,640. c. $1,779,120. d. $1,999,200. 4. On July 1, 2004, Risen Co. issued 500 of its 10%, $1,000 bonds at 99 plus accrued interest. The bonds are dated April 1, 2004 and mature on April 1, 2014. Interest is payable semiannually on April 1 and October 1. What amount did Risen receive from the bond issuance? a. $507,500 b. $500,000 c. $495,000 d. $482,500 5. The 10% bonds payable of Jacobs Company had a net carrying amount of $1,140,000 on December 31, 2004. The bonds, which had a face value of $1,200,000, were issued at a discount to yield 12%. The amortization of the bond discount was recorded under the effective interest method. Interest was paid on January 1 and July 1 of each year. On July 2, 2005, several years before their maturity, Jacobs retired the bonds at 102. The interest payment on July 1, 2005 was made as scheduled. What is the loss that Jacobs should record on the early retirement of the bonds on July 2, 2005? a. $24,000. b. $75,600. c. $67,200. d. $84,000. 6. Keane Co. includes one coupon in each bag of dog food it sells. In return for eight coupons, customers receive a leash. The leashes cost Keane $3.00 each. Keane estimates that 40 percent of the coupons will be redeemed. Data for 2004 and 2005 are as follows: Bags of dog food sold Leashes purchased Coupons redeemed 2004 500,000 18,000 120,000 2005 600,000 22,000 150,000

The premium expense for 2004 is a. $37,500. b. $45,000. c. $52,500. d. $75,000. The estimated liability for premiums at December 31, 2004 is a. $11,250. b. $15,000. c. $26,250. d. $30,000. The estimated liability for premiums at December 31, 2005 is a. $16,875. b. $31,875. c. $33,750. d. $63,750. 7. Unruh Co. is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals from its plant. Unruh's lawyer states that it is probable that Unruh will lose the suit and be found liable for a judgment costing Unruh anywhere from $800,000 to $4,000,000. However, the lawyer states that the most probable cost is $2,400,000. As a result of the above facts, Unruh should accrue a. a loss contingency of $800,000 and disclose an additional contingency of up to $3,200,000. b. a loss contingency of $2,400,000 and disclose an additional contingency of up to $1,600,000. c. a loss contingency of $2,400,000 but not disclose any additional contingency. d. no loss contingency but disclose a contingency of $800,000 to $4,000,000.

8. The effective interest on a 12-month, zero-interest-bearing note payable of $500,000, discounted at the bank at 12% is a. 13.04%. b. 12%. c. 8.93%. d. 13.64%.

ANSWERS 1. D 1. A 2. A B A 4. A 5. B 6. D D D 7. B 8. D

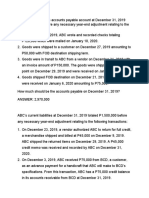

Junior Philippine Institute of Accountants Financial Accounting 2 Review Fitz Music Company carries a wide variety of musical instruments, sound reproduction equipment, recorded music and sheet music. To promote sale, Fitz uses two promotion techniques premiums and warranties. The premium is offered on the recorded and sheet music. Customers receive a coupon for each P10 spent on recorded music and sheet music. Customers may exchange 200 coupons and P200 for a CD player. Fitz pays 340 for each CD player and estimates that 60% of the coupon will be redeemed. A total of 6,500 CD players used in the premium program were purchased during the year and there were 1,200,000 coupons redeemed in 2010. Musical instrument and sound reproduction equipment are sold with a one-year warranty for replacement of parts and labor. The estimated warranty cost is 2% of sales. Replacement parts and labor for warranty work totaled P1,640,000 during 2010. Fitz sales for 2010 totaled P72,000,000 P54,000,000 from musical instruments and sound reproduction equipment and P18,000,000 from recorded and sheet music. The balances in the accounts related to warranties and premiums on Jan.1,2010 were: Inventory of premium CD players P399,500 Estimated premium claims outstanding 448,000 Estimated liability from warranties 1,360,000 Based on the preceding information, determine the amounts that will be shown on the 2010 financial statemens: 1. Warranty Expense a. 1,640,000 b. 1,080,000 c. 800,000 d. 360,000

2. Estimated liability from warranties a. 1,920,000 c. 240,000 b. 1,080,000 d. 800,000 3. Premium expense a. 1,836,000 b. 840,000 c. 756,000 d. 2,189,500

4. Inventory of premium CD players a. 399,500 c. 2,210,000 b. 569,500 d. 739,500 5, Estimated premium claims outstanding a. 364,000 c. 756,000 b. 840,000 d. 672,000

You might also like

- P 1Document27 pagesP 1Mark Lorenz SarionNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Re & BVDocument3 pagesRe & BV-100% (1)

- Fa 1 CompreDocument16 pagesFa 1 CompreTwainNo ratings yet

- UCP: CVP Analysis and ExercisesDocument10 pagesUCP: CVP Analysis and ExercisesDin Rose GonzalesNo ratings yet

- Quiz#1 MaDocument5 pagesQuiz#1 Marayjoshua12No ratings yet

- Repair Cost Probabilit yDocument2 pagesRepair Cost Probabilit yNicole AguinaldoNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Change in Unit Cost From Prior Department and Valuation of InventoryDocument8 pagesChange in Unit Cost From Prior Department and Valuation of InventoryHarzen Joy SampolloNo ratings yet

- Prelim Exam Discussion: Priority of OrderDocument3 pagesPrelim Exam Discussion: Priority of OrderMarianne Portia Sumabat100% (1)

- Multiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Document3 pagesMultiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Kimmy ShawwyNo ratings yet

- Fin AcctgDocument9 pagesFin AcctgCarl Angelo0% (1)

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaNo ratings yet

- Working Capital Quiz - Optimize Cash and Reduce CostsDocument3 pagesWorking Capital Quiz - Optimize Cash and Reduce CostsVincent Larrie MoldezNo ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Umuc Acc311 - Acc 311 Quiz 1 2015Document5 pagesUmuc Acc311 - Acc 311 Quiz 1 2015teacher.theacestudNo ratings yet

- Chapter 10-Investments in Noncurrent Operating Assets-AcquisitionDocument34 pagesChapter 10-Investments in Noncurrent Operating Assets-AcquisitionYukiNo ratings yet

- Absorption vs Variable Costing Activity 2Document2 pagesAbsorption vs Variable Costing Activity 2Gill Riguera100% (1)

- CGT Drill Answers and ExplanationsDocument4 pagesCGT Drill Answers and ExplanationsMarianne Portia SumabatNo ratings yet

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- Quiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewDocument1 pageQuiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewEly RiveraNo ratings yet

- Justa Corporation US market analysisDocument11 pagesJusta Corporation US market analysisMohsin Rehman0% (1)

- CH BsaDocument1 pageCH BsaLovErsMaeBasergoNo ratings yet

- Sale and Leaseback Accounting QuestionsDocument28 pagesSale and Leaseback Accounting QuestionsEdrickLouise DimayugaNo ratings yet

- Financial Asset Measurement and AmortizationDocument5 pagesFinancial Asset Measurement and AmortizationLara Jane Dela CruzNo ratings yet

- Intangible AssetsDocument22 pagesIntangible AssetsKaye Choraine Naduma100% (1)

- DocDocument20 pagesDochis dimples appear, the great lee seo jinNo ratings yet

- Garfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesDocument2 pagesGarfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesvenice cambryNo ratings yet

- Heats Corporation Current and Noncurrent LiabilitiesDocument1 pageHeats Corporation Current and Noncurrent LiabilitiesjhobsNo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet

- Fin Acc 2 Review MaterialsDocument17 pagesFin Acc 2 Review Materialsmaria evangelistaNo ratings yet

- Projected Pension CalculationsDocument13 pagesProjected Pension CalculationsjessamaeNo ratings yet

- CA 04 - Job Order CostingDocument17 pagesCA 04 - Job Order CostingJoshua UmaliNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Financial Management - Part 1 For PrintingDocument13 pagesFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- COST ACCOUNTING 1 8 Final Allocation of Joint CostsDocument15 pagesCOST ACCOUNTING 1 8 Final Allocation of Joint CostsZoe MendozaNo ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- Chapter 5 SM HeheDocument9 pagesChapter 5 SM HeheMaricel De la CruzNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Management Services II Final ExamDocument5 pagesManagement Services II Final ExamBry LgnNo ratings yet

- Reviewing key accounting conceptsDocument13 pagesReviewing key accounting conceptschristine anglaNo ratings yet

- Data vs Info, Characteristics of Useful Info, Goal Conflict & CongruenceDocument3 pagesData vs Info, Characteristics of Useful Info, Goal Conflict & CongruenceHagarMahmoud0% (1)

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- Presented Below Is Information Pertaining To Delsnyder Specialty Foods ADocument1 pagePresented Below Is Information Pertaining To Delsnyder Specialty Foods ALet's Talk With HassanNo ratings yet

- RAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESDocument4 pagesRAMON MAGSAYSAY TECHNOLOGICAL UNIVERSITY MANAGEMENT ADVISORY SERVICESPrincess Claris ArauctoNo ratings yet

- Liabilities Long TermDocument3 pagesLiabilities Long TermEngel QuimsonNo ratings yet

- Earnings Per ShareDocument3 pagesEarnings Per ShareYeshua DeluxiusNo ratings yet

- Amortization of Intangible AssetsDocument2 pagesAmortization of Intangible Assetsemman neriNo ratings yet

- D15Document12 pagesD15neo14No ratings yet

- Bank always drawer and draweeDocument15 pagesBank always drawer and draweeLester AguinaldoNo ratings yet

- Chapter 6 - Effective Interest MethodDocument62 pagesChapter 6 - Effective Interest MethodCeline Therese BuNo ratings yet

- MODULE 2 CVP AnalysisDocument8 pagesMODULE 2 CVP Analysissharielles /No ratings yet

- 29Document4 pages29Carlo ParasNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- PREsentation For AccountingDocument1 pagePREsentation For AccountingFitz Gerald BalbaNo ratings yet

- Chariots of The GodDocument1 pageChariots of The GodFitz Gerald BalbaNo ratings yet

- EXERCISeDocument11 pagesEXERCISeFitz Gerald BalbaNo ratings yet

- 01 Quiz Bee - P1 and TOA (Easy) PDFDocument4 pages01 Quiz Bee - P1 and TOA (Easy) PDFSamNo ratings yet

- Management Advisory ServicesDocument66 pagesManagement Advisory ServicesFitz Gerald BalbaNo ratings yet

- Chapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Document68 pagesChapter 6-Process Costing: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Jose Dula IINo ratings yet

- Microsoft Word - 02 Quiz Bee - P1 and TOA (Average) PDFDocument5 pagesMicrosoft Word - 02 Quiz Bee - P1 and TOA (Average) PDFNora PasaNo ratings yet

- Cost of Merchandise Sold $604,783Document5 pagesCost of Merchandise Sold $604,783Fitz Gerald BalbaNo ratings yet

- Lone Pine Café Statement of Financial Position As of November 2, 2009Document2 pagesLone Pine Café Statement of Financial Position As of November 2, 2009Fitz Gerald BalbaNo ratings yet

- Adbce CostingDocument1 pageAdbce CostingFitz Gerald BalbaNo ratings yet

- Abcde PostDocument1 pageAbcde PostFitz Gerald BalbaNo ratings yet

- Advanced Accounting Baker Test Bank - Chap015Document55 pagesAdvanced Accounting Baker Test Bank - Chap015donkazotey89% (9)

- Fitz Music Company Financial Accounting 2 ReviewDocument5 pagesFitz Music Company Financial Accounting 2 ReviewFitz Gerald BalbaNo ratings yet