Professional Documents

Culture Documents

HT MaRS Survey Indias Best Medical Insurers

Uploaded by

basilmkallungalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HT MaRS Survey Indias Best Medical Insurers

Uploaded by

basilmkallungalCopyright:

Available Formats

14 |

userschoice

INDIAS BEST MEDICAL INSURERS

business |

H I N D U STA N T I M E S , M U M B A I M O N DAY, M A R C H 2 8 , 2 0 1 1

SPECTRE OF UNCERTAINTY The Hindustan Times-MaRS Survey of Indias Best Medical Insurers reveals that overall, customer satisfaction levels arent very high, implying that all companies need to focus more on serving the customer

Arnab Mitra

arnab.mitra@hindustantimes.com

Still room for improvement

Every medical insurer claims it is the best. And the truth is that almost every insurer does offer something that others do not. So, how do you decide which is the best for you? To help you make the choice, we bring you the most definitive answer the Hindustan Times-MaRS Survey of Indias Best Medical Insurers which rated 15 top insurers on customer satisfaction on settlement and satisfaction on customer servicing. The first which included six parameters like claim settlement, TPA responsiveness, speed of service, delivery of promised services, etc., while the second included parameters like ease of product enquiry, levels of transparency, quality and spread of hospital network, attitude of company agents, clarity of diseases covered and excluded, etc. A word of caution will be necessary here. The final results were very close meaning there isnt a lot separating the best from the rest. Our survey shows that Tata AIG and ICICI Lombard are the (joint) highest ranked medical insurers on customer service, while Star Health & Allied Insurance Co. comes out on top in claim settlements. But the leaders dont lead by a lot a few points more on one or two parameters and less on a few others could have altered the results quite dramatically. Another caveat overall, satisfaction levels arent very high, implying that all companies need to focus more on serving the customer. Says Raghu Roy, managing director of MaRS, HTs knowledge partner for this survey: An industry average of 740 (out of a maximum possible score of 1,000) on claim settlement satisfaction is definitely not a great score. And that the highest score by any company is 765, only a few points above the industry average, also suggests that the claim settlement process may never make the customer fully satisfied. This is, perhaps, to be expected. This scenario is repeated in satisfaction with customer servicing. Customers are not happy the industry average is 746 (out of a maximum possible score of 1,000). One fact stands out: that companies do not exhibit high differentials from each other on this measure. An interesting finding is that the industry as a whole seems to be servicing customers better in Bangalore, Lucknow, Kolkata and Mumbai. Respondents in these cities gave the industry scores that are higher than the all-India average, both on customer satisfaction as well as satisfaction with claim settlements. Bangalore is the only city to give scores of more than 800 on both these parameters (respondents gave scores

NEW DELHI: Blame it on advertisements.

Doctors looks on as Dr Ross Crawford (not in picture) operates on a cadaver during a two-day specialised course on Cadaver Hip Arthoplasty at AIIMS in New Delhi. The photograph has been used here for representational purposes, gesturing at the need for insurance players to take a lesson or two in taking caring of their customers. ARIJIT SEN / HT PHOTO

of 811 on customer service and 810 on claim settlement). Obviously, companies arent being able to replicate the Bangalore model elsewhere. This is most obvious in Chennai, Hyderabad, Delhi and Ahmedabad, which gave the industry scores less than the national average. One fact that stands out is that private insurers have stolen a clear march over their public sector counterparts. Except for Delhi, which ranked United India Insurance Co. first, none of the cities ranked any public sector insurer on top. Clearly, every single company has a long way to go.

CUSTOMERS VERDICT: THE BEST COMPANIES

Top 5 companies in claim settlement Top 5 companies in customer service

758

Star Health & Allied

758

752

750

748

764 759

TATA AIG

THE INDUSTRY AS A WHOLE SEEMS TO BE SERVICING CUSTOMERS BETTER IN BANGALORE, LUCKNOW, KOLKATA AND MUMBAI. RESPONDENTS HERE GAVE THE INDUSTRY SCORES HIGHER THAN THE ALL-INDIA AVERAGE.

National Insurance

735

ICICI Lombard

745

748

Reliance Gen Insurance

TATA AIG

ICICI National Reliance Star Health Lombard Insurance Gen & Allied Insurance

GRAPHICS: PRASHANT CHAUDHARY

SAMPLE SIZE: A TOTAL OF 2074 MEDICAL INSURANCE HOLDERS FROM 8 CITIES Higher figure indicates greater satisfaction level

SATISFACTION WITH CUSTOMER SERVICING WAS MEASURED USING 6 DIMENSIONS

What makes National Insurance third best

TIME LAG Experts say that claims settlement takes longer in NIC compared to its competitors

HT Correspondent

letters@hindustantimes.com

A World Bank study claims that 99% of Indians will face financial crunch in case of any critical illness, underlining the need for health insurance. THINKSTOCK

In the HT-MaRS survey, customer satisfaction on customer servicing and interaction was measured using six parameters product enquiry stage, purchase transaction, policy issuance, hospital network, renewal, and transparency. And the public sector National Insurance Company (NIC) ranked third, coming after private sector Tata AIG and ICICI Lombard. There was also that little matter about it being the only state-owned company to feature at all among the top five in terms of customer satisfaction. The survey was carried out among 2074 medical insurance policy holders in eight major cities of India Delhi, Lucknow, Kolkata, Mumbai, Ahmedabad, Chennai, Bangalore and Hyderabad. While industry analysts said that the insurer had resorted to reasonable pricNEW DELHI:

The four state-owned Emphasis has to be on consumer general insurance companies awareness and satisfaction, are looking to engage a third provision of quality health care, party administrator to ensure improved insurance services and that customers are not put through greater collaboration between any major trouble insurers and healthcare providers

NSR CHANDRA PRASAD AMIT MITRA

ing, which went in its favour, insurance sector experts pointed out that claims settlement takes longer in NIC compared to its competitors, which might explain the third position. It takes about one to one-and-a-half months for settlement of claims in NIC, said a leading third party administrator (TPA), on conditions of anonymity. So what can public sector insurers do to get better in the area of customer satisfaction? The four PSU insurers National Insurance Company, New India

Assurance, Oriental Insurance and United India Insurance which together manage about R6,000 crore of health insurance business, complain about being saddled with a commercially unviable claims settlement ratio of 115%. They have to say that the way TPAs function also has a major bearing on customer satisfaction, and forming a common TPA is one way of cutting down on costs. The four state-owned general insurance companies are looking to engage a third party administrator to ensure

that customers are not put through any major trouble especially when we have no health regulator, the process is on track and we hope to have one soon, said NIC chairman and managing director NSR Chandra Prasad. TPAs are intermediaries between patients and insurance firms. Typically stationed at hospitals, TPAs take care of the administrative process of mediclaim policies. This arrangement will provide economies of scale to the four insurers, said Prasad. NIC has set a claim settlement target for 2010-11 at 90%. And as Prasad lets in, We are focused on customer service more than profits and business models. As Amit Mitra, secretary general of industry body Federation of Indian Chambers of Commerce and Industry puts it, The emphasis has to be on consumer awareness and satisfaction, provision of quality health care, improved insurance services and greater collaboration and trust between insurers and healthcare providers.

H I N D U STA N T I M E S , M U M B A I M O N DAY, M A R C H 2 8 , 2 0 1 1

userschoice

INDIAS BEST MEDICAL INSURERS

CUSTOMERS VERDICT: THE DEFINITIVE GUIDE TO THE BEST SERVICE PROVIDERS ACROSS INDIA

Eight cities give their verdict on the best medical insurers

United India Oriental Insurance ICICI Lombard Bharti AXA TATA AIG

business | 15

WHAT HAPPENED In July 2010, PSU insurers stopped cashless treatment alleging over-billing by hospitals

HT Correspondent

letters@hindustantimes.com

Cashless offer helped Tata AIG score

the-cashless-way debate continues to rock the insurance boat, choppy waters notwithstanding, a few insurance firms have managed to ensure steady claim processing for their clients. Tata AIG bagged second place in claim settlement satisfaction, according to a Hindustan Times-MaRS survey of health insurance firms. We had not stopped accepting claims even when the controversy over cashless hospitalisation was on last year, explained Gaurav Garg, managing director, Tata AIG. The impasse over cashless hospitalisation began in July last year when alleging over-billing by hospitals, stateowned general insurance companies withdrew the facility of cashless treatment. Now, this step would have made little difference even in 2006, when the insured revenue was less than 10% of hospital billing. But since then the health insurance market has consistently grown at a 40% CAGR, as stated by the Confederation of Indian Industry report, and naturally the implications are huge. According to the industry average, settlement ratio of the industry is about 65-75% for individual policies and 100% for group insurance policies. Many companies offer group health insurance policies to their employees. Group insurance premium comes at a fraction of individual policies, and dressNEW DELHI: While the to-go-or-not-to-go-

768 746 737 724 722

TATA AIG HDFC Ergo Reliance Gen Insurance National Insurance New India Insurance

820 783 782 779 757

Star Health HDFC Ergo ICICI Lombard TATA AIG Bajaj Alliance

822 784 784 778 759

Bajaj Alliance National Insurance Star Health & Allied United India New India Insurance

723 717 698 694 687

Delhi

Kolkata

Mumbai

Chennai

FOR ALL INSURANCE PLAYERS THE EXPERT ADVICE IS: IRON OUT OUTSTANDING ISSUES BETWEEN HOSPITALS AND INSURANCE FIRMS AND WORK ON BETTER SERVICE DELIVERY

es up the package nicely while being easy on the employers pocket. While an individual policy of a cover of R2 lakh could cost about R3,000 annually for a 30-year old person, a group insurance cover for the same person would barely cost his employer a few hundred rupees. Lately, insurance companies have quietly raised premium rates alleging that hospitals have been inflating bills hurting their bottomlines. Non-life insurance companies have also started charging higher premiums from corporations offering group health insurance to their employees. In the last few months, group insurance premiums have gone up by about 25%. To keep costs under control some companies have already started restructuring health insurance benefits, such as curtailing benefits for dependants, offered to employees. To keep costs in control from this year onwards any cover for additional benefits to dependent parents will have to be borne by the employee, said the human resources director of one of Indias largest information technology companies, who did not wish to be identified. In fact, not being present in group insurance may have helped Tata AIG. Although Garg says, Though we are not present in group insurance at the moment, we may consider entering the segment in wake of the free pricing policy. But for all the insurance players out there, the expert advice seems to be: iron out outstanding issues between hospitals and insurance firms and work on better service delivery and customer satisfaction. Gopal Verma, director, e-Meditek, a third party administrator, says, Insurance firms must work towards having a framework to settle claims within a week to ensure that customers do not have to go through uncertainty. Like they say, healthy, wealthy and wise.

Star Health & Allied ICICI Lombard Reliance Gen Insurance National Insurance Oriental Insurance

842 835 831 828 819

Reliance Gen Insurance United India New India Assurance ICICI Lombard TATA AIG

735 735 713 710 709

HDFC Ergo Reliance Gen Insurance TATA AIG Star Health & Allied Bajaj Alliance

736 729 704 702 677

Star Health & Allied Oriental Insurance New India Assurance United India TATA AIG

870 818 815 794 782

Bangalore Customer satisfaction on interaction at product enquiry level Top 5 companies

ICICI Lombard

Hyderabad Customer satisfaction on interaction at purchase transaction Top 5 companies

Ahmedabad

Lucknow

762

756

756

754

751

760

National Insurance

756

TATA AIG

ICICI Lombard

National Insurance

Star Health & Allied

Reliance Gen Insurance

TATA AIG

754

New India Assurance

752 750

Customer satisfaction during policy issuance Top 5 companies

760

760

758

754

752

ICICIs USP: Speedy disbursement of claims

HT Correspondents

Reliance Gen Insurance

letters@hindustantimes.com

As public sector insurers pow-wowed with hospitals, private sector players made hay. Most of them continued with cashless claims and gained steadily, at least in terms of customer perception. ICICI Lombard was rated the best in the area of customer satisfaction by the HT-Mars survey. We did not discontinue with cashless hospitalisation at any point, said Sanjay Datta, head, customer service, ICICI Lombard. The companys premium from health insurance in 2010-11 was R1,000 crore, an increase of about 20% over the previous fiscal. According to a report by the Comptroller and Auditor General of India, the private sector general insurance players are estimated to garner

NEW DELHI:

health insurance premium of R30,000 crore within 2015, almost thrice the current premium. The same report also suggested that though the health portfolio was growing at a phenomenal rate, PSU insurers were losing their market share to private sector companies. Despite growth in the volume of business PSUs continued to incur losses. And the losses incurred had much to do with the lack of monitoring in group mediclaim policies. What especially seems to have tipped the scales in favour of ICICI Lombard is the speed of settlement seven days in all. Says Datta, We settle claims within a defined period of time and besides, we keep the customer informed about the status of the claim settlement process and naturally our customers want to stay with us.

Star Health & Allied

ICICI Lombard

TATA AIG

New India Assurance

Reliance Gen Insurance

Customer satisfaction on hospital network Top 5 companies

Star Health & Allied

Customer satisfaction on interaction during renewal Top 5 companies

ICICI Lombard

Customer satisfaction on perceived transparency of the companies Top 5 companies

766 763 762 755 754

757 755 750 746 744

TATA AIG

TATA AIG

ICICI Lombard National Insurance Reliance Gen Insurance

Star Health & Allied TATA AIG ICICI Lombard National Insurance Reliance Gen Insurance

756 751 748 741 737

GRAPHIC: PRASHANT CHAUDHARY

National Insurance Bajaj Alliance New India Assurance

Star shines brighest in claim settlement

HT Correspondents

Higher figure indicates greater satisfaction level

letters@hindustantimes.com

NEW DELHI : When it comes to claim settlement, private insurance companies are perceived to be better than their public sector counterparts, reveals the findings of the Hindustan Times-MaRS survey. Respondents to the survey ranked Indias first stand-alone health insurance company, Star Health & Allied Insurance Company, as the best in terms of settlement of mediclaim policies. Health insurance in India covers around 11% of the population, according to the latest Comptroller and Auditor General (CAG) report. But low penetration notwithstanding, health insurance is the most sought after portfolio next only to motor

insurance. And as Gopal Verma, director, eMeditek, a third-party administrator (TPA) points out; stand-alone health insurance companies will play a critical role in the domestic market to increase penetration. Star Health & Allied Insurance Company along with a few other companies have a single window clearance mechanism which reduces the settlement to less than a week, said Verma. Industry experts said that once the regulatory issues including the foreign direct investment (FDI) norms are addressed, several more standalone health insurance companies will foray into India. The Insurance Amendment Bill, that is pending in Rajya Sabha, seeks to enhance the cap on FDI in private insurers from the current 26% to 49%.

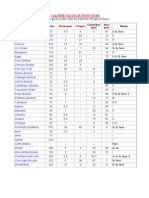

METHODOLOGY

The study was carried out in eight major cities of India Delhi, Lucknow, Kolkata, Mumbai, Ahmedabad, Chennai, Bangalore and Hyderabad. The study team was led by Vishal Ramchandani (vishal@marspvt.net). A total of 2074 medical insurance holders constituted the total sample size across 8 cities for 15 medical insurance companies. The sample spread by the insurance companies are given below. Brand Sample size Apollo Munich 106 Bajaj Allianz 191 Bharti AXA 112 Cholamandalam MS 41 HDFC Ergo 145 ICICI Lombard 198 Max Buppa 23 National Insurance 206 New India Assurance 181 Oriental Insurance 168 Reliance Gen Insurance 174 Royal Sundaram 71 Star Health & Allied 135 TATA AIG 158 United India 165 2074 Customer satisfaction on claim settlement was measured using six attribute parameters contactibility of surveyor/TPA, surveyor/TPA responsiveness, surveyor claim process knowledge, procedure/paperwork for claim settlement, speed of service/time taken in claim settlement, and delivery of promised services in the policy. Customer satisfaction on customer servicing and interaction was carried out using six dimensions product enquiry stage, purchase transaction, policy issuance, hospital network, renewal, and transparency. Weights used for each of the six dimensions to arrive at the aggregate score on customer interaction was: Product enquiry stage 12% Purchase transaction Policy Issuance Hospital Network Renewal Process Transparency 15% 16% 21% 12% 24% answer queries, Speed of service/ transaction. POLICY ISSUANCE Five attributes: Timely receipt of documents, intimation of policy status, speed of service, simplicity of procedure for issue of policy, and attitude of companys agents. NETWORK Two attributes: Hospital network - quality of hospitals, hospital network - number of tie-ups RENEWAL Five attributes: Timely intimation of renewal, timely receipt of renewal notice, ease of renewing the policy, timely renewal, receipt of policy documents, and speed of service. TRANSPARENCY Four attributes: Clarity on diseases covered, clearly stated policy wordings, regular product updates, transparent no claim bonus credits.

Each customer interaction dimension was measured using a 2-6 attribute parameters, for a total of 27 attribute parameters, as given below. PRODUCT ENQUIRY Five attributes: Detailed information provided, specification of documentation, process of purchasing explained, and speed of service. PURCHASE TRANSACTION Six attributes: Ease of purchasing the policy, detailed product information, transparency in transaction, courtesy and politeness, willingness of staff to

You might also like

- Banking Ombudsman Compaint FormDocument2 pagesBanking Ombudsman Compaint FormNeelakanta KallaNo ratings yet

- The Calorie Chart of Indian Food ItemsDocument3 pagesThe Calorie Chart of Indian Food Itemshgopalkrishnan100% (1)

- Term Insurance Ebook by JagoinvestorDocument19 pagesTerm Insurance Ebook by JagoinvestorJackson Dcosta100% (1)

- AN713 - Controller Area Network (CAN) BasicsDocument9 pagesAN713 - Controller Area Network (CAN) BasicsRam Krishan SharmaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case Study V TQMDocument11 pagesCase Study V TQMJelyne PachecoNo ratings yet

- Service QualityDocument21 pagesService QualityAKHIL KMNo ratings yet

- ST10378841 BMNG5122 Test1Document26 pagesST10378841 BMNG5122 Test1asandamkolo1No ratings yet

- The Role of TQM Models in The Sustainable Tourism DevelopmentDocument6 pagesThe Role of TQM Models in The Sustainable Tourism DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 72-Article Text-155-1-10-20191125Document28 pages72-Article Text-155-1-10-20191125Arjun DwiNo ratings yet

- Riyaz Main Project PDFDocument71 pagesRiyaz Main Project PDFATS PROJECT DEPARTMENTNo ratings yet

- Ashwini Chavan HR ProjectDocument67 pagesAshwini Chavan HR ProjectDivyesh100% (1)

- Marketing Research BPMM 3033 Group 6Document13 pagesMarketing Research BPMM 3033 Group 6Yun LauNo ratings yet

- 5 Customer Survey TemplatesDocument8 pages5 Customer Survey Templatesafnan hanafiNo ratings yet

- Siri, Alexa, and Other Digital Assistants: A Study of Customer Satisfaction With Artificial Intelligence ApplicationsDocument59 pagesSiri, Alexa, and Other Digital Assistants: A Study of Customer Satisfaction With Artificial Intelligence Applicationsmanoj kumar DasNo ratings yet

- Raginnath V.G Final DestDocument90 pagesRaginnath V.G Final DestraginnathNo ratings yet

- A Project Report On Marketing Yamaha - Prateek KapilDocument40 pagesA Project Report On Marketing Yamaha - Prateek KapilKshitij Kapil67% (6)

- Evaluating TMMP ServicesDocument18 pagesEvaluating TMMP ServicesAxeliaNo ratings yet

- Ahp Matrix CsiDocument19 pagesAhp Matrix CsiMuhammad RifqiNo ratings yet

- The Effect of Satisfaction, Trust, and Commitmenton Word of Mouth in The Restaurant BusinessDocument10 pagesThe Effect of Satisfaction, Trust, and Commitmenton Word of Mouth in The Restaurant BusinessAJHSSR JournalNo ratings yet

- Impact of Self-Service Technology On Customer SatisfactionDocument5 pagesImpact of Self-Service Technology On Customer SatisfactionFerdinand BernardoNo ratings yet

- Colicev Et Al 2019 IJRMDocument17 pagesColicev Et Al 2019 IJRMdainaNo ratings yet

- The Effect of Trust and Brand Image On Customer Retention With Customer Loyalty As Intervening Variables To Customers of Sharia Commercial Banks.Document13 pagesThe Effect of Trust and Brand Image On Customer Retention With Customer Loyalty As Intervening Variables To Customers of Sharia Commercial Banks.AULIA SU ASTIKA DEWINo ratings yet

- Simón 2Document21 pagesSimón 2Rene AriasNo ratings yet

- CH 1Document13 pagesCH 1fanusNo ratings yet

- Consumer Behavior: Twelfth EditionDocument38 pagesConsumer Behavior: Twelfth EditionSugam AgrawalNo ratings yet

- Customer satisfaction: contrasting academic and consumer viewsDocument10 pagesCustomer satisfaction: contrasting academic and consumer viewsRaluca NicolaeNo ratings yet

- Measuring Quality in Automobile Aftersales: Autoservqual ScaleDocument15 pagesMeasuring Quality in Automobile Aftersales: Autoservqual ScaleChiradeep BhattacharyaNo ratings yet

- Requirements For Implementation: Student - Feedback@sti - EduDocument4 pagesRequirements For Implementation: Student - Feedback@sti - EduCristopher Rico DelgadoNo ratings yet

- MAR3023 Module 4-6 Quizzes Q&ADocument8 pagesMAR3023 Module 4-6 Quizzes Q&Adwinag8100% (5)

- Your Guide To Practical Experience BlueprintingDocument134 pagesYour Guide To Practical Experience BlueprintingNashmil MobasseriNo ratings yet

- MKT202 MBT NSU Chapter 01Document22 pagesMKT202 MBT NSU Chapter 01Shàhríàrõ Dã RàkínskìNo ratings yet

- Assessment - Correlationn and RegressionDocument2 pagesAssessment - Correlationn and RegressionSHARMAINE CORPUZ MIRANDANo ratings yet

- Thomas Hatton Appointed New President and CEO at The MSR GroupDocument2 pagesThomas Hatton Appointed New President and CEO at The MSR GroupPR.comNo ratings yet

- The Official ProdMan Compendium of ThinC, MDI GurgaonDocument84 pagesThe Official ProdMan Compendium of ThinC, MDI GurgaonAniket SinghNo ratings yet