Professional Documents

Culture Documents

Results Tracker 08.11.2013

Uploaded by

Mansukh Investment & Trading SolutionsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Tracker 08.11.2013

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

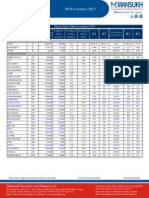

Results Tracker

Q2FY14

Friday,08 November 2013 make more, for sure.

Results to be Declared on 8th November 2013

COMPANIES NAME Aditya Birla Chem Ahlcon Par APM Inds Apollo Finvest Ashiana Hous Ashirwad Steel Asutosh Enter Balmer Lawr BEML Bhilwara Tex Blue Circle BN Rathi Bombay Cycle Cambridge Tech Chambal Fert City Union Bank Coastal Road Comfort Fincap CPEC Crompton Greav Cybertech Sys DB Intl Stock Dion Global Sol Divis Lab Dredging Corp Dunlop India Dynamatic Tech Dynavision Easun Reyrolle Emco Emmessar Bio FARMAX IND Fortune Intl Futuristic Sec GBLINFRA GD Trading GIVO Global Capital Golden Crpt Goldstone Tech Graphite India Great Eastern Sh Gujchem Dist HealthFore Tech IL&FS TRANS IMC Finance Indiaco Vent Indian Bank Indian Hotels Indian Oil Corp Indo-National Insilco JD Orgochem JMD Telefilms JRG Securities Kamadgiri Fashion Karan Woosin KEI Inds KHOOBSURAT Kingfisher Air Kothari Indl Krebs Bio KS Oils Lakshmi Prec Maha Rashtra Maharashtra Poly Mahashree Trad Mangalam Cem Mangalore Chem Manugraph India Marg Max India Mcdowell Hold MOLDTKPACK MSR India Nagarjuna Agrichm National Perox National Plast Inds NDTV Neuland Lab Oxides & Special Panoramic Univ Pilani Invt PNB Ponni Sugar Erod Power Finance Pricol Prism Medico QUEST SOFTEC Rainbow Denim Rajkumar Forge Rama Petro Rander Corp Rashtriya Chem Reliable Vent Repro India RODIUM S&S Power Safari Inds Sainik Finance Santosh Fine SEL Shasun Pharma Shilpi Cable Tech Shivagrico Soma Textiles Southern Gas SREI Infra STL Global Subros Sun TV Network Tamboli Cap Tata Motors Thirumalai Chem Timken India Tyche Inds Uco Bank Uflex United Brew Hldg United Credit United Spirits Uttam Value Valiant Comm Vardhman Tex Veejay Lakshmi Vijay Textiles Vintage Sec Westlife Dev YBRANTDIGI

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Results Tracker

Q2FY14 make more, for sure.

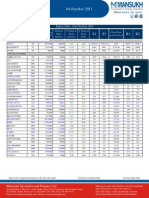

Results Announced on 07th November 2013 (Rs Million)

India Cements

Quarter ended 201309 10937.8 1 1119 751.3 367.7 682.1 -314.4 -89.1 9.6 -225.3 3071.8 10.23 201209 11256.8 1.7 2082.3 666.9 1415.4 698.8 716.6 225.8 -27.5 490.8 3071.8 18.5 % Var -2.83 -41.18 -46.26 12.66 -74.02 -2.39 -143.87 -139.46 -134.91 -145.9 0 -44.69 Year to Date 201309 23345 2.5 3054.6 1750.1 1304.5 1361.6 -57.1 0 0 -57.1 3071.8 13.08 201209 23307.1 2.1 4896.5 1616.3 3080.2 1390.4 1689.8 578.3 -5.3 1111.5 3071.8 21.01 % Var 0.16 19.05 -37.62 8.28 -57.65 -2.07 -103.38 -100 -100 -105.14 0 -37.72 Year ended 201303 46136.2 20.5 8619.5 3077.5 5342 2818.4 2523.6 888.1 51.7 1635.5 3071.8 18.68 201203 42151.9 75 8962.3 2639.6 6322.7 2512.9 3809.8 880.1 502.4 2929.7 3071.8 21.26 % Var 9.45 -72.67 -3.82 16.59 -15.51 12.16 -33.76 0.91 -89.71 -44.18 0 -12.13

Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%)

he revenue declined to Rs. 10937.80 millions for the quarter ended September 2013 as compared to Rs. 11256.80 millions during the orresponding quarter last year.The Net Loss for the quarter ended September 2013 is Rs. -225.30 millions as compared to Net Profit of s. 490.80 millions of corresponding quarter ended September 2012Operating profit for the quarter ended September 2013 decreased to 1119.00 millions as compared to 2082.30 millions of corresponding quarter ended September 2012.

Tech Mahindra

Quarter ended 201309 201209 Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%) 41562.4 143.6 8989.4 234.7 8754.7 0 8754.7 2368.3 0 6386.4 2323.9 21.63 15078.7 40.1 2352.8 196.4 2156.4 413.8 1742.6 141.3 0 1601.3 1276.4 15.6 % Var 175.64 258.1 282.07 19.5 305.99 0 402.39 1576.08 0 298.83 82.07 38.61 Year to Date 201309 77091.2 1756.5 18078.4 406.2 17672.2 1017.2 16655 4279.9 0 12375.1 2323.9 23.45 201209 30028.7 98.3 5108.5 391.4 4717.1 784 3933.1 656.8 0 3276.3 1276.4 17.01 % Var 156.73 1686.88 253.89 3.78 274.64 29.74 323.46 551.63 0 277.72 82.07 37.85 Year ended 201303 60018.9 339.5 10677.4 935.1 9742.3 1570.1 8172.2 1647 0 6525.2 1281.2 17.79 201203 52430.2 677.3 8736 774.3 7283 1505.3 5777.7 1172.1 0 4605.6 1274.9 16.66 % Var 14.47 -49.87 22.22 20.77 33.77 4.3 41.44 40.52 0 41.68 0.49 6.77

The Total revenue for the quarter ended September 2013 of Rs. 41562.40 millions grew by 175.64% from Rs. 15078.70 millions.Net Profit for the quarter ended September 2013 zoomed to 298.83% from Rs. 1601.30 millions to Rs. 6386.40 millions.Operating profit for the uarter ended September 2013 rose to 8989.40 millions as compared to 2352.80 millions of corresponding quarter ended September 2012.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Results Tracker

Q2FY14 make more, for sure.

Data Source : ACE Equity

NAME

Varun Gupta Mohit Taneja

DESIGNATION

Head - Research Research Analyst

E-MAIL

varungupta@moneysukh.com

mohit.t@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

You might also like

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Answers To Second Midterm Summer 2011Document11 pagesAnswers To Second Midterm Summer 2011ds3057No ratings yet

- Petronas Swot AnalysisDocument2 pagesPetronas Swot AnalysisAfiqah Yusoff70% (10)

- Auditor's Cup Questions-2Document8 pagesAuditor's Cup Questions-2VtgNo ratings yet

- BILAX BrochureDocument8 pagesBILAX BrochureJeremy GordonNo ratings yet

- An Overview of SMEDocument3 pagesAn Overview of SMENina HooperNo ratings yet

- Managing Account PortfoliosDocument14 pagesManaging Account PortfoliosDiarra LionelNo ratings yet

- GST Functional BOE Flow Phase2Document48 pagesGST Functional BOE Flow Phase2Krishanu Banerjee89% (9)

- Save The ChildrenDocument2 pagesSave The ChildrenPrakash SinghNo ratings yet

- Digest Fernandez Vs Dela RosaDocument2 pagesDigest Fernandez Vs Dela RosaXing Keet LuNo ratings yet

- Renaming of The Dept. of Geology, Univ. of Kerala.Document6 pagesRenaming of The Dept. of Geology, Univ. of Kerala.DrThrivikramji KythNo ratings yet

- Print Control PageDocument1 pagePrint Control PageCool Friend GksNo ratings yet

- Pocket ClothierDocument30 pagesPocket ClothierBhisma SuryamanggalaNo ratings yet

- Statistic SolutionsDocument53 pagesStatistic SolutionsRahmati Rahmatullah100% (2)

- From Homeless To Multimillionaire: BusinessweekDocument2 pagesFrom Homeless To Multimillionaire: BusinessweekSimply Debt SolutionsNo ratings yet

- Kisan Diwas - 2013Document9 pagesKisan Diwas - 2013sumeetchhabriaNo ratings yet

- EU Languages Day QUIZ2Document2 pagesEU Languages Day QUIZ2Emily2008No ratings yet

- Airline Industry Metrics - MA - Summer 2017Document21 pagesAirline Industry Metrics - MA - Summer 2017Yamna HasanNo ratings yet

- Belgian Ale by Pierre Rajotte (1992)Document182 pagesBelgian Ale by Pierre Rajotte (1992)Ricardo Gonzalez50% (2)

- Chapter 3 - Project SelectionDocument15 pagesChapter 3 - Project SelectionFatin Nabihah100% (2)

- Advanced Accounting Test Bank Questions Chapter 8Document19 pagesAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamNo ratings yet

- Light Activated RelayDocument8 pagesLight Activated RelayAceSpadesNo ratings yet

- International Student GuideDocument56 pagesInternational Student Guidealexcvet90No ratings yet

- Garantias Copikon VenezuelaDocument3 pagesGarantias Copikon VenezuelaMaria SanzNo ratings yet

- Catalog EnglezaDocument16 pagesCatalog EnglezaCosty Trans100% (1)

- Power PSU's in INDIADocument53 pagesPower PSU's in INDIAUjjval JainNo ratings yet

- Valuation of Asset For The Purpose of InsuranceDocument13 pagesValuation of Asset For The Purpose of InsuranceAhmedAli100% (1)

- EFE Matrix For RevlonDocument4 pagesEFE Matrix For RevlonPrateek SinglaNo ratings yet

- Personal Assignment Fraud Audit ReviewDocument8 pagesPersonal Assignment Fraud Audit ReviewNimas KartikaNo ratings yet

- Peace Corps FINANCIAL ASSISTANTDocument1 pagePeace Corps FINANCIAL ASSISTANTAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Chapter 11 Appendix Transfer Pricing in The Integrated Firm: ExercisesDocument7 pagesChapter 11 Appendix Transfer Pricing in The Integrated Firm: ExerciseschrsolvegNo ratings yet