Professional Documents

Culture Documents

Return of Contribution

Uploaded by

SuhailCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Return of Contribution

Uploaded by

SuhailCopyright:

Available Formats

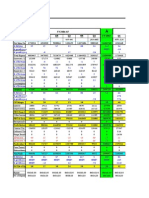

Name & Address of the factory or Establishment Employer's Code No.

Insurance Number 2 No. of days for which wages paid 4 Total amt. of wages paid 5

Swift Securitas Pvt. Ltd., Page 1 of 4 57, Rajdhani Enclave, Pitampura, New Delhi-110034. 22000394330001018

Employees' contribution wages paid 6 Average working & drawing wages Daily with in the insurable wage wages ceiling 7 8 8A

Whether still continues

S NO 1

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50

Name of Incurance Person 3

REMARKS 9

TOTAL(C/F)=

Name & Address of the factory or Establishment Employer's Code No.

Insurance Number No. of days for which wages paid Total amt. of wages paid -

Swift Securitas Pvt. Ltd., Page 2 of 4 57, Rajdhani Enclave, Pitampura, New Delhi-110034. 22000394330001018

Employees' contribution wages paid Average working & drawing wages Daily with in the insurable wage wages ceiling

Whether still continues

S NO

Name of Incurance Person TOTAL(B/D)=

REMARKS

51 52 53 54 55

GRAND TOTAL

*Due Date for submission 12th may/11th November Name of Branch Office

Return of Contribution -Employee' State Insurance Corporation Employer's Code No.

FORM-5

RETURN OF CONTRIBUTIONS

EMPLOYEES' STATE INSURANCE CORPORATION

(Regulation-26)

Name & Address of the factory or Establishment Particulars of the Principal Employer(s) a) Name b) Designation c) Residential Address Contribution Period from to

I furnish below the details of the Employer's and Employee's share of contributions in respect of the under mentioned insured persons. I hereby declare that the return includes each 7 every employee, employed directly or through an immediate employer or in connection with the work of the factory/establishment or any work connected with the administration of the factory/establishment or purchase of raw materials, sale or distribution of finished products etc. to whom the ESI Act,1948 applies. In the contribution period to which this return relates and that the contributions in respect of employer's and employee's share have been correctly paid in accordance with the provisions of the Act and Regulations. Emploees' Share Employer' Share Total Contribution Details of Challans :S. No. Month Date of Challan Amount Name of the Bank and Branch Remarks

1 2 3 4 5 6

SBI, SHAKURPUR, DELHI.

G. Total

Total amount paid Rs.

0

0

Page 3 of 4

*Due Date for submission 12th may/11th November

I declare that a) b) c) d) e) f) g)

Return of Contribution -Employee' State Insurance Corporation

FORM-5

All the records and Registers have been maintained as per provision contained in ESI Act, Rules & Regulation fromed therein. During the period of return During the above period During the above period During the above period During the above period During the above period No. of declaration forms have been submitted. No. of TICs have been received No. of PICs have been received No. of TICs have been distributed amoung the elifible Ips. accidents have been reported to the concerned Branch Office. No. of employee direcltly employed by us have been covered and a total wages of have been paid to such employees.

Rs.

h)

During the period No. of employees directly employed by us have not been covered and a total wages of Rs. paid to such employees.

have been

i)

During the period wages of Rs.

No. of employees employed through immediate employer have been covered and a total have been paid to such employees No. of employees employed through immediate employer have not been covered and a total have been paid to such employees

j)

During the period wages of Rs.

k) 1 2 3 4 5 l) 1 2 3 4 5

Following components of wages have been tasken into consideration for the purpose of payment of contribution.

Following components of wages have not been tasken into consideration for the purpose of payment of contribution.

The above mentioned information is based on records and any information if found incorrect will render me liable for presecutions under provision of ESI Act and action for recovery of contribution due along with interest and damages as per provisions of the ESI Act.

Place Date

Signature & Degignation of the Employer (With Rubber Stamp)

CERTIFICATE BY CHARTERED ACCOUNTANT

(To be submitted in case of employers employing 40 of more employees)

Certified that I have verified the above return from the records &* Registers of M/S.

and found it to be correct.

Signature & Seal of the Chartered Accountant with Membership No. Important instructions : Information to be given in "Remarks Column(No.9)" I) II) III) IV) V) VI) VII) If any I.P. is appointed for the first time and / or leaves during the contribution period indicate "A.date" and/or "Ldate". Please indicate Insurance Nos. in asvending order. Figures in Column 4,5 &6 shall be in respect of wage periods ended during the contribution period. Invariably strike totals of Column 4,5 & 6 of the return. No overwritting shall be made. Any corrections, if made, should be signed by the employer. Every page of this Return hould bear full signature and rubber stamp of the employer. Daily wages in Column 7 of the return shall be calculation by dividing figures in column 5 by figures in column to two decimal places.

For * CP ending 31st March, due date is 12th May For * CP ending 30th September, due date is 11th November

Page 4 of 4

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MIS Financials FormatDocument23 pagesMIS Financials FormatTango BoxNo ratings yet

- Freeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingDocument24 pagesFreeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingRockyNo ratings yet

- Hamlet's Seven Soliloquies AnalyzedDocument3 pagesHamlet's Seven Soliloquies Analyzedaamir.saeedNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- FS2 Learning Experience 1Document11 pagesFS2 Learning Experience 1Jona May BastidaNo ratings yet

- CPG FMCG Food Benchmark StudyDocument94 pagesCPG FMCG Food Benchmark StudySuhailNo ratings yet

- Swedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismDocument9 pagesSwedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismPorfirio MoriNo ratings yet

- Office of The Court Administrator v. de GuzmanDocument7 pagesOffice of The Court Administrator v. de GuzmanJon Joshua FalconeNo ratings yet

- The Magic Limits in Harry PotterDocument14 pagesThe Magic Limits in Harry Potterdanacream100% (1)

- Badur Travel: Daily Sales ReportDocument5 pagesBadur Travel: Daily Sales ReportSuhailNo ratings yet

- CF Statement (Aurobindo Pharma)Document18 pagesCF Statement (Aurobindo Pharma)SuhailNo ratings yet

- TATA Steel Limited (Overview)Document4 pagesTATA Steel Limited (Overview)SuhailNo ratings yet

- Bal Sheet (Aurobindo Pharma)Document2 pagesBal Sheet (Aurobindo Pharma)SuhailNo ratings yet

- Child Labour in Bangladesh: Key StatisticsDocument7 pagesChild Labour in Bangladesh: Key StatisticsSuhailNo ratings yet

- Presentation (Aurobindo Pharma)Document20 pagesPresentation (Aurobindo Pharma)SuhailNo ratings yet

- Income (Gail)Document8 pagesIncome (Gail)SuhailNo ratings yet

- Valuation (Gail)Document4 pagesValuation (Gail)SuhailNo ratings yet

- Aurobindo Pharma Company Overview and Financial AnalysisDocument14 pagesAurobindo Pharma Company Overview and Financial AnalysisSuhailNo ratings yet

- Bal Sheet (Gail)Document4 pagesBal Sheet (Gail)SuhailNo ratings yet

- P&L Consolidated (Aurobindo Pharma)Document10 pagesP&L Consolidated (Aurobindo Pharma)SuhailNo ratings yet

- Debt Schedule (Gail)Document1 pageDebt Schedule (Gail)SuhailNo ratings yet

- India Ltd. Ratio Analysis 2005-2013Document2 pagesIndia Ltd. Ratio Analysis 2005-2013SuhailNo ratings yet

- Cash Flow Statement (Gail)Document1 pageCash Flow Statement (Gail)SuhailNo ratings yet

- Price ListDocument3 pagesPrice ListSuhailNo ratings yet

- Sales Analysis SampleDocument14 pagesSales Analysis SampleSuhailNo ratings yet

- Daily ReportDocument3 pagesDaily ReportSuhail100% (1)

- XL 0000011Document546 pagesXL 0000011SuhailNo ratings yet

- Gap HistDocument111 pagesGap HistSuhailNo ratings yet

- MIRIK HEALTHFOODS MONTHLY SALES REPORTDocument2 pagesMIRIK HEALTHFOODS MONTHLY SALES REPORTSuhailNo ratings yet

- PP IndexDocument15 pagesPP IndexSuhailNo ratings yet

- 420C14Document38 pages420C14Suhail100% (1)

- Sales Rep Incentive Plan WorksheetDocument2 pagesSales Rep Incentive Plan WorksheetSuhailNo ratings yet

- BreakevenDocument6 pagesBreakevenKhan MuhammadNo ratings yet

- Maximizing Profit with Excel Solver: A Quick TourDocument15 pagesMaximizing Profit with Excel Solver: A Quick TourJune V. ObleaNo ratings yet

- Total Supply Chain Management Cost Data CollectionDocument4 pagesTotal Supply Chain Management Cost Data CollectionSuhailNo ratings yet

- Marlin Processing 12 April Batch 11Document13 pagesMarlin Processing 12 April Batch 11SuhailNo ratings yet

- Inver Powderpaint SpecirficationsDocument2 pagesInver Powderpaint SpecirficationsArun PadmanabhanNo ratings yet

- Vipinesh M K: Career ObjectiveDocument4 pagesVipinesh M K: Career ObjectiveJoseph AugustineNo ratings yet

- Government of Telangana Office of The Director of Public Health and Family WelfareDocument14 pagesGovernment of Telangana Office of The Director of Public Health and Family WelfareSidhu SidhNo ratings yet

- Syllabus Sibos CLTDocument5 pagesSyllabus Sibos CLTgopimicroNo ratings yet

- 100 Bedded Hospital at Jadcherla: Load CalculationsDocument3 pages100 Bedded Hospital at Jadcherla: Load Calculationskiran raghukiranNo ratings yet

- Transpetro V 5 PDFDocument135 pagesTranspetro V 5 PDFadityamduttaNo ratings yet

- Intentional Replantation TechniquesDocument8 pagesIntentional Replantation Techniquessoho1303No ratings yet

- Syllabus For The Post of ASI - Traffic - WardensDocument2 pagesSyllabus For The Post of ASI - Traffic - WardensUbaid KhanNo ratings yet

- Elliptic FunctionsDocument66 pagesElliptic FunctionsNshuti Rene FabriceNo ratings yet

- Senior Civil Structure Designer S3DDocument7 pagesSenior Civil Structure Designer S3DMohammed ObaidullahNo ratings yet

- Sustainable Marketing and Consumers Preferences in Tourism 2167Document5 pagesSustainable Marketing and Consumers Preferences in Tourism 2167DanielNo ratings yet

- Present Tense Simple (Exercises) : Do They Phone Their Friends?Document6 pagesPresent Tense Simple (Exercises) : Do They Phone Their Friends?Daniela DandeaNo ratings yet

- Iso 30302 2022Document13 pagesIso 30302 2022Amr Mohamed ElbhrawyNo ratings yet

- Experiment No. 11 Fabricating Concrete Specimen For Tests: Referenced StandardDocument5 pagesExperiment No. 11 Fabricating Concrete Specimen For Tests: Referenced StandardRenNo ratings yet

- The Secret Path Lesson 2Document22 pagesThe Secret Path Lesson 2Jacky SoNo ratings yet

- Gambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiDocument6 pagesGambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiPRADNJA SURYA PARAMITHANo ratings yet

- Adorno - Questions On Intellectual EmigrationDocument6 pagesAdorno - Questions On Intellectual EmigrationjimmyroseNo ratings yet

- MEE2041 Vehicle Body EngineeringDocument2 pagesMEE2041 Vehicle Body Engineeringdude_udit321771No ratings yet

- Batman Vs Riddler RiddlesDocument3 pagesBatman Vs Riddler RiddlesRoy Lustre AgbonNo ratings yet

- Learners' Activity Sheets: Homeroom Guidance 7 Quarter 3 - Week 1 My Duties For Myself and For OthersDocument9 pagesLearners' Activity Sheets: Homeroom Guidance 7 Quarter 3 - Week 1 My Duties For Myself and For OthersEdelyn BuhaweNo ratings yet

- Unit 9Document3 pagesUnit 9Janna Rick100% (1)

- Computer Conferencing and Content AnalysisDocument22 pagesComputer Conferencing and Content AnalysisCarina Mariel GrisolíaNo ratings yet

- Spelling Errors Worksheet 4 - EditableDocument2 pagesSpelling Errors Worksheet 4 - EditableSGillespieNo ratings yet

- Verbos Regulares e IrregularesDocument8 pagesVerbos Regulares e IrregularesJerson DiazNo ratings yet