Professional Documents

Culture Documents

CIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988

Uploaded by

piptipaybOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988

Uploaded by

piptipaybCopyright:

Available Formats

CIR v Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988 FACTS: Algue, Inc.

, a domestic corporation engaged in engineering, construction and other allied activities. Philippine Sugar Estate Development Company had earlier appointed Algue as its agent, authorizing it to sell its land, factories and oil manufacturing process. [There was a sale for which] Algue received as agent a commission of P126,000.00, and it was from this commission that the P75,000.00 promotional fees were paid to the aforenamed individuals. The payees duly reported their respective shares of the fees in their income tax returns and paid the corresponding taxes thereon, and there was no distribution of dividends was involved. [Algue claimed the 75,000 to be deductible from their tax, to which the CIR disallowed.] ISSUE: Whether or not the Collector of Internal Revenue correctly disallowed the P75,000.00 deduction claimed by private respondent Algue as legitimate business expenses in its income tax returns. HELD: NO CIR is not correct. The burden is on the taxpayer to prove the validity of the claimed deduction. In the present case, however, we find that the onus has been discharged satisfactorily. The private respondent has proved that the payment of the fees was necessary and reasonable in the light of the efforts exerted by the payees in inducing investors and prominent businessmen to venture in an experimental enterprise and involve themselves in a new business requiring millions of pesos. This was no mean feat and should be, as it was, sufficiently recompensed. Taxes are the lifeblood of the government and so should be collected without unnecessary hindrance. On the other hand, such collection should be made in accordance with law as any arbitrariness will negate the very reason for government itself. It is therefore necessary to reconcile the apparently conflicting interests of the authorities and the taxpayers so that the real purpose of taxation, which is the promotion of the common good, may be achieved. It is said that taxes are what we pay for civilization society. Without taxes, the government would be paralyzed for lack of the motive power to activate and operate it. Hence, despite the natural reluctance to surrender part of one's hard earned income to the taxing authorities, every person who is able to must contribute his share in the running of the government. The government for its part, is expected to respond in the form of tangible and intangible benefits intended to improve the lives of the people and enhance their moral and material values. This symbiotic relationship is the rationale of taxation and should dispel the erroneous notion that it is an arbitrary method of exaction by those in the seat of power. But even as we concede the inevitability and indispensability of taxation, it is a requirement in all democratic regimes that it be exercised reasonably and in accordance with the prescribed procedure. If it is not, then the taxpayer has a right to complain and the courts will then come to his succor. For all the awesome power of the tax collector, he may still be stopped in his tracks if the taxpayer can demonstrate, as it has here, that the law has not been observed.

You might also like

- VAT CasesDocument57 pagesVAT CasesGerald RoxasNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- CIR Vs CA GR 125355Document6 pagesCIR Vs CA GR 125355Melo Ponce de LeonNo ratings yet

- Tax Remedies: Bacc 2 Income Taxation Franklin D. Lopez, CpaDocument4 pagesTax Remedies: Bacc 2 Income Taxation Franklin D. Lopez, CpaJaeun SooNo ratings yet

- CIR vs. AlgueDocument2 pagesCIR vs. AlgueJayson AbabaNo ratings yet

- DENREU Vs Secretary Florencio B AbadDocument68 pagesDENREU Vs Secretary Florencio B AbadRica Corsica LazanaNo ratings yet

- JURISDICTION - Inding Vs SandiganbayanDocument1 pageJURISDICTION - Inding Vs SandiganbayanEdrich John100% (1)

- Preliminary Assessment Notice and Final Assessment NoticeDocument5 pagesPreliminary Assessment Notice and Final Assessment NoticeGuiltyCrown0% (1)

- A Short Case Study On The Ten Principles of EconomicsDocument8 pagesA Short Case Study On The Ten Principles of EconomicsRaunak ThakerNo ratings yet

- Cir Vs HendersonDocument3 pagesCir Vs Hendersoneunicesaavedra11No ratings yet

- Case 23 - Basco Vs PagcorDocument1 pageCase 23 - Basco Vs PagcorMadame VeeNo ratings yet

- Just compensation reckoning dateDocument1 pageJust compensation reckoning datepiptipaybNo ratings yet

- Atp Cases 2021Document77 pagesAtp Cases 2021Meku DigeNo ratings yet

- Train Law 2018Document55 pagesTrain Law 2018Mira Mendoza100% (1)

- Villanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.Document5 pagesVillanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.billy joe andresNo ratings yet

- LTO v. City of ButuanDocument2 pagesLTO v. City of Butuan8111 aaa 1118No ratings yet

- PAL v. EduDocument2 pagesPAL v. EduJoan Eunise FernandezNo ratings yet

- Calalang v. LorenzoDocument1 pageCalalang v. LorenzoJay-ar Rivera BadulisNo ratings yet

- Rights of Shareholders Case DigestsDocument27 pagesRights of Shareholders Case DigestsMykee NavalNo ratings yet

- 3admin - 9Document4 pages3admin - 9JMXNo ratings yet

- 4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Document6 pages4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Charles Mateo100% (3)

- Cir v. John Gotamco - SonsDocument2 pagesCir v. John Gotamco - SonsLEIGH TARITZ GANANCIALNo ratings yet

- Deutsche Bank vs. CirDocument1 pageDeutsche Bank vs. CirDee WhyNo ratings yet

- Reynaldo R. San Juan Vs CSC, DBM, Cecilia Almajose GR No. 92299, April 19, 1991Document3 pagesReynaldo R. San Juan Vs CSC, DBM, Cecilia Almajose GR No. 92299, April 19, 1991Joan PabloNo ratings yet

- Estate Tax Accrual and Payment ObligationDocument6 pagesEstate Tax Accrual and Payment ObligationAngelie ManingasNo ratings yet

- CIR Vs CA Power of CIR PDFDocument6 pagesCIR Vs CA Power of CIR PDFLouise Nicole Alcoba100% (1)

- Lina v. Paño (G.R. No. 129093)Document1 pageLina v. Paño (G.R. No. 129093)Joan PabloNo ratings yet

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Document2 pagesDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Kent UgaldeNo ratings yet

- CIR Vs Isabela Cultural CorporationDocument2 pagesCIR Vs Isabela Cultural CorporationLauren KeiNo ratings yet

- I. INTRODUCTION - Concepts and Principles A. Public Office and Public Officers 1) DefinitionsDocument10 pagesI. INTRODUCTION - Concepts and Principles A. Public Office and Public Officers 1) DefinitionsLara Michelle Sanday BinudinNo ratings yet

- Guingona, Jr. vs. City Fiscal of Manila: VOL. 137, JULY 18, 1985 597Document34 pagesGuingona, Jr. vs. City Fiscal of Manila: VOL. 137, JULY 18, 1985 597Christian LucasNo ratings yet

- PNB v. Agudelo, 58 Phil. 655Document32 pagesPNB v. Agudelo, 58 Phil. 655Eve Salt100% (1)

- 140-French Oil Mills Machinery Co., Inc. vs. CA 295 Scra 462 (1998)Document3 pages140-French Oil Mills Machinery Co., Inc. vs. CA 295 Scra 462 (1998)Jopan SJNo ratings yet

- Air Canada Tax Ruling on Philippine SalesDocument2 pagesAir Canada Tax Ruling on Philippine SalesNikita BayotNo ratings yet

- Home Guaranty Corp. v. R-11 Builders Inc., 22 June 2011Document2 pagesHome Guaranty Corp. v. R-11 Builders Inc., 22 June 2011Mark Alvin DelizoNo ratings yet

- Taxation CasesDocument87 pagesTaxation CasesDazzle DuterteNo ratings yet

- Hilton Hotel PDFDocument1 pageHilton Hotel PDFTadas KubiliusNo ratings yet

- G.R. No. L-50466 May 31, 1982 CALTEX (PHILIPPINES) INC., Petitioner, Central Board of Assessment Appeals and City Assessor of PASAY, RespondentsDocument1 pageG.R. No. L-50466 May 31, 1982 CALTEX (PHILIPPINES) INC., Petitioner, Central Board of Assessment Appeals and City Assessor of PASAY, RespondentsLorenzo HammerNo ratings yet

- 027-Lutz v. Araneta, 98 Phil 148Document3 pages027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- G.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestDocument1 pageG.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestKTNo ratings yet

- Pepsi Vs TanauanDocument2 pagesPepsi Vs TanauanRobert QuiambaoNo ratings yet

- CIR v. CTA and PetronDocument15 pagesCIR v. CTA and PetronJennylyn Biltz AlbanoNo ratings yet

- 19-Mondano Vs Silvosa 97 Phil 143Document3 pages19-Mondano Vs Silvosa 97 Phil 143enan_intonNo ratings yet

- B. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Document2 pagesB. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Rhenee Rose Reas SugboNo ratings yet

- Valenton Vs MurcianoDocument2 pagesValenton Vs MurcianoowenNo ratings yet

- Ivler V Judge San Pedro GR No 172716 11172010Document14 pagesIvler V Judge San Pedro GR No 172716 11172010Ubeng Juan Dela VegaNo ratings yet

- 63) Tuazon v. Orosco, 5 Phil 596Document4 pages63) Tuazon v. Orosco, 5 Phil 596Micho DiezNo ratings yet

- 10 Zamora v. Heirs of Carmen IzquierdoDocument12 pages10 Zamora v. Heirs of Carmen IzquierdoJaypoll DiazNo ratings yet

- Tax Deduction Allowed for Promotional Fees Paid by Agent in Property Sale GR No. L-28896Document4 pagesTax Deduction Allowed for Promotional Fees Paid by Agent in Property Sale GR No. L-28896Katrine Olga Ramones-CastilloNo ratings yet

- 10-Acting Commissioner of Customs vs. Manila Electric Company 77 SCRA 469, G.R. No. L-23623Document3 pages10-Acting Commissioner of Customs vs. Manila Electric Company 77 SCRA 469, G.R. No. L-23623Tin CaddauanNo ratings yet

- Escarda vs. ManaloDocument2 pagesEscarda vs. ManaloKatrina MontesNo ratings yet

- CIR Vs MarubeniDocument3 pagesCIR Vs MarubeniendpointNo ratings yet

- City of Manila v. Coca-Cola BottlersDocument17 pagesCity of Manila v. Coca-Cola BottlersRo CheNo ratings yet

- Refined Digest PILDocument9 pagesRefined Digest PILptbattungNo ratings yet

- Yamane v. BA Lepanto Condo Corp.Document1 pageYamane v. BA Lepanto Condo Corp.Secret SecretNo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs MacaraigcqpascuaNo ratings yet

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADocument2 pagesBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloNo ratings yet

- Association of Customs Brokers, Inc. v. Municipal Board, City of Manila, 93 Phil. 107Document5 pagesAssociation of Customs Brokers, Inc. v. Municipal Board, City of Manila, 93 Phil. 107Randy LorenzanaNo ratings yet

- Four siblings not liable as partnershipDocument4 pagesFour siblings not liable as partnershipKrister VallenteNo ratings yet

- Presentation1 - ConflictsDocument19 pagesPresentation1 - ConflictsJohn Henry NagaNo ratings yet

- Camarines Norte Electric Cooperative Vs TorresDocument8 pagesCamarines Norte Electric Cooperative Vs TorresTats YumulNo ratings yet

- 18 Manila Electric Company vs. Province of LagunaDocument7 pages18 Manila Electric Company vs. Province of Lagunashlm bNo ratings yet

- Asuncion v. de YriarteDocument4 pagesAsuncion v. de YriarteClement del RosarioNo ratings yet

- No law impairing contractsDocument9 pagesNo law impairing contractsKleyr De Casa AlbeteNo ratings yet

- CIR Vs Algue, Inc.Document1 pageCIR Vs Algue, Inc.AngelNo ratings yet

- Commissioner VS AlgueDocument2 pagesCommissioner VS AlguebelleferiesebelsaNo ratings yet

- New Microsoft Word DocumentDocument9 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- Ra 8799Document45 pagesRa 8799Colleen Rose GuanteroNo ratings yet

- Congress To Conduct Recount To Determine PCOS AccuracyDocument3 pagesCongress To Conduct Recount To Determine PCOS AccuracypiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- Bar Matter 180Document2 pagesBar Matter 180tagacapizNo ratings yet

- New Microsoft Word DocumentDocument11 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- Specpro Cases 3-9-15Document48 pagesSpecpro Cases 3-9-15piptipaybNo ratings yet

- Conflicts Cases 3-7-15Document53 pagesConflicts Cases 3-7-15piptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- Claims Under The Labor Code For Compensation and Under The Social Security Law For Benefits Are Not The Same As To Their Nature and PurposeDocument1 pageClaims Under The Labor Code For Compensation and Under The Social Security Law For Benefits Are Not The Same As To Their Nature and PurposepiptipaybNo ratings yet

- Claims Under The Labor Code For Compensation and Under The Social Security Law For Benefits Are Not The Same As To Their Nature and PurposeDocument1 pageClaims Under The Labor Code For Compensation and Under The Social Security Law For Benefits Are Not The Same As To Their Nature and PurposepiptipaybNo ratings yet

- United Philippine Lines, Inc. And/Or Holland America Line, Inc. V. Francisco Beseril 487 SCRA 248 (2006), THIRD DIVISION (Carpio Morales, J.)Document1 pageUnited Philippine Lines, Inc. And/Or Holland America Line, Inc. V. Francisco Beseril 487 SCRA 248 (2006), THIRD DIVISION (Carpio Morales, J.)piptipaybNo ratings yet

- Discussion I. Gaps in Laws Relating To Child Internet Pornography Addressed by Republic Act 9775, Otherwise Known As The Anti-Child Pornography Act of 2009Document7 pagesDiscussion I. Gaps in Laws Relating To Child Internet Pornography Addressed by Republic Act 9775, Otherwise Known As The Anti-Child Pornography Act of 2009piptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- Seafarer resignation disputeDocument1 pageSeafarer resignation disputepiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument26 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentpiptipaybNo ratings yet

- Alabang Country Club terminates food department due to lossesDocument1 pageAlabang Country Club terminates food department due to lossespiptipaybNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentpiptipaybNo ratings yet

- Special Topics & Updates TaxationDocument7 pagesSpecial Topics & Updates TaxationMhadzBornalesMpNo ratings yet

- IGive Information FlyerDocument2 pagesIGive Information FlyeraaaaNo ratings yet

- Charity Membership Form TemplateDocument2 pagesCharity Membership Form TemplateLIJITH KUMARNo ratings yet

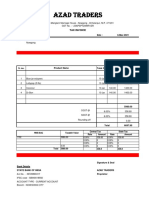

- Invoice 26Document2 pagesInvoice 26asim khanNo ratings yet

- Aag - Sspofadv 10Document1 pageAag - Sspofadv 10Ismail ShabbirNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Chapter 16 Homework SolutionsDocument6 pagesChapter 16 Homework SolutionsJackNo ratings yet

- Your 2022 Budget HighlightsDocument2 pagesYour 2022 Budget HighlightsCityPressNo ratings yet

- Bhupendar 02 AprDocument1 pageBhupendar 02 AprVikram JoshiNo ratings yet

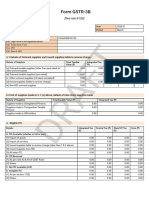

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )Pabitra Kumar PrustyNo ratings yet

- MEPCO ONLINE BILL DETAILS FOR M/S DEODAR (PVT) LTD INCLUDING ELECTRICITY USAGE AND APPLICABLE CHARGESDocument1 pageMEPCO ONLINE BILL DETAILS FOR M/S DEODAR (PVT) LTD INCLUDING ELECTRICITY USAGE AND APPLICABLE CHARGESWaris Corp.No ratings yet

- Taxation 2006Document3 pagesTaxation 2006Lenard TrinidadNo ratings yet

- Welcome To Admin - Staff PageDocument2 pagesWelcome To Admin - Staff PageDominic Isaac AcelajadoNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Philippine Certificate of Compensation FormDocument1 pagePhilippine Certificate of Compensation Formregin pioNo ratings yet

- Mepco Online BillDocument1 pageMepco Online BillFahad ShabbirNo ratings yet

- Taxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireDocument5 pagesTaxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireParkEdJopNo ratings yet

- Chapter 2 Problems and SolutionsDocument4 pagesChapter 2 Problems and SolutionsEstonilo, Monica BenesaNo ratings yet

- Calculating partnership profit and loss distributionDocument5 pagesCalculating partnership profit and loss distributionJerickho JNo ratings yet

- AMAN BILL & Invoice FormatDocument27 pagesAMAN BILL & Invoice FormatManpreet SachdevaNo ratings yet

- MCQ INCOME TAXATION Chapter 13Document14 pagesMCQ INCOME TAXATION Chapter 13Lindbergh Sy0% (1)

- Steps On How To Register Your Laundry BusinessDocument1 pageSteps On How To Register Your Laundry BusinessJoseph GutierrezNo ratings yet

- BIR RMO No. 6-2021Document5 pagesBIR RMO No. 6-2021Earl PatrickNo ratings yet

- Tuition Fee ThreatsDocument2 pagesTuition Fee ThreatsEira ShaneNo ratings yet

- Chapter 6 Introduction To The Value Added TaxDocument27 pagesChapter 6 Introduction To The Value Added TaxJoanna Louisa GabawanNo ratings yet