Professional Documents

Culture Documents

An Overview of The Financial System and The Role of Financial Institutions

Uploaded by

AAUMCLOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Overview of The Financial System and The Role of Financial Institutions

Uploaded by

AAUMCLCopyright:

Available Formats

An overview of the financial system and the role of financial institutions

A. Three Goals of the Financial System I. The first goal of the financial system (FS) is to facilitate the flow of funds from savers (entities with a surplus of funds) to investors (entities with a deficit of funds). Before going any further, we need to first remember the distinction between real assets and financial assets. A real asset is an entity that generates a flow of goods or services over time. Examples include land, people, factories, inventions, business plans, goodwill with consumers, reputation. Anything that generates a flow of goods or services counts. Key point: real assets need not be tangible. A financial asset is a legal contract that gives its owner a claim to payments, usually generated by a real asset. Examples include currency ($), stocks, bonds, bank deposit, bank loans, options, futures, etc. Ultimate investors sell financial assets to savers; they use the proceeds to buy real assets (buying real assets is the same thing as investment). Sometimes people sell financial assets to finance consumption too! Given this first role, the FS is the place where savers (or, more generally, economic agents with a surplus of funds relative to their immediate need for those funds) meet investors (or, more generally, economic agents with a deficit of funds relative to their immediate need for those funds). The financial system channels funds from savers to investors. In equilibrium, savings = investment. (This equation has to be true globally but not for individual countries. For example, in the US savings < investment because foreigners are financing a chunk of US investment. Thats what a trade deficit implies.) Important aside: the term investors is often used loosely, and we will often use the term loosely in this class. When a firm builds a factory or when a person buys a house, that is investment. When a person buys stock, that is, strictly speaking, savings. However, the purchase of a share of stock is commonly called investment, and stockholders are called investors.

Page 1 of 15

Agents can invest using their own funds, using indirect finance, or using direct finance. When agents invest out of their own funds (i.e. by spending past accumulated savings), they bypass the FS entirely (although they usually use the FS while savings are accumulated). When agents use indirect finance, funds come from a financial intermediary, which are then invested (or spent on consumption goods). A financial intermediary is a firm that pools the savings of many agents and then passes those funds through to agents that want to invest them. The intermediary is the middleman, not the ultimate source of funds! When an agent uses direct finance, funds are provided to the investors directly, without the use of an intermediary. For example, firms sometimes sell shares of stock directly to the public in an IPO. Flow of funds through the FS: Indirect Finance

Financial Intermediaries

Funds

Funds

Lender-Savers: 1. Households 2. Firms 3. Government

Funds

Financial Markets

Funds

Borrower-Investors: 1. Firms 2. Government 3. Households

Direct Finance

Page 2 of 15

II. The second goal of the FS is to allow economic agents to share risks. There are many risks that have very high costs but low likelihood of occurring such as hurricanes, early death, failure of a business (maybe these are not so rare!), collapse of the WTC. Risk averse people prefer to share these risks rather than bear them alone. Question: How does the FS allow agents to share these risks?

III. The third main goal of the FS is to generate liquidity. There are two notions of liquidity, both of which are important. The market liquidity of an asset (real or financial) is the ease with which it may be traded. Here are the key characteristics of a liquid assets: Standardized Value is well understood by all Many potential buyers and sellers Question: Rank the following financial assets by their liquidity: Share of IBM Bond issued by IBM Loan from Citibank to a small business Your car Your house Intermediaries such as brokers and dealers enhance market liquidity. The second notion of liquidity, funding liquidity, is the ability of an entity to come up with cash on short notice. For example, a firm holding cash on its balance sheet, or a person with cash in their wallet, has a high degree of funding liquidity. Firms and households need funding liquidity to have the option to make investments on short notice. The financial system supplies this liquidity with currency (government supplied), demand deposits (supplied by banks) & lines of credit (also mainly supplied by banks). This course is about the role that financial services firms (FSF) play in allowing the financial system to achieve its three goals, and how FSFs make a profit filling this role.

Page 3 of 15

B. Financial Contracting To facilitate flows of funds from savers to investors, the financial system creates financial assets. Financial assets are merely legal contracts between suppliers of funds (savers) and users of funds (investors). These contracts specify the cash flow rights and control rights of the supplier and user of funds. The art of the deal, at least in finance, is knowing how to write these financial contracts efficiently and, of course, how to value them. Question: What is the relationship between cash flow rights and control rights? To get a start toward an answer, think about the difference between these two dimensions for common stock and debt. A question that will arise often in the course: Why do financial contracts look the way they do? And, how do FSF make money writing and efficiently enforcing financial contracts. The answer comes from three key costs of financial contracting. I. Transactions costs It would be prohibitively expensive for large firms to raise enough funds to finance their investments if they had to contract individually with thousands of people. Instead, transactions costs are minimized by hiring an FSF. Example: Investment banks help reduce the need for large firms to contract with their many owners by writing a standard contract (e.g. a share of stock) and then marketing those standardized contracts on behalf of that large firm. Innovative ways to lower transaction costs can generate profits. Example: Internet IPOs auctions may threaten the old-style, relationship-based investment banking approach of book-building. Another example, which we will study later, is Prosper.com, and online lending company that brings savers and investors together without a bank in the middle. II. Adverse Selection Preliminary concept: When one party to a financial transaction has better knowledge than the other, there is asymmetric information. Adverse Selection tends to occur whenever there is asymmetric information. Adverse selection occurs when seller of a financial asset knows more than the buyer. Under these conditions, the seller will try to sell low quality assets and hold high quality ones. Questions for discussion: How does adverse selection affect life insurance, lending, and securities trading? One obvious solution to adverse selection problem: eliminate the asymmetric information.

Page 4 of 15

Question: How do FSFs solve adverse selection problems in life insurance, lending, and securities trading? Innovative ways to reduce adverse selection generate profits. For example, insurance companies use credit scores to price auto insurance. III. Moral hazard Moral hazard is the risk that one party to a financial contract may have a strong monetary incentive to break that contract because they can conceal their actions (again, asymmetric information can worsen moral hazard problem). Solutions to moral hazard problems include monitoring to restrict bad behavior and contracting devices designed to minimize the incentives to chisel. Examples of monitoring: covenants, board of directors Examples of contractual schemes to improve incentives: co-payments and deductibles, collateral and limits on leverage. (Question for sports enthusiasts: Why do you think baseball contracts are guaranteed, whereas football contracts are not? Hint: Which sport suffers from the greater moral hazard problem?) Question: What is the moral hazard problem that occurs when you buy fire insurance? What about when you borrow money? How do FSFs deal with the problem? Innovative ways to reduce moral hazard can generate profits. Example: auto loans in which the borrowers ability to drive the car depends on their remaining up-to-date on their payments.

IV. Much of the value-added, or profits, that are created in the FS industry arise from clever ideas that reduce the transactions costs, adverse selection costs and moral hazard costs inherent in financial contracts. If you think hard about these problems and can come up with novel solutions, you can be successful.

Page 5 of 15

C. Creating and Enhancing the Market Liquidity of Financial Assets I. Liquid assets are more valuable than illiquid assets. Hence, if an FSF can buy a financial asset and increase the liquidity of the assets, they have made a profit.

II. Where does liquidity come from? Information is the key component for creating liquidity of a financial asset. If the owner of a financial asset knows more about its value than anyone else, they will have trouble selling that asset at a fair price. This is another form of the adverse selection problem. Purchasing a used car is a classic example of adverse selection. FS industry can enhance liquidity by disseminating information to potential buyers. 1. There are cases where FS firms disseminate information to enhance liquidity: Detailed prospectus for an offering Corporate debt rated by Moodys or S&P 2. What makes dissemination of believable information possible? Reputation capital: Future profits that would be lost if the firm provides bad information Financial capital: Current accumulated profits that would be lost Private regulation: e.g. Public Accounting Firms (who have substantial capital...) Government regulation: The SEC enforces rules regarding disclosure 3. There are other times when FS firms choose to keep secrets and hold onto a financial asset rather than try to enhance its liquidity and sell it.

Page 6 of 15

D. Risk-Sharing / Risk management I. FSFs specialize in assessing and managing risk. Thus, many firms will delegate this function to an FSF. An obvious example is the insurance industry. A less obvious example from banking is the letter of credit. A letter of credit is a promise by the issuer (the bank) to make good on the obligations of a beneficiary (the party paying a fee to the bank) if that beneficiary fails to perform. Commercial letters of credit are commonly used to remove the risks of non-payment in import/export industries. Standby letters of credit are used to shift risk to the bank in other business contexts. Example: commercial paper standby letters of credit allow relatively risky companies to issue these highly liquid, short-term debt obligations that otherwise would not be able to access this market. Another way that FSFs use risk management techniques to enhance liquidity is through credit enhancement. A simple example of credit enhancement: e.g. a parents co-signing their childrens credit card. Key point: FSF must maintain good reputation for high credit quality to play this role. Both financial and reputational capital are valuable assets for risk management function, just as they are in information production and dissemination. In addition, FSF must know how to manage the risks that they assume efficiently. Life insurance companies must understand mortality risks, banks must understand the risks that borrowers will fail to pay, and so on. We will therefore study in detail some of the core concepts in risk management, especially as applied to banking.

II. The concept of risk-sharing and liquidity creation are closely linked. As we saw, asymmetric information is a key barrier to liquidity. One way that FSFs create liquid financial assets is by splitting a financial asset into two: one that concentrates all of the risk and remains illiquid, and the other that is relatively safe and therefore liquid. Because liquidity is so valuable, this process add value and can therefore be profitable. We will see this when we study securitzation later in the course. We will also see how this process went awry in recent years (e.g. the subprime debacle). Question: Why is a safe asset likely to be very liquid?

Page 7 of 15

E. The Different Kinds of Financial Services Firms (for more details, see Chapters 1-6 in the textbook) I. Depository Institutions These institutions create financial assets to fund investment (and sometimes consumption); they raise funds by selling financial assets to ultimate savers. Example: Banks pool the savings of agents with surplus funds (deposits), and then lend those funds out to agents with deficits of funds (loans). The depository institutions are commercial banks, S&Ls, and credit unions. A key function of depository institutions is asset transformation. Asset transformation occurs when the assets (lefthand side of the balance sheet) have low liquidity, but the deposits (main component of the righthand side of banks balance sheets) have high liquidity. Question: How do the reputation and financial capital of the bank help it transform illiquid loans into liquid deposits? What is the role of the government in providing asset transformation? Depository institutions bundle all three functions of the financial system. Creating financial assets (bank deposits, loans) Enhancing liquidity (asset transformation) And risk management (diversification of the loan portfolio, holding capital, trading) Commercial banks in particular provide many additional services that we will study in detail throughout the course.

II. Finance companies Finance companies are very much like depository institutions, with two key differences: (1) their liabilities are composed of commercial paper and other debt securities rather than deposits; (2) they are regulated very lightly, in contrast to the depositories. We will discuss later in the course why depositories in particular are regulated more intensively than other FSFs. Often finance companies are subsidiaries of manufacturing firms (e.g. GE capital, Ford Motor Credit Corporation, General Motors Acceptance Corporation). These finance companies often make loans and leases to help sell the firms manufactured goods. III. Venture capital firms Page 8 of 15

Venture capital firms are the least regulated and smallest (in aggregate) of the financial intermediaries. They differ from the other two classes in the kinds of companies that they finance. Firms that are very risky and potentially very rapid growth are most likely to draw interest from venture capitalists (VC). VC firms go beyond the financing role of other intermediaries and get intimately involved in the management of the companies that they invest in. The ultimate goal of the VC is to allow the firm to grow to sufficient size to allow it to issue shares of stock to the public, or to have some else (such as an competitor or a major customer) acquire the whole firm. At that point, VC can use their capital to finance new start ups. IV. Securities firms and Investment banks The securities industry is involved in brokerage services for both the primary and secondary securities markets. The primary securities market is where corporations first sell securities; the secondary securities market is where holders of previously issued securities trade those securities amongst themselves (e.g. NYSE). The key functions of securities firms are: -Securities Underwriting: Marketing and distributing new issues of debt and equity for corporations. -Brokerage and Market Making: In market making, a securities dealer holds an inventory of a security and stands ready to buy the security from anyone at the bid price, and sell the security at the ask price. Other firms act strictly as brokers, that is, agents that conduct trades on behalf of customers. -Trading: This activity is similar to market making, although the firm may be engaged in speculating about the direction of price change. -Mergers & Acquisitions (M&A): Assisting firms wanting to expand by buying another company, or wanting to sell out to another company. This entails finding merger partners, provide advice about deal pricing and structure, underwriting securities to facilitate a deal, and so on.

Page 9 of 15

V. Insurance companies There are two main kinds of insurance companies, life/health and property&casualty. Both kinds tend to hold corporate debt securities (often privately-placed debt) as their main asset. For life/health companies, there main liability is the obligation to pay health and death benefits, and for P&C companies, the main liability is the obligation to pay claims on property and casualty insurance policies. Assets are purchased from the proceeds raised from premiums on insurance policies.

VI. Mutual funds Mutual funds are FSF that pool the resources of individuals and firms and invest those funds in a large, diversified portfolio of financial assets. There are many kinds of mutual funds, the differences having to do with the kinds of financial assets they buy, the way they are regulated, and the way they are taxed. Money market mutual funds: Buy short-term assets such as commercial paper Bond funds: Buy medium and long-term bonds (corporate and government) Stock funds: Buy stocks. Pension funds: Various kinds, but all receive preferential tax treatment Mutual funds are required by regulation to disclosure their investment objectives in a prospectus, to disclose their holdings at regular intervals, and are limited in the degree of short selling that they can do. Hedge funds: These are pooled investment vehicles like mutual funds but they are very lightly regulated. Hedge funds usually raise funds from wealthy investors and also from pension funds, University endowments and state funds. They avoid most regulations on disclosure requirements and are unrestricted in the kinds of assets that they can hold. Also, hedge funds face no restrictions on short positions. We will discuss hedge funds in detail later in the course when we study the demise of LTCM.

Page 10 of 15

VII. Rating Agencies Rating agencies are firms such as Moodys and S&P the rate public securities. There main function is to provide a standardized assessment of the default probability on debt securities. VIII. Government-Sponsored Enterprises These are the two mortgage companies, Fannie Mae and Freddie Mac, as well as a set of 12 privately-owned Federal Home Loan Banks. Fannie and Freddie support the provision of mortgage credit by buying and/or guaranteeing mortgages. By taking this risk from the private sector, the GSEs grease the wheels of the securitization process (more later). They also have implicit and, as of July 2008, explicit support of the US Treasury, which allows them to provide their services at below-market rates. This is good for their shareholders (and mortgage borrowers) but bad (expensive) to taxpayers... It will be interesting to see if they survive the semester in their current form (I am betting they wont). The 12 Federal Home Loan Banks are owned by their members, which are financial institutions (mainly saving institutions). They borrow in the capital markets and lend funds to their members. Because they borrow at subsidized rates due to government backing, these banks also subsidize mortgage lending.

F. In class Exercise: Describe how and the extent to which each kind of FSF helps the financial system fulfill each of its three key functions. Creation of Financial Assets Depository Institutions Liquidity Creation Risk-Sharing / Risk Management

Page 11 of 15

Finance Companies

Venture Capital Firms

Page 12 of 15

Creation of Financial Assets Securities firms / Investment Banks

Liquidity Creation

Risk-Sharing / Risk Management

Insurance companies

Pension Fund and Mutual Fund Companies

Page 13 of 15

Creation of Financial Assets Rating Agencies

Liquidity Creation

Risk-Sharing / Risk Management

GSEs

Page 14 of 15

G. The lines between these firms are blurring! The descriptions above of the different kinds of FSFs should be viewed with some caution because the lines between these firms are increasingly becoming blurred. In the old days, the lines between depositories and the other FSFs were strictly drawn by regulation. These regulations have been almost completely eliminated, and the financial industry is taking advantage of the new environment. For example, JPMorganChase is not only one of the largest traditional commercial banks in the world, it is also a market leader in underwriting securities. Citigroup, which was formed by the merger of Citicorp and Travelers in 1998, owns a major commercial bank (Citibank), investment bank (Salomon Smith Barney) and continues to have some insurance businesses, although it sold off a major piece of that business recently. This firm could not have existed legally in the United States during the 1980s. Even without financial conglomeration, the lines have been blurred by innovation. For example, the cash-management accounts offered by securities firms like Merrill-Lynch look an awful lot like bank deposits. Other securities firms such as Goldman Sachs have recently become important lenders to large corporations, a business formerly dominated by commercial banks. While the institutional feature of FSFs have changed and will continue to change, the key functions (creation of financial assets, liquidity creation, risk-sharing) do not.

Page 15 of 15

You might also like

- Financial IntermediationDocument20 pagesFinancial IntermediationFrances Bea Waguis100% (1)

- Fim Cha2Document9 pagesFim Cha2newaybeyene5No ratings yet

- FINANCIAL SYSTEM Role in Economic DevelopmentDocument4 pagesFINANCIAL SYSTEM Role in Economic Developmentrevathi alekhya80% (10)

- Financial Structure AnalysisDocument75 pagesFinancial Structure AnalysisNhatty WeroNo ratings yet

- Financial Markets and Institutions Explained (Explore RelationshipDocument6 pagesFinancial Markets and Institutions Explained (Explore RelationshipKhen CaballesNo ratings yet

- Untitled 1Document3 pagesUntitled 1cesar_mayonte_montaNo ratings yet

- How financial markets efficiently allocate savingsDocument3 pagesHow financial markets efficiently allocate savingsShaira BaltazarNo ratings yet

- Fmi C1Document15 pagesFmi C1Nigussie BerhanuNo ratings yet

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaNo ratings yet

- Financial Intermediaries: Financial Institution Bank Bank Deposits Loans Assets LiabilitiesDocument3 pagesFinancial Intermediaries: Financial Institution Bank Bank Deposits Loans Assets LiabilitiesRishikaysh KaakandikarNo ratings yet

- Chapter Two-The Financial Environment: Markets, Institutions and Investment BanksDocument4 pagesChapter Two-The Financial Environment: Markets, Institutions and Investment Banksmaquesurat ferdousNo ratings yet

- Capital Market Midterm ExamDocument4 pagesCapital Market Midterm ExamJessa Dela Cruz SahagunNo ratings yet

- Function of Financial Intermediaries PDFDocument29 pagesFunction of Financial Intermediaries PDFOliwaOrdanezaNo ratings yet

- Pasig Catholic College: Financial Markets Chap. 2. Overview of The Financial SystemDocument51 pagesPasig Catholic College: Financial Markets Chap. 2. Overview of The Financial SystemVictorioLazaroNo ratings yet

- How Money Flows Through Financial MarketsDocument4 pagesHow Money Flows Through Financial MarketsMinh NguyệtNo ratings yet

- Financial IntermediaryDocument10 pagesFinancial Intermediaryalajar opticalNo ratings yet

- Finalcil Market - Bba Unit One &twoDocument79 pagesFinalcil Market - Bba Unit One &twoBhagawat PaudelNo ratings yet

- Financial EnvironmentDocument12 pagesFinancial Environmentsohail janNo ratings yet

- Classifying Financial Transactions and InstrumentsDocument6 pagesClassifying Financial Transactions and InstrumentsblacroseNo ratings yet

- Credit Management HandbookDocument56 pagesCredit Management HandbookMuhammad HamadNo ratings yet

- FinBasics by IIFT StudentsDocument16 pagesFinBasics by IIFT StudentsAnubhav AronNo ratings yet

- Chapter 2 - Overview Financial SystemDocument130 pagesChapter 2 - Overview Financial SystemMy Lộc HàNo ratings yet

- Chap 003Document18 pagesChap 003van tinh khuc100% (2)

- Financial Markets and Institutions 7th Edition Saunders Solutions ManualDocument30 pagesFinancial Markets and Institutions 7th Edition Saunders Solutions Manualrosiegarzamel6100% (21)

- Unit 1Document16 pagesUnit 1Shivam YadavNo ratings yet

- Business and The Financial Markets Chapter 03Document50 pagesBusiness and The Financial Markets Chapter 03James KuruvalakaNo ratings yet

- Report in MTH of IntDocument6 pagesReport in MTH of IntAngie ValenzuelaNo ratings yet

- Fim - Activity 2Document3 pagesFim - Activity 2Sittie Rajma SapalNo ratings yet

- Chapter 1Document10 pagesChapter 1tamirat tadeseNo ratings yet

- Chapter 1Document13 pagesChapter 1mark sanadNo ratings yet

- Business: FinanceDocument71 pagesBusiness: FinanceIan Bethelmar UmaliNo ratings yet

- Regulations and Types of FIDocument5 pagesRegulations and Types of FIAbdul AleemNo ratings yet

- FIM-revision-2Document116 pagesFIM-revision-2Bao Khanh HaNo ratings yet

- Unit ThreeDocument22 pagesUnit ThreeEYOB AHMEDNo ratings yet

- Financial System OverviewDocument10 pagesFinancial System OverviewYonas N IsayasNo ratings yet

- Financial InstitutionDocument3 pagesFinancial InstitutionroilesatheaNo ratings yet

- Financial MarketDocument3 pagesFinancial MarketChristian FloraldeNo ratings yet

- Financial InstitutionsDocument4 pagesFinancial InstitutionsTrifan_DumitruNo ratings yet

- DocumentDocument3 pagesDocumentjasvindersinghsagguNo ratings yet

- Chapter - IDocument9 pagesChapter - IHabte WorkuNo ratings yet

- Investments Complete Part 1 1Document65 pagesInvestments Complete Part 1 1THOTslayer 420No ratings yet

- SAINT MARY’S UNIVERSITY Faculty of Accounting and finance Financial market and institution assignment oneDocument10 pagesSAINT MARY’S UNIVERSITY Faculty of Accounting and finance Financial market and institution assignment oneruhamaNo ratings yet

- Saint Mary's University Faculty of Accounting and Finance Financial Market and Institution Assignment OneDocument10 pagesSaint Mary's University Faculty of Accounting and Finance Financial Market and Institution Assignment OneruhamaNo ratings yet

- Efficient financial system objectives and flow of fundsDocument3 pagesEfficient financial system objectives and flow of fundsJea Ann CariñozaNo ratings yet

- Financial Institutions in the Financial SystemDocument10 pagesFinancial Institutions in the Financial SystemRahel SolomonNo ratings yet

- C - T 3. D N - D F I: Hapter Hree Eposit Taking and ON Eposit Taking Inancial NstitutionsDocument15 pagesC - T 3. D N - D F I: Hapter Hree Eposit Taking and ON Eposit Taking Inancial Nstitutionsyared haftuNo ratings yet

- BFM NotesDocument10 pagesBFM Notesravitejaraviteja11111No ratings yet

- Chapter 1-An Overview of Financial SystemDocument15 pagesChapter 1-An Overview of Financial SystemKalkayeNo ratings yet

- Financial Markets, Institutions and InstrumentsDocument9 pagesFinancial Markets, Institutions and InstrumentsPaula Rodalyn MateoNo ratings yet

- Compilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalDocument24 pagesCompilation of All Activities: Opol Community College Poblacion, Opol Misamis OrientalAngie CondezaNo ratings yet

- Case Study FaaaaaaaaaaaaaDocument4 pagesCase Study FaaaaaaaaaaaaaKshitiz BhandulaNo ratings yet

- Case Study - Financial MarketsDocument9 pagesCase Study - Financial Marketsbtsvt1307 phNo ratings yet

- Financial Markets and Institutions: What Is Intermediation' and Disintermediation'Document67 pagesFinancial Markets and Institutions: What Is Intermediation' and Disintermediation'Shalini SumanNo ratings yet

- Overview of Financial Systems ChapterDocument5 pagesOverview of Financial Systems ChapterJasleen GillNo ratings yet

- Sumber KeuanganDocument43 pagesSumber KeuanganMarshella WijayaNo ratings yet

- Financial Imst &mark Unit - 2Document57 pagesFinancial Imst &mark Unit - 2KalkayeNo ratings yet

- FinanceDocument6 pagesFinanceIssac KNo ratings yet

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsFrom EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsNo ratings yet

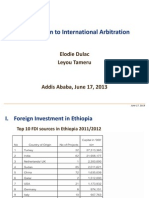

- Drafting International Arbitration AgreementsDocument44 pagesDrafting International Arbitration AgreementsAAUMCLNo ratings yet

- Session 1 - Introduction To IADocument17 pagesSession 1 - Introduction To IAAAUMCLNo ratings yet

- Session 3 - Challenge & Recognition and EnforcementDocument38 pagesSession 3 - Challenge & Recognition and EnforcementAAUMCLNo ratings yet

- Session 2 - Arbitration ProceedingsDocument42 pagesSession 2 - Arbitration ProceedingsAAUMCLNo ratings yet

- Management Science FinalDocument8 pagesManagement Science FinalAAUMCLNo ratings yet

- 33Document8 pages33AAUMCLNo ratings yet

- Coca Cola Case Study AnalysisDocument18 pagesCoca Cola Case Study AnalysisAAUMCLNo ratings yet

- 33Document8 pages33AAUMCLNo ratings yet

- Imm5645e PDFDocument0 pagesImm5645e PDFkulwinderpuriNo ratings yet

- Tax On Coffee ExchangeDocument2 pagesTax On Coffee ExchangeAAUMCLNo ratings yet

- Promotion of Foreign ExchangeDocument26 pagesPromotion of Foreign ExchangeAAUMCLNo ratings yet

- Tax On Partially Produced Skin For ExportDocument2 pagesTax On Partially Produced Skin For ExportAAUMCLNo ratings yet

- Accelerated Refund of Taxes Paid of Foreign Exchange PDFDocument4 pagesAccelerated Refund of Taxes Paid of Foreign Exchange PDFYoftahe.MNo ratings yet

- Cadiz vs. Court of Appeals, 474 SCRA 232, October 25, 2005Document15 pagesCadiz vs. Court of Appeals, 474 SCRA 232, October 25, 2005marvin ninoNo ratings yet

- General and Subsidiary Ledgers ExplainedDocument57 pagesGeneral and Subsidiary Ledgers ExplainedSavage NicoNo ratings yet

- Risk Based Inspection Professional: Certification Preparation ProgramDocument6 pagesRisk Based Inspection Professional: Certification Preparation ProgramMuhammad HannanNo ratings yet

- Finance of International Trade and Related Treasury OperationsDocument2 pagesFinance of International Trade and Related Treasury OperationsmuhammadNo ratings yet

- RFBT 2 Oblicon and SalesDocument8 pagesRFBT 2 Oblicon and SalesLilibeth Dee GabuteroNo ratings yet

- Cards Operations of NBL - An Overview of Kartikpur Branch by SanaullahDocument58 pagesCards Operations of NBL - An Overview of Kartikpur Branch by SanaullahMd Sana Ullah Nur MishowryNo ratings yet

- Reconcile Bank BalancesDocument5 pagesReconcile Bank BalancesMAHENDERNo ratings yet

- Krantisinh Project Report FinalDocument20 pagesKrantisinh Project Report FinalSanket MehtaNo ratings yet

- Chit Fund CompanyDocument34 pagesChit Fund CompanyPARAS JAINNo ratings yet

- Executive Calendar: Senate of The United StatesDocument28 pagesExecutive Calendar: Senate of The United StatesJoel Eljo Enciso SaraviaNo ratings yet

- J K CementDocument6 pagesJ K CementdantroliyaNo ratings yet

- Berkenkotter v. Cu UnjiengDocument1 pageBerkenkotter v. Cu UnjiengJulie AnnNo ratings yet

- MERCADO01 document titlesDocument5,500 pagesMERCADO01 document titlesjanis4185No ratings yet

- 1296169172JH 011311 - WebDocument12 pages1296169172JH 011311 - WebCoolerAdsNo ratings yet

- Financial Inclusion Model in Jharkhand AnalyzedDocument8 pagesFinancial Inclusion Model in Jharkhand AnalyzedsantoshtissNo ratings yet

- TD Economics: The Weekly Bottom LineDocument8 pagesTD Economics: The Weekly Bottom LineInternational Business TimesNo ratings yet

- Nadig Reporter Newspaper Chicago June 12 2013 EditionDocument24 pagesNadig Reporter Newspaper Chicago June 12 2013 Editionchicagokenji0% (1)

- 1980 04 25 Riley ReviewDocument8 pages1980 04 25 Riley Reviewkbreenbo1No ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- RSD ICBS v3Document35 pagesRSD ICBS v3Glutton ArchNo ratings yet

- Platni Sistemi Participants ListDocument6 pagesPlatni Sistemi Participants ListKristijan PetrovskiNo ratings yet

- Nabigha EjazDocument2 pagesNabigha Ejaznabgha_bNo ratings yet

- HR Air Asia - InterviewDocument2 pagesHR Air Asia - InterviewChandu NaiduNo ratings yet

- Network Issues in BankingDocument9 pagesNetwork Issues in BankingKrishnaVkNo ratings yet

- Tevin Fawkes Feb StatementDocument2 pagesTevin Fawkes Feb StatementSaint NickNo ratings yet

- The Youth Market For Internet Banking Services: Perceptions, Attitude and BehaviourDocument19 pagesThe Youth Market For Internet Banking Services: Perceptions, Attitude and Behaviourandra_deea90No ratings yet

- Presentation On ICICI Bank.Document16 pagesPresentation On ICICI Bank.minhaz4uNo ratings yet

- Different Types of DepositsDocument25 pagesDifferent Types of DepositsMohamad SayeedNo ratings yet

- Fixed Deposits - January 17 2019Document1 pageFixed Deposits - January 17 2019Tiso Blackstar GroupNo ratings yet

- UBL Internship Report OverviewDocument93 pagesUBL Internship Report OverviewIfrah BatoolNo ratings yet