Professional Documents

Culture Documents

Cta 2D CV 08150 D 2013oct01 Ass

Uploaded by

arksters0 ratings0% found this document useful (0 votes)

43 views19 pagescourt of tax appeals

Original Title

CTA_2D_CV_08150_D_2013OCT01_ASS

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcourt of tax appeals

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views19 pagesCta 2D CV 08150 D 2013oct01 Ass

Uploaded by

arksterscourt of tax appeals

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

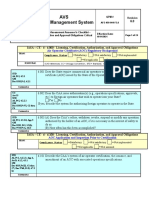

REPUBLIC OF THE PHILIPPINES

COURT OF TAX APPEALS

QUEZON CITY

SECOND DIVISION

ATLAS CONSOLIDATED

MINING AND DEVELOPMENT

CORPORATION,

Petitioner,

-versus-

ATTY. KIM S. JACINTO-

HENARES, IN HER CAPACITY

AS THE COMMISSIONER OF

INTERNAL REVENUE, AND

MELQUIADES A. CANCELA,

IN HIS CAPACITY AS THE

OIC-REVENUE DISTRICT

OFFICER OF REVENUE

DISTRICT NO. 70, MASBATE

CTA Case No. 8150

Members:

Castaneda, Jr., Chairperson

Casanova, and

Cotangco-Manalastas, JJ.

Promulgated:

CITY,

R d t

OCT 0 1 Z013 /

espon en.

}(- - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - }(

If : en .,..

DECISION

COTANGCO-MANALASTAS,J.:

This case involves a Petition for Review (With Application

for Temporary Restraining Order and/ or Writ of Preliminary

Injunction and Motion for Suspension of Collection of Ta}()

filed pursuant to Section 4 of the National Internal Revenue

Code (NIRC) of 1997, as amended, in relation to Section 7(a)(1)

of Republic Act (RA) No. 1125, as amended by RA No. 9282.

While this instant case is pending, petitioner seeks the

issuance of (i) an order suspending the collection of the alleged

deficiency e}(cise ta}(es for ta}(able years 1991, 1992 and 1993

covered by Assessment Notices issued by respondent against

petitioner; and (ii) a temporary restraining order and/ or writ of

preliminary injunction preventing respondents and all persons

acting under their direction and authority from (a) collecting t

DECISION

CTA CASE NO. 8150

Page 2 of 19

on the Assessments, (b) issuing a warrant of distraint/levy and

thereby distraining and levying on petitioner's properties and

(c) filing a judicial action for collection of the alleged deficiency

excise taxes.

After trial, petitioner seeks for the issuance of a decision

(i) making permanent the order suspending the collection of

the alleged deficiency excise taxes covered by the Assessment

Notices and the temporary restraining order /writ of

preliminary injunction prayed for ; (ii) reversing, canceling, and

setting aside the Assessments; and (iii) reversing, canceling,

and setting aside the revocation of BIR Ruling No. DA-722-

2006 dated December 15, 2006, including the Memorandum

Letter to the Regional Director of Revenue Region No. 10 dated

July 13, 2010 and Revenue Memorandum Circular (RMC) No.

67-2010.

THE FACTS

Petitioner is a corporation duly organized and existing

under the laws of the Philippines, with principal office at the

7th Floor, Quad Alpha Centrum Building, 125 Pioneer Street,

Mandaluyong City. l

Respondent Commissioner of Internal Revenue (CIR) is a

public officer duly appointed by the President of the Republic

of the Philippines and is the head of the Bureau of Internal

Revenue (BIR) . Respondent CIR is vested with the power to

interpret tax laws and to decide matters arising from the Tax

Code. 2 She holds office at the BIR National Office Building,

Diliman, Quezon City.

Respondent Revenue District Officer Melquiades A.

Cancela (Respondent RDO) is a public officer and is the head

of the BIR Revenue District Office No. 70, Masbate City.

Respondent RDO is tasked with the duty to ensure that all

laws, and rules and regulations affecting national internal

revenue are faithfully executed and complied with.

3

On February 29, 2000, BIR Revenue Region No. 10

issued Assessment Notices directing petitioner to pay on or

before March 29, 2000 alleged deficiency excise taxes for/-

1

Par. I, Admitted Facts, Joint Stipul ati on of Facts and Issues (JSFI), docket, p. 237.

2

Par. 2, Admitted Facts, JSFI , docket, p. 237.

3

Par. 3, Admitted Facts, JSFI, docket, p. 23 8.

DECISION

CTA CASE NO. 8150

Page 3 of 19

taxable years 1991, 1992 and 1993.

4

The Assessments were

broken down as follows:

1991 1992 1993 Total

Basic Tax P19,625,697.63 P33,734,557.57 P28,971,060.96 P82,331 ,316.16

50% 9,812,848.81 16,867,278.79 14,485,530.48 41,165,658.08

Surcharge

20% Interest 17,663,127.86 30,361,101.81 26,073,954.86 74,098,184.53

(per annum)

P47,101,674.30 P80,962,938.17 P69 ,530,546. 30 P197

1

595

1

158.77

On May 24, 2000, petitioner received a Formal Letter of

Demand

5

, attached to which are the Assessment Notices, from

BIR Revenue Region No. 10 requesting petitioner to settle its

alleged deficiency excise tax liabilities. 6

Petitioner failed to file an administrative protest within

the period prescribed under Section 228 of the NIRC of 1997,

as amended.

7

On November 21, 2006, petitioner wrote the BIR

requesting for the issuance of a ruling confirming that it is no

longer subject to assessment and collection by the BIR with

respect to excise tax due from petitioner for taxable years 1991

to 1993.8

On December 15, 2006, the BIR issued BIR Ruling No.

DA-722-20069 confirming, among others, that the period to

collect on the Assessments has already prescribed.

1

o The

ruling, in part, provides:

"In the instant case, since the enumerated exceptions

mentioned above are not present, the period within which to

assess and collect is three (3) years. Thus, since the returns

are no longer available for examination, the timeliness of the

assessment prescribed in Section 203 of the said Code

cannot be ascertained. On the other hand, even if it were to

be assumed that the assessment notice dated February 29,

2000 was issued within the prescriptive period, Atlas'

liability for the subject excise taxes would still have been

extinguished as the period within which to collect has /-

4

Par. 4, Admitted Facts, JSFI , docket, p. 238; Exhibits "A", "5-b", "B", "5-c", "C", "5-d", docket, pp. 294-

296.

5

Exhibits "D", "5", docket, p. 297.

6

Par. 5, Admitted Facts, JSFI, docket, p. 238.

7

Par. 5, Petition for Review, docket, p. 3.

8

Exhibit "E", docket, pp. 298-301.

9

Exhibit "F", docket, pp. 302-305.

10

Par. 6, Admitted Facts, JSFI, docket, p. 238.

DECISION

CTA CASE NO. 8150

Page 4 of 19

likewise prescribed as more than six years have lapsed from

the time of the issuance of the notice."

On November 24, 2008, the Regional Director of BIR

Revenue Region Office No. 10 wrote the BIR requesting the

reversal/revocation of the above ruling on the ground of

alleged misrepresentation of the facts presented by petitioner.

According to the Regional Director, petitioner, contrary to its

representations in the Request for Confirmatory Ruling,

"willfully neglected to file the required excise tax returns and

failed to pay the excise tax due within the prescribed period."

11

On December 17, 2008, the Revenue District Officer of

Revenue District No. 70 of Masbate City demanded the

payment of the alleged deficiency excise taxes from

petitioner.

12

On January 13, 2009, petitioner received the above

Demand Letter.I3

On January 15, 2009, in response to the above Demand

Letter, petitioner wrote the respondent RDO stating that the

BIR has issued BIR Ruling No. DA-722-2006 which confirmed

that the period within which an action may be instituted for

the collection of the assessed excise taxes had already

prescribed.

14

On July 13,

Memorandum Letter

declaring BIR Ruling

2006 null and void.1s

20 10, Respondent CIR issued the

addressed to the Regional Director

No. DA-722-2006 dated December 15,

Subsequently, RMC No. 67-2010 was issued on August

10, 20 10 circularizing the full text of the Memorandum

Letter.

1

6

Pursuant to RMC No. 67-2010, Respondent RDO sent to

petitioner another letter dated August 11, 20 10 demanding

payment of the Assessments within ten (10) days after receipt J,

11

Pars. 7 and 8, Admitted Facts, JSFI, docket, p. 238.

12

Par. 9, Admitted Facts, JSFI , docket, p. 239; Exhibit " 12", BIR Records, pp. 226-227.

13

Par. I 0, Admitted Facts, JSFI , docket, p. 239.

14

Exhibit "H", docket, pp. 308-309.

15

Par. II , Admitted Facts, JSFI , docket, p. 239.

16

Exhibit "1", docket, pp. 314-3 I 6; Exhibit " 14", BIR Records, pp. 3 I I -313.

DECISION

CTA CASE NO. 8150

PageS of 19

of the letter by petitioner.1

7

The letter states that if full

settlement will not be received, the letter shall serve as formal

notice of Warrant of Distraint and/or Levy and Garnishment

with Notices of Tax Lien on all existing properties of petitioner.

On August 17, 20 10, petitioner filed the instant Petition

for Review (With Application for Temporary Restraining Order

and/ or Writ of Preliminary Injunction and Motion for

Suspension of Collection of Tax).

On August 19, 2010, Respondent CIR, through

Respondent RDO, issued a Warrant of Distraint and/or Levy

against petitioner. The Warrant was served by the BIR on

September 24, 2010.18

On August 31, 2010, respondents filed their Opposition

19

to petitioner's Application for Temporary Restraining Order

(TRO) and/ or Writ of Preliminary Injunction and Motion for

Suspension of Collection of Tax. Respondents based its

opposition on the following grounds: (1) The Honorable Court

of Tax Appeals (CTA) has no jurisdiction over petitioner's case;

(2) petitioner's causes of action are not proper issues that may

be elevated before the Honorable CTA; and (3) petitioner did

not present any valid ground for its application for TRO to be

granted.

Petitioner filed its Reply

2

o to respondents' Opposition on

September 13, 2010. Petitioner countered, among others, that

the Honorable Court has jurisdiction over the petition; that the

rule on exhaustion of administrative remedies is not

applicable; that the revocation of the Ruling was an exercise of

quasi-judicial power under the second paragraph of Section 4

of the NIRC of 1997, as amended; and that petitioner is

entitled to the issuance of the TRO.

On October 13, 2010, respondents filed their Answer2

1

and averred the following special and affirmative defenses: ( 1)

the Honorable CTA has no jurisdiction to entertain the

petition; (2) respondents' right to assess petitioner had not yet

prescribed; (3) respondents' right to collect taxes from J-

17

Pars. 12 and 13, Admitted Facts, JSFI , docket, p. 239; Exhibit "J", docket, p. 317.

18

Exhibits "K", " 15", docket, p. 318.

19

Docket, pp. 57-66.

20

Docket, pp. 73-93.

21

Docket, pp. 114-1 22.

DECISION

CTA CASE NO. 8150

Page 6 of 19

petitioner is within the prescribed period; and (4) respondent

CIR has a legal basis in revoking BIR Ruling No. DA-722-2006.

In the Resolution22 dated October 14, 2010, the Court

granted petitioner's application for TRO and/ or writ of

preliminary injunction and motion for suspension of collection

of tax, treating the same as a Motion for the Suspension of

Collection of Tax in accordance with Rule 10, Section 2 of the

Revised Rules of the Court of Tax Appeals.

23

The Court found

that the collection of deficiency excise taxes may unduly

jeopardize the interest of petitioner. Petitioner was ordered to

file a surety bond.

On October 27, 2010, respondents filed a Motion for

Reconsideration2

4

of the above resolution. On November 23,

2010, petitioner filed its Comment25 thereto.

In compliance with the October 14, 2010 Resolution,

petitioner submitted CAP General Insurance Corporation

Surety Bond [Bond No. JCL(8) 00078] in the amount of

P296,392,738.06 on October 28, 201026.

In the Resolution27 dated January 5 , 2011, the Court

denied respondent's Motion for Reconsideration of the October

14, 2010 Resolution for lack of merit. The Court likewise

found the documents submitted by petitioner in relation to its

surety bond in compliance with the October 14, 2010

Resolution. Consequently, the Court enjoined respondents

and all persons acting under their direction or authority from

undertaking any and all remedies to collect, including the

issuance of a Warrant of Distraint and Garnishment and/or

Levy, from petitioner on its assessed deficiency taxes.

On January 26, 2011 , this Court issued a Notice of Pre-

Trial Conference28, notifying the parties that the case is set for

pre-trial conference on February 17, 2011 and directing the

parties and their respective counsels to be present at the pre-

trial and to file with this Court their respective Pre-Trial Briefs

at least three (3) days before the date of pre-trial. ?

22

Docket, pp. 126- 13 I.

23

Erroneously referred to in the Resolution as " Rule I 0, Section 2 of (R.A.) 9282".

24

Docket, pp. 132- 140.

25

Docket, pp. 191-200.

26

Docket, pp. 142- 144; 147- 172.

27

Docket, pp. 208-2 1 I.

28

Docket, p. 216.

DECISION

CfA CASE NO. 8150

Page 7 of 19

On February 1, 2011, respondents filed their Pre-Trial

Brief29; while petitioner filed its Pre-Trial Brief3 on February

15,2011.

During the pre-trial proceedings held on February 17,

20 11, this Court gave the counsel for petitioner a period of

twenty (20) days from February 17, 2011 or until March 9,

2011 within which to submit the Joint Stipulation of Facts

and Issues.

31

On March 9, 2011, the parties submitted their Joint

Stipulation of Facts and Issue. 32

On March 29, 20 11, this Court issued the Pre-Trial

Order33, summarizing the facts and issues stipulated by the

parties, the evidence to be presented by the parties and the

hearing dates, and stating that the pre-trial is deemed

terminated.

During trial, petitioner presented Mr. Jesus C. Valledor,

Jr.

3

4, Assistant Vice President for Administration and

Comptroller of petitioner as its witness.

Thereafter, petitioner filed on September 5, 2011 its

Formal Offer of Evidence3s, submitting Exhibits "A" to "L", and

"L-1", which were admitted by this Court in the Resolution36

dated January 2, 2012, except Exhibit "G".

On the other hand, respondents presented Revenue

Officer Reynaldo S. Negro3

7

and Revenue District Officer

Melquiades A. Cancela38 as their witnesses.

Thereafter, respondents filed on June 1, 2012 their

Formal Offer of Evidence39, submitting Exhibits "1" to "17",

inclusive of their sub-markings, which were admitted by this

Court in the Resolution

40

dated July 12, 2012, except Exhibits{

29

Docket, pp. 217-220.

30

Docket, pp. 222-233.

3 1

Minutes ofthe February 17, 20 11 Pre-Trial Proceedings, docket, p. 235.

32

Docket, pp. 237-241 .

33

Docket, pp. 248-252.

34

Minutes of Hearing dated March 30, 20 II , docket, p. 258.

35

Docket, pp. 275-283.

36

Docket, pp. 410-412.

37

Minutes of Hearing dated February I, 2012, docket, p. 416.

38

Minutes of Hearing dated March 5, 2012, docket, p. 427.

39

Docket, pp. 431-435.

40

Docket, pp. 457-459.

DECISION

erA CASE NO. 8150

Page 8 of 19

"1", "7", "4" and "6". Subsequently, on November 27, 2012,

respondent filed its Supplemental Formal Offer of Evidence.

41

Thereafter, in the Resolution

42

dated December 19, 2012, this

Court admitted Exhibits "1" and "7". During the May 6, 2013

hearing

4

3 , the Court likewise admitted Exhibits "4" and "6".

On July 31, 2013, this case was submitted for decision

4

4,

considering respondent's Memorandum

4

s filed on July 11 ,

20 13 and petitioner's Memorandum

4

6 filed on July 22, 20 13

by registered mail and received by this Court on July 25,

2013.

ISSUES

The parties submitted the following issues

47

for this

Court's resolution:

1. Whether or not this Honorable Court has jurisdiction

over the Petition;

2. Whether or not the BIR's right to collect on the

Assessments has prescribed;

3 . Whether or not the Respondent Commissioner erred

in revoking BIR Ruling No. DA-722-2006; and

4. Whether or not the revocation of BIR Ruling No. DA-

722-2006 is prejudicial to Petitioner's defense of

prescription.

DISCUSSION /RULING

The Court's Jurisdiction

This Court shall first resolve the issue pertaining to the

jurisdiction of this Court over the instant case. t--

41

Docket, pp. 534-538.

42

Docket, pp. 543-546.

43

Minutes of Hearing dated May 6, 20 12, docket, p. 633.

44

Docket, p. 787.

45

Docket, pp. 661-679.

46

Docket, pp. 739-784.

47

Issues to be Resolved, JSFI , docket, p. 239.

DECISION

CTA CASE NO. 8150

Page 9 of 19

Respondents argue that the Court has no jurisdiction

over the present petition. Since petitioner admitted that it

failed to file any administrative protest against respondents'

Formal Letter of Demand and Assessment Notices within the

prescribed period under Section 228 of the NIRC of 1997, as

amended, then, the assessment became final and executory on

June 23, 2000, or 30 days after the receipt of the Formal

Letter of Demand and Assessment Notices on May 24, 2000.

The assessment not having been protested or contested, there

could never be a decision on disputed assessment that may be

appealed to this Court. As cited under Section 7(a)(1) of RA

No. 1125, as amended by RA No. 9282, what is reviewable by

the CTA is the decision of the CIR on a disputed assessment.

Respondents also argue that petitioner's causes of action

are not proper issues that may be elevated before this Court.

An examination of the petition for review shows that

petitioner's cause of action is anchored on respondent CIR's

revocation of its previous requested ruling, i.e., BIR Ruling No.

DA-722-2006 dated December 15, 2006, and her issuance of

RMC No. 67-2010 dated August 10, 2010 circularizing the

revocation of the said ruling. The revocation of the said ruling

and RMC must be properly elevated before the Secretary of

Finance, under the rules on exhaustion of administrative

remedies and based on Section 4 of the NIRC of 1997, as

amended, and further clarified by RMC No. 40-A-02

4

8.

On the other hand, petitioner counters that this Court's

jurisdiction is not limited to "disputed assessments" as

claimed by respondents. Based on Section 7(a)(1) of RA No.

1125, as amended by RA No. 9282, this Court has the power

to hear and decide tax disputes in general, which includes

other matters arising under the Tax Code or other laws

administered by the BIR. In its petition for review, petitioner

acknowledged that it failed to file an administrative protest

within the period prescribed, thus, the Assessment Notices

became final and executory on June 23, 2000. However,

respondents failed to exert efforts to collect on the

Assessments, by distraint or levy, or by a proceeding in court

within the prescribed period under Section 222 of the NIRC of

1997, as amended. Such period lapsed on February 27, 2005.

Thus, petitioner's reason for refusing to pay the Assessments

is because of the lapse of the BIR's period to collect. Petitioner J--

48

Department Order No. 7-02, "Providing for the Implementing Rules of the First Paragraph of Section 4

ofthe National Internal Revenue Code of 1997, Repealing for this Purpose Department Order No. 005-99

and Revenue Administrative Order No. 1-99".

DECISION

CTA CASE NO. 8150

Page 10 of 19

submits that notwithstanding the finality of the assessments,

this Court has jurisdiction over the petition since one of the

issues relates to the right of respondents to legally collect the

assessed taxes.

Petitioner also asserts that review of rulings issued by the

CIR has been ruled to be within the jurisdiction of this Court

and not the regular courts, since it falls within "other matters

arising from" the Tax Code and other laws administered by the

BIR. Contrary to respondents' argument, RMC No. 40-A-02

does not apply to the present case because the revocation of

the ruling falls under the second paragraph of Section 4 of the

NIRC of 1997, as amended. Assuming arguendo that RMC No.

40-A-02 applies, filing of the petition without prior resort to

the Secretary of Finance is justified under the circumstances.

There is no dispute that the assessments for deficiency

excise taxes for taxable years 1991, 1992 and 1993 have

become final and executory. Petitioner received the Formal

Letter of Demand and Assessment Notices for deficiency excise

taxes on May 24, 2000. However, it failed to file an

administrative protest within thirty (30) days from the date of

receipt of the Formal Letter of Demand and Assessment

Notices as prescribed under Section 228 of the Tax Code.

Hence, petitioner's deficiency excise taxes became final ,

executory and demandable on June 23, 2000. In fact, both

parties agreed that the assessments became final and

executory on June 23, 2000. 49

Consequently, the main issue in this case boils down on

the prescription of the BIR's right to collect on the

assessments.

Section 7(a)(1)of RA No. 112sso, as amended by RA No.

9282, provides:

"Sec. 7. Jurisdiction. - The CTA shall exercise:

(a) Exclusive appellate jurisdiction to review by

appeal, as herein provided:

( 1) Decisions of the Commissioner of Internal

Revenue in cases involving disputed assessments, /--

49

Par. 5, Petition for Review, docket, p. 3 and Respondents' Memorandum, docket, p. 663.

50

An Act Creating the Court of Tax Appeals.

DECISION

CTA CASE NO. 8150

Page 11 of 19

refunds of internal revenue taxes, fees or other

charges, penalties in relation thereto, or other

matters arising under the National Internal

Revenue or other laws administered by the Bureau

of Internal Revenue;

xxx xxx xxx. " (Emphasis supplied)

From the foregoing provision, the appellate jurisdiction of

t h e CTA is not limited to cases which involve decisions of the

CIR on matters relatin g to assessments or refunds. The second

part of the provision covers other cases that arise out of the

NIRC or related laws administered by the BIR as held in the

case of Philippine Journalists, Inc. v. CIRSI.

In CIR us. Hambrecht & Quist Philippines, Inc. 52 , the

Supreme Court held :

"... the issue of prescription of the BIR's right to

collect taxes may be considered as covered by the term

"other matters" over which the CTA has appellate

jurisdiction.

Furthermore, the phraseology of Section 7, number (1),

denotes an intent to view the CTA's jurisdiction over

disputed assessments and over "other matters" arising under

the NIRC or other laws administered by the BIR as separate

and independent of each other. This runs counter to

petitioner's theory that the latter is qualified by the status of

the former, i.e., an "other matter" must not be a final and

unappealable tax assessment or, alternatively, must be a

disputed assessment.

Likewise, the first paragraph of Section 11 of Republic

Act No. 1125, as amended by Republic Act No. 9282, belies

petitioner's assertion as the provision is explicit that, for as

long as a party is adversely affected by any decision, ruling

or inaction of petitioner, said party may file an appeal with

the CTA within 30 days from receipt of such decision or

ruling. The wording of the provision does not take into

account the CI R's restrictive interpretation as it clearly

provides that the mere existence of an adverse decision,

ruling or inaction along with the timely filing of an appeal

operates to validate the exercise of jurisdiction by the CTA.

To be sure, the fact that an assessment has become

final for failure of the taxpayer to file a protest within {

51

G.R. No. 162852, December 16,2004.

52

G.R. No. 169225, November 17, 2010.

DECISION

CfA CASE NO. 8150

Page 12 of 19

the time allowed only means that the validity or

correctness of the assessment may no longer be

questioned on appeal. However, the validity of the

assessment itself is a separate and distinct issue from

the issue of whether the right of the CIR to collect the

validly assessed tax has prescribed. This issue of

prescription, being a matter provided for by the NIRC, is

well within the jurisdiction of the CTA to decide."

(Emphasis supplied)

From the foregoing, the issue on the prescription of the

BIR's right to collect taxes is covered by the term "other

matters arising under the National Internal Revenue Code".

Hence, this Court has jurisdiction over the subject matter of

the present petition.

BIR's Right to Collect

Respondents claim that from the time the assessment

became final, executory and demandable, respondents exerted

sufficient efforts to collect petitioner's delinquent account. On

July 28, 2000, respondents, through Rene Q. Aguas, Regional

Director of Revenue Region No. 10, filed a criminal complaint53

against Fernando S. Verde as President of petitioner for non-

payment of excise tax. Subsequently, an Information5

4

dated

September 27, 2000 was filed in the Regional Trial Court.

Thereafter, a Warrant of Arrest was issued. To date, accused

Fernando S. Verde remains at large. Respondents even sent

letters to various government offices to confirm whether

petitioner has any leviable property. Unfortunately, no

property could be levied. Since accused could not be located,

his absence prevented respondents from collecting the

deficiency excise taxes, thereby suspending the running of the

prescriptive period to collect provided under Section 222 of the

NIRC of 1997, as amended, in relation to Section 223 thereof.

Petitioner counters that the criminal case should not be

deemed to have been filed in the absence of proof authorizing

the Regional Director to prosecute and conduct the criminal

proceeding. Even assuming that respondents' argument is

correct, there is no criminal case that can suspend the

running of the prescriptive period to collect. In any event,

respondents' reliance on Section 223 of the NIRC of 1997, as

amended, is misplaced. Neither the filing of a criminal case

nor failure to arrest the accused is a situation contemplated by f.-

53

Exhibit 6, BIR Records pp. 137-1 39.

54

Exhibit 7, docket, p. 541 .

DECISION

CTA CASE NO. 8150

Page 13 of 19

Section 223 that would suspend the runn1ng of the

prescriptive period to collect.

Section 222(c) of the NIRC of 1997, as amended,

provides:

"SEC. 222. Exceptions as to Period of Limitation of

Assessment and Collection of Taxes. -

XXX XXX XXX

(c) Any internal revenue tax which has been

assessed within the period of limitation as prescribed in

paragraph (a) hereof may be collected by distraint or levy

or by a proceeding in court within five (5) years following

the assessment of the tax." (Emphasis supplied)

From the foregoing provision, when the BIR validly issues

an assessment, within either the three-year or ten-year period,

whichever is appropriate, then the BIR has another five years

after the assessment within which to collect the national

internal revenue tax due thereon by distraint, levy, and/ or

court proceeding. The assessment of the tax is deemed made

and the five-year period for collection of the assessed tax

begins to run on the date the assessment notice had been

released, mailed or sent by the BIR to the taxpayer.ss

In this case, there is no dispute on the validity of the

issuance of the Assessment and on its finality, only on the

prescription of the period to collect the deficiency excise taxes.

While the Formal Letter of Demand56 was undated and the

Assessment Notices5

7

were dated February 29, 2000 and

received by petitioner on May 24, 2000, there was no showing

as to when the said Assessment Notices were released, mailed

or sent by the BIR. Still, it can be granted that the latest date

the BIR could have released, mailed or sent the Assessment

Notices to petitioner was on the same date they were received

by the latter. Counting the five-year prescriptive period from

May 24, 2000, then the BIR only had until May 24, 2005

within which to collect the assessed deficiency excise taxes.

On December 17, 2008, or more than eight (8) years from

the time the assessments were made, Respondent RDO wrote /

55

Bank of the Philippine Islands vs. CIR, G.R. No. 139736, October 17, 2005.

56

Exhibits "D", "5", docket, p. 297.

57

Exhibits "A", "5-b", "8 ", "5-c", "C", "5-d", docket, pp. 294-296.

DECISION

CTA CASE NO. 8150

Page 14 of 19

a letter to petitioner demanding payment of the deficiency

excise taxes. ss Respondent RDO wrote another letter dated

August 11, 2010, reiterating its demand for payment.s9 In the

same letter, Respondent RDO stated that if full settlement will

not be received, the letter shall serve as formal notice of

Warrant of Distraint and/or Levy and Garnishment with

Notices of Tax Lien on all existing properties of petitioner.

Records show that Respondent RDO issued a Warrant of

Distraint and/ or Levy against petitioner only on August 19,

2010. The Warrant was served by the BIR on September 24,

2010.60 Existing jurisprudence establishes that distraint and

levy proceedings are validly begun or commenced by the

issuance of the Warrant and service thereof on the taxpayer.

6 1

Therefore, the service of the Warrant on petitioner on

September 24, 20 10 was already beyond the prescriptive

period for collection of the deficiency excise taxes, which had

expired on May 24, 2005. Neither has the BIR filed any

collection case in court against petitioner.

However, respondents insist that the running of the

prescriptive period to collect was suspended since the accused

Fernando S. Verde remains at large. We are not convinced.

Section 223 of the NIRC of 1997, as amended, provides:

SEC. 223. Suspension of Running of Statute of

Limitations. - The running of the Statute of Limitations

provided in Sections 203 and 222 on the making of

assessment and the beginning of distraint or levy or a

proceeding in court for collection, in respect of any

deficiency, shall be suspended for the period during which

the Commissioner is prohibited from making the assessment

or beginning distraint or levy or a proceeding in court and for

sixty (60) days thereafter; when the taxpayer requests for a

reinvestigation which is granted by the Commissioner; when

the taxpayer cannot be located in the address given by him

in the return filed upon which a tax is being assessed or

collected: Provided, That, if the taxpayer informs the

Commissioner of any change in address, the running of the

Statute of Limitations will not be suspended; when the

warrant of distraint or levy is duly served upon the taxpayer,

his authorized representative, or a member of his household {

58

Exhibit " 12", BIR Records, pp. 226-227.

59

Exhibit "J", docket, p. 317.

60

Exhibits " K", " 15", docket, p. 318.

61

Bank of the Philippine Islands vs. CIR, G.R. No. 139736, October 17, 2005, citing Republic v. Hizon,

G.R. No. 130430, 13 December 1999, 320 SCRA 574; Advertising Associates, Inc. v. Court of Appeals,

G.R. No. L-59758, 26 December 1984, 133 SCRA 765; Palanca, et a/. v. CIR, 114 Phil 203 ( 1962).

DECISION

CTA CASE NO. 8150

Page 15 of 19

with sufficient discretion, and no property could be located;

and when the taxpayer is out of the Philippines.

From the foregoing, the running of the statute of

limitations under Sections 203 and 222 of the NIRC of 1997,

as amended, may be suspended in the following instances:

case.

1) For the period during which the Commissioner

is prohibited from making the assessment or beginning

distraint or levy or a proceeding in court and for sixty (60)

days thereafter;

2) When the taxpayer requests for a reinvestigation

which is gran ted by the Commissioner;

3) When the taxpayer cannot be located in the

address given by him in the return filed upon which a tax is

being assessed or collected: Provided, That, if the taxpayer

informs the Commissioner of any change in address, the

running of the Statute of Limitations will not be suspended;

4) When the warrant of distraint or levy is duly

served upon the taxpayer, his authorized representative, or a

member of his household with sufficient discretion, and no

property could be located; and

5) When the taxpayer is out of the Philippines.

None of the instances mentioned above is present in this

This Court does not agree with respondents' claim that

the period to collect the deficiency excise taxes was suspended

considering that accused Fernando S. Verde could not be

located and it seems that there is no property of petitioner that

can be located.

The third instance under Section 223 of the NIRC of

199.7, as amended, applies only if the whereabouts of the

taxpayer cannot be ascertained. 62

In this case, even though the whereabouts of petitioner's

then President, Fernando S. Verde, was unknown, still the

corporate address of petitioner was known to respondents.

There is nothing in the records that would show that J

62

CIR vs. BASF Coatings+ Inks Philippines, Inc., CTA EB Case No. 664, June 16,2011.

DECISION

CTA CASE NO. 8150

Page 16 of 19

respondents cannot locate any officer or employee of petitioner

at its corporate address. Respondents could have served the

Warrant of Distraint and/or Levy upon Mr. Jesus C. Valledor,

Jr., who is connected with petitioner since January 198863, or

any responsible officers or authorized representative of

petitioner after the assessments became final and executory.

However, it failed to do so and resorted only to the filing of a

criminal complaint against Fernando S. Verde as then

President of petitioner.

There is likewise nothing in the records that would show

the other efforts made by respondents to collect on the

deficiency tax from May 24, 2000 to May 24, 2005, or the

period within which the BIR can collect on the deficiency

excise taxes. The BIR records show that respondent RDO

inquired with the Municipal Assessor of Aroroy, Masbate, the

City Assessor of Masbate City, Provincial Assessor of Masbate

City, the Registry of Deeds of Masbate and the Department of

Environment and Natural Resources - Mines and Geosciences

Bureau, if petitioner has any leviable property, and all

government agencies replied in the negative. However, making

inquiries into any leviable property of petitioner is not one of

the instances that will suspend the running of the period to

collect on the deficiency tax. Moreover, all of these

communications were made only in 2008, long after the period

to collect on the deficiency tax has prescribed. Also, these

communications were not offered in evidence.

Respondents should have served the Warrant of Distraint

and/ or Levy upon petitioner first notwithstanding the fact that

no property can be located. It is not essential that the Warrant

of Distraint and/ or Levy be fully executed so that it can

suspend the running of the statute of limitations on the

collection of the tax. It is enough that the proceedings have

validly begun or commenced and that their execution has not

been suspended by reason of the voluntary desistance of the

respondent BIR Commissioner. It is only logical to require that

the Warrant of Distraint and/ or Levy be, at the very least,

served upon the taxpayer in order to suspend the running of

the prescriptive period for collection of an assessed tax,

because it may only be upon the service of the Warrant that

the taxpayer is informed of the denial by the BIR of any/.--

63

Judi cial Affidavit of Mr. Jesus C. Vall edor, Jr, Exhi bit "L", docket, p. 253.

DECISION

CTA CASE NO. 8150

Page 17 of 19

pending protest of the said taxpayer, and the resolute

intention of the BIR to collect the tax assessed.

64

The Supreme Court explained in the case of Republic of

the Philippines us. Ablaza6s the rationale behind the

prescriptive period for actions for collection, to wit:

"The law prescribing a limitation of actions for the

collection of the income tax is beneficial both to the

Government and to its citizens; to the Government because

tax officers would be obliged to act promptly in the making of

assessment, and to citizens because after the lapse of the

period of prescription citizens would have a feeling of

security against unscrupulous tax agents who will always

find an excuse to inspect the books of taxpayers, not to

determine the latter's real liability, but to take advantage of

every opportunity to molest peaceful, law-abiding citizens.

Without such legal defense, taxpayers would furthermore be

under obligation to always keep their books and keep them

open for inspection subject to harassment by unscrupulous

tax agents. The law on prescription being a remedial

measure should be interpreted in a way conducive to

bringing about the positive purpose of affording protection to

the taxpayer within the contemplation of the Commission

which recommended the approval of the law. "

Respondents also cite Section 281 of the NIRC of 1997,

as amended, as additional basis for the suspension of the

running of the prescriptive period to collect the deficiency tax,

which provides in part:

"SECTION 281. Prescription for Violations of any

Provision of this Code. - xxx xxx xxx

XXX XXX XXX

The prescription shall be interrupted when

proceedings are instituted against the guilty persons and

shall begin to run again if the proceedings are dismissed for

reasons not constituting jeopardy.

The term of prescription shall not run when the

offender is absent from the Philippines."

Needless to say, the above provision pertains to

prescription on the criminal liability for the violation of the

NIRC and not prescription on the right to collect on the

deficiency tax.

64

Supra, Note 55.

65

G.R. No. L-14519, July 26, 1960.

DECISION

CTA CASE NO. 8150

Page 18 of 19

Anent BIR Ruling No. DA-722-2006, suffice it to say that

it was not the legal basis for the grant of the relief sought

herein, hence, no reason exists for the Court to delve on the

validity of its revocation.

It bears to stress that BIR Rulings are not conclusive in

the interpretation of tax laws. Said rulings should not be taken

as the gospel truth of the interpretation of tax laws which will

deprive the courts of its statutory mandate to interpret said

laws. They are merely persuasive in nature. 66

WHEREFORE, premises considered, the Petition for

Review is hereby GRANTED.

The Assessment Notices dated February 29, 2000 for

deficiency excise taxes for taxable years 1991, 1992 and 1993

are hereby CANCELLED and WITHDRAWN for failure of

respondents to enforce collection thereof within the period

allowed by law.

Consequently, the Warrant of Distraint and/or Levy

issued on August 19, 2010 is hereby declared NULL and VOID

and of no legal effect. Respondents and all persons acting

under their direction or authority are now precluded from

collecting the amount of P197,595,158.77, representing

petitioner's excise tax liabilities for taxable years 1991, 1992

and 1993.

The CAP General Insurance Corporation Surety Bond

[Bond No. JCL(8) 00078] in the amount of P296,392,738.06

posted by the petitioner shall be cancelled upon the finality of

this decision.

SO ORDERED.

AMELIA R. COTANGCO-MANALASTAS

Associate Justice

66

Jewel Pawnshop Corp. vs. CIR, CTA Case No. 6824, September 14, 2004.

DECISION

CTA CASE NO. 8150

Page 19 of 19

WE CONCUR:

J.tfANITO c. CASTANEDR,'JR.

Associate Justice

ATTESTATION

I attest that the conclusions in the above Decision were

reached in consultation before the case was assigned to the

writer of the opinion of the Court's Division.

36ANITO C. CASTANEDA, JR.

Associate Justice

Chairperson

CERTIFICATION

Pursuant to Section 13, Article VIII of the Constitution

and the Division Chairperson's Attestation, it is hereby

certified that the conclusions in the above Decision were

reached in consultation before the case was assigned to the

writer of the opinion of the Court.

Presiding Justice

You might also like

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Commissioner of Internal Revenue v. GS GrainsDocument12 pagesCommissioner of Internal Revenue v. GS GrainsimianmoralesNo ratings yet

- Court upholds tax assessments against Surigao Micro Credit CorpDocument24 pagesCourt upholds tax assessments against Surigao Micro Credit CorpJerik ElesioNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City First DivisionDocument20 pagesRepublic of The Philippines Court of Tax Appeals Quezon City First DivisionYna YnaNo ratings yet

- CTA upholds lack of LOA voids tax assessmentDocument8 pagesCTA upholds lack of LOA voids tax assessmentCamille CastilloNo ratings yet

- Republic of The Philippines Quezon CityDocument32 pagesRepublic of The Philippines Quezon CityDyrene Rosario UngsodNo ratings yet

- Court Oft Ax Appeals: Special Third DivisionDocument47 pagesCourt Oft Ax Appeals: Special Third DivisionDean MarkNo ratings yet

- R S On E: First Divi IONDocument23 pagesR S On E: First Divi IONSugisaki HanaNo ratings yet

- Court Review of BIR Assessment of Bank's FCDU TransactionsDocument16 pagesCourt Review of BIR Assessment of Bank's FCDU TransactionsAramea BaneraNo ratings yet

- CTA_2D_CV_10175_D_2023JUL10_ASS (1)Document27 pagesCTA_2D_CV_10175_D_2023JUL10_ASS (1)Vince Lupango (imistervince)No ratings yet

- Active v. CirDocument32 pagesActive v. CirKim AgustinNo ratings yet

- Court: Republic of The Philippines of Tax Appeals Quezon CityDocument18 pagesCourt: Republic of The Philippines of Tax Appeals Quezon CityDiana BaldozaNo ratings yet

- CTA_EB_CV_02589_D_2023JUL28_ASS (1)Document28 pagesCTA_EB_CV_02589_D_2023JUL28_ASS (1)Vince Lupango (imistervince)No ratings yet

- Court: Cta Case No. 9272Document24 pagesCourt: Cta Case No. 9272yakyakxxNo ratings yet

- BPI Appeals DST Assessment on Foreign Exchange SalesDocument39 pagesBPI Appeals DST Assessment on Foreign Exchange SalesGee GuevarraNo ratings yet

- Cta 3D CV 08694 A 2018jun28 AssDocument25 pagesCta 3D CV 08694 A 2018jun28 AssLady Paul SyNo ratings yet

- Due Process UpheldDocument33 pagesDue Process UpheldsalpanditaNo ratings yet

- Waterfront v. CIRDocument18 pagesWaterfront v. CIRaudreydql5No ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument3 pagesPetitioner Vs Vs Respondent: First DivisionNika RojasNo ratings yet

- En Banc: Republic of The Philippines Court of Tax Appeals Quezon CityDocument31 pagesEn Banc: Republic of The Philippines Court of Tax Appeals Quezon CityVanessa Grace TamarayNo ratings yet

- CTA Case Summary on Tax Assessment DisputeDocument29 pagesCTA Case Summary on Tax Assessment DisputeaitoomuchtvNo ratings yet

- Republic of Philippines Court of Tax Appeals Quezon City: Archipelago Motor No. 1258Document12 pagesRepublic of Philippines Court of Tax Appeals Quezon City: Archipelago Motor No. 1258alyssaNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City Special Second DivisionDocument45 pagesRepublic of The Philippines Court of Tax Appeals Quezon City Special Second DivisionAbby ParaisoNo ratings yet

- First Division: Court of Tax AppealsDocument27 pagesFirst Division: Court of Tax AppealsYna YnaNo ratings yet

- Court of Tax Appeals: DecisionDocument18 pagesCourt of Tax Appeals: DecisionAnonymous 1AgYRerl8No ratings yet

- Court of Tax Appeals: Barrio Manufacturing Corporation, Fiesta CT A Case No. 9880Document16 pagesCourt of Tax Appeals: Barrio Manufacturing Corporation, Fiesta CT A Case No. 9880Diana BaldozaNo ratings yet

- Universal Weavers Corp. vs. CIR, J. Delos SantosDocument14 pagesUniversal Weavers Corp. vs. CIR, J. Delos SantosChristopher ArellanoNo ratings yet

- 13 - Paymentwall Inc. v. CIRDocument29 pages13 - Paymentwall Inc. v. CIRCarlota VillaromanNo ratings yet

- Court Reviews Tax Assessments Against Mobile FirmDocument16 pagesCourt Reviews Tax Assessments Against Mobile FirmAurcus JumskieNo ratings yet

- 01-City of Manila v. Grecia-Cuerdo GR No 175723Document6 pages01-City of Manila v. Grecia-Cuerdo GR No 175723ryanmeinNo ratings yet

- Cta 1D CV 08507 D 2014may29 AssDocument17 pagesCta 1D CV 08507 D 2014may29 AssElen CiaNo ratings yet

- Cta 2D CV 07809 D 2009dec16 AssDocument39 pagesCta 2D CV 07809 D 2009dec16 AssNash LedesmaNo ratings yet

- Cta 3D CV 08766 D 2016dec15 AssDocument32 pagesCta 3D CV 08766 D 2016dec15 Assメアリー フィオナNo ratings yet

- Cta Eb CV 02321 D 2022mar02 AssDocument29 pagesCta Eb CV 02321 D 2022mar02 AssgregNo ratings yet

- CBK Power Company Limited vs. Commissioner of Internal Revenue PDFDocument20 pagesCBK Power Company Limited vs. Commissioner of Internal Revenue PDFLuigi JaroNo ratings yet

- CTA upholds tax assessments against Philippine Aerospace Development Corporation but modifies interest impositionsDocument11 pagesCTA upholds tax assessments against Philippine Aerospace Development Corporation but modifies interest impositionsVanessa Grace TamarayNo ratings yet

- CIR v. SVI TechnologiesDocument23 pagesCIR v. SVI Technologiesaudreydql5No ratings yet

- CTA Case Summary: Nyk-Filjapan Shipping Corp vs CIRDocument21 pagesCTA Case Summary: Nyk-Filjapan Shipping Corp vs CIRCarlota VillaromanNo ratings yet

- Gidwani v. PeopleDocument5 pagesGidwani v. PeopleFrances Ann TevesNo ratings yet

- CTA Case No. 9074 - Subic Water vs. CIRDocument83 pagesCTA Case No. 9074 - Subic Water vs. CIRJeffrey JosolNo ratings yet

- Cta 1D CV 08892 D 2016sep30 Ref PDFDocument20 pagesCta 1D CV 08892 D 2016sep30 Ref PDFiptrinidadNo ratings yet

- McDonald's VAT Case DecisionDocument12 pagesMcDonald's VAT Case DecisionSaint AliaNo ratings yet

- Commissioner of Internal Revenue v. Transfield PhilippinesDocument9 pagesCommissioner of Internal Revenue v. Transfield PhilippinesBeltran KathNo ratings yet

- Jile' ' TL : Republic of The Philippines Court of Tax Appeals Quezon CityDocument15 pagesJile' ' TL : Republic of The Philippines Court of Tax Appeals Quezon CityMark RojoNo ratings yet

- CIR Right to Collect Tax PrescribedDocument16 pagesCIR Right to Collect Tax PrescribedPrhylleNo ratings yet

- Republic of the Philippines Court of Tax Appeals DecisionDocument30 pagesRepublic of the Philippines Court of Tax Appeals DecisionRandy BelloNo ratings yet

- CIR v. MCC Transport Singapore Pte. LTD., C.T.A. EB Case No. 1961 (C.T.A. Case No. 9045), (July 14, 2020) )Document10 pagesCIR v. MCC Transport Singapore Pte. LTD., C.T.A. EB Case No. 1961 (C.T.A. Case No. 9045), (July 14, 2020) )Kriszan ManiponNo ratings yet

- Bank of The Philippine Islands vs. Commissioner of Internal RevenueDocument12 pagesBank of The Philippine Islands vs. Commissioner of Internal RevenueMaria Nicole VaneeteeNo ratings yet

- C.T.A. EB CASE NO. 1771. March 13, 2019Document13 pagesC.T.A. EB CASE NO. 1771. March 13, 2019nathalie velasquezNo ratings yet

- 154.CIR Vs BPIDocument7 pages154.CIR Vs BPIClyde KitongNo ratings yet

- Court Decision on Local Business Tax AssessmentDocument20 pagesCourt Decision on Local Business Tax AssessmentJason MergalNo ratings yet

- 4 - CIR v. Kudos Metal Corp.Document3 pages4 - CIR v. Kudos Metal Corp.JaysieMicabaloNo ratings yet

- Bdo V CirDocument20 pagesBdo V CirKrys MartinezNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonDocument30 pagesRepublic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonjohnnayelNo ratings yet

- Court upholds tax assessments against Philippine hotelDocument36 pagesCourt upholds tax assessments against Philippine hotelYna YnaNo ratings yet

- BPI vs. CIR, G.R. No. 181836, July 09, 2014Document8 pagesBPI vs. CIR, G.R. No. 181836, July 09, 2014raph basilioNo ratings yet

- Supreme Court: Republic of TheDocument23 pagesSupreme Court: Republic of TheKin Pearly FloresNo ratings yet

- Special Second Division: DecisionDocument22 pagesSpecial Second Division: DecisionMarcy BaklushNo ratings yet

- 22) ASIAN TRANSMISSION Vs CIR - J.BersaminDocument5 pages22) ASIAN TRANSMISSION Vs CIR - J.BersaminStalin LeningradNo ratings yet

- Commission On Audit Circular No. 88-282aDocument4 pagesCommission On Audit Circular No. 88-282aPrateik Ryuki100% (2)

- Transpo ReviewerDocument108 pagesTranspo ReviewerSui100% (1)

- 30B6 NotesDocument42 pages30B6 NotesarkstersNo ratings yet

- Commission On Audit Circular No. 88-282aDocument4 pagesCommission On Audit Circular No. 88-282aPrateik Ryuki100% (2)

- Certificate of Employment - AimeeDocument1 pageCertificate of Employment - AimeearkstersNo ratings yet

- Conflicts 9139 CA 613Document6 pagesConflicts 9139 CA 613arkstersNo ratings yet

- Understanding PPP, BOT and JV ProjectsDocument248 pagesUnderstanding PPP, BOT and JV ProjectsambonulanNo ratings yet

- Motion To Quash NotesDocument2 pagesMotion To Quash NotesarkstersNo ratings yet

- Registering a Business in the PhilippinesDocument6 pagesRegistering a Business in the PhilippinesTina RosalesNo ratings yet

- Family Law CaliforniaDocument6 pagesFamily Law CaliforniaarkstersNo ratings yet

- Merged Bar SyllabusDocument107 pagesMerged Bar SyllabusarkstersNo ratings yet

- LipDocument1 pageLiparkstersNo ratings yet

- De Castro DoctrinesDocument111 pagesDe Castro DoctrinesarkstersNo ratings yet

- Personal LawDocument10 pagesPersonal LawarkstersNo ratings yet

- Macronutrients Calculator Excel SpreadsheetDocument23 pagesMacronutrients Calculator Excel SpreadsheetarkstersNo ratings yet

- Macronutrients Calculator Excel SpreadsheetDocument23 pagesMacronutrients Calculator Excel SpreadsheetarkstersNo ratings yet

- G.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsDocument8 pagesG.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsKaren BandillaNo ratings yet

- 7B1 Executive Secretary V Southwing Heavy Industries 2006Document36 pages7B1 Executive Secretary V Southwing Heavy Industries 2006arkstersNo ratings yet

- DRC Vs UgandaDocument2 pagesDRC Vs Ugandaarksters100% (1)

- Liability of Accommodation Party in Loan AgreementDocument1 pageLiability of Accommodation Party in Loan Agreementarksters100% (1)

- TortsDocument10 pagesTortsarkstersNo ratings yet

- Zaguirre V CastilloDocument4 pagesZaguirre V CastilloarkstersNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Digest in Cases in Constitutional Law II Renz PagayananDocument266 pagesDigest in Cases in Constitutional Law II Renz PagayananarkstersNo ratings yet

- RH Bill - Position PaperDocument3 pagesRH Bill - Position Paperarksters0% (1)

- Position PaperDocument4 pagesPosition PaperarkstersNo ratings yet

- Order NotesDocument5 pagesOrder NotesarkstersNo ratings yet

- Full Leg Res HWDocument24 pagesFull Leg Res HWarkstersNo ratings yet

- Full Leg Res HWDocument24 pagesFull Leg Res HWarkstersNo ratings yet

- Authum Infra - PPTDocument191 pagesAuthum Infra - PPTmisfitmedicoNo ratings yet

- Theories of Crime Causation 1 PDFDocument28 pagesTheories of Crime Causation 1 PDFJeanilyn Palma100% (1)

- Network TopologyDocument36 pagesNetwork TopologykanagalasasankNo ratings yet

- MUH050220 O-12 - Final PDF 061221Document123 pagesMUH050220 O-12 - Final PDF 061221Ricardo OkabeNo ratings yet

- International Aviation Safety Assessment Assessor’s ChecklistDocument23 pagesInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaNo ratings yet

- Zeal Court Acid Attack AppealDocument24 pagesZeal Court Acid Attack Appealshanika33% (3)

- Garden of LoversDocument10 pagesGarden of LoversAmy100% (1)

- The Star News June 18 2015Document36 pagesThe Star News June 18 2015The Star NewsNo ratings yet

- Introduction to Comparative Law MaterialsDocument5 pagesIntroduction to Comparative Law MaterialsnnnNo ratings yet

- 1981 MIG-23 The Mystery in Soviet Skies WPAFB FTD PDFDocument18 pages1981 MIG-23 The Mystery in Soviet Skies WPAFB FTD PDFapakuniNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiraj PNo ratings yet

- 636965599320795049Document210 pages636965599320795049AakshaNo ratings yet

- Respondent.: (G.R. No. 227482. July 1, 2019.)Document2 pagesRespondent.: (G.R. No. 227482. July 1, 2019.)mei atienza100% (1)

- Professional Regulation Commission (PRC) - LuceroDocument9 pagesProfessional Regulation Commission (PRC) - LuceroMelrick LuceroNo ratings yet

- Carbon Monoxide Safety GuideDocument2 pagesCarbon Monoxide Safety Guidewasim akramNo ratings yet

- Mutual Fund Industry Study - Final BEDocument45 pagesMutual Fund Industry Study - Final BEPrerna KhoslaNo ratings yet

- M. C. Mehta V. Union of IndiaDocument14 pagesM. C. Mehta V. Union of Indiashort videosNo ratings yet

- Ejercito V. Sandiganbayan G.R. No. 157294-95Document4 pagesEjercito V. Sandiganbayan G.R. No. 157294-95Sabel FordNo ratings yet

- In Re Sycip, 92 SCRA 1 (1979)Document3 pagesIn Re Sycip, 92 SCRA 1 (1979)Edgar Joshua Timbang100% (4)

- This Your Letter: of PhilippinesDocument4 pagesThis Your Letter: of PhilippinesAlphaphilea PsNo ratings yet

- Admin Cases PoliDocument20 pagesAdmin Cases PoliEunice Iquina100% (1)

- Mariam-uz-Zamani, Wife of Emperor Akbar and Mother of JahangirDocument6 pagesMariam-uz-Zamani, Wife of Emperor Akbar and Mother of JahangirMarinela UrsuNo ratings yet

- Concessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipuraDocument113 pagesConcessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipurapelicanbriefcaseNo ratings yet

- ULI110U 18V1S1 8 0 1 SV1 Ebook PDFDocument205 pagesULI110U 18V1S1 8 0 1 SV1 Ebook PDFTunahan KızılkayaNo ratings yet

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- A Critical Look at Tanzani's Development Vision 2025Document4 pagesA Critical Look at Tanzani's Development Vision 2025Haron KombeNo ratings yet

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDocument2 pagesDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCONo ratings yet

- Legal Profession Cases CompilationDocument13 pagesLegal Profession Cases CompilationManuelMarasiganMismanosNo ratings yet

- Biography On Mahatma Gandhi MitaliDocument11 pagesBiography On Mahatma Gandhi Mitaligopal kesarwaniNo ratings yet