Professional Documents

Culture Documents

Ocean Carriers

Uploaded by

Marc de NeergaardCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ocean Carriers

Uploaded by

Marc de NeergaardCopyright:

Available Formats

Ocean Carrier Case Study

by

Stratton Oakmont

Anna Barzanti, Lorenzo Maria Bollani, Marc de Neergaard, Riccardo Arosio

Class 18

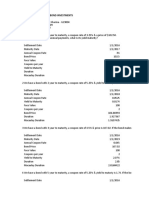

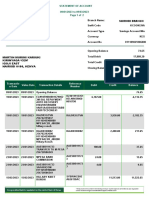

EXECUTIVE SUMMARY. January 2001. A shipping company, Ocean Carriers, faces the urgent investment choice of ordering a new cape-size carrier due to a charterer requiring service of such in 2 years time. The lease agreement provides the company with a declared cash flow for 3 years until the expiration, but at that time the company starts facing uncertainties. Forecasting expected cash flows and evaluating corporate policy shows that the only profitable choice is when buying the $39M vessel and operating the business in Hong Kong; moreover, revoking the routine scrapping of the ship after 15 years to operate it for 25 years controversially. SUMMARY OF FACTS. The initial investment will be split up in parts according to an installment plan, citing yearly payments beginning in January 2001 with $3.9M, $3.9M and $31.2 M respectively, totaling a nominal $39M. While in 2007, a 5-year repeating CAPEX will amount to $0.3M and grow to $8.5M in 2022. The initial capital investment will be depreciated over 25 years with an estimated scrapping value of $5M after 15 year. Meanwhile, the repeating CAPEX increases the scope of operation for the vessel with 5 years with each occurrence. An additional investment will made 2001 in net working capital of $500,000, growing with inflation (expected constant at 3% annually). Daily operating expenses starts at $4,000, increasing annually at 100bps above inflation, excluding other costs which is set to $0. The cash flow from trading the vessel for the first 3 years are considered almost credit risk free since they are charted by an established client. In 2007, Ocean Carriers will in the projected scenario assume the price of the volatile spot rate without ability to lock higher charter rates for longer periods, this shall be taken as the pessimistic view. External help used a vital relationship in order to establish expectations about the daily hire rights descending form in 18,714 in 2007 to 13,448 in 2027 and established that newer ships earn a premium price. Lastly, the discount rate, or WACC equals 9% and further data can be found in the exhibits.

STATEMENT OF THE PROBLEM. If management were to meet short-term customer demand by committing into a considerable long-term investment, what internal and external conditions would justify this venture and how would it create additional value for the shareholders if fulfilled. ANALYSIS. The fragmented shipping industry is one of the most essential industries for continuous globalization and growth; industry prospects are surprisingly stable in contrast to the normal logistics businesses that are highly cyclical. Daily hire rates are found by the interaction of the supply and demand of vessels. The supply is influence by market demand for shipping capacity, the efficiency and size of vessels and the rate of scrapping. The demand is influenced by the situation of the world economy, technological changes and trade patterns. There is a strong positive relationship between spot/time charter hire rates and demand for iron ore vessel shipments (exhibition 5). This is due to the fact that rates are set by current market conditions and expectations that also influences investment decisions in new vessels. In 2001 the iron and coal industry faces a stagnant situation with a reduction of shipment of 0.9%, while the supply increases with the introduction of 63 new ships in 2001-2002. By the end of 2000 the major part of the ships available are new (29M of DWT are Under 5 Years of age) suggesting a decrease in the average/times rate and an additional decrease in the spot rates. Moreover, given only few scrappings in recent years and young age of cape-sizes, we can expect that the suppliers to lower their prices and thus also spot rates in the short run, including next year. (exhibition 6) The forecast is highly optimistic about the industrys long-term prospects with continuous growth. Real economic growth will give rise to higher demand for the commodities transported and spot rates will alienate with the ones from 2000. In fact, in 2002 the iron industry will recover, especially because of an increase in the trading volumes, thanks to the growth of the Indian and Australian market, also influenced by the efficiency gains due to gradual technological improvements.

The choice of making 3 installment payments provides the company with a large non-recurring capital outflow in 2 short years that will cause grave liquidity constraints, investing $500,000 in net working capital compensates for this. However, Ocean Carriers should try to increase the payments period in order to be able to keep working capital at higher levels.

Using the data provided, exhibition 15 and 25 shows how the only profitable choice with current expectations are to choose Hong Kong as main office while using the boat for 25 years, making a NPV of $ 1,363,560. All other alternatives create negative NPVs that should not be accepted since it decreases shareholder value. In order for New York to break even in 15 years, the ship has to cost $27,213,696, which is a lot less than demanded. Worth noting is that the IRR is only 3.979% in the profitable option, which is a very low rate of return considering that they could just invest their money elsewhere on the market. Concerning the WACC which equals 9% for Ocean Carriers, it seems that they are either giving out to much dividends, have low growth expectations or because they are funded by mostly debt. Reevaluating the capital structure is strongly recommended since lower costs would decrease the discount rate and increase the NPV. The corporate strategy obviously has to be reevaluated concerning when to decommission the vessel since this makes the project not financially supported. The higher costs of operating an older vessel is obviously lower that the gains of doing so.

RECOMMENDATIONS. There need to be more data to support that the firm is able to lock higher prices which would enable them to receive higher cash flows and with greater certainty. Extending the years of service for the vessels from 15 to at least a span where NPV is positive is crucial for future projects to be even considered. Furthermore, it is necessary to be a reevaluate why the WACC is so high, even in an industry with such a stable growth projects. Stockholders are able to gain more elsewhere and thats a problem for the management of the company. (exhibition 6/other).

Exhibit 15

Exhibit 25

You might also like

- Ocean Carriers Case StudyDocument7 pagesOcean Carriers Case Studyaida100% (1)

- Ocean Carriers Case Study ReportDocument3 pagesOcean Carriers Case Study ReportUsama Farooq0% (1)

- Ocean Carriers Capesize Ship Project AnalysisDocument10 pagesOcean Carriers Capesize Ship Project AnalysisScottMeltonNo ratings yet

- OC Group evaluates new capsize shipDocument5 pagesOC Group evaluates new capsize shipGeorge Kolbaia80% (5)

- Ocean Carriers 2020 - A5Document10 pagesOcean Carriers 2020 - A5Mohith ChowdharyNo ratings yet

- Final Ocean Carriers Case ReportDocument7 pagesFinal Ocean Carriers Case ReportStefanoAquilinoNo ratings yet

- Ocean CarriersDocument7 pagesOcean CarriersAvinash ChoudharyNo ratings yet

- Ocean Carriers Case StudyDocument5 pagesOcean Carriers Case StudyJennifer Johnson71% (17)

- Ocean Carriers Reports - Final Case SolutionDocument9 pagesOcean Carriers Reports - Final Case SolutionNadia VirkNo ratings yet

- Ocean CarriersDocument3 pagesOcean CarrierswoheduoleyetuNo ratings yet

- Ocean Carriers Case StudyDocument7 pagesOcean Carriers Case StudyaidaNo ratings yet

- Ocean Carries HBS Case StudyDocument4 pagesOcean Carries HBS Case StudyRatul EsrarNo ratings yet

- Ocean Carriers Capsize Vessel Investment AnalysisDocument5 pagesOcean Carriers Capsize Vessel Investment AnalysisflwgearNo ratings yet

- OceanCarriers KenDocument24 pagesOceanCarriers KensaaaruuuNo ratings yet

- Overview of Ocean Carriers CaseDocument2 pagesOverview of Ocean Carriers CaseIrakli SaliaNo ratings yet

- Lecture Note 6 (Case Ocean Carrier)Document25 pagesLecture Note 6 (Case Ocean Carrier)Jing Zhou100% (1)

- Case 1 Ocean CarrierDocument15 pagesCase 1 Ocean CarrierAngeline WangNo ratings yet

- Case Study Ocean CarriersDocument5 pagesCase Study Ocean Carriersmetzor100% (4)

- Ocean Carriers FinalDocument4 pagesOcean Carriers FinalBilal AsifNo ratings yet

- Ocean Carrier CaseDocument17 pagesOcean Carrier CasechiaweesengNo ratings yet

- Ocean CarriersDocument17 pagesOcean CarriersMridula Hari33% (3)

- Ocean CarriersDocument26 pagesOcean Carriersclassmate0% (1)

- Ocean Carriers - Final SheetDocument2 pagesOcean Carriers - Final SheetandroidDownloadOnly100% (2)

- Ocean CarriersDocument3 pagesOcean CarriersHarita KuppaNo ratings yet

- Ocean Carriers MemoDocument2 pagesOcean Carriers MemoAnkush SaraffNo ratings yet

- 25 Years Use Tax ScenarioDocument14 pages25 Years Use Tax ScenarioToshalina Nayak50% (4)

- Ocean Carriers ExerciseDocument13 pagesOcean Carriers ExercisesafderNo ratings yet

- Ocean - Carriers Revised 2011Document7 pagesOcean - Carriers Revised 2011Prashant MishraNo ratings yet

- Ocean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeDocument6 pagesOcean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeJayzie LiNo ratings yet

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Sampa Video Financial Projections and AssumptionsDocument10 pagesSampa Video Financial Projections and AssumptionskanabaramitNo ratings yet

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Flash Memory, Inc.Document2 pagesFlash Memory, Inc.Stella Zukhbaia0% (5)

- ClarksonDocument2 pagesClarksonYang Pu100% (3)

- Midland Energy Case StudyDocument5 pagesMidland Energy Case StudyLokesh GopalakrishnanNo ratings yet

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Document13 pagesMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaNo ratings yet

- Midland Energy Resources (Final)Document4 pagesMidland Energy Resources (Final)satherbd21100% (3)

- Economy Shipping Co Case SolutionDocument7 pagesEconomy Shipping Co Case SolutionPaco Colín100% (2)

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- Midland Energy Case StudyDocument5 pagesMidland Energy Case Studyrun2win645100% (7)

- Calaveras VineyardsDocument12 pagesCalaveras Vineyardsapi-250891173100% (4)

- Airthread ValuationDocument19 pagesAirthread Valuation45ss28No ratings yet

- AirThread ValuationDocument6 pagesAirThread ValuationShilpi Jain0% (6)

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionAbhishek GargNo ratings yet

- MW Petroleum Corporation (A)Document6 pagesMW Petroleum Corporation (A)AnandNo ratings yet

- Economy Shipping Case AnswersDocument72 pagesEconomy Shipping Case Answersreduay67% (3)

- Ocean CarriersDocument2 pagesOcean CarriersRini RafiNo ratings yet

- AnalysisDocument2 pagesAnalysisZhieh LorNo ratings yet

- Ocean Carriers Case: Executive SummaryDocument5 pagesOcean Carriers Case: Executive SummarykokoNo ratings yet

- Group18 OceanCarrierDocument2 pagesGroup18 OceanCarrierSAHILNo ratings yet

- Case Study: Ocean Carriers Inc.: Members Team: TitanicDocument9 pagesCase Study: Ocean Carriers Inc.: Members Team: TitanicAnkitNo ratings yet

- Ocean Carriers Project EvaluationDocument5 pagesOcean Carriers Project Evaluationsaaaruuu0% (1)

- Ocean Carrier Investment AnalysisDocument8 pagesOcean Carrier Investment AnalysisStefanoNo ratings yet

- Ocean Carriers Project AnalysisDocument11 pagesOcean Carriers Project AnalysisSameer KumarNo ratings yet

- Second-Hand Vs New Building - The Better OptionDocument5 pagesSecond-Hand Vs New Building - The Better OptionNikos Noulezas100% (2)

- OCBC Asia Credit - Offshore Marine Sector - Many Moving Parts (11 Mar 2015) PDFDocument14 pagesOCBC Asia Credit - Offshore Marine Sector - Many Moving Parts (11 Mar 2015) PDFInvest StockNo ratings yet

- Capesized BrainsDocument7 pagesCapesized Brainsreluca11No ratings yet

- Rating Methodology For Shipping CompaniesDocument7 pagesRating Methodology For Shipping CompaniesprasadcshettyNo ratings yet

- BIMBSec - Oil Gas News Flash 20120709Document3 pagesBIMBSec - Oil Gas News Flash 20120709Bimb SecNo ratings yet

- TT06 - QuesDocument3 pagesTT06 - QuesLe Tuong MinhNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- External Sources of Finance Long TermDocument2 pagesExternal Sources of Finance Long Termabrar mahir SahilNo ratings yet

- Assignment #2Document3 pagesAssignment #2Chad OngNo ratings yet

- Financing Disbursement Master Roll: B0685 Malapatan RegularDocument18 pagesFinancing Disbursement Master Roll: B0685 Malapatan RegularAsa Ph MalapatanNo ratings yet

- Final Askari ReportDocument110 pagesFinal Askari ReportjindjaanNo ratings yet

- Financial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRDocument8 pagesFinancial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRTawanda Tatenda HerbertNo ratings yet

- Targeting Presentation Nov' 07Document15 pagesTargeting Presentation Nov' 07Shashank SahuNo ratings yet

- Martin Murimi KariukiDocument2 pagesMartin Murimi KariukiKameneja LeeNo ratings yet

- Pas 21-The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21-The Effects of Changes in Foreign Exchange RatesAryan LeeNo ratings yet

- Ratio Analysis Of: Bata Shoe Company (BD) LTDDocument19 pagesRatio Analysis Of: Bata Shoe Company (BD) LTDMonjur HasanNo ratings yet

- Accountancy For Lawyers - Practice QuestionsDocument3 pagesAccountancy For Lawyers - Practice QuestionsNantege ProssielyNo ratings yet

- Debt Limit Letter To Congress 20210928Document2 pagesDebt Limit Letter To Congress 20210928ZerohedgeNo ratings yet

- Receivable Financing: Pledge, Assignment and FactoringDocument35 pagesReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASNo ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

- BDB Annual Report 2021 - Part - 4Document111 pagesBDB Annual Report 2021 - Part - 42023149467No ratings yet

- Finance areas interconnectionDocument3 pagesFinance areas interconnectionCASTOR, Vincent PaulNo ratings yet

- Final Accounts Without AdjustmentsDocument22 pagesFinal Accounts Without AdjustmentsFaizan MisbahuddinNo ratings yet

- Pledging of ReceivablesDocument2 pagesPledging of ReceivablesPrince Alexis GarciaNo ratings yet

- Applied Auditing Solution Manual Nginaescala AsuncionDocument166 pagesApplied Auditing Solution Manual Nginaescala AsuncionQuenn NavalNo ratings yet

- Functions and Effects of Money in an EconomyDocument71 pagesFunctions and Effects of Money in an Economysweet haniaNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- CH 3 - Lap Konsolidasi PengantarDocument45 pagesCH 3 - Lap Konsolidasi PengantarJulia Pratiwi ParhusipNo ratings yet

- Agricultural Business ManagementDocument5 pagesAgricultural Business ManagementAreicra NutNo ratings yet

- Pakistan Stock Exchange Limited: Internet Trading Subscribers ListDocument3 pagesPakistan Stock Exchange Limited: Internet Trading Subscribers ListMuhammad AhmedNo ratings yet

- ECS1601 Chapter 16 Narrated Slides Foreign Sector Exchange RatesDocument31 pagesECS1601 Chapter 16 Narrated Slides Foreign Sector Exchange RatesConnor Van der MerweNo ratings yet

- Gainesboro Machine Tools Corporation: Other Cases in Which Dividend Policy Is An Important IssueDocument22 pagesGainesboro Machine Tools Corporation: Other Cases in Which Dividend Policy Is An Important IssueUshnaNo ratings yet

- American Economic Association The American Economic ReviewDocument9 pagesAmerican Economic Association The American Economic ReviewWazzupWorldNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceN.prem kumarNo ratings yet

- Equity YyyDocument33 pagesEquity YyyJude SantosNo ratings yet