Professional Documents

Culture Documents

Apprisal Sample

Uploaded by

moon.satkhiraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apprisal Sample

Uploaded by

moon.satkhiraCopyright:

Available Formats

Client Organisation: Barclays

A Client PLC

Human Capital Management

Report

AAA AAA AAA

p

2005

BB BB BB

Review

BB BB BB

CC CC

BB

AA

BBB BBB

AA

CCC CCC

Please note: This report is designed for

ill t ti l f idi

Human Capital Report 2005

Human Capital Management

Client Report [period 01.01.04 31.112.04]

Draft 01.02.06

illustration only as a means of providing a

template with example content and layout.

All references within reflect common

elements but do not refer to any specific

organisation or person.

Client Organisation: Barclays

The purpose of this document is to provide an illustrative guide to a human

capital report. We advise reading our accompanying HC Reporting white paper to

Purpose of this document

p p g p y g p g p p

gain further context and understanding regarding the actual reporting construct.

It is not meant to be prescriptive or comprehensive, merely an indication of likely

headings and content . Guidance notes are included where you see the following

format:

Guidance notes

Should you wish to obtain further information or assistance with regard to

producing a document or should you wish to receive specific Human Capital

Reporting related training*, then please contact our international HCR Corporate

Solutions Team on:

+ 44 20 7 887 6108 or e-mail: hcr@valuentis.com .

*VaLUENTiS International School of Human Capital Management

Human Capital

Measurement

VB VB- -HR HR Rating Rating

HC Reporting HC Reporting

Performance Performance

Talent Talent

Employee Employee

engagement engagement

Employer brand Employer brand

Every so often comes a

new market leader

Measurement

Human Capital

Management

HR Function

Effectiveness

HC Scorecard HC Scorecard

Talent Talent

Reward Reward

Retention Retention

HC HC

Benchmarking Benchmarking

HR Strategy HR Strategy

HR Value proposition HR Value proposition

HR Delivery model HR Delivery model

Organisation Measurement

& Effectiveness

Diagnosis ? Design ? Implementation

HR Capability HR Capability

Organisational Organisational- -HR HR

work work- -out out

programmes programmes

Scorecards Scorecards

Value Value- -based based

enterprise management enterprise management

M&A integration M&A integration

Restructures Restructures

HR Audits HR Audits

Sales team effectiveness Sales team effectiveness

Client management Client management

Human Capital Report 2005 2

Global Headquarters: 2nd Floor, Berkeley Square House, Berkeley Square, London, W1J 6BD

Tel: +44 20 7 887 6108 Fax: +44 20 7 887 6100? www.valuentis.com? www.vbhr.com

Next.

Client Organisation: Barclays

Different levels of reporting

VaLUENTiS white paper Human Capital Reporting: A summary of draft proposals

provides the rationale for organisations to aspire to three different levels of

reporting, Standard, Intermediate and Advanced.

Each level contains a number of expected (mandatory) components with certain

options/variations as shown in the table below.

This takes account of where organisations are today and where they can progress

to, over time. Naturally we would expect readers of the information to push for

everybody to the advanced level as soon as possible.

There are plans for a fourth and fifth level as and when organisations have

reached the Advanced ceiling reached the Advanced ceiling.

Levels of HC Reporting

g

a

t

e

d

i

c

e

t

l

y

s

i

s

n

g

o

r

m

e

n

t

Level of

HC

reporting

P

a

r

t

o

f

e

x

i

s

t

i

n

g

d

o

c

u

m

e

n

t

S

e

p

a

r

a

t

e

d

e

d

i

c

a

H

C

R

e

p

o

r

t

H

C

P

o

l

i

c

i

e

s

H

C

I

n

i

t

i

a

t

i

v

e

s

C

o

m

p

a

n

y

p

r

a

c

t

i

s

p

e

c

i

f

i

c

s

H

C

O

S

t

a

t

e

m

e

n

t

P

e

o

p

l

e

F

l

o

w

s

t

a

t

e

m

e

n

t

P

r

o

d

u

c

t

i

v

i

t

y

s

t

a

t

e

m

e

n

t

K

P

I

s

S

e

g

m

e

n

t

a

l

a

n

a

l

E

n

h

a

n

c

e

d

r

a

t

i

o

r

e

p

o

r

t

i

n

g

A

d

d

i

t

i

o

n

a

l

H

C

d

o

m

a

i

n

r

e

p

o

r

t

i

n

V

B

-

H

R

R

a

t

i

n

g

e

q

u

i

v

a

l

e

n

t

V

B

-

H

R

R

a

t

i

n

g

n

a

r

r

a

t

i

v

e

H

C

V

a

l

u

e

s

t

a

t

e

m

Standard

- - -

Intermediate

-

-

Advanced

-

Optional

Mandatory

- Not applicable

The three levels are designed to provide

organisations with flexible options given their intent

to publish human capital related information.

Human Capital Report 2005 3

Read on.

Client Organisation: Barclays

Content

1. Review of 2005

2. Driving organisational performance

through HCM policies

T l t t

We propose that

the HC report

for the period 01.01.05 31.12.05]

Talent management

Employee wellness

Diversity & employee opportunities

Flexible employment & reward

3. Human Capital initiatives

Employee engagement

R it t & t ti

the HC report

should be a

standalone

document or

contained as a

section within the

annual accounts.

Recruitment & retention

Learning

4. Company practice insight

5. Human Capital - Report of Directors

6. Human Capital Reporting statements

Human Capital Operating statement

P l Fl t t t PeopleFlow statement

HC Productivity statement

7. Business segment review

8. Our VB-HRRating

People

Purpose

Profit

Human Capital Report 2005

Client Organisation: Barclays

Review of 2005

As a leading company in our field, we recognise

the huge part people play in the delivery of our

products and services to the market-place Our products and services to the market place. Our

financial performance is a testament to this

contribution. As part of our global strategy, we

place significant importance in reporting aspects

of our people, the essence of which is contained

within this report.

Our strategy is based on continually gaining competitive advantage

which can only be maintained through the dedication, development

d f l and management of our people assets.

Our performance based culture is designed to get the best from our

people and we feel that it is necessary to place just as much

emphasis on measuring the people aspects of the business as the

traditional measures.

This document provides a window through which our various

investors and stakeholders can see with more transparency and as

such understand and acknowledge our commitment to continued

excellence.

Human Capital Report 2005 5

J. W. Smithers

Chief Executive Officer

Client Organisation: Barclays

Driving Organisational Performance through HCM

policies

Talent management This section Talent management

Selecting our future managers and leaders helps us to ensure that we continue to be a high-performing

organisation that can exceed the expectations of our customers, staff and other stakeholders. We make sure

that we canspot potential andhighperformance, throughuse of our annual appraisal system.

The Enhancing our Performance tool is now available on the company intranet, and allows us to provide all

managers in the Group effective feedback on how they are performing. The 360-degree assessment

incorporates feedback from people who work for them as well as their peers and their own manager,

combining different viewpoints to help themidentify their strengths, as well as the area of their performance or

outcomes that theymight wishto improve with targetedsupport.

This section

should provide

readers with an

outline of specific

policies that the

organisation

wishes to make

known.

y g p g pp

Similarly, we ensure that all our employees receive effective formal and informal feedback on how they are

performing. We are currently rolling out a series of workshops to ensure that all our staff with people

management have a similar approachtowards givingfeedback.

Employee wellness

We have a zero-tolerance view of accidents in the workplace. As we

regard Health &Safety as a core aspect of howwe do business, employees

receive Health & Safety briefings as part of their induction programmes,

with additional annual training updates provided in the case of specialist

roles.

We provide all colleagues the opportunity to receive free eye tests, and

offer subsidised gymmembership as part of our overall Healthy Mind in a

Healthy Body programme. We have received positive feedback from

colleagues since launchingthe programme, withreducedlevels of stress.

I t ff t th t f l f t l di ti

Diversity and employee opportunities

We aspire to creating a diverse workforce that reflects the communities we work in. We recognise diversity as

a way that can add value to the business through incorporating different experiences and viewpoints. This

helps us enhance the waywe deal with our clients andultimatelywe believe it helps our competitive position.

In our staff canteens, we ensure that a range of low-fat, low-sodiumoptions

are available daily, and provide nutritional information so that our

colleagues canmake their owninformedchoices.

To support the way we put this into practice, we ensure that all decisions around hiring, developing and

promoting are based on work-related criteria as laid down in detailed policies. All our recruiters are trained to

avoid discrimination in their questions and assessments and we supplement our interviewing with competency-

basedassessments.

We are committed to providing all employees with equal opportunities based on merit, irrespective of their

race, gender, sexuality or beliefs. Our policy, Respect for everyone is intended to support this and prohibits

discrimination on any grounds. We communicate our equality and diversity policy at induction and provide

guidance to managers on equal opportunities, including recruitment of disabled employees and ethnic

i iti E l t di i i ti h t th h C l i t d L t

Human Capital Report 2005 6

minorities. Employees can report discrimination or harassment through our Complaints procedure. Last year

we received 15 discrimination-related complaints, down from 18 in the previous year. All 15 were resolved

followingdialogue betweenthe individuals concerned.

Client Organisation: Barclays

Driving Organisational Performance through HCM

policies (continued)

Flexible employment and reward Flexible employment and reward

Our flexible working policy applies across all parts of our business (subject to local legislative requirements).

Our employment practices give employees the flexibility to managetheir work-life balance. These include:

part-time working from12 to 36 hours per week; employees can choose a variety of hours per day and

days per week

job share within appropriate roles, two colleagues can share a full-time job

two weeks paid paternity leave (following the birth of a baby)

parental leave (for childcare)

career break schemes of up to one year (e g for personal development or caring responsibilities) career break schemes of up to one year (e.g. for personal development or caring responsibilities)

paid time away fromwork for jury service, bereavement and emergency incidents.

Our pay and benefits package rewards employees for their contribution to the business, and allows each

person to tailor his or her package to suit their needs. Core benefits include a competitive salary, which takes

account of the markets in which our businesses operate, bonus opportunity and Group profit sharing a

means for all our employees to share in the broader success of the Group.

Human Capital Report 2005 7

Client Organisation: Barclays

Human capital initiatives

Employee engagement This section provides Employee engagement

We recognise that engaging our workforce is a key contributor to company performance. Our Have your say

engagement survey is now in its third year. The survey provides us with a means of assessing employee

opinions, commitment and engagement, as well as an index for comparison year-on-year. In our survey

carried out in May 2005, we achieved an overall 78% response. This demonstrated that colleagues are clear

about what is expected of them, but that we need to improve day-to-day communications and act to prevent a

perceptionof increasedwork pressures anddeteriorationin work-life balance.

Our employee engagement score across the Group rose from689 to 692 with the majority of operating units

This section provides

more granular details of

specific initiatives either

undertaken during the

reported year or

otherwise planned for the

coming year.

Our employee engagement score across the Group rose from68.9 to 69.2, with the majority of operating units

reporting increases, representing a trend that has continually increased. This would suggest that we are paying

attentionto the things that matter to our workforce but recognisingthat we still have roomfor improvement.

Recruitment & retention

Our Employer of Choice programme, designed to portray a consistent image of

the organisation across Europe, formally concluded early in the period and has

beenwell receivedamongst potential recruits andnewstarters. beenwell receivedamongst potential recruits andnewstarters.

All internal job opportunities are advertised internally on the intranet, as well as

through appropriate external means, such as agencies or newspaper

advertisements.

Our practice of awarding sign-on and referral packages continues to be well

received in the marketplace and amongst our employees. The success of the

referral package has contributed to a reduction in overall recruitment costs by

Learning

We want everyone who works for us to have the opportunity to develop their skills and knowledge, so that they

can perform their jobs to the best of their ability and develop their careers with us. We provide a range of

different types of training, including courses, workshops, on-the-job support, mentoring, support in achieving

relatedexternal qualifications andsubsidisedaccess to professional subscriptions.

referral package has contributed to a reduction in overall recruitment costs by

some 600,000against 2004figures.

Feedback fromstaff suggests that the increased focus on individual development, through the rollout of the

My Career programme of workshops and intranet tools, with the review of our development suite, has been

received positively. The effectiveness of this programme is being evaluated through multiple approaches,

including a series of questions in the engagement survey, with initial findings suggesting that this programme

has bothincreasedstaff engagement (byupto 1.2points) andcustomer satisfaction.

As part of the development process, the web-based Enhancing our Performance tool gives all managers in

Human Capital Report 2005 8

the Group effective feedback on howthey are performing. The 360-degree assessment focuses on the results

theycreate andhowtheyachievethemthroughincorporatingmultiple viewpoints.

Client Organisation: Barclays

Company practice insight

Flexible working

This section may

want to provide

t l i i

Flexible working

We recognise that engaging our workforce is a key contributor to

company performance. To ensure that all our employees are able to

contribute to the maximum, we aim wherever possible to give them the

flexibility they need to balance their various commitments and manage

their work/life balance appropriately.

Edwin, who joined us as a graduate in 2001, has opted to take advantage

of our unpaid leave of absence policy that all employees qualify for after

four years service, to teach English in Australia for six months before

actual mini case

studies to ground

statements made

under the policies

and/or initiatives

sections.

y , g

going travelling. My friends are all impressed with the flexibility I have,

andhowsupportive my colleagues have beenhe confided.

Anja has recently transitioned froma full-time role to a four-day week, to

spend more time as a volunteer with her local hospice. Imreally pleased

to be able to give something back to the community, and the company

has been fantastic at letting me re-evaluate how I worked in support of

that, she said.

All over Europe, we now offer employees the options that give themthe

flexibility they ask for, whilst ensuring that they still play an active and

effective role in the workplace.

Graduate recruitment

All our staff are vital to our effective operations and success, and we

place high emphasis in identifying high-flyers fromall walks of life to add

to our talent pool. We hire a selected number of graduates each year from

top University campuses across Europe, and our dedicated graduate

recruitment teamis kept busy year-round in handling the many requests

we receive, for full-time work andour sought-after internships.

Martin, our European Graduate Recruitment Manager, tells us how the p g

milk-round at top Universities seems to get more competitive each year.

Of course our competitors are at the same events, he smiles, but

graduates always get excited when they start to learn about what working

for us is really like. Theres just something about the way our people

respond to their questions that they find so engaging, and that really helps

us differentiate ourselves oncampus.

As part of our annual review of our employer brand on campus, we

discovered that, for the third year running, we have been recognised as

th I ld t lik t k f i t

Human Capital Report 2005 9

the companyI wouldmost like to work for in our sector.

Client Organisation: Barclays

Human Capital Reporting statements

Report of the Directors

The following statements are set out in accordance with human capital reporting standards 2006 (HCRC)

andas suchprovide a breakdownof the performance, compositionandproductivityof our humancapital.

The development of employees, to ensure that we possess the necessary skills and behaviours to achieve

our strategic business objectives is given a high priority We place emphasis on ensuring effective our strategic business objectives, is given a high priority. We place emphasis on ensuring effective

management succession, and have developed well-established approaches for recruiting and developing

graduates andother youngpeople into the Group.

Our Code of Conduct outlines our commitment to respect for individuals, no matter what their background

and culture. We have a policy of recruiting from the widest possible labour market and determining the

careers of our employees solelyontheir ownmerit.

Accordingly, we consider suitably qualified disabled people for employment and assist themin overcoming

handicaps at work. In the unfortunate case where an employee develops a disability during employment,

we seek to provide themwithassistance in retraining we seek to provide themwithassistance in retraining.

Internal communication is a priority for us, as our colleagues carry forward our reputation, brand and

knowledge. We share information through a variety of approaches, utilising our intranet as well as internal

publications and briefing sessions. Our senior managers review staff feedback and suggestions every

month, and every year we hold a formal management reviewof themes and issues that emerge throughout

the year.

Byorder of the board.

C J Burns

Human Capital Report 2005 10

C.J . Burns

Secretary.

Client Organisation: Barclays

Human Capital Operating Statement

ye 31

st

Dec 2005 ye 31

st

Dec 2004

Information regarding this statement

can be found in our white paper or

through our training events. There are

different ways in which to report the

actual data, i.e. whether to report

accompanying percentages, more

ye 31

st

Dec 2005 ye 31

st

Dec 2004

OPERATING INCOME %

Revenue (000s) 1,057,016 1,015,020

FTEs 16,352 16,047

Revenue per FTE 64,641 63,253

OPERATING COSTS

Total operating costs (000s) 904,371 815,094

People costs (000s) 532,181 464,317

Human Capital Intensity (HCI) 58 85 56 96

2

p y g p g ,

comment etc, though this will to a

great degree depend on the type of

organisation.

Human Capital Intensity (HCI) 58.85 56.96

OPERATING INCOME ATTRIBUTABLE

TO HC (HCIR per FTE)

38,041

36,029

% %

ANCILLARY PEOPLE COSTS (APC)

Training & Development costs (000s) 8,176 7,342

Recruitment costs (000s) 2,314 2,954

1

Health & Safety costs (000s) 740 691

HR functional and related costs (000s) 6,254 6,879

Outplacement costs (000s) 256 53

Total 17,740 17,919

HC LEVERAGE (HCIR/APC per FTE) 35.06 32.26

3 4

5

Results

1. HCI*R (Revenue contributed by HC) per FTE increased from 36,029 to

38,041, including an increase in staff of 305 (+1.9%) to 16,352 see the

PeopleFlowstatement.

2. Human Capital intensity (people costs/total costs) has increased from

56.96% to 58.85%, further underlining the importance of people to our

business.

3. HC Leverage has increased from 32.26 to 35.06 representing an

improvement of 8.7%.

4. Average HC leverage (using VaLUENTiS HC performance index) has a

cross sector index score of 49.56. Our performance ranks in the 45

th

percentile.

5. Overall ancillary people costs have declined by 179,000 (1%) due mainly

in the reduction of recruitment and HR functional related costs over 2004,

partiallyoffset bythe increase in training&development spend.

Human Capital Report 2005 11

p y y g p p

Client Organisation: Barclays

Notes to Human Capital Operating Statement

1.1 Revenue. This relates to figures for the overall Group as stated in the accompanying

Accompanying notes form the

backbone of the reporting

information, providing depth of

understanding and transparency

for the intended reader. A

comprehensive understanding is

Profit &Loss Statement.

1.2 FTEs. See PeopleFlow Statement for detailed analysis of headcount figures. PTACS

approachhas beenadoptedto account for the use of agencystaff andcontract workers.

1.3 Revenueper FTE. Derivedthroughcalculationin line with relatedOperatingPrinciple.

1.4 Total Operating Costs. Reported figures exclude depreciation and amortisation in line

with related Operating Principle. Figures do not exclude Ancillary People Costs (see

Note 1.8)

1.5 People costs. 532.1 million is comprised of Directors Remuneration of 1.9 million, a

p g

required of the HCR operating

principles which can be gained

through VaLUENTiS white paper

or specific training provision.

p p ,

contribution to pension schemes of 7.8 million (reducing the FRS17 deficit to 27.4

million) andPayroll costs of 522.5million.

1.6 Human Capital Intensity. Derived through calculation in line with related Operating

Principle.

1.7 HCI*R per FTE. Derivedthroughcalculationin line withrelatedOperatingPrinciple.

1.8 Ancillary People Costs. Costs as stated have not been excluded fromthe Total Operating

Costs as set out in Note 1.4. We have adopted this approach as APC is not deemed to

impact materiallyonTotal OperatingCost figures. p y p g g

1.9 Training & Development. Costs of 8.2 million are disaggregated as follows. Pre-

threshold training costs do not apply, as the cost of induction is captured in Recruitment

costs, see Note 1.10. Threshold training costs equal 7.6 million in the period, of which

5.8 million relates to HR delivery and procurement of external provision, and 1.8

million relates to line delivery and direct procurement of external provision. As the

organisation does not possess a dedicated Training Department, costs have been

derived through pro-rata allocation of HR personnel costs and associated procurement

spend. Post-threshold development costs equal 0.6 million, all of which relates to

t l i i external course provision.

1.10Recruitment. Costs of 2.3 million include fees paid to agencies totalling 1.6 million,

Induction costs of 0.3 million (which are excluded from Training Costs as set out in

Note 1.9) and an allocation of HR departmental resource time and associated budget of

0.4million.

1.11Health &Safety. Costs of 0.7mrelate to related training provision of 0.1 million, related

insurance payments of 0.4m, 0.1mof pre-recruitment health screening and 0.1mof

employee health assessments. No court awards relating to Health & Safety, or

associatedliabilities have beenincurredwithinthe period associatedliabilities have beenincurredwithinthe period.

1.12HR functional and related. Costs of 6.3 million include HR budgeted resource and

expense items not otherwise included in reported cost categories of 5.6m, 0.2 million

spent on employee surveys and the use of Agency staff totalling 0.5 million. No

employment tribunals have takenplace withinthe period.

1.13Outplacement costs. 0.3 million relates entirely to redundancy costs within the period

causedbythe reductionin the scale of Frenchoperations.

1.14Contractor/Agent. Costs of 0.5 million relate to the use of Agency staff within the period

andhave beenincludedwithinthe HR functional costs (see Note 1 12)

Human Capital Report 2005 12

andhave beenincludedwithinthe HR functional costs (see Note 1.12).

1.15Total APC. Derivedthroughcalculationin line with relatedOperatingPrinciple.

1.16HC Leverage. Derivedthroughcalculationin line with relatedOperatingPrinciple.

Client Organisation: Barclays

PeopleFlow

Statement

STAFFING ye 31

st

Dec 2005 ye 31

st

Dec 2004

%

Information regarding this statement

can be found in our white paper or

through our training events. There are

different ways in which to report the

actual data, i.e. whether to report

accompanying percentages, more

comment etc, though this will to a

%

No of full-time staff at start of year 14,011 13,865

Number of part-time staff at start of year (FTE

eqv)

1,932 1,491

Number of other at start of year (FTE eqv) 104 175

Full time equivalents (FTEs) at start of

year

16,047 15,531

STAFFING MOVEMENT % %

Number of FTEs recruited in period (+) 1,427 1,874

comment etc, though this will to a

great degree depend on the type of

organisation.

Number of acquisitioned FTEs during period (+) - -

1,427 1,874

Number of voluntary leavers (FTE) in period (-) 996 1,065

Number of FTEs made redundant or outplaced

in period (-)

35 217

Number of FTE retirements in period (-) 91 76

Number of FTEs outsourced in period (-) -

Full time equivalents (FTEs) at end of year 16,352 16,047 q ( ) y , ,

STAFFING MISCELLANEOUS

Mean tenure (years) 5.2 5.3

Mean age of workforce 34 34

Retirement population 5,391 5,304

Human Capital Report 2005 13

Client Organisation: Barclays

Notes to the Peopleflow Statement

2.1 FTEs at start of year. Consistent with figures at year end 2004. Part-time staff is

comprised of staff who work less than the contracted weekly 40 hours. Other staff

relates to 97 agency staff utilised to provide short-term cover and 7 staff on contracts

that expired within the period under review. Figures at start of period include 375 x full-

time staff on maternity/paternity leave and 223 x part-time staff on maternity/paternity

leave.

2.2 FTEs recruited in period. This includes 1,318 full-time permanent staff and 194 part-time

permanent staff. Group operations do not rely on seasonal staff and therefore these are

not includedwithinstatedfigures.

23 N b f i iti d FTE d i i d N i iti h b d ithi th 2.3 Number of acquisitioned FTEs during period. No acquisitions have been made within the

period.

2.4 Number of voluntary leavers in period. This is comprised of 720 full-time permanent staff

and332part-time permanent staff.

2.5 Number of FTEs made redundant or outplaced. Redundancies relate to the reduction of

the French operations within the period, following an appropriate period of consultation,

resulting in 33 full-time employees opting for redundancy packages rather than

relocation options offered. In addition, 2 employees have been dismissed within the

periodfor (unrelated) disciplinaryreasons periodfor (unrelated) disciplinaryreasons.

2.6 Number of FTE retirements. Our retiree population has increased by 91 full-time staff, of

whom12have chosento take earlyretirement.

2.7 Number of FTEs outsourced. No FTEs have been subject to outsourcing arrangements

withinthe period.

2.8 Full-time equivalents at end of year. This accordingly totals 16,352 at year-end, derived

incalculationwith relatedOperatingPrinciple.

2.9 Mean tenure. This has been calculated fromthe anniversary of start dates of full-time

t t ff l d fl t th fi t d permanent staff onlyandreflects the figure at year-end.

2.10Mean age. This has been calculated for all full-time and part-time permanent staff only

and reflects the figure at year-end. Further detail is provided in the Regional analysis

section.

2.11Retirement population. This reflects current numbers of staff receiving a pension from

the Group(includingDirectors).

Human Capital Report 2005 14

Client Organisation: Barclays

HC Productivity Statement

CONTRACTED RESOURCE ye 31

st

Dec 2005 ye 31

st

Dec 2004

Total number of FTE days contracted in year 3 530 340 3 401 289

Information regarding this statement

can be found in our white paper or

through our training events. There are

different ways in which to report the

actual data, i.e. whether to report

accompanying percentages, more

comment etc, though this will to a

great degree depend on the type of

Total number of FTE days contracted in year 3,530,340 3,401,289

Total number of FTE vacation days taken in

year

336,987 333,144

TOTAL NUMBER OF CONTRACTED FTE

DAYS AVAILABLE

3,193,353 3,068,145

WORK RESOURCE ADJUSTMENT

FTE days gained through recorded overtime

work (+)

61,932 65,371

FTE days lost to illness (-) 18,431 19,016

FTE days lost to work-related illness/injury (-) 2,773 2,816

FTE days lost to industrial action (-) 249 167

1

2

great degree depend on the type of

organisation.

FTE days lost to industrial action ( ) 249 167

FTE days recorded as lost under miscellaneous

(-)

763 1,075

ACTUAL NUMBER OF CONTRACTED FTE

DAYS WORKED

3,233,069 3,110,442

PRODUCTIVITY

HCI*Revenue per FTE day (optimal) 192.96 185.42

HCI*Revenue per FTE day (actual) 190.59 182.90

HCI*Revenue per FTE day differential 2.37 2.52

5

3

4

EMPLOYER-EMPLOYEE RELATED INDICES

Employee engagement index 69.2 68.5

Employer brand index 71.3 71.0

HUMAN CAPITAL MANAGEMENT INDEX

VB-HR Rating BB-BB-R BB-B-R

HC Performance Sustaining + Sustaining +

6

7

8

Results

1. For ease of reference, numbers under this heading are actual and not in (000s).

2. Over time recorded does not obviously include unrecorded over time nor any discretionary

efforts of employees.

3. HCI*Revenue per FTE day (optimal) is the revenue generated per people contribution

based on the contracted days (i.e. before any overtime and lost work days).

4. HCI*Revenue per FTE day (actual) is the revenue generated per people contribution

based on the actual number of days worked (i.e. including any overtime and lost work

days). Since revenue recorded is a post-adjustment (actual) number it does not record the

actual gain/loss fromthe contracted days.

5. HCI*Revenue per FTE day differential is the resulting gain/loss. A positive number shows

the attributable loss (inefficiency) of the operation.

6. Overall employee engagement index score increased from 68.5 to 69.2 (75

th

percentile)

with improvements seen across all five domains, line-of-sight, work environment, reward,

development and organisational architecture. However there was considerable variation

across the group see business segment reviewon page 18.

7. Similarly, we recorded an overall improvement in our employer brand index score and

have now broken through the 70

th

percentile (VaLUENTiS global index) see also

business segment reviewsection on page 18.

Human Capital Report 2005 15

8. Our overall VB-HR Rating has improved to BB-BB-R (see page 20 of this report for

further information)

Client Organisation: Barclays

Notes to the HC Productivity Statement

3.1 Total number of contracted FTE days available. Derived through calculation in line with

relatedOperatingPrinciple.

3.2 Total number of FTE days contractedin year. No additional informationrequired.

3.3 Total number of FTE vacationdays taken. No additional informationrequired.

3.4 Actual number of contracted FTE days worked. Derived through calculation in line with

relatedOperatingPrinciple.

3.5 FTE days gained through recorded overtime work. 14% of the workforce is eligible for

overtime work.

36 FTE days lost to illness This figure includes 1645 days lost that are categorised as 3.6 FTE days lost to illness. This figure includes 1,645 days lost that are categorised as

long-temsickness and16,786categorisedas short-termsickness.

3.7 FTE days lost to work-related illness or injury. Work-related illness or injury has resulted

in 2,773 days lost, of which 622 days are categorised as long-termsickness and 2,151

categorised as short-term sickness. We are pleased to report that our workforce has

beenfree fromfatalityor death-in-service withinthe period.

3.8 FTE days lost to industrial action. Three separate episodes in the French operations

resulted in 189 days being lost. A further 60 days have been recorded as lost through

associatednegotiationandconflict resolutionbyHR professionals andother staff. g y p

3.9 FTE days lost under miscellaneous. We apply the definition as set out in the related

OperatingPrinciple.

Human Capital Report 2005 16

Client Organisation: Barclays

Business-HC segment review (geography)

Organisations have a variety of

ways to present this data though

this should follow the format

used in the main accounts This

Human Capital Operating Statement

Year ending December 31 2005 UK Germany Spain France Italy Portugal

OPERATING INCOME % % % % % %

Revenue (000s) 701,919 236,282 72,317 23,346 15,134 8,018

FTEs 10,294 3,893 1,412 354 278 121

used in the main accounts. This

example follows geographical

split. Knowledge regarding

preparing segmental data can be

gained through attending our

specific training events.

Revenue per FTE 68,187 60,694 51,216 65,949 54,439 66,264

OPERATING COSTS

Total operating costs (000s) 587,126 214,333 60,187 22,496 13,390 6,839

People costs (000s) 352,551 121,313 34,422 13,543 7,158 3,194

Human Capital Intensity (HCI)

59.88 56.60 57.19 60.20 53.46 46.70

OPERATING INCOME ATTRIBUTABLE TO HC

(HCIR per FTE)

40,830

34,353 29,290 39,701 29,103 30,945

ANCILLARY PEOPLE COSTS (APC)

1

Training & Development costs (000s) 5,148 2,017 616 202 125 68

Recruitment costs (000s) 1,457 362 310 112 52 21

Health & Safety costs (000s) 476 189 56 9 7 3

HR functional and related costs (000s) 4,010 1,366 417 274 125 62

Outplacement costs (000s) 59 23 6 168 - -

Total 11,150 3,957 1,405 765 309 154

HC LEVERAGE (HCIR/APC per FTE) 37.70 33.80 29.44 18.37 26.18 24.31

2

3

Notes to segment information

1. Human capital intensity ratios reflect different human capital operating models, with Italy and Spain

operations recently set up. It is expected that these will increase over the next two years.

2. Contains 678,549 group costs. If stripped from UK ancillary costs, HC leverage increases to 40.14.

We have not reallocated Group HR spend across the various geographies.

3. For comparative purposes, average HC leverage (using VaLUENTiS HC performance index) has a

t i d f 49 56 cross sector index score of 49.56.

4. .

Human Capital Report 2005 17

Client Organisation: Barclays

Business-HC segment review (geography)

PeopleFlow

Statement

Year ending December 31 2005 UK Germany Spain France Italy Portugal

STAFFING

No of full-time staff at start of year 9,046 3,403 1,157 320 177 84

Number of part-time staff at start of year (FTE

eqv)

1,232 491 123 55 31 -

Number of other at start of year (FTE eqv) 78 26 - - - -

Full time equivalents (FTEs) at start of year 10,356 3,920 1,280 375 208 84

STAFFING MOVEMENT

Number of FTEs recruited in period (+) 788 222 265 14 91 47

Number of acquisitioned FTEs during period (+) - - - - - -

788 222 265 14 91 47

Number of voluntary leavers (FTE) in period (-) 533 167 130 2 21 10

Number of FTEs made redundant or outplaced in

period (-)

26 6 3 33 - -

Number of FTE retirements in period (-) 91 76 - - - -

1

2

3

Number of FTEs outsourced in period (-) - - - - - -

Full time equivalents (FTEs) at end of year 10,294 3,893 1,412 354 278 121

STAFFING MISCELLANEOUS

Mean tenure (years) 5.2 6.3 5.8 3.7 1.4 1.3

Mean age of workforce 34 38 29 32 27 26

Retirement population 5,039 352 5 - - -

4

Notes to segment information

1. Included here are interim positions and other directly employed contractors.

2. UK accounted for just over 55% of total new employees in 2005, as against 62% of total of voluntary

leavers.

3. Details of the redundancies in our French operation can be found under the main Human Capital

Operating statement.

4. UK operations account for 64.5% of total employees.

5. .

Human Capital Report 2005 18

Client Organisation: Barclays

Business-HC segment review (geography)

CONTRACTED RESOURCE UK Germany Spain France Italy Portugal

Total number of FTE days contracted in year

(000s)

2212 836 304 84 67 28

Total number of FTE vacation days taken in year

(000s)

205 87 29 8 6 2

TOTAL NUMBER OF CONTRACTED FTE DAYS

AVAILABLE (000s)

2,007 749 275 76 61 26

WORK RESOURCE ADJUSTMENT

FTE days gained through recorded overtime work

(+)

51,188 5,762 2,462 498 1,130 892

1

2

(+)

FTE days lost to illness (-) 13,539 3,161 1,345 199 147 40

FTE days lost to work-related illness/injury (-) 1,812 544 239 85 61 32

FTE days lost to industrial action (-) 82 104 6 54 3 -

FTE days recorded as lost under miscellaneous

(-)

549 126 65 13 8 2

ACTUAL NUMBER OF CONTRACTED FTE

DAYS WORKED (000s)

2,042 751 276 76 62 27

PRODUCTIVITY /FTE day /FTE day /FTE day /FTE day /FTE day /FTE day

HCI*Revenue per FTE day (optimal) 209.42 178.55 150.39 184.92 132.63 144.01

HCI*Revenue per FTE day (actual) 205.83 178.08 149.85 184.92 130.49 138.68

3

4

2

HCI Revenue per FTE day (actual) 205.83 178.08 149.85 184.92 130.49 138.68

HCI*Revenue per FTE day differential +3.59 +0.47 +0.54 0.00 +2.14 +5.33

Notes to segment information

For ease of reference, numbers under this heading are actual and not in (000s).

Over time recorded does not obviously include unrecorded over time nor any discretionary efforts of employees

HCI*Revenue per FTE day (optimal) is the revenue generated per people contribution based on the contracted days (i.e.

before any overtime and lost work days).

HCI*Revenue per FTE day (actual) is the revenue generated per people contribution based on the actual number of days

worked (i.e. including any overtime and lost work days). Since revenue recorded is a post-adjustment (actual) number it does

not record the actual gain/loss fromthe contracted days.

5

2005 2004 2005 2004 2005 2004 2005 2004 2005 2004 2005 2004

EMPLOYER-EMPLOYEE RELATED INDICES

Employee engagement index 69.2 68.5 66.3 66.1 70.4 70.3 65.1 69.3 73.5 70.8 72.6 71.4

not record the actual gain/loss fromthe contracted days.

HCI*Revenue per FTE day differential is the resulting gain/loss. A positive number shows the attributable loss (inefficiency) of

the operation.

6

Response rate (%) 81 79 68 70 78 78 67 75 91 95 84 85

Employer brand index 71.3 71.0 70.2 69.9 73.1 71.4 62.3 62.3 na na

HUMAN CAPITAL MANAGEMENT INDEX

VB-HR Rating [Current-Future-Risk] [BB-BB-R] [BB-B-R] [BB-BB-R] [B-B-R] na na

HC Performance Sustaining + Sustaining Sustaining + OPQ - -

Notes to segment information

6. We measure our Employee engagement through VaLUENTiS global engagement 5-domain index.

7. We measure our Employer brand through VaLUENTiS E-B

global

framework which is a composite index, including internal and

7

Human Capital Report 2005 19

external evaluation.

Client Organisation: Barclays

Business-HC

segment review

Further information on specific human

The following charts provide additional

information regarding employees across the

Group.

Further information on specific human

capital issues can be reported here

to supplement baseline numbers on

previous pages. For example, further

ratio analysis can be found here

though care must be taken to report

meaningful numbers rather than a

host of benchmark data.

FTEs by country

Spain, 1,412

France, 354

Italy, 278

Portugal, 121

UK 10 294

Germany, 3,893

The Group operates across six European

countries, with the UK representing the

majority of the workforce. The following chart

shows FTE numbers bycountryat year-end.

This figure includes both full-time and part-

time workers, in line with our approaches

towards flexible working.

These figures are broken down further in the

UK, 10,294

FTE age di stri buti on

46%

25%

3%

49%

23%

3%

31 40

21-30

20 and under

These figures are broken down further in the

PeopleFlow

statement.

The chart on the left displays the distribution of

employees by age group. We are able to

benefit fromthe wide range of life and career

experience displayedbyour colleagues.

The average length of service is just over 5

4%

7%

15%

46%

5%

6%

14%

0% 10% 20% 30% 40% 50% 60%

Over 60

51-60

41-50

31-40

% of full-time workforce

2004

2005

F l ti i ti i th kf

The average length of service is just over 5

years, but in many cases colleagues choose

to stay with us significantly longer than that.

We recognise employee with awards on the

anniversary of their service at five-year

periods, and our Chairman was the Guest of

Honour at the 2005annual Retirees Dinner.

W h t t b 2010 t i th

Female participation in the workforce

10%

20%

30%

40%

50%

60%

Target

We have a target by 2010 to raise the

participation of women in our workforce to

50.5% across the Group. The following chart

shows that we have already achieved this

target in Germany and the UK, but still have

work to do to encourage participating in other

European countries. Local HR teams are

working with the Group and operating units to

see how this can be most appropriately

Human Capital Report 2005 20

0%

UK Germany Spain France Italy Portugal

pp p y

achieved.

Client Organisation: Barclays

VB-HRRating

VB-HR Rating

The VB-HR Rating is shown here as we

believe it is the only instrument globally that can

be reported in Human Capital reviews. If you are

unfamiliar with this tool then www.vbhr.com will

be a useful resource. The Rating provides

management with a means of evaluating current

human capital management practice including a

future oriented perspective which has become

g

HR Strategy

BB BB R

HR Functional

Capital

Human Capital Management

Overall

ranking

AAA

AA

A

BBB

BB

B

CCC

CC

C

R

rmi n

r

RR

RRR

BB R BB

future oriented perspective which has become

an important market need

Workforce

Intelligence

Organisational

HCM

Capital

BB

R BB BB

BB

R BBB BB

HCM

Architecture

BB

R BBB BB

Management Employees

BB

R BB

BB

R BBB BBB

HR Customer-

agency

BB

R BB BB

HR Capability

BB

R BB BB

Human

Capital

HR Procurement

BB

BB

BB

R

EFFECTIVENESS

MAINTENANCE

RISK

BB

BB

R

EFFECTIVENESS

MAINTENANCE

RISK

The VB-HR Rating is a cross-sector Rating system that assesses the performance of human capital

management practice across the organisation from current (Effectiveness), future (Maintenance) and risk

perspectives.

A VB-HR Rating Level 3 exercise (audit) was undertaken by VaLUENTiS in November 2005. The overall

RISK RISK

A VB HR Rating Level 3 exercise (audit) was undertaken by VaLUENTiS in November 2005. The overall

ranking is formed fromaggregated data provided on each company operation. Investors can download the

VB-HRRating report fromwww.aclientplc.com/investor-relations.

Forward outlook

BB-BB-R (positive to the mean) represents an acceptable rating Certain future indicators ranked BBB BB-BB-R (positive to the mean) represents an acceptable rating. Certain future indicators ranked BBB

including Management, HCM architecture and HR procurement reflecting the investments we have been

making in these areas over the past two years. We believe that these will start to impact in other areas and

we are expecting to achieve BBB-BBB-R award in 2006 with a corresponding uplift in overall productivity

and organisational performance. We are currently constructing specific HC value measures to report in

2006reviewwhichwill supplement the VB-HR Rating.

Human Capital Report 2005 21

You might also like

- Identifying Patient Safety PrioritiesDocument10 pagesIdentifying Patient Safety PrioritiesReybs -isabella CalubNo ratings yet

- Nursing Catalog - NascoDocument26 pagesNursing Catalog - NascomodiezhamNo ratings yet

- Noise Knowledge Questionnaire Part II: I-Sociopolitical AspectDocument4 pagesNoise Knowledge Questionnaire Part II: I-Sociopolitical AspectAsal Salah100% (1)

- Mod2 - Ch3 - Health IndicatorsDocument13 pagesMod2 - Ch3 - Health IndicatorsSara Sunabara100% (1)

- Critical Analysis of Patient and Family Rights in Jci Accreditation and Cbahi Standards For HospitalsDocument10 pagesCritical Analysis of Patient and Family Rights in Jci Accreditation and Cbahi Standards For HospitalsImpact JournalsNo ratings yet

- Aintree HospitalsDocument36 pagesAintree HospitalsHarsimran DuaNo ratings yet

- Protocol For The Management of Outpatient Services Ed1 Jan 2013Document31 pagesProtocol For The Management of Outpatient Services Ed1 Jan 2013Dumitru BuzneaNo ratings yet

- Emergency Nurses Association (ENA)Document5 pagesEmergency Nurses Association (ENA)Ngu W PhooNo ratings yet

- Perfomance Analysis of CarrefourDocument20 pagesPerfomance Analysis of CarrefourPragya Shubhi KhareNo ratings yet

- Essential skills and competencies for frontline managersDocument3 pagesEssential skills and competencies for frontline managersSahaana KalyanramanNo ratings yet

- Annual Report of Durdans HospitalDocument176 pagesAnnual Report of Durdans HospitaloshanNo ratings yet

- Seminar PresentationDocument31 pagesSeminar Presentationapi-520940649No ratings yet

- A 2020 Vision of Patient CenteredDocument13 pagesA 2020 Vision of Patient CenteredElya Amaliia100% (1)

- Strengthen Patient Experience: (Implementation Plan of IDC Program) Domain 1: CommunicationDocument23 pagesStrengthen Patient Experience: (Implementation Plan of IDC Program) Domain 1: CommunicationRina LestariNo ratings yet

- CAM ICU PocketCards PDFDocument2 pagesCAM ICU PocketCards PDFFikriNo ratings yet

- Lean ServicesDocument23 pagesLean ServicesJawath BinaNo ratings yet

- Seminar JCI - 9 Feb 2012Document16 pagesSeminar JCI - 9 Feb 2012Mahardika PertiwiNo ratings yet

- Self ApprisalDocument2 pagesSelf ApprisalcoolkurllaNo ratings yet

- Brenda Creaney PresentationDocument21 pagesBrenda Creaney Presentationmonir61No ratings yet

- IHI Patient Family Experience of Hospital Care White Paper 2011Document34 pagesIHI Patient Family Experience of Hospital Care White Paper 2011Sorina VoicuNo ratings yet

- Transforming Leadership For Patient SatisfactionDocument4 pagesTransforming Leadership For Patient SatisfactionpietroNo ratings yet

- A Project Proposal On Hospital Management System in JavaDocument2 pagesA Project Proposal On Hospital Management System in JavaPirzada SwatiNo ratings yet

- Indus HospitalDocument33 pagesIndus HospitalKhushbakht Suhail100% (1)

- Quality and Patient SafetyDocument19 pagesQuality and Patient SafetyRekhaNo ratings yet

- APPG Patient Empowerment ReportDocument36 pagesAPPG Patient Empowerment ReportkiranNo ratings yet

- National Model Clinical Governance FrameworkDocument44 pagesNational Model Clinical Governance Frameworkwenhal100% (1)

- Implementing Course Mini-Projects to Achieve Program OutcomesDocument6 pagesImplementing Course Mini-Projects to Achieve Program Outcomescoep05100% (1)

- 2011 Alarms Summit Final Low ResDocument48 pages2011 Alarms Summit Final Low ResYousafValderramaLunaNo ratings yet

- Healthcare Operations Manager Compliance in Miami Fort Lauderdale FL Resume Kyle JohnsonDocument2 pagesHealthcare Operations Manager Compliance in Miami Fort Lauderdale FL Resume Kyle JohnsonKyleJohnsonNo ratings yet

- Indus Hospital ReportDocument17 pagesIndus Hospital Reportanishsobhani100% (1)

- Quality Improvement Manager in Northwest Indiana Resume Nancy WulffDocument2 pagesQuality Improvement Manager in Northwest Indiana Resume Nancy WulffNancy WulffNo ratings yet

- Strategies To Improve Handoff CommunicationDocument2 pagesStrategies To Improve Handoff CommunicationJames SimmonsNo ratings yet

- Quality Control & Quality Improvement: Under SupervisionDocument20 pagesQuality Control & Quality Improvement: Under Supervisionheba abd elazizNo ratings yet

- Out Patient DepartmentDocument5 pagesOut Patient DepartmentShikhaNo ratings yet

- JCI International Library of Measures ANIK BUKUDocument325 pagesJCI International Library of Measures ANIK BUKUnurulNo ratings yet

- Hospital MarketinDocument47 pagesHospital Marketinchandraprakash_shuklNo ratings yet

- MEdical Tourism 1Document17 pagesMEdical Tourism 1Sagarika RoyNo ratings yet

- CQE 7 Nursing Quality Indicators 1Document24 pagesCQE 7 Nursing Quality Indicators 1Inder Singh YadavNo ratings yet

- Health Care Value ChainDocument24 pagesHealth Care Value ChainallisterotherNo ratings yet

- Customer Satisfaction and Service MarketingDocument22 pagesCustomer Satisfaction and Service MarketingAnshita GargNo ratings yet

- 2007 International Patient Safety GoalsDocument1 page2007 International Patient Safety GoalsElias Baraket FreijyNo ratings yet

- Customer Services in Hospital SectorDocument13 pagesCustomer Services in Hospital SectorAshish ChdNo ratings yet

- Ways To Improve The Health SystemDocument18 pagesWays To Improve The Health SystemB I N SNo ratings yet

- Hospital Performance Management PDFDocument8 pagesHospital Performance Management PDFCamille FernandezNo ratings yet

- Basics of QualityDocument71 pagesBasics of QualitySumaira KanwalNo ratings yet

- Hospitalist Program Toolkit: A Comprehensive Guide to Implementation of Successful Hospitalist ProgramsFrom EverandHospitalist Program Toolkit: A Comprehensive Guide to Implementation of Successful Hospitalist ProgramsNo ratings yet

- Director of NursingDocument3 pagesDirector of Nursingapi-78929871No ratings yet

- Hospital Case StudyDocument5 pagesHospital Case StudySherin A AbrahamNo ratings yet

- Hospital Committees Part4Document7 pagesHospital Committees Part4fatmanajehNo ratings yet

- Customer Care StrategyDocument11 pagesCustomer Care StrategyPrabhu SelvarajNo ratings yet

- Patient Safety: What Should We Be Trying To Communicate?Document32 pagesPatient Safety: What Should We Be Trying To Communicate?cicaklomenNo ratings yet

- SwotDocument25 pagesSwotkanikatekriwal126No ratings yet

- Ifp 23 Estimating Retirement Needs and How Much Do You Need On RetirementDocument9 pagesIfp 23 Estimating Retirement Needs and How Much Do You Need On Retirementsachin_chawlaNo ratings yet

- Zendesk Benchmark Report 2014Document18 pagesZendesk Benchmark Report 2014Eduardo RodriguesNo ratings yet

- Evidencebased Healthcare and Quality ImprovementDocument8 pagesEvidencebased Healthcare and Quality ImprovementJemimah BureresNo ratings yet

- Qi Nursing Communication Final - Nurs 484Document12 pagesQi Nursing Communication Final - Nurs 484api-558100249No ratings yet

- Internship Report PresentationDocument17 pagesInternship Report PresentationNikhil BhatNo ratings yet

- Director Patient Experience in Metropolitan Atlanta GA Resume Stephanie TaylorDocument3 pagesDirector Patient Experience in Metropolitan Atlanta GA Resume Stephanie TaylorStephanie TaylorNo ratings yet

- NABH Newsletter Highlights Focus on Quality Healthcare StandardsDocument16 pagesNABH Newsletter Highlights Focus on Quality Healthcare StandardsNeeraj JoshiNo ratings yet

- Andaman FlyerDocument2 pagesAndaman Flyermoon.satkhiraNo ratings yet

- Schedule for Cambridge Mock ExamsDocument1 pageSchedule for Cambridge Mock Examsmoon.satkhiraNo ratings yet

- HO ProcessDocument1 pageHO Processmoon.satkhiraNo ratings yet

- Cut over Sequence FlexiBSC BS2xx MigrationDocument5 pagesCut over Sequence FlexiBSC BS2xx Migrationmoon.satkhiraNo ratings yet

- 7 Ldf4-50aDocument5 pages7 Ldf4-50amoon.satkhiraNo ratings yet

- GSM DT KpiDocument5 pagesGSM DT KpiKalpesh JesalpuraNo ratings yet

- English Conversation Pour FormationDocument217 pagesEnglish Conversation Pour FormationMed JabrNo ratings yet

- Human Resources ManagementDocument18 pagesHuman Resources ManagementztrinhNo ratings yet

- Shareholding Agreement PFLDocument3 pagesShareholding Agreement PFLHitesh SainiNo ratings yet

- 14.30 GrimwadeDocument32 pages14.30 GrimwadeJuan QuintanillaNo ratings yet

- Developer Extensibility For SAP S4HANA Cloud On The SAP API Business HubDocument8 pagesDeveloper Extensibility For SAP S4HANA Cloud On The SAP API Business Hubkoizak3No ratings yet

- Research TitleDocument5 pagesResearch TitleAthena HasinNo ratings yet

- Ethics GE 6: Tanauan City CollegeDocument15 pagesEthics GE 6: Tanauan City CollegeRowena Bathan SolomonNo ratings yet

- Unit Ii GSS I B.edDocument41 pagesUnit Ii GSS I B.edshekhar a.p0% (1)

- Marijuana Advertising Order Denying Preliminary InjunctionDocument6 pagesMarijuana Advertising Order Denying Preliminary InjunctionMichael_Lee_RobertsNo ratings yet

- Illuminati Confessions PDFDocument227 pagesIlluminati Confessions PDFberlinczyk100% (1)

- Self Concept's Role in Buying BehaviorDocument6 pagesSelf Concept's Role in Buying BehaviorMadhavi GundabattulaNo ratings yet

- The Boy in PajamasDocument6 pagesThe Boy in PajamasKennedy NgNo ratings yet

- Display of Order of IC Constitution and Penal Consequences of Sexual HarassmentDocument1 pageDisplay of Order of IC Constitution and Penal Consequences of Sexual HarassmentDhananjayan GopinathanNo ratings yet

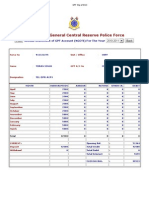

- Annual GPF Statement for NGO TORA N SINGHDocument1 pageAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Base Rates, Base Lending/Financing Rates and Indicative Effective Lending RatesDocument3 pagesBase Rates, Base Lending/Financing Rates and Indicative Effective Lending Ratespiscesguy78No ratings yet

- What Is The Meaning of Tawheed and What Are Its Categories?Document7 pagesWhat Is The Meaning of Tawheed and What Are Its Categories?ausaf9900No ratings yet

- James Tucker - Teaching Resume 1Document3 pagesJames Tucker - Teaching Resume 1api-723079887No ratings yet

- What Is A Pitch BookDocument4 pagesWhat Is A Pitch Bookdonjaguar50No ratings yet

- Skanda Purana 05 (AITM)Document280 pagesSkanda Purana 05 (AITM)SubalNo ratings yet

- Lecture Law On Negotiable InstrumentDocument27 pagesLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Benno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981Document198 pagesBenno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981alenin1No ratings yet

- Ought To, Should, Must and Have ToDocument2 pagesOught To, Should, Must and Have Topinay athena100% (1)

- Office 365 - Information Security Management System (ISMS) ManualDocument18 pagesOffice 365 - Information Security Management System (ISMS) ManualahmedNo ratings yet

- IBS AssignmentDocument4 pagesIBS AssignmentAnand KVNo ratings yet

- Networking and TESOL career goalsDocument2 pagesNetworking and TESOL career goalsSadiki FltaNo ratings yet

- The Power of Habit by Charles DuhiggDocument5 pagesThe Power of Habit by Charles DuhiggNurul NajlaaNo ratings yet

- Civil Service Commission upholds invalidation of 96 appointmentsDocument20 pagesCivil Service Commission upholds invalidation of 96 appointmentsKriszanFrancoManiponNo ratings yet

- XTRO Royal FantasyDocument80 pagesXTRO Royal Fantasydsherratt74100% (2)

- Reflection Paper AristotleDocument3 pagesReflection Paper AristotleMelissa Sullivan67% (9)

- E-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingDocument14 pagesE-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingSrivatsan SeetharamanNo ratings yet