Professional Documents

Culture Documents

Fernandes, John 2012 SFI Redacted

Uploaded by

Massachusetts Citizens for JobsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fernandes, John 2012 SFI Redacted

Uploaded by

Massachusetts Citizens for JobsCopyright:

Available Formats

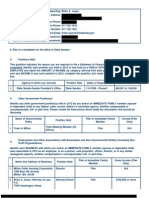

Name of Person Reporting: John Fernandes Current Home Address: Home Phone: Office Phone: 508-473-1070 Fax Number:

508-478-4420 Office Email: john.fernandes@mahouse.gov Name of spouse residing in household: Name of child(ren) residing in household:

2. Filer is a Candidate for the office of State Representative.

3:

Positions Held

This question indicates the reason you are required to file a Statement of Financial Interests and must be completed. Identify each position you held in 2012 or now hold as a PUBLIC OFFICIAL or DESIGNATED PUBLIC EMPLOYEE and report the AMOUNT of INCOME, by category, derived from each position in 2012. If you did not earn any INCOME in any such position in 2012, complete the question, but check the Income Not Applicable box.

1.

Agency in which you serve(d) House of Representatives

Position Held State Representative

Dates of Employment 1/3/2007 - Present

Income $60,001 to 100,000

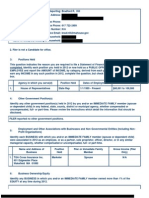

4:

Other Government Position(s)

Identify any other government position(s) held in 2012 by you and/or an IMMEDIATE FAMILY member (spouse or dependent child) in any federal, state, county, district or municipal agency, whether compensated or uncompensated, full- or part-time. Please review the Instructions which detail the information that should be disclosed. FILER reported no other government positions.

5:

Employment and Other Associations with Businesses and Non-Governmental Entities (Including NonProfit Organizations)

Identify each BUSINESS with which you and/or an IMMEDIATE FAMILY member (spouse or dependent child) were associated in 2012 as an employee, or as a partner, sole proprietor, officer, director, or in any similar managerial capacity, whether compensated or uncompensated, full- or part-time.

Name and Address of Business

Position Held Proprietor

Filer or Immediate Family Member Filer

Gross Income (Filer Only) $100,000 or more

1. John V. Fernandes, Attorney 12 Main Street P.O. Box 436 Milford MA 01757 2. EMC Corporation 50 Constitution Blvd Franklin MA 02038 3. Mile High Associates 12 Main Street

Director

Spouse

N/A

Partner

Filer

Less than $1,001

Milford MA 01757 4. Price WaterhouseCoopers P.O. Box 30004 Tampa FL 33630 5. MetroWest Chamber of Commerce 1671 Worcester Road Framingham MA 01701 Financial Consultant Clerk Child(ren) N/A

Child(ren)

N/A

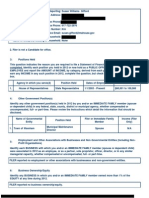

6:

Business Ownership/Equity

Identify any BUSINESS in which you and/or an IMMEDIATE FAMILY member owned more than 1% of the EQUITY at any time during 2012. FILER reported no business ownership/equity.

7:

Transfer of Ownership/Equity Interests

Identify any EQUITY in a BUSINESS (reported in Question 5 or 6) which you transferred to any IMMEDIATE FAMILY member at any time during 2012. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no transfers of business ownership/equity interests.

8:

Leaves of Absence

Identify any BUSINESS with which you (not an IMMEDIATE FAMILY member) were previously associated and with which you had an understanding at any time during 2012 regarding employment at any future time. FILER reported no leaves of absence.

9:

Gifts

Identify any GIFTS received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no gifts.

10:

Honoraria

Identify any HONORARIUM received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no honoraria.

11:

Reimbursements

Identify any REIMBURSEMENTS received by you and/or an IMMEDIATE FAMILY member at any time during 2012. FILER reported no reimbursements.

12:

State or Local Government Securities

Identify each SECURITY issued by the Commonwealth or any public agency thereof or county or municipality located in the Commonwealth, owned by you and/or an IMMEDIATE FAMILY member with a fair market value in excess of $1,000, as of December 31, 2012, and report any INCOME received by you at any time from such security in 2012, if such INCOME was in excess of $1,000. Please be aware that state employees who own state bonds and county employees who own county bonds may need to file a disclosure of such ownership with the Commission, in addition to disclosure of such ownership here. Please review the Instructions for more information. FILER reported no state or local government securities.

13:

Securities and Investments

Identify each SECURITY or other INVESTMENT, including the Commonwealths U-Fund, with a fair market value in excess of $1,000, beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. To report SECURITIES and INVESTMENTS held in trust, see Questions 14-21. Any INCOME received by you at any time during 2012 in excess of $1,000 from SECURITIES issued by the Commonwealth or any public agency thereof or county or municipality located in the Commonwealth should be reported in Question 12. Description of Security Common Stock Mutual Fund Mutual Fund Common Stock Mutual Fund Mutual Fund Common Stock Common Stock Common Stock Mutual Fund Mutual Fund Mutual Fund Mutual Fund Principal Place of Business or State of Incorporation Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Massachusetts Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Owner (Filer or Immediate Family Member) Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse

1. 2. 3. 4. 5. 6. 7. 8. 9. 10.

Name of Issuer

Liberty Media Corp ARTIO GLOBAL HIGH INCOME FUND CL A ASTON/ANCHOR CAPITAL ENHANCED EQUITY FUND CL N Brocade Communications CALAMOS MARKET NEUTRAL INCOME FUND CL A COPELAND TRUST COPELANDRISK MANAGED DIVIDENDGROWTH DIRECTV DISCOVERY COMMUNICATIONS INC EMC Corporation FEDERATED STRATEGIC INCOME FUND CL A

11. FIRST EAGLE GLOBAL FUND CL A 12. 13. FRANKLIN/TEMPLETON GLOBAL BOND FUND CL A INVESCO BALANCED-RISK ALLOCATION FUND

14. 15. 16.

IShares Trust Russell 1000 Growth Index Fund LORD ABBETT SHORT DURATION INCOME FUND CL A MAINSTAY EPOCH GLOBAL EQUITY YIELD FUND INSTL

Mutual Fund Mutual Fund Mutual Fund Mutual Fund Common Stock Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Mutual Fund Bond

Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only) Not Applicable (use in Q13 only)

Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse Filer and Spouse

17. MAINSTAY MARKETFIELD 18. McData Corp. 19. PIMCO COMMODITY REAL RETURN ST FUND

20. Pimco Funds 21. Pin Oak Agressive Stock Fund 22. Powershares ETF Tr II S&P 500 ETF 23. PRINCIPAL GLOBAL DIVERSIFIED INCOME FUND

24. PUTNAM CAPITAL SPECTRUM 25. REVENUESHARES ETF TRUST 26. VAN ECK GLOBAL HARD ASSET FUND CL A

27. VANGUARD DIVID APPRECIATION 28. 29. VIRTUS EMERGING MARKETS OPPORTUNITIES FUND -Cl A VIRTUS MULTI-SECTOR SHORT TERM BOND CL A

14:

Business and Charitable Trusts

If you and/or an IMMEDIATE FAMILY member had a beneficial ownership interest or served as a trustee of a BUSINESS or CHARITABLE TRUST as of December 31, 2012, you need to answer this question. You are not required to disclose the address of the BUSINESS or CHARITABLE TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no business or charitable trusts.

15:

Business and Charitable Trust Assets

Report all securities and other investments, with a fair market value in excess of $1,000, held in a BUSINESS or CHARITABLE

TRUST(S) and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You are not required to disclose the address of a property held in the BUSINESS or CHARITABLE TRUST(S) if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no business or charitable trust holdings.

16:

Family Trust Assets

Report all SECURITIES and other INVESTMENTS, with a fair market value in excess of $1,000, held in a FAMILY TRUST and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. If your home is held in a FAMILY TRUST, report details on the property in Question 22 if it is located in Massachusetts. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed. FILER reported no family trusts.

17:

Realty Trusts

If you and/or an IMMEDIATE FAMILY member had a beneficial ownership interest or served as a trustee of a REALTY TRUST as of December 31, 2012, you need to answer this question. You are not required to disclose the address of the REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question with Home Address. Please review the Instructions which detail the information that should be disclosed.

Name,Date and Address of Trust

Name of Grantor(s) John Fernandes & Ernest Pettinari

Name of Trustee(s) John Fernandes & Ernest Pettinari

Beneficiaries John Fernandes

Percentage of Equity Owned (Filer Only) 50%

1. Main Pond Realty Trust Date: 7/ 14/ 1992 12 Main Street Milford 22 01757

18:

Realty Trust: Real Property Assets

Report all real property held in a REALTY TRUST and beneficially owned by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You are not required to disclose the address of the REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question Home Address. Please review the Instructions which detail the information that should be disclosed. Name of Trust Address of Property Held in Trust 12 Main Street Milford MA 01757 Description of Property Held in Trust Commercial Assessed Value and Net Income

Record Owner(s) (Name(s) on Deed)

1. Main Pond Realty Trust

Assessed Value: John Fernandes and ernest Pettinari, $100,000 or Trustees of the Main Pond Realty more Trust Net Income: Less than $1,001

19:

Business, Charitable and Realty Trusts: Mortgage Obligations

Report all mortgages, including home equity and reverse mortgage loans, as of December 31, 2012, on any property held in a BUSINESS, CHARITABLE or REALTY TRUST and disclosed in response to Question 15

and/or 18. You are not required to disclose the address of a BUSINESS, CHARITABLE or REALTY TRUST if it is the same as your current home address. Where applicable, you should answer this portion of the question Home Address. Please review the Instructions which detail the information that should be disclosed.

1.

Name Of Trust

Address of Property 12 Main Street Milford MA 01757

Creditor Name and Address Medway Co-op 70 Main Street Medway MA 02053

Original Amount Borrowed and Amount Owed Original Ammount: $100,000 or more Amount Owed: $100,000 or more

Year Due and Interest Rate Year Due:2013 7%

20:

Business, Charitable, Family and Realty Trusts: Purchases/Transfers of Property in Massachusetts Only

Report all purchases by and/or transfers to any BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST of property located in Massachusetts which occurred at any time during 2012. FILER reported no purchase/transfers of realty trust property in Massachusetts.

21:

Business, Charitable, Family and Realty Trusts: Sales/Transfers of Property in Massachusetts Only

Report all sales and/or transfers by any BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST of property located in Massachusetts which occurred at any time during 2012. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no sale/transfers of realty trust property in Massachusetts.

22:

Real Property Owned in Massachusetts

Identify any real property in Massachusetts with an assessed value in excess of $1,000, in which you and/or an IMMEDIATE FAMILY member held an interest as of December 31, 2012. EXCLUDE: Out-of-state property or property located in Massachusetts held for business or rental purposes. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren).

1.

Address of Property

Description of Property Primary Residence

Person(s) Holding Interest Filer and Spouse

Assessed Value (Filer Only) $100,000 or more

2.

Vacation Residence

Filer and Spouse

$100,000 or more

23:

Business, Investment and Rental Properties

Identify any real property with an assessed value in excess of $1,000 as of December 31, 2012, regardless of location, including time-sharing arrangements, held for business, investment or rental purposes, in which you and/or an IMMEDIATE FAMILY member had a direct or indirect interest. Property held in a REALTY TRUST should be reported in Question 18. EXCLUDE: Properties held primarily for personal or family use. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and

Child(ren) or Child(ren).

Address of Property

Description of Property Rental Property

Person(s) Holding Interest Filer

Assessed Value and Net Income (Filer Only) Assessed Value:$100,000 or more Net Income:$5,001 to 10,000 Assessed Value:$100,000 or more Net Income:$5,001 to 10,000

1. 15 Forest Street Milford MA 01757 2. 33/ 34 Prospect Heights Milford MA 01757

Rental Property

Filer

24:

Real Property Purchases

Identify any real property located in Massachusetts which was purchased by or otherwise transferred to you and/or an IMMEDIATE FAMILY member at any time during 2012. Purchases of property held in a BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST should be reported in Question 20. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no real property purchases.

25:

Real Property Sales

Identify any real property located in Massachusetts which was sold by or otherwise transferred from you and/or an IMMEDIATE FAMILY member at any time during 2012. Sales of real property held in a BUSINESS, CHARITABLE, FAMILY and/or REALTY TRUST should be reported in Question 21. You are not required to disclose the name of your spouse or any dependent child(ren). Where applicable, you should answer this portion of the question by indicating the relationship, e.g., Filer and Child(ren), Spouse, Spouse and Child(ren) or Child(ren). FILER reported no real property sales.

26:

Mortgage Loan Information

Identify all mortgages, including home equity and reverse mortgage loans, in excess of $1,000, outstanding on December 31, 2012, for which you and/or an IMMEDIATE FAMILY member were obligated. If the mortgage loan was for your current home, exclude the original AMOUNT borrowed or owed. You are not required to disclose your current home address. Where applicable, you should answer this portion of the question with Home Address. For an IMMEDIATE FAMILY member, do not report the AMOUNTS borrowed and owed.

1.

Address of Property

Creditor Name and Address Milford Federal Savings And Loan Main Street Milford MA 01757 Milford Federal Savings And Loan Main Street Milford MA 01757

Original Amount Borrowed and Amount Owed Original Amount: $100,000 or more Amount Owed: $100,000 or more

Year Due and Interest Rate 3.25% 2016

2. 15 Forest Street Milford MA 01757

Original Amount: $100,000 or more Amount Owed: $100,000 or more

4.25% 2032

3. 33/ 34 Prospect Heights Milford MA 01757

Milford Federal Savings and Loan Main Street Milford MA 01757

Original Amount: $100,000 or more Amount Owed: $100,000 or more

4.25% 2032

27:

Mortgage Receivable Information

Identify any real property located in Massachusetts on which you and/or an IMMEDIATE FAMILY member held a mortgage as of December 31, 2012. Also identify any real property located out-of-state which was held for business or rental purposes on which you and/or an IMMEDIATE FAMILY member held a mortgage as of December 31, 2012. Report the name and address of the mortgagee (the person obligated to you and/or an IMMEDIATE FAMILY member) and the assessed value by category. If the mortgage is held only by an IMMEDIATE FAMILY member, do not report the assessed value of the property. EXCLUDE: Mortgages on outof-state property if the property is held primarily for personal or family use. FILER reported no mortgage receivables.

28:

Other Creditor Information

Identify each debt, loan or other liability, including mortgage(s), home equity and reverse mortgage loans on property located out-of-state, in excess of $1,000, owed by you and/or an IMMEDIATE FAMILY member as of December 31, 2012. You must report the loan collateral, which is the property assigned to guarantee payment. EXCLUDE: Any liability of $1,000 or less; installment loans (cars, household effects, etc.); educational loans; medical and dental debts; credit card purchases (other than cash advances); support or alimony obligations; debts owed to a spouse or CLOSE RELATIVE; and debts incurred in the ordinary course of a BUSINESS. Please review the Instructions which detail the information that should be disclosed. FILER reported no other creditor information.

29:

Debts Forgiven

Identify each creditor who at any time during 2012 forgave any indebtedness in excess of $1,000 owed by you and/or an IMMEDIATE FAMILY member. EXCLUDE: Any debts forgiven by a spouse, a CLOSE RELATIVE, or the spouse of a CLOSE RELATIVE. FILER reported no debts forgiven.

1: I John V Fernandes certify that: I made a reasonably diligent effort to obtain required information concerning myself and IMMEDIATE FAMILY MEMBER(S); and The information provided on this form is true and complete, to the best of my knowledge.

Submitted under the pains and penalties of perjury.( 5/ 21/ 2013)

The Following Immediate Family Members declined to disclose information: The Following are the specific Question(s) for which answers were declined by each Immediate Family Member: The following are the specific question(s) which I decline to answer in whole or in part, because I assert the information is privileged by law. The explanation of the basis of your claim of privilege is: N/A

You might also like

- Kaufman, Jay 2012 Statement of Financial InterestsDocument8 pagesKaufman, Jay 2012 Statement of Financial InterestsMassachusetts Citizens for JobsNo ratings yet

- Humason, Donald 2012 SFI RedactedDocument6 pagesHumason, Donald 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Honan, Kevin 2012 SFI RedactedDocument7 pagesHonan, Kevin 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Howitt, Steven 2012 SFI RedactedDocument10 pagesHowitt, Steven 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Henriquez, Carlos 2012 SFI RedactedDocument8 pagesHenriquez, Carlos 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Jehlen, Patricia 2012 SFI RedactedDocument6 pagesJehlen, Patricia 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Hogan, Kate 2012 SFI RedactedDocument7 pagesHogan, Kate 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Jones, Bradley 2012 SFI RedactedDocument6 pagesJones, Bradley 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Joyce, Brian 2012 SFI RedactedDocument7 pagesJoyce, Brian 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Kafka, Louis 2012 Statement of Financial InterestsDocument6 pagesKafka, Louis 2012 Statement of Financial InterestsMassachusetts Citizens for JobsNo ratings yet

- Holmes, Russell 2012 SFI RedactedDocument6 pagesHolmes, Russell 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Gregoire, Danielle 2012 SFI RedactedDocument6 pagesGregoire, Danielle 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Heroux, Paul 2012 SFI RedactedDocument6 pagesHeroux, Paul 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Golden, JR., Thomas A. 2012 SFI RedactedDocument7 pagesGolden, JR., Thomas A. 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Gordon, Kenneth 2012 SFI RedactedDocument6 pagesGordon, Kenneth 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Fox, Gloria 2012 SFI RedactedDocument8 pagesFox, Gloria 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Hecht, Jonathan 2012 SFI RedactedDocument9 pagesHecht, Jonathan 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Hedlund, Robert 2012 SFI RedactedDocument8 pagesHedlund, Robert 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Galvin, William C. 2012 SFI RedactedDocument7 pagesGalvin, William C. 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Harrington, Sheila 2012 SFI RedactedDocument7 pagesHarrington, Sheila 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Hill, Bradford 2012 SFI RedactedDocument6 pagesHill, Bradford 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Haddad, Patricia 2012 SFI RedactedDocument8 pagesHaddad, Patricia 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Gifford, Susan 2012 SFI RedactedDocument6 pagesGifford, Susan 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Garry, Colleen 2012 SFI RedactedDocument6 pagesGarry, Colleen 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Finegold, Barry 2012 SFI RedactedDocument9 pagesFinegold, Barry 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Finn, Michael 2012 SFI RedactedDocument6 pagesFinn, Michael 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Gobi, Anne 2012 SFI RedactedDocument6 pagesGobi, Anne 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Garballey, Sean 2012 SFI RedactedDocument8 pagesGarballey, Sean 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Garlick, Denise 2012 SFI RedactedDocument8 pagesGarlick, Denise 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- Fiola, Carole 2012 SFI RedactedDocument7 pagesFiola, Carole 2012 SFI RedactedMassachusetts Citizens for JobsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Urban Altoids EDC Kit v2.2.1Document2 pagesUrban Altoids EDC Kit v2.2.1richard philpNo ratings yet

- Generator Exciter & Voltage ExciterDocument34 pagesGenerator Exciter & Voltage ExciterYasir MehmoodNo ratings yet

- History of Titan Watch IndustryDocument46 pagesHistory of Titan Watch IndustryWasim Khan25% (4)

- Only PandasDocument8 pagesOnly PandasJyotirmay SahuNo ratings yet

- Stahl Cable Festoon SystemsDocument24 pagesStahl Cable Festoon SystemsDaniel SherwinNo ratings yet

- MT6771 Android ScatterDocument27 pagesMT6771 Android ScatterСенильга МакароваNo ratings yet

- Alignment Cooling Water Pump 4A: Halaman: 1 Dari 1 HalamanDocument3 pagesAlignment Cooling Water Pump 4A: Halaman: 1 Dari 1 Halamanpemeliharaan.turbin03No ratings yet

- Car NB Documents (YOPH02PC02)Document21 pagesCar NB Documents (YOPH02PC02)PaulNo ratings yet

- Cereal Partners World Wide (Case Presentation)Document42 pagesCereal Partners World Wide (Case Presentation)Misbah JamilNo ratings yet

- Assignment 2 Front SheetDocument17 pagesAssignment 2 Front SheetPhanh NguyễnNo ratings yet

- Office of The Integrity Commissioner - Investigation Report Regarding The Conduct of Councillor Mark Grimes (July 05, 2016)Document44 pagesOffice of The Integrity Commissioner - Investigation Report Regarding The Conduct of Councillor Mark Grimes (July 05, 2016)T.O. Nature & DevelopmentNo ratings yet

- Phyton para Sujetar HerramientasDocument21 pagesPhyton para Sujetar HerramientasAlex D H RuizNo ratings yet

- Registration of Ownership TranferDocument6 pagesRegistration of Ownership TranferIronHeart MulaaferNo ratings yet

- A Review of Bharat Nirman ProgrammeDocument3 pagesA Review of Bharat Nirman Programmevivek559No ratings yet

- Comprehensive Case 1 BKAR3033 A221Document3 pagesComprehensive Case 1 BKAR3033 A221naufal hazimNo ratings yet

- PM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentDocument3 pagesPM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentNikeyNo ratings yet

- 280Document6 pages280Alex CostaNo ratings yet

- Bamboo in AsiaDocument72 pagesBamboo in Asiafitria lavitaNo ratings yet

- MAINTENANCE AND RELIABILITY ENGINEERING - Lecture 1Document24 pagesMAINTENANCE AND RELIABILITY ENGINEERING - Lecture 1K ULAGANATHANNo ratings yet

- 325W Bifacial Mono PERC Double Glass ModuleDocument2 pages325W Bifacial Mono PERC Double Glass ModuleJosue Enriquez EguigurenNo ratings yet

- 3 IT18 Information Assurance and Security 2 Prelim ExamDocument2 pages3 IT18 Information Assurance and Security 2 Prelim Examsarah miinggNo ratings yet

- Aartv Industrial Training ReportDocument48 pagesAartv Industrial Training ReportRupal NaharNo ratings yet

- Vytilla Mobility Hub - Thesis ProposalDocument7 pagesVytilla Mobility Hub - Thesis ProposalPamarthiNikita100% (1)

- Maisie Klompus Resume 02Document1 pageMaisie Klompus Resume 02api-280374991No ratings yet

- Royal Harare Golf Club: An Oasis of Excellence in The Midst of Political and Economic DevastationDocument24 pagesRoyal Harare Golf Club: An Oasis of Excellence in The Midst of Political and Economic DevastationCompleatGolferNo ratings yet

- Student Name Student Number Assessment Title Module Title Module Code Module Coordinator Tutor (If Applicable)Document32 pagesStudent Name Student Number Assessment Title Module Title Module Code Module Coordinator Tutor (If Applicable)Exelligent Academic SolutionsNo ratings yet

- Income from Business and Profession Section 28,29&30Document14 pagesIncome from Business and Profession Section 28,29&30imdadul haqueNo ratings yet

- Pe 1997 01Document108 pagesPe 1997 01franciscocampoverde8224No ratings yet

- Logiq 180 UsuarioDocument414 pagesLogiq 180 UsuariolaboratorioelectroNo ratings yet

- App Form BLIDocument8 pagesApp Form BLIPaulo LuizNo ratings yet