Professional Documents

Culture Documents

Product Evaluation Form: Step 1: Determine Fixed Costs

Uploaded by

Ashley MorganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Evaluation Form: Step 1: Determine Fixed Costs

Uploaded by

Ashley MorganCopyright:

Available Formats

Product Evaluation Form

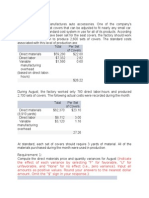

Step 1: Determine fixed costs Fixed costs are the business expenses that remain the same, regardless of the number of products produced or services provided. Wages, rent, marketing expenses, and equipment are examples of fixed costs. The sample table below illustrates the fixed costs encountered by most J companies. !t assumes a company of "# employees meeting "$ weeks. %&lease note' wages are not paid for the first meeting.( Expenses . J company employees wages %"" x ).*# hour( ,. J company officers wages %"" x )$ per meeting( -. .ent and other fixed expenses, paid to local J rea /ffice with sales tax upon liquidation 0. 1arketing supplies Sample Company $$ hours, )"" per employee, %"# employees x )"" + )""#( )$$ per officer, %* officers x )$$ + )""#( )$* Your Company

)$*

2. /ther

F. Total fixed costs

$ !"

345#67 $"

The 3uman .esources 0epartment can tell you what the agreed7upon wage structure is. For most J companies, the wage structure does not differ from the one previously noted8 it is the same as the wage structure specified in the -harter9,ylaws approved in 1eeting Two. The 1arketing 0epartment should recommend a marketing budget. :ote' Wages are variable costs because the number of workers and hours needed to produce an item or good can vary as demand increases or decreases. !n J companies, however, workers typically are ;employed< for a fixed number of hours. s a result, it is convenient to think of wages as a fixed cost for the purposes of this exercise. Step : Determine varia#le costs The company=s variable costs are the expenses that fluctuate or ;vary< with the number of goods produced and sold. For example, a company selling prepackaged candy will spend more on material as production increases. >ariable cost can be related to both production and the sales process. For each unit sold, your company will have to pay sales commissions and sales tax. !n 4tep 6 on the following page, you will have an opportunity to calculate these sales7related variable costs. The following worksheet will help you estimate the variable cost of material when additional units are produced. With assistance from the &roduction 0epartment, you will estimate your company=s material costs using the chart below.

Product . &ro?ected total cost of materials

Sample Company )"##

Your Company

,. 0ivided by the number of units

"##

C. $aterial cost per unit

$1

Step %: 345#67 $"

Determine prices :ow that you have determined the fixed and variable costs for your product, you can establish a profitable price. The following chart will help you determine your gross profit per unit at various test prices. @ross profit is the difference between the price and the variable costs of producing and selling your product. 2nter one high and one low test price for your product. !nclude sales tax. Ase the material cost per unit from 4tep $. -alculate your gross profit per unit at different prices. Sample Price &1 )*.## 7.*# 7.$* 7".## )6.$* Sample Price & )B.## 7.B# 7.6# 7".## )D."# Test Price &1 Test Price &

'. (et price per retail unit )aria#le Costs ,. 4ales commissions %"#C( -. 4ales tax 0. 1aterial cost per unit %4tep $( E. *ross per unit

+nstructions: ,ine '. 2nter two test prices for your product. /ne price should be ;high,< and the other ;low.< ,ine -. 2nter the "# percent sales commission cost. ,ine C. 2nter the city and state sales tax amount. !n the example, the sales tax rate was five percent %)*.## x .#*+.$*(. ,ine D. 2nter the materials cost per unit from 4tep $, Eine -. 4ubtract Eines ,, -, and 0 from Eine , and enter the result on Eine 2. ,ine E. This is your gross profit per unitFthe difference between your price and the variable costs per unit of production and sales.

Step .: 345#67 $"

Determine t/e #rea01even point break7even analysis frequently is used by manufacturing companies to set prices. !t helps a company determine the number of units that must be sold to cover costs %or break even(. Sample Price &1 Sample Price & Test Price &% Test Price &.

Fixed -ost %4tep "( 0ivide the @ross &rofit per Anit -rea01Even Point 2units3

)$G#

)$G#

)6.$*

)D."#

4% units

55 units

+ndividual and *roup Sales *oal fter you calculate the break7even point for the desired price, determine how many units each employee will need to sell to break even. What about making a profitH fter you reach the break7 even point, your company begins to make a profit. The more you sell, the more sales commission you earnI +ndividual sales 6oal' JJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJ *roup sales 6oal' JJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJ

345#67 $"

You might also like

- Unit 2Document7 pagesUnit 2Palak JainNo ratings yet

- Marketing Analysis - Breakeven AnalysisDocument25 pagesMarketing Analysis - Breakeven AnalysisFaiq Ahmad KhanNo ratings yet

- Break Even Point AnalysisDocument11 pagesBreak Even Point AnalysisRose Munyasia100% (2)

- Marvel Parts Cost AnalysisDocument40 pagesMarvel Parts Cost Analysisyuikokhj0% (2)

- Kotler POM 15e IM Notes Appendix MarketingByTheNumbersDocument49 pagesKotler POM 15e IM Notes Appendix MarketingByTheNumbersMuhammad UmairNo ratings yet

- Break-Even 8.1&8.2Document23 pagesBreak-Even 8.1&8.2Jelian E. TangaroNo ratings yet

- Total Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionDocument44 pagesTotal Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionChinh Lê Đình100% (1)

- CVP Analysis-1Document40 pagesCVP Analysis-1Gul Muhammad BalochNo ratings yet

- 2010-09-02 235812 EurondaDocument6 pages2010-09-02 235812 EurondaKylie TarnateNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageDocument40 pagesCost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageJeejohn Sodusta0% (1)

- Engineering Economics Lecture Sheet - 4 CVPDocument41 pagesEngineering Economics Lecture Sheet - 4 CVPebrahimbutexNo ratings yet

- Sensitivity Analysis and Uncertainty in CVPDocument12 pagesSensitivity Analysis and Uncertainty in CVPsinghalok1980No ratings yet

- Cost Volume Profit Analysis Problems and SolutionsDocument10 pagesCost Volume Profit Analysis Problems and SolutionshollyhuangNo ratings yet

- INSY 3300 Homework 2Document3 pagesINSY 3300 Homework 2jjf10No ratings yet

- Accounting Formulas 1 PDFDocument5 pagesAccounting Formulas 1 PDFmianmobeenaslam80% (5)

- Job Costing and Activity-Based Costing ExplainedDocument6 pagesJob Costing and Activity-Based Costing ExplainedmujeroenNo ratings yet

- CVP analysis determines breakeven point and target incomeDocument16 pagesCVP analysis determines breakeven point and target incomeSandeep KulkarniNo ratings yet

- Heuristics - Dianogtics AnalyticsDocument68 pagesHeuristics - Dianogtics Analyticsnthieu0102No ratings yet

- Break - Even Analysis: Learning ObjectivesDocument4 pagesBreak - Even Analysis: Learning ObjectivesJassel SuanNo ratings yet

- Break Even Point Analysis Definition, Explanation Formula and CalculationDocument5 pagesBreak Even Point Analysis Definition, Explanation Formula and CalculationTelemetric Sight100% (2)

- Contribution Margin Definition - InvestopediaDocument6 pagesContribution Margin Definition - InvestopediaBob KaneNo ratings yet

- Break EVEN Point Analysis1Document16 pagesBreak EVEN Point Analysis1Akash TiwariNo ratings yet

- Cost-Volume-Profit Analysis: Fixed CostsDocument9 pagesCost-Volume-Profit Analysis: Fixed CostsSatarupa BhoiNo ratings yet

- A. Detailed Organizational Structure of Finance DepartmentDocument22 pagesA. Detailed Organizational Structure of Finance Departmentk_harlalkaNo ratings yet

- Break Even Analysis Smoke Industry CaseDocument9 pagesBreak Even Analysis Smoke Industry CaseThu Phương NguyễnNo ratings yet

- Cost BehaviorDocument17 pagesCost BehaviorRona Mae Ocampo ResareNo ratings yet

- Cost Behavior Patterns & CVP Analysis: Chapter SixDocument9 pagesCost Behavior Patterns & CVP Analysis: Chapter Sixabraha gebruNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Chapter 4 CVP AnalysisDocument40 pagesChapter 4 CVP Analysisthrust_xone100% (1)

- Break Even Analysis FMDocument6 pagesBreak Even Analysis FMRahul RajwaniNo ratings yet

- Break-Even PointDocument6 pagesBreak-Even Pointsheebakbs5144No ratings yet

- Break Even AnalysisDocument4 pagesBreak Even Analysissatavahan_yNo ratings yet

- Breakeven AnalysisDocument29 pagesBreakeven AnalysisJohn SteveNo ratings yet

- Break Even Analysis. Presentation by MOhammad NawazDocument5 pagesBreak Even Analysis. Presentation by MOhammad NawaznwzashrafNo ratings yet

- Day 3Document33 pagesDay 3Leo ApilanNo ratings yet

- 3 - BREAK EVEN ANALYSIS - UploadDocument5 pages3 - BREAK EVEN ANALYSIS - Uploadniaz kilamNo ratings yet

- Break-Even Point, Return On Investment and Return On SalesDocument8 pagesBreak-Even Point, Return On Investment and Return On SalesGaurav kumarNo ratings yet

- Break-Even Point Analysis ExplainedDocument6 pagesBreak-Even Point Analysis ExplainedLouis FrongelloNo ratings yet

- CVP Analysis F5 NotesDocument7 pagesCVP Analysis F5 NotesSiddiqua KashifNo ratings yet

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- Estimation of Breakeven PointDocument5 pagesEstimation of Breakeven Point247599 vdp.et.mech.16No ratings yet

- Pricing Strategies for Maximizing ProfitsDocument24 pagesPricing Strategies for Maximizing Profitsmajidpathan208No ratings yet

- Pricing Strategy StepsDocument6 pagesPricing Strategy StepstafakharhasnainNo ratings yet

- Break Even Analysis CalculatorDocument5 pagesBreak Even Analysis CalculatorSasikumar R NairNo ratings yet

- The 3 Essentials of Construction Estimating Tax ImplicationsDocument5 pagesThe 3 Essentials of Construction Estimating Tax Implicationsdjjc21478No ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Asiment SolutionDocument4 pagesAsiment Solutionmansoor1307100% (1)

- Cost-Volume-Profit RelationshipsDocument11 pagesCost-Volume-Profit RelationshipsErfan TanhaeiNo ratings yet

- Business NoteDocument3 pagesBusiness Notechinhour thavNo ratings yet

- How to calculate material variance and break even pointDocument5 pagesHow to calculate material variance and break even pointSumitNo ratings yet

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- ABC CostingDocument28 pagesABC CostingKiraYamatoNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Better Sleep, Better YouDocument1 pageBetter Sleep, Better YouAshley MorganNo ratings yet

- Derivative RulesDocument3 pagesDerivative RulesAshley MorganNo ratings yet

- Eco-System Related PassagesDocument4 pagesEco-System Related PassagesAshley MorganNo ratings yet

- Writing The Analytical EssayDocument3 pagesWriting The Analytical EssayAhmed HajiNo ratings yet

- Analyzing Persuasive Language and TechniquesDocument12 pagesAnalyzing Persuasive Language and TechniquesAshley MorganNo ratings yet

- Study Finds Frictional HeatDocument3 pagesStudy Finds Frictional HeatAshley MorganNo ratings yet

- Python OopDocument26 pagesPython OopAshley MorganNo ratings yet

- Establish A Tourist Harassment Hotline - GleanerDocument2 pagesEstablish A Tourist Harassment Hotline - GleanerAshley MorganNo ratings yet

- Python OOPDocument46 pagesPython OOPSanchit BalchandaniNo ratings yet

- College Accountingch10Document12 pagesCollege Accountingch10Ashley MorganNo ratings yet

- Employment Work Conditions PDFDocument31 pagesEmployment Work Conditions PDFAshley MorganNo ratings yet

- Abstracts Samples StudentsDocument4 pagesAbstracts Samples StudentsAmrendra KumarNo ratings yet

- QuestionDocument1 pageQuestionAshley MorganNo ratings yet

- Language Analysis: Language To PersuadeDocument4 pagesLanguage Analysis: Language To PersuadeAshley MorganNo ratings yet

- 2 OenbringDocument24 pages2 OenbringAshley MorganNo ratings yet

- EnzymesDocument8 pagesEnzymesAshley MorganNo ratings yet

- Language Analysis Exam Revision 2013Document27 pagesLanguage Analysis Exam Revision 2013Ashley MorganNo ratings yet

- Resume MistakesDocument7 pagesResume MistakesAshley MorganNo ratings yet

- As BiologyDocument127 pagesAs BiologyRob Gomez100% (5)

- What Is Your ExcuseDocument1 pageWhat Is Your ExcuseAshley MorganNo ratings yet

- LOVE, We Hear It Every Single Day ! Ah Come On !Document1 pageLOVE, We Hear It Every Single Day ! Ah Come On !Ashley MorganNo ratings yet

- 5 Productivity TipsDocument3 pages5 Productivity TipsAshley MorganNo ratings yet

- Chris Brown Cover Tease: 'I Hope That I Am Not Defined by Just A Few Moments in My Life'Document3 pagesChris Brown Cover Tease: 'I Hope That I Am Not Defined by Just A Few Moments in My Life'Ashley MorganNo ratings yet

- Structure and Roles of Nucleic AcidsDocument9 pagesStructure and Roles of Nucleic AcidsAshley MorganNo ratings yet

- CommasDocument3 pagesCommasAshley MorganNo ratings yet

- Lecture 9 - Genetic EngineeringDocument13 pagesLecture 9 - Genetic EngineeringazwelljohnsonNo ratings yet

- The New York TimesDocument1 pageThe New York TimesAshley MorganNo ratings yet

- Lecture 8 - Natural SelectionDocument6 pagesLecture 8 - Natural SelectionAshley MorganNo ratings yet

- LipidsDocument10 pagesLipidsAshley MorganNo ratings yet

- Lecture 7 - The Cell CycleDocument16 pagesLecture 7 - The Cell CycleazwelljohnsonNo ratings yet

- Introduction To Costing LectureDocument134 pagesIntroduction To Costing LectureNitin JaiswalNo ratings yet

- Farm Mech PowDocument46 pagesFarm Mech PowAYSON N. DELA CRUZNo ratings yet

- Application of Costing Techniques in Ornamental Fish CultureDocument10 pagesApplication of Costing Techniques in Ornamental Fish Cultureraj kiranNo ratings yet

- PRTC First Answer Key PDFDocument48 pagesPRTC First Answer Key PDFnanabaNo ratings yet

- Standard Costing and Variance AnalysisDocument33 pagesStandard Costing and Variance AnalysisKim Dong ChenNo ratings yet

- IE UpdatedDocument58 pagesIE Updateddinhlap237100% (1)

- Acquisition and Disposition of Property, Plant and EquipmentDocument63 pagesAcquisition and Disposition of Property, Plant and EquipmentKashif Raheem100% (1)

- RR 9 98 PDFDocument7 pagesRR 9 98 PDFJoey Villas MaputiNo ratings yet

- Cost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6Document14 pagesCost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6ተዋህዶ 23 - Tewahedo 23No ratings yet

- Ans Ch25 Igcse Bus ST TCDDocument4 pagesAns Ch25 Igcse Bus ST TCDyawahabNo ratings yet

- Cost Accounting Manager or SR Cost Analyst or Plant Controller oDocument3 pagesCost Accounting Manager or SR Cost Analyst or Plant Controller oapi-77304624No ratings yet

- Costing MCQDocument19 pagesCosting MCQCostas PintoNo ratings yet

- Accounting For Biological Assets: ObjectivesDocument14 pagesAccounting For Biological Assets: Objectivesrajmeet75% (4)

- GREAT BEAR RESOURCES LTD. Financial Statements 20211110 SE000000002967812994Document14 pagesGREAT BEAR RESOURCES LTD. Financial Statements 20211110 SE000000002967812994Leon GribanovNo ratings yet

- Replicon BIData Model ReferenceDocument32 pagesReplicon BIData Model ReferencePank GuravNo ratings yet

- Inventory Valuation and CostingDocument7 pagesInventory Valuation and CostingMelyssa Dawn Gullon0% (1)

- Target PricingDocument9 pagesTarget PricingMohd SuhailiNo ratings yet

- Cost Accounting: Managerial Emphasis NotesDocument9 pagesCost Accounting: Managerial Emphasis NotesMayNo ratings yet

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocument7 pagesSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (44)

- SAP-Material Master Detailed ViewsDocument34 pagesSAP-Material Master Detailed ViewsAlena JosephNo ratings yet

- Parle 4PsDocument94 pagesParle 4PsPankaj Gandhi100% (1)

- Arens Aud16 Inppt21Document26 pagesArens Aud16 Inppt21Maya Aprilia100% (1)

- Value EngineeringDocument18 pagesValue Engineeringjohnplaya1234100% (1)

- CSEC Introductory Math TestDocument3 pagesCSEC Introductory Math TestDKzNo ratings yet

- Management AccountingDocument320 pagesManagement AccountingAnandha Raj Munnusamy100% (1)

- JOB ORDER COSTING Practice SetDocument5 pagesJOB ORDER COSTING Practice SetGoogle UserNo ratings yet

- Standard Cost Accounting in Oracle ERPDocument26 pagesStandard Cost Accounting in Oracle ERPMurali KrishnaNo ratings yet

- Pow - Street Light (Crossing-Tago)Document240 pagesPow - Street Light (Crossing-Tago)Judy Anne BautistaNo ratings yet

- BSA 13C - ME Payroll ProblemDocument3 pagesBSA 13C - ME Payroll ProblemEdrian Genesis SebleroNo ratings yet

- Annual Statement: 1 July 2021 - 30 June 2022Document6 pagesAnnual Statement: 1 July 2021 - 30 June 2022Thong THAONo ratings yet